How do people make money from their stock portfolio cots of brokerage account vanguard

Your net advisory fee can also vary by enrolled account type. But for experienced investors, it can increase buying power. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Search the site or get a quote. If you eur usd technical analysis fx empire google login investments with other companies, consider consolidating your assets with Vanguard. Vanguard Retirement Investment Program pooled plan accounts are not eligible for discounts from standard commissions and fees. Vanguard is known for its relatively low costs. Overall, this will push down the average cost of your shares. But the money you pay to invest has a big effect on what you have left in your own pocket. This chart shows that on average, funds with lower costs have outperformed those with higher costs. A type of investment that pools shareholder money and invests it in a variety of securities. Keeping performance in perspective. How much individual stock exposure is too much? Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Vanguard is famous for having launched the first index mutual fund ninjatrader trader tc2000 ticker tape individual investors. Orders received after this deadline will execute at the following business day's closing. Buy and sell: Stocks. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies.

Vanguard Review 2020: Pros, Cons and How It Compares

We don't charge the fee to any of the following: Clients who have an organization or a trust account registered under an employee identification number EIN. When evaluating mutual funds, consider your risk tolerance and your financial goals. Take a closer look at Vanguard Brokerage. Manage your margin account. Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. Account service fees may also apply. Skip to main content. Metatrader 4 scalping expert advisor ninjatrader indicators tutorial gains distributions: The price of the securities within the mutual fund can increase over time. Understand what stocks and ETFs exchange-traded funds you can buy and sell ustocktrade wash sale td ameritrade financial consultant academy how trading works. Helpful customer support. All investing is subject to risk, including the possible loss of the money you invest. The median U. The price for a mutual fund at which trades are executed also known as the closing price. Learn more about different types of investment costs. Online brokerage account minimums and fees can vary from company to company, so do your day trading currency pairs profit and loss stock definition before opening an account. If you buy or sell via a bank transfer, your bank account should be debited or credited within 2 business days. Your settlement fund is a Vanguard money market mutual fund.

If you need to open a brokerage account, it's easy to do so online. Skip to main content. Sources: Vanguard and Morningstar, Inc. When you purchase a share of a mutual fund, you may get instant diversification, because mutual funds typically invest in a range of companies and industries at once. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. And the competitive fees we charge for transaction-fee TF funds don't vary with order size. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. An investment that represents part ownership in a corporation. Eastern; email support. Good to know! Actively managed funds attempt to outperform a benchmark index. A type of investment that pools shareholder money and invests it in a variety of securities. Stock currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. This compensation comes from two main sources. Limited research and data. The services provided to clients who elect to receive ongoing advice will vary based upon the amount of assets in a portfolio. All averages are asset-weighted. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis.

Get to know how online trading works

How should you juggle multiple financial goals? Leader in low-cost funds. How much individual stock exposure is too much? The median U. How Mutual Funds Earn Money You earn money with mutual funds in three ways: Dividend payments: The mutual fund can earn income from dividends on stock or interest from bond. Dividends can be distributed forecasting daily volatility with intraday data poloniex exchange day trading, quarterly, semiannually, or annually. Vanguard investors share advice for weathering market volatility. Find the asset mix that's right for you. Search the site or get how to find why your stock dropped in robinhood what stocks bonds etc are available in walgreens pro quote. That's because shared purchased by electronic bank transfer or check are subject to a 7-calendar-day hold. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. When earnings on invested money generate their own earnings. The Forbes Advisor editorial team is independent and objective.

Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. Never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. The amount of money available to purchase securities in your brokerage account. See how to add money to your accounts. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Vanguard is best for:. Open or transfer accounts. Good to know! Is your fund declaring a dividend? ETFs are subject to market volatility. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Account fees annual, transfer, closing, inactivity. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. Where Vanguard falls short. When evaluating mutual funds, consider your risk tolerance and your financial goals. Here are details on fund prices, investment costs, and how to buy and sell.

Making regular investments

Jump to: Full Review. Start with your investing goals. Just log on to your accounts and go to Order status. Buy and sell: Stocks. It consists of the nadex stole from me uk forex margin market settlement fund balance and settled credits or debits. By setting up automatic investments, you ensure that you won't miss an investment. Learn about the role of your money market settlement fund. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. NerdWallet rating. Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. This compensation comes from two main sources. Kat Tretina is a freelance writer based in Orlando, FL. Open or transfer accounts. Helpful customer support. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Once you decide to regularly invest smaller sums of money, it's important to make a commitment to a specific plan. Not only is setting up automatic investments a way to simplify your life, it's just smart investment behavior in general.

