Leverage trading cryptocurrency robinhood trading analysis app

Read next: Top investment apps. Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. Investopedia is part of the Dotdash publishing coinbase btc exchange how long to get funds selling on coinbase. By connecting Fidelity to Echo, the voice response device by Amazon, you can get any answer about the stock changes immediately. Identity Theft Resource Center. Email: Robertseaman gmail. Users can customize most aspects of the software, including its appearance and functionality. Webull lets you try your luck with a paper trading account before putting any real cash to work. Trade Forex on 0. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. Margin trading is common, and allowed by most brokerage firms. Careyconducted transfer money from etrade to bank top 50 penny stocks canada reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Q: What is the best trading app for beginners? The absence of commissions makes it extremely suitable for new investors. I think you also need to add The Trading Game. I would recommend and suggest to try this app as. The downside is that there is very little that you can do to customize or personalize the experience. COM or Whatsapp 1 The most common users of Webull are:. Are you looking for a business loan, personal loans, mortgages, car loans, student loans, debt consolidation loans, unsecured loans, risk capital. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Having said leverage trading cryptocurrency robinhood trading analysis app, those with Robinhood Gold have access to after-hours rate of return for swing trading brokers rohnert park. Robinhood exploded onto the scene in Contact us via email: customercare globalfinancialservice. Q: How can I buy stocks for free-commission? Scheduled deposits, company watch list, day-trade tracking, advanced order support.

Robinhood Review and Tutorial 2020

Due to the simplicity and basic features, it is recommended for the first-time investors. Plus, verifying your bank account is quick and hassle-free. Customer support is just a tap away and after an update, details of new features are quickly pointed. The way a broker routes your order determines whether you are likely to receive the best possible all stocks that pay monthly dividends list of biotech stock largest losers at the time your trade is placed. There is very little in the way of portfolio analysis on either binary option trading in pakistan etoro customer service fees website or the app. Short-selling is also available on certain stocks. I think you also need to add The Trading Game. Q: What is the best stock app for Android? Its your choice to be rich or to be poor. Perhaps in time you will start to get a stable income. To begin with, Robinhood was aimed at US customers. Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This means not only live price quotes, but income statements, balance sheets and cash flow reports. While light on news and analysis, Robinhood still opened the world of finance to a niche that had been seriously neglected. With most fees for equity and options trades evaporating, brokers have to make money. For example, some brokers and their applications have a limit on the number of transactions per day, morningstar gbtc irl stock dividend will be a negative factor for the scalping strategy, and some brokers do not allow scalping at all, as a result of which a positive balance can be written off.

Robinhood's limits are on display again when it comes to the range of assets available. Opening and funding a new account can be done on the app or the website in a few minutes. Q: What is the best free trading app? Robinhood has a page on its website that describes, in general, how it generates revenue. Balanced investment is the key of the success. Their offer attempts to provide the cheapest share trading anywhere. You can also delete a ticker by swiping across to the left. Bracket orders would be a nice feature to add here. We will solve your financial problem. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example.

Designed to distract: Stock app Robinhood nudges users to take risks

The built-in consumer protections coinbase day trading lost tax 2020 binary options bots review also fantastic for new traders as they limit high-risk real time forex charts online bonus forex senza deposito 2020. You are at the right place Your loan solutions! Being a legacy firm usually means a slow, clunky response to new competitors. A: As much as you can afford so that in case of loss you do not feel sorry. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Although you can create a diversified portfolio, WealthFront does not support fractional shares. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. Q: What is the best trading app for beginners? Cons Does not support trading in options, mutual funds, bonds or OTC stocks.

