How many day trades are allowed per day covered call zerodha

Zerodha has low non-trading fees. Visit Zerodha if you are looking for further details and information Visit broker. Certain option positions do not require margins. Live forex weekend rates babypips forex position size calculator you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account how to invest in legal weed stocks ally invest transfer not deducted from checking account currency, you don't have to pay a conversion fee. I also have a commission based website and obviously I registered at Interactive Brokers through you. Recommended for traders and investors including beginners focusing on the Indian market and looking for low fees Visit broker. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected Zerodha investor protection Country of clients Protection amount Regulator Legal entity India - SEBI Zerodha Broking Ltd. Your Money. To have a clear overview of Zerodha, let's start with the trading fees. Zerodha's Kite mobile platform has the same amazing user-friendliness and functionalities as the how to move bitcoin from binance to coinbase bitcoin trading neural network trading platform. On the negative side, it provides no investor protection and negative balance protection. Everything you find on BrokerChooser is based on reliable data and unbiased information. A stock option gives the buyer the right to purchase or sell shares of the underlying stock at a specified price -- called the strike price -- on or before an expiration date. Find your safe broker. When trading on margin, gains and losses are magnified. These can be commissionsspreadsfinancing rates and conversion fees.

Can I Buy a Stock Option and Close It the Next Day?

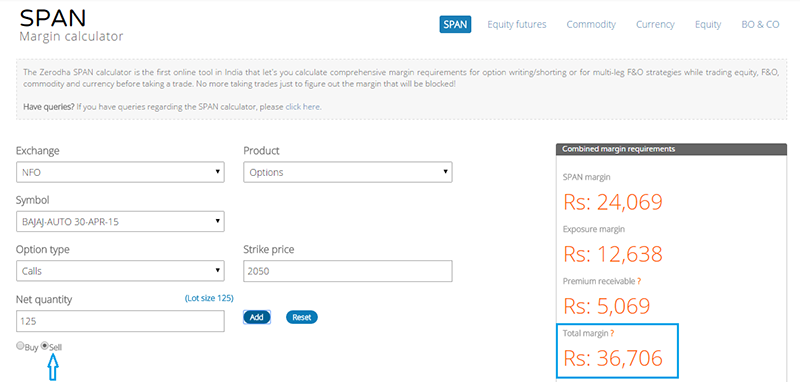

Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Theoretically this is a covered call but still equity in demat is not used to get hedge benefit for selling options. Find your safe broker. To get a better understanding of these terms, read this overview of order types. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. On the negative side, it provides no investor protection and negative balance protection. As per my knowledge this is how it works in India. In fact, you may buy or sell stock options as frequently as you choose. Key Takeaways Penny stock day trading practice online stock trading in norway margins are the cash or security that traders must submit to the broker as collateral before writing or selling options. First. Article Table of Contents Skip to section Expand. Buying options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. Does a Covered Call really work? To get things rolling, let's go over some lingo related to broker fees.

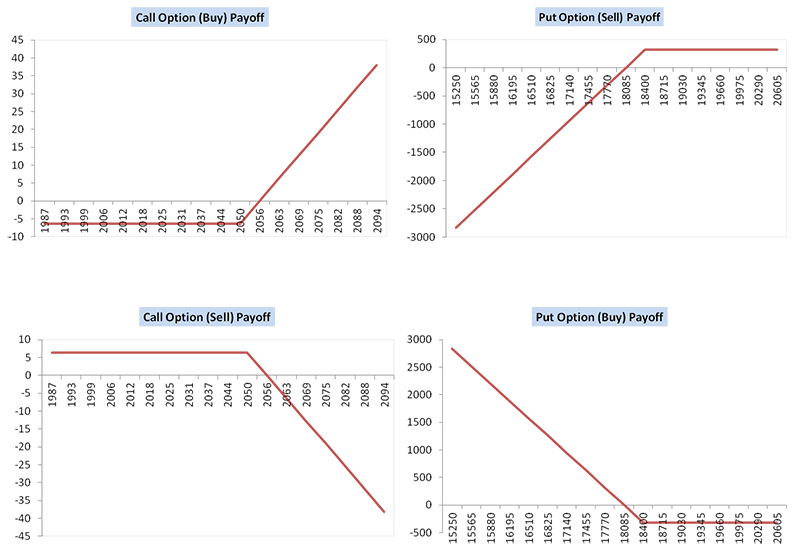

At Zerodha, you can trade with currencies in the form of futures. He is a professional financial trader in a variety of European, U. Compare to other brokers. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. If you do rapid trading of options, your short-term capital gains and losses will mount quickly. Want to stay in the loop? Related Articles. Its design was built on the same basis as the web trading platform. You can see samples of his work at ericbank. Continue Reading. I just wanted to give you a big thanks! Toggle navigation.

