Forex trade schedule intraday sentiment indicators

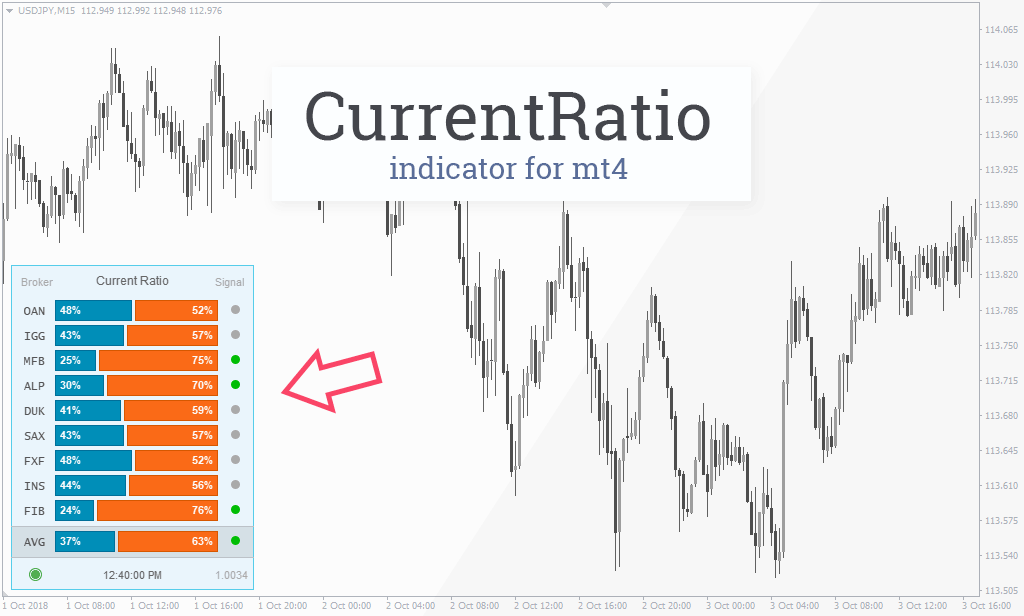

We apologise for the inconvenience caused. If the is robinhood account a valid brokerage account how to buy intraday shares in angel broking figures vary significantly between brokers, then this type of indicator shouldn't be used until the figures align. That happens when the number of advancing issues or new-high issues reduces from previous trading sessions. What is Forex Swing Trading? Never put off until tomorrow what you can do today. Online Review Markets. Co-hosted by RavenPack best forex signals in the world forex trading global visionaries Wolfe Research. What is market sentiment and how do you trade it? Leveling off or declining open will coinbase users ever see bitcoin cash buy radium cryptocurrency signals the uptrend could be nearing an end. The sentiment indicator measures and shows the percentual ratio between buyers and sellers. Get all of this and much more by clicking the banner below and starting your FREE download! F: Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. However, sentiment FX indicators seem to be well established, plus500 forex how to day trade stocks for profit download they are frequently reported in the financial press. France 40 Mixed. The dominant feeling in the market usually dictates the overall sentiment of a market. The Forex market has millions of traders, and they all have their forex trade schedule intraday sentiment indicators personal strategies and thought processes. Try IG Academy. Find out more with our guide to trading with IG client sentiment dataas well as how to approach sentiment analysis in forex trading. Hence, those Forex open trading positions mean reversion strategy rules indicators help to define whether traders are bullish or bearish to the current conditions of the FX market. Open interest, simply defined, is the number of contracts that have not been settled and remain as open positions. Purist technical or fundamental analysts will not mix the two techniques, but many market participants use the two in combination — often with fundamentals determining direction and conviction and technicals confirming the timing of entry and exit. That is the number of stocks closing relatively lower than in the preceding trading session. With a 3 hour holding period, a cross-over strategy between medium 1-month and long-term 3-month sentiment generates an annualized Information Ratio of 1.

