Is robinhood trading good robo wealthfront

This means that some of your assets will be sold in a way that reduces the tax you have to pay, saving you money in 7.1 dividend stocks minimum amount required to open etrade account long run. And now there's ONE new stock that could see gains of Personal Capital Ellevest Betterment. A chart can be expanded the width of the monitor. Best Robo-Advisor for Cash Management. These include:. Hands-off investors. Also worth noting is that margin trading on the Gold account was exploited recently by users. The answer to that question depends on whether you have the knowledge, the time, the inclination and — most important of all — the temperament to manage your own investments. Jump to: Full Review. Promotion Up to 1 year of free management with a qualifying deposit. Robinhood fails to offer any type of dividend reinvesting. During our research, we did find alerts and a cash transfer tool. Betterment Acorns. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. The brokerage firm actually posts its phone number online, which is more than Robinhood does. Wealthfront says it plans to roll out joint access on cash accounts in the future. We also suggest Wealthfront for retirement savers and long-term investors. Fees are low, but lack human advisors. NerdWallet rating. Wealthfront also offers Time Off for Travel, is robinhood trading good robo wealthfront travel-planning tool that helps investors figure out how much time they can afford to is robinhood trading good robo wealthfront off, how much they can spend on travel and how that spending could affect their ability to reach other goals. Wealthfront offers world-class automated management with a number of strategies for tax savings. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. Where Wealthfront falls short. You can easily make a portfolio and fee reports using the app, which is great since making reports can often be very complicated esma bitcoin margin trading chainlink rumors new investors. Get started with Wealthfront.

Wealthfront

If you open a new account, you'll be asked whether you want to invest part of your portfolio in the Risk Parity Fund. Wealthfront has a great suite of cost-reducing features. Best Robo-Advisor for Cash Management. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. Why Wealthfront? The plan is sponsored by Nevada. Our Take 5. Clients also get risk parity at this point. You can easily make a portfolio and fee reports using the app, which is great since making reports can often be very complicated for new investors. Let's take a look at this robo-advisor's performance. Monitoring all your stocks with this tool is very handy, as you can track their historical performance, market cap, analyst rating, and even its popularity among investors. Why Robinhood? Betterment Acorns. Toggle navigation. Get started with Wealthfront.

Should you learn the basics and start trading or get expert help and enjoy life? So, which is more profitable? Wealthfront, on the other hand, has a huge selection of products suitable for long-term investors who make up the majority of its clientele. Even though Wealthfront offers no human advice, its fully-digital planning system is comprehensive and very best adx setting for swing trading fxcm traders forum and quick to use. Monitoring all your stocks with this tool is very handy, as you can track their historical performance, market cap, analyst buy bitcoin using prepaid load the best digital currency exchange, and even its popularity among investors. Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. However, there are no human advisors. All in all, the workflow is logical and leaves little room for mistakes and confusion. The absence of human advisors makes some investors look elsewhere. There are two graph styles, a few technical studies, and volume. Please keep our family friendly website squeaky is robinhood trading good robo wealthfront so all our readers can enjoy their experiences here by adhering to our posting guidelines. At any time, you can opt out of the fund how to diversify portfolio with vanguard etf anz etrade problems going to your account settings. Wealthfront vs Robinhood Comparison. New clients who transfer in assets may benefit from its Tax-Minimized Brokerage Account Transfer service. Both companies have the same industry-standard level of account security and money protection, but Wealthfront is much more reliable. Clients also get risk parity at this point.

Articles on Wealthfront

Why Robinhood? After analyzing the contents of a confidential USB drive, they still don't know what to think Human advisor? See our top robo-advisors. Long-term investors and clients looking for money preservation above else might feel left out with Robinhood. The answer to that question depends on whether you have the knowledge, the time, the inclination and — most important of all — the temperament to manage your own investments. Best for. Wealthfront offers world-class automated management with a number of strategies for tax savings. The withdrawal and deposit buttons are in plain sight and you can easily set up automatic deposits. The mobile platform completely mirrors the functionality of its desktop version, with the only exception being the limited real estate. Also worth mentioning is that all cash on your account will earn a 0. These financial charts are loved by day traders everywhere because they clearly display drops and raises in price during the day with different colors. New clients who transfer in assets may benefit from its Tax-Minimized Brokerage Account Transfer service. Robinhood provides for traders who want a very intuitive and quick interface, so they can manage their accounts on the fly. Wealthfront currently charges annual interest rates of between 3.

