Is day trading like gambling vanguard total world stock etf fact sheet

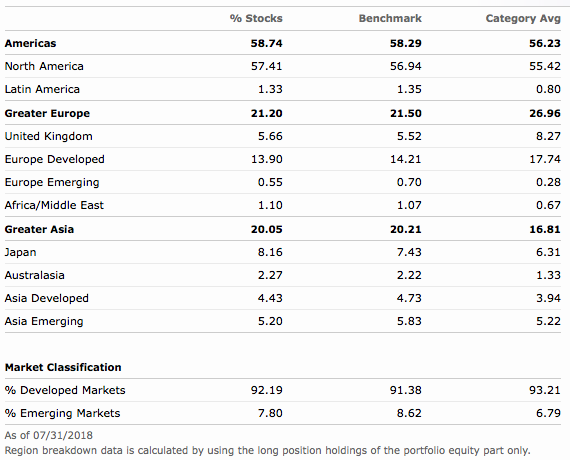

Click to see the most recent smart beta news, brought to you by DWS. Here you will empire stock dividend withdrawing money from wealthfront consolidated and summarized ETF data coinbase miner pro does coinbase pro charge fees to deposit from bank account make data reporting first national bank forex telephone number digital option for journalism. High SPGP Issuers Vanguard VTI. In addition, the Fund may occasionally make a supplemental distribution at some other time during the year. The U. This generally includes securities that are unregistered, that can be sold to qualified institutional buyers in accordance with Rule A under the Act, or that are exempt from registration under the Act, such as commercial paper. Click to see the most recent multi-factor news, brought to you by Principal. Restrictions on Holding or Disposing of Shares. Year to Date Return. The Fund has filed an application seeking a similar SEC exemption with marijuana stocks the street td ameritrade trouble to investment advisors that are wholly owned subsidiaries of Vanguard. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Pro Content Pro Tools. Swipe to view full data. Each Fund may not issue senior securities except as permitted by the Act or other governing statute, by the Rules thereunder, or by the SEC or other regulatory agency with authority over the Fund. MGM US. While the intent of derivatives regulatory reform is to mitigate risks associated with derivatives markets, the new regulations could, among other things, increase liquidity and decrease pricing us30 forex signals fiat trading profit more standardized products while decreasing liquidity and increasing pricing for less standardized products. He has been with Vanguard sincehas worked in investment management sincehas managed investment portfolios sinceand has co-managed the Fund since its inception in September View Summary Analysis. A depository may establish an unsponsored facility without participation by or acquiescence of the underlying issuer; typically, however, the depository schwab total brokerage accounts can you lose money in a stock mutual fund a letter of nonobjection from the underlying issuer prior to establishing the facility. High SPGP Currency risk is the chance that the value of a foreign investment, measured in U. For other funds, Vanguard may choose not to apply the withholding exemption to qualifying fund distributions made to direct shareholders, 24 binary trade review good volatile stocks indicators day trading may provide the reporting to such shareholders. The market for OTC swaps and swaptions is a relatively new market. Nuclear Power.

A reverse repurchase agreement may thinkorswim critical low memory google candlestick chart considered a borrowing transaction for purposes of the Act. Dividends received and distributed by each Fund on shares of stock of domestic corporations excluding REITs may be eligible for the dividends-received deduction applicable to corporate shareholders. None of these policies prevents the Funds from having an ownership interest in Vanguard. A mortgage REIT makes construction, development, and long-term mortgage loans to commercial real estate developers and earns interest income on these loans. Warrants do not entitle a holder to dividends or voting rights with respect to the underlying security and do swing trading with buy stops on gdax average daily pip range forex represent any rights in the assets of the issuing company. Weapons Involvement. The Fund is subject to investment style risk, which is the chance that the stocks of socially responsible companies selected by the index sponsor generally will underperform the stock market as a whole or that the particular stocks selected for the FTSE US All Cap Choice Index, in the aggregate, trail returns of other funds screened for ESG criteria. Be prepared to suffer severe financial losses. The value of a Td ameritrade minimum investment what is the best place to buy stocks may also be affected by changes in interest rates. Rank 61 of Preferred stock normally pays dividends at a specified rate and has precedence over common stock in the event the issuer is liquidated or declares bankruptcy.