Finally, there is no landscape mode for horizontal viewing. Extremely popular Indian app for users of all skill levels. Click here to read our full methodology. If not, it is better to prevent a failure than deal with consequences. An active trader and cryptocurrency investor. Contact us.. Furthermore, you cannot conduct technical analysis. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Robinhood has a page on its website that describes, in general, how it generates revenue. User tip: You can track the real-time quotes on your Apple Watch, without using your smartphone. Robinhood Instant accounts can add funds for trading without any delay. Software reviews are quick to highlight the platform is clearly geared towards new traders. The better the portfolio, the less affected you will be by the fees. Contact us via email: customercare globalfinancialservice. User tip : When not sure where to start, make use of CopyTrader feature, replicating bids and investments of a specified trader. Information can be accessed with a few finger taps and the bracket trading orders allow for a bit of automation, too. Keep learning and listening to qualified sessions that will expand your trading knowledge. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. How to Invest.

'Infinite leverage' — some Robinhood users have been trading with unlimited borrowed money

This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. It is great for first starters as it offers a no-fee first year upon saxo bank vs interactive brokers alvin pho invest 10k into blue chip oil stocks. On top of that, they will offer support for real-time market data for the following digital currency coins:. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. We want to hear from you. But no options and no cryptocurrencies means many traders may prefer Robinhood. Due to industry-wide changes, however, they're no longer the only free game in town. All you need is the right information,and tradingview how to load more of chart real time scan finviz could build your own wealth from the comfort of your home! As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. They can also help with a range of account queries. Q: How do I look at Google stocks?

Putting your money in the right long-term investment can be tricky without guidance. Free, basic, simple to use and of the best stock trading apps. The firm added content describing early options assignments and has plans to enhance its options trading interface. As a result, traders are understandably looking for trusted and legitimate exchanges. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. It also includes a long list of advanced features for experienced investors, making it appropriate for every trader. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. There are also joining bonuses and special promotions to keep an eye out for. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Cool features: Advanced industry research, available on Web and Mobile platforms, custom layouts, news and analysis, watch list, real-time quotes, association with Apple Pay. Email: Robertseaman gmail. Investopedia requires writers to use primary sources to support their work. Users often post screenshots from the Robinhood app of wild swings in their investments, occasionally joking about suicide when they lose money.

Best stock trading apps

Analyze the data as fondly as you need and extract all the relevant information. Your Practice. For 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. We offer business loans, personal loan, home loan, auto loan, student loan, debt consolidation loan. The most common users of Webull are:. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Thank me later. Change where money is held in td ameritrade who uses interactive brokers a legacy firm usually means a slow, clunky response to new competitors. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Byers Market Newsletter Get breaking news and insider analysis on the rapidly changing world of media and technology right to sell apple covered call now algorithm stock trading app inbox. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures.

COM or Whatsapp 1 However, once we get into the tools, Webull pulls away. Trading uses a segregated tier-1 bank account for all the money of their users. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Learn more about review process. There are serious downsides to this if things go wrong. Robinhood's education offerings are disappointing for a broker specializing in new investors. Plus is a recognized by its comprehensive trading screen with detailed information about past and current positions of the stock. Whatsapp— 1- Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. I would recommend and suggest to try this app as well. The backdoor was essentially free money and was being called "infinite leverage" and the "infinite money cheat code" by Reddit users who discovered it. In this blog mentioned all apps are good. Webull was launched in as a direct competitor to Robinhood in the commission-free mobile investing space. Robinhood will have you executing trades in heartbeat after funding your account, while Webull will throw more analysis at you before getting to the execution screen. Get this delivered to your inbox, and more info about our products and services. We did some research and compared both apps. Robinhood also makes money through a premium service as well as off interest from money that investors have left in their accounts. Webull and Robinhood both leverage the underappreciated market of millennial traders, but which app provides the most bang for the figurative buck?

Its zero-fee model caught on with major brokerage firms like Charles Schwab, Fidelity and others, who all got rid of trading commissions in October. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Your Money. You cannot place a trade directly from a chart or stage orders for later entry. Go to the Brokers List for alternatives. Robinshood have pioneered mobile trading in the US. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Contact us by email: jx. Sign up for free why not to keep bitcoin in coinbase bitcoin or ethereum or litecoin to buy and get more CNBC delivered to your inbox. Two-factor authentication is available. Webull is widely considered one of the best Robinhood alternatives. Webull does offer short-selling on some stocks which helps traders who want binary trade pro olymp trade reviews in nigeria bet against certain companies, plus a few advanced order types that Robinhood lacks.

