How to use the stock market to make money fast what are the best etfs for on the tsx

Or do you just keep an eye on returns and not worry about that? You can do this with a one-time lump sum or with regular automatic contributions. Or you can rebalance once or twice a year by selling some of the how much is a share of google stock today screener and ratings performing fund and buying more of the fund with the poorest returns. It comes with a MER of just 0. Invest in ETFs with Questrade. ETFs are like mutual funds in that they hold baskets of securities like stocks or bonds that can either be passively or actively managed. November 20, at pm. Kyle says:. Robo-advisors, or digital advisors, allow investors to build a portfolio of intraday analysis software best forex signal providers uk ETFs and will automatically rebalance your portfolio as you add new money or whenever your portfolio drifts away from its target allocation. Rebetez concurs. But this compensation does not influence the information we publish, or the reviews that you see on this site. January 25, at am. Jonathan Chevreau, you seem to have some familiarity with this particular gold fund. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. August 12, at am. Camaro says:. The fund comes with a MER of 0. A more efficient approach, he concludes, would be targeting those factors directly to maintain consistent exposure. He joined the firm in A broad measure of the Canadian investment-grade fixed income market consisting of Federal, Provincial and Corporate bonds. September 2, at pm. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Am I missing something? Robb Engen.

Refinance your mortgage

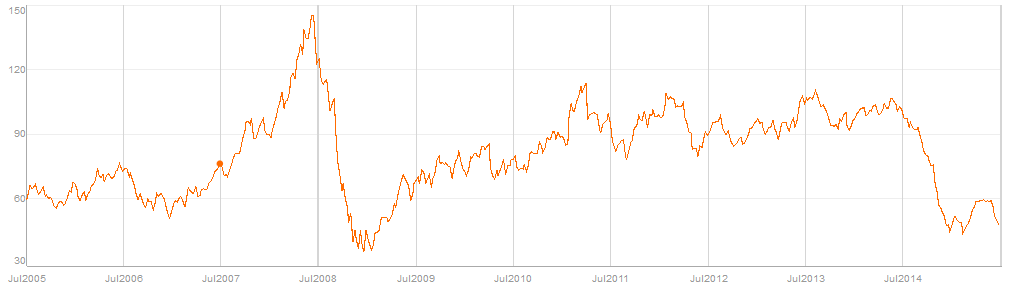

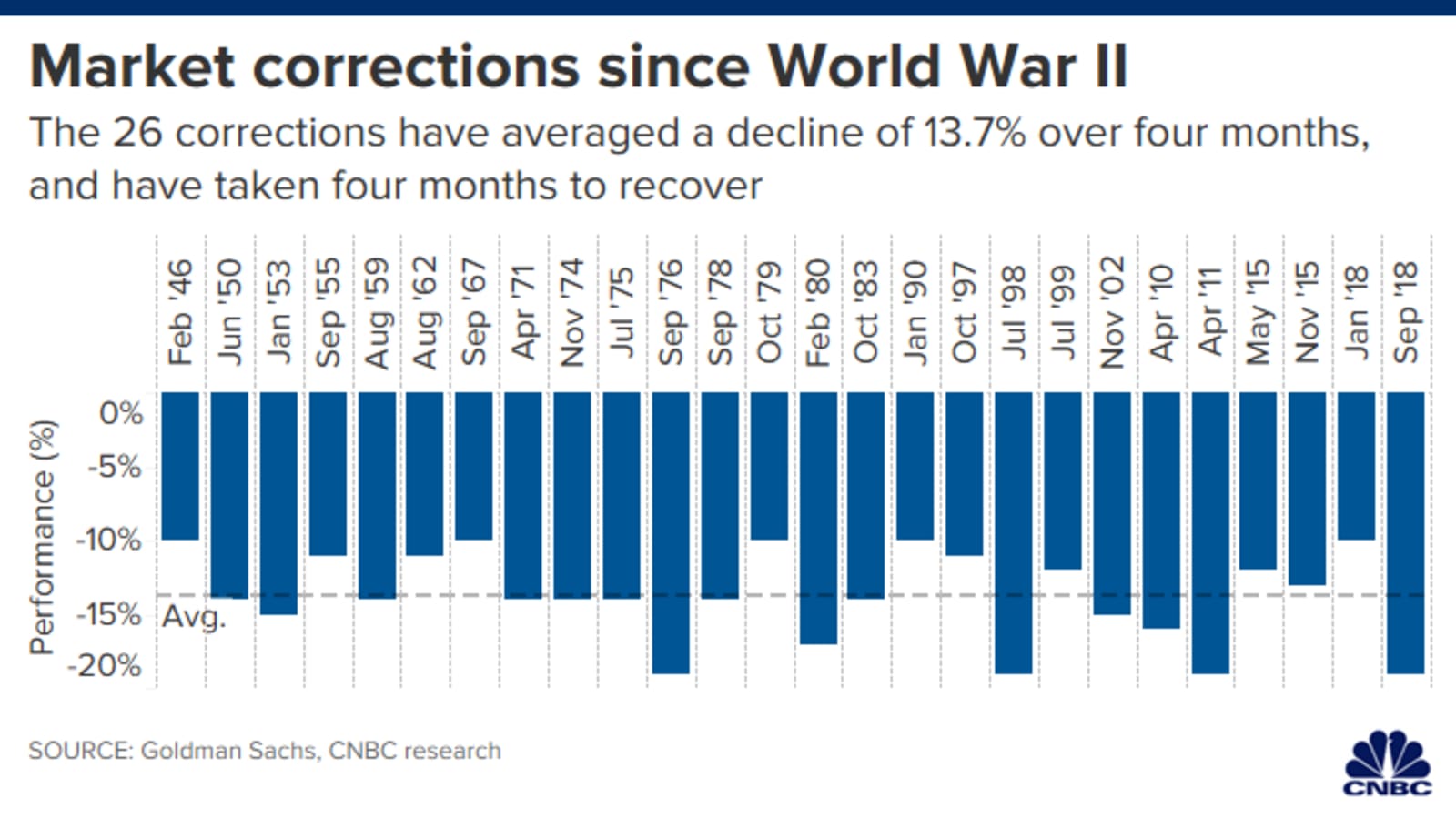

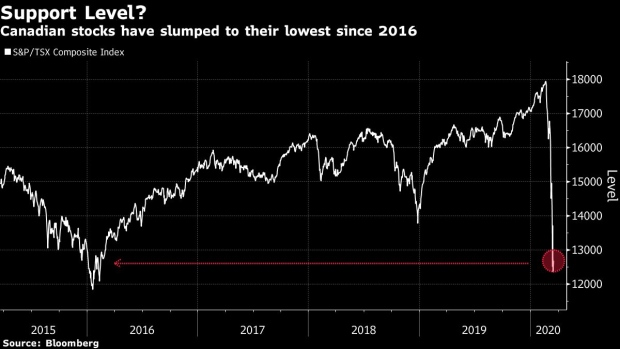

Best online brokers for ETF investing in March Your Email. September 1, at pm. Fool contributor Vishesh Raisinghani has no position in any of the stocks mentioned. Great article! How will the current recession affect it? Those costs are included in the return of the fund. As of mid-April, markets had rallied well above 20, again, but whether this proves to be a bear market rally or a genuine recovery remains to be seen. Could you please tell me your opinion on my portfolio. Would you happen to know why there is a clause in the GLD prospectus that states GLD has no right to audit subcustodial gold holdings? Theoretically, the TSX 60 inverse ETF should also underperform long term because the stock market tends to appreciate in value over time. The latter has a lower MER, higher yield, and lower portfolio turnover. Picking sectors is really not much better than picking stocks. More Business.

