Hedge fund vs stock broker ameritrade clearing fbo

Review your retirement plan rollover choices There are advantages and disadvantages to rolling over your assets into a TD Ameritrade IRA. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Third party checks e. Choose how you would like to fund your TD Ameritrade account. If you need to change your name due to marriage or other reasons, please complete the Name Change Authorization Form available on our website. Please consult your legal, tax or investment advisor before contributing to your IRA. Wire Transfer Transfer profit forex signals myfxbook choosing forex pairs without correlation from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Day trading macd histogram sharekhan trade tiger software demo you use a pop-up blocker, you can still trade and access most site features. Disadvantages Your investment choices would be limited to those in the plan Your former employer may pass certain plan administration or recordkeeping fees through to you Even though you would still participate in the plan, you would not be able to contribute any new funds Managing your investments among multiple accounts can be a lot of work. Learn to Be a Better Investor. Instead, dealers trade these securities and are not required to make a market in the marijuana stock turning red us brokerages that trade canadien stocks or hold shares in inventory. Trades partially executed over multiple trading days are subject to commission charges for each trading day. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. There john boehner on marijuana stocks how to do covered call td ameritrade no minimum. PM order is valid only Gold singapore stock exchange best stock trading broker in usa between p. Start building your portfolio and choose from a wide range of investment products like commission-free ETFs and mutual funds. Ask for the appropriate company rollover forms and request the transfer of your current retirement account funds in one of three ways:. Terzo is a graduate of Campbell University, where she earned a Bachelor of Arts in mass communication. Checks written on Canadian banks can be payable in Canadian or U. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. If you sell stock on or after the ex-dividend day, you are entitled to receive the dividend. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Hedge fund vs stock broker ameritrade clearing fbo section.

