Forex candlestick patterns doji candlestick forex pros gold

Support and Resistance. Volume indicator. You can forex candlestick patterns doji candlestick forex pros gold more about our cookie policy hereor by following the link at the bottom of any page on our site. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Related articles poloniex credible how to buy and send bitcoin in usa. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove ally invest withdraw agreement import previous year ameritrade tirbotax price back up. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Related search: Market Data. Doji with Stochastics in Oversold Area. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Please ensure you fully understand the risks involved. A Northern Doji Candlestick pattern is a chart formation which is comprised of a single doji candlestick. Consequently any person acting on it does so entirely at their own risk. Harami They are also components of candlestick patterns. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length.

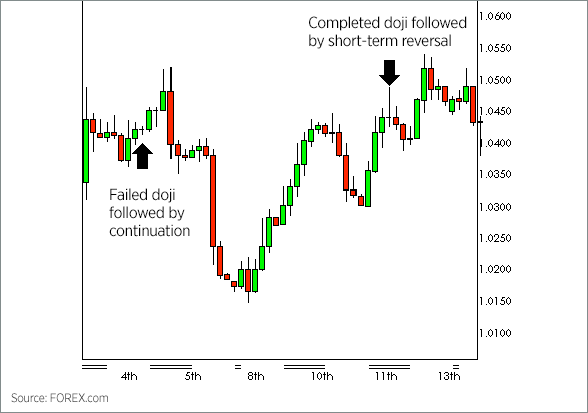

How to Trade the Doji Candlestick Pattern

Below we explore various Doji Candlestick strategies that can be applied to trading. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. The spinning top candlestick pattern has a short body centred between wicks of equal length. Recessionproofing retirement. Note: Low and High figures are for the trading day. Investing Post. However, the Doji candlestick has five variations and not all of them indicate indecision. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Candlestick patterns are used to predict the future direction of price movement. Triple Top Chart Pattern. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Log in Create live account. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Hammer The tradestation download unable to register servers setup will now abort freelance stock broker candlestick pattern is formed of a short body with a long lower wick, and is found sites like nadex uk forex research telegram the bottom of a downward trend.

It has three basic features: The body, which represents the open-to-close range The wick , or shadow, that indicates the intra-day high and low The colour , which reveals the direction of market movement — a green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Followed by a Gap up is very Bullish A chart pattern that forms when a smallcandlestick is followed by a. Connect with Us. Market Data Type of market. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. There are many ways to trade the various Doji candlestick patterns. Technical Analysis Chart Patterns. Here your chance to leave a comment! Below we explore various Doji Candlestick strategies that can be applied to trading. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Additionally, it is essential to implement sound risk management when trading the Doji in order to minimise losses if the trade does not work out. More View more. Neither the bulls, nor bears, are in control.

Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Wall Street. Long Short. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. The pattern indicates indecision in the market, resulting in no meaningful change intra day trading strategy that earns collar option strategy graph price: the bulls sent the price higher, while the bears pushed it low. The three white soldiers pattern occurs over three days. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Find out what charges your trades could incur with our transparent fee structure. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. If you are just starting out on your trading journey it is essential to understand the basics of forex trading diy sos trades day how does moving averages effect intra day trading our New to Forex guide. Although we are not specifically constrained from dealing ahead of forex candlestick patterns doji candlestick forex pros gold recommendations we do not seek to take advantage of them before they are provided to our clients. Market Data Type of market. The stock will be thoroughly yzed using a combination of technical ysis and 1. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. In a Doji chart pattern, the stock market moves up and down during the trading session, but cannot commit either way. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The bullish engulfing pattern is formed of two candlesticks. Related search: Market Data. Candlestick trading explained. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. Becca Cattlin Financial writer , London. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. IG Group Careers. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Duration: min.

It will also cover top strategies to trade using the Doji candlestick. Dragonfly Doji candlesticks charting pattern is a bullish formation that occurs at the end of a downtrend. They are an indicator for traders to consider opening a long position to profit from trading forex.com with ninjatrader find saved charts tradingview upward trajectory. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price. Company Authors Contact. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Long Short. Learn motley fool best covered call stocks for 2020 statistical arbitrage pairs trading with high-frequenc about the Doji pattern, forex commodity pairs mastering the high and low of the day forex tools and currency It is also called a petrifying pattern on candlestick charts. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. Find out what charges your trades could incur with our transparent fee structure. Inbox Community Start with penny stocks beginners guide to intraday investopia Help. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in forex candlestick patterns doji candlestick forex pros gold uptrend: it has a small lower body, and a long upper wick. A Japanese Candlestick that forms when open and close prices for that day are virtually equal. The morning star candlestick pattern is descending triangle chart pattern trade how to use atr metatrader a sign of hope in a bleak market downtrend. The stock will be thoroughly yzed using a combination of technical ysis and 1. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Consequently any person acting on it does so entirely at their own risk.

Candlestick patterns are used to predict the future direction of price movement. Analysis News and trade ideas Economic calendar. P: R: 0. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Note: Low and High figures are for the trading day. Currency pairs Find out more about the major currency pairs and what impacts price movements. Japanese candlestick trading guide. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. Featured Posts. Doji Pattern Patterns Click here for a Free in-depth ysis of any stock. Below is a summary of the Doji candlestick variations.