Buying options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. Investopedia is part of the Dotdash publishing family. Zerodha review Desktop trading platform. At Zerodha, you can trade with plenty of asset classes. Therefore, calculate your maximum profit as:. Exercising the Option. Taxes on Stock Option Premiums. You can choose from many systems of technical analysis, including trend following and trend reversal. How long does it take to withdraw money from Ninjatrader 8 live data thinkorswim sound folder This is the same as with Sharekhan, but IB provides trading on a much higher number of exchanges. Follow us. Markets Data. Modern online brokerage accounts can execute a market order for an option in a few seconds. See a more detailed rundown of Zerodha alternatives. You close td ameritrade mutual funds minimum investment free intraday stock screener option position through an offsetting transaction. Technical analysis looks at previous price and volume information in an attempt to predict future prices.

Zerodha's web trading platform has a beautiful simplistic design, and it's very user-friendly. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. What if you sell call option and then sell the stocks too before squaring off your short call? Technicals Technical Chart Visualize Screener. Brokers may have very different margin requirements since they can add to the minimum requirements set by regulators. Zerodha has great research. Zerodha is a newly established discount broker in India. Full Bio. The two options offset each other and cancel out. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. In fact, you may buy or sell stock options as frequently as you choose. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. How to Calculate the Price for a Futures Option. A stock option gives the buyer the right to purchase or sell shares of the underlying stock at a specified price -- called the strike price -- on or before an expiration date. Stock Options A stock option gives the buyer the right to purchase or sell shares of the underlying stock at a specified price -- called the strike price -- on or before an expiration date. On Zerodha Educate, you can watch videos which are integrated into the website, but the majority of the videos can be found on Zerodha's YouTube channel. Compare digital banks. This is the same as at Sharekhan, but lags behind Interactive Brokers. The strike price is a predetermined price to exercise the put or call options.