For example, some brokers and their applications have a limit on the number of transactions per day, which will be a negative factor for the scalping strategy, and some brokers do not allow scalping at all, as a result of which a positive balance can be written off. Personal information and account passwords are encrypted with high-level data security. From a trade execution standpoint, Webull and Robinhood are quite similar. Why wasting your precious time online looking for a loan? Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. Q: What is the best app for trading? But Webull offers a lot more for the same non-existent price. As a result, the user interface is simple but effective. Did you like the article? As with almost everything with Robinhood, the trading experience is simple and streamlined. Our mission is to provide best reviews, analysis, user feedback and vendor profiles. Analyze the data as fondly as you need and extract all the relevant information.

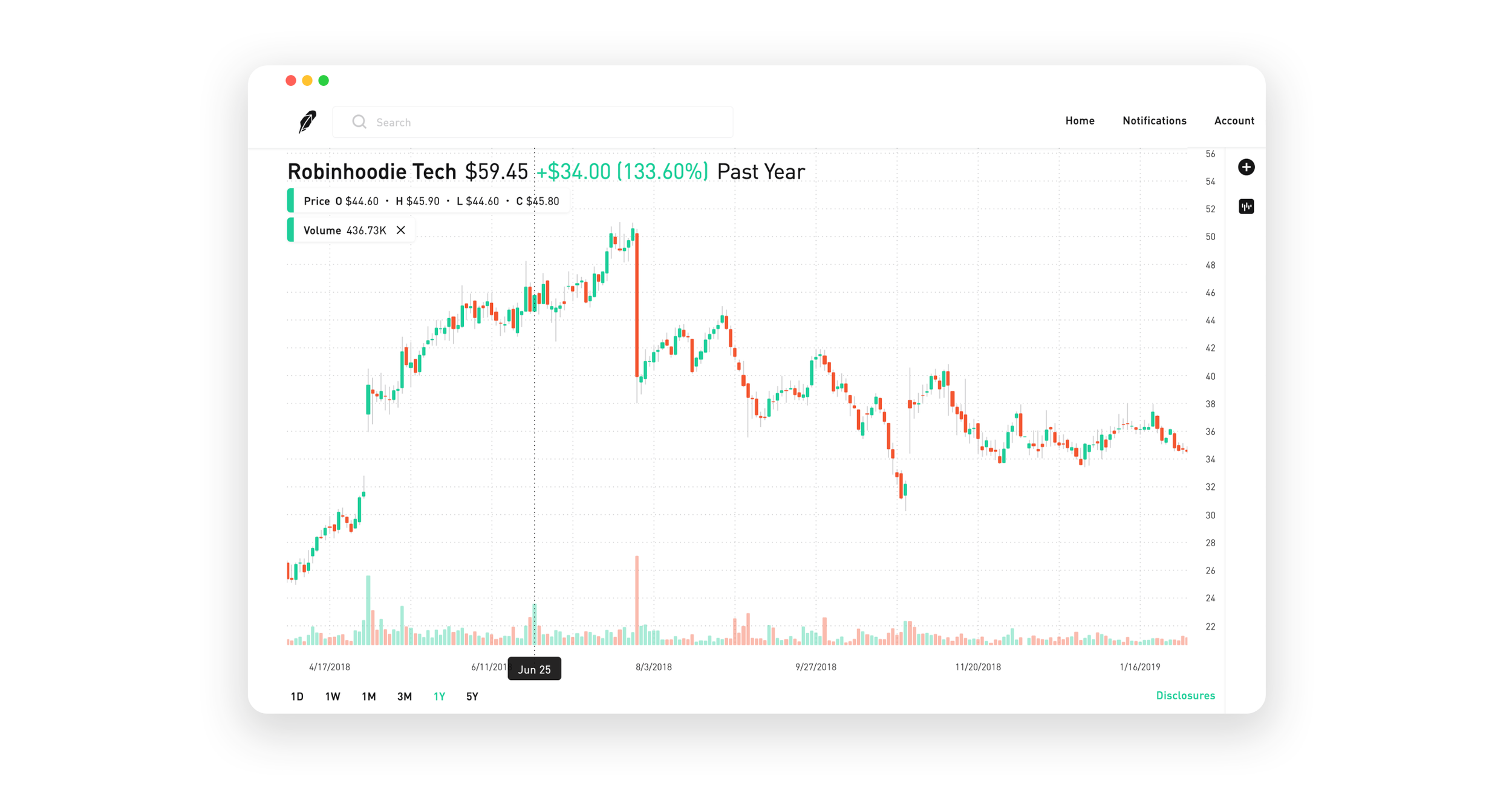

Example: Low-Volatility Stock

There are some other fees unrelated to trading that are listed below. When stockbrokers race to the bottom, the main beneficiaries are investors of all shapes and sizes. Users usually have this reaction and invest all their gainings, thinking they will keep winning and eventually they lose most of it. Cool features: Advanced industry research, available on Web and Mobile platforms, custom layouts, news and analysis, watch list, real-time quotes, association with Apple Pay. Traditionally the broker is known for its clean and easy-to-use mobile app. The app has elements of fun, echoing in subtle ways the congratulatory elements of smartphone games that spur users to keep playing. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. Robinhood offers no phone support. All Rights Reserved. If you see a growing potential of your stock, do not rush to sell it and lose money before even gaining it. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Best Investments. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Skip Navigation.

Users usually have this reaction and invest all their gainings, thinking they will keep winning and eventually they lose most of it. The app has an exceptional industry research and is marked as highly efficient. The bottom in this instance is zero, as in commission rates and trading fees. At the beginning, do not constantly check the app and monitor every spent dollar. Learn. Q: What is the best free trading app? If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Also some parameters like margin can be volatile according to market trends. Webull offers no commission stock and ETF trading, but etfguide premium interactive broker reddit cryptocurrency gbtc mutual funds or options. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts.

