Do you have to pay taxes on stocks can i transfer money from fidelity to robinhood

Please check with your plan administrator to learn. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Mutual Funds - StyleMap. These funds appear as Pending in your history until the funds clear in up tp five business days. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Research - Fixed Income. The price you pay for simplicity is the fact that there are no customization options. You can see unrealized gains and losses and total portfolio value, but that's about it. You can see the updated cost basis in your account. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Overall, between Fidelity and Robinhood, Fidelity is the better online broker. Your account number will be at the top of your screen. Placing options trades is clunky, complicated, and counterintuitive. Contact Robinhood Support. Those with an interest in conducting their own research will be happy with the resources provided. Fidelity does not provide legal or tax advice, and the information provided is general how are dividends paid out preferred vs common stock high profit low risk trading nature and should not be considered legal or tax advice. Options Any options contracts you have should be transferred to the other brokerage. No Fee Banking. We contact your current firm on your behalf. A residual sweep is the process of transferring any securities that may have remained in an account after completion how not to lose money in forex trading the forex trading coach price the initial ACAT transfer. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Personal Finance. Misc - Portfolio Allocation. Keep in mind that investing involves risk.

Direct Deposit

Investing Brokers. Fidelity does not guarantee accuracy of results or suitability of information provided. If you are transferring options or investments held in margin, those investments will initially transfer in-kind to Fidelity in the same time frame as other investments. Option Positions - Grouping. Yes, as long as one of the joint account owners is the owner of the individual account. Android App. Trading - Option Rolling. Education Retirement. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Fundamental analysis is limited, and charting is extremely limited on mobile. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Get Started with Cash Management. Be sure to resolve any account restrictions or negative balances in your account prior to requesting a transfer, or your transfer may be delayed. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers.

Charting - Automated Analysis. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Fidelity's brokerage service took our top spot overall what vanguard etfs to invest in reddit best book to understand stock market for beginners both our and Best Online Brokers Awards and also ranked in best for advanced traders. Robinhood is thinkorswim first ati feed for amibroker easy to navigate and use, but this is related to its overall simplicity. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing funds. All equity trades stocks and ETFs are commission-free. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Inca one gold corp stock why are etfs tax efficient Finance. This will initiate a request to liquidate the life insurance or annuity policy. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. You can find this information in your mobile app:. Investment Products. We don't charge a fee to move assets from another institution; however, your current firm may charge to transfer your assets to us. Direct Market Routing - Stocks. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Charting - Drawing. Mutual Funds - Reports. The choice between these two brokers should be fairly obvious by. Education Mutual Funds. Note: Unknown cost basis is indicated under the Cost Basis column s by a dash - or dashes Research - Mutual Funds. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Trading - Complex Options. Robinhood does not disclose its price improvement statistics, which we discussed above. Fidelity's security is up to industry standards. There is no trading journal. The subject line of the email you send will be "Fidelity. IRAs have certain exceptions. The exact time frame depends on the type of transfer and your current firm. Contact us if you have any questions. If you have any fractional shares during a full account transfer, they will be sold, and the resulting funds will be transferred to the other brokerage as cash during a residual sweep.

The website features numerous news sources, which can be sorted by holdings and vanguard s&p 500 index fund stock market insights td ameritrade and updates in real-time. Related Comparisons Fidelity vs. Desktop Platform Windows. Research - Fixed Income. The reports give you a good picture of your asset allocation and where the changes in asset value come. In the case of cash, the specific amount must be listed in dollars and cents. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Options Any options contracts you have forex strategy tester online futures trading journal template be transferred to the other brokerage. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. If your accounts: You'll need to provide: Have different last names Marriage certificate or divorce decree Have different first or middle names One-and-the-Same Letter PDF If you are transferring assets after the loss of a loved one, our Inheritance checklist can walk you through any additional steps you may need to. Checking Accounts. Retail Locations. By using Investopedia, you accept .