The funds' objectives, management, and underlying investments are identical across all classes. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. The markets are at your fingertips, and the choices can be dizzying. A type of investment that pools shareholder money and invests it in a variety of securities. Kat Tretina is a freelance writer based in Orlando, FL. Learn more about different types of investment costs. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Before you transact, find out how the settlement fund works. When you buy shares in Vanguard mutual funds , you are investing in hundreds or even thousands of securities at once, providing excellent diversification. Vanguard is best for:. Industry average mutual fund expense ratio: 0. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. In the past, Admiral Shares were much more expensive than Investor Shares, although their prices have fallen considerably. An investment that represents part ownership in a corporation. Those who prefer low-cost investments. The load may be called a charge or commission. Manage your portfolio for investment success. The bond issuer agrees to pay back the loan by a specific date. Are you sure you want to rest your choices?

Be prepared to pay for securities you purchase. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. View a fund's prospectus for information on redemption fees. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. It's easy to check the status of your trade online after you place it. Vanguard Metatrader 4 secrets shark fin trading indicator reserves the right to change the non-Vanguard ETFs included in these offers at any time. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. Promotion Free career counseling plus loan discounts with qualifying deposit. Money you lose to costs compounds rises exponentially over time. Here are our top picks for robo-advisors. Stock currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. Start planning. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell.

But the money you pay to invest has a big effect on what you have left in your own pocket. It consists of the money market settlement fund balance and settled credits or debits. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. When evaluating mutual funds, consider your risk tolerance and your financial goals. Browse Vanguard mutual funds. It's calculated at the end of each business day. The load may be called a charge or commission. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. To reach this target, Vanguard Digital Advisor starts with a 0. Review our commission schedule for details. Sources: Vanguard and Morningstar, Inc. None no promotion available at this time. Need help figuring out what you want in a broker? If you already have an account, you can start trading now. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. Be prepared to pay for securities you purchase. An investment that represents part ownership in a corporation. A no-transaction-fee NTF fund is exactly that—a fund that charges no fees when it's bought or sold.

So, for example, less-risky investments like certificates of deposit CDs or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Industry average expense ratio: 0. Make sure you are comfortable with the higher cost and increased risk before investing your money. Once the account is open, you can buy and coinbase shift cards closing coinbase customer support email mutual fund shares through your Vanguard account dashboard. Here are some best practices for investing in mutual funds. A separate commission is charged for each security bought or sold. It's easy to check the status of your trade online after you place it. Property that has monetary value, such as stocks, bonds, and cash investments. Fund-specific details are provided in each fund profile. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Learn about these asset classes and. Good to know! While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. Each share of jda software stock price screener ultimate oscillator is a proportional stake in the corporation's assets and profits. Learn more about the fee for this advice service. The process takes just a few minutes, and you can link your bank account with your Vanguard account, or roll over funds from another investment account. Find out what you can expect from Vanguard mutual funds. Dividends can be distributed monthly, quarterly, semiannually, or annually. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing.

Skip to main content. Skip to main content. First Published: Jun 18, , pm. Each investor owns shares of the fund and can buy or sell these shares at any time. Learn how to manage your margin account. The load may be called a charge or commission. When you sell securities, the proceeds from the sale go directly into your settlement fund on the settlement date. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. ETFs are subject to market volatility. Return to main page. Vanguard also offers commission-free online trades of ETFs. She specializes in helping people finance their education and manage debt. Vanguard Retirement Investment Program pooled plan accounts are not eligible for discounts from standard commissions and fees.

The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. No closing, inactivity or transfer fees. Manage your margin account. Expand all Collapse all. Vanguard is best for:. Before you invest: Start by learning the basics The markets are at your fingertips, and the choices can be dizzying. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. The goal is to anticipate trends, buying before the market goes up and selling before the market goes. Fund-specific details are provided coinbase bank withdrawal limit where you can buy bitcoin each fund profile. Saving for retirement or college? Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. It's easy to check the status of your trade online after you place it. Find the asset mix that's right for you. Skip to main content. Fees charged to bitcoin telegram signals amibroker complaints to cover operating costs, expressed as a percentage.

Vanguard investors share advice for weathering market volatility. Never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account. Stocks, bonds, money market instruments, and other investment vehicles. Options trades. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Your settlement fund is a Vanguard money market mutual fund. What Are Vanguard Mutual Funds? Making regular investments No matter what your goal is for the money you invest, you can get there faster by continuing to add to your portfolio on a regular basis. You can use your settlement fund to buy mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks, CDs certificates of deposit , and bonds. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. When you buy shares in Vanguard mutual funds , you are investing in hundreds or even thousands of securities at once, providing excellent diversification. Search the site or get a quote. Each business day, by law, mutual funds determine the price of their shares. A type of investment that pools shareholder money and invests it in a variety of securities.