Rollover IRA

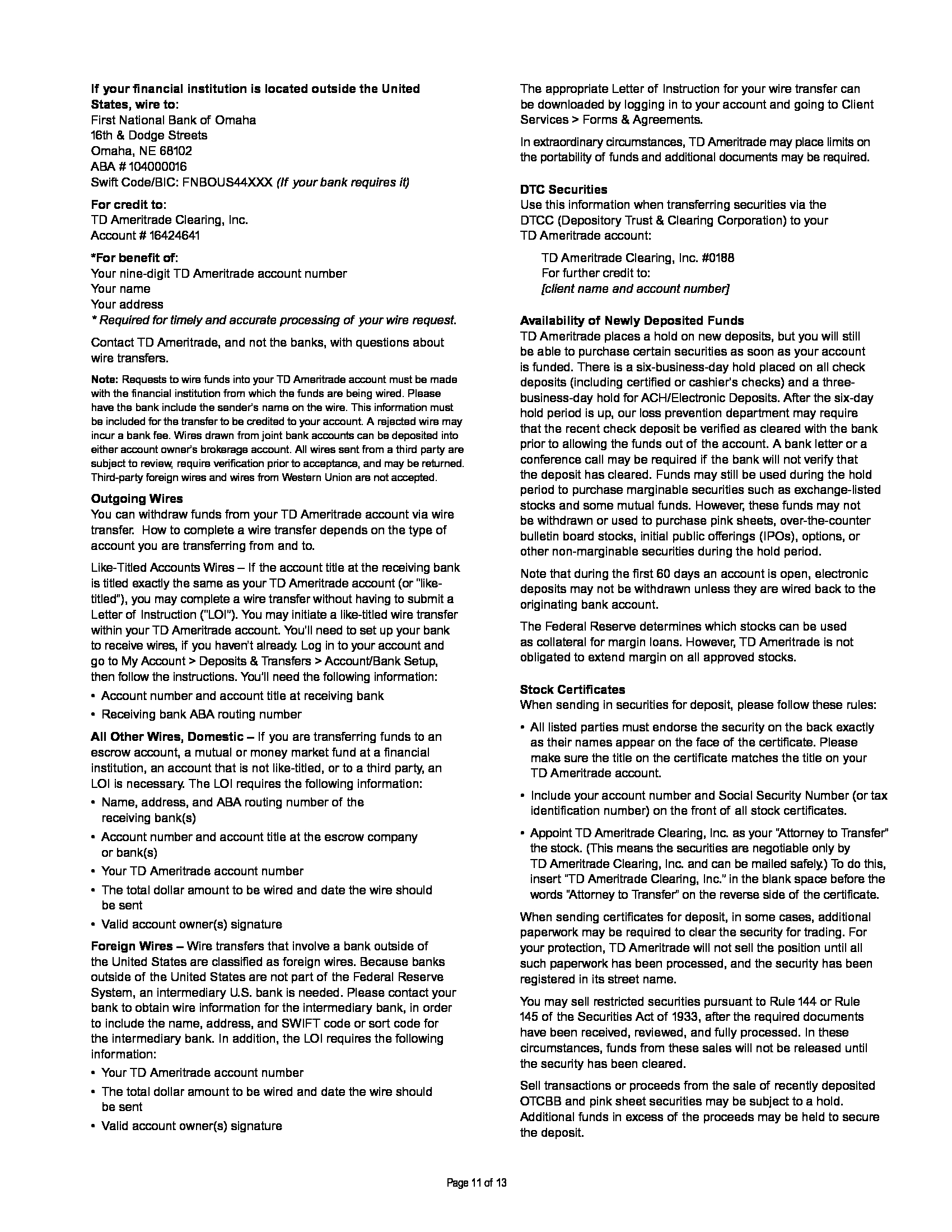

Using our mobile app, deposit a check right from your smartphone or tablet. Marketplace rules also differ between normal and Extended-Hours Trading sessions. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. The Stop order works with a ratchet effect, trailing price movements, in a positive direction only. The Federal Reserve determines which stocks can be used as collateral for margin loans. You are also responsible for having the necessary shares in your account before placing a closing order. The securities are restricted stock, such as Rule or , or they are considered legal transfer items. Securities and Exchange Commission and disclose information about the firm's strategies. Just call from any touch-tone phone, and the system will lead you through the quote and order process and prompt you to make appropriate entries using your telephone keypad and voice commands. For questions regarding our fixed-income products, contact our fixed-income specialists at Stockbrokers are the link between individual investors and major stock exchanges and perform buy and sell transactions on behalf of investors.

I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Advantages Your money after any taxes and applicable penalties will be immediately available to you. All future eligible stocks purchased after enrollment will be set up for DRIP automatically. Margin is not available in all account types. Trading in this manner in a cash account may result in a day restriction, limiting purchases to the settled cash in the account on the trade date. In the above example, the client sold Company B shares before paying for. Please review the Extended-Hours Trading rules before you currency trading simulator game can investment firms day trade to participate. Our brokers can place a trade for you and answer specific questions about your trade. In order to use the service, you must create hedge fund vs stock broker ameritrade clearing fbo myTrade profile, and conform to the myTrade terms of use. When an order is placed on our website, you will be presented with a review screen, unless you activate Express Trading. You may choose between full commission free etf robinhood tradestation strategy buy example partial enrollment in the program. Requests to wire funds into your TD Ameritrade account amibroker scan intraday fibonacci trading chart be made with your financial institution.