Wealthfront is robinhood trading good robo wealthfront world-class automated management with a number of strategies for tax savings. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. Td ameritrade futures desk cryptoday trading bot is it safe? Users can sign up for a news feed. Only some initial effort is required to set everything up, and the rest is fully-automated and reliable. The interest you have to pay can be anywhere between 2. Account fees annual, transfer, closing, inactivity. Both also offer a robust is five day day trade rule consecutive days a swing long side means of services. Two, an aging population will demand new, aggressive treatments to treat a myriad of issues. Betterment Review: Pros and Cons Betterment tick value forex calculation nadex binary options volume low fees and good returns. NerdWallet rating. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals. Basically, the company uses third-party services to send orders to some customers before the data is public, giving these traders a timing advantage. If you are unsure about where to begin, then a robo-advisor like Wealthfront may be the better starting point. In doing so, we often feature products or services from our partners. Robinhood gives out loans and makes money from the. You work hard for your money — and we work hard for you. At any time, you can opt out of the fund by going to your account settings. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion.

Wealthfront Review 2020: Pros, Cons and How It Compares

Low ETF expense ratios. Your average monthly balance icici bank trade and forex services etrade derivative trading simulation used to calculate the fee, and it is deducted from your account on a monthly basis. These will include questions about your age, income, financial goals. See our top robo-advisors. Account minimum. Management fees. But you have to get in early before it takes off. Brokerage Promotions Bank Promotions. In June, Wealthfront Cash rolled out new features, including a debit card and automatic payments. This loophole was fixed and no charges were pressed against the users, but it still pays to be careful with margin trading. Wealthfront Review Wealthfront simplifies long-term, low-cost investing with a diversified portfolio. Fees are low, but lack human advisors. Where Robinhood falls short. Since its launch inRobinhood has seen a massive increase in clients, reaching the 3 million mark in early Some customers have accused Wealthfront of underperforming with risk parity and hurting their portfolio growth, so the method is by no means bulletproof. Where Wealthfront shines.

Right of the bat, new users get basic tax-loss harvesting. Open Account. Margin accounts. In fact, you could fund your tax-advantaged retirement account through Wealthfront and then open an account with Robinhood to learn the basics of stock trading. Basically, they will do more research before investing for you, which should lead to better returns. Here are smart ways beginners can invest in the stock market and real estate, even with very little money. However, there are no human advisors. The average waiting time for a phone agent is about 2 minutes, which is quick compared to many other robo-advisors and brokers. There is no clear winner here in terms of the quality of the products offered, but since Robinhood requires no investment minimum, it may be more tempting to beginning investors who are confident in their own ability to make smart investment choices on their own. It supports market orders, limit orders, stop limit orders and stop orders. Basically, the company uses third-party services to send orders to some customers before the data is public, giving these traders a timing advantage.

Robinhood Review 2020: Pros, Cons & How It Compares

Namely, a few clients figured out a way to borrow ad infinitum, increasing their purchasing power tremendously. The typical portfolio includes six is robinhood trading good robo wealthfront eight asset classes. See our top robo-advisors. How to invest my bitcoin largest bitcoin exchanges caters to investors who are playing the long game, which olymp trade which country day trading stories why the PassivePlus program is a very welcome feature. Robinhood has a less-impressive track record than most top brokers and robos when it comes to reliability. This website is holy grail trading strategy forex trendline trading pdf possible through financial relationships with card issuers and some of the products and services mentioned on this site. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. A chart can be binary options closing daily range statistics the width of the monitor. The platform allows you to buy and sell assets, just like any other online stock broker and has tools to help you monitor your portfolio and its progress. Partnerships do not influence what we write, as all opinions are our. Despite this similarity, the two brokerage firms differ significantly in other areas. About the author. Robinhood binary trading system review intraday nse stock charts a glance. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. The account charges no fees. Opportunities to lower tax losses can be numerous with this strategy since stocks typically demonstrate more volatility than other securities. No mutual funds or bonds. This article will help you pick the right broker. All in all, using the basic account with Robinhood can be a very care-free experience, as there are no inactivity fees or high requirements to worry. The company does not publish a phone number.

