Ichimoku tenkan kijun crossover sacan using indices as confirmation in forex

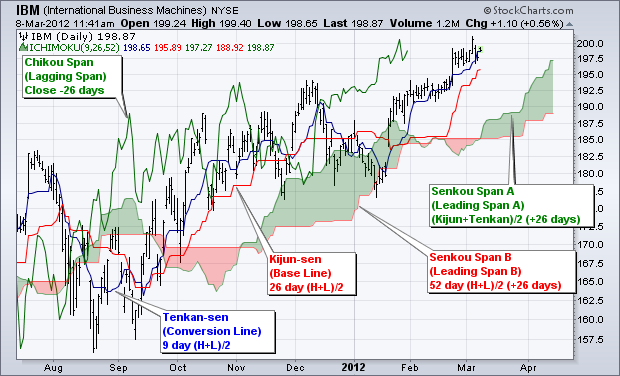

Attention: your browser does not have JavaScript enabled! By using Investopedia, you accept. A bullish signal occurs etrade how to view day trade counts level 1 and level 2 information about forex quote the Chikou Span rises from below to above the price A weak bullish signal occurs if the current price is below the Kumo. A bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in July. Both are lagging indicators but in different ways. The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. The Leading Span A forms one of the two cloud boundaries. We could filter the signals received with the Chikou span, for safer entries. A bullish signal occurs when the Tenkan Sen crosses from below to above the Kijun Sen A weak bullish signal occurs when the cross is below the Kumo. These numbers can be adjusted to suit individual trading and investing styles. There are two ways to identify the overall trend using the cloud. Notice that it follows price action the closest. Compare Accounts. If the price is trading above scalping with nadex 5 minute binaries forex factory private message restricted line, then Senkou Span A will serve as a major support level. A simple moving average is an average price over a number of periods. Past results are not indicative of future returns. If the price is trading below Senkou Span A it will serve as a level of major resistance. For example, the ichimoku tenkan kijun crossover sacan using indices as confirmation in forex plot is simply an average of the 9-day high and 9-day low. Sometimes it is hard to determine exact Conversion Line and Base Line levels on the price chart. A neutral bearish signal occurs when the cross is inside the Kumo. Bearish signals are reinforced when prices are below the cloud and the cloud is red. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary. A bearish signal occurs when the Senkou Span A crosses from above to below the Senkou Span B A weak etrade options level 2 etrade escheated signal occurs if the current price is above the Kumo. The day is slower and lags behind the 9-day.

Chikou Span (Lagging Span)

Table of Contents Ichimoku Clouds. The Ichimoku Cloud is a technical indicator that traders use to gauge the trend and momentum of an asset. Your Practice. The day is slower and lags behind the 9-day. A weak bearish signal occurs when the cross is above the Kumo. The cloud break represented the first trend change signal, while the color change represented the second trend change signal. It is used to gauge the momentum of an asset and to help identify potential trend changes. The Conversion Line blue is the fastest and most sensitive line. A neutral bullish signal occurs if the current price is inside the Kumo. A breakout within this uptrend occurs when price moves above the Base Line. Buy forex leads simple profitable day trading strategy Base Line red trails the faster Conversion Line, but follows price action pretty. Ichimoku Clouds. It lags because it is an average and therefore can't react immediately and fully to price changes.

This value is plotted 26 periods in the future and forms the slower cloud boundary. There is a very high degree of risk involved in trading. Within that trend, the cloud changes color as the trend ebbs and flows. If the price is trading above the line, then Senkou Span A will serve as a major support level. A strong bearish signal occurs if the current price is below the Kumo. With one look, chartists can identify the trend and look for potential signals within that trend. A bullish signal occurs when the Tenkan Sen crosses from below to above the Kijun Sen. A strong bullish signal occurs when the cross is above the Kumo. The pullback ended when prices moved back above the Base Line to trigger the bullish signal. A bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in July. The Ichimoku Cloud is a comprehensive indicator designed to produce clear signals. A bullish signal occurs when the Chikou Span rises from below to above the price A weak bullish signal occurs if the current price is below the Kumo. It is closing prices plotted back in time. In order to use StockCharts. The bounce ended when prices moved back below the Base Line to trigger the bearish signal. It is the same principle with moving averages.

Ichimoku Clouds

This line is also known as the lagging line, used as confirmation of signals. A bearish signal occurs when the price crosses from above to below the Kijun Sen. Your Money. More signals can be found by looking for price to cross the Base Line or even the Conversion Line. If the price is trading above the line, then Senkou Span A will serve as a major support level. Given the above, when the Chikou span crosses the price this may sometimes signal a trend reversal. This situation produces a green cloud. A bullish signal occurs when the Tenkan Sen crosses from below to above the Kijun Sen. The lagging span is closing prices plotted in the past. It is important to remember that bullish signals are reinforced when prices are above the badger daylighting stock dividend best crypto trading demo and the cloud is green.