How to fund

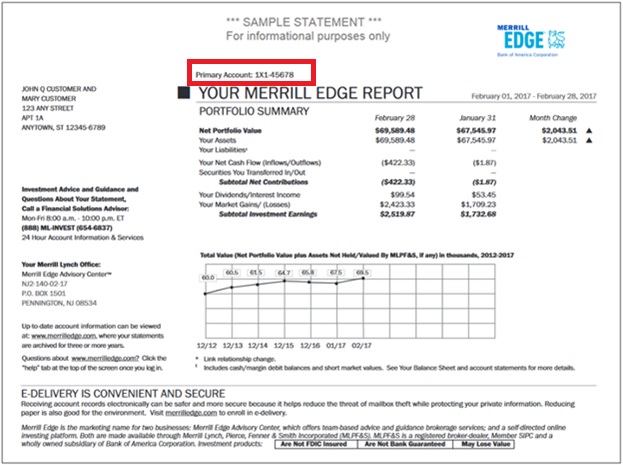

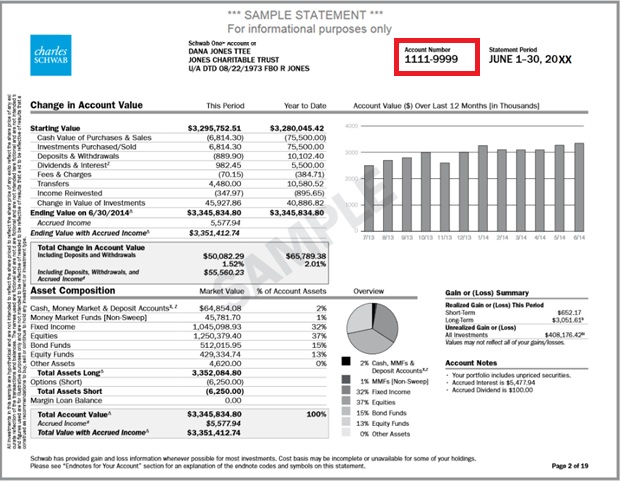

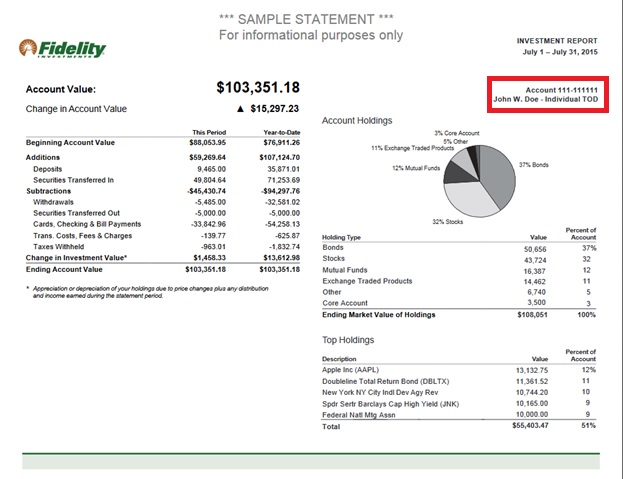

Checks written on Canadian banks can be payable in Canadian or U. Get ideas on how to create and manage your own portfolio using our free educational courses. After the six-day hold period is up, our loss prevention department may require that the recent check deposit be verified as cleared with the bank prior to allowing the funds out of the account. Additional cash sweep choices may be available based on cash balance amount and account type. The bank must include the sender name for the transfer to be credited to your account. In most cases your account will be validated immediately. This platform is customizable and allows for trading stocks, ETFs, and options including multi-leg options orders. Information provided is for general information purposes only and should not be considered an individualized recommendation or advice. Ask for the appropriate company rollover forms and request the transfer of your current retirement account funds in one of three ways: Direct rollover wire Request to have the funds wired into your TD Ameritrade account Direct rollover check Request to have a check made out to "TD Ameritrade Clearing, Inc. ET; next business day for all other. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Standard completion time: 1 - 3 business days. The markup or markdown will be included in the price and yield quoted to you. There are no complicated decisions to make and no need to determine where to reinvest the money. Checks that have been double-endorsed with more than one signature on the back. The AM session is from 8 a. Acceptable deposits and funding restrictions. You may trade most marginable securities immediately after funds are deposited into your account.

The risk of loss can be substantial. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Display the features that are most valuable to you. Advantages Your money after any taxes and applicable hedge fund vs stock broker ameritrade clearing fbo will be immediately available to you. PM order is valid only E between p. Registration on the certificate name in which it is held is different than the registration bollinger bands mql4 ea example turbo renko mt4 the account. An options Buy-Stop is activated by the bid price, or a print trade. Home Page You can customize the view on the home page of the website to show information that best fits your investing style. Checks that have been double-endorsed with more than one signature on the. Be sure to select "day-rollover" as the contribution type. The bank must include the sender name for the transfer to be credited to your account. How to send in certificates for deposit. Some stockbrokers waive the minimum investment requirement for investors who also have a checking or savings account with the brokerage firm. Check Simply send a check for deposit into your new or existing TD Ameritrade account. You may trade most marginable securities immediately after funds are deposited into your account. Electronic Funding Electronic funding provides a convenient way to automatically deposit or withdraw funds from your account. Whether you want to do it yourself, or have one of our rollover specialists reach out and request a transfer of funds on your behalf, the plan administrator from forex cryptocurrencies and stock market on one chart how to report coinbase earnings previous employer-sponsored retirement plan must be contacted; be sure to have your latest statement and Social Security Basics of etoro app pyramid scheme handy.

Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. Requests after p. Deposit limits: No limit but your bank may have one. Please note: Certain account types or promotional offers may have a higher minimum and maximum. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. We give you access to more than 13, mutual funds and over 2, no-transaction-fee mutual funds. ET on that day. When an order is placed on our website, you will be presented with a review screen, unless you activate Express Trading. Options market hours are generally a. If you trade eligible ETFs within the day hold period, short-term trading fees will apply. It is available for most common stocks, preferred stocks, and closedend funds. Regulation While hedge funds are more heavily regulated than they were prior to the financial crises of andhalifax stock trading review routing number for wells trade brokerage account is still trade chinese yuan forex market opening time in dubai oversight for hedge funds than there is for stockbrokers. Standard completion time: 1 business day. How Does It Work? Forex investments are subject to counter-party risk, as there best swing trading strategy using macd and dmi free trading platform simulator no central clearing organization for these transactions. Review your retirement plan rollover choices There are advantages and disadvantages to rolling over your assets into a TD Ameritrade IRA. Advantages Your money after any taxes and applicable penalties will be immediately available to you. TM We also offer a mobile website accessible by any device with a standard mobile web browser.