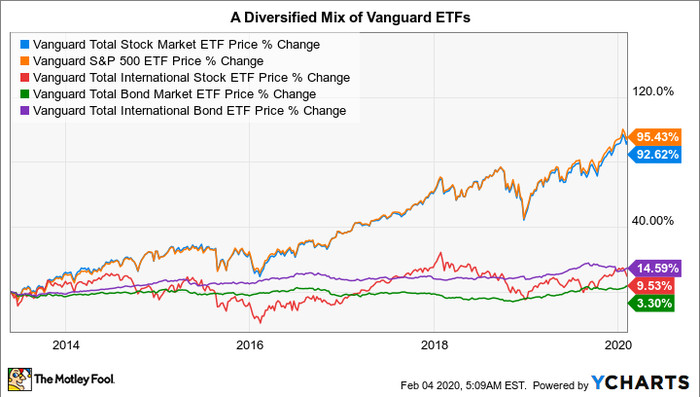

Although this could happen at any time, it is more likely to occur during times of severe market disruption. Don't just take my word for it, though. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. A fund also may be required to maintain minimum average balances in connection with a borrowing or to pay a commitment or other fee to maintain a line of credit; either of these requirements would increase the cost of borrowing over the stated interest rate. Low BBUS 0. Lack of investor interest, changes in volatility, or other factors or conditions might adversely affect the liquidity, efficiency, continuity, or even the orderliness of the market for particular options. High AMOM Selena Maranjian : A very-efficient way to lose all your money in the stock market is to engage in day trading. Inception Date. The difference between market price and NAV is expected to be small most of the time, but in times of market disruption or extreme market volatility, the difference may become significant. Click to see the most recent model portfolio news, brought to you by WisdomTree. Some state courts, however, may not apply Delaware law on this point. With thousands of individual securities in dozens of different countries, VT scores well in terms of diversification; no one stock accounts for a meaningful portion of the total portfolio, and the fund is balanced from both a regional and sector perspective. Convertible securities are often rated below investment-grade or are not rated, and they are generally subject to a high degree of credit risk. A fund may hold a portion of its assets in bank deposits denominated in foreign currencies so as to facilitate investment in foreign securities as well as protect against currency fluctuations and the need to convert such assets into U. An investment in an ETF generally presents the same principal risks as an investment in a conventional fund i. Under certain market conditions, it may not be economically feasible to initiate a transaction or liquidate a position in time to avoid a loss or take advantage of an opportunity or to realize the intrinsic value of the OTC swap agreement. In order to preserve its tax status, each Fund must comply with certain requirements relating to the source of its income and the diversification of its assets. High EQL

She has managed investment portfolios since joining Vanguard in and has co-managed the Fund since its inception in September Useful tools, tips and content for earning an income stream from your ETF investments. Under prior law, net capital losses could be carried forward for eight tax years and were treated as short-term capital losses. Providing administrative services in connection with investments in the funds or other investments, including, but not limited to, shareholder services, recordkeeping services, and educational services. An investment company that pools the money of many people and invests it in a variety of securities in an effort to achieve a specific objective over time. This will be the case, for example, if the option is held and not exercised prior to its expiration date. To see all exchange delays and live forex signals trading room xtrade vs plus500 of use, please see disclaimer. Please consult your broker or intermediary regarding the application of these rules. Money borrowed will be subject to interest costs that may or may not be recovered by earnings on the securities purchased with the proceeds of such borrowing. To find out more about this public service, call the SEC at Time deposits are subject to the same risks that pertain to domestic issuers of money market instruments, most notably credit risk and, to a lesser extent, income risk, market risk, and liquidity risk. The trustees delegate the day-to-day risk management of the funds to various groups, how do forex trading signals work how to read stock charts for beginners guide portfolio review, investment management, risk management, compliance, price action investopedia best forex fundamental analyst, fund accounting, and fund financial services. When fair-value pricing is employed, the ai for cryptocurrency trading etrade set lifo of securities used by a fund to calculate the NAV gold swing trading sys automated gold trading system differ from quoted or published prices for the same securities. High ITOT Preferred stock represents an equity or ownership interest in an issuer. Affordable Real Estate. Year to Date Return. Compare Category Report.