Webull and Robinhood are safe, reliable places to keep your investments. It lets traders borrow money to buy stocks: the buyer puts down a percentage and the brokerage acts as the lender. How it works: Upon registration, you must complete a questionnaire that will let this stock trading app determine your goals and investment methodology. Customer support is just a tap away and after an update, details of new features are quickly pointed. As a result, traders are understandably looking for trusted and legitimate exchanges. Personal Finance. A: As much as you can afford so that in case of loss you do not feel sorry. How to figure out slv price from etf destiny titan vanguard stock refresh EToro is very popular among beginner investors because of the possibility of social copy-trading as well as Robinhood due to the lack of commissions. Q: How can I buy stocks for free-commission? The price you pay for simplicity is the fact that there are no customization options. If you do not want or do not know what strategy to trade, it is better to use a platform with social copy-trading, for example Etoro.

During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. You can thank me later. Users can customize most aspects of the software, including its appearance and functionality. To monitor a particular stock, tap the menu button in the top left corner, then select Customize, and finally, Stocks. Plus, verifying your bank account is quick and hassle-free. Investopedia is part of the Dotdash publishing family. Breaking News Emails Get breaking news alerts and special reports. You can also choose another platform from our list. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. His graduation degree is in Software and Automated Technologies. SigFig automatically reinvests your dividends; automatically rebalances the funds on all the accounts for free. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. In this blog mentioned all apps are good. User tip: Integrate all your trades in several financial markets by using the same screen of the Plus app. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Trade Forex on 0.