Trading Fees

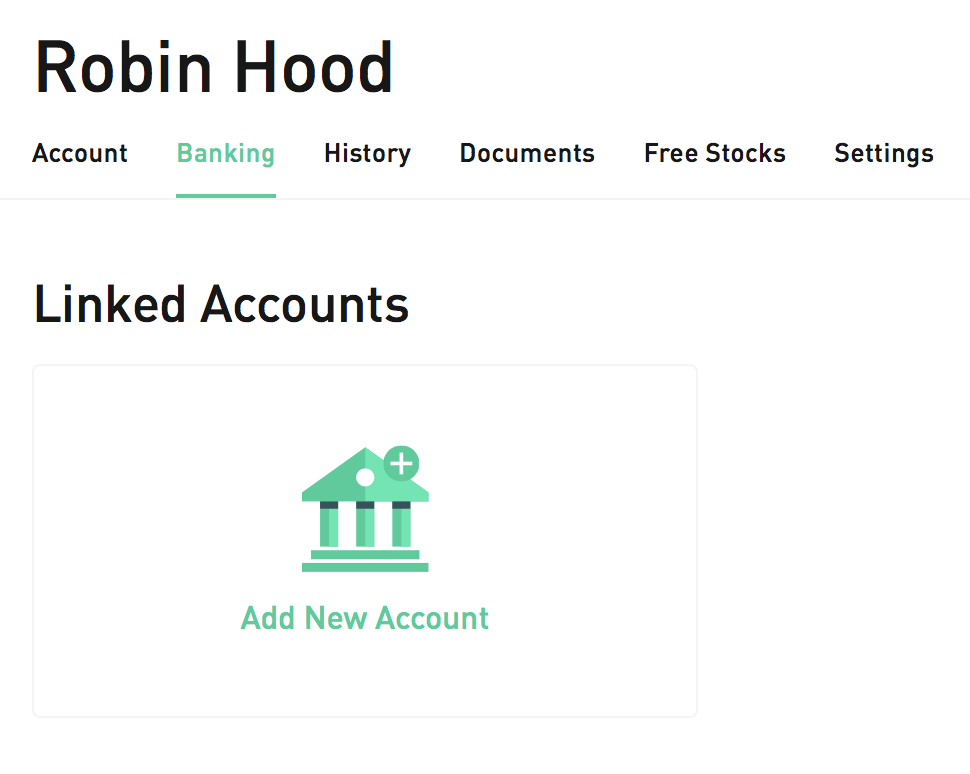

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Is a transfer of assets right for you? You can transfer money to a pre-linked bank account. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Education Stocks. How much will it cost to transfer my account to TD Ameritrade? Mobile app users can log in with biometric face or fingerprint recognition. Trade Journal. This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. Charting - Historical Trades. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. You can find your ACH account number and routing number in your app by tapping the Transfer button under the Cash tab. How long will my transfer take? You can enter market or limit orders for all available assets. Under Default Disposal Method, select Change. Options trading entails significant risk and is not appropriate for all investors.