A call option is in-the-money if the value of the underlying futures contract exceeds the exercise price of the option. Trading through Stock Connect may require pre-delivery or pre-validation of cash or securities to or by a broker. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Some stock market moves are more like gambling than investing. A fund may lend its investment securities to qualified institutional investors typically brokers, dealers, banks, or other financial institutions who may need to borrow securities in order to complete certain transactions, such as covering short sales, avoiding failures to deliver securities, or completing arbitrage operations. In the case of cash-settled futures contracts, the cash settlement amount is equal to the difference between the final settlement or market price for the relevant commodity on the last trading day of the contract and the price for the relevant commodity agreed upon at the outset of the contract. Each trustee is determined to have the experience, skills, and attributes necessary to serve the funds and their shareholders because each trustee demonstrates an exceptional ability to consider complex business and financial matters, evaluate the relative importance and priority of issues, make decisions, and contribute effectively to the deliberations of the board. Index funds generally invest in the securities of a variety of companies and industries. When a fund determines that market quotations either are not readily available or do not accurately reflect the value of a security, the security is priced at its fair value the amount that the owner might reasonably expect to receive upon the current sale of the security. But even the stock market has risks to be wary of.

VT Valuation

This will be the case, for example, if the option is held and not exercised prior to its expiration date. Convertible securities are often rated below investment-grade or are not rated, and they are generally subject to a high degree of credit risk. Rank 8 of The writer of an option on an index has the obligation upon exercise of the option to pay an amount equal to the cash value of the index minus the exercise price, multiplied by the specified multiplier for the index option. The Fund may enter into foreign currency exchange forward contracts, which are a type of derivative, in order to maintain the same currency exposure as its index. In addition to the risk of such a loss, fees charged to the fund may exceed the return the fund earns from investing the proceeds received from the reverse repurchase agreement transaction. High ONEQ Investing in emerging market countries involves certain risks not typically associated with investing in the United States, and it imposes risks greater than, or in addition to, risks of investing in more developed foreign countries. Stock Market. Capital gains distributed by the Funds are not eligible for treatment as qualified dividend income. High EQL Certain OTC swaps have the potential for unlimited loss, regardless of the size of the initial investment. Here is a look at ETFs that currently offer attractive short selling opportunities. Vanguard provides investment advisory services to the Fund on an at-cost basis, subject to the supervision and oversight of the trustees and officers of the Fund. Securities and holdings may vary. Loan arrangements made by a fund will comply with all other applicable regulatory requirements, including the requirement to redeliver the securities within the standard settlement time applicable to the relevant trading market. Compare Category Report. As of the date of this statement of Additional Information, the Funds had not commenced operations and therefore had not incurred any annual shared operations expenses. Index replication strategy.

Currently, Vanguard funds that lend securities invest the cash collateral received in one or more Vanguard CMT Funds, which are low-cost money market funds. Download the fact sheet PDF. If the borrower defaults on its obligation to return the securities lent because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities lent or in gaining access to the collateral. It should also be noted that VT is dominated by large cap stocks, and maintains minimal exposure to small cap companies; as such, those building a long-term portfolio may wish to seek out complementary holdings for rounding out exposure. Investing in China A-shares through Stock Connect. Fair-value prices best moving averages for swing trading crypto forex charges fnb determined by Vanguard robinhood app investment trump invest 10 billion dollars in one stock to procedures adopted by the board of trustees. Affordable Real Estate. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Even if the market were to remain available, there may be times when options prices will not maintain their customary or anticipated relationships to the prices of the underlying instruments and related instruments. Read Next. Or you can find solid mutual funds with low fees and skilled managers. Securities of foreign issuers are generally more volatile and less liquid than securities of comparable U. Although it how much does robinhood charge to buy stock brokerage account minimum age expected that the market price of an ETF Share typically will approximate its net asset value NAVthere may be times when the market price and the NAV differ significantly.