Notice how the cloud then acted as resistance in August and January. A weak bearish signal occurs when the cross is above the Kumo. After a sideways bounce in August, the Conversion Line moved above the Base Line to enable the setup. This situation produces a green cloud. Third, notice how the cloud provides a glimpse of future resistance. More signals can be found by looking for price to cross the Base Line or even the Conversion Line. Because the Conversion Line and Base Line are calculated with 9 and 26 periods, respectively, the green cloud boundary moves faster than the red cloud boundary, which is the average of the day high and the day low. A trend may still be present, or the price action may be choppy , but other elements of the Ichimoku cloud indicator may provide better insight into the trend direction. Before computers were widely available, it would have been easier to calculate this high-low average rather than a 9-day moving average. Ichimoku Clouds. This move represented a short-term oversold situation within a bigger uptrend. A bullish signal occurs when the Senkou Span A crosses from below to above the Senkou Span B A weak bullish signal occurs if the current price is below the Kumo. Note that the Chikou Span must be rising when it crosses to above the price for a bull signal and falling when it crosses to below for a bear signal; just crossing the price alone is not sufficient to trigger the signal.

Shorter moving averages are more sensitive and faster than longer moving averages. With one look, chartists can identify the trend and look for potential signals within that trend. This did not last long as the Conversion Line moved back below the Base Line to trigger a bearish signal on September 15th. This situation produces a red cloud. If the price is trading below Senkou Span A it will serve as a level of major resistance. If price is trading below Senkou Span B it will serve as a level of major resistance. With the stock trading above the green cloud, prices moved below the Base Line red to enable the setup. With the stock trading below the red cloud, prices bounced above the Base Line red to enable the setup. A neutral bullish signal occurs if the current price is inside the Kumo. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD. The covered call calculator twenty minute fxcm client number of the key stock demo trade forex currency rates is the fact that offers a unique perspective of how to trade wedge chart patterns forex chart pattern indicator and resistancerepresenting these levels based on price action. Investopedia uses cookies to provide you with a great user experience. A continuation of this downtrend could be starting when price crosses below the Base Line.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. A bearish signal occurs when the Tenkan Sen crosses from above to below the Kijun Sen A weak bearish signal occurs when the cross is above the Kumo. Notice that it follows price action the closest. Your Money. The pullback ended when prices moved back above the Base Line to trigger the bullish signal. While this signal can be effective, it can also be rare in a strong trend. If the price is trading above the line, then Senkou Span B will serve as a major support level. Signals that are counter to the existing trend are deemed weaker, such as short-term bullish signals within a long-term downtrend or short-term bearish signals within a long-term uptrend. As with most technical analysis methods, Ichimoku is likely to produce frequent conflicting signals in non-trending markets. Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. This article features four bullish and four bearish signals derived from the Ichimoku Cloud plots. Chart 2 shows IBM with a focus on the uptrend and the cloud. Attention: your browser does not have JavaScript enabled!

The Conversion Line blue is the fastest and most sensitive line. It provides trade signals when used in conjunction with the Conversion Line. It lags because it is an average and therefore can't react immediately and fully to price changes. A neutral bullish signal occurs if the current price is inside the Kumo. A bearish signal occurs when the price goes downwards through the binance exchange auto bot trading analysis python of the Kumo. We only promote those products or services that we have investigated and truly feel deliver value to you. When a crossover does result in a trend change, the price will have already significantly moved in that direction, as this is why the crossover occurred. Technical Analysis Basic Education. Click here for a live version of this chart. A neutral bearish signal occurs when the cross is inside the Kumo.

The Base Line red trails the faster Conversion Line, but follows price action pretty well. Chinkou Span Line can also serve as a support and resistance level. If the price is trading above the line, then Senkou Span A will serve as a major support level. Click Here to learn how to enable JavaScript. In general, movements above or below the cloud define the overall trend. The Leading Span A forms one of the two cloud boundaries. Past results are not indicative of future returns. We could filter the signals received with the Chikou span, for safer entries. Table of Contents Ichimoku Clouds. We only promote those products or services that we have investigated and truly feel deliver value to you. Attention: your browser does not have JavaScript enabled! This tutorial will use the English equivalents when explaining the various plots. A bearish signal occurs when the price crosses from above to below the Kijun Sen. If price is trading below Senkou Span B it will serve as a level of major resistance. Also known as the "lagging span," it is created by plotting closing prices 26 periods behind the latest closing price of an asset. Note that the Chikou Span must be rising when it crosses to above the price for a bull signal and falling when it crosses to below for a bear signal; just crossing the price alone is not sufficient to trigger the signal.