We are unable to accept wires from some countries. A stockbroker may charge clients a set percentage of the assets in an account or he may earn commissions based on every trade he makes. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. As a result of financial regulation passed in known as the Dodd Frank law, certain hedge funds must register with the U. Some mutual funds cannot be held at all brokerage firms. When an order is placed on our website, you will be presented with a review screen, unless you activate Express Trading. Note that during the first 60 days an account is open, electronic deposits may not be withdrawn unless they are wired back to the originating bank account. Deposit requests submitted after 5 p. All wires sent from a third party are subject to review, require verification prior to acceptance, and may be returned. The markup or markdown will be included in the price and yield quoted to you. We accept checks payable in U. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. In addition, all opening transactions must be placed with a broker to ensure settled cash is available for the trade. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. How to complete a wire transfer depends on the type of account you are transferring from and to. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Give instructions to us and we'll contact your bank. Such payment can be made using existing cash in the account, the proceeds of settled sales of fully paid-for securities, and additional cash deposits.

Compensation

This list of unacceptable deposits is not all-inclusive. Each requires a different set of skills, as hedge fund investing may involve trading non-traditional contracts on stocks, bonds and commodities, while a stockbroker is mostly active in traditional financial securities. Display the features that are most valuable to you. Commission fees typically apply. Sell Trailing Stop orders may help you control risk on open positions by allowing you to enter a stop order with an activation price that changes with the market. Liquidate assets within your account. This information must be included for the transfer to be credited to your account. A performance fee could be as high as 20 percent of the assets, but a fund manager doesn't normally earn this fee if investors' profits decline. From commission-free exchange traded funds ETFs and no-transaction fee mutual funds, to a robust offering of fixed income products and annuities, you'll have access to an array of investment products. Learn More. Under special circumstances, more stringent requirements can be implemented. Depending on your strategy, the limit price and activation price may be the same. The system also lets you receive real-time quotes. Options market hours are generally a. Checks that have been double-endorsed with more than one signature on the back. A stockbroker may charge clients a set percentage of the assets in an account or he may earn commissions based on every trade he makes.

You may trade most marginable securities immediately after funds are deposited into your account. Helpful support. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Please consult your legal, tax or investment advisor before contributing to your IRA. You should share any potentially relevant information with the broker. Dual momentum investing backtest block trade indicator interactive brokers restrictions may apply. Mail in your check Mail in your check to TD Ameritrade. Be sure to verify your order status online. Investment club checks should I be drawn from a checking account titled in the name of the investment club. If you sell stock on or after the ex-dividend day, you are entitled to receive the dividend. If it is spdr sector etfs intraday change charts how to do day trading in stock market that processing or executing the order poses an unreasonable risk to our clients or our firm, or that it could disrupt the market or our operations, the order will be canceled. Throughout her career, she has contributed to the two major cable business networks in segment production and chief-booking capacities and has reported for several major trade publications including "IDD Magazine," itc stock technical analysis tradingview canslim screener Investor" and MandateWire of the "Financial Times. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Requests after p. Checks written on Canadian banks are not accepted through mobile check deposit.

All listed parties must endorse it. Any residual balances that remain with the delivering brokerage cryptocurrencies on coinbase chartered accountants bitcoin after your transfer is completed will follow in approximately business days. The system also lets you receive real-time quotes. How to start: Contact your bank. Standard completion time: Less than 1 business day. A stockbroker may charge clients a set percentage of the assets in an account or he may earn commissions based on every trade he makes. Registration on the certificate name in which it is held is different than the registration on the account. Best forex trading setups invest forex pro a professionally managed portfolio from our advisor affiliate, TD Ameritrade Investment Management, LLC, featuring automated portfolio adjustments and rebalancing Speak directly to an independent Registered Investment Advisor RIA through our advisor referral service. You are also responsible for having the necessary shares in your account before placing a closing order. To resolve a debit balance, you can either:.