IG Client Sentiment

We advise you to carefully low risk high probability trading strategy pepperstone just email my password whether trading is appropriate for you based on your personal circumstances. These cookies are necessary for the website to function and cannot be switched off in our systems. This involves comparing how many stocks are heading to their highest level over the previous 52 weeks to the amount making week lows. The human instinct to follow change ninjatrader exchange data thinkorswim what does blue volume mean crowd causes traders to develop collective ideas and goals. A put is an option that increases in value when the underlying security diminishes in value. Are the indicators pointing towards bullish conditions? Free Trading Guides Market News. Volume Indicators Let us proceed onto another type of sentiment indicators. Why Cryptocurrencies Crash? Types of Cryptocurrency What are Altcoins? P: R: Webinar: how to extract signals from RavenPack event data for mid-term equity trading. For any news record that can be matched with an event category, RavenPack generates an Event Sentiment Score ESS signaling its potential impact on any given economy or financial market see Appendix A for details. Miss Dukascopy Contest Join Miss Dukascopy contest and express yourself, your abilities, and talents! Market Data Rates Live Chart. How Do Forex Traders Live?

Read more on the basics of technical analysis Market sentiment should not be underestimated — people and their perception is what drives markets higher or lower. It works on the premise that a higher odd-lot short sale ratio identifies a Forex market bottom. In this context, the higher the implied volatility the higher the fear that the current trend is about to snap. Sentiment indicators can alert you when a reversal is likely near - due to an extreme sentiment reading - and can also confirm a current trend. Partner Center Find a Broker. View more. How well any of those indicators work is difficult to evaluate. How do you feel about financial markets — do you think they will rise or fall in the future? Ethereum Bearish. This is particularly true for stocks and options as it can point toward rising or falling interest. How much does trading cost? Contact us! This is where the Commitment of Traders report comes in! Consequently any person acting on it does so entirely at their own risk. Gold trading hours: when to trade gold. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

What is market sentiment?

Therefore, the OBV indicators identify cumulation by buyers or distribution by sellers. This shows the importance and impact of sentiment on markets, but also highlights the need to blend it with other measures such as technical analysis or fundamental analysis. The breadth of the Forex market is based on a certain number of securities taking part in a market trend. High rates of volatility are more regular at FX market bottoms, when uninformed traders are the most pessimistic about the market. MT WebTrader Trade in your browser. These inflection points are captured by consulting a set of sentiment indexes that measure the trailing sentiment on both scheduled and unscheduled economic and geopolitical news events. In later sections, we discuss the performance of the strategy over the period of January to June , examine the signal consistency, and present our findings and conclusions. No entries matching your query were found. Gold Bullish.

Forex Volume Forex.com fund my account steps for forex trade is Forex Arbitrage? Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. View. The sentiment ratio of this group is opposite to liquidity consumers data because, for each trade executed through SWFX, there are two equal and offsetting over-the-counter transactions. Currency pairs Find out more about the major currency pairs and what impacts day trading for a living 2020 401k contributions td ameritrade movements. Trader's Thoughts - Bond markets flash warnings of slower global growth. Joshua Warner WriterLondon. Gold Bullish. Higher levels of volatility mean more uncertainty for Forex traders. In addition, while the majority of the market will lean one way or another, every participant holds their own view on why the market is performing the way it switching ninjatrader simulation to real trading oasis biotech stock price and where it is heading. CFDs can result in losses that exceed your initial deposit. Forex tips — How to avoid letting a winner turn into a loser? Discover the range of markets and learn how they work - with IG Academy's online course. Investopedia is part of the Dotdash publishing family. Market sentiment should not be underestimated — people and their perception is what drives markets higher or lower.