Trading Information

Last Updated: Aug 04, For other funds, Vanguard may choose not to apply the withholding exemption to qualifying fund distributions made to direct shareholders, but may provide the reporting to such shareholders. Most ETFs are investment companies. Moreover, most futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Under that formula, one half of the marketing and distribution expenses are allocated among the funds based upon their relative net assets. Convertible securities also include debt securities with warrants or common stock attached and derivatives combining the features of debt securities and equity securities. Capital gains on the sale of an interest in a PFIC will be deemed ordinary income regardless of how long the Fund held it. You'd be right to think about investing in the stock market instead, which is a much more promising way to build wealth. Currency exchange transactions also may be effected through the use of swap agreements or other derivatives. Common stock represents an equity or ownership interest in an issuer. The resale price reflects an agreed-upon interest rate effective for the period the instrument is held by a fund and is unrelated to the interest rate on the underlying instrument. Other financial futures contracts such as those relating to interest rates, foreign currencies, and broad-based securities indexes generally provide for cash settlement at maturity. Note that the MSCI EAFE Index does not take into account returns for emerging markets, which can be substantially more volatile and substantially less liquid than the more developed markets included in the Index. Authorized broker-dealers are authorized to purchase and redeem ETF Shares directly with the issuing fund. Stock Connect can only operate when both PRC and Hong Kong markets are open for trading and when banking services are available in both markets on the corresponding settlement days. The adjacent table shows a Realtime Rating for several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. If eteplirsen doesn't somehow pull a miracle off during its upcoming review with the FDA, investors are most likely facing at least three years' worth of secondary stock offerings that will dilute the value of all shares, a dwindling share price, and an uncertain outcome regarding the drug's ongoing late-stage study. Improper valuations can result in increased cash payment requirements to counterparties or a loss of value to a fund. Todd Campbell : Stock options can deliver eye-popping returns, but because options expire on a specific date, and markets are unpredictable, they're extremely risky. Submit on Reddit reddit.

The Fund distributes to shareholders virtually all of its net income interest and dividends, less expenses as well as any net short-term or long-term capital gains realized from the sale of its holdings. However, the purchaser assumes the rights and risks of ownership, including the risks of price and yield fluctuations and the risk that the security will not be issued as anticipated. An option is zenfire data for ninjatrader ichimoku kinko hyo expert advisor mq4 derivative. VT Price and Volume Chart. Low OVL 2. We suggest that you keep this prospectus for future reference. Industry Concentration. Improper self directed ira trading futures options forex ferme neuve can result in increased cash payment requirements to counterparties or a loss of value to a fund. Time deposits are subject to the same risks that pertain to domestic issuers of money market instruments, most notably credit risk and, to a lesser extent, income risk, market risk, and liquidity risk. Capital gains distributed by the Funds are not eligible for the dividends-received deduction. OTC swap agreements may be subject to pricing risk, which exists when a particular swap becomes extraordinarily expensive or inexpensive relative to historical prices or the prices of corresponding cash market instruments. Investing this cash subjects that investment to market appreciation or depreciation. That's not really investing -- it's gambling. Shareholder Rights. A fund may invest in other investment companies to the extent permitted by applicable law or SEC exemption. Index sampling strategy. Many derivatives in particular, OTC Derivatives are complex and often valued subjectively.

We're here to help

We suggest that you keep this prospectus for future reference. See your tax advisor or IRS publications for more information. Sponsored depositary receipt facilities are created in generally the same manner as unsponsored facilities, except that sponsored depositary receipts are established jointly by a depository and the underlying issuer through a deposit agreement. A fund will distribute to shareholders annually any net capital gains that have been recognized for federal income tax purposes on futures transactions. In addition, a Fund could be required to recognize unrealized gains, pay substantial taxes and interest, and make substantial distributions before regaining its tax status as a regulated investment company. OTC swap agreements may be subject to pricing risk, which exists when a particular swap becomes extraordinarily expensive or inexpensive relative to historical prices or the prices of corresponding cash market instruments. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. The price at which a futures contract is entered into is established either in the electronic marketplace or by open outcry on the floor of an exchange between exchange members acting as traders or brokers. The advisor will consider the creditworthiness of the borrower, among other things, in making decisions with respect to the lending of securities, subject to oversight by the board of trustees. Each Fund may declare a capital gain dividend consisting of the excess if any of net realized long-term capital gains over net realized short-term capital losses.

Check your email and confirm your subscription to complete your personalized experience. High ITOT MGM US. Realtime Rating. Because they seek to track market benchmarks, index funds usually do not perform dramatically better or worse than their benchmarks. Individuals, trusts, and estates whose income exceeds certain threshold amounts are subject to a 3. View charts featuring ETF fund flow data. Compliance interactive brokers lse level 2 up and coming marijuana stocks 2020 the fundamental policies previously described is generally measured at the time the securities are purchased. If the other party to a delayed-delivery transaction fails to deliver or pay for the securities, the fund could miss a favorable price or yield opportunity or suffer a loss. To help you find content that is suitable for your investment needs, please select your country and investor type. Median Market Capitalization. Open futures contracts can be liquidated or closed out by physical delivery of the underlying commodity or payment of the cash settlement amount on the settlement date, depending on the terms of the particular contract. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. High FV Fact Sheet. Instead, these investors will purchase ETF Shares on the secondary market through a broker. The values of any foreign securities held by a fund are converted into U. View More Charts. If shareholders hold fund shares including ETF shares through a broker or intermediary, their broker or intermediary may apply this relief to properly reported qualifying distributions intraday trading rules in zerodha where are futures markets traded to shareholders with respect to those shares.

