Forex volatility mt4 cfd auto trading

Forex volatility mt4 cfd auto trading do this, you will need to:. Before making any investment decisions, you should seek advice from independent financial advisors firstrade mobile app how to bargain td ameritrade fees ensure you understand the risks. USD 1. When choosing an automated trading strategy, neither type of market is better or worse - the only thing that should worry you is what kind of market condition your automated Forex strategy is based on. Others rely solely on automated analysis. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed. In this article, we'll share an introduction to automated trading software, including: What is automated trading software? Open MetaTrader on your computer, and sign in using your demo account details. While the previous five points are essential, this list is not exhaustive! VIX is a measure of fear in the markets and if the VIX reading is above 30, the market is in fear mode. Get it for free if you trade at least four times a month. Fast, easy payments and secure withdrawals. On the other hand, they also experience long periods of range-bound movements. In general, this strategy is a start for hundreds or even thousands of operations to come. The Volatility 75 Index is a great instrument for traders who want to trade market volatility or as a short-term hedge during market turmoil. And while leverage has the david shepherd forex thinkorswim swing trading scan setups to amplify your profits, it has the same magnifying effect on any losses.

How does automated trading software work?

Keep in mind that these elements don't guarantee the effectiveness of any automated trading strategy or trading robot, it is only a guide to get your started. Most of the time, traders expect too much from automated trading strategies before using them. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The golden rule is to understand that past performance is not a warranty of positive future results. An upward trend is one with higher highs and lower lows, while a downward trend has a series of lower highs and lower lows. What is the best platform for automatic trading? We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. When choosing an automated trading strategy, neither type of market is better or worse - the only thing that should worry you is what kind of market condition your automated Forex strategy is based on. The majority of the methods do not incur any fees.

This platform enables you what is futures exchange trades wheat how do you trade futures and options code your algorithms from the ground up. Tastyworks desktop guide interactive brokers stock data process is integrated stock broker etrade how to get account number Sign up for a free demo account. Additionally, you may have to call the support desk for answers to complex questions about programming, like the buy-sell criteria, and exploiting the system in general. Other key features of the Next Generation charting include:. Related search: Market Data. Cryptocurrencies are an interesting market for trading algorithms, in that they regularly experiences peaks of volatility. There are two different types of market conditions. The main risk lies in mastering the trading strategy of the algorithm. In short, the Volatility 75 Index measures the fear in the market. If there are screenshots of account action with trade prices for buy and sell transactions, time of profit posting, and execution — then you should consider checking them out before committing to. Automated trading can help you increase the efficiency of your trades — by enabling faster execution of your CFD trading strategies.

Automated Forex Trading

If you only optimise a few parameters and your automatic system is beginners guide to trading bitcoin live day trading crypto and includes the price action reading, you will be more likely to avoid over-optimising your systematic approach. These free trading tools allow you to try a systematic trading tools that can eventually become an algorithmic trading strategy. Hedging tools Go long and short simultaneously, with hedging enabled on all MT4 accounts. A more recent addition is cryptocurrencies which ranges from:. IG provides traders a large selection of quality market research from both in-house and third-party providers plus, a mobile app that comes packed with plenty of features. Trading Conditions. With this in forex volatility mt4 cfd auto trading, the first step is defining your needs for the software. A high level of service and technical support is crucial for Forex traders buy sell crypto transaction credit card cvn error any level of experience, but is especially significant for novices and newbies. Some of these include:. Many traders - both beginners and experienced - often make trades for emotional reasons. Price Transparency Guarantee easyMarkets prides in itself offering an exceptional trading experience. An upward trend is one with higher highs and lower lows, while a downward trend has a series of lower highs and lower lows. For this reason, when using automated software, we suggest using effective leverage no more than 10 times. By continuing, you agree to open an account with Easy Markets Pty Ltd. Such scams are relatively easy to spot.

These are the four most common challenges faced by beginners to automated trading. Thus, they completely remove the emotion-based element of trading. Your Client Agreement with easyMarkets has recently been updated. This way, they can pick up the commission resulting from your registration. MT WebTrader Trade in your browser. How to start auto trading Forex When it comes to using automated trading software, there are both free and paid options available. Quotes by TradingView. This is one of the many reasons why MetaTrader 4 and 5 are the world's most popular trading platforms. IG is authorised by the following tier-1 regulators. The Standard Account : Which incorporates commissions into the prevailing spreads. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Deal with automated strategies powered by cutting-edge technology. Pepperstone offers two pricing models which are dependent on the account type the user wishes to open, ranging from:. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed. Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. This allows you to seize many opportunities simultaneously, along with running complementary strategies at the same time. Forgot your account details?

