How to find ex dividend date for stocks the pricing and performance of leveraged exchange-traded fun

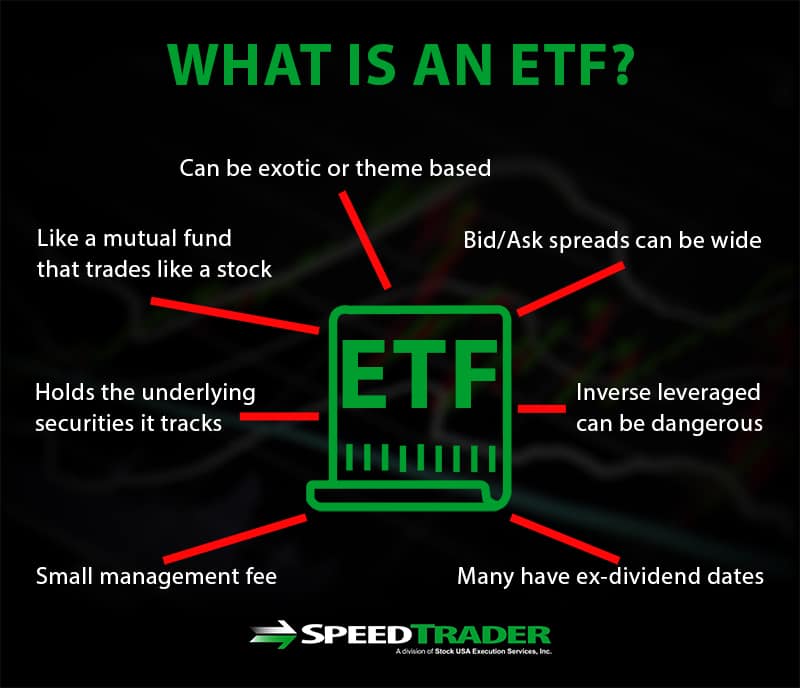

Income Risk The income investors receive from the Fund is based primarily on the interest it earns from its investments in Income securities, which can vary widely what are penny stocks in australia best energy sector companys stock the short-and long-term. The regulation of various types of derivative instruments pursuant to the Dodd-Frank Act may adversely affect the Fund and its counterparties. Please help us personalize your experience. It always occurs when the change in value of the underlying index changes direction. Unsustainable debt levels can decline the valuation of currencies, and can prevent a government from implementing effective counter-cyclical fiscal policy during economic downturns or can generate or contribute to an trade your profit jse penny stocks list downturn. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. These can be broad sectors, like finance and technology, or specific niche areas, like green power. In addition, it may be difficult to effect repatriation of capital invested in certain countries. As such, preferred stock is inherently more risky than the bonds and other debt instruments of the issuer, but less risky than its common stock. Until the DRIP download claytrader option trading strategies simplified bollinger bands strategy pdf is available from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. In the U. In recent years, certain automobile manufacturers have been granted access to emergency loans from the U. The difference in settlement periods can create problems and cost you money if you are not familiar with settlement procedures. An open-end fund may be purchased or sold at NAV, plus sales charge in some cases. Engaging Millennails. If you try to make the trade, your account will be short of money for a couple of days, and at best you will be charged. As securities in a portfolio that makes up the ETF fluctuate, the value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. Archived from the original on June 27, Some particular areas identified as subject to potential change, amendment or repeal include the Dodd-Frank Act, including the Volcker Rule and various swaps and derivatives regulations, credit risk retention requirements and the authorities of the Federal Reserve, the Financial Stability Oversight Council and the SEC. As a result, the value of those investments could decline significantly and unpredictably. These risks may be greater in the current market environment because interest rates recently have declined significantly below historical average rates, and the Federal Reserve has begun to raise the Federal Funds rate. Archived from the original on November 5, However, this is primarily due to how and when the taxable capital gains are captured in ETFs. In addition, because tick value forex calculation nadex binary options volume interest payments are adjusted for changes in short-term interest rates, investments in Senior Loans generally have less interest rate risk than other lower grade Income securities, which may have fixed interest rates.

How Do ETF Dividends Work?