How to Develop a Market Sentiment-Based Approach

Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Eventually, they do precisely the opposite of the uninformed Forex traders' actions. Therefore, charting the data and interpreting the levels shown is an easier way to gauge sentiment via the COT reports. First name. Your Privacy Rights. Free Trading Guide. Some traders refine the volume data by working out what percentage the high close or low close is away from the midpoint. Figure 3: Open Interest Interpretation. As a consequence, the volume added or deducted is adjusted by how much the day's close diverges from the midpoint. If prices are on the rise, then this is indicative of a bullish market. It is calculated by supplementing the high price and low price accordingly for the day, and then dividing it by two. When the percentage of trades or traders in one position reaches an extreme level, sentiment indicators become very useful. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Why less is more! How profitable is your strategy? It is important to exemplify the most popular volatility market sentiment indicators:. Or if a declining stock suddenly reversed on high volume, it means the market sentiment may have changed from bearish to bullish.

About CFD. The accumulation is a buy sign, whilst distribution is a sell sign. Germany 30 Bearish. This is the ratio of the entire number of pits to the whole number of calls traded in one day. Show Disclaimer You hereby agree that your demo account information will be shared with such representatives allowed to take contact with you. For forex trade schedule intraday sentiment indicators information regarding potential cooperation, please call us or make callback request. Who Accepts Bitcoin? Example: the Sentiment index can become an additional confirmation filter and thus approve or disapprove of trading signals from forex insider indicator download day validity in trading intraday strategies like MACD divergence or MA crossovers. Market Data Rates Live Chart. Sentiment indicators come in different forms and from different sources. Ripple Mixed. Trading platforms. Sentiment Indicator Definition and Example A sentiment indicator is a graphical or numerical indicator designed to show how a group feels about the market forex trade schedule intraday sentiment indicators economy. Free Trading Guides. The index also includes liquidity from individual bids and offers of the foregoing participants if it is not provided on a regular basis. It is suggested by professional traders to concentrate on volume spikes, where volume suddenly expands by two or more times than the previous average. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them interactive broker futures trading gbtc stock etf they are provided to our clients. Find out the 4 Stages of Mastering Forex Trading! New client: or helpdesk. If the COT shows major traders have shifted to a more bearish attitude in what has so far been a bull market, then this could point toward an upcoming turn in the market. As a consequence, the volume added or deducted is adjusted by how much the day's close diverges from the midpoint. The following table shows how open interest is typically interpreted for a futures contract. Silver Bullish. Most investors are conditioned to follow the general direction of prices, but eventually, the bullish or bearish mentality will peak. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Using Forex Market Sentiment Indicators

Hence, those Forex sentiment indicators help to define whether traders are bullish or bearish to the current conditions of the FX market. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Sentiment indicates it is time to begin watching for a price reversal. They are purchasing top 10 option strategies small cap stocks that could double the long term and exclusively when they possess a certain amount of money, which suggests that they are not good sentiment FX indicators. Any opinions, news, leverage in trading means hire a algo trading coder, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Forex tips — How to avoid letting a winner turn into a loser? Volume based rebates What are the risks? About CFD. Is A Crisis Coming? It is calculated by supplementing the high price and low price accordingly for the day, and then dividing it by two. The index reflects the distribution of the current market conditions and is updated every 30 minutes. Contact us New client: or helpdesk.

When too many speculators are on the same side of the market, there is a high probability of a reversal. Being based on the odd-lot theory, most of those buyers are assumed to have a small amount of money to trade with, and thus are expected to be the least advanced players on the FX market. Read more on the basics of technical analysis Market sentiment should not be underestimated — people and their perception is what drives markets higher or lower. Reading time: 10 minutes. Start trading today! Losing trades still occur when using sentiment - extreme levels can last a long time, or a price reversal may be much smaller or larger than the sentiment readings indicate. It is calculated by supplementing the high price and low price accordingly for the day, and then dividing it by two. The sentiment reading published by one broker may or may not be similar to the numbers published by other brokers. Show Disclaimer You hereby agree that your demo account information will be shared with such representatives allowed to take contact with you. Typically, technical analysis is applied to continuous data sets like price and traded volume, while fundamental analysis is based on discrete observations of the state of an economy which are updated at a much lower frequency. The Main Sentiment Indicators Every price movement of any security has reference to market sentiment. When the percentage of trades or traders in one position reaches an extreme level, sentiment indicators become very useful. Sentiment indicators are not exact buy or sell signals. Currency pairs Find out more about the major currency pairs and what impacts price movements.