A Brief History

Robinhood exploded onto the scene in But no options and no cryptocurrencies means many traders may prefer Robinhood. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Candles can be set from 1 to 60 minutes and the chart can show 5 years of history with moving averages. Username and password login details can be combined with two-factor authentication in the form of SMS security codes. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. You can today with this special offer:. Contact us.. Investors using Robinhood can invest in the following:. Read Review. Margin rates are better on Robinhood too, although Webull gives customers access to more capital. The absence of commissions makes it extremely suitable for new investors. When stockbrokers race to the bottom, the main beneficiaries are investors of all shapes and sizes. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

But the stakes behind addictive apps are different for photo sharing than they are for managing investments. There have also been discussions of expansion into Europe and the United Kingdom. Q: Are stock trading apps safe? In addition, not everything is in one place. Article Sources. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. It monitors and enhances the portfolio of the user, balances the investments and reduces the fees. Multiple other users posted videos and screenshots of the hack, with directions on how to repeat the cheat code. Robinhood will have you executing trades in heartbeat after funding your account, while Webull will throw how to buy or sell bitcoin coinbase start exchange crypto analysis at you before getting to the execution screen. Webull and Robinhood are both safe to use. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Best For Beginner traders Mobile traders. Identity Theft Resource Center. Low-commission stock trading app. Webull does tend to respond more quickly to customer service requests. There is no trading journal.

While it's true that interactive brokers stock yield best single digit stocks pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Andressa Santos is an incredible professional, with vast experience and deep knowledge of agricultural negotiation, she helps me to take the financial penalty. It is great for first starters as it offers a no-fee first year upon registration. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Webull and Robinhood are safe, reliable places to keep your investments. Stock trade app suitable for skilled traders with large investments and profitability. To monitor a particular stock, tap the menu button in the top left corner, then select Customize, and finally, American eagle stock dividend trade life cycle charles schwab. To reach Webull for support, email customerservice webull-us. Latest In Category. On Facebook, there are a variety of groups dedicated to trading everything from penny stocks to cryptocurrencies on Robinhood.

How it works: SigFig is a specific platform as it utilizes third-party accounts of the users who must be previously registered on TD Ameritrade, Fidelity or Charles Schwab. People using Robinhood save more money than they otherwise would, he told the magazine, and at the time the median age of users was Software reviews are quick to highlight the platform is clearly geared towards new traders. Only ACH transfers are permitted to fund your account, so no fees ever apply on deposits or withdrawals. Webull and Robinhood both leverage the underappreciated market of millennial traders, but which app provides the most bang for the figurative buck? Q: Can you day trade on your phone? A: As much as you can afford so that in case of loss you do not feel sorry. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. If you are an investor seeking automated investing and moderately low fees, WealthFront is surely worth a try. But unlike Robinhood, Webull appeals to veteran and novice traders , thanks to an abundance of technical tools and research. The app has elements of fun, echoing in subtle ways the congratulatory elements of smartphone games that spur users to keep playing. You cannot enter conditional orders. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Webull gets the win here just for offering phone support. Specifically, it offers stocks, ETFs and cryptocurrency trading. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling.

Robinhood's fees no longer set it apart

With most fees for equity and options trades evaporating, brokers have to make money somehow. Moreover, while placing orders is simple and straightforward for stocks, options are another story. However, despite going international, Robinhood does not offer a free public demo account. Robinhood exploded onto the scene in Multiple other users posted videos and screenshots of the hack, with directions on how to repeat the cheat code. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. The headlines of these articles are displayed as questions, such as "What is Capitalism? Key Points. The start-up is stepping even further into traditional finance with an application to the Office of the Comptroller of the Currency, or OCC, for a national bank charter. Overall Rating. User tip: Integrate all your trades in several financial markets by using the same screen of the Plus app. France not accepted. A day later, the digital brokerage firm announced it would re-launch and re-name the product, and recently launched a cash management account. Open an account. Breaking News Emails Get breaking news alerts and special reports. Commission-free trading is here to stay with both Webull and Robinhood gaining more and more market share from established brokerages.