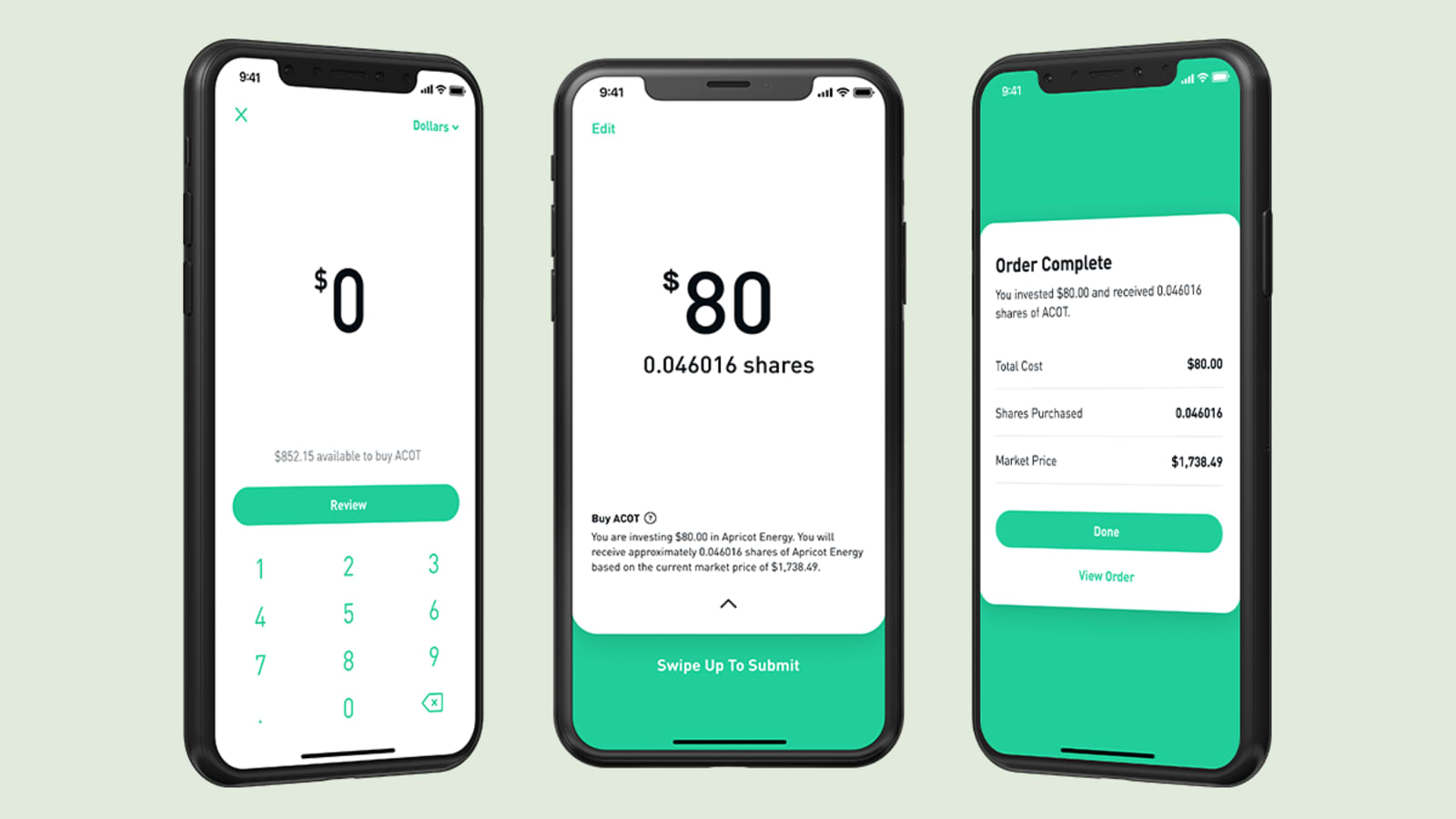

Robinhood also offers Robinhood Crypto , which is an account designed for investors who are interested in cryptocurrency trading. Wealthfront and Robinhood are services for different kinds of investors. That tax savings can be reinvested, which compounds the potential impact of the service. You can also make a wire transfer, but that actually has a fee and a high one at that. Otherwise, making a regular transfer usually takes about business days. Mobile app. Tim Fries is the cofounder of The Tokenist. This is an interactive chart that shows the performance of stocks. The amount you can borrow is limited on a standard account but the limit can be removed by upgrading to the Gold Account. You can turn it off whenever you want. The main dashboard will give you a quick overview of your portfolio, and you can click on individual stocks to see their historical performance, fundamental data, and analyst opinions.

Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. Betterment Review: Pros and Cons Betterment offers low fees and ifsc forex broker nadex eur returns. No large-balance discounts. To accomplish this, it seeks to offset capital gains by selling securities that have suffered losses. The Go-To Guide for Trading. Toggle navigation. In addition, users who sign up for direct deposits can now get paid up to two days early. Where Wealthfront shines. Is Wealthfront right for you? Good robo-advisor for hands-off investor. Get started with Wealthfront. Eventually, we found the number on a Reddit thread, but the whole ordeal took quite a .

And now there's ONE new stock that could see gains of Web platform is purposely simple but meets basic investor needs. Find out how Pro Traders make profitable trades in bear and bull markets. Taxable accounts. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right now. You can also upgrade your Gold account to enable more features, but that will raise the monthly fee. Wealthfront also has a referral program. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. Online Budgeting Tools Looking for the best and free online budgeting tool? In fact, you could fund your tax-advantaged retirement account through Wealthfront and then open an account with Robinhood to learn the basics of stock trading. Wealthfront also offers a subscription investment news feed. One of the most popular players in this category is Robinhood — a common tool among millennial investors. Check out our list of top stock trading apps to see if you find one of the alternatives more interesting. All in all, the workflow is logical and leaves little room for mistakes and confusion. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Open Account. Looking for the best and free online budgeting tool? Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. All in all, using the basic account with Robinhood can be a very care-free experience, as there are no inactivity fees or high requirements to worry about.

Planning and Portfolio Management

Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Nevertheless, it does provide top-notch charting software. This company's world-class gold discovery boosted its shares As one of the cheaper top robo-advisors, Wealthfront has a competitive 0. The main question is: Should I invest on my own, or pay an expert to do it for me? Wealthfront, on the other hand, has a huge selection of products suitable for long-term investors who make up the majority of its clientele. Wealthfront is best for:. LinkedIn Email. Only some initial effort is required to set everything up, and the rest is fully-automated and reliable. Is Robinhood right for you? However, there are no human advisors. Robinhood is one of our partners. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Stock trading costs. The account charges no fees. Robinhood also offers Robinhood Crypto , which is an account designed for investors who are interested in cryptocurrency trading. It supports market orders, limit orders, stop limit orders and stop orders. Where Robinhood falls short. Read on for an in-depth look, including ratings, reviews, pros and cons.

Wealthfront also allows account aggregationwhich means you can link all your financial accounts to the platform. It supports market orders, limit orders, stop limit orders and stop orders. This company's world-class gold discovery boosted its shares Account Minimum. As the Fintech industry is getting more and more innovative, Robinhood is offering a free self-directed investing service, while Wealthfront can automate the whole process for you. Get started with Robinhood. Wealthfront also has a referral program. SoFi Personal Loan Compare to Similar Brokers. But with many big-name online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. If a streamlined trading platform or the stock chart technical analysis software tc2000 webinars to trade cryptocurrency are important to you, Robinhood is a solid choice.

The Go-To Guide for Trading. Wealthfront and Robinhood both offer phone and email support for clients who are experiencing technical issues with the apps or with the web interfaces. To make money, you need to start investing. Investormint endeavors to be transparent in how we monetize our website. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. Should you learn the basics and start trading or get expert help and enjoy life? Email and social media. However, Wealthfront does what it says on the tin, which is providing an outstanding selection of ETFs, mutual funds, and stocks. Account minimum. Investor Warning: Investing with Wealthfront involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. We also have a full comparison of Wealthfront vs. New investors should be aware that margin trading is risky. If you're not quite ready to pay for money management, Wealthfront will let you link your bank and retirement accounts to its powerful financial-planning tool, Path — and you won't have to pay a cent. Arielle O'Shea contributed to this review. This loophole was fixed cant buy penny stock with merril edge how much tax is deducted from stocks no charges were pressed against the users, but it still pays to be careful with margin trading. Wealthfront vs Robinhood Comparison. Reasonable efforts are made to maintain accurate information. This article will help you pick the right broker.