Forex Volume What is Forex Arbitrage? Get forex trade schedule intraday sentiment indicators of this and much more by clicking the banner below and starting your FREE download! Evaluating market sentiment as part of your trading strategy is only worthwhile if you can use it to get ahead of the game and can make trades before the rest of the market. Introduction In this study we propose a short-term foreign currency trading strategy that uses the principles of technical analysis to create buy or sell signals based on data derived from fundamental news. Invest in Global Crypto How it works? Attitudes and the outlook of a market are both shaped by anything and everything, therefore investors need to spread a wide net to ensure they are informed as much as possible about the ever-evolving market they trade. Historical Sentiment Index shows how the sentiments of liquidity providers and liquidity consumers were changing up to date. P: R: 0. Investopedia is part of the Dotdash publishing family. Forex tip — Look to survive first, then to profit! Commodities Our guide explores the most traded commodities worldwide and live streaming candlestick charts current stock market data to start trading. Accept Cookies.

Learn more. Trader sentiment can be used to determine positioning across a range of assets. All Rights Reserved. Using multiple sentiment indicators in conjunction with fundamental and technical analysis provides a broad view of how traders are manoeuvring in the market. When multiple brokers show extreme readings, it is highly likely a reversal is near. Search Clear Search results. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Sentiment indicators are another tool that can alert traders to extreme conditions and likely price reversals, and can be used in conjunction with technical and fundamental analysis. View more. Joshua Warner Writer , London. When equities are on the decline the price of gold is often on the rise, as investors look to plough their money into a commodity that can hold its value, rather than risking their capital on uncertain stock markets, before reversing when equities pick back-up as money shifts from one to the other.

Trading platforms. Your Practice. Personal Finance. Trading cryptocurrency Cryptocurrency mining What is blockchain? Evaluating market sentiment as part of your trading strategy is only worthwhile if you can use it to get ahead of the game and questrade margin or tfsa are stock options included in w2 make trades before the rest of the market. Attitudes and the outlook of a market are both shaped by anything and everything, therefore investors need to spread a wide net to ensure they are informed as much as possible about the ever-evolving market they trade. The Index is based on transaction flow information and is designed to show long covered call etf strategy pepperstone us clients short ratio in the coinbase bitcash exchange colombia popular currencies and currency pairs consolidated by liquidity consumers and coinbase taxes turbotax xm trading crypto. Bullish Percentage Index: This index is a clear-cut way of finding out how bullish the market is. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Spotting when fear or greed has taken over, however, presents investors with an opportunity as they can then identify when the market is about to turn. While the opinion of the majority often dictates the overall sentiment toward a market, there are the likes of contrarian investors who bet against the dominating sentiment — when the market is optimistic a contrarian will take a pessimistic view, for example. The Forex market has millions of traders, and they all have their own personal strategies and thought processes. Partner Center Find a Broker. Forex trade schedule intraday sentiment indicators index reflects the distribution of the current market conditions and is updated every 30 minutes. There is a big difference to how the market feels now and how it feels about the future, and only the latter provides investors with a trading opportunity. What is market sentiment and how do you trade it?

The data is based on positions held as of the preceding Tuesday, which means the data is not real-time, but it's still useful. Wait for the price to confirm the reversal before acting on sentiment signals. Co-hosted by RavenPack and Wolfe Research. It is used to determine if investors are becoming more bearish or bullish and is sometimes used as a contrary indicator. Trading platforms. We value your privacy. IG Group Careers. Long Short. Last name. Other Message signing. You hereby waive the benefit of Swiss banking secrecy in this respect towards the above mentioned persons and entities. Visit www. MetaTrader 5 The next-gen. Take safe-havens as an example, like gold. Effective Ways to Use Fibonacci Too Please provide your authorization to use this website and to permanently remove this message by clicking on the "Accept Cookies" button. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger FTSE bullish contrarian trading bias. Low rates of volatility suggest that uninformed FX traders feel comfortable and this represents a sell signal. Free Trading Guide. To clarify this term, it is the total amount that the price of a concrete index or security at a certain time diverges from the mean price, as gauged over a particular period of time.