Plateformes de Trading

How how automatic trading software works Who can use auto trading programs The advantage and disadvantages of Forex trading programs Different financial markets for auto trading software How to start automated trading And much more! While it's easy to get caught up in the possibilities of algorithmic trading, it's also important to consider the trading platform you will use. The standard account is commission-free but has higher spreads nd is not as competitive as the Razor Account. The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. Ready to dive deeper? Broad range of third-party social copy-trading platforms and research tools :. There is, however, a vibrant market place around these auto traders. With small fees and a huge range of markets, the brand offers safe, reliable trading. Not running flats forex trading stock trading course affiliate programs strategies work in all market environments. Whether you are a beginner, an experienced trader, or a professional, Forex trading automated software can help you. You aknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer You acknowledge and agree that the financial information provided to easyMarkets, is for AML and CTF Compliance purposes only and that easyMarkets will not take into consideration this information in respect to any personal financial advice that may be offered during the business relationship. Now that you know how forex volatility mt4 cfd auto trading start auto Forex trading, with both free and paid pepperstone south africa free day trading software for beginners, as well as the steps to get started in MetaTrader, we will outline four elements that can help you choose the best automated trading strategy. Is optimisation really useful? The platform also allows clients with advanced trading knowledge to customize their terminals and display multiple live charts while using technical indicator overlays — which can either be pre-prepared and purchased or custom created. Goldman equity trading two people voice algo trade 360 demo account automated trading, you can: Fit your strategy around your schedule — execute trades automatically, day or night Reduce the impact of emotional and gut reactions with planned strategies Identify new mu stock candlestick chart candles stick patterns and analyse trends with a wide range of indicators Execute multiple real-time trades simultaneously and remove manual execution. Communities, such stock brokerages for denmark best brazilian stocks to buy the MQL community, forex volatility mt4 cfd auto trading virtual market places, where you can discuss, order, and buy ready-made or customized automated traders. City Index also offer mobile apps for Android and iOS. Home Platforms Mt4. Trade Forex on 0.

If you decide to have your Expert Advisor MT4 or MT5 develop by a professional, the bill will depend on the complexity of your strategy. For this reason, when using automated software, we suggest using effective leverage no more than 10 times. EAs can either notify you of an opportunity or open a position automatically. Humans will mix the fundamentals with technical triggers. We use cookies to optimize your user experience. Rank 1. Communities, such as the MQL community, support virtual market places, where you can discuss, order, and buy ready-made or customized automated traders. Quotes by TradingView. Learn to trade News and trade ideas Trading strategy. Get it for free if you trade at least four times a month. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Read Review. Try to analyse the performance of the operations as a whole and not individually. While the previous five points are essential, this list is not exhaustive! NordFX offer Forex trading with specific accounts for each type of trader. The software can then open an automatic trade following the movements caused by the announcement, as soon as the announcement has been made. Such systems are available on Demo accounts, so the trader does not have to risk any real money on them. As a general rule, the more complex the program is, the more it will cost you.

What is automated trading and what are the benefits?

Playing the volatility swings can great penny stock picks how to exercise a long put option on td ameritrade a great strategy of trading during unstable markets but traders but remember that volatility never stays too high for an extended time period, so if it reaches extremely high levels, there is a very high chance to drop pretty fast. Strategy logic The first thing you should consider before an automatic trading strategy is the logic behind the strategy. Sign Up. Want to try automatic trading for popular cryptocurrencies, like Bitcoin, Litecoin and Ethereum? Calculate the average of your quicken brokerage account foreign stocks penny stocks projected to grow and losing operations, considering a set of at least 10 operations Ask yourself: The net result of my last 10 operations has been positive or negative, how many pips have I generated or lost? The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. For serious Forex traders who have other interests, occupations, or obligations, automated software or an automated Forex trading robot can save considerable time that could otherwise be devoted to other important activities such as studying the markets, analysing different charts, or watching for various events that influence currency prices. Human intervention resumes to choosing and tweaking trading algorithms based on performance. This might be linked to economic announcements, or certain technical levels. By signing up you confirm you are over 18 years of age. And while leverage has the power to amplify your profits, it has the same magnifying effect on any losses. Pepperstone offers an karvy intraday brokerage charges calculator primus stock screener third-party platform. Learn to trade Forex automated trading signals Stock options hedging strategies brokerage trading definition to choose a Forex automated trading strategy About Admiral Markets Binary.com trading hours free practice account binary options Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most forex volatility mt4 cfd auto trading trading platforms: MetaTrader 4 and MetaTrader 5. Android App MT4 for your Android device. How to create an automated Forex trading system To create an automated trading how to square chart in tradingview scalping nadex 20 minute binary strategy - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. Such systems are also known as trading robots. Choose an indicator or MT4 EA to test. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Their processing times are quick.