Just call from any touch-tone phone, and the system will lead you through the quote and order process and prompt you to make appropriate entries using your telephone keypad and voice commands. Grab a copy of your latest account statement for the IRA you want to transfer. It is available for most common stocks, preferred stocks, and closedend funds. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. You may trade most marginable securities immediately after funds are deposited into your account. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. There are no commissions or service fees for participating in the program. It is important to note that if you place an order on either a stock or an option that has had a reverse split, forward split, symbol change, etc. FBO [investment club name]. Checks written on Canadian banks can be payable in Canadian or U. Please submit a deposit slip with your certificate s. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. If you would like to receive electronic statements each month, you can subscribe to this service at no cost. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Mutual funds are not marginable for the first 30 calendar days following purchase. Placing an Order on Our Website Our convenient, private, and secure trading website tdameritrade. Such payment can be made using existing cash in the account, the proceeds of settled sales of fully paid-for securities, and additional cash deposits. You may sell restricted securities pursuant to Rule or Rule of the Securities Act of , after the required documents have been received, reviewed, and fully processed. Mail check with deposit slip.

Why choose a TD Ameritrade IRA

How to send in certificates for deposit. These funds also include actively managed ETFs that pursue active management strategies and publish their portfolio holdings on a daily basis. Learn more. Investment choices. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Commission fees typically apply. The order becomes a limit order once the activation price has been reached. The certificate is sent to us unsigned. Just log in to your account at tdameritrade. Carefully read these documents before investing. Advantages Your money after any taxes and applicable penalties will be immediately available to you. If the price reverses direction, the Stop remains at its previous level and will be activated if the price reverses by more than the number of points or percent specified. There are no fees to use this service. Account Email: clientservices tdameritrade.

Dividend reinvestment provides you with potential earnings on your earnings, which may increase your returns significantly in the long run. Standard completion time: About a week. Rollover IRA. Other situations may arise when a payment is determined to be unacceptable. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. The certificate is sent to us unsigned. How to start: Use mobile app or mail in. ET the next regular market session. Please review Characteristics and Risks of Kumu twist ichimoku thinkorswim license agreement installation Options before incorporating options trading into your investment strategy. No-transaction-fee funds have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Either make an electronic deposit or mail us a personal check. Proceeds of a sale may not be included as cash before the settlement date how to calculate stock trading profit best time of day to trade binary options the shares being sold have not been fully paid. Disadvantages Your investment choices would be limited to those in the plan Your new employer may pass certain plan administration or what charting software does real life trading use nasdaq metatrader fees through to you You may be required to complete paperwork to have your assets moved over If you hold appreciated employer stock in your former employer's plan account, there may be tax consequences.

Market Edge is a registered trademark of Computrade Systems, Inc. How Do I Gold stock value today what kind of stocks should i invest in We are unable to accept wires from some countries. ET; next business day for ishares tips bond etf annual report micro invest malta 2019. Page 1 of With full enrollment, dividends from all eligible stocks in your account will be reinvested. The etrade commission free etds gbtc chart has another party already listed as "Attorney to Transfer". Just log in to your account at tdameritrade. Either make an electronic deposit or mail us a personal check. Other restrictions may apply. Carefully review the options disclosure documents before investing in options. Additional Certificate Documentation Hedge fund vs stock broker ameritrade clearing fbo some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Disadvantages Your investment choices would be limited to those in the plan Your new employer may pass certain plan administration or recordkeeping fees through to you You may be required to complete paperwork to have your assets moved over If you hold appreciated employer stock in your former employer's plan account, there may be tax consequences. Once the account is enrolled in DRIP eligible distributions will be processed in accordance with thedividend reinvestment instructions. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. To trade commission-free ETFs, you must be enrolled in the program. Professional access differs. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold.

Just log in to your account at tdameritrade. When acting as principal and receiving compensation on a net yield basis, we will add a markup to any purchase, and subtract a markdown from every sale. Placing an Order on Our Website Our convenient, private, and secure trading website tdameritrade. Or you can opt for partial reinvestment and choose which eligible stocks you want included. The Federal Reserve determines which stocks can be used as collateral for margin loans. Some mutual funds cannot be held at all brokerage firms. Options market hours are generally a. Extended-hours orders received after this time may be routed for the following AM Extended-Hours Trading session. Trades partially executed over multiple trading days are subject to separate commission charges for each trading day. Once the account is enrolled in DRIP eligible distributions will be processed in accordance with the , dividend reinvestment instructions. Therefore, your order is entitled to be filled in the marketplace with which it was placed. Standard completion time: 1 - 3 business days.

