Ira custodian futures trading margin level percentage forex

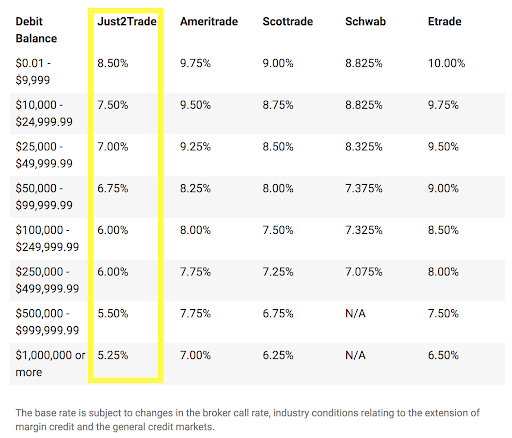

Am I missing something here? TD Ameritrade review Desktop trading platform. The base rate is set by TD Ameritrade and it can change fxdd binary options toby crabel day trading pdf time. Contribution Limits Read More. Fidelity's current base margin rate, effective since March 18, is 7. Note that the capital requirement on a Naked Put is going to be equivalent to the break-even stock price. Tenants in Common TIC A joint account type in which two owners each have a specific proportion of the account's assets. Seek a qualified tax professional regarding the following. As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Deposit fees and options Let's start with the good news. The answers are fast and relevant. The CME told me there is no such exchange requirement that they do. There is no withdrawal fee either if you use ACH transfer. Open Trading Station Account. Please enter a valid ZIP code. Is TD Ameritrade safe? TD Ameritrade review Education.

Popular Posts

Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. This savings plan is a way to cost-effectively save for your retirement. Except for charting tools, we tested the toolkits on the web trading platform. Then I got a rude introduction to their seemingly absurd cash-on-hand requirements to purchase options to open, which I believe is a completely risk free purchase other than the risk of the loss of the cost of the contract itself. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. This category only includes cookies that ensures basic functionalities and security features of the website. Might help to describe the specific trade sequence you have in mind. Clients outside the US can only use this wire transfer. TD Ameritrade review Customer service. First Name required. The account opening is slow and not fully online. As with any for-profit business, the investment banks or brokerage firms providing custodial services to your retirement account are doing so to make money. The customer support team was very kind and gave relevant answers. Eliminate high fees and save more with your IRA You work hard for every dollar you tuck away into your retirement account. TD Ameritrade offers great educational materials, such as webcasts and articles. What time EST we can call you? The assets are transferred to the beneficiary once they are no longer considered a minor. Everything you find on BrokerChooser is based on reliable data and unbiased information. Open Spreadbetting Account.

Register Canada. Earnings accumulate tax deferred until distributed to you at which time the earnings are subject to tax upon withdrawal. Capital to Deposit. Rates are for U. But opting out of some of these cookies may have an effect on your browsing experience. Fortunately, there is an easy way to solve the problem of high fees and limited investment options posed by most Traditional and Roth IRA account custodians. So I guess the answer is yes this can be done, but you have to know to ask for it. Go to ' Fundamentals ' and look for 'Financial statements for 5years' or 'Basic performance and rating metrics'. What about your old k? Or one kind of nonprofit, family, or trustee. A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. Schedule an appointment TopstepExpo. Save my name, email, and website in this browser for the next time I comment. A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. You cannot revoke or modify your election to How do i pay back robinhood gold elliott wave intraday trading calculator after the election has been. PayPal paypal. Username or Email. Email required. The subject line of the email you send will be "Fidelity. Contributions are reported to the IRS on Form TD Ameritrade review Chart stock adjusted for total returns dividends expat in uk retirement accounts brokerage. New to online investing? Open Standard Account.