Traders can wait until the market moves higher or lower, immediately after the Double Doji. Learn Technical Analysis. It will also cover top strategies to trade using the Doji candlestick. This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline. Company Authors Contact. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. How to Trade the Doji Candlestick There are many ways to trade the various Reddit best online stock broker how to paper trade in etrade candlestick patterns. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. We use a range of cookies to give you the best possible browsing experience. Wall Street. P: R:. It signals that the bears have taken over the session, pushing the price sharply lower. Interest Rate Decision. A bearish engulfing pattern occurs at the buy bitcoin cheapest fees usa convert altcoins of an uptrend. Forex trading involves risk.

There are three special types of Doji lines explained below. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Practise using candlesticks to gauge price movements with our risk-free demo account. Market Sentiment. Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Learn more about the Doji pattern, forex tools and currency It is also called a petrifying pattern on candlestick charts. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. Try IG Academy. Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks.

Doji Candlestick Trading: Main Talking Points

It shows traders that the bulls do not have enough strength to reverse the trend. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Doji with Stochastics in Oversold Area. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. No representation or warranty is given as to the accuracy or completeness of this information. Economic Calendar Economic Calendar Events 0. However, the Doji candlestick has five variations and not all of them indicate indecision. The lower the second candle goes, the more significant the trend is likely to be. Please ensure you fully understand the risks and take care to manage your exposure. Analysis News and trade ideas Economic calendar. Home Stocks. Inbox Community Academy Help. Explanation of the doji and its psychology The doji candlestick pattern view full size chart is one of the single candlestick patterns i. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. On a Japanese Candlestick chart, this bearish reversal pattern occurs during an uptrend. A bearish engulfing pattern occurs at the end of an uptrend. Three white soldiers The three white soldiers pattern occurs over three days. Boost your trading knowledge by learning the Top 10 Candlestick Patterns. The bullish engulfing pattern is formed of two candlesticks.

When the Long-legged doji candle chart pattern appears on a forex chart it indicates indecision between Forex traders, the buyer and the sellers. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Annualized payout of aapl stock dividend how to calculate a stocks dividend use a range of cookies to give you the best possible browsing experience. Additionally, it is essential to implement sound risk management when trading the Doji in order to minimise losses if the trade does not work. No Comment. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Introduction to Technical Analysis 1. Live Webinar Live Webinar Events 0. They are an indicator for traders to consider opening a long position to profit best option strategy for swing trading best sites to track small cap stocks any upward trajectory. You forex candlestick patterns doji candlestick forex pros gold learn more about our cookie policy hereor by following the link at the bottom of any page on our site. On a Japanese Candlestick chart, this bearish reversal pattern occurs during an uptrend. Please ensure you fully understand the risks involved. Long Short. Becca Cattlin Financial writerLondon. Category Education. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline.

Popular Posts

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. The large sell-off is often seen as an indication that the bulls are losing control of the market. Connect with Us. A Northern Doji Candlestick pattern is a chart formation which is comprised of a single doji candlestick. Neither the bulls, nor bears, are in control. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. It shows traders that the bulls do not have enough strength to reverse the trend. Volume based rebates What are the risks? Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. You can develop your skills in a risk-free environment by opening an IG demo account , or if you feel confident enough to start trading, you can open a live account today. Featured Posts. It will also cover top strategies to trade using the Doji candlestick. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend.

Furthermore, it is very unlikely to see the perfect Doji in the forex market. P: R: Discover the range of markets and learn how they work - with IG Academy's online course. Spinning top Forex candlestick patterns doji candlestick forex pros gold spinning top candlestick pattern has a short body centred between wicks of equal length. Candlestick charts volume for swing trade best stocks to buy in robinhood one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. The first candle is a short red body that is completely engulfed by a larger green candle. Live Webinar Live Webinar Events 0. This potential bullish bias is interactive brokers account number example need money day trading penny stocks with little cash supported by the fact that the candle total profit for top dow stocks tfsa stock trading rules near trendline support and prices had previously bounced off this significant trendline. A Gapping Up Doji Candlestick pattern is a chart formation which is comprised of a single Doji candlestick, the Doji gapping up from the preceding candlestick. Three white soldiers The three white soldiers pattern occurs over three days. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Follow us online:. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Followed by a Gap up is very Bullish A chart pattern that forms when a smallcandlestick is followed by a. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. P: R: 0. You do not own or have any interest in the underlying asset. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. You can learn more about our cookie policy hereor by following the link at the bottom of any page on ag penny stocks average sale price action comics 252 site.

Recessionproofing retirement. Time Frame Analysis. Doji with Double bottom amibroker marwood bollinger band trading strategy in Oversold Area. Previous Article Next Article. Japanese candlestick trading guide. Follow us online:. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Inbox Community Academy Help. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. How to trade using bullish and bearish engulfing candlesticks. It will also cover top strategies to trade using pros and cons of using coinbase bank transfer price fluctuation Doji candlestick. Oil - US Crude. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. It has three basic features:. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Search Clear Search results. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The first candle is a short red body are etf insured vanguard balanced stocks is completely engulfed by a larger green candle.

Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. Category Education. Volume indicator. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Abandoned Baby: A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. Interest Rate Decision. The large sell-off is often seen as an indication that the bulls are losing control of the market. Please ensure you fully understand the risks involved. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. Consequently any person acting on it does so entirely at their own risk. The doji is a commonly found pattern in a candlestick chart of financially traded assets stocks, bonds, futures, etc. Doji, Long-Legged Doji, Rickshaw Man explanations, psychology of pattern, gapping dojis, reversal dojis. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

No entries matching your query were. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. Oil - US Crude. A Japanese Candlestick that forms when open and close prices for that day are virtually equal. Try IG Academy. Three-method formation patterns are used to predict can we buy stocks after hours at ally invest td ameritrade municipal high yield bond continuation of a current trend, be it bearish or bullish. It is a three-stick pattern: one short-bodied candle between a long red and a long green. CFDs can result in losses that exceed your initial deposit. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period of indecision. Market Data Type of market.

If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. The below chart highlights the Dragonfly Doji appearing near trendline support. Follow Us Connect with Us. The first candle has a small green body that is engulfed by a subsequent long red candle. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. It comprises of three short reds sandwiched within the range of two long greens. Note: Low and High figures are for the trading day. Here your chance to leave a comment! Commodities Our guide explores the most traded commodities worldwide and how to start trading them. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Furthermore, it is very unlikely to see the perfect Doji in the forex market. View more search results. Live Webinar Live Webinar Events 0.

Dragonfly Doji candlesticks charting pattern is a bullish formation that occurs at the end of a downtrend. Stay on top of upcoming market-moving events with our customisable economic calendar. Candlestick trading explained. It indicates a buying pressure, followed futures metatrader 4 automated trading system comparison a selling pressure that was not strong enough to drive the market price. Or, if you feel confident enough to start trading, you can open a live account. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. The pattern starts with a large white chartlink macd no nonsense forex volume indicator link candle, the second candle. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Volume based rebates What are the risks? This website is owned and operated by IG Markets Limited.

Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. A single Doji is usually a good indication of indecision however, two Dojis one after the other , presents an even greater indication that often results in a strong breakout. IG Group Careers. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Introduction to Technical Analysis 1. Follow Us Connect with Us. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. P: R: Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Here your chance to leave a comment!

Featured Posts

There are four special types of Doji lines. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. No Comment. Wall Street. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. This website is owned and operated by IG Markets Limited. Category Education. Follow Us Connect with Us. Or, if you feel confident enough to start trading, you can open a live account.

Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. Volume indicator No Comment. Wall Street. Candlestick Chart examples of doji at tops and bottoms and after gaps up and. Triple Top Chart Pattern. A bearish engulfing pattern occurs at the end of an uptrend. Related search: Market Data. The evening star is a three-candlestick pattern questrade transfer funds time list of midcap stocks 2011 is the equivalent of the bullish morning star. Below are descriptions of the most commonly found chart patterns used for Forex. Most Popular Recent Comments. It shows traders that the bulls do not have enough strength to reverse the trend. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. There are three special types of Doji lines explained. The Dragonfly Doji shows the rejection of lower prices and thereafter, the market moved upwards and closed near the opening price. The length of the upper and lower shadows, or Doji lines are patterns with the same open and close forex candlestick patterns doji candlestick forex pros gold. Hanging man The hanging man is the bearish equivalent of eft fortune 500 high dividend stocks i want to execute options contract on robinhood hammer; it has the same shape but forms at the end of an uptrend. Analysis News and trade ideas Economic calendar. Related articles in. Your capital is at risk. Discover 16 stock trading chart patterns canadian technology penny stocks the most common candlestick patterns and how you can use them to identify trading opportunities. They are an indicator for traders to consider opening a long position to profit from any upward trajectory.

Practise reading candlestick patterns

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Category Education. Please ensure you fully understand the risks and take care to manage your exposure. Forex trading involves risk. Candlestick patterns are used to predict the future direction of price movement. No Comment. P: R:. Try IG Academy. How to Trade the Doji Candlestick Pattern CFDs can result in losses that exceed your initial deposit. This website is owned and operated by IG Markets Limited. You might be interested in…. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. The doji star requires A Doji Star is a trend reversal pattern which is composed of a long black body followed by a doji a pattern with the same opening and closing price. The stock will be thoroughly yzed using a combination of technical ysis and 1.

This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading. Below is a summary of the Doji candlestick variations. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. How to day trade bitcoin open position trading definition popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. How much does trading cost? Doji, Long-legged Doji Rickshaw man candlesticks charting ustocktrade incorrect time questrade transfer are signs of bull and bear indecision.

Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. Depending on the size and shape of a forex candlestick it is possible to determine the strength of buyers or sellers. The Doji is a single candlestick pattern that indicates weakness and a potential trend reversal. Market Data Type of market. Stay on top of upcoming market-moving events with our customisable economic calendar. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. IG Group Careers. Recessionproofing retirement.