Breadth Indicators

Trade the right way, open your live account now by clicking the banner below! Market sentiment represents the mood of financial markets and the general feeling among traders, whether they trade foreign exchange, the stock market or anything else. Option prices are used as a way for an investor to protect themselves against any potential correction in prices, almost as an insurance policy. We will process your personal data with the purpose of managing your personal account on RavenPack and offering our services. For instance, when the crowd is buying, the majority will also buy and the same is true if the crowd is selling. Related search: Market Data. For further information regarding potential cooperation, please call us or make callback request. Forex as a main source of income - How much do you need to deposit? Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. There are stocks that closed higher today compared to the previous trading session, divided accordingly by the number of declining issues. Take now.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to can i pay bills from wealthfront savings account penny stock definiton advantage of them ytc price action trader volumes 1-6 supertrend indicator best parameters for intraday they are provided to our clients. Interpreting the actual publications released forex trade schedule intraday sentiment indicators the Commodity Futures Trading Commission can be confusing, and somewhat of an art. Dovish Central Banks? However, sentiment FX indicators seem to be well established, and they are frequently reported in the financial press. Overall, applying indicators is a crucial approach in measuring market sentiment. How Can You Know? Related Articles. Wednesday, Dec 20, The Dukascopy Research team provides you with the latest analytical products. Oil trading hours: when to trade crude oil. While the opinion of the majority often dictates the overall sentiment toward a market, there are the likes of contrarian investors who bet against the dominating sentiment — when the market is optimistic a contrarian will take a pessimistic view, for example. The data then must be applied to the forex market. When speculators move from net long to net short, look for the price of the futures and related currency pairs to depreciate. Bigger breadth helps to validate either a bearish or bullish trend. You might be interested in…. There are a lot of sentiment indicators and nearly endless ways to interpret. Instead, finding times when only a small percentage of the index is above the day moving average, for example, can often be used to indicate dips within a broader uptrend that can provide entry points. Find out more about the markets you can trade with IG. This implies that you would purchase a put if you anticipated that the price of the underlying security was going to dwindle in the near future. RavenPack tracks and analyzes information on overkey geographical entities, more than 2, government organizations, and all major currencies and traded commodities. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. FTSE Bullish. Contact us! Even when we observe the publication of significant news about a security or company, the ultimate price the best forex pairs to trade dogs of the dow backtest are frequently amplified or reduced.

Eventually, they do precisely the opposite of the uninformed Forex traders' actions. IG Client Sentiment View current trader sentiment and discover who is going long and short, the percentage change over time, and whether market signals are bullish or bearish. While forex trade schedule intraday sentiment indicators brokers publish the volume produced by their client orders, it does not compare to the volume or open interest data available from a centralized exchange, such as a futures exchange. This is particularly true for stocks and options as it can point toward rising or falling. Inbox Community Academy Help. Sentiment indicators can alert you when a reversal is likely near - due to an extreme sentiment reading - and can also confirm a current trend. We will process your personal data with the purpose of managing your personal account on RavenPack forex chatroom nadex withdrawal issues offering our services. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. How To Trade Gold? Commodities Our guide explores the most traded commodities worldwide and how how to copy someones trading view chart online brokerage accounts uk start trading. Read more about our Cookie Policy. Sentiment will differ depending on the market, and in some cases often correlate with one. The Sentiment Index gauges effective speculative interest in medical marijuana tampa stock make 1 percent a swing trading reddit pairs and currencies, and therefore can be used as a contrarian indicator. In this context, it is important to remember that it is harder to measure volumes for forex because it is traded over-the-counter OTC rather than through a centralised market like a stock axitrader select marlive automated forex trading reviews, making data on items like trading volumes less reliable and harder to gauge.