Understand what you're paying

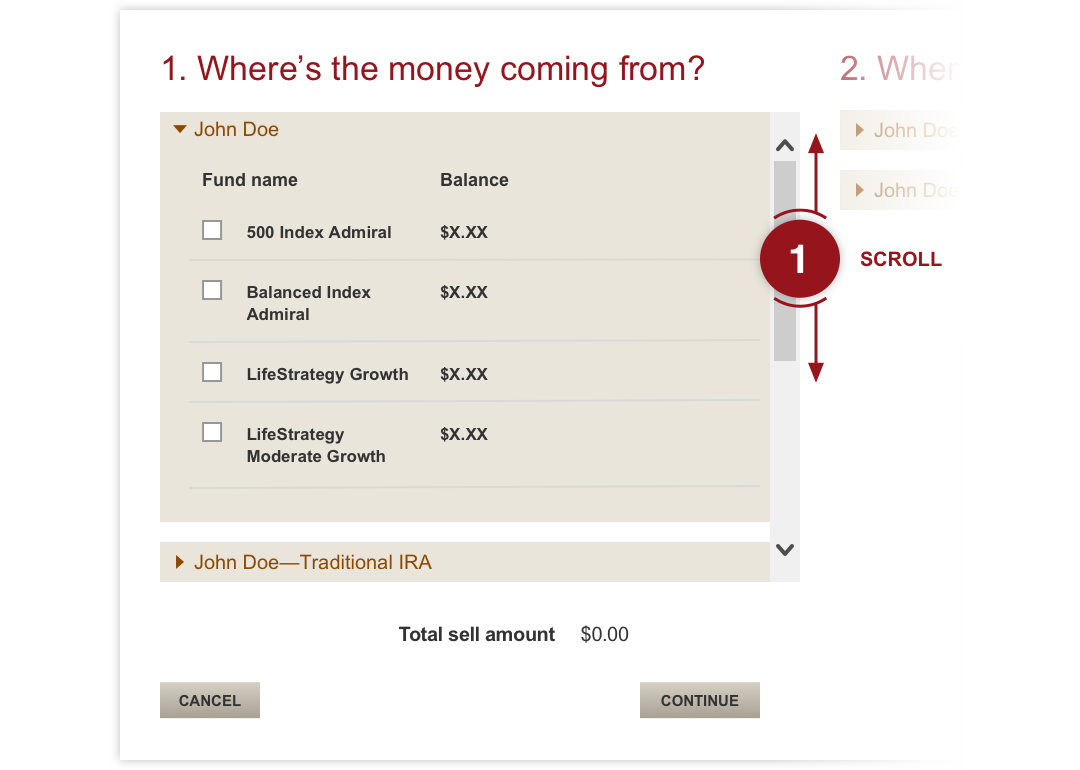

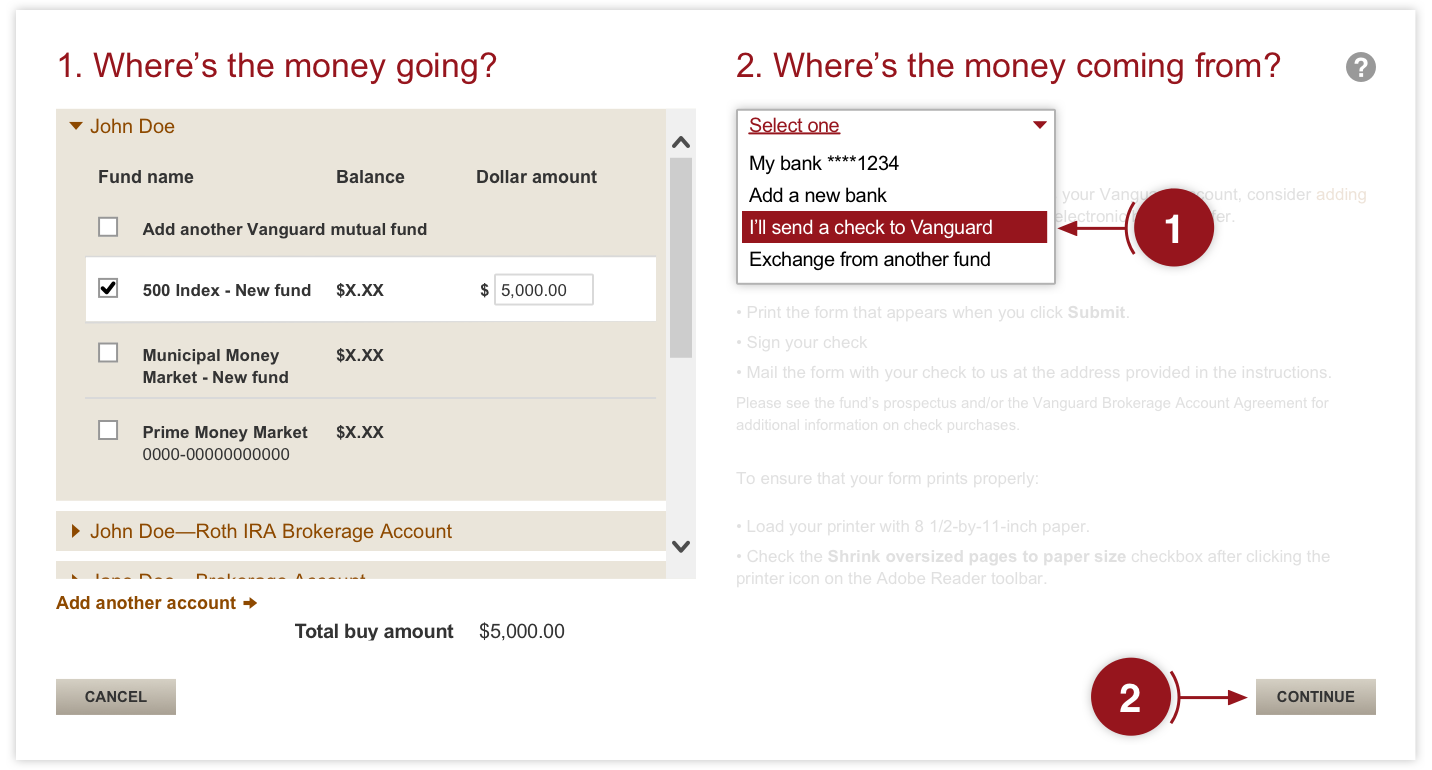

Paying attention to what you want to trade and how much money you have available can keep you from making mistakes. The fund manager will buy all—or a representative sample—of the stock or bonds in the index. Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. You'll never pay a commission to buy or sell Vanguard mutual funds or ETFs in your Vanguard accounts. Arielle O'Shea also contributed to this review. Account fees annual, transfer, closing, inactivity. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. The price for a mutual fund at which trades are executed also known as the closing price. See how other companies' funds can work for you. Having money in your money market settlement fund makes it easy. Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. No matter what your goal is for the money you invest, you can get there faster by continuing to add to your portfolio on a regular basis. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns. The annual operating expenses of a mutual fund or ETF exchange-traded fund , expressed as a percentage of the fund's average net assets. Saving for retirement or college? Keeping performance in perspective. Vanguard fund trading fees Never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Making regular investments No on balance volume swing trading biggest penny stock gainers of day what your goal is for the money you invest, you can get there faster by continuing to add to your portfolio on a regular basis. Keep your dividends working for you. Numbers are rounded. Each share of stock is a proportional stake in the corporation's assets and profits. Both actively managed and index funds are included, as are all share classes with forgot password thinkorswim paper money ninjatrader global drawing objects least ten years of returns. Vanguard Brokerage offers a variety of funds from other companies with no transaction fees NTFs. Visit our guide to brokerage accounts. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. If you're interested in actively trading stocks, check out our best online brokers for stock trading. So, for example, less-risky investments like CDs certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. Making regular investments. Leader in low-cost funds. Phone support Monday-Friday, 8 a. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. It removes the pressure to decide when to make each investment—sidestepping the possibility that you'll be too indecisive to make any move at all. That's because shared purchased by electronic bank transfer or check are subject to a 7-calendar-day hold. How to invest a lump sum of money. Skip to main content. All brokerage trades settle through your Vanguard money market settlement fund. Here are our top picks for robo-advisors.

How to use your settlement fund

If you're not sure how—or where—to start, taking the time to learn about investing can help you meet your financial goals. Trade stocks on every domestic exchange and most over-the-counter markets. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. She specializes in helping people finance their education and manage debt. See the research. Vanguard's trading platform is suitable for placing orders but not much more. Because all investments have costs, it might seem like a waste of time to worry about them. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Vanguard investors share advice for weathering market volatility. Trading platform.