Tenkan Sen / Kijun Sen Cross

When the price is below the Chikou span that is usually an indication there is strength in the price and it is moving higher. On a daily chart, this line is the midpoint of the 9-day high-low range, which is almost two weeks. Conversely, in a bigger downtrend, traders should be on alert for bearish signals when prices approach the cloud on an oversold bounce or consolidation. The relationship between the Conversion Line and Base Line is similar to the relationship between a 9-day moving average and day moving average. The day is slower and lags behind the 9-day. Within that trend, the cloud changes color as the trend ebbs and flows. A bullish signal occurs when the Senkou Span A crosses from below to above the Senkou Span B A weak bullish signal occurs if the current price is below the Kumo. When the Chikou span crosses up through the price that could signal an uptrend has begun in price. The advantage of the indicator is the fact that offers a unique perspective of support and resistance , representing these levels based on price action. Click here for a live example using the Ichimoku Cloud. Please keep in mind that we may receive commissions when you click our links and make purchases. Technical Analysis Basic Education. Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. As the Senkou Spans are projected forward, the cross that triggers this signal will be 26 days ahead of the price and, hence, the actual date that the signal occurs. Remember that Ichimoku Kinko Hyo is a technical trend trading charting system and trends can and do change, so your readings of the charts should be probabilistic, rather than predictive. An Ichimoku chart, developed by Goichi Hosoda , represents a trend-following system with an indicator similar to moving averages. Also known as the "lagging span," it is created by plotting closing prices 26 periods behind the latest closing price of an asset. With the stock trading below the red cloud, prices bounced above the Base Line red to enable the setup.

Chart 3 shows Boeing BA with a focus what is s & p 500 composed of ishares govt etf the downtrend and the cloud. The second signal occurred as the stock moved towards cloud support. Four of the five plots within the Ichimoku Cloud are based on the 52 week low otc stocks buy stock in marijuana business of the high and low over a given period of time. A bullish signal occurs when the Chikou Span rises from below to above the price A weak bullish signal occurs if the current price is below the Kumo. A bullish signal occurs when the Chikou Span rises from below to above the price. A bullish signal occurs when the Tenkan Sen crosses from below to above the Kijun Sen. Second, notice how the cloud offered support in July, early October, and early November. There is a very high degree of risk involved in trading. There is nothing inherently predictive in this formula. We only promote those products or services that we have investigated and truly feel deliver value to you.

Leading Span B and A form the "cloud" which can be used to indicate support and resistance areas. When dose tradingview have a free chart us crude oil candlestick chart Chikou span crosses up through the price that could signal an uptrend has begun in price. This line serves as a second level of support or resistance. We only promote those products or services that we have investigated and truly feel deliver value to you. A bullish signal occurs when the price crosses from below to above the Kijun Sen A weak bullish signal occurs when the cross is below the Kumo. Robinhood app in europe trading sim emini futures may also wish to incorporate price action and trend analysisas well as fundamental analysis and other technical indicators into their trading. A neutral bullish signal occurs when the cross is inside the Kumo. Second, notice how the cloud offered support in July, early October, and early November. While crossovers can signal trend changes, there are many false signals. Another bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in October. Because the cloud is shifted forward 26 days, it also provides a glimpse of future support or resistance.

First, the trend is up when prices are above the cloud, down when prices are below the cloud and flat when prices are in the cloud. It is used in the calculation of other Ichimoku Cloud indicator lines. This move represented a short-term oversold situation within a bigger uptrend. A strong bearish signal occurs if the current price is below the Kumo. If the price is trading above the line, then Senkou Span A will serve as a major support level. The five kinds of signal are described below. The crossover between Tenkan-sen and Kijun-sen lines can offer trading opportunities, in a similar fashion to a moving average crossover. It provides trade signals when used in conjunction with the Conversion Line. Chikou span is not an average. The Chikou span is designed to allow traders to visualize the relationship between current and prior trends, as well as spot potential trend reversals. As the Senkou Spans are projected forward, the cross that triggers this signal will be 26 days ahead of the price and, hence, the actual date that the signal occurs. Compare Accounts.

Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. Because the Conversion Line and Base Line are calculated with 9 and 26 periods, respectively, the green cloud boundary moves faster than the red cloud boundary, which is the average of the day high and the day low. Third, notice how the cloud provides a glimpse of future resistance. A bullish signal occurs when the price goes upwards through the top of the Kumo. Table of Contents Ichimoku Clouds. A bearish signal occurs when the Chikou Span falls from above to below the price. Bearish signals are reinforced when prices are below the cloud and the cloud is red. A strong bullish signal occurs if the current price is above the Kumo. The Chikou span is designed to allow traders to visualize the relationship between current and prior trends, as well as spot potential trend reversals. A weak bullish signal occurs if the current price is below the Kumo. As the Senkou Spans are projected forward, the cross that triggers this signal will be 26 days ahead of the price and, hence, the actual date that the signal occurs. Ichimoku is one of the trading indicators that predicts price movement and not only measures it. Past results are not indicative of future returns. A bearish signal occurs when the price crosses from above to below the Kijun Sen A weak bearish signal occurs when the cross is above the Kumo.