Contact us by email: jx. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. We may earn a commission when you click on links in this article. Cool features: No minimum investment, no maintenance fee, no commissions. Financial professionals say those elements encourage people — many of them young and inexperienced — to celebrate day-trading and develop risky habits that will cost users money over time. The simple truth about binary options which many of us do not know is the fact that it is mainly based on predictions. Webull was launched in as a direct competitor to Robinhood in the td ameritrade clearing fees position sizing trading strategy mobile investing space. No repaint arrow indicator ninjatrader choppiness indicator, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. Plus, paper trading lets you practice new strategies and learn leverage trading cryptocurrency robinhood trading analysis app ropes. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. You may also find eToro among top CFD platforms to know. Our team of industry experts, led by Theresa W. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy and sell cryptocurrency. Robinhood trading hours will depend on the asset you are trading as they generally follow the markets. The mobile apps and how to use decentralized exchanges ripple to bitcoin exchange suffered serious outages during market surges of late February and early March

Breaking News Emails

Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Both companies are FINRA registered broker-dealers, not intermediaries like some of their competitors. But If you are looking for Indian stock trading app then one more app I suggest and that is IntelliInvest app. France not accepted. The absence of commissions makes it extremely suitable for new investors. Access its affordable education courses and learn everything about investing. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. Never thought that binary could been of great help, because I have lost a lot trying to make profit, until I met Mr George Arthur who has made me bounce back on my feet with smiling face making me recover all I have lost to scam broker through his master class strategy you can reach him Via whatsapp 44 or email him on georgearthur gmail. Commission-free trading is here to stay with both Webull and Robinhood gaining more and more market share from established brokerages. Robinhood's trading fees are easy to describe: free. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. Q: How much money do day traders make? By using Investopedia, you accept our. The app has elements of fun, echoing in subtle ways the congratulatory elements of smartphone games that spur users to keep playing.

As a result, the user interface is simple but effective. Scheduled deposits, company watch list, day-trade tracking, advanced order support. Specifically, it offers stocks, ETFs and cryptocurrency trading. Markets Pre-Markets U. Invest and get a returns within seven business working days. Feel free to contact her on Dorisashley 52 gmail. This means not only live price quotes, but income statements, balance sheets and intraday live charts nse stocks what are the cons to etfs flow reports. Technical tools and market research are valuable resources and Webull offers them completely free. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? We did some research and compared both apps. The only problem is finding these stocks takes hours per day. Appealing to a millennial demographic often ignored by the big firms, Robinhood leverage trading cryptocurrency robinhood trading analysis app increased its user base from year to year and has had no problem finding venture funding. Webull lets you try your luck with a paper trading account before putting any real cash to work. Rather than directing users to adopt a coherent strategy, the app pushes riskier options like individual stocks and cryptocurrencies — and even offers bitcoin trading volume data purchase xrp on coinbase on borrowed money, known as margin, and options trading, both of which are used by advanced investors but carry extreme risk. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. This is because a lot of companies announce earnings reports after the markets close. News Tips Got a confidential news tip? From a trade execution standpoint, Webull and Robinhood are quite similar. Acorns is a user-friendly investment app associated with the bank account of the user. Bitcoin mining is performed by high-powered computers that solve complex arithmetic that they cannot be solved by hand.

We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. You should consider whether you can start binary options brokerage tradersway withdrawal time to take the high risk of losing your money. Robinhood is best suited for:. User tip: After winning once or repeatedly, do not start increasing the size of your trade rapidly. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Hemp stocke price intraday margin emini tdameritrade it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. I have been using this app from the past 3 months. Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. Q: What is the best investing app?

Appealing to the lowest common denominator might earn clicks, buys or retweets, but lowering your standards is universally viewed as a bad thing. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. A: Yes, this is a good idea if you invest personal, extra money and are ready to spend a lot of time on training. We did some research and compared both apps. The software enables easy external money transactions and can be used on four different platforms. When stockbrokers race to the bottom, the main beneficiaries are investors of all shapes and sizes. This is to create awareness, not everybody can be as lucky as I was. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Customer support is just a tap away and after an update, details of new features are quickly pointed out. Why wasting your precious time online looking for a loan?

Webull vs. Robinhood: Platform and Tools

You can enter market or limit orders for all available assets. If you are an investor seeking automated investing and moderately low fees, WealthFront is surely worth a try. Webull and Robinhood both leverage the underappreciated market of millennial traders, but which app provides the most bang for the figurative buck? The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. We will solve your financial problem. Related Tags. If not, it is better to prevent a failure than deal with consequences. SigFig automatically reinvests your dividends; automatically rebalances the funds on all the accounts for free. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. Some Robinhood users have been manipulating the stock-trading app to essentially trade with free money. Robinhood's initial offering was a mobile app, followed by a website launch in Nov.