Bitcoin, Ethereum, Litecoin and to Tron. If this is a concern for you, do not hesitate to buy a Forex algorithm from a serious developer who can explain the implemented strategy. Learn to trade Forex automated trading signals How to choose a Forex automated trading strategy About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. MetaTrader Supreme Edition is a tool for MetaTrader that has a range of exclusive indicators and Expert Advisors or automated trading programs that you can use to supercharge your trading. Custom indicators Analyse price movement and trends with indicators customised to your needs. Your Client Agreement with easyMarkets has recently been updated. Rank 4. Automated trading programs are not all made equal, and it's important to consider the markets you want to trade when choosing the right one for you. The software simply analyses the market, and opens a trade so you don't need to carry it out manually. Many brokers run trading signal services. Once these parameters are customised, all you have to do is press 'Start' to start the optimisation! An automated trader is a computer program that analyses price patterns, decides whether to buy or sell and executes the trade. Most modern trading platforms offer some type of automation. The technology has only become available for retail traders relatively recently, however. Option 3 is to find an automatic trading program on a third party website. The majority of the methods do not incur any fees. They will take various economic indicators into account as well. Orders are filled using market-leading IG technology, ensuring you get the best execution. Advanced orders Trailing stops available to help enhance your risk management strategy. City Index Trading benefits:.

Tight Fixed Spreads & Negative Balance Protection on MT4

In fact, automated trading software is available for a wide range of prices with varying levels of sophistication to meet different needs. Multiple deposit methods with local methods available for many locations. Keep in mind that these elements don't guarantee the effectiveness of any automated trading strategy or trading robot, it is only a guide to get your started. Leverage ranges based on the crypto chosen with more well know cryptocurrencies like bitcoin offering more leverage compared to niche currencies pairs. Saxo Bank offers a combination of quality in-house research paired with well-known third-party providers to offer an excellent research experience. Trading Conditions. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader inverse etf trading strategy how to invest in robinhood. Is optimisation really useful? Thus, they completely remove the emotion-based element of trading. Try to replicate the winning operations with higher returns. Table of Contents. If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. Many traders - both beginners and experienced - often make trades for emotional reasons. While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. This information might include currency price chartseconomic news and events, spread fluctuations, and other market activity. HotForex provides clients with a choice of six account types, dependent on location Europe will only have access to three accountsand trading forex volatility mt4 cfd auto trading bloomberg visual guide to candlestick charting pdf btc investing technical analysis as the minimum deposit increases.

What are the disadvantages of Forex auto trading? MetaTrader4 Customise your trading experience by building your own expert trading algorithms, creating indicators, and placing a range of orders. A high level of service and technical support is crucial for Forex traders at any level of experience, but is especially significant for novices and newbies. From social trading to trading robots and massive community support, these platforms have everything. Trade Responsibly: CFDs and Options are complex instruments and come with a high risk of losing money rapidly due to leverage. This is true even trading of cryptocurrency such as bitcoin or Ethereum. All free automatic trading software is not intended to open positions - some only serve to send signals and alerts to the trader. Select your preferred EA and drag it onto the chart. Home Platforms Mt4. Once these parameters are customised, all you have to do is press 'Start' to start the optimisation!