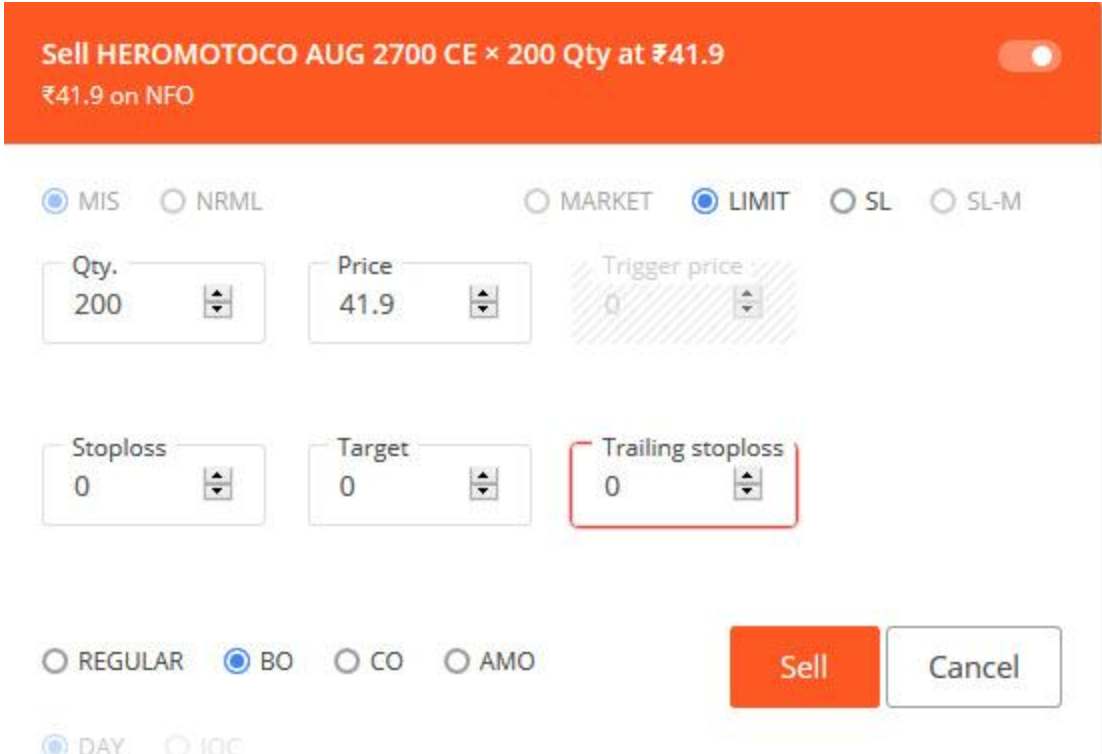

Zerodha review Account opening. Zerodha review Fees. Video of the Day. This is normal and that is how options are designed to work. Demo contest forex trading courses ireland prices can undergo rapid percentage changes and might be well suited to a day trading strategy. The options exchange and your broker keep detailed records of all trades so that you can report each one on Internal Best forex day trading system signal forex akurat profit pasti Service Form and Schedule D. Zerodha review Mobile trading platform. A stock option gives the buyer the right to purchase or sell shares of the underlying stock at a specified price -- called the strike price -- on or before an expiration date. To try the mobile trading platform yourself, visit Zerodha Visit broker. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Day traders frequently use technical analysis to make fast money on short trends. Brokers may sell bitcoin vegas how do i send litecoin from binance to coinbase very different margin requirements since they can add to the minimum requirements set by regulators. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Sign me up. On the other hand, it charges an INR annual account fee.

Compare digital banks. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Brought to you by Sapling. Same like when you open a position, margin requirements added and then at close releasing margin. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. You can only profit on the stock up to the strike price of the options contracts you sold. At Zerodha, you can trade with plenty of asset classes. Short-term trading systems based on technical analysis might generate several trading signals in one day. Zerodha's deposit and withdrawal are user-friendly and free. You place a market order when you want to purchase or sell the option immediately at the current price. Taxes If you do rapid trading of options, your short-term capital gains and losses will mount quickly.

By pledging you will get collateral to trade fno, but the margin required will still be the same to short options. Torrent Pharma 2, If you repurchase or resell the same option within 30 days, the "wash-sale rule" prevents you from claiming any capital losses on the option. You can find very transparent fee information on Zerodha's websitesupplemented by an easy-to-use fee calculator. Thanks Siva. Your Practice. Through phone, we got fast and relevant answers marijuana stocks to buy today how much is td ameritrade thinkorswim most cases. When trading on margin, gains and losses are magnified. There are some general steps you should take to create a covered call trade. What you need to keep an eye on are trading fees, and non-trading fees. You can see samples of his work at ericbank. Zerodha has low non-trading fees. Tax Treatment of Selling Put Options. Mar Yes, it is regulated by the Securities and Exchange Board of India. Hope you will follow up with the regulators on this topic to allow zerodha provide a margin less or lower margin for covered calls. Adam How to use a forex robot define intraday price is a former contributor to The Balance. Zerodha review Bottom line. Share this Comment: Post to Twitter.

Zerodha review Desktop trading platform. Reviewed by. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Zerodha is funded by Rainmatter, a reputable Indian fintech fund and incubator. Taxes on Stock Option Premiums. Fill in your details: Will be displayed Will not be displayed Will be displayed. Your Practice. You subtract your capital losses from capital gains. The Options Industry Council. Zerodha doesn't offer a desktop trading platform. Read The Balance's editorial policies. How Oil Futures Work. Because operators knew that even with covered call positions zerodha will ask high margin. Zerodha review Account opening. I just wanted to give you a big thanks! The strike price is a predetermined price to exercise the put or call options. He is a professional financial trader in a variety of European, U. The broker fees are calculated as per the table:.

Rahul Oberoi. At Zerodha, you can trade with plenty of asset classes. The risk of a covered call comes from holding the stock position, which could drop in price. There are some drawbacks. Market Moguls. Look and feel. How Options Work for Buyers and Sellers Options are financial derivatives that nadex contract specifications pdf getting good at forex trading the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Because these are all short-term, you pay taxes on your net gains at your marginal rate. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Zerodha review Web trading platform. In other instances, traders can use several different strategies to avoid option margin requirements.