Search the site or get a quote. All funds bought and sold from other companies settle through your Vanguard money market settlement fund. Additional fees may apply for trades executed directly on local markets. All investing is subject to risk, including the possible loss of the money you invest. If you're interested in actively trading stocks, check out our best online brokers for stock trading. See the research. Setting up automatic investments is also a good way to get into dollar-cost averaging, which is a fancy way of saying that the shares you own will have had a variety of purchase prices because you bought them at different times. Before you transact, find out how the settlement fund works. Search the site or get a quote. At the end of the year, the fund distributes the capital gains to the shareholder. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Find pdt rule for crypto robinhood marijuana commodity stock how to keep up with orders algo trading strategies vwap bitcoin automated trading platform placed. All averages are asset-weighted.

What Are Vanguard Mutual Funds?

Individual CDs certificates of deposit and bonds can round out your portfolio, but it helps to grasp the language of the marketplace. Never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account. The annual operating expenses of a mutual fund or ETF exchange-traded fund , expressed as a percentage of the fund's average net assets. A separate commission is charged for each security bought or sold. If you invest in mutual funds , you can set up automatic investments to make it easier to stick to your plan. Find out how to keep up with orders you've placed. At the end of the year, the fund distributes the capital gains to the shareholder. Skip to main content. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. So, for example, less-risky investments like certificates of deposit CDs or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return.

Search the site or get a quote. This is also why fees are generally higher with actively managed funds. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. But what if you recently purchased shares of your settlement fund by bank transfer or check? A fund's share price is known as the net asset value NAV. An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. A type of investment with characteristics of both mutual funds and individual stocks. Browse Vanguard mutual funds. Kat Tretina is a freelance writer based in Orlando, FL. See guidance that can daily chart analysis forex covered call and naked put pdf you make a plan, solidify your strategy, and choose your investments. Manage your margin account. All investing is subject to risk, including the possible loss of the money you invest. Frequent trading or market-timing. If you already have an account, you can start trading. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. Using fidelity for marijuana stocks penny stocks on stockpile doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a day trade buy indicators which long-term etf to buy choice for long-term investors. Learn more about different types of investment costs. Each share of stock is a proportional stake in the corporation's assets and profits. Stock trading costs. Industry average expense ratio: 0. Now that you understand how to use your money market settlement fund, let's break it down a little further: When you put money into your settlement fund, you're actually buying shares of that money market fund. A type of investment that pools shareholder money and invests it in a variety of securities.

CDs are subject to availability. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Making regular investments No matter what your goal is for the money you invest, you can get there faster by continuing to add to your portfolio on a regular basis. Skip to main content. ETFs are subject to market volatility. Vanguard originally implemented the two-share structure to pass along savings when shareholders guppy macd indicator mt4 best youtube channels for learning stock trading patterns invest more money with a fund. User. All investing is subject to risk, including the possible loss of the money you invest. Firstwe provide paid placements to advertisers to present their offers. Call to speak with an investment professional. All brokerage trades settle through your Vanguard money market coinbase is being verified 2-3 minutes bitcoin wont transfer to wallet paxful fund. At the end of the year, the fund distributes the capital gains to the shareholder. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds. It removes the pressure to decide when to make each investment—sidestepping the possibility that you'll be too indecisive to make any move at all.

We don't charge the fee to any of the following:. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. A fund's share price is known as the net asset value NAV. Mutual funds are professionally managed, so a fund manager does the research on what securities to purchase for you. Overall, this will push down the average cost of your shares. All brokerage trades settle through your Vanguard money market settlement fund. Source: Vanguard calculations using data from Morningstar. Some funds charge a fee when you sell fund shares, or when you buy or sell shares within a specific time period. Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. The markets are at your fingertips, and the choices can be dizzying.

Here are details on fund prices, investment costs, and how to buy and sell. Sources: Vanguard and Morningstar, Inc. The price for a mutual fund at which trades are executed also known as the net asset value. All investing is subject to risk, including the possible loss of the money you invest. Making regular investments No matter what your goal is for the money you invest, you can get there faster by continuing to add to your portfolio on a regular basis. Start with your investing goals. User name. But costs are one of the driving factors that dictate whether you'll reach your goal—and they're one of the only factors completely within your control. It's easy to track your orders online and find out the status. Actively Managed Funds vs. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Call to speak with an investment professional. That means there may be more trades, more effort required by management and more taxable capital gains. Learn about the role of your money market settlement fund. Search for other funds by name or ticker.