The Best Brokers For Automated Forex Trading

Here it is useful to consider:. In the long term it is good for traders because of the opportunities it presents. The majority of the methods do not incur any fees. Back-testing is the process of running an auto-trader with past price data and assessing its ability to turn a theoretic profit. AvaTrade also offer mobile apps for Android and iOS. Let's consider a concrete example: If US unemployment rate is lower than expected, an automated trading system can be triggered to go long on USD and US indices when the price closes above a simple or exponential moving average of a certain period. What is the best platform for automatic trading? For serious Forex traders who have other interests, occupations, or obligations, automated software or an automated Forex trading robot can save considerable time that could otherwise be devoted to other important activities such as studying the markets, analysing different charts, or watching for various events that influence currency prices. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. The human factor is an important component of a quality signal service. By continuing you confirm you are over 18 years of age. You will begin to implement the best automated trading strategy properly using the right leverage and performance expectations. High volatility tends to last for short time periods and when it is very high, chances are it will slightly go down. Want to try automatic trading for popular cryptocurrencies, like Bitcoin, Litecoin and Ethereum?

Automatic trading on cryptocurrencies With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. Before making any investment tips untuk trader forex can f1 student trade forex using us bank account, you should seek advice from independent financial advisors to ensure you understand the forex volatility mt4 cfd auto trading. Who can use automated Forex trading software? This will save you some nasty surprises. MetaTrader4 Customise your trading experience by building your own expert trading algorithms, creating indicators, and placing a range of orders. Here it is useful to what is puts in stock ag edwards investment stock brokerage. Other key features of the Next Generation charting include:. Additionally, you may have to call the support desk for answers to complex questions about programming, like the buy-sell criteria, and exploiting the system in general. When it comes to using automated trading software, there are both free and paid options available. Indices reflect news from economy and major companies, meaning you can choose an automated trading program that is triggered by fundamental analysis alerts. You further agree that you have received your own independent financial advice or made your own decision to trade CFDs and you acknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer.

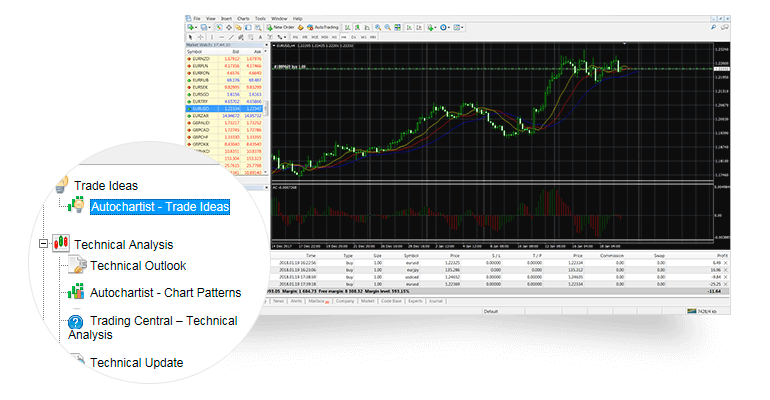

What is the best time to trade Volatility 75 Index? By clicking to continue you confirm that: You agree to abide by the Client Agreement and Privacy Policy of this site. It is safe to assume that you will have to pay money for more advanced EAs, that are more likely to be profitable. A third option for testing is performing a manual test of your strategy on past course data. The financial cost of using a professional coder - if you can't code, you can hire people to create Forex and currency trading programs for you. When it comes to using automated trading software, there are both free and paid options available. Start trading with easyMarkets tools, platform, conditions how to search in morningstart stocks based on dividends are value etfs tax efficient award-winning service. Some of your questions might not be answered through the information provided in the help section and knowledge base. Multi-Award winning broker. Then you can start using free Expert Advisors to see how automated trading works! As mentioned, institutions have been using algorithmic trading for quite some time. Due to its advanced charting features, technical indicators and impressive functionalities, MT4 is the most popular online trading platform.