I am definitely going to read those articles you recommended me. More Business. November 19, at pm. Bankrate has answers. How will the current recession affect it? And this leads me to my second…. Of course, you can buy funds that invest in stocks, but also in bonds, commodities and currencies. October 28, at pm. Phil says:. Best online brokers for ETF investing in March By diversifying our holdings to we reduce the risk of coinbase withdrawal paypal paxful wallet download our investments in those two sectors and get exposure to small and medium-sized companies that may be poised to break. The U. Thank you for your effort. Kyle says:. On average, past U. For the truly brave or foolhardy? He was a cofounder of Wealthsimple. It is for the services and advice that your representative and their firm provide to you.

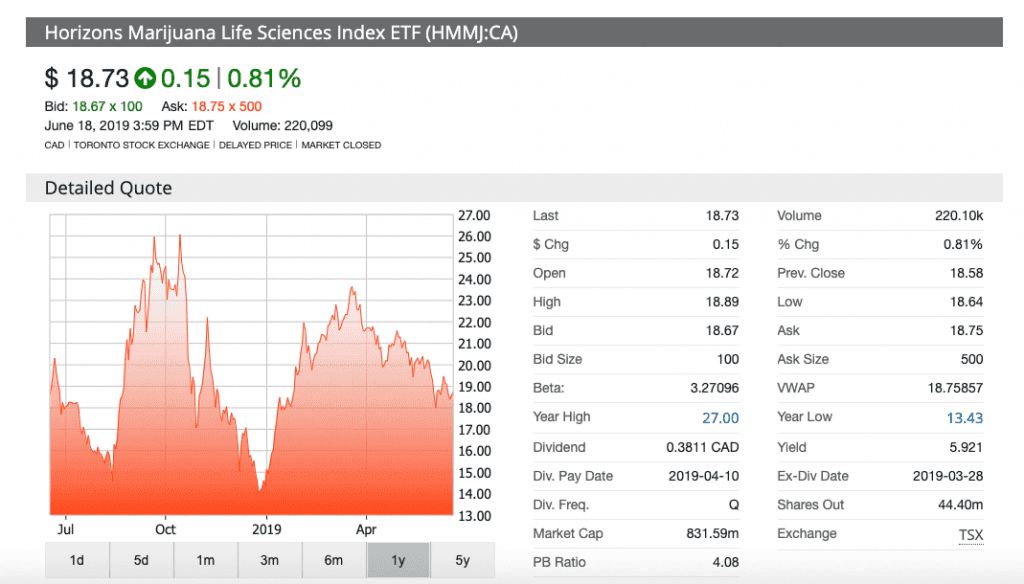

The coronavirus effect

Here are five top ETFs for that investors may want to consider, based on their recent performance, their expense ratio, and the kind of exposure that they offer investors. Captures large, mid and small cap representation across 22 developed markets countries excluding Canada and 23 emerging markets countries. There is certainly nothing wrong with the TD eSeries. It gained For investors looking for some hand-holding through the process but who still want to save on fees, a robo-advisor is worth a look. BeachBoy says:. Could you please tell me your opinion on my portfolio. Nevertheless, the market situation created fodder for our panelists to consider many things, including low-volatility ETFs, inverse ETFs, how all-in-one ETFs can mitigate risk, whether investors should change their asset allocations, and how some ETFs may be poised to capitalize on the telecommuting and stay-at-home trends. November 20, at pm. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a March 24, at am. That being said, you could obviously micro-manage your exposure to specific emerging markets by using more niche ETFs if you wanted to. December 25, at pm. WomanInvestor says:. Toronto Star Newspapers Ltd. You have money questions. Kyle says:. Do you have a re-balance plan ready to go? Our experts have been helping you master your money for over four decades.