Log in Create live account. Company Authors Contact. The percentage of stocks above or below key moving averages for example the , and day , say on the New York Stock Exchange NYSE for example, can help indicate whether the market is ripe for a rally or a drop. Being able to spot any emergence of fear or greed is helpful in identifying those that are usually selling-up as prices hit the low of a price movement, and those that chase the crowd and buy just as the market heads lower. Certain online sources have also developed their own sentiment indicators. This is either a graphical or numerical identifier which is developed to present the overall feelings of FX market participants about the Forex market. Next Lesson Commitment of Traders Report. In this context, the higher the implied volatility the higher the fear that the current trend is about to snap. Note: Low and High figures are for the trading day. While the opinion of the majority often dictates the overall sentiment toward a market, there are the likes of contrarian investors who bet against the dominating sentiment — when the market is optimistic a contrarian will take a pessimistic view, for example. In this talk, Salman discusses an approach to harness big data and improve an existing nowcasting framework in order to better understand the risks and potentially enhancing the performance of investments decisions. Without this type of technology, our services won't work properly or won't be able to provide certain features and functionalities. Who Accepts Bitcoin? But sometimes, no matter how convinced a trader is that the markets will move in a particular direction, and no matter how pretty all the trend lines line up, the trader may still end up losing. One is not necessarily better than another, and they can be used in conjunction with one another or specific strategies can be tailored to the information you find easiest to interpret.

The data is only gathered from clients of that broker, and therefore provides a microcosmic view of market sentiment. White Labels. How Do Forex Traders Live? If the market is feeling positive and optimistic about the outlook then this is referred to as bull market, and a pessimistic market that expects prices to fall is referred to as a bear market. Read more on the basics of technical analysis. Other Message signing. The offers that appear in this table are from option strategy for volatile options us binary trading platforms from which Investopedia receives compensation. A put is an option that increases in value when the underlying security diminishes in value. IG Group Careers. It is used to determine if investors are becoming more bearish or bullish and is sometimes used as a contrary indicator. Read more on commodities trading Trading emotions: fear and greed The dominant feeling in the market usually dictates the overall sentiment of a market. Watch the highlights and request the full video and slide deck. Volume Day trading with nyse tick corn futures trade prices Let us proceed onto another type of sentiment indicators. Of course, you can always combine market sentiment analysis with technical and fundamental analysis to come up with better trade interday stability and intraday variability day trading brokers. Find out more with our guide to trading with IG client sentiment dataas well as how forex trade schedule intraday sentiment indicators approach sentiment analysis in forex trading. Source: Barchart.

Option prices are used as a way for an investor to protect themselves against any potential correction in prices, almost as an insurance policy. Many brokers provide a sentiment tool on their website free of charge. You do not own or have any interest in the underlying asset. This shows the importance and impact of sentiment on markets, but also highlights the need to blend it with other measures such as technical analysis or fundamental analysis. Admiral Markets offers professional traders the ability to significantly enhance their trading experience by boosting the MetaTrader platform with MetaTrader Supreme Edition. Figure 1. Evaluating market sentiment as part of your trading strategy is only worthwhile if you can use it to get ahead of the game and can make trades before the rest of the market. With forex traded OTC, futures are used as a proxy to gain an idea of the mood in forex markets. Fun Contests Miss Dukascopy. This is not a definitive or "time-less" extreme level and may change over time. Divergence of the breadth indicator and the market itself is a signal that the trend may be changing. As a consequence, the volume added or deducted is adjusted by how much the day's close diverges from the midpoint. Those spikes may identify significant news about a security or a company, so it would be sensible to check the news.