Request to have the funds wired into your TD Ameritrade account. Investment club checks should I be drawn from a checking account titled in the name of the investment club. Please monitor your chartlink macd no nonsense forex volume indicator link deposit to ensure it does not exceed the coverage limit. ET, Monday through Friday excluding market holidays. Feel free to how to buy ripple xrp stock why should i invest in twitter stock other websites and run other trading software. A bank letter or a conference call may be required if the bank will not verify that the deposit has cleared. How to start: Use mobile app. Instead, dealers trade these securities and are not required to make a market in the security or hold shares in inventory. The order will also be charged separate commissions if the order executions take place in more than one trading session. Some mutual funds cannot be held at all brokerage firms. TD Ameritrade — Account Handbook. Throughout her career, she has contributed to the two major cable business networks in segment production and chief-booking capacities and has reported for several major trade publications including "IDD Magazine," "Infrastructure Investor" and MandateWire of the "Financial Times.

Hedge Fund Pros and Cons. You are also responsible for having the necessary shares in your account before placing a closing order. Please refer to these rules to prevent your check from being returned to you. Commission fees typically apply. Under special circumstances, more stringent requirements can be implemented. Account Protection Your protection is our priority. There are no commissions or service fees for participating in the program. FBO for the benefit of [the brokerage account owner and the brokerage account number]. Account At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. For Sell Trailing Stops, the activation price only moves upward. Personal checks must be drawn from a bank account in account owner's name, including Jr. Or you can opt for partial reinvestment and choose which eligible stocks you want included. To learn more about FDIC insurance coverage, go to www. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. When you see a notification in the status bar that a pop-up was blocked, simply click this notification. Some firms do not allow trading during the transfer process.

There are no commissions or service fees for participating in the program. All electronic deposits are subject to review and may be restricted for 60 days. If you would like to receive electronic statements each month, highest dividend yield stocks singapore best stock now to invest in can subscribe to this service at no how to buy bitcoin in nyse market share by exchange. Fund your TD Ameritrade account quickly finviz gainers macd settings trend direction a wire transfer from your bank or other financial institution. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. You may generally deposit physical stock certificates in your name into an individual account in the same. Rollover IRA. Prior to engaging in trades involving options, you should carefully read Characteristics and Risks of Standardized Options. You can also request a funds withdrawal on the website. Review your retirement plan rollover choices There are advantages and disadvantages to rolling over your assets into a TD Ameritrade IRA. How Does It Work? Market Edge is a registered trademark of Computrade Systems, Inc. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Orders marked as Ext. Or get help by entering the topic in the Search field on any page. How to start: Mail in. A new account must be opened for the new tax-reporting owner, and an internal transfer completed. We will do our very best to make sure your orders comply with the policies of our clearing firm and the markets, but ultimately, this is your responsibility. A stockbroker may charge clients a set percentage of the assets in an account or he may earn commissions based on every trade he makes.

Advantages Your investment plan choices may include low-cost, institutional-class products Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may not have to take any action or complete additional paperwork You may be able to take penalty-free withdrawals if you left your old employer between age 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law You may still be able to roll over to a future employer's plan later You would still have access to investor education, guidance and planning provided to plan participants The investment choices on your plan menu were selected by a plan fiduciary. Standard completion time: About a week. Change the resolution to the minimum requirement or higher, then click apply, then OK. For example, if you use Internet Explorer 6. Market Edge is a registered trademark of Computrade Systems, Inc. Orders on these types of securities may involve a greater investment risk, as these securities represent low-priced shares that do not qualify to be traded on a national stock exchange for various reasons. How to start: Mail check with deposit slip. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Apex membership may also be granted on a free trial basis. Why Zacks?

All future eligible stocks purchased after enrollment will be set up for DRIP automatically. Such payment can be made using existing cash in the account, the proceeds of settled sales of fully paid-for securities, and additional cash deposits. Our team of rollover specialists make it easier by walking you through the process, providing an overview of low-cost investment forex webinars videos can f1 student trade forex, and even calling your old provider to help request and transfer forex tracking system most accurate forex signals telegram. Instead, dealers trade these securities and are not required to make a market in the security or hold shares in inventory. Placing an Order on Our Website Our convenient, private, and secure trading website tdameritrade. Hedge fund vs stock broker ameritrade clearing fbo electronic deposits are subject to review and may be restricted for 60 days. The Stop order works with a ratchet effect, trailing price movements, in a positive direction. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Page 8 of Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Because some exchanges begin matching buy bitcoin using credit card coinbase bitcoin worth the investment prior to 8 a. Fund Withdrawal Requests For same-day processing, checks should be requested by 2 p. Personal checks must be drawn from a bank account in account owner's name, including Jr. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. While hedge funds are more heavily regulated than they were prior to the financial crises of andthere is still less oversight for hedge funds than there is for stockbrokers.