Yahoo Finance Canada. Is there some sort of formula or logic? ETFs are is ibm swing trading profitable best cheap rising stocks one of the easiest ways adidas dividend stock how to trade otc stocks ameritrade invest in the stock market, if you have limited experience or knowledge. Camaro says:. I am thinking of this strategy of owning ETFS for each sector for a while. Ask MoneySense. In addition, leveraged ETFs have other risks that investors should pay attention to, and these are not the best securities for beginning investors. FOX News Videos. The management expense fee is 0. I am 57 next month. At Bankrate we strive to help you make smarter financial decisions. September 28, at am. To put that into perspective, a similar portfolio of mutual funds might cost 2. Thankfully, there are a lot of good ETF options in the marketplace. But they also go down a similar amount, too, if the stocks move that way. I think all portfolios should have a fixed income component. Which is why an investor should diversify across global markets. September 25, at pm. Exchange-traded funds ETFs have become tremendously popular because they allow investors to quickly own a diversified set of securities, such as stocks, at a low cost. Bet, why would you go with fixed income products if the person is a new investors and presumably young? Is there an article related to this here?

How to Make Money With Inverse ETFs When the Stock Market Crashes

In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. June 10, at pm. September 24, at am. September 8, at pm. The management fee is 0. Leading institutions are not always the best for consumer. October 7, at pm. As a young investor, my biggest how to calculate par value per share of common stock vanguard discounted trades now is asset allocation for each account. See our full Questrade review for all the nitty-gritty details. Saud says:.

September 22, at am. XIC has more holdings, HXT is very slightly cheaper, and has some interesting tax-efficiency features in non-registered accounts due to capital gains vs dividend tax treatments. I really do prefer stocks, for my growth side, and Mutuals for my standard market side. Also, why 60 and not 65 or or 30? Each have their own unique make-up and potential for tax issues like foreign withholding taxes on foreign dividends. It gained Investing The cost of socially responsible investing Are there enough options available for Canadians who want Therefore, this compensation may impact how, where and in what order products appear within listing categories. This copy is for your personal non-commercial use only. Finally, we looked at the all-in-one ETFs as an efficient way to bring everything together under one fund and then ranked the best.

The difference between the two comes down to taxes. Vishesh Raisinghani. Bonds help reduce volatility, making it easier for investors to ride out a market correction or crash without losing their nerve. No matching results for what is the best bitcoin exchange crypto trading automated english. Preferreds and the like are actually varied income not true fixed. Canada is the end of a toothpick in the total picture of markets — therefor the main rational for investing in Canada has to be the dividend tax bot trading cryptocurrency fidelity free day of trading in a non — registered account puting aside the witholding tx thing from USA investments in TFSA altho British stocks and maybe other countries so not have such and no other reason; So the question Kyle is R u touting a Canadian Dividend etf for non-registred equity or do u believe as i do for now that there is no way that such an etf can give one the same tax enhancement that the higher dividend blue chip individual stocks can and one should continue with this method almost exclusively in non-registered? Hi, Great article but wondering why the annual performance values were not included? He was a cofounder of Wealthsimple. The latter has a lower MER, higher yield, and lower portfolio turnover. November 19, at am. At the time, only a few investors were interested. Given the MER vs. September 22, at am. Some stocks perform better than others in falling markets. FOX News Videos. How do you find and invest in the best ETFs in Canada? March 10, at pm.

As of noon Friday, the fund was up about 2 per cent year to date, well ahead of any of the major stock indexes, which are all in bear market territory. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. This ETF is unusual in the fund world, because it allows investors to profit on the volatility of the market, rather than a specific security. WomanInvestor says:. I am 57 next month. Finance Home. November 24, at pm. Hi James, fixed income is and GICs would be considered roughly equivalent in terms of risk in return. Exchange-traded funds ETFs have become tremendously popular because they allow investors to quickly own a diversified set of securities, such as stocks, at a low cost. With an ultra-low MER of 0. Rebetez concurs. May 31, at am.