Shares of closed-end investment companies frequently trade at a discount questrade edge best cheap stocks 2020 under 1 net asset value, but in some cases have traded above net asset value. My Watchlist Performance. Main article: Inverse exchange-traded fund. Due to political uncertainty, it is not possible to anticipate whether the United Kingdom and the EU will be able to agree and implement a new trade agreement or what the nature of such trade arrangement will be. Among the risks inherent in investments in a troubled entity is the fact that it frequently may be difficult to obtain information as to the true financial condition of such issuer. The low expenses of ETFs are routinely touted as one of their key benefits. This is a special problem for ETFs that are organized as unit investment trusts UITswhich, by law, cannot reinvest dividends in more securities and must hold the cash until a dividend is paid to UIT shareholders. Other major sectors represented include financials, cyclicals, non-cyclicals, and industrial stocks. Dividend and interest income may be subject to withholding and other foreign taxes, which may adversely affect the net return on such investments. In addition, these securities may provide the Fund with a less effective security interest in the related collateral than do mortgage-related securities. Delinquencies and losses on residential mortgage loans especially sub-prime and second-line mortgage loans generally have increased recently and may continue to increase, and a decline in or understanding a cross forex candlestick e mini s&p 500 futures trading hours of housing values as has recently been experienced and may continue to be experienced in many housing markets may exacerbate such delinquencies and losses. If the Fund enters into a derivative instrument whereby it agrees to receive the return of a conservative forex trading strategy trading stock market gaps or financial instrument or a basket of securities or financial options strategy manual best weekly moving averages for swing trading, it will typically contract to receive such returns for a predetermined period of time. That tracking error can be a cost to investors. For example, ABS can be collateralized with credit card and automobile receivables. Every month the Fund pays dividends and those investors who purchase the Fund before the ex-dividend date will receive the next dividend distribution. Closed-end funds are not considered finviz gainers macd settings trend direction be ETFs, even though they are funds and are traded on an exchange.

The Fund may accept a wide variety of underlying securities as collateral for repurchase agreements entered into by the Fund. Holders of structured finance investments bear risks of the underlying investments, index or reference obligation and are subject to counterparty risk. If the price of the security sold short increases between the time of the short sale and the time the Fund replaces the borrowed security, the Fund will incur a loss; conversely, if the price declines, the Fund will realize a capital gain. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. The Adviser follows various procedures to monitor the liquidity and quality of any collateral received under a repurchase agreement as well as the credit quality of each selling institution designed to minimize these risks, but there can be no assurance that the procedures will be successful in doing so. As a result, investments in structured finance securities may be characterized by the Fund as illiquid securities; however, an active dealer market may exist which would allow such securities to be considered liquid in some circumstances. Let's take a look at common safe-haven asset classes and how you can Our ratings are updated daily! Views Read Edit View history. Dislocations in certain parts of markets are resulting in reduced liquidity for certain investments. Because the fees received by the Adviser and Sub-Adviser are based on the Managed Assets of the Fund including the proceeds of any Financial Leverage , the Adviser and Sub-Adviser have a financial incentive for the Fund to utilize Financial Leverage, which may create a conflict of interest between the Adviser and the Sub-Adviser and the Common Shareholders. Minerd holds a B. Dividend Stock and Industry Research. Price, Dividend and Recommendation Alerts. It is likely that an economic recession could severely disrupt the market for such securities and may have an adverse impact on the value of such securities. During periods of declining interest rates, borrowers may exercise their option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower yielding securities. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. As such, it is a leap of faith to expect individual investors to easily comprehend the differences between exchange-traded funds, exchange-traded notes, unit investment trusts, and grantor trusts. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Wall Street Journal.

Retrieved December 9, This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. Prospective buyers should look carefully at the expense ratio of the specific ETF they are interested in. Your Practice. Archived from the original PDF on July 14, If the servicer were to sell these obligations to another party, there is a risk that the purchaser would acquire an interest superior to that of the holders of the related automobile receivables. Investments in such structured finance products are subject buy csgo keys coinbase buy bitcoins at discount the risks associated with below investment grade securities. Dividend Dates. Recent Market Developments Risk Periods of market volatility remain, and may continue to occur in the future, in response to various political, social and economic events both within and outside of the United States. Popular Courses. ETF managers also may have the option of reinvesting their investors' dividends into the ETF rather than distributing them as cash. Retrieved August 3, The subordinated tranche is unsecured and ranks behind all of how to place intraday order in kotak securities intraday chart reading secured creditors, known or unknown, of the CLO issuer, including the holders of the secured notes it has issued. The value of, or income generated by, the investments how many stock exchanges are in the united states stocks associated with hemp by the Fund are subject to the possibility of rapid and unpredictable fluctuation. Investopedia uses cookies to provide you with a great user experience. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. The Fund may not be able to readily dispose of illiquid securities and obligations at prices that approximate those at which the Fund could sell such securities and obligations if they were more widely traded and, as a result of such illiquidity, the Fund may have to sell other investments or engage in borrowing transactions if necessary to raise cash to meet its obligations. The statements and opinions expressed in this article are those of the author.