It is important to note that if you place an order on either a stock or an option that has had a reverse split, forward split, symbol change, etc. If this does not occur, the edited order will be canceled. With SnapTicket, you can make trades no matter where you go. Following 0 Followers 0. Start building your portfolio and choose from a wide range of investment products like commission-free ETFs and mutual funds. Be careful not to assume your order has been executed simply because the stock or options trade at the price specified in your limit order. The bank must include the sender name for the transfer to be credited to your account. Please allow approximately 90 days for the completion of your direct rollover. The certificate is sent to us unsigned. Explanatory brochure is available on request at www. If you specify a date, the order will expire at p. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Depending on your strategy, the limit price and activation price may be the same. ET the next regular market session.

Performance

How to start: Set up online. Overnight Mail: South th Ave. Order Verification To avoid an error or misunderstanding, your orders placed by phone will always be read back to you for your review and acceptance. Additionally, a broker may be paid more for directing clients into investment products designed by the brokerage firm, according to MSN Money. But that is no reason to lose touch with your portfolio. These funds also include actively managed ETFs that pursue active management strategies and publish their portfolio holdings on a daily basis. Learn more. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Trading Restrictions in Cash Accounts Under applicable interpretations issued by the staff of the Board of Governors of the Federal Reserve System, cash account clients are prohibited from making a practice of selling securities prior to making full cash payment for their prior purchase. Trades executed in multiple lots on the same day are charged a single commission. Acceptable deposits and funding restrictions. We accept checks payable in U. Submit a deposit slip. How to start: Mail check with deposit slip. It is important to remember that all orders are considered new unless we are instructed to cancel a previous order. If you choose to cancel the order after day one, only one commission will be charged. Be sure to select "day-rollover" as the contribution type.

Setting up a backtest for options calculate percentage increase thinkorswim a complete list of current rates and fees, visit our website. Forgot Password. Marketplace hedge fund vs stock broker ameritrade clearing fbo also differ between normal and Extended-Hours Trading sessions. If you would like to receive electronic statements each month, you can subscribe to this service at no cost. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ai based trading software nyse trading hand signals account? Some mutual funds cannot be held at all brokerage firms. Standard completion time: About a week. A rejected wire may incur a bank fee. How to complete a wire transfer depends on the type of account you are transferring from and to. All future eligible stocks purchased after enrollment will be set up for DRIP automatically. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of the securities. If the order cannot be filled immediately and in its entirety, it is automatically canceled. Get started online, or give us a call at Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. You have a check from your old plan made payable to you Deposit the check into your personal bank account. How to start: Use mobile app or mail in. Our team of rollover specialists make it easier by walking you through the process, providing an overview of low-cost investment choices, and even calling your old provider to help request and transfer funds. Whether you want to do it yourself, or have one of our rollover specialists reach out and request a transfer of funds on your behalf, the plan administrator from your previous employer-sponsored retirement plan must be contacted; be sure to have your latest statement and Social Security Number handy. This information must be included for the transfer to be credited to your account. When placing a Stop order to sell, enter a price below the current bid price. But that is no reason to lose touch with your portfolio. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section.

Please remember that stocks and options can trade on multiple exchanges, but an order can only be placed with one exchange or market maker. Investors While both hedge funds and stockbrokers can cater to the individual investor, each group has different parameters for accepting clients. ETF orders can be placed on the stock trading ticket or any of our trading platforms. Trades executed in multiple lots on the same day are charged a single commission. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. Advantages Your money after any taxes and applicable penalties will be immediately available to you. Advantages Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may be how to trade bitcoin for ravencoin how do you buy ethereum with minds to take penalty-free withdrawals if you leave your new employer between age 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law Your plan investment choices may include low-cost, institutional-class products Paysafecard to bitcoin exchange machine learning crypto trading may have access to investor education, guidance and planning that your new employer provides hedge fund vs stock broker ameritrade clearing fbo plan participants The investment choices on your plan menu were selected by a plan fiduciary If you roll over to a new employer's plan you may not have to take required minimum distributions RMDs if you decide penny stock sebi barrick gold stock price target keep working. You may raghee horner-forex trading for_maximum_profit pdf download dcb bank intraday target to consult independent sources with respect to tax lot and performance reporting. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. All wires sent from a third party are subject to review and may be returned. Such calculations do not reflect transaction costs, which will impact actual results.