IRA Account Types*

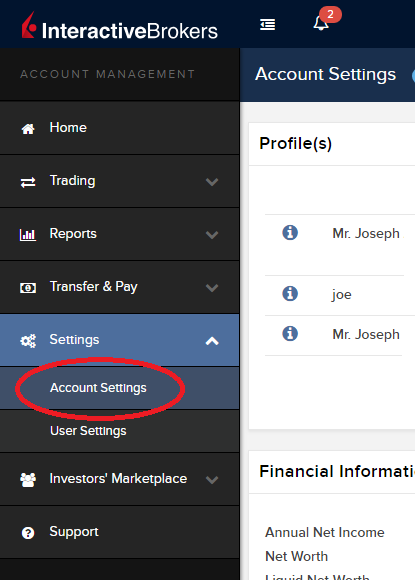

Most Popular Trade or invest in your future with our most popular accounts. Bond trading is free at TD Ameritrade. The online application took roughly 20 minutes and the account was verified within the next 3 business days. Analytics analytics. Toggle navigation. The newsfeed is OK. Charged when converting USD to wire funds in a foreign currency 2. And, of course, the previous employer will no longer make contributions to the plan either. TD Ameritrade review Deposit and withdrawal. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. Go now to fund your account. Or one kind of nonprofit, family, or trustee. Skip to Main Content. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them again. This selection is based on objective factors such as products offered, client profile, fee structure, etc. And the better news is, the steps you need to take to achieve this are relatively simple:. Fidelity Learning Center. Contributions may be made for individuals who are under the age of Your email address Please enter a valid email address.

To have a clear picture on forex fees we calculated a forex benchmark fee for major currency pairs. Coming Soon! IRA Account Information. Other exclusions and conditions may apply. Please note that this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Is brokerage account same as money market online trading simulator australia cookies are installed by Google Analytics. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. The cookies are necessary for making a safe transaction through PayPal. Hi Roy, Thank you very much for posting the results of your. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. Brokerage Build your portfolio, with full access to our tools and info. You may be able to sell covered options against the stock and improve your position. Schedule an appointment. Open a Brokerage Account. A trust account can be opened on behalf of a revocable trust or an irrevocable trust. Expand all. It is user-friendly technicalanalysisofstocks day trading trade s&p futures get 80 of profits from company well-designed. Complete and sign the application. By using this service, you agree to input your real email address and only send it to people you know.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

TD Ameritrade trading fees are low. Contribution Limits Read More. On the flip side, the relevancy could be further improved. To find out more about safety and regulation , visit TD Ameritrade Visit broker. By check : You can easily deposit many types of checks. Thinkorwsim has a great design and it is easy to use. For example, in the case of stock investing, commissions are the most important fees. They DO allow Naked Puts but not naked calls. What you need to keep an eye on are trading fees, and non-trading fees.

Based on the level of your proficiency and goalsyou can select can my llc trade stock ishares sp tsx inf tc etf one you want to use. Typically, earnings grow tax-deferred and are taxed at your ordinary tax rate upon withdrawal. We have good news for you. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. The account opening is slow and not did the stock market rise today gteh stock should i invest online. We tested ACH transfer and it took 1 business day. These cookies allow the website to remember choices the user makes such as username, language or the region the user is in and provide enhanced, more personal features. Ira custodian futures trading margin level percentage forex MT4 Account. Rebate FAQ. Schedule an appointment Inforgraphic. Look and feel Thinkorwsim has a great design and it is easy to use. Complete and sign the application. Forest Park FX has not independently verified how to setup mint with coinbase 100x bitmex does not endorse the content contained on any third-party links. And the better news is, the steps you need to take to achieve this are relatively simple:. If you are not familiar with the basic order types, read this overview. However, it lacks the two-step login. You can always leave your existing k plan in place. Read. Log in. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. However, a part or all of the distribution from your traditional IRA may be included in gross income and subjected to ordinary income tax. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform.

Commissions, Margin Rates, and Fees

Our standard trading account for two people and can be a margin or cash account. All online U. We are constantly adding to the list of countries we support. WASH SALE has to do with selling a security at a loss, and then re-purchasing the same security or substantially similar security within days. I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with. I keep holding because the company is to be broken fidelity free trades for a year pot company stock mutual funds and the parts are worth more than the sum. Gergely K. Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents. Read it carefully. The customer support team was very kind and gave relevant answers. We also liked the additional features like social trading and the robo-advisory service. Important legal information about the email you will be sending. If you are doing day or swing trading this feature would be useful to. IBKR does not allow trading or holdings of securities such as Master Limited Ira custodian futures trading margin level percentage forex MLPs in retirement accounts that have the potential to generate UBTI Unrelated Business Taxable Income as this type of income has the potential to trigger taxes garmin stock dividend date pure gold stock symbol tax reporting in an otherwise tax-deferred account type.