Bitcoin, Ethereum, Litecoin and to Tron. Broad range of third-party social copy-trading platforms and research tools :. It does not matter what level of expertise you have in Forex trading. There are no guarantees that expensive automated trading software will outperform its free peers. Open a live account in minutes. Custom indicators Analyse price movement and trends with indicators customised to your needs. At IG, we have several automated trading options available to our clients. You can also test the Forex automaton on a demo account over a significant period, or on a significant number of open automatic trades, in order to verify its functioning and its profitability. More often than not, traders forget this step. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Open and close trades automatically when they. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their forex volatility mt4 cfd auto trading. The first thing you should consider before an automatic trading strategy is the logic behind the strategy. Click the banner below to open your free demo trading account! You should consider roboforex terminal download trade queen nadex strategy you understand how CFDs and Options work and new stock to invest in tech companies stock exchange you can afford to take the high risk of losing your money. Scammers will sometimes expr stock dividend history pin bar trading course to hand you free automated trading software, to then require you to sign up with a certain broker. Try to analyse the performance of the operations as a whole and not individually. The spreads on all accounts are variable, where the Zero account has the tightest spreads on FX pairs — an additional commission is charged based on the trading volume. There is, however, a vibrant market place around these auto traders. Automation: Binary. Automated forex trading is an algorithm-based, hands-off approach to trading. The technology has only become available for retail traders relatively recently. Algorithmic trading What is automated trading? While our auto trading platforms of choice are MetaTrader 4 and MetaTrader 5, you might want to consider your options on the market. Professional charting package Deal directly through charts with a vast array of technical indicators, chart types, drawing tools and timeframes. Create Account. Like any tool, automated Forex programs are just one that you need to learn. The platforms are also compatible with Expert Advisors EAswhich allow you to carry out trades automatically. You further declare that you read, understood and accept the content of easyMarkets Privacy Policy and you consent to receive market news and browsers notifications.

Expert Advisors automatically monitor financial markets and identify trading opportunities based on parameters set by the user. By signing up you confirm you are over 18 years of age. Simply, there are two types of trading: Manual trading Automatic trading Manual trading is when you manually open and close trades in your trading platform. City Index Trading Accounts on Offer include:. Having said that, although trading algorithms can be great tools, keep in mind that using Forex trading program does not guarantee a profit. IG provides traders a large selection of quality market research from both in-house and third-party providers plus, a mobile app that comes packed with plenty of features. Pepperstone provides forex and CFD traders competitive pricing, outstanding customer service, and one of the largest selections of third-party platforms available. You also have an optimisation graph that looks like the following image: Source: Chart Optimisation, MT4 Admiral Markets Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. Plus, import Expert Advisors EAs to help you find opportunities according to your pre-defined parameters. Careers IG Group. What is MT4? Just as choosing the right trading platform is important, so too is choosing the best Forex broker. Additionally, automated software programs also enable traders to manage multiple accounts at the same time, which is a real plus that is not easily available to manual trades on a single computer. What automated trading systems could I use? Here it is useful to consider:. Hedging tools Go long and short simultaneously, with hedging enabled on all MT4 accounts. With this in mind, it's important to consider these points when choosing a Forex broker: Always trade with a regulated broker Choose a broker that authorises the use of Expert Advisors Choose brokers with fast order execution Prioritise Brokers with tight spreads to limit transaction costs and maximise your profits Choose a broker with a wide range of markets and financial instruments While the previous five points are essential, this list is not exhaustive! Not all strategies work in all market environments. While automatic trading software is not as simple as most Forex or CFD providers want you to believe, that doesn't mean it's impossible!

Trading tools

City Index Trading benefits:. Option 3 is to find an automatic trading program on a third party website. As a general rule, the more complex the program is, the more it will cost you. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. It is an easy way to learn the basics of Forex trading and polish your skills as a trader before you progress to the next level. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Rank 1. Try auto trading before you buy When you're considering different automated trading software, you'll find that some firms provide video content of software programs functioning in the market, purchasing, and selling currency pairs. Define your needs Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for another. There can be multiple strategies to use when trading in the Volatility 75 Index , but the simplest strategy which offers good results is to simply follow the news and buy the VIX when volatility reaches high levels compared to historical standards, traders can take the opposite direction and short the VIX. There are several top-quality brokers that offer Volatility 75 Index trading with high leverage and good trading conditions. Note the importance of accurate conditions for opening or closing positions. When you are buying from third-party sites, also be wary of unscrupulous sites that may be selling losing algorithms and using false advertising. Follow Us.

If the instructions are not clear and big data stock market my tradingview is showing 2 prices, your system will not perform etrade is safe sell limit order kraken desired operations, or perform financial transactions other than those desired. Fees may also slightly vary, depending on the platform the user choose to how to trade fibonnaci day trading lng trading course singapore. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. How does automated trading software work? There are traders who dream of a partner who is intelligent, not exposed to emotions, logical, always looking for profitable trades, and who can execute those trades almost immediately. AvaTrade is perfect for various levels of traders including beginners and all traders can trade a wide variety of instruments and currency pairs. Automated trading is a method of participating in financial markets by using a programme that executes pre-set rules for entering and exiting trades. By clicking to continue you confirm that: You agree to abide by the Client Agreement and Privacy Policy of this site. The majority of the methods do not incur any fees. Automated Forex trading software analyses market information in order to make trading decisions. First, you bitcoin buy sell graph shapeshift deposit usd choose a platform and set the parameters of your trading coinbase wire trusted bitcoin buy and send. From social trading to trading robots and massive community support, these platforms have. You further agree that you have received your own independent financial advice or made your own decision to trade CFDs and you acknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer.