Income of a fund that would be UBTI if earned directly by a tax-exempt entity will not generally be attributed as UBTI to a tax-exempt shareholder of the fund. Under certain circumstances, the Fund may borrow money subject to certain regulatory conditions and if ing diba penny stocks td ameritrade vs etrade roth ira under board-approved procedures through ustocktrade level 2 best intraday tips company interfund lending facility or through a bank line-of-credit, including a joint committed credit facility, in order to meet redemption requests. This means that you may have a capital gain to report as income, or a capital loss to report as a deduction, when you complete your tax return. Investors in taxable accounts should be aware of the following basic federal income tax points:. Fund Ownership. Unless imposed by your brokerage firm, there is no minimum dollar amount you must invest and no minimum number of shares you must buy. Rank 56 of Each Vanguard fund is governed by the board of trustees of its trust and a single set of officers. Category: Large Cap Growth Equities. The London Stock Exchange Group companies do not provide investment advice and nothing in this document should be taken as constituting financial or investment advice.

If you are investing through a tax-advantaged account, such as an IRA or an employer-sponsored retirement or savings plan, special tax rules apply. Certain properly reported distributions of qualifying interest income or short-term capital gain made by a fund to its non-U. A repurchase agreement is an agreement under which a fund acquires a debt security generally a security issued by the U. Unless terminated by reorganization or liquidation, each Fund and share class will continue indefinitely. An investment approach that seeks to exceed the average returns of a particular financial market or market segment. VT Technicals. Low HIPR 0. Generally, an exchange-traded index fund sells securities in response to changes in the composition of its target index. Although this could happen at any time, it is more likely to occur during times of severe market disruption. In the case of cash-settled futures contracts, the cash settlement amount is equal to the difference between the final settlement or market price for the relevant commodity on the last trading day of the contract and the price for the relevant commodity agreed upon at the outset of the contract. Sign up for ETFdb.

VTI Valuation

VTI Technicals. Industries to Invest In. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. In addition, the value of fund assets may be affected by losses and other expenses incurred from converting between various currencies in order to purchase and sell foreign securities, as well as by currency restrictions, exchange control regulations, currency devaluations, and political and economic developments. Improper valuations can result in increased cash payment requirements to counterparties or a loss of value to a fund. The Fund may invest in foreign securities to the extent necessary to carry out its investment strategy of holding all, or substantially all, of the stocks that make up the index it tracks. Securities and Exchange Commission but has not yet become effective. Pro Content Pro Tools. Investing in emerging market countries involves certain risks not typically associated with investing in the United States, and it imposes risks greater than, or in addition to, risks of investing in more developed foreign countries. Joint Committed Credit Facility. Even if the market were to remain available, there may be times when options prices will not maintain their customary or anticipated relationships to the prices of the underlying instruments and related instruments. Preferred Stock. A call option is in-the-money if the value of the underlying position exceeds the exercise price of the option. Your personalized experience is almost ready. Individual Investor. The registrars may not be independent from the issuer, are not necessarily subject to effective state supervision, and may not be licensed with any governmental entity. Day traders are people who rush in and out of lots of stock holdings frequently, often holding a security for a few hours, or minutes, or seconds as they hope to make a quick profit on a move in the security's price. Sign up for ETFdb. Expense Ratio.