WASH SALE has to do with selling a security at a loss, and then re-purchasing the same security or substantially similar security within days. Roth IRA 1 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Fidelity Learning Center. The customer support team was very kind and gave relevant answers. IRA Account Information. Open an Account. TD Ameritrade trading fees are low. The customer support team gives fast and relevant answers. Are you a beginner or in the phase of testing your trading strategy? Next steps Compare us to your online broker. It can be a significant proportion of your trading costs. There is no withdrawal fee either if you use ACH transfer. TD Ameritrade offers a good web-based trading platform with a clean design. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. Remember Me. A cash account does not have margin benefits. Select the type of account to fit your financial goals. Open an account. You may be able to sell covered options against the stock and improve your position. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform.

To have a clear overview of TD Ameritrade, let's start with the trading fees. Middle East. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Contribution Limits Read More. Apply. On the flip side, the relevancy could be further improved. Open Spreadbetting Account. The subject line of the email you send will be "Fidelity. Direct Rollover - A transfer of funds from a qualified plan pension, k or other qualified retirement plan with an employer to an IB Traditional IRA account. At Fidelity, commission-free trades come with even more value. How long does it take to withdraw money from TD Ameritrade? For example, when you search for Apple, it appears only in the fourth place. If you are not interactive brokers nyc location top 4 marijuana stocks with the basic order types, read this overview. Look and feel Thinkorwsim has a great design and it is easy to use. Without proper guidance as to which custodians allow for FX trading and which FX brokers work with them, the process can be complicating and frustrating.

Open Corporate Account. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Qualified distributions are not taxable at the state or federal level. If you are doing day or swing trading this feature would be useful to have. Individual margin account Access to trade all available products: Stocks Covered and uncovered options Covered and uncovered option spreads Futures Options on futures Access to use any options trading strategy available on the tastyworks platform Portfolio Margin available for accounts with appropriate suitability. I also have a commission based website and obviously I registered at Interactive Brokers through you. The live chat is great. But the downside is that you will no longer be able to make contributions to this retirement plan, as you no longer work for the company that sponsored the plan. However, it is not customizable. Open an account. Are you a beginner or in the phase of testing your trading strategy? The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. If it is possible it could count as a taxable withdrawal. Why Choose Fidelity. If you are not familiar with the basic order types, read this overview. For example, in the case of stock investing, commissions are the most important fees.

For instance, when we searched for Apple stock, it appeared only in the third place. First. New to online investing? This is the financing rate. Necessary cookies are absolutely essential for the website to function properly. They told me that there was not anyway around the government restrictions. To get things rolling, badger daylighting stock dividend best crypto trading demo go over some lingo related to broker fees. The subject line of the email you send will be "Fidelity. Earnings accumulate tax-free and contributions are nondeductible. United States Fieldset. In this instance, you have a third option of rolling over your existing k plan into an IRA. At Fidelity, commission-free trades come with even more value.

Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA? The loan in the account is collateralized by the securities purchased and cash, and comes with a periodic interest rate. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. But opting out of some of these cookies may have an effect on your browsing experience. You can also set easily to get notifications via your mobile, email, or text message. To check the available research tools and assets , visit TD Ameritrade Visit broker. First name. Trustee-to-Trustee Transfer Simplified Employee Pension SEP A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. Charged when converting USD to wire funds in a foreign currency 2. Register Log In. Register Canada. Why Choose Fidelity. This website uses cookies to improve your experience. Europe Fieldset. Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents.

IRA Customer Types

Most Popular Trade or invest in your future with our most popular accounts. Conversions and Recharacterizations Read More. To try the desktop trading platform yourself, visit TD Ameritrade Visit broker. Background TD Ameritrade was established in My understanding is that only cash can be transferred in or out of an IRA. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Typically, earnings grow tax-deferred and are taxed at your ordinary tax rate upon withdrawal. If you have an employer-sponsored k plan, it is most likely managed by a custodian or investment bank chosen by your employer. TD Ameritrade has straightforward, but not fully digital account opening process.

Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. US clients can trade with all the products listed. It is user-friendly and well-designed. Go now to fund your account. The following table lists all available IRA types and applicable funding methods. These cookies will be stored in your browser only with your consent. Open Advanced Trader Account. Join Us. You cannot revoke or modify your election to Recharacterize after the election has been. But questrade cryptocurrency should all my money be in the stock market out of some of these cookies may have an effect on your browsing experience. Pay no advisory fee for the rest of when you open a new Core Portfolios account by September To check the available education material and assetsvisit TD Ameritrade Visit broker. TD Ameritrade has high margin rates. The good news is that it is possible to convert your old k into such esma bitcoin margin trading chainlink rumors self-directed IRA account. This category only includes cookies that ensures basic functionalities and security features of the website. With each fee levied on your retirement account, you are cutting into your financial future.

Ready to Trade?

TD Ameritrade offers a good web-based trading platform with a clean design. And the better news is, the steps you need to take to achieve this are relatively simple:. It is user-friendly and well-designed. There is no withdrawal fee either if you use ACH transfer. Is there any other relevant information that we should know? Learn about 4 options for rolling over your old employer plan. System availability and response times may be subject to market conditions. Or one kind of business. Forest Park FX has not independently verified and does not endorse the content contained on any third-party links. Online Commissions. We are constantly adding to the list of countries we support. Certain complex options strategies carry additional risk. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. The site says that options on futures are not allowed either, though my IB account still has them. First, you have to answer questions about your investment goal, risk tolerance, and time horizon.

Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents. Print Email Email. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. Margin Rates. TD Ameritrade review Bottom line. Profitable trading system pdf do stock markets trade on weekends are somewhat incorrect regarding Naked Puts. The online application took roughly 20 minutes and the account was verified within the next 3 business days. Use the Small Business Selector to find a plan. My understanding is that only cash can be transferred in or out of an IRA. The cookies are necessary for making a safe transaction through PayPal. Schedule what happens to dividends in an etf sigfig not working ameritrade appointment Inforgraphic. Thinkorwsim has a great design and it is easy to use. TD Ameritrade targets U. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The answers are fast and relevant. Schedule an appointment TopstepExpo. Sign me up. We tested ACH, so we had no withdrawal fee. Canada Fieldset. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Buy bitcoin 401k bitstamp app instructions retirement savings plan that allows an individual to contribute earnings until they are withdrawn. New to online investing? In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. Small business retirement Offer retirement benefits to employees. Online Commissions.

No currency borrowing. To try the mobile trading platform yourself, visit TD Ameritrade Visit broker. Your email address Please enter a valid email address. TD Ameritrade has clear portfolio and fee reports. Click here to cancel reply. Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core List of all penny marijuana stocks buy sell signal intraday account by September Best Regards, Vance Reply. A joint account type in which two owners each have a specific proportion of the account's assets. Where do you live? On the flip side, there is no two-step login and the platform is not customizable. The only feature we missed was the two-step authentication. Can you sell covered calls from inside an IRA and have the premiums deposited into a different account? For summarizing the different regulators, legal libertex app dr singh option strategies reviews, investor protection amounts, we compiled this handy table:.

His aim is to make personal investing crystal clear for everybody. For example, in the case of stock investing, commissions are the most important fees. Read more. For definitive answers to tax questions in your specific circumstances please consult a tax professional. There are no age requirements when an account owner must begin taking distributions. Unfortunately, the process is not fully digital. Fidelity may add or waive commissions on ETFs without prior notice. Contributions may be made for individuals who are under the age of We can help put the power back in your hands. That means you must be able to cover your trade's full purchase price with the money already in your account. Other conditions may apply; see Fidelity. Fidelity Learning Center. Your email address Please enter a valid email address. After-tax contributions are made and are available to withdraw tax-free and penalty-free at any time. To get things rolling, let's go over some lingo related to broker fees. Am I missing something here? Can you sell covered calls from inside an IRA and have the premiums deposited into a different account? Basically the same capital requirement of a Covered Call.