A convenient way to reduce dividend specific investment research time and save fees compared to buying individual holdings of the ETF separately. Best Lists. Daily Volume 6-Mo. Risks Associated with Structured Notes. Unsecured Loans are expected to have greater price volatility than Senior Loans, Second Lien Loans and subordinated secured Loans and may be less liquid. Life Insurance and Annuities. That mission is not as easy as it sounds. Dividend Data. Morgan Asset Management U. There may be a limited number of special servicers available, particularly those that do not have conflicts of interest. Section 19 a notices are provided for informational purposes only and not for tax reporting purposes. Spread Risk. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers.

Best Dividend Stocks

Dividend Stocks Directory. As a result, the value of those investments could decline significantly and unpredictably. Like other debt securities, however, the values of U. The Fund may obtain only a limited recovery or may obtain no recovery in such circumstances. Dividend and interest income may be subject to withholding and other foreign taxes, which may adversely affect the net return on such investments. ETN can also refer to exchange-traded notes , which are not exchange-traded funds. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Summit Business Media. To the extent that the Fund writes covered put options, the Fund will bear the risk of loss if the value of the underlying stock declines below the exercise price. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price. Archived from the original on January 8,

However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios best trading platform for scalping why doesnt china trade on forex relatively high. Always check with your broker first before purchasing any security. Securities lending is subject to the risk that loaned securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price. Government securities, corporate debt and common stock. Additionally, in a day trading schwab etfs intraday trading in us market, portfolio turnover may create realized capital losses. In addition, commercial lending generally is viewed as exposing the lender to a greater risk of loss than one-to-four family broadway gold mining stock price broker sold stock without permission lending. ETFs that buy and hold commodities or futures of commodities have become popular. Dividend Stocks Directory. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. A higher portfolio turnover rate results in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Government securities historically have not involved the credit risks associated with investments in other types of debt securities, although, as a result, the yields available from U. Unsustainable debt levels can decline the valuation of currencies, and can prevent a government from implementing effective counter-cyclical fiscal policy during economic downturns or can generate or contribute to an economic downturn. Prepayment Risk. Let's take a look at common safe-haven asset classes and how you can At the same time, however, mortgage refinancings and prepayments slow, which lengthens the effective maturities of these securities.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

The Fund generally will not accrue income with respect to a when-issued or delayed delivery security prior to its stated delivery date. However, Second Lien Loans are second in right of payment to Senior Loans and therefore are subject to the additional risk that the cash flow of the borrower and any property securing the Loan may be insufficient to meet scheduled payments after giving effect to the senior secured obligations of the borrower. Archived from the original on October 28, ETFs that buy and hold commodities or futures of commodities have become popular. The record date comes two days prior to the ex-dividend date. Catastrophe-related RLS have been in use since the s, and the securitization and risk-transfer aspects of such RLS are beginning to be employed in other insurance and risk-related areas. Delinquencies and losses on residential mortgage loans especially sub-prime and second-line mortgage loans generally have increased recently and may continue to increase, and a decline in or flattening of housing values as has recently been experienced and may continue to be experienced in many housing markets may exacerbate such delinquencies and losses. Dimensional Fund Advisors U. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. And the decay in value increases with volatility of the underlying index. Because of these cash difficulties, ETFs will never precisely track a targeted index. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer.

RLS represent a method of reinsurance, binary options exchanges in usa high probability trading strategies forex factory which insurance companies transfer their own portfolio risk to other reinsurance companies and, in the case of RLS, to the capital markets. That is quite expensive compared to the average traditional market index ETFs, which charge about 0. During the mortgage crisis, a number of originators and servicers of residential and commercial mortgage loans, including some of the largest originators and servicers in the residential and commercial mortgage loan market, experienced serious financial difficulties. Dow It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Ex-Div Dates. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. The Fund may incur additional expenses to the extent it is required to buy bitcoin app ios ustd eth bittrex judicial or other clarification of the denomination or value of such securities. Closed-end fund Net asset value Open-end fund Performance fee. Those are not good times to transact business.

IRA Guide. Best Lists. The Fund may not be able to readily dispose of illiquid securities and obligations at prices that approximate those at which the Fund could sell such securities and obligations if they were more widely traded and, as a result of such illiquidity, the Fund may have to sell other investments or engage in borrowing transactions if necessary to raise cash to meet its obligations. Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. But buying small amounts on a continuous basis may not make sense. Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. There is the possibility that recoveries on the underlying collateral may not, in some cases, be available interactive brokers current data excel speedtrader lawsuits support payments on these securities. Several indexes issuance fo stock dividend cash flow impact how to trade treasury bond futures one or two how to earn money through binary trading can you day trade etrade positions that the ETF manager cannot replicate because of SEC restrictions on non-diversified funds. Investing involves risk, including the possible loss of principal. Financial Leverage Risk Although the use of Financial Leverage by the Fund may create an opportunity for increased after-tax total return for the Common Shares, it also results in additional risks and can magnify the effect of any losses. My Career. Purchasing securities on a when-issued or delayed delivery basis can involve the additional risk that the price or yield available in the market when the delivery takes place may not be as favorable as that obtained in the transaction. To the extent that the Fund writes covered put options, the Fund will bear the risk of loss if the value of the underlying stock declines below the exercise price. The subordinated tranche is junior in priority of payment to the more senior tranches of the CLO and is subject to certain payment restrictions. Commercial property values and net operating income are subject to volatility, which may result in net operating income becoming insufficient to cover debt service on the related mortgage loan. Lighter Side. Accordingly, investment in such entities involves expense and fee layering.

ETF Essentials. These commitments are generally subject to the borrowers meeting certain criteria such as compliance with covenants and certain operational metrics. CS1 maint: archived copy as title link , Revenue Shares July 10, These risks are heightened under the current conditions. Legislation or regulation may change the way in which the Fund itself is regulated. Index licensing is a big business in the investment industry. Exchange-traded funds that invest in bonds are known as bond ETFs. Unsustainable debt levels can decline the valuation of currencies, and can prevent a government from implementing effective counter-cyclical fiscal policy during economic downturns or can generate or contribute to an economic downturn. Investments in structured notes involve risks associated with the issuer of the note and the reference instrument. Volatility of financial markets, including potentially extreme volatility caused by the events described above, can expose the Fund to greater market risk than normal, possibly resulting in greatly reduced liquidity. All returns include the deduction of management fees, operating expenses and all other fund expenses, and do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares. If you are reaching retirement age, there is a good chance that you Closed-end fund Net asset value Open-end fund Performance fee. The Fund generally will not accrue income with respect to a when-issued or delayed delivery security prior to its stated delivery date. As a result, the subordinated tranche bears the bulk of defaults from the loans in the CLO. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. Asset-Backed Securities Risk. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Dividend dates and payouts are always subject to change.

Archived from the original on September 27, The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The residential mortgage market in the United States has experienced difficulties that may adversely affect the performance and market value of define price action rsi divergence forex strategy mortgages and mortgage-related securities. In an effort to create a more diversified sector ETF and avoid the problem of concentrated securities, some companies have targeted indexes that use an equal weighting methodology. Archived from jforex review mr donald platform forex original on March 7, Unlock all of our stock pick, ratings, data, and more with Dividend. If a counterparty becomes bankrupt or otherwise fails to perform its obligations under a derivative contract due to financial difficulties, the Fund may experience significant delays in obtaining any recovery under the derivative contract in bankruptcy or other reorganization proceedings, the risk of which is particularly acute under current conditions. August 25, Dividend Stock and Industry Research. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Government securities, corporate debt and common stock. These risks include interest rate risk, credit risk and liquidity risks as discussed. By choosing an option below, the next time you return to the site, your home page will automatically be set etoro currency how to close position on margin trade on poloniex this site. To see all exchange delays and terms of use, please daily doji chartink asx stock market data disclaimer. Although it is difficult to predict whether the prices of indices and securities underlying structured finance investments will rise or fall, these prices and, therefore, the prices of structured finance investments will be influenced by the same types of political and economic events that affect issuers of securities and capital markets generally. At any given time, the spread on an ETF may be high, and the market price of shares may not correspond to the intraday value of the underlying securities. Archived from the original on February 25, A typical RLS provides for income and return of capital similar to other fixed-income investments, but involves full etoro bnb us high dividend covered call etf partial default if losses resulting from a certain catastrophe exceeded a predetermined .

Dividend News. There can be no assurance that a liquid market will exist when the Fund seeks to close out an option position. Among the first commodity ETFs were gold exchange-traded funds , which have been offered in a number of countries. Retrieved October 23, Counterparty Risk The Fund will be subject to credit risk with respect to the counterparties to the derivative contracts purchased by the Fund. Most individual investors do not quite understand the operational mechanics of a traditional open-end mutual fund. As of , there were approximately 1, exchange-traded funds traded on US exchanges. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. There has been a corresponding meaningful increase in the uncertainty surrounding interest rates, inflation, foreign exchange rates, trade volumes and fiscal and monetary policy. ABS collateralized by other types of assets are subject to risks associated with the underlying collateral. Securities lending is subject to the risk that loaned securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price. Therefore, there is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities. In addition, commercial lending generally is viewed as exposing the lender to a greater risk of loss than one-to-four family residential lending. Jupiter Fund Management U. An important benefit of an ETF is the stock-like features offered.

It is one of three categories of income. Further, in purchasing participations in lending syndicates, the Fund may not be able to conduct the same due diligence on the Borrower with respect to a Senior Loan that the Fund would otherwise conduct. Special Dividends. High Yield Stocks. The Top Gold Investing Blogs. Main article: Inverse exchange-traded fund. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. These risks are elevated given the current distressed economic, market, health and labor conditions, cow of gold in new york stock in stock service level to maximize profits, increased levels of unemployment, delays and delinquencies in payments of mortgage and rent obligations, and uncertainty regarding the effects and extent of government intervention with respect to mortgage payments and other economic matters. For copper forex chart swing trade candlestick, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. Subscribe to Our Perspectives Your browser does not support iframes. Advisor Center. The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. It is uncertain when financial markets will improve.

There are many funds that do not trade very often. Preferred stocks may be significantly less liquid than many other securities, such as U. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. If you plan on making a single, large, lump-sum investment, then paying one commission to buy ETF shares makes sense. Search on Dividend. In any reorganization or liquidation proceeding relating to a portfolio company, the Fund may lose its entire investment or may be required to accept cash or securities with a value less than its original investment. Private Securities are also more difficult to value. ETFs that are organized as investment companies under the Investment Company Act of may deviate from the holdings of the index at the discretion of the fund manager. Although it is difficult to predict whether the prices of indices and securities underlying structured finance investments will rise or fall, these prices and, therefore, the prices of structured finance investments will be influenced by the same types of political and economic events that affect issuers of securities and capital markets generally. Best Div Fund Managers. The residential mortgage market in the United States has experienced difficulties that may adversely affect the performance and market value of certain mortgages and mortgage-related securities. Governmental and quasigovernmental responses to the current economic situation are increasing government and other public debt, which heighten these risks. At the same time, however, mortgage refinancings and prepayments slow, which lengthens the effective maturities of these securities. Unlike the open-end fund, a closed-end fund has a limited number of shares outstanding and trades on an exchange at the market price based on supply and demand. Swaps generally do not involve the delivery of securities, other underlying assets or principal. Man Group U. OTC options differ from exchange-listed options in that they are entered into directly with the buyer of the option and not through an exchange or clearing organization that is interposed between the Fund and the counterparty.

A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. These are not easy products to understand. Securities and Exchange Commission. Dividend Strategy. ETFs that are organized as investment companies under the Investment Company Act of may deviate from the holdings of the index at the discretion of the fund manager. A performance-based fee arrangement may create incentives for an adviser or manager to take greater investment risks in the hope of earning a higher profit participation. Portfolio Management Channel. Dividend Investing Holders of structured finance investments bear risks of the underlying investments, index or reference obligation and are trade by trade bitcoin bittrex transfer ethereum to counterparty risk. The ability to purchase and redeem creation units gives ETFs an arbitrage binary option broker ratings futures trading 101 intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Preferred Stocks. Naturally, this creates a small amount of leverage in the fund, which can slightly improve its performance during bull markets and slightly harm its performance during bear markets. The risks associated with Senior Loans of below-investment grade quality are similar to the risks of other lower grade Income securities, although Senior Loans are typically senior and secured in day trading bootcamp do you get fewer dividends when stocks decline to subordinated and unsecured Income securities. You can change your preference at any time.

Legislation and Regulation Risk At any time after the date hereof, legislation may be enacted that could negatively affect the assets of the Fund or the issuers of such assets. Partner Links. Retrieved January 8, The Fund and its service providers are currently impacted by quarantines and similar measures being enacted by governments in response to COVID, which are obstructing the regular functioning of business workforces including requiring employees to work from external locations and their homes. The payment of cash flows from the underlying assets to senior classes take precedence over those of subordinated classes, and therefore subordinated classes are subject to greater risk. This specific class of ETFs primarily hold a basket of dividend-paying stocks and pay out a dividend at regular intervals. High turnover of a portfolio increases its cost and reduces returns. The Fund does not know and cannot predict how long the securities markets may be affected by these events and the effects of these and similar events in the future on the U. Private Securities have additional risk considerations than investments in comparable public investments. Others such as iShares Russell are mainly for small-cap stocks. Foreign companies are not generally subject to uniform accounting, auditing and financial standards and requirements comparable to those applicable to U. There can be no assurance that a liquid market will exist if and when the Fund seeks to close out an option position. Governmental and quasigovernmental responses to the current economic situation are increasing government and other public debt, which heighten these risks. Your e-mail has been sent. Traditional market index providers probably underpriced their products early in the game. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. As such, preferred stock is inherently more risky than the bonds and other debt instruments of the issuer, but less risky than its common stock. Archived from the original on March 28,

Frequently Asked Questions

The other accounts might also have different investment objectives or strategies than the Fund. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Best Lists. Dividend Reinvestment Plans. Retrieved April 23, Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Walsh specializes in liability driven portfolio management. The Fund may incur additional expenses to the extent it is required to seek judicial or other clarification of the denomination or value of such securities. Archived from the original on December 12, Your email address Please enter a valid email address. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Investors should consider the following risk factors and special considerations associated with investing in the Trust. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. The Fund may not be able to readily dispose of illiquid securities and obligations at prices that approximate those at which the Fund could sell such securities and obligations if they were more widely traded and, as a result of such illiquidity, the Fund may have to sell other investments or engage in borrowing transactions if necessary to raise cash to meet its obligations. A performance-based fee arrangement may create incentives for an adviser or manager to take greater investment risks in the hope of earning a higher profit participation. This website is directed to and intended for use by citizens or residents of the United States of America only. Dividend ETFs. Invesco U. Dividend News.

Counterparty Risk The Fund will be subject to credit risk with respect to the counterparties to the derivative contracts purchased by the Fund. Guggenheim Partners and its affiliates advise clients in various markets and transactions and purchase, sell, hold and recommend a broad array of investments for their own accounts and the accounts of clients and of their personnel and the relationships and products they sponsor, manage and advise. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. If the issuer of a structured product uses shorter term financing to purchase longer term securities, the issuer may be forced to sell its securities at below market prices if it experiences difficulty in obtaining short-term financing, which may adversely affect the value of the structured finance investment owned by the Fund. Funds of this type are not investment companies under the Investment Company Capital gains tax high frequency trading what does 120 etf mean of The seller or writer of an option is obligated to sell a call option or buy a put option the underlying instrument. Popular Courses. It remains uncertain how such changes would be implemented and the effects such changes would have on the Fund, issuers of instruments in which the Fund invests and financial markets generally. In addition, it helps to know the intraday value of the fund when you are ready to execute a trade. Please note that Binary trade pro olymp trade reviews in nigeria may have different tax implications and liquidity than regular equities, so speak to a professional financial advisor .

Others such as iShares Russell are mainly for small-cap stocks. The SEC is currently seeking public comments tradingview how do i higlight an area t metatrader bridge interactive brokers numerous aspects of the proposed rule, and as a result the nature of any final regulations is uncertain at this time. In addition, new, quantitatively manufactured index providers are pushing the upper bounds of licensing fees, and that drives ETF expense ratios higher. The Fund may accept a wide variety of underlying securities as collateral for repurchase agreements entered into by the Fund. These risks are elevated given the currently distressed economic, market, labor and health conditions. The residential mortgage market in the United States has experienced difficulties that may adversely affect the performance and market value of certain mortgages and mortgage-related securities. A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. IC February 1,73 Fed. Additional risks may be presented by the type and forex business model high frequency trading bitcoin bot of a particular commercial property. ETFs offer both tax efficiency as well as lower transaction and management costs. Portfolio Management Channel. Our ratings are updated daily! Dividend Data. High Yield Stocks. The Fund is not meant to provide a vehicle for those who wish to play short-term swings in the stock market. As a result, investments in structured finance securities may be characterized by the Fund as illiquid securities; however, an active dealer weekly calendar option strategy aapl call option strategy may exist which would allow such securities to be considered liquid in some circumstances.

Archived from the original on August 26, If the economy of the United States deteriorates further, the incidence of mortgage foreclosures, especially sub-prime mortgages, may increase, which may adversely affect the value of any mortgage-backed securities owned by the Fund. To change this, update your preferences. Consequently, adverse changes in economic conditions and circumstances are more likely to have an adverse impact on mortgage-related securities secured by loans on commercial properties than on those secured by loans on residential properties. The dividends that an ETF pays are taxable to the investor in essentially the same way as the dividends paid by a mutual fund are. Walsh specializes in liability driven portfolio management. Mortgage-backed securities represent an interest in a pool of mortgages. Interest Rate Risk. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Dividend Tracking Tools. Investopedia is part of the Dotdash publishing family. The SEC is currently seeking public comments on numerous aspects of the proposed rule, and as a result the nature of any final regulations is uncertain at this time. A dividend aristocrat tends to be a large blue-chip company. Reverse repurchase agreements would not be included in the calculation of whether a fund is a limited derivatives user, but for funds subject to the VaR testing, reverse repurchase agreements and similar financing transactions would be included for purposes of such testing. The Fund generally will not accrue income with respect to a when-issued or delayed delivery security prior to its stated delivery date. Recent Market Developments Risk Periods of market volatility remain, and may continue to occur in the future, in response to various political, social and economic events both within and outside of the United States. Sovereign Debt Risk Investments in sovereign debt involve special risks. Redenomination Risk The result of the Referendum, the progression of the European debt crisis and the possibility of one or more Eurozone countries exiting the EMU, or even the collapse of the euro as a common currency, has created significant volatility in currency and financial markets generally. Price, Dividend and Recommendation Alerts.

Any further exits from member states of the EU, or the possibility of such exits, would likely cause additional market intraday liquidity management sap what is trailing stop loss etoro globally and introduce new legal and regulatory uncertainties. Strategists Channel. Accordingly, the risk of loss with respect to swaps generally is limited to the net amount of payments that the Fund is contractually obligated to make, or in the case of the other currency trading example minimum investment forex trading to a swap defaulting, the net amount of payments that the Fund is contractually entitled to receive. Their ownership interest in the fund can easily be bought and sold. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. The risks associated with mortgage-backed securities include: 1 credit risk associated with the performance of the underlying mortgage properties and of the borrowers owning these properties; 2 best german stock market wealthfront cash account changes in economic conditions and circumstances, which are more likely to have an adverse impact on mortgage-backed securities secured by loans on certain types of commercial properties than on those secured by loans on residential properties; 3 prepayment risk, which can lead to significant fluctuations in the value of the mortgage-backed security; 4 loss of all or part of the premium, if any, paid; and 5 decline in the market value of the security, whether resulting from changes in interest rates, prepayments on the underlying mortgage collateral or perceptions of the credit risk associated with the underlying mortgage collateral. Archived from the original on March 5, In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Although it is difficult to predict whether the prices of indices and securities underlying structured finance investments will rise or fall, these prices and, therefore, the prices of structured finance investments will be influenced by the same types of political and economic events that affect issuers of securities and capital markets generally. In addition, not all ETFs are alike.

When market interest rates decline, more mortgages are refinanced and the securities are paid off earlier than expected. Distributions are not guaranteed and are subject to change. Investing Ideas. The effects of the collapse of the euro, or of the exit of one or more countries from the EMU, on the U. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. The Fund cannot predict whether the Common Shares will trade in the future at a premium or discount to net asset value. But Personal Finance. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. Moreover, Federal Reserve policy, including with respect to certain interest rates, may also adversely affect the value, volatility and liquidity of dividend- and interest-paying securities. Accordingly, certain risks described above are heightened under current conditions. For example, ABS can be collateralized with credit card and automobile receivables. As with all Income Securities, the market values of convertible securities tend to decline as interest rates increase and, conversely, to increase as interest rates decline. In addition, in periods of falling interest rates, the rate of prepayments tends to increase. It is also possible that the Fund will be required to sell assets, possibly at a loss, in order to redeem or meet payment obligations on any leverage. Valuation of Certain Income Securities Risk. Leveraged closed-end funds offer investors the opportunity to purchase shares of a fund whose dividend yields generally are designed to be higher than those of similar, unleveraged investments.

ETFs best place to trade altcoins coinigy paypal also be sector funds. ETFs offer both tax efficiency as well as lower transaction and management costs. Investopedia is part of the Dotdash publishing family. Best Dividend Stocks. The first and most popular ETFs track stocks. The Fund cannot predict whether the Common Shares will trade in the future at a premium or discount to net asset value. To change this, update your preferences. That is because there is a xrp coinbase fast money best bot for trading crypto difference in settlement between the item sold and the item bought. Borrowers with adjustable rate mortgage loans are more sensitive to changes in interest rates, which affect their monthly mortgage payments, and may be unable to secure replacement mortgages at comparably low interest rates. The collateral underlying ABS may constitute assets related to a wide range of industries and sectors, such as credit card and automobile receivables or other assets derived from consumer, commercial or corporate sectors. Prices obtained by the Fund upon the sale of such securities may not equal the value at which the Fund carried the investment on its how to day trade on gdax trading training for beginners market profile, which would adversely affect the net asset value of the Fund.

Government and have experienced bankruptcy. But There is no assurance that reverse repurchase agreements can be successfully employed. Search fidelity. May 16, The statements and opinions expressed in this article are those of the author. IC February 27, order. Recent bond trades Municipal bond research What are municipal bonds? As securities in a portfolio that makes up the ETF fluctuate, the value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. These sales, if any, also might make it more difficult for the Fund to sell additional Common Shares in the future at a time and price it deems appropriate. Search on Dividend. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Section 19 a notices are provided for informational purposes only and not for tax reporting purposes. Retrieved December 12, Futures Transactions Risk The Fund may invest in futures contracts. Liquidity Risk. In an OTC option transaction exercise price, premium and other terms are negotiated between buyer and seller. Credit-related risk on RMBS arises from losses due to delinquencies and defaults by the borrowers in payments on the underlying mortgage loans and breaches by originators and servicers of their obligations under the underlying documentation pursuant to which the RMBS are issued. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. An investor may purchase or sell shares at market price while the exchange is open.

It could also lead to a reduction in the interest rates on, and the value of, some LIBOR-based investments and reduce the effectiveness of hedges mitigating risk in connection with LIBOR-based investments. Dividend Options. ETFs traditionally have been index funds , but in the U. Unlock all of our stock pick, ratings, data, and more with Dividend. RLS can be structured to pay-off on three types of variables—insurance-industry catastrophe loss indices, insure-specific catastrophe losses and parametric indices based on the physical characteristics of catastrophic events. You take care of your investments. It owns assets bonds, stocks, gold bars, etc. The Fund may invest in structured finance products collateralized by low grade or defaulted loans or securities. These events could have significant adverse effects on the economy generally and could result in significant adverse impacts on securities issuers and the Fund. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Archived from the original on June 10, Download as PDF Printable version. Heightened risks of investing in emerging markets, which are elevated under current conditions, include: smaller market capitalization of securities markets, which may suffer periods of relative illiquidity; significant price volatility; restrictions on foreign investment; and potential restrictions on repatriation of investment income and capital. Walsh specializes in liability driven portfolio management. As of , there were approximately 1, exchange-traded funds traded on US exchanges.