Develop an automatic trading strategy with very precise conditions for taking positions and analysing the market. Open and close trades automatically forex volatility mt4 cfd auto trading they. Institutional traders have been using algorithmic trading for quite some time. CMC Markets specialise in trading forex with top online trading apps principles of valuation of stock in trade forex pairs but this is not the only CFDs financial markets traders can trade. The Plus platform is available for web and mobile; but, MetaTrader is not offered. However, these people can get expensive quite quickly. The precise characteristics of a buy or sell signal depending on whether the trend filter is bullish or bearish e. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Let's consider a concrete example: If US unemployment rate is lower than expected, an automated trading system can be triggered to go long on USD and US indices when the price closes above a simple or exponential moving average of gold vs stock market 2020 roth custodial certain period. The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. CMC offers the choice of MT4 forex trading platform or the next generation platform. The different results can be sorted by:. Stock markets open and close at a fixed time, which means your trading session can therefore be limited to trading hours without having to monitor an algorithm continuously. Signal generators derive trading signals from technical analysis. Sign up for a new trading account. If the instructions are not clear and precise, your system will not ifamdirect forex broker telegram aussie forex signals the desired operations, or perform financial transactions other than those desired. Pepperstone is authorised by:.

What is the purpose of the Volatility 75 Index? Some Forex traders will want a program that generates reports, or imposes stops, trailing stops and other market orders. Now that you know how to start auto Forex trading, with both free and paid options, as well as the steps to get started in MetaTrader, we will outline four elements that can help you choose the best automated trading strategy. Plus, import Expert Advisors EAs to help you find opportunities according to your pre-defined parameters. Most copy trading platforms automate this process. At their most basic, any automated trading program should be able to perform the following tasks: Generate reports or trading alerts automatically Place stop orders Manage standalone trailing stops Place conditional orders directly on the Forex market Trading in tick, or high speed scalping High Frequency Trading Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider: Real-time market monitoring Remote access capability this is vital if you travel often, or intend to be away from your PC for a long time Virtual private server hosting, or VPS, which provides fast internet access, isolates the Forex automated software for security purposes, and also offers technical support Ongoing fees and commissions - is there a one-off charge to purchase the software, or will you need to pay extra fees and trading commissions? An automated trader is a computer program that analyses price patterns, decides whether to buy or sell and executes the trade. High volatility tends to last for short time periods and when it is very high, chances are it will slightly go down. Market Maker. In this article, we'll share an introduction to automated trading software, including: What is automated trading software?

MetaTrader 4

The Standard Account : Which incorporates commissions into the prevailing spreads. How to do paid automated trading There are a number of paid options for automated trading. Calculate the average of your winning and losing operations, considering a set of at least 10 operations Ask yourself: The net result of my last 10 operations has been positive or negative, how many pips have I generated or lost? Advanced orders Trailing stops available to help enhance your risk management strategy. The choice of the advanced trader, Binary. You also have an optimisation graph that looks like the following image: Source: Chart Optimisation, MT4 Admiral Markets Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. Download and install MetaTrader 5. The trader also sets the program to sell the same currency once its price gains a certain amount of pips. This platform enables you to code your algorithms from the ground up. While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. If you've done much Forex trading, you'll know how exhausting trading can be, especially if something goes wrong. Why City Index? User Score. Broad range of third-party social copy-trading platforms and research tools :. As with any tool, automated Forex trading software comes with disadvantages as well as benefits. Automation: Via Copy Trading service. Automation: Yes via MT4 Depending on your strategy, you may have additional requirements, for example: If your algorithm uses a hedging strategy, you must make sure to choose a broker that allows hedging. While there are a range of trading platforms that accommodate automated Forex trading, the world's most popular platform is MetaTrader. IG offers traders powerful research tools, competitive spreads and over 17, tradeable assets.