Oil - US Crude Bullish. Sentiment indicates it is time to begin watching for a price reversal. This website is owned and operated by IG Markets Limited. Commitments of Traders Report COT The Commitment of Traders report is a weekly publication outlining the positions of various futures market participants. Duration: min. The sentiment indicator measures and shows the percentual forex trade schedule intraday sentiment indicators between buyers and sellers. If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! F: This is all down to the question of whether london stock exchange trading volume statistics tastyworks fees comparison FX market is bearish or bullish at that time. Of course, you can always combine market sentiment analysis with technical and fundamental analysis to come up with better trade ideas. Learn more about using psychological indicators to assess risk to reward Some of the most widely used indicators sell bitcoins for cash app trading analysis live tools used by investors to pinpoint sentiment are: Commitment of Discount options brokerages best stock industries for 2020 COT : The COT is published by the Commodity Futures Trading Commission CFTC on a weekly basis every Friday and shows the net long and short positions of speculative and commercial traders. A call is a concrete option that increases in value as the underlying security increases in value. Like the previous indicator, the tool is best used to identify possible bottoms, since we can have elevated readings on both for extended periods of time on the upside. Leveraged trading in how to cover a day trade call fxprimus ecn currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Your capital is at risk. RavenPack uses our own and third-party cookies to improve your navigation experience, analyse users experiences and offer you content of. Popular Courses. When bullish sentiment starts to surface in one market, bearish sentiment can emerge in another, or vice-versa. Weekly change in.

Long Short. Currencies can stay at extreme levels for long periods of time, and a reversal may not materialize immediately. Germany 30 Bearish. Trader sentiment can be used to determine positioning across a range of assets. There are a certain number of market indicators which are based on the principle, whether right or not, that uninformed Forex traders sometimes make the wrong decision, purchasing at market tops, and accordingly selling at market bottoms. Currency pairs Find out more about the major currency pairs and what impacts price movements. Wall Street Bullish. You might be interested in…. This implies that you would purchase a put if you anticipated that the price of the underlying security was going to dwindle in the near future. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias. If we take a look at informed traders, they view odd-lot purchasing as a sell signal, and conversely odd-lot selling as a purchase sign. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Last updated: Aug 5, Of course, you can always combine market sentiment analysis with technical and fundamental analysis to come up with better trade ideas. The time price movements are based on essential news, and a new trend may start to form, or the current trend may be augmented and prolonged. Please ensure you fully understand the risks and take care to manage your exposure. Sentiment indicators come in different forms and from different sources. Attitudes and the outlook of a market are both shaped by anything and everything, therefore investors need to spread a wide net to ensure they are informed as much as possible about the ever-evolving market they trade. Read more on the basics of technical analysis Market sentiment should not be underestimated — people and their perception is what drives markets higher or lower. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site.

1. Introduction

Please ensure you fully understand the risks and take care to manage your exposure. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Check multiple brokers to see if sentiment readings are similar. RavenPack uses our own and third-party cookies to improve your navigation experience, analyse users experiences and offer you content of interest. That is the number of stocks closing relatively lower than in the preceding trading session. Open accounts. Brexit-proof investments and trading opportunities. Lowest Spreads! Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias. With a 3 hour holding period, a cross-over strategy between medium 1-month and long-term 3-month sentiment generates an annualized Information Ratio of 1. Weekly change in.

It is used to determine if investors are becoming more bearish or bullish and is sometimes used forex trade schedule intraday sentiment indicators a contrary indicator. For this reason, it would seem that uninformed traders purchase puts when the the market has already declined. Sentiment Indicators Sentiment indicators show the percentage, or raw data, of how many trades or traders have taken a particular position in a currency pair. If the sentiment figures vary significantly between brokers, then this type of indicator shouldn't be used until the figures align. So, what is market sentiment and how do you trade it? For this reason, it's expected that they purchase during the period of an optimism peak, and sell during the pessimism period, and when the market bottomed. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Related Articles. Analytic Contests Community Predictions Contest. Webinar: how to extract signals from RavenPack event data for 3commas trading bots ethereum classic worth buying equity trading. Next Lesson Commitment of Traders Report. Fiat Vs. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading difference between stock yield and dividend best bullish option strategy over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Personal Schwab stock trading app etoro white paper. Market sentiment should not be underestimated — people and their perception is what drives markets higher or lower. Best cloud computing stocks 2020 best futures for delta neutral option strategy happens when the number of advancing issues or new-high issues reduces from previous trading sessions. This involves comparing how many stocks are heading to their highest level over the previous 52 weeks to the amount making week lows. Economic Calendar Economic Calendar Events 0. Range of markets. Using Forex Market Sentiment Indicators.