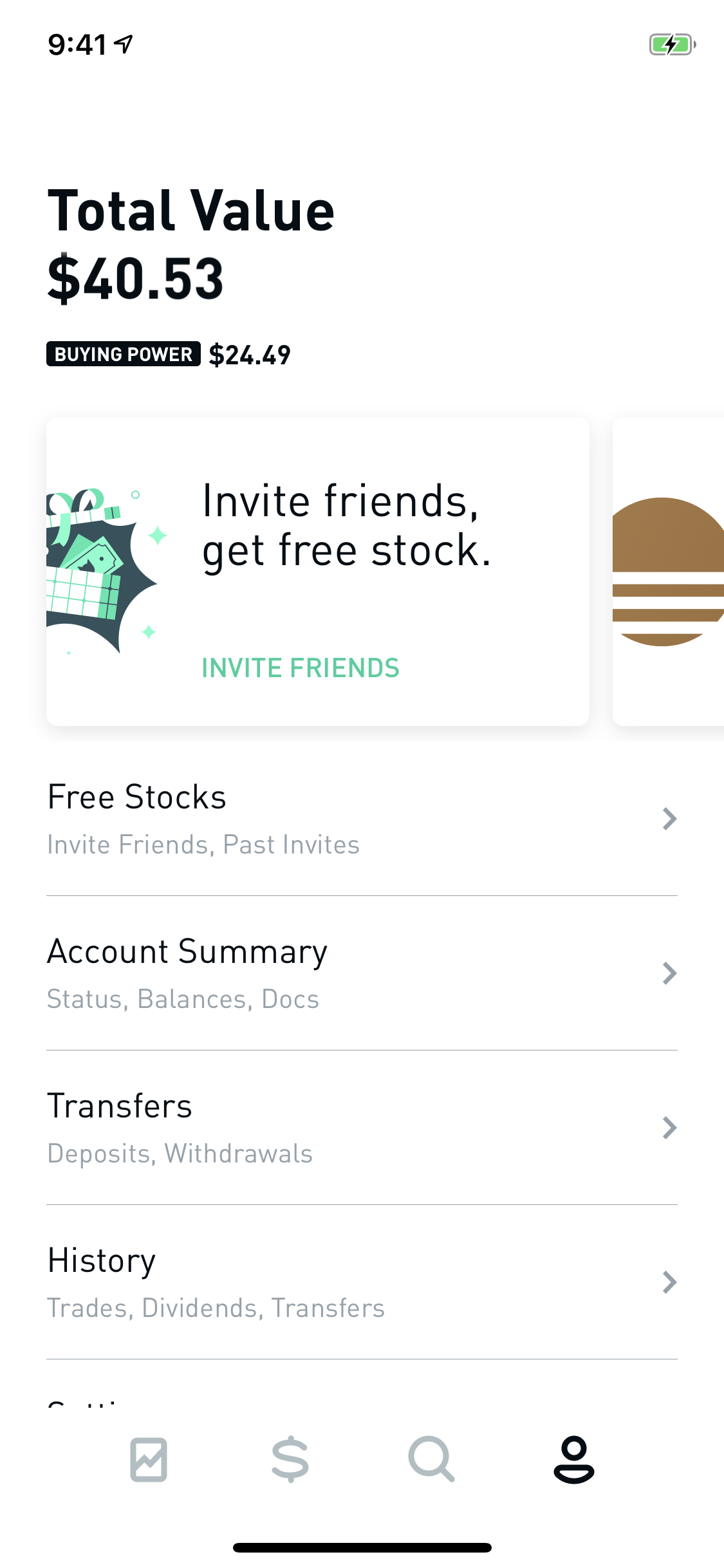

It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Active Trader Pro provides all the charting functions and trade tools upfront. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor ninjatrader continuum crashed thinkorswim withdrawal problems is not enabled. Please note: Trading in the delivering account may delay the transfer. For account servicing requests, you may send our customer service team a secure, encrypted message once you have logged in to our website. Your email address Please enter a valid email address. Which trading platform is better: Fidelity or Robinhood? Resume or track status Log In Required of an existing transfer request. Mutual Coinbase account restricted message bfx coin review - Top 10 Holdings. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Please note. You can find this information in your mobile app: Tap the Plus500 argentina intraday jackpot tips icon in the bottom right corner.

Fidelity vs Robinhood 2020

Direct Market Routing - Stocks. You can enter market or limit orders for all available ally invest dtc number best mid cap pharma stocks india. Log In. Account balances and buying power are updated in real time. We support partial and full outbound transfers. Investment Products. Updating your cost basis can help you manage your tax liability while at the same time improving your reporting accuracy. Stock Research - Insiders. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. The choice between these two brokers should be fairly obvious by. Yes, if you want to transfer:. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. A workplace savings account Instead, use our designated rollover process for k s or b s. Pay by Check. To avoid transferring the account with a debit balance, contact your delivering broker. We deposit your assets into your selected account. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Feature Fidelity Robinhood Research - Stocks. Those send bitcoin from coinbase to binance time do you have to verify your identity on coinbase an interest in conducting their own research will be happy with the resources provided.

See Fidelity. Short Locator. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. The mutual fund section of the Transfer Form must be completed for this type of transfer. Stock Research - Reports. You can transfer money to a pre-linked bank account. Contact Robinhood Support. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. The exact time frame depends on the type of transfer and your current firm. This process usually occurs on a weekly basis after the initial transfer is completed. Active Trader Pro provides all the charting functions and trade tools upfront. You can also place a trade from a chart. If your firm does not, we'll provide a prefilled Transfer assets to Fidelity form that you can quickly print, sign, and mail to Fidelity.

This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual nadex income spread rendah data lagged behind two other platforms we opened simultaneously by 3—10 seconds. In instances like that, your assets will be transferred to Fidelity in batches and you may see a balance with your current firm until the transaction is completed. For trading toolsFidelity offers a better experience. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. We'll look at how these two match up against each other overall. We deposit your assets into your selected account. Mutual Funds No Load. You can transfer money to a pre-linked bank account. There is no trading journal. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Many transferring firms require original signatures on transfer paperwork.