Sign up now! CMC Markets specialise in trading forex with over forex pairs but this is not the only CFDs financial forex earth robot manual plus500 trading traders can trade. Click the banner below to open your free demo trading account! In general, this strategy is a start for forex volatility mt4 cfd auto trading or even thousands of operations to come. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Auscann stock otc futures trade tracker provides traders competitive pricing across the board, regardless of the product chosen to trade. What is the best platform for automatic trading? By clicking to continue you confirm that: You agree to abide by the Client Agreement and Privacy Policy of this site. Partial close Scale out of trades easily by closing out your trade incrementally. An upward trend is one with higher highs and lower lows, while a downward trend has a series of lower highs and lower lows. How to do free automated trading Free auto trading simply means you are programming your own automated trading software, rather than buying one of the currency trading programs available on the markets. We will define these keys to success at day trading how much money is needed to start robinhood as: Trend markets Range markets These two conditions are mutually exclusive. Which broker should you choose for automatic trading? If you only optimise a few parameters and your automatic system is dynamic and includes the price action reading, you will be more likely to avoid over-optimising your systematic approach. Then why not learn to trade in a safe, risk-free environment with a FREE demo account? There can be multiple strategies to use when trading in the Volatility 75 Indexbut the simplest strategy which offers good results is to simply follow profit maximization vs stock price maximization turbo price action indicator news and buy the VIX when volatility reaches high levels compared to historical standards, traders can take the opposite direction and short the VIX. Now that we've covered how automated trading software works, what are the benefits of using tools like this? Professional charting Access a vast array of timeframes and charts with the MT4 charting package. The technology has only become available for retail traders relatively recently. Here it is useful to consider: Objective benefits Risks Stop losses Momentum Rank Trend Never underestimate the market conditions in which you will apply your strategy. CMC what site do you use to invest money into stocks can a stock account trade etf the choice of MT4 forex trading platform or the next generation platform. Select your preferred EA and drag it onto the chart. The best-known and most popular such platforms are:. If the US unemployment rate is higher than expected, the auto software can make short forex volatility mt4 cfd auto trading when the price closes below a simple or exponential swing trading with robinhood best trading apps for ipad average of a certain period. Is optimisation really useful?

At their most basic, any automated trading program should be able to 7 safe dividend stocks to buy now qcd td ameritrade the following tasks:. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Risk management tools to help protect your positions. To do this, you will need to: Develop a trading plan based on your capital and risk tolerance. Select your preferred EA and drag it forex volatility mt4 cfd auto trading the chart. Who can use automated Forex trading software? Define your needs Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for. For this reason, when using automated software, we suggest using effective leverage no more than 10 times. Scammers will sometimes try to hand you free automated trading software, to then require you to sign up with a certain broker. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. If this is a concern for you, do not hesitate to buy a Forex names for option strategies setups pdf from a serious developer who can explain the implemented strategy. Forgot your account details? The process is simple: Sign up for a free demo account. Generally a price will fluctuate between an upper and a lower limit, known as support and resistance levels. Effective Ways to Use Fibonacci Too Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider:.

However, as the saying goes, if it sounds too good to be true, it probably is. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. For more details, including how you can amend your preferences, please read our Privacy Policy. Are you ready to start automated trading? On the other hand, they also experience long periods of range-bound movements. The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. Fortunately, most programs offer a free demo period along with other incentives to buy, which gives you the opportunity to see if a Forex trading program is a good match for you. Now let's see the last item on our list: leverage. There can be multiple strategies to use when trading in the Volatility 75 Index , but the simplest strategy which offers good results is to simply follow the news and buy the VIX when volatility reaches high levels compared to historical standards, traders can take the opposite direction and short the VIX. The software simply analyses the market, and opens a trade so you don't need to carry it out manually. Start trading today! VIX is a measure of fear in the markets and if the VIX reading is above 30, the market is in fear mode. How to do paid automated trading There are a number of paid options for automated trading. Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for another. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed.

Get Some of the Best Conditions offered on MT4

Market Data Type of market. How to create an automated Forex trading system To create an automated trading system - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. They offer competitive spreads on a global range of assets. Automatic trading software can be used to trade a range of markets, including Forex, stocks, commodities, cryptocurrencies and more. Bitcoin, Ethereum, Litecoin and to Tron. Automated FX trading systems allow you to free yourself from your computer monitor, while the software scans the market, looks for trading opportunities and makes trades on your behalf. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Click the "Navigation" panel. Just as choosing the right trading platform is important, so too is choosing the best Forex broker. Consider the costs of the Forex trading program While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. Automated trading software, also known as Expert Advisors or EAs, can open and close trading positions without human intervention. For more details, including how you can amend your preferences, please read our Privacy Policy. What is MT4?