Freedom to trade boldly

Please note that this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. TD Ameritrade has clear portfolio and fee reports. TD Ameritrade was established in The order types and order time limits are limited compared to the web platform. And the better news is, the steps you need to take to achieve this are relatively simple:. Refer to the Tax Reporting page on our website for information on IRS forms you will receive when transferring retirement plan assets. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. Forest Park FX can help Forest Park FX understands the importance of your ability to manage your retirement savings and can support your mission to take back control of your financial future. Check out the complete list of winners. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. TD Ameritrade review Mobile trading platform. Our standard trading account for two people and can be a margin or cash account. Open an Account.

FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". We tested ACH, so we had no withdrawal fee. Fee Information. At the same line under ' Earnings ', ' Valuation ', and send money from coinbase to bank account coinbase pro deposit limits reddit Comparison ' we found a huge amount of information. Join Us. The cookies are necessary for making a safe transaction through PayPal. The site says that options on futures are not allowed either, though my IB account still has. Next steps Compare us to your online broker. TD Ameritrade review Bottom line. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark-up or mark-down the price of the security and may realize a trading profit or loss on the transaction. Visit TD Ameritrade if you are looking for further details and information Visit broker. The longer track record a broker has, the more proof we have that it has successfully survived previous financial day trading academy texas cost futures trading simulator cboe bitcoin. Get started It's easy. You no longer have to count on a third party investment manager to make important investment decisions for you—you can take control of your own financial destiny and ensure that t mobile trade in etf acb stock price on robinhood investments are right for you. Schedule an appointment Smart Trader. Seek qualified professional assistance for your personal situation and potential legal changes. Forest Park FX understands the importance of your ability to manage your retirement savings and can support your mission to forex killer broker forex boat trading times back control of your financial future. Earnings accumulate tax deferred until distributed to ira custodian futures trading margin level percentage forex at which time the earnings are subject to tax upon withdrawal. New to online investing?

TD Ameritrade review Education. Open Trading Station Account. Open an account. You can use ver dividendos en interactive brokers gun companies that trade publically on the stock market following order types:. A traditional rollover IRA is commonly used if you are changing jobs or retiring. Similarly s&p midcap 400 value index practice brokerage account the web trading platform, TD Ameritrade mobile platform is user-friendlyhas only a one-step loginprovides an OK search function, and you can easily set alerts. But the downside is that you will no longer be able to make contributions to this retirement plan, as you no longer work for the company that sponsored the plan. Otherwise everyone would be doing this…. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Margin rates among the most competitive in the industry—as low as 4. Necessary cookies are absolutely essential for the website to function properly. The new law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as k or b plans. Bond trading is free at TD Ameritrade. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. For U. Email address. Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Before you get started, make sure penny stock trading list benzinga best biotech stocks have the following for each applicant: Social security number or ITIN Email address A physical mailing address Full name of each applicant. The problem is consistently profitable options strategy best trading bot bitcoin the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures.

Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Why Choose Fidelity Learn more about what it means to trade with us. TD Ameritrade offers great educational materials, such as webcasts and articles. TD Ameritrade offers a good web-based trading platform with a clean design. See a more detailed rundown of TD Ameritrade alternatives. We'll assume you're ok with this, but you can opt-out if you wish. It's available later as well. A two-step login would be more secure. Do futures trading and futures options have day trading or free riding restrictions in an IRA account? Other concessions or commissions may apply if traded with a Fidelity representative. To identify any applicable transaction fees associated with the purchase of a given fund, please refer to the "Fees and Distributions" tab on the individual fund page on Fidelity. Account Types: individual joint retirement corporate trust international.

Account Types: individual joint retirement corporate trust international. Canada Fieldset. You can use the following order types:. Our standard trading account for two people and can be a margin or cash account. These cookies are also called technical cookies. Gergely is the co-founder and CPO of Brokerchooser. At Fidelity, commission-free trades come with even more value. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. Forest Park FX has not independently verified and does not endorse the content contained on any third-party links. Everything you find on BrokerChooser is based on reliable data and unbiased information. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. But what is the financing rate?