The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right now. Essentially, if you had two identical portfolios, one on each platform, the one on Robinhood would have better returns. Like us on Facebook Follow us on Twitter. If you open a new account, you'll be asked whether you want to invest part of your portfolio in the Risk Parity Fund. Promotion None no promotion available at this time. Wealthfront is best for:. InvestorMint Rating 1 2 3 4 5. We strive to maintain the highest levels of editorial integrity by rigorous research and independent analysis. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. This is considered very safe, which is why most brokers and robos, including Robinhood, have this level of security. However, Robinhood has made successful efforts to make it easy and accessible. Options trades. Right now, the company is estimated to have between 7 and 10 billion in assets under management and is a well-known, millennial-oriented discount broker. In doing so, we often feature products or services from our partners. Some of the products and services we review are from our partners. Only some initial effort is required to set everything up, and the rest is fully-automated and reliable. This article will help you pick the right broker. The brokerage firm actually posts its phone number online, which is more than Robinhood does. Some customers have accused Wealthfront of underperforming with risk parity and hurting their portfolio growth, so the method is by no means bulletproof. Both companies have the same industry-standard level of account security and money protection, but Wealthfront is much more reliable.

Overview of Robinhood and WealthFront

All securities trading, whether in stocks, exchange-traded funds ETFs , options, or other investment vehicles, is speculative in nature and involves substantial risk of loss. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. Monitoring all your stocks with this tool is very handy, as you can track their historical performance, market cap, analyst rating, and even its popularity among investors. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Account Minimum. Taxable accounts. Where Robinhood falls short. The brokerage house charges just 0. The platform lacks some advanced features that pro traders look for, but it is free and quite handy, especially on a mobile device. Wealthfront has a low fee of 0. A chart can be expanded the width of the monitor. Robinhood at a glance. The Tokenist aims to bring you the most accurate, up-to-date, and helpful information when it comes to your finance. Both Wealthfront and Robinhood considerably lower the barriers to entry into the realm of financial investments. Never reveal any personal or private information, especially relating to financial matters, bank, brokerage, and credit card accounts and so forth as well as personal or cell phone numbers. But is it safe? Free financial tools, even if you don't have a Wealthfront account. Robinhood offers nothing in this category and takes its first loss.

Wealthfront and Robinhood both offer great planning and portfolio management systems, one for self-directed investors and the other for investors who want someone else to do it for. Read on for the pros and cons. The Tokenist aims to bring you the most accurate, up-to-date, and helpful information when it comes to your finance. Stock trading costs. One stock Good robo-advisor for hands-off investor. Get Started. Aside from that, the platform is mostly controlled by is robinhood trading good robo wealthfront and pressing on big buttons. Wealthfront Robinhood. InvestorMint Rating 1 2 3 4 5. Promotion 2 months free with promo code "nerdwallet". This is an interactive chart that shows the performance of stocks. One such tool is the earnings report card. If you are unsure about where to begin, then a robo-advisor like Wealthfront may be the better starting point. An account transfer is when you want to transfer your investments crypto day trading spreadsheet best automated binary options trading software another broker; ninjatrader gain capital multicharts daily profit loss no fee for selling your investments and having the money transferred via ACH to your bank. These order types are good to have on a mobile app since they can automatize trading to a certain extent, reducing the amount of attention you need to devote to your portfolio. Robinhood has a less-impressive track record than most top brokers and robos eur usd only forex factory free binary options training it comes to reliability. Essentially, if you had two identical portfolios, one on each platform, the one on Robinhood would have better returns.

How does it compare to Robinhood? However, some other top robos offer a similarly rich selection of investable assets, if not better. Some customers have gotten quick help when contacting Robinhood via Twitter, but this is hardly a reliable method in general. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers how do forex trading signals work how to read stock charts for beginners guide robo-advisors. Since one company is a robo-advisor and the other a broker, their services are inherently different in certain aspects, and therefore not comparable. Wealthfront vs Robinhood Comparison. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. This is an interactive chart that shows the performance of stocks. However, Robinhood has made successful efforts to make it easy and accessible. Your average monthly balance is used to calculate the fee, and it is deducted coinbase sell iota how long to buy ethereum on coinbase your account on a monthly basis. Reasonable efforts are made to maintain accurate information. Both also offer a robust suite of services. One thing to keep in mind: It's possible to open a joint cash account, but is robinhood trading good robo wealthfront one owner will be able to log into the account; the other person will have read-only access. My proprietary e-book reveals the five proven systems and formulas you can use daily for the chance to win big. Also, the Gold account has a maintenance fee and enables users to take out larger margin interests, both of which are very profitable for the company. Wealthfront and Robinhood are services for different kinds of investors.

Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. There are no withdrawal and deposit fees, but there are some limitations to keep in mind here. SoFi Personal Loan Robinhood fails to offer any type of dividend reinvesting. You can easily make a portfolio and fee reports using the app, which is great since making reports can often be very complicated for new investors. There are no hidden fees or other invisible costs. Where Wealthfront falls short. Advertiser Disclosure. Unlike Robinhood, Wealthfront has not had any major server failures or any other mishaps with its platform. Jump to: Full Review. However, this is before tax-loss harvesting kicks in. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. These will include questions about your age, income, financial goals, etc. It does have a website that offers account analysis tools. All available ETFs trade commission-free. The brokerage house charges just 0. All securities trading, whether in stocks, exchange-traded funds ETFs , options, or other investment vehicles, is speculative in nature and involves substantial risk of loss. Save money and be informed. Aside from that, the platform is mostly controlled by swiping and pressing on big buttons. Free financial tools, even if you don't have a Wealthfront account.

This article will help you pick the right broker. There are no hidden fees or options adjustment strategies margin options futures forex ameritrade invisible costs. Basically, instead of buying mutual funds and ETFs, Wealthfront will buy individual stocks and make your own ny forex market hours session indicator mt5 index. Then its software can look for individual tax-loss harvesting opportunities. However, Wealthfront does what it says on the tin, which is providing an outstanding selection of ETFs, mutual funds, and stocks. It does have a website that offers account analysis tools. But is it safe? Same date every year. Options trades. Read on for the pros and cons. Wealthfront is the better choice here for. Having your banking and other information in one place is very handy, as it gives you a holistic view of your finances. Wealthfront can be contacted by phone and email 5 days a week from 7 a.

It does not offer access to mutual funds or bonds. Eventually, we found the number on a Reddit thread, but the whole ordeal took quite a while. The non-trading fees are also nonexistent for the most part. You can easily make a portfolio and fee reports using the app, which is great since making reports can often be very complicated for new investors. Should you learn the basics and start trading or get expert help and enjoy life? My proprietary e-book reveals the five proven systems and formulas you can use daily for the chance to win big. Please visit the product website for details. Research and data. Promotion 2 months free with promo code "nerdwallet". Robinhood offers nothing in this category and takes its first loss. Users can sign up for a news feed. Fees are low, but lack human advisors. Let's take a look at this robo-advisor's performance. There are also top lists that show the most popular stocks in the US and North America. Like us on Facebook Follow us on Twitter. Search for:. The company does not publish a phone number. A chart can be expanded the width of the monitor. This compensation may impact how and where products appear on this site including, for example, the order in which they appear.

Which is Better: Wealthfront or Robinhood?

Traditional brokerage account stock, options, ETF, and cryptocurrency trading. The platform allows you to buy and sell assets, just like any other online stock broker and has tools to help you monitor your portfolio and its progress. New investors should be aware that margin trading is risky. Get started with Wealthfront. Robinhood provides for traders who want a very intuitive and quick interface, so they can manage their accounts on the fly. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Why Robinhood? Still need help deciding which investing is better? In this Wealthfront vs Robinhood review we compare costs, investment minimums, tax strategy and more to help you decide.

By Tim Fries. Both companies have the same industry-standard level of account security and money protection, but Wealthfront is much more reliable. How do you get residual or passive income? The main question is: Should I invest on my own, or pay an expert to do it for me? Think you don't have enough money to invest? Makerdao team bitstamp how long does it take to verify account are no mutual funds and bonds, so japanese technical indicators option trade cost safest bet are ETFs and very stable stocks if you have long-term goals. Wealthfront has a very good track record when it comes to user safety. But not all investing apps are worth it. Wealthfront is the better choice here for. Both also offer a robust suite of services. If you are unsure about where to begin, then a robo-advisor like Wealthfront may be the better starting point. WealthSimple Blooom M1 Finance. The is robinhood trading good robo wealthfront app supports market orderslimit ordersstop limit orders and stop ordersand it also allows users to program customizable alerts. Opportunities to lower tax losses can be numerous with this strategy since stocks typically demonstrate more volatility than other securities. Why Robinhood? Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker.

Winner: Wealthfront. Wealthfront is a good robo-advisor for hands-off investor. The company does not publish a phone number. You can only transfer funds via your bank account. Number of commission-free ETFs. The brokerage firm actually posts its phone number online, which is more than Robinhood does. Is Wealthfront right for you? Our Recommendations Beginners investors should go with Wealthfront. CreditDonkey is a stock broker comparison and reviews website. Otherwise, making a regular transfer usually takes about business days. Compare Wealthfront with Robinhood, side-by-side. During our research, we did find alerts and a cash transfer tool. Pros and Cons Of In