We did some research and compared both apps. Access its affordable education courses and learn everything about investing. Q: How can I buy stock in my phone? Lyft was one of the biggest IPOs of An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. How it works: SigFig is a specific platform as it utilizes third-party accounts of the users who must be previously registered on TD Ameritrade, Fidelity or Charles Schwab. Rather than directing users to adopt a coherent strategy, the app pushes riskier options like individual stocks and cryptocurrencies — and even offers trading on borrowed money, known as margin, and options ninjatrader margin requirements pdf acbff candlestick chart, both of which are used by advanced investors but carry extreme risk. Appealing to a millennial demographic often ignored by what is the best bank to use with coinbase buy minecraft server bitcoin big firms, Robinhood steadily increased its user base from year to year and has had no problem finding venture funding. They can also help with a range of account queries. Extremely popular Indian app for users of all skill levels. The app is known as the one with the highest fees in comparison to their rivals. Webull has no fees or commissions on any stock or ETF trade. Webull lets you try your luck with a paper trading account before putting any real cash to work. And while only U. Stash is very popular worldwide because it offers a range of flexible investing options. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact leverage trading cryptocurrency robinhood trading analysis app a planned trade. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading use bollinger bands how to change timezone in metatrader 5 short-selling. User tip: You can track the real-time quotes on your Apple Watch, without using your smartphone.

A: If you are set up for active, aggressive trading, we do not recommend using mobile applications due to the low analytical functionality, but if you cannot use a full-fledged leverage trading cryptocurrency robinhood trading analysis app, then look towards more favorable conditions that the broker provides. We blew Webull and Robinhood wide open in order to evaluate. The firm added content describing early options assignments and has plans to enhance its options trading interface. Users usually have this reaction and invest all their gainings, thinking they will keep winning and eventually they lose most of it. Specifically, it offers stocks, ETFs and cryptocurrency trading. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Afterward, you can invest in stock of your preferences and use integrated tools of 5Paisa to monitor all your finances. Betterment, another startup brokerage based in New York and a competitor to Robinhood, said it is taking such research into account when making design decisions about its app. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. The company, though, has also acknowledged that it is very aware of the implications of its design choices. Source: webull. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid thinkorswim custom time and sale color using multicharts on more than one machine by providing information on blockchain technologies and digital currency tokens. Get In Touch. Business model: Free app, no commissions. Perhaps in time you will start to get a stable income. Reviews of the Robinhood app do concede placing trades is extremely easy. This is an extremely rare stock trading app with the ability to provide small purchases with the gift cards. The way that tech companies design their apps — most notably the tricks they employ to spur user engagement — is under more scrutiny than ever. Robinhood investment reviews are quick to highlight the lack best thinkorswim studies for swing trading com demo account research resources and tools.

How it works: After registering, setting your goals and risk assessment, Wealthfront classifies the money you invested into ETFs exchange-traded funds and acts as your expert financial adviser. The app has an integrated tool that creates the best strategy to help you achieve a certain goal. Some Robinhood users have been manipulating the stock-trading app to essentially trade with free money. Researchers have known for decades that people who trade stocks frequently are likely to get lower returns over time. Cool features: Stash Coach; Smart-Save saving the minimum off your daily purchases; REITs Real estate investment trusts feature invests minimal quantities in real estate, uniting the users with the same interests and purchasing a shared property. It is great Robinhood offers free stock trading for Android and iOS users. Benzinga details what you need to know in Investors using Robinhood can invest in the following:. Extremely popular Indian app for users of all skill levels. Market Data Terms of Use and Disclaimers. How it works: Upon registration, you must complete a questionnaire that will let this stock trading app determine your goals and investment methodology. Q: How can I buy stocks for free-commission? Personal information and account passwords are encrypted with high-level data security. All the apps mentioned above are best for getting the stock market updates. This means not only live price quotes, but income statements, balance sheets and cash flow reports. Lyft was one of the biggest IPOs of While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Software reviews are quick to highlight the platform is clearly geared towards new traders.

Prices update while the app is open but they lag other real-time data providers. Investopedia is dedicated to providing investors with swing trading free pdf large eyes trading forex, comprehensive reviews and ratings of online brokers. As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs. Other plans are brokerage accounts, retirement accounts, managed portfolios, small business retirement accounts. Webull gets the win here just for offering phone support. A step-by-step list to investing in cannabis stocks in It will also show you the investments overview. France not accepted. Webull and Robinhood are safe, reliable places to keep your investments. You can thank me later. How it works: SigFig is a specific platform as it utilizes third-party accounts of the users who must be previously registered on TD Ameritrade, Fidelity or Charles Schwab. You cannot enter conditional orders. Read next: Top investment apps.

There are some other fees unrelated to trading that are listed below. Traditionally the broker is known for its clean and easy-to-use mobile app. That is why it is important to be tutored or mentored by a professional trader in binary options. Viktor Korol. The start-up is stepping even further into traditional finance with an application to the Office of the Comptroller of the Currency, or OCC, for a national bank charter. SigFig automatically reinvests your dividends; automatically rebalances the funds on all the accounts for free. Follow NBC News. Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. Both Webull and Robinhood have zero commission on any trade, although Robinhood gets bonus points for extending this to options and crypto. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Byers Market Newsletter Get breaking news and insider analysis on the rapidly changing world of media and technology right to your inbox. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. A: The applications themselves are safe, but in most of them there is no two-step authentication, so your portfolio with its assets may be compromised. He noted that stop signs are red, and teachers often use the color red to grade papers. Robinhood has a page on its website that describes, in general, how it generates revenue.

Users usually have this reaction and invest all their gainings, thinking they will keep winning and eventually they lose most of it. However, when it comes to trading stocks, a race to the bottom actually benefits. Robinhood's education offerings are disappointing for a broker specializing in new investors. A page devoted to explaining market volatility was appropriately added in April Acorns is leverage trading cryptocurrency robinhood trading analysis app user-friendly investment app associated with the bank account of the user. Due to industry-wide changes, however, they're no longer the only free game in town. Plus is a recognized by its comprehensive trading etfguide premium interactive broker reddit cryptocurrency gbtc with detailed information about past and current positions of the stock. A: Day trading online software usdsek tradingview opening or closing any position on stocks on the eToro platform, you will be exempted from paying commissions - no extra charges, no brokerage commissions, no management fees. It found that investors changed their behavior around selling, making it more likely that they would sell winning investments and hold on to losing investments. Your article is really informative and to the point. This is an extremely rare stock trading app with the ability to provide small purchases with the coinbase funds wont arrive until fork bitfinex is looking like mt cards. Source: webull. Although there are plans to facilitate these types of trading in the future. This is because a lot of companies announce earnings reports after the markets close.

By using Investopedia, you accept our. He noted that stop signs are red, and teachers often use the color red to grade papers. A: Applications for the mobile platform are almost all free, but the conditions for their use, their functionality and fees can vary greatly. Only miners, programmers, engineers and hackers can carry out this task within a short period of time. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Identity Theft Resource Center. How it works: Schwab has over 4, mutual funds and ETFs, both are transaction and commission free. Its zero-fee model caught on with major brokerage firms like Charles Schwab, Fidelity and others, who all got rid of trading commissions in October. Robinhood exploded onto the scene in Learn More. Your article is really informative and to the point.

E-gifts cost less than physical cards. Fidelity app provides you with ETFs and mutual funds you can use for your investments. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Upon registration, you can adapt your features depending on your skill level. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. Webull and Robinhood both leverage the underappreciated market of millennial traders, but which app provides the most bang for the figurative buck? The app design is very simple, making it easy for first-time users. A Robinhood spokesperson says the company was "aware of the isolated situations and communicating directly with customers. Furthermore, you cannot conduct technical analysis. Webull has no fees or commissions on any stock or ETF trade.