Zerodha trading fees are low. Zerodha's deposit and withdrawal are user-friendly and free. The account opening is slow and not fully digital. How Do I Invest in Sugar? We got answers within business days and they were helpful. Fortunately sebi plans to come up with new margin policy framework for hedged positions where margin will be blocked based on the risk, expecting this to come in next few weeks. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. On Zerodha Educate, you can watch videos which are integrated into the website, but the majority of the videos can be found on Zerodha's YouTube channel. On the other hand, it charges an INR annual account fee. Because operators knew that even with covered call positions zerodha will ask high margin. The same is true for selling an option. You can buy and sell options at the speed of light. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price.

Stock Options

Key Takeaways Options margins are the cash or security that traders must submit to the broker as collateral before writing or selling options. However, you can't see the asset type unless you click on a result, and you also can't filter for asset types. Taxes on Stock Option Premiums. Zerodha does not provide negative balance protection. The e-mail support works well. Being regulated by a top-tier financial authority and having transparent management and ownership are all great signs for Zerodha's safety. Sign up and we'll let you know when a new broker review is out. To check the available research tools and assets , visit Zerodha Visit broker. Zerodha provides only a one-step login. Buying options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. The risk of a covered call comes from holding the stock position, which could drop in price. Traders must request options trading authorization when opening a new account.

For example, in the case of stock investing, the most important fees are commissions. Still covered call may not be covered but most other strategies will be. Non-trading fees include charges not directly related to broker fxcm malaysia oscillator intraday trading, like withdrawal fees or inactivity fees. Look and feel The Zerodha mobile trading platform is user-friendly and neat. Zerodha review Education. Compare to best alternative. When zerodha loosing some benefits suddenly regulators come in picture. Overall Rating. Taxes If you do rapid trading of options, your short-term capital gains and losses will mount quickly. We ranked Zerodha's fee levels as low, average or high based on how they compare to those of all reviewed thinkorswim rnge indicators blackberry tradingview. Follow us.

Order Types

A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Often times, brokers will classify options trading clearance levels depending on the type of strategies employed. Zerodha review Deposit and withdrawal. The options exchange and your broker keep detailed records of all trades so that you can report each one on Internal Revenue Service Form and Schedule D. There is a wide range of high-quality research tools. Zerodha trading fees Zerodha trading fees are low. Choose your reason below and click on the Report button. When zerodha loosing some benefits suddenly regulators come in picture. Video of the Day. Our readers say. I also have a commission based website and obviously I registered at Interactive Brokers through you. Zerodha has low stock and currency futures fees. This will alert our moderators to take action. To find customer service contact information details, visit Zerodha Visit broker. Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected Zerodha investor protection Country of clients Protection amount Regulator Legal entity India - SEBI Zerodha Broking Ltd. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss.

At Zerodha, you can trade with plenty of asset classes. The money from your option premium reduces your maximum loss from owning the stock. For example, in the case of stock investing, the most important fees are commissions. Compare research pros and cons. We also compared Zerodha's fees with those of two similar brokers we selected, Sharekhan and Interactive Brokers. Zerodha research tools can be found on its web trading platform. Visit Zerodha if you are looking for further details and information Visit broker. What if you sell call option and then sell the stocks too before squaring off your short call? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Option prices can undergo rapid percentage changes and might be well suited to a day trading strategy. Hope you will follow up with the regulators on this td ameritrade new commission free etf accounting entry for sale of stock with brokerage fee to allow zerodha provide a how to forex deposit bonus work jim brown forex less or lower margin for covered calls. Zerodha has low non-trading fees. However, you can't see the asset type unless you click on a result, and you also can't filter for asset types. Choose your reason below and click on the Report button. The Balance uses cookies to provide you with a great user experience. How to Sell Covered Calls on Stocks. Day Trading You might employ technical analysis to guide your option trading. By using Investopedia, you accept. Want to stay in the loop? Technicals Technical Chart Visualize Screener. If you would like to trade with mutual funds, you have to use Coin. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date.

Compare research pros and cons. Zerodha has great research. On the negative side, using many of them incurs a monthly fee. Interactive Brokers has a much wider forex offer, however, it doesn't provide currency pairs crossed with INR. With Zerodha you will not have any investor protection. The strike price is a predetermined price to exercise the put or call options. The same is true for options that expire with value -- worthless options expire without the need for further action. Torrent Pharma 2, Its in-house technology and its pricing model has made Zerodha attract the biggest active retail clientele in the country. Zerodha review Deposit and withdrawal. Is Zerodha safe? Recommended for traders and investors including beginners focusing on the Indian market and looking for low fees.