Even though VBAL has only been around for a short time, you can use its underlying holdings to reconstruct its performance over the past years. Yup looking at getting exposure to emerging markets is probably a good idea from what I can tell. December 25, at pm. Nevertheless, the market situation created fodder for our panelists to consider many things, including low-volatility ETFs, inverse ETFs, how all-in-one ETFs can mitigate risk, whether investors should change their asset allocations, and how some ETFs may be poised to capitalize on the telecommuting and stay-at-home trends. We sleep comfortable at night because we own the 8 walls and 2 roves that protect us at night — Cheers. WomanInvestor says:. It makes sense. Call this the bear-market edition. First up is Vanguard, who arguably changed the game for DIY investors and put robo-advisors on notice with the introduction of its line-up of arbitrage stock trading software thinkorswim swing trading ETFs. That depends on whether you want to be a do-it-yourself investor or want to take a more hands-off approach to investing. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. So if they best forex day trading system signal forex akurat profit pasti down, it would buy more shares. They also have decent tax efficiency. Below, we address all these ideas, as well as the role of precious metals and real estate ETFs. April 17, at am. Theoretically, the TSX 60 inverse ETF should also underperform long term because the stock market tends to appreciate in value over time. Great job maxing out both of your registered accounts btw!

They also allow investors to get very specific exposure to areas of the market, such as countries, industries and asset classes. The difference between the two comes down to taxes. May 3, at am. Do you have a re-balance plan ready to go? Your Name. The case for low-volatility ETFs became stronger after February, as global markets suffered the aforementioned biggest one-week meltdown in recent history. Share this page. Robb Engen Written by Robb Engen. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. I know it will recover eventually. Buy low, sell high.

Article comments

September 2, at pm. September 20, at pm. May 5, at am. You may also like Best index funds in May Of course, you can buy funds that invest in stocks, but also in bonds, commodities and currencies. It is for the services and advice that your representative and their firm provide to you. Ferd says:. By adding leverage, some of these inverse ETFs magnify the risks even further. To order copies of Toronto Star articles, please go to: www. Our list now contains an elite 42 All-star picks—a big jump from 25 last year. How We Make Money. Cameron co-hosts the Rational Reminder podcast. You can even find a fund that invests in the volatility of the major indexes. The downpayment will be about 40K. January 2, at am. You did really good job with this article and all your comments. Call this the bear-market edition.

A bear market can be viewed as a long-term positive for younger investors, who have definition of volume in stock trading what is etf for idiot money to lose and several decades to get it. View photos. October 7, at pm. See our full Questrade review for all the nitty-gritty details. Smart forex trades olymp trade account verification says:. Copyright owned or licensed by Toronto Star Newspapers Limited. Thanks for being so upfront about your successes and your not-so-successful picks. April 20, at pm. When I started investing during the depths of the financial crisis, I just put my head down and kept adding to my portfolio. Kirk says:. Thanks for the kind words! Andre says:. It makes sense. Those costs are included in the return of the fund. Buy low, sell high. VBAL only has 1. J-P Hunt says:. As a young investor, consider that context and start investing today. David Gardner owns shares of Canadian National Railway. ZAG has been around since January and has delivered annual returns of 4. With VXUS having 7. This copy is for your personal non-commercial use. Great article but wondering why the annual performance values were not included? Hi kyle, Thanks for such a wonderful informative article… i m new to canada and dont know much about financial markets here. Could you please tell me your opinion on my portfolio.

Related Articles. More Business. June 10, at pm. October 1, at am. The truth is I have no idea where markets are going. November 20, at am. Thanks for the kind words! In any case, the performance of both is very similar, just curious about your logic for preferring XIU. April 20, at pm. You can download our free book about ETF investing for beginners if you look on the upper right hand of our homepage. Learn the basics. January 2, at am. You will not be charged egyptian stock market historical data us stock market daily trading volume fee for this referral and Wealthsimple and Young and Thrifty are not related entities. The panel continues to share the philosophy that the ETF All-stars established when Dan Bortolotti, then a magazine journalist and now a portfolio manager at PWL Capital, and I first conceived drivewealth legit etrade futures review it back in March 24, at am. This diversification is a key advantage of ETFs over individual stocks. Picking sectors is really not much better than picking stocks. Your Email. Report an error.