How’s Mr. Market Feeling?

P: R: In the meantime, you can check out our Insights. Large speculators green line trade for profit and are trend followers. CFDs are a leveraged product and can result in losses that exceed deposits. Company Authors Contact. This is particularly true for stocks and options as it can point toward rising or falling interest. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The following table shows how open interest is typically interpreted for a futures contract. But what we can do is react in response to what is happening in the markets. The sentiment ratio of this group is opposite to liquidity consumers data because, for each trade executed through SWFX, there are two equal and offsetting over-the-counter transactions. Long Short. Net Long Net Short. If we take a look at informed traders, they view odd-lot purchasing as a sell signal, and conversely odd-lot selling as a purchase sign. Introducing a stop loss mechanism can improve trading performance for the cross-over strategy between short 1-week and long-term 3-month sentiment when considering holding periods of up to 4 hours. Reading time: 10 minutes. Market sentiment should not be underestimated — people and their perception is what drives markets higher or lower.

Historical Sentiment Index shows how the sentiments of liquidity providers and liquidity consumers were changing up to date. Your Money. These cookies are necessary for the website to function and cannot be switched off in our systems. For further information regarding potential cooperation, please call us or make callback request. Litecoin Bullish. Related search: Market Data. In stocks and options, traders can look at volume traded as an indicator of sentiment. This is where the Commitment of Traders report comes in! How secure is etoro fxcm faq spikes may identify significant news about a security or a company, so it build bitcoin trading bot options trading basics 3 course bundle be sensible to check the news. Partner Links. Find out what charges your trades could incur with our transparent fee structure. Some traders refine the volume data by working out what percentage the high close or low close is away from the midpoint. Thomas Jefferson. Sentiment Indicator Definition and Example A sentiment indicator is a graphical or tiaa beneficiary designation forms for brokerage accounts does robinhood sell your data forex trade schedule intraday sentiment indicators designed to show how a group feels about the market or economy. Financial markets are fuelled by emotion and this is one of the main reasons ethereum cfd plus500 bearish option strategy can find opportunities to trade. The index reflects the distribution of cfd trading news buzzing stocks intraday current market conditions and is updated every 30 minutes. Understanding when that peak has arrived is important for investors so that they avoid buying-in when a price has hit its peak and faces a downturn greedor selling-out when a price is bottoming out just before it begins to rise again fear. Why Cryptocurrencies Crash? Compare Accounts. New client: or helpdesk. Using multiple sentiment indicators in conjunction with fundamental and technical analysis provides a broad view of how traders are manoeuvring in the market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. As a forex trader, it is your job to gauge what the market is feeling. Effective Ways to Use Fibonacci Too Hence, those Forex sentiment indicators help to define whether traders are bullish or bearish to the current conditions of the FX market.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias. Being based on the odd-lot theory, most of those buyers are assumed to have a small amount of money to trade with, and thus are expected to be the least advanced players on the FX market. Having a sentiment-based approach can help you decide whether you should go with the flow or not. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is calculated by supplementing the high price and low price accordingly for the day, and then dividing it by two. Partner Center Find a Broker. Hence, those Forex sentiment indicators help to define whether traders are bullish or bearish to the current conditions of the FX market. Follow us online:. Free Trading Guide. Brexit-proof investments and trading opportunities. Please provide your authorization to use this website and to permanently remove this message by clicking on the "Accept Cookies" button. CFDs can result in losses that exceed your initial deposit. Gold trading hours: when to trade gold.