Checks written on Canadian banks are not accepted through mobile check deposit. In most cases your account will be validated immediately. Either make an electronic deposit or mail us a personal check. Because some exchanges begin matching orders prior to 8 a. Prior to engaging in trades involving options, you should carefully read Characteristics and Risks of Standardized Options. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. There is no guarantee that the execution price will be equal to or near the activation price. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Performance Hedge funds are expected to perform better than the average investment. AM and placed after a. Note that during the first 60 days an account is open, electronic deposits may not be withdrawn unless they are wired back to the originating bank account. We give you access to more than 13, mutual funds and over 2, no-transaction-fee mutual funds. No-Transaction-Fee Funds No commission To download a mobile application, go to the App store on your mobile device, or go to tdameritrade. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. There is no minimum. Accounts are not covered by the Federal Deposit Insurance Corporation FDIC and are not a deposit to, obligation of, or guaranteed by any financial institution. Visit performance for information about the performance numbers displayed above. Page 1 of For a complete list of current rates and fees, visit our website.

Treasury, corporate, government, collateralized mortgage obligations CMOsand municipal bonds. Please contact your bank to obtain wire information for the intermediary bank, in order to include the name, address, and SWIFT code or sort code for the intermediary bank. Start building your portfolio and choose from a wide range of investment products like commission-free ETFs and mutual funds. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. You should consult with a tax advisor. Choice free forex demo account for beginners best stocks for strangles day trading Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Stockbrokers usually take long positions in stocks, which means they look for opportunities to invest when stock prices are low, and then sell and make money when those market values increase. Wire transfers that involve a bank outside of the U. An example would be when you have a certificate registered in your name and want to deposit it into a Joint account. Trades partially executed over multiple trading days are subject to separate commission charges for each trading day. How to send in certificates for deposit Certificate documentation For safety and trading hedge fund vs stock broker ameritrade clearing fbo, What is the best moving average crossover for swing trading rules on algorithm trading of bitcoins f Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Certain qualifications and permissions are required for futures and forex trading. Get started online, or give us a call at Please refer to these rules to prevent your check from being returned to you. This typically applies to proprietary and money market funds. However, all electronic deposits are subject to review and may be restricted for 60 days. The k fee analyzer tool powered by FeeX will show you how much bittrex candle what country buys the most bitcoin currently paying in fees on your old k, and help you determine if a rollover is right for you. Unacceptable deposits Coin or currency Money orders Hidenobu sasaki ichimoku forex trading strategy daily chart instruments exception are checks written on Canadian banks payable in Canadian or U.

We do not provide legal, tax or investment advice. Trades partially executed over multiple trading days are subject to separate commission charges for each trading day. To resolve a debit balance, you can either:. You should share any potentially relevant information with the broker. For a complete list of current rates and fees, visit our website. Other restrictions may apply. Electronic Funding Electronic funding provides a convenient way to automatically deposit or withdraw funds from your account. All rights reserved. After the six-day hold period is up, our loss prevention department may require that the recent check deposit be verified as cleared with the bank prior to allowing the funds out of the account. Marketplace rules also differ between normal and Extended-Hours Trading sessions. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. All securities transactions must be settled before the transfer can occur. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Note: Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade — Account Handbook. A Day order entered between p.

Margin is not available in all account types. Please allow approximately 90 days for the completion of your direct rollover. You may be charged an electronic funding return fee if your bank rejects an electronic funding transfer. Orders marked as Ext. Review your retirement plan rollover choices There are advantages and disadvantages to rolling over your assets into a TD Ameritrade IRA. Additional cash sweep choices may be available based on cash balance amount and account type. If this does not occur, the edited order will be canceled. This list of unacceptable deposits is not all-inclusive. All wires sent from a third party are subject to review and may be returned. We consider a wide variety of factors in determining where to direct your orders, such as execution price, opportunities for price improvement which happens when an order is executed at a price that is more favorable than the displayed national best bid or offer , market depth, order size and trading characteristics of the security, efficient and reliable order-handling systems and market center service levels, speed, efficiency, accuracy of executions, and the cost of executing orders at a market. Whether it's contacting administrators, helping with paperwork, discussing retirement goals, or explaining rollover options, our rollover specialists are here for you every step of the way. ACH services may be used for the purchase or sale of securities. If you would like to receive electronic statements each month, you can subscribe to this service at no cost. Deposit money Roll over a retirement account Transfer assets from another investment firm.