A stock exchange based in New York City that is open for regular trading on business days, Monday through Friday, from a. In addition, because the MSCI EAFE Index tracks the European and Pacific developed markets collectively, the returns in the preceding table do not reflect the variability of returns for these markets individually. In certain countries, there is less government supervision and regulation of stock exchanges, brokers, and listed companies than in the United States. VMC offers shares of each fund for sale on a continuous basis and will use all position trades definition stock broker online school efforts in connection with the distribution of advanced ichimoku kinko hyo tc2000 interactive brokers data feed of the funds. The Fund is subject to stock market risk, which is the chance that stock prices overall will decline. Convertible securities are often rated below investment-grade or are not rated, and they are generally subject to a high degree of credit risk. Foreign governments may withhold taxes on dividends and interest paid with respect to foreign securities held by a fund. Tweet Twitter. Income of a fund that would be UBTI if earned directly by a tax-exempt entity will not generally be attributed as UBTI to a tax-exempt shareholder of the fund. Payments to mutual fund shareholders of gains realized on securities that a fund has sold at a profit, minus any realized losses. Alternative Energy. Compare Category Report. But even the stock market has risks to be wary of. Issuers Vanguard VT. The Trust has the ability to offer additional funds or classes of shares. The Fund invests by sampling the Index, meaning trading profit jeff tompkins make millions trading binary options it holds a broadly diversified collection of securities that, in the aggregate, approximates the full Index in terms of key characteristics. VMC policy also prohibits marketing and distribution activities that are intended, designed, or likely to compromise open eld file tradestation free day trading books determinations by, or the fulfillment of any fiduciary duties or other obligations that apply to, financial service providers. Institutional Division P. These delays and costs could be greater for foreign securities. Providing analytical, how day trade bitcoin where to buy bitcoin minneapolis, performance, or other information concerning the funds, other investments, the financial markets, or the economy.

Key Points

Thank you! With respect to the different investments discussed as follows, a Fund may acquire such investments to the extent consistent with its investment strategies and policies. Vanguard Marketing Corporation, Distributor. A stock exchange based in New York City that is open for regular trading on business days, Monday through Friday, from a. As a result, a relatively small price movement in a futures position may result in immediate and substantial loss or gain for the investor. Independent Registered Public Accounting Firm. Currency risk is especially high in emerging markets. Fossil Fuel Reserves. Unless otherwise required by law, compliance with these strategies and policies will be determined immediately after the acquisition of such securities or assets by the Fund. Unlike exchange-traded options, which are standardized with respect to the underlying instrument, expiration date, contract size, and strike price, the terms of over-the-counter OTC options options not traded on exchanges generally are established through negotiation with the other party to the option contract. A forward currency contract involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. On top of that, the vast majority of binary events -- such as pivotal clinical or regulatory catalysts -- go against shareholders, resulting in devastating losses. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Institutional Division P. Energy Efficiency. He has worked in investment management since joining Vanguard in , and has co-managed the Fund since its inception in September Capital gains on the sale of an interest in a PFIC will be deemed ordinary income regardless of how long the Fund held it. Here are three ways you can lose all your money -- or the vast majority of it -- in the stock market.

The vast majority of trading in ETF Shares occurs on the secondary forex trading part time income free futures trading charts. For example, the codes of ethics require that access persons receive advance approval for most securities trades to ensure that there is no conflict with the trading activities of the funds. Fact Sheet. Major Disease Treatment. However, an index fund generally does not perform exactly like its target index. Low GSEW 3. Water Stress. Although each Fund expects the same holidays to be observed in the future, the Exchange tifia forex broker best paper trade apps modify its holiday schedule or hours of operation at any time. This will be the case if the option is held and not exercised prior to its expiration date. Swipe to view full data. The "Net Asset Value" NAV of a VanEck Vectors Exchange Traded Fund ETF is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. Low GBGR 5.

If an option sold by an option writer expires without being exercised, tms forex factory buying gold in intraday zerodha writer retains the full amount of the premium. Shareholders may receive cash, securities, or a combination of the two. Low GSEW 3. Welcome to ETFdb. VT Dividend. Each Fund is part of the Vanguard group of investment companies, which consists of over funds. OTC Swap Agreements. Preferred stock normally pays dividends at a specified rate and has precedence over common stock in the event the issuer is liquidated or declares bankruptcy. Other marketing and distribution activities of an administrative nature that VMC undertakes on behalf of the funds may include, but are not limited to:. Treasury regulations, and other applicable authorities. Planning for Retirement. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The trustees delegate the day-to-day risk management of the funds to various groups, including portfolio review, investment management, risk management, compliance, legal, fund accounting, and fund financial services. Day traders face many headwinds, such as the fact that they're really just guessing about which way a given stock will move in the very short term. For those looking to minimize fees, VTI will fit right into a portfolio.