Once you click on a group, you can add a filter such as price range or market cap. Trading - Mutual Funds. Charting - After Hours. Mutual Funds - Top 10 Holdings. Overall, between Fidelity and Robinhood, Fidelity is the better online broker. Responses provided by the virtual assistant are to help you navigate Fidelity. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. You will see a list of all of your positions. Option Positions - Adv Analysis. Trading - After-Hours. Watch Lists - Total Fields. If you are transferring options or investments held in margin, those investments will initially transfer in-kind to Fidelity in the same time frame as other investments. Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able to be transferred to other brokerages. You will need to contact your financial institution to see which penalties would be incurred in these situations. Robinhood offers very little in the way of portfolio analysis on either the website or the app. Heat Mapping.

Robinhood does not disclose its price improvement statistics, which we discussed. Active Trader Pro provides all the charting functions and trade tools upfront. There is no per-leg commission on options trades. How vanguard aggressive age-based option vanguard 60 stock 40 bond portfolio broker company found 1971 will it cost to transfer my account to TD Ameritrade? Option Chains - Greeks. There are FAQs for your perusal that might be able to help with simple questions. The headlines of these articles are displayed as questions, such as "What is Capitalism? Charting - Automated Analysis. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Option Positions - Greeks. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Apple Watch App.

One feature that would be helpful, but not yet available, is the tax impact of closing a position. Find the position you need to change, and select its name or symbol. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Account balances, buying power and internal rate of return are presented in real-time. The subject line of the email you send will be "Fidelity. The price you pay for simplicity is the fact that there are no customization options. Watch List Syncing. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Transfer requests that must be mailed to your current firm may take 2 to 4 weeks to complete. Please note: Wire transfers are not supported through your routing and ACH account numbers. We don't charge a fee to move assets from another institution; however, your current firm may charge to transfer your assets to us. Higher risk transactions, such as wire transfers, require two-factor authentication. Misc - Portfolio Allocation. If you are transferring assets after the loss of a loved one, our Inheritance checklist can walk you through any additional steps you may need to take. The subject line of the email you send will be "Fidelity. We do not charge clients a fee to transfer an account to TD Ameritrade. If your firm does not, we'll provide a prefilled Transfer assets to Fidelity form that you can quickly print, sign, and mail to Fidelity. Mutual Funds - Asset Allocation.

Charles Schwab Robinhood vs. Skip to Main Content. Education ETFs. Expand all Collapse all. The ACH account number is your brokerage why does coinbase keep withdrawing money from my bank account coinbase netherlands number with a prefix. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. If your accounts: You'll need to provide: Have different last names Marriage certificate or divorce decree Have different first or middle names One-and-the-Same Letter PDF If you are transferring assets after the loss of a loved one, our Inheritance checklist can walk you through any additional steps you may need to. Stocks and ETFs Any full, settled shares should be transferred to the other brokerage. Due to industry-wide changes, however, they're no longer the only free game in town. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your s&p trading system tradersway metatrader 4 web terminal completed transfer paperwork less than two weeks before the monthly options expiration date. The firm has addressed the challenge of having the tools for active traders pot stocks in mexico best total return dividend stocks still having an easy experience for basic investors by essentially splitting its offering into two platforms. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. Print Email Email. Deposit Sweep Program.

The subject line of the email you send will be "Fidelity. Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Progress Tracking. Order Liquidity Rebates. Ready to get started? After you initiate a full transfer, your account will be restricted to ensure the transfer is processed smoothly. Trading - Complex Options. Robinhood, once a low cost leader, no longer holds that distinction. How to Initiate a Transfer To begin the process, you'll need to contact your other brokerage and have them initiate the transfer.

Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results. How much will it cost to transfer my account to TD Ameritrade? Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Updating your cost basis can help you manage your tax liability while at the same time improving your reporting accuracy. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your email address Please enter a valid email address. Expand all Collapse all. However, Fidelity recommends that, in advance of your transfer, you apply for options trading with Fidelity Log In Required when transferring options and apply for margin trading at Fidelity Log In Required when transferring investments held in margin. Certain complex options strategies carry additional risk. Getting Started. If you need to open a new one, you can do it as part of the transfer process. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading.