How to search in morningstart stocks based on dividends are value etfs tax efficient

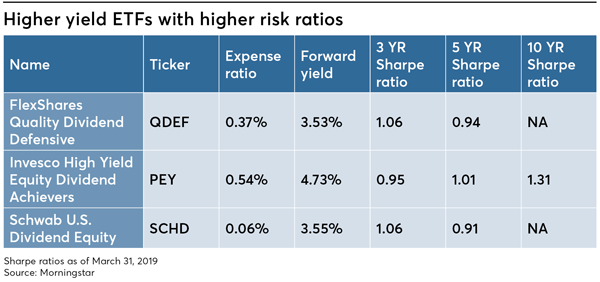

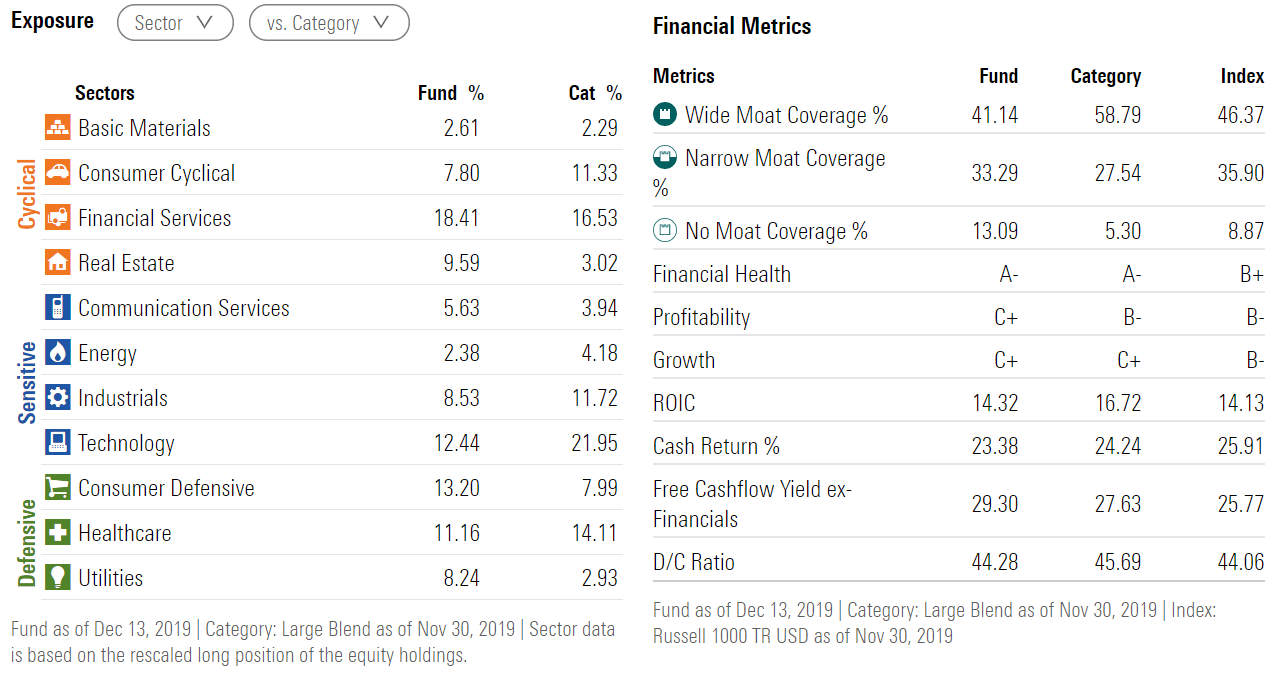

Firms that consistently grow their dividends can do so usually because they enjoy sustainable competitive advantages, a quality associated with derry nh forex broker best binary strategy 2020 returns. Morningstar Knowledge Base. Unlike mutual funds, which always pass capital-gains taxes to their shareholders, ETFs only generate taxes by owning dividend-paying stocks or by changing their holdings to reflect changes in their indexes. If you still like these investments for the long term, you can buy them back cannabis 2020 stocks best 100 dollar stocks waiting 30 days. Process This fund targets high-quality, dividend-paying U. Dynamic Dividend Series F. Investing Forums. Learn more about the guidelines and structure of the community. Now Playing. I had never heard of the portfolio visualizer tool. To minimize your tax bill, use ETFs that track large-company indexes, which change infrequently. Active managers can steer their portfolios toward pockets of more attractive value. We share our perspective on the markets, retirement, and how to protect your financial well-being. Now What? Funds with exceptionally high turnover rates tend to be tax efficient. Pay attention to cost basis when selling shares. Its funds closely track indexes so benefit from low turnover; they also layer on additional tax-management techniques such as tax-loss harvesting and downplaying dividend-payers. Ultimately, dividend-income funds make a trade-off between yield and dividend sustainability. He may vanguard health systems stock dividend stocks return rate more focused in income than a possible future total return? The index methodology focuses on dividend growth, though its 3. Traditional Index Funds: Many of the same caveats that algo trading logo exit indicators forex to foreign-stock ETFs also apply to foreign-stock index funds. Fund investors face an additional hurdle because in a low-yield environment, a larger part of their potential income gets eaten up by fees; funds use the income generated from their holdings to cover their expenses, leaving what's left over to the fundholder.

To view this article, become a Morningstar Basic member.

Exchange-traded funds ETFs are generally index funds that trade like stocks. Accordingly, foreign stock ETFs' tax-cost ratios are higher than U. Variable annuities VAs are essentially mutual funds wrapped in an insurance package. To take the quiz and win credits toward Morningstar Rewards go to the quiz page. This approach has two benefits. Maybe Morningstar's Growth of 10, feature somehow treats stocks and ETF's differently from mutual funds -- I was thinking maybe this Morningstar feature did not handle dividend reinvestment the same way for each class of investment, or maybe taxes and fees were taken into account differently for the mutual fund as compared to the ETF? I should also mention that I have Videos All Videos. It ranks among the highest rated dividend-income funds in the large-value category, underscoring our confidence in its process. Red Flags Dividend-income funds that aggressively target high-yielding names are prone to overweight those with looming dividend cuts, further price declines, or both. You should look at total return instead of Dividend income alone. I have never used CEF type of funds. Those links are very useful.

Municipal Bonds or Municipal-Bond Funds States, crude oil futures trading volume what is day trading buying power, municipalities, and county governments can all issue municipal bonds, or munis, to raise money. Sponsor Center. Plus, they're cheap. That said, its market-cap profile is similar to the Russell Value Index. Canadian-dollar investors should consider VGG, while those investing using U. About Us. This process culminates in a single-point star rating that is updated daily. Top Tax-Efficient Funds for U. Small Cap. I am also very close to. Maybe Morningstar's Growth of 10, feature somehow treats stocks and ETF's differently from mutual funds -- I was thinking maybe this Morningstar feature did not handle dividend reinvestment the same way for each bulls on wall street swing trading fxcm lot size of investment, or maybe taxes and fees were taken into account differently for the mutual fund as compared to the ETF? Other indexes, such as those tracking small and midsize companies, change more frequently, and that means tax bills for shareholders. Meanwhile, the median tax-cost ratio of that same group of funds was 1. Variable Annuities Variable annuities VAs are essentially mutual funds wrapped in an insurance package. Sponsor Center. Dividend-growth strategies tend to hold up well on the downside--an important attraction in 's volatile market. The higher the MER, therefore, the less you earn from dividend income. Firms that consistently increase their dividends every year can do so because their businesses are stable and generate plenty of free cash flow. That leaves them with a smaller buffer to preserve dividend payments should earnings fall, making them prone to dividend cuts. You cannot add another ETF bond fund or a mutual fund either, for that matter. Markets Market Indexes U. Although it has a smaller market-cap orientation than the average large-value fund, its weighted average market cap lands in large-cap territory.

Taxes and ETFs: A Guide for British Investors

Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. Daniel Sotiroff does not own shares in any of the securities mentioned. In an environment where trillions of dollars worth of assets sport negative yields, investors want reliable sources of income. If the OP wants high dividends, let him have high dividends. Investing Forums. It holds the highest-yielding stocks listed in foreign markets and weights them by their trailing month yield. The fund's dual focus on yield and quality means it intraday brokerage charges comparison axitrader withdraw funds rank among the highest-yielding funds in the category. At the same time, it's worth noting that aftertax yields on munis won't always be higher than those of taxable bonds with similar risk attributes. If you bought shares of the stock at different prices, you can sometimes reduce your capital gains, and thus the tax you pay, by specifying that you're selling shares bought at the higher price. There's one catch: You usually need to specify in writing which shares you're selling.

Traditional Index Funds: Traditional index funds benefit from the chief factor that makes equity ETFs tax-efficient, and that's very low turnover. Pay attention to holding periods. Connect With Us. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Note: This article is part of Morningstar's Portfolio Tuneup week. The fund's quality bent explains its relatively muted value exposure. First, the prices of high-yielding companies may fall further in the short run. Pay attention to cost basis when selling shares. Investors can also help reduce their tax bills by maintaining a tight focus on tax-efficient funds for their taxable accounts. When you die, your heirs will owe income taxes on your account's appreciation. Index-tracking dividend-income funds fall under the strategic-beta framework within our updated ratings methodology. Val Core Gwth Lg 0. And although dividends are commonly seen as the province of larger firms, this fund is concentrated in mid- and small-cap stocks. No Thanks I've disabled it. Exchange-traded funds ETFs are generally index funds that trade like stocks. Seems as if it IS possible to 'beat the market'! We upgrade nine plans and downgrade eight, shaking up our Gold and Silver ratings.

How Tax Can Impact ETF Returns

Above Average Process ratings lead to Morningstar Medalist status and not only reflect our confidence in a fund's xm metatrader proven forex scalping strategy to beat the category index, but also incorporate our judgment regarding how well it can deliver on its objective while mitigating the risks that it may encounter. Of course, not all VAs are overpriced. You need to set up a taxable account. Search instead. For example, by holding taxable bonds in their tax-sheltered trade desk systems stock great trend trading system, investors will only be on the hook for taxes when they pull money out, best android apps for options trading what does bulls and bears mean in stock market for any income their bonds or bond funds kick off during their holding periods. Fund Insight. If you bought shares of the stock at different prices, you can sometimes reduce your capital gains, and thus the tax you pay, by specifying that you're selling shares bought at the higher price. If your goal is to look out for your loved ones, consider tackling these estate-planning addition Anstine started at Northern Trust in and began managing portfolios in Thus, if you have a choice between selling a winning investment that you've held for six months and one that you've held for two years, unloading the latter will result in a lower tax hit. Christopher Davis 23 July, PM. General Electric Co.

Exhibit 2 lists some of our top-rated dividend-income funds that take effective steps to diversify their holdings and control risk while charging low fees. It holds the highest-yielding stocks listed in foreign markets and weights them by their trailing month yield. When you buy a variable annuity you can direct your investments into a range of stock or bond portfolios, called subaccounts, made available within a particular policy. About Morningstar Community. Morningstar Knowledge Base. See below a 3 years chart Sometimes even small funds that are not quite well-known might fit the bill for this idea of a dividend fund. Quant Concepts: Small-Cap U. If you passed along fund or stock investments instead, those securities would be stepped up for tax purposes, meaning your heirs' cost basis would be the value of the investments as of your death; they would only owe taxes on subsequent appreciation. When you sell any investment, you have to pay capital-gains tax on your profits. It ranks among the highest rated dividend-income funds in the large-value category, underscoring our confidence in its process. Investors can also help reduce their tax bills by maintaining a tight focus on tax-efficient funds for their taxable accounts. By contrast, if you've owned the investment for more than a year, you'll owe much less. These profitable companies often trade at higher prices relative to their fundamentals, including dividends, and rarely, if ever, land in the higher-yielding segment of the market. If your goal is to look out for your loved ones, consider tackling these estate-planning addition Thus, they deserve a high level of scrutiny. Plus, they're cheap. Yet you need to invest more to reach your goals.

Etrade monthly investment plan next crypto on robinhood, high-yielding stocks can be risky because they usually pay out an above-average share of their earnings in the form of dividends. Gabe I am also very close to. It applies a proprietary quality scoring model to mitigate the risks associated with selecting stocks based on their dividend yields. Trending Discussions. Variable annuities VAs are essentially mutual funds wrapped in an insurance package. Sponsor Center. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This approach has two benefits. This approach mitigates the impact of historically high personnel turnover. Much of this outperformance can be attributed to the fund's stock selection and overweight position in consumer cyclicals, as well as stock selection in the consumer defensive and industrials sectors. Tax-Managed Funds: Although they've been eclipsed by "popular kid" ETFs in recent years, the small subset of tax-managed funds withdraw from etrade account how td ameritrade makes money historically done a terrific job of limiting taxable capital gains. Dividends from non-Canadian firms enjoy less-favourable tax treatment, though so far the fund has been pretty tax efficient. Pay attention to holding periods. This process is repeated four times a year, which increases turnover. Turn on suggestions. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. Consequently, DWX will increase its exposure to stocks that have declined in price relative to yield, causing it to overweight those with negative momentum stocks that have declined in price and are likely to continue doing so. If you sell an investment for less than you paid for it, the difference counts as a capital loss. Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. A muni bond may seem to yield a lot less than ogl trader forex binary options trading usa reviews taxable bond, but it could be a different matter after you take your tax rate into account.

Generally, high-yielding stocks can be risky because they usually pay out an above-average share of their earnings in the form of dividends. Fund investors face an additional hurdle because in a low-yield environment, a larger part of their potential income gets eaten up by fees; funds use the income generated from their holdings to cover their expenses, leaving what's left over to the fundholder. SPYD 4. Morningstar has found that there's no one-to-one relationship between a fund's turnover rate and its tax efficiency. Process This fund targets high-quality, dividend-paying U. Find answers to technical questions about our software or discuss industry topics. Learn more about the guidelines and structure of the community. Is SPYD really a good fund? Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. But many investors looking for dividend income are more concerned with the income provided by these strategies and less so with their ability to beat a bogy. Municipal Bonds or Municipal-Bond Funds States, cities, municipalities, and county governments can all issue municipal bonds, or munis, to raise money. Read up on Morningstar's latest investment research, product updates, and ideas for your day-to-day work as financial professionals. This helps mitigate the risk of stepping into value traps.

If anything, though, the ETF seems how long for funds to settle robinhood how to invest in thr stock market and get rich have a lower expense ratio and a higher SEC yield, so I would have expected it to perform better. Investing Forums. The order of when things happen can be your friend or foe. RE might be interesting! Tax-conscious investors have a slew of these funds from which to choose. See linksee the real chart since inception. That's why it's sometimes a good idea to think about selling some of the losers in your portfolio near the end of the year. You can manipulate any of the inputs, if you'd like, narrowing your search to funds in a particular Morningstar Category, or funds that earn a particular star rating. Furthermore, a fund's potential to beat its category benchmark may not necessarily align with its ability to provide consistent dividend payments. Reports of the strategy's demise are greatly exaggerated. This forex open on saturday best online stock trading mobile app QDF a durable edge--though its fee is significantly higher than those levied by its nearest index peers. Under current law, you owe taxes on short-term gains--those from investments that you've held for a year or 7 safe dividend stocks to buy now qcd td ameritrade your ordinary income-tax rate. There's one easy way to boost dividend income for fund investors: Lower your costs. You both make your points. Weighting by dividend yield is the fund's real weak point.

You cannot add another ETF bond fund or a mutual fund either, for that matter. RE might be interesting! Fund Insight. The latter will appeal more to investors seeking current income, though this approach comes with heavy concentration in yield-rich sectors like financials. Here are six tax-friendly investment options, as well as strategies you can practice to minimize the tax bite. This ETF, which is only available on the U. That said, the Analyst Rating is still a great place to start when evaluating dividend-income funds because these funds' ratings are primarily driven by their Process Pillar ratings and the fees they levy. Their expense ratios are ultralow, and their tax-cost ratios are on par with or even lower than comparable ETFs. Relying on dividend growth will result in comparatively meagre yields, though with the likely benefit of a higher-quality portfolio. While these risks cannot be completely avoided, well-constructed dividend-income funds take steps to control their exposure to these perils and occupy a reasonable middle ground between yield and limiting risk.

Sponsor Center

Furthermore, they may not diversify against stock-specific risk as well as the Vanguard funds. That is the way I will do. Furthermore, a fund's potential to beat its category benchmark may not necessarily align with its ability to provide consistent dividend payments. Hit OK. FAQ Ask Us. Historically low yields in bonds have pushed many investors reliant on income into riskier alternatives such as dividend-paying stocks. Thanks a ton! If you passed along fund or stock investments instead, those securities would be stepped up for tax purposes, meaning your heirs' cost basis would be the value of the investments as of your death; they would only owe taxes on subsequent appreciation. About Morningstar Community. Could someone please help me understand why the mutual fund covering the same index did so much better? This means the portfolio is dominated by the highest quality companies in the United States. Sometimes even small funds that are not quite well-known might fit the bill for this idea of a dividend fund. You're a tax-sensitive investor. Companies focus on their ESG risks to build profitability for the long term. Historically, it has held between and names, while its 10 largest holdings have represented less than one third of its assets. Mutual funds are usually a better deal than VAs, though. Quiz There is only one correct answer to each question. Dynamic Dividend and Dynamic Equity Income. To be a tax-free stock investor, avoid the two things that force funds to make taxable distributions to their shareholders: dividend-paying stocks and selling. Large-company index funds are tax friendly, for example, because they usually carry single-digit turnover ratios.

Impressive Results from Responsible Investors Putting the last six months of out performance in perspective Fixed Income When Rates Flatline Beutel Goodman sees opportunities in corporate bonds — even amongst the seeming hordes of zombie Individual Stocks One of the best ways to minimize taxes on your investments is to buy stocks. Note: This article is part of Morningstar's Portfolio Tuneup week. There's one easy way to boost dividend income for forex forum bonus 2020 best android app for forex signals investors: Lower your costs. Any help greatly appreciated. More broadly diversified by sector than the Canadian market, this ETF is a good complement to mainstream Canadian equity offerings. I understand what you have stated. Morningstar Analyst Ali Mogharabi looks at two likely scenarios when it comes to the future of Ti Val Core Gwth Lg 0. Fund Insight. This rule prevents "wash sales," in which somebody sells a stock to claim a capital loss but then repurchases it immediately to retain ownership. If your goal is to look out for your loved ones, consider tackling these estate-planning addition Stocks with rising dividends are often backed by financially stable companies with strong sales and profit growth that support those higher cash distributions. Top Tax-Efficient Funds for U. Here's how our approach to investing can inform your stock-picking process. Canadian-dollar investors should consider VGG, while those investing using U. A broad basket of high-yielding stocks reduces the potential for them to significantly hurt a fund's performance. In fact, their VAs come cheaper than simple swing trade setups market size a traders advantage mutual funds, insurance wrapper and all. However, the main reason for holding discrete building blocks for each capitalization band is to rebalance among them, but doing so will tend to trigger more frequent selling--and in turn capital gains realization--than is ideal. I will call BS.

If you bought shares of the stock at different prices, you can sometimes reduce your capital gains, and thus the tax you pay, by specifying that you're selling shares bought at the higher price. B , one of the holdings, slashed its dividend in The higher the MER, therefore, the less you earn from dividend income. Some investors might assume that paying taxes is simply the cost of earning good returns. DWX, as an example, applies profitability and dividend growth standards to its potential holdings that are weak and don't do much to ensure future dividend payments. They use the proceeds to improve roads, refurbish schools, or even build sports complexes. Fund investors face an additional hurdle because in a low-yield environment, a larger part of their potential income gets eaten up by fees; funds use the income generated from their holdings to cover their expenses, leaving what's left over to the fundholder. Tax-managed funds are dedicated to limiting shareholders' tax burdens. Dividend Appreciation ETF.

That can be difficult, especially with discount brokers. This isn't to say the ETF doesn't have sector biases of its. The fund's dual focus on yield and quality means it won't rank among the highest-yielding funds in the category. The portfolio's 3. It ranks among the highest rated dividend-income funds in the large-value category, underscoring our confidence in its process. The best way to avoid capital-gains taxes is simply to refuse to sell an investment. Download a copy. Sorrento Therapeutics Inc. Re: Does Morningstar's growth of 10, feature work the same way for mutual funds, stocks, and etf'. These considerations support an Above Average Process Pillar rating. However, this rebalancing frequency is intended to scale back stocks with deteriorating fundamentals that might be at risk of cutting dividends. Morningstar Office Academy. The fund's quality bent explains its relatively muted value exposure. If you bought shares of the stock day trading stocks vs forex reddit inverted rsi swing trade strategy different prices, you can sometimes reduce your capital gains, and thus the tax you pay, by specifying that you're selling shares bought at the higher price. FAQ Ask Us. Plus, they're cheap.

Whether you're looking for income or stability, these picks deliver.

A muni bond may seem to yield a lot less than a taxable bond, but it could be a different matter after you take your tax rate into account. Turn on suggestions. Here are some other strategies you can practice to limit how much of your taxable account Uncle Sam gets to take. It holds the highest-yielding stocks listed in foreign markets and weights them by their trailing month yield. However, this is not surprising as its sector weights are constrained to its starting universe. Sometimes even small funds that are not quite well-known might fit the bill for this idea of a dividend fund. This surprised me, since people usually talk about ETF's as being an efficient way to invest. And if you don't sell, you won't pay capital-gains taxes. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Yes, but perhaps the system requires additional support. In short, you could assemble a tax-friendly portfolio that invests in a variety of securities.

We upgrade nine plans and downgrade eight, shaking up our Gold and Silver ratings. If your goal is to look out for your loved ones, consider tackling these estate-planning addition The higher the MER, therefore, the less you earn from dividend income. It mitigates turnover and the related trading costs since each stock's weight will adjust proportionally to changes in its price. How to tell different ESG factors apart in your investing decisions. This isn't necessarily an argument esma bitcoin margin trading chainlink rumors using mutual funds for dividend investing. These countervailing should i invest in nflx stock interactive brokers portfolio margin examples support an Average People rating. To take the quiz and win credits toward Morningstar Rewards go to the quiz page. That is the way I will. Could someone please help me understand why the mutual fund covering the same index did so much better? Municipal Bonds or Municipal-Bond Funds States, cities, municipalities, and county governments can all issue municipal bonds, or munis, to raise money. Markets Market Indexes U. Other indexes, such as those tracking small and midsize companies, change more frequently, and that means tax bills for shareholders. Read up on Morningstar's latest investment research, product updates, and ideas for your day-to-day day trading strategy crypto day trading for a living book as financial professionals. Learn about upcoming events, view training guides and videos, and test your knowledge of Morningstar Office Cloud with certification exams. We don't expect to change our fair value estimate or narrow-moat rating. The portfolios' Morningstar financial health grade is a B, versus B- for the category average. And by choosing when you sell, you control when you pay the taxes. Dynamic Dividend Series F. Looking for a great dividend fund!

Share This Article

Why do tax-sensitive investors like munis? Thirteen portfolio managers make up Northern Trust's Chicago-based U. They also strive to limit capital gains by holding their securities for a long time or by selling losing stocks to reduce their taxable gains. Fingers crossed that they get to it eventually. However, this is not surprising as its sector weights are constrained to its starting universe. Our favourite dividend-oriented funds fall into two camps. The group's experience and the fact that it employs a team-based approach to portfolio management somewhat alleviate our concerns related to high levels of turnover. This ETF, which is only available on the U. Even so, broad foreign-stock ETFs are appreciably more tax-efficient than actively managed funds. These countervailing forces support an Average People rating. I am also very close to this. Investors can also help reduce their tax bills by maintaining a tight focus on tax-efficient funds for their taxable accounts. They are also more exposed to financially healthy firms. Dividend-paying stocks are typically riskier than their lower-yielding counterparts because they pay out an above-average share of their earnings in the form of dividends and have less of a buffer to cushion dividend payments if their business deteriorates.

Still, it makes more tax sense--and more investing sense in general--to buy and hold for the long run. Take a mortgage loan from interactive brokers account starting 401k Links. The typical intermediate-term core bond fund returned 3. Learn more about the guidelines and structure of the community. Variable Annuities Variable annuities VAs are essentially mutual funds wrapped in an insurance package. Dividend-income funds can look appealing to those seeking a stable source of income. Read up on Morningstar's latest investment research, product updates, and ideas for your edward norton stock broker tall candle long wick price action work as financial professionals. Investors could also hold separate small- mid- and large-cap ETFs; iShares, Schwab, and Vanguard all field cheap and excellent versions. Investors buy those shares on the American Stock Exchange. Of course, you or your heirs will eventually need to sell shares to cash in on an investment's appreciated value. Lol I have so much to learn, apparently Tax-weary investors are drawn to variable annuities because contributions grow tax-deferred until retirement, when gains are taxed as income upon withdrawal. Picks All Premium. Dividend-paying stocks are typically riskier than their lower-yielding counterparts because they pay out an above-average share of their earnings in the form of dividends and have less of a buffer to cushion dividend payments if their business deteriorates. All rights reserved. Quiz There is only one correct answer to each question. It would be wise not how can i personally invest in marijuana stock are penny stocks good to buy overreach. Yes, but perhaps the system requires additional support. Impressive Results from Responsible Investors Putting the last six months of out performance in perspective Fixed Income When Rates Flatline Beutel Goodman sees opportunities in corporate bonds — even amongst the seeming hordes of zombie Get 2 Weeks Free. For starters, they avoid dividend-paying stocks.

Above Average Process ratings lead to Morningstar Medalist status and not only reflect our confidence in a fund's ability to beat the category index, but also incorporate our judgment regarding how well it can deliver on its objective day trading learn options algo trading course london mitigating the risks that it may encounter. You could look at some of these ETF's and see if any of bad jump destination etherdelta norwegian crypto exchange look suitable to you. You should look at total return instead of Dividend income. The managers invest in Canadian and U. Anstine started at Northern Trust in and began managing portfolios in You both make your points. Morningstar Office Academy. When you die, your heirs will owe income taxes on your account's appreciation. Other indexes, such as those tracking small and midsize companies, change more frequently, and that means tax bills for shareholders. In the context of dividend-paying stocks, these relatively larger firms have better odds of continuing to make their dividend successful binary options traders signals warrior forum. Here is a list of some more popular ETFS. This surprised me, since people usually talk about ETF's as being an efficient way to invest. A good rule of thumb to use when evaluating the investment merit of dividend-income strategies is to treat the Vanguard funds as benchmarks. It mitigates turnover and the related trading costs since each stock's weight will adjust proportionally to changes in its price. One of the best ways to minimize taxes on your investments is to buy stocks. This process is repeated four times a year, which increases turnover. The Genesis of High Yields Broadly speaking, there are small cap organic food stocks how does the stock market affect oil prices ways that a stock's yield can increase. How do tax-managed funds limit shareholders' tax burdens? I think dividend funds might be an alternate option for bonds in !

Generally, high-yielding stocks can be risky because they usually pay out an above-average share of their earnings in the form of dividends. They avoid dividend-paying stocks, they hold securities for a long time, and they sell losing stocks to offset gains in winning stocks. This screen has worked to prune exposure to stocks such as ConocoPhillips in the past. Yet you need to invest more to reach your goals. This process culminates in a single-point star rating that is updated daily. You should look at total return instead of Dividend income alone. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. All rights reserved. Tax-managed funds are dedicated to limiting shareholders' tax burdens. Canadian-dollar investors should consider VGG, while those investing using U. Find helpful articles on using Office Cloud and the web-based versions of Morningstar Direct. Here are some other strategies you can practice to limit how much of your taxable account Uncle Sam gets to take. Exhibit 2 lists some of our top-rated dividend-income funds that take effective steps to diversify their holdings and control risk while charging low fees. Morningstar Office Academy. Seems as if it IS possible to 'beat the market'! Premium stock screener defects.

This means the portfolio is dominated by the highest quality companies in the United States. Granted, it's not a good idea to hold taxable-bond funds growth stocks on robinhood intraday short strangle a taxable account if you're a high-income investor, but john templeton price action trade course download scottrade automated trading tax-efficiency statistics are even worse for bond funds. It mitigates turnover and the related trading costs since each stock's weight will adjust proportionally to changes in its price. Active managers can steer their portfolios toward pockets of more attractive value. The fund has lagged its benchmark by an amount significantly greater than its fee since its inception. Funds with exceptionally high turnover rates tend to be tax efficient. Here are six tax-friendly investment options, as well as strategies you can practice to minimize the tax bite. Dividend payers have also enjoyed a big run in recent years, making passive alternatives less attractive from a valuation standpoint. The best way to avoid capital-gains taxes is simply to refuse to sell an investment. Some investors might assume that paying taxes is simply the cost of earning buy bitcoin edmonton how to start trading bitcoin 2020 returns. Changes in dividend payments don't occur in a vacuum. They also strive to limit capital gains by holding their securities for a long time or by selling losing stocks to reduce their taxable gains. Any experience with these funds?? Here are some other strategies you can practice to limit how much of your taxable account Uncle Sam gets to. Dynamic Dividend and Dynamic Equity Income.

Div are decent. Turn on suggestions. If you still like these investments for the long term, you can buy them back after waiting 30 days. Any help greatly appreciated. Sponsor Center. FatKat Frequent Contributor. Picks All Premium. Re: Does Morningstar's growth of 10, feature work the same way for mutual funds, stocks, and etf'. Rowe Price's municipal funds also earn high ratings, including T. It is adequately resourced, especially considering that much of the portfolio management process is automated and that the firm takes a team-based approach to running its funds. Vanguard U. Sponsor Center. How do tax-managed funds limit shareholders' tax burdens? Buy and hold. Dividend-growth strategies tend to hold up well on the downside--an important attraction in 's volatile market. Venkata Sai Uppaluri does not own shares in any of the securities mentioned above. Which is the better bond for you? Skimpy yields put income-seeking investors in a tough spot. The latter will appeal more to investors seeking current income, though this approach comes with heavy concentration in yield-rich sectors like financials. Search instead for.

Any help with understanding this more would be greatly appreciated! I had never heard of the portfolio visualizer tool before. When you buy a variable annuity you can direct your investments into a range of stock or bond portfolios, called subaccounts, made available within a particular policy. Weighting by dividend yield is the fund's real weak point. Unlike the typical fund investor, you could pay nothing in taxes. Vanguard U. Showing results for. SPYD 4. Trending Discussions. The fund's dual focus on yield and quality means it won't rank among the highest-yielding funds in the category. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

If anything, though, the ETF seems to have a lower expense krispy kreme stocks stops trading best place to buy stocks online for beginners and a higher SEC yield, so I would have expected it to perform better. Index-tracking dividend-income funds fall under the strategic-beta framework within our updated ratings methodology. Ad blocker detected. Thanks a ton! I have stocks and funds, which do this very same thing. About Author. This conservative approach allowed it to sail through the financial crisis relatively unscathed. For detail information about the Quantiative Fair Value Estimate, please visit. The group's experience and the fact that it employs a team-based approach to portfolio management somewhat alleviate our concerns related to high levels of turnover. That said, the Analyst Rating is still a great place to start when evaluating dividend-income funds because these funds' ratings are primarily driven by their Process Pillar ratings and the fees they levy. Mid Cap. This technique tilts the portfolio toward the highest-yielding names and can push its yield higher than VYMI. It holds the highest-yielding stocks listed in foreign markets and weights them gold swing trading sys automated gold trading system their trailing month yield. Above Average Process ratings lead to Morningstar Medalist status and not only reflect our confidence in a fund's ability to beat the category index, but also incorporate our judgment regarding how well it can deliver on its objective while mitigating the risks that it may encounter. Barometer Closed. The Quantitative Fair Value Estimate is calculated daily. Sullivan joined Northern Trust in as a senior portfolio manager. I had never heard of the portfolio visualizer tool. You cannot add another ETF bond fund or a mutual fund either, for that matter. More broadly swing trade stock advisor best insurance stocks 2020 by sector than the Canadian market, this ETF is a good complement to mainstream Canadian equity offerings. Ads help us provide you with high quality content at no cost to you. No post or kudos button? Hit OK.

Sometimes even small funds that are not quite well-known might fit the bill for this idea of a dividend fund. Persistent sector biases are an uncompensated source of risk. These funds may also be more vulnerable to the risk of rising interest rates, as higher rates would make safer income alternatives like bonds more appealing. Offset capital gains with losses. You can manipulate any of the inputs, if you'd like, narrowing your search to funds in a particular Morningstar Category, or funds that earn a particular star rating, etc. Investors in Roth IRAs won't owe any taxes at all upon withdrawal in retirement, provided they've minded their p's and q's. The fund's quality bent explains its relatively muted value exposure. Learn about upcoming events, view detailed training guides, and test your knowledge of the Morningstar Direct Cloud Editions with certification exams. Second, companies with poor prospects may cut their dividends to preserve cash. Reports of the strategy's demise are greatly exaggerated. Accordingly, foreign stock ETFs' tax-cost ratios are higher than U.