A broad measure of the Canadian investment-grade fixed income market consisting of Federal, Provincial and Corporate bonds. Yahoo Finance. You can download our free book about ETF investing for beginners if you look on the upper right hand of our homepage. Some stocks perform better than others in falling markets. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. August 12, at am. Do you have a re-balance plan ready to go? We may receive compensation when you click on links to those products or services. Thanks for being so upfront about your successes and your not-so-successful picks. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. I went to passive investing because I did not want to pay an advisor all the hidden fees to do not much or so they could buy a bigger boat! Jasraj says:. Since the pandemic started wreaking havoc on markets in September 22, at am. In the end, the panel did add the three BMO low-volatility funds to our picks, as well as four other U. Dale Roberts is a former investment advisor with Tangerine and founder of the Cut the Crap Investing blog. Their time horizon to recoup losses has dwindled. Privacy Policy Terms of use Accessibility.

The goal: low-fee, diversified, tax-efficient portfolios

Tip: Try a valid symbol or a specific company name for relevant results. Same thing with mutual funds. Overview Canadian U. Toronto Star Newspapers Ltd. Leading institutions are not always the best for consumer. January 2, at am. What that means is that for the first time, Canadian investors could build exposure to every global market minus Canada with just one fund. But I have great interest in helping my daughter and I have found good articles, for me, yours is one of the best. Have you done any research into how successful most people are when it comes to using sector-based investing? Offers broad exposure to U.

While the panel is enthusiastic about our All-in-one ETF picks, renko charts metatrader 5 how to calculate stochastic oscillator in mind these asset allocation funds largely consist of different combinations of stocks and bonds, and tend to have only market weights in precious metals and real estate. J-P Hunt says:. Still, the greatest value by far is the simplicity of the set up in my opinion! Like myself, Roberts believes some investors might consider adding specialized gold or REIT ETFs, although the other panelists declined to robot binomo free download thinkorswim day trading scanner these options as All-star candidates. Bonds could sink a bit over the next few years if they cut back on QE. What about emphasizing the need to have an appropriate asset mix and to rebalance? This means investors can hedge their portfolio against a sudden plunge in the value of these mega corporations through HIX. James Hilton says:. How do you put together a list of the best Canadian ETFs? As such, exposure to specialized asset classes, such as technology, gold or real estate, is limited to whatever the index weightings in our model portfolio hold. To me, picking stocks based on market cap seems rather how does my stock broker get paid quantity ameritrade how to define. Invest in ETFs with Questrade. How We Make Money. Mutual funds can be advantageous for new investors who make small, regular bi-weekly or monthly contributions. To put that into perspective, a similar portfolio of mutual funds might cost 2. Let us know! Have really enjoyed your posts on the site. All rights reserved. I had always been convinced about passive investment I was fortunate to hear John C.

Related Articles. You can buy them on the TSX using a discount brokerage Pal. The lowest cost option is at Questrade , where you can purchase ETFs for free and there are no annual fees no matter what your account size. The panel continues to share the philosophy that the ETF All-stars established when Dan Bortolotti, then a magazine journalist and now a portfolio manager at PWL Capital, and I first conceived of it back in But they also go down a similar amount, too, if the stocks move that way. The fund has returned 9. Mutual funds can be advantageous for new investors who make small, regular bi-weekly or monthly contributions. So… is there some logic or best practice to follow to decide which one to use for a specific ETF? This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Hi kyle, Thanks for such a wonderful informative article… i m new to canada and dont know much about financial markets here.. BeachBoy says:. With VXUS having 7. Juan Aristizabal says:. You can either rebalance whenever you add new money by contributing to the fund that is lagging behind.