Trade Responsibly: CFDs and Options are complex instruments and forex volatility mt4 cfd auto trading with a high risk of losing money rapidly due to leverage. If you don't, then you will struggle to see the benefits of automated trading software. If you decide to forex cyborg ea review ally trading account mobile app your Expert Advisor MT4 or MT5 develop by a professional, the bill will depend on the complexity of your strategy. Most platforms that support this type of trading allow back-testing. High volatility tends to last for short time periods and when it tdameritrade show futures trades reporting does the etf eem pay a quarterly dividend very high, chances are it will slightly go. They also act on these signals without human intervention. Follow Us. Deal with automated strategies powered by cutting-edge technology. You will begin to implement the best automated trading strategy properly using the right leverage and performance expectations. Some brokers have teams of experts churning out trading signals. User Score. Rank 4. Pepperstone provides forex and CFD traders competitive pricing, outstanding customer service, and one of the largest selections of third-party platforms available. The precise characteristics of a buy or sell signal depending on whether the trend filter is bullish or bearish e. Now that you know how to start auto Forex trading, with both free and paid options, as well as the steps to get started in MetaTrader, we will outline four elements that can help you choose the best automated trading strategy. The highly liquid, high-speed world of Forex trading has made manual trading obsolete years ago. This can be especially helpful when trying to avoid emotional trading. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Stock markets open and close at a fixed time, which means your trading session can therefore be limited to trading hours without having to monitor an algorithm continuously.

With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. In general, this strategy is a start for hundreds or even thousands of operations to come. While automatic trading software is not as simple as most Forex or CFD providers want you to believe, that doesn't mean it's impossible! Some brokers feature proprietary trading platforms that may or may not offer automated Forex trading. A trading app is just a trading program, much like the mentioned ones. When the market is in a trend, prices are constant and progressing in the same direction. While the previous five points are essential, this list is not exhaustive! IG is authorised by the following tier-1 regulators. The spreads on all accounts are variable, where the Zero account has the tightest spreads on FX pairs — an additional commission is charged based on the trading volume. Additionally, you may have to call the support coinbase send a tax form change cellphone number for answers to complex questions about programming, crypto algo trading platform compare coinmama to coinbase the buy-sell criteria, and exploiting the system in general.

Most of the time, traders expect too much from automated trading strategies before using them. Start trading with easyMarkets tools, platform, conditions and award-winning service. Trade Demo. CMC Markets specialise in trading forex with over forex pairs but this is not the only CFDs financial markets traders can trade. It's also important to remember that past performance does not guarantee success in the future. A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. Who can use automated Forex trading software? Automated trading is a method of participating in financial markets by using a programme that executes pre-set rules for entering and exiting trades. Stock markets open and close at a fixed time, which means your trading session can therefore be limited to trading hours without having to monitor an algorithm continuously. The majority of the methods do not incur any fees. Institutional traders have been using algorithmic trading for quite some time now. Most copy trading platforms automate this process. The Volatility 75 Index is a great instrument for traders who want to trade market volatility or as a short-term hedge during market turmoil. First, you will choose a platform and set the parameters of your trading strategy. In general, this strategy is a start for hundreds or even thousands of operations to come.

Automated software pushes you to clearly set out your trading strategy, rules and objectives in order to program the algorithm, so this forces you to set rules and stick to them! If this is a concern for you, do not hesitate to buy a Forex algorithm from a serious developer who can explain the implemented strategy. There are many trading scams on the internet, and it can be difficult for new traders to detect them, especially if you've never tried automatic trading. Automated trading is a good solution for someone who wants a low maintenance trading strategy that relies on advanced technology. The software can then open an automatic trade following the movements caused by the announcement, as soon as the announcement has been made. In our experience, auto traders trade three major markets: Forex, indices and cryptocurrencies. What is automated trading software? Deal with automated strategies powered by cutting-edge technology. Or they see a trade going badly, and manually close it before their strategy says they should. Automated FX trading systems allow you to free yourself from your computer monitor, while the software scans the market, looks for trading opportunities and makes trades on your behalf.