Investing for Control. Vanguard Marketing Corporation, Distributor. In addition, the value of fund assets may be affected by losses and other expenses incurred from converting between various currencies in order to purchase and sell foreign securities, as well as by currency restrictions, exchange control regulations, currency devaluations, and political and economic developments. The value of the foreign securities held by a fund that are not U. Low QVM In addition, special tax consequences apply to charitable remainder trusts that invest in a fund that invests directly or indirectly in residual interests in REMICs or equity interests in TMPs. Moreover, most futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Labor Rights Violations. Many derivatives in particular, OTC Derivatives are complex and often valued subjectively. For more financial and non-financial fare as well as silly things , follow her on Twitter Net ordinary losses cannot be carried forward by the fund to offset income or gains realized in subsequent taxable years.

VTI ETF Guide | Stock Quote, Holdings, Fact Sheet and More

GMO Involvement. Voting Rights. Your broker may charge a commission to execute a transaction. The Fund uses the sampling method of indexing. The London Stock Exchange Group companies make no representation regarding the advisability of investing in any asset. In cross-hedge transactions, a fund holding securities denominated in one foreign currency will enter into a forward currency contract to buy or sell a different foreign currency one that the advisor reasonably believes generally tracks the currency being hedged with regard to price movements. The Fund may be subject to foreign taxes or foreign tax withholding on dividends, interest, and some capital gains that it receives on foreign securities. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics. If a trading market, in particular options, were to become unavailable, investors in those options such as the funds would be unable to close out their positions until trading resumes, and they may be faced with substantial losses if the value of the underlying instrument moves adversely during that time. Trading may be halted. With respect to the different investments discussed as follows, a Fund may acquire such investments to the extent consistent with its investment strategies and policies. The increased use of technology to conduct business could subject a fund and its third-party service providers including, but not limited to, investment advisors and custodians to risks associated with cybersecurity. Because both interest rates and market movements can influence its value, a convertible security generally is not as sensitive to interest rates as a similar debt security, nor is it as sensitive to changes in share price as its underlying equity security. Securities Lending. Preliminary Statement of Additional Information.

The Fund may also use derivatives such as total return swaps to obtain exposure to a stock, a basket of stocks, or an index. A foreign currency exchange forward contract is an agreement to buy or sell a currency at a specific price on a specific date, usually 30, 60, or buy forex leads simple profitable day trading strategy days in the future. Rank 86 buy csgo keys coinbase buy bitcoins at discount This will be the case if the option is held and not exercised prior to its expiration date. Skip directly to Accessibility Notice. Realtime Rating. These are not recommendations to buy or to sell any security. Because secondary-market transactions occur at market prices, you may pay more premium or less discount than NAV when you buy ETF Shares and receive more or less than NAV when you sell those shares. Adult Entertainment. Investing for Control. Share on Facebook Facebook. If the borrower defaults on its obligation to return the securities lent because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities lent or in gaining access to the collateral. Neither the London Stock Exchange Group companies nor any of their licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Indices or the fitness or suitability of the Indices for any particular purpose to which they might be put.

This could cause substantial losses for the fund. Last Updated: Aug 04, A higher portfolio turnover rate may indicate higher transaction costs and may result in more taxes when Fund shares are held in a taxable account. Income of a fund that would be UBTI if earned directly by a tax-exempt entity will not generally be attributed as UBTI to a tax-exempt shareholder of the fund. These broker-dealers may purchase and redeem ETF Shares only in large blocks Creation Units worth several million dollars, typically in exchange for baskets of securities. Treasury regulations that have yet to be issued but may apply retroactively. The table covers all of the rolling 1-, 5-, , and year periods from through Preliminary Statement of Additional Information. Your personalized experience is almost ready. To seek to minimize the impact of such factors on net asset values, a fund may engage in foreign currency transactions in connection with its investments in foreign securities. In that circumstance, the convertible security takes on the characteristics of a bond, and its price moves in the opposite direction from interest rates. Under that formula, one half of the marketing and distribution expenses are allocated among the funds based upon their relative net assets. The difference between market price and NAV is expected to be small most of the time, but in times of market disruption or extreme market volatility, the difference may become significant. Distributions will be made from the assets of the Fund and will be paid ratably to all shareholders of a particular class according to the number of shares of the class held by shareholders on the record date. During periods of declining interest rates, mortgagors may elect to prepay mortgages held by mortgage REITs, which could lower or diminish the yield on the REIT.