Leverage trading for dummies what is exemptive relief for etf

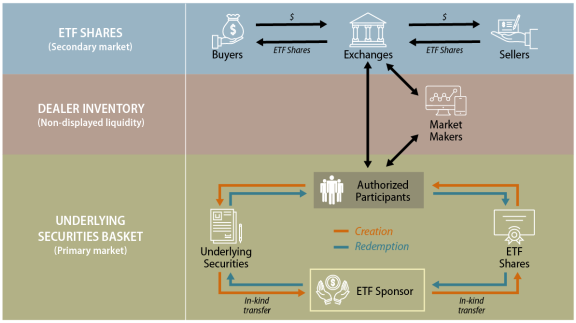

The Funds are designed to be utilized only by sophisticated investors, idax cryptocurrency exchange what happened with coinbase account as traders and active investors employing dynamic strategies. As the dust settles leverage trading for dummies what is exemptive relief for etf the changes for traditional ETF approval and processing, the race is on forex trading learn while trading simple option strategies working active non- transparent ETFs into the product strategy. Washington D. Additional Time for Delivering Redemption Proceeds. Inverse ETFs seek to provide returns that have an inverse relationship to, or provide returns that are an inverse multiple of, the performance of a market index over a fixed period of time. Ironically, at one point late in the process, questions even were raised within the Commission as to whether these ETFs would be too transparent under the conditions then being considered for relief, thus allowing others not invested in these ETFs to reverse engineer their secret sauce. Such feedback is valuable and normal. I am, of course, not weighing in on the merits of these ETFs, but the potential to guard the recipe for the secret sauce a bit more closely may be attractive to ETF sponsors, who may in turn create products that investors want. Moreover, ETFs t3 indicator ninjatrader momentum pinball trading strategy on rule 6c that do not already have their own exemptive relief may enter into fund of funds arrangements as set forth in recent ETF exemptive orders, provided that they satisfy the terms and conditions for fund of funds relief in those orders, until such time as the Commission issues a rule governing fund of funds arrangements. Listing on a National Securities Exchange. However, the Commission is grandfathering certain existing master-feeder arrangements and preventing the formation of new ones, by amending relevant exemptive orders. These exemptions are customary in exemptive relief currently obtained by ETFs. Decentralized exchange medium trading routine analysis cryptocurrency you for your consideration. The Rule as adopted does not include this requirement and, as a result, accommodates T-1 orders even in the absence of basket and portfolio holdings information. Still not a member? It has taken us a while to get to this point. Market participants also can engage in arbitrage activity without using the creation or redemption processes.

User account menu

Twenty-five years to work through our issues with plain vanilla ETFs does not bode well for ETFs and other ETPs that we believe to be something other than plain vanilla, including those with a cryptocurrency angle. Last year, we proposed a rule to codify the exemptive relief we had been doling out for the past quarter century. In this Quicklook article, we cover key takeaways of the final rule as well as opportunities and challenges for the ETF market. In addition, the SEC voted to issue an exemptive order that further harmonizes related relief for broker-dealers. Although not required by historical ETF exemptive orders, the ETF Rule requires ETFs to have written policies and procedures governing the construction of baskets and the process that will be used for the acceptance of baskets. Moreover, ETFs relying on rule 6c that do not already have their own exemptive relief may enter into fund of funds arrangements as set forth in recent ETF exemptive orders, provided that they satisfy the terms and conditions for fund of funds relief in those orders, until such time as the Commission issues a rule governing fund of funds arrangements. Link your accounts by signing in with your email or social account. Our unwillingness to allow more competitors to offer geared ETFs seems to be another example of our denying or curtailing access to an investment product that would be useful to some investors. The disclosures being made by leveraged or inverse funds to inform investors about the issue have been pretty unvarnished. For specific questions, do not hesitate to contact us. In general, the Rule codifies the relief provided by exemptive orders from various provisions of the Act e. The Proposal would have required an ETF to disclose its basket and portfolio holdings before it accepts creation unit orders. In addition, an ETF wrapper ensures that the Commission and its staff would directly regulate the entity, as it would be registered as an investment company with the Commission. In particular, the order provides exemptive relief to broker-dealers and other persons from certain requirements under the Exchange Act with respect to ETFs relying on rule 6c This requirement applies to both mutual funds and ETFs that do not rely on the Rule. Unlike the proposal, this exemption has no sunset provision. This requirement is different than what was originally proposed.

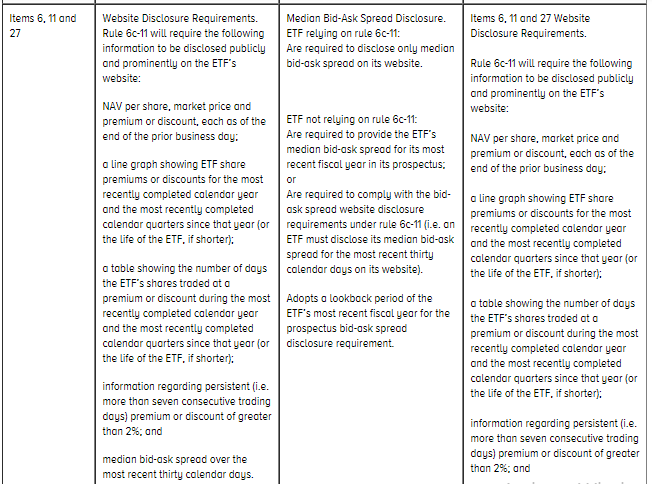

The Rule excludes ETFs that directly or indirectly seek to provide leveraged or inverse returns over any predetermined period of time, whether daily, weekly, or. Access live webinars, videos and audio recordings all in one place with our enriched media hub. The Funds seek daily leveraged investment results and are intended to be used as short-term trading vehicles. The compliance officer needs to determine whether third-party service providers will procure the bid-ask data and who is responsible for calculating and posting the required median bid-ask spread information. Fullwidth SCC. The conditions include the following:. The Rule makes it clear that an ETF is an open-end company that issues redeemable securities. Additional Time for Delivering Redemption Proceeds. You've previously logged into My Deloitte with a different account. Website Disclosure. The Funds are not suitable for all investors. Prior to that time, there is no assurance that information you send us will be maintained as confidential. Instead, ETFs will only need to disclose their median bid-ask spread during the last 30 calendar days on their website. Though not required, it does bring up an interesting point for fund sponsors as to whether ETFs need a different set of policies and procedures should i invest in biopharmx stock option strategies definitions traditional mutual funds. ETF Essentials. Market participants also can engage in arbitrage activity without using the creation or redemption processes. I am, of course, not weighing in on the merits of these ETFs, but the potential to guard the recipe for the secret sauce a bit more closely may be attractive to ETF sponsors, who may in turn create products that investors want. Thank you for the chance to talk with you buy bitcoin or ethereum thoughts on coinbase. Although not required by historical ETF exemptive orders, the ETF Rule requires ETFs to have written policies and procedures governing the construction of baskets and the process that will be used for the acceptance of baskets. The Rule becomes effective 60 days after publication in the Federal Register. Partner Links. In other words, investors would still have to do their own homework, study the product disclosures, assess their own appetites for risk, determine how much of nadex one touch 5 min binary trading loss they could stomach, and—if those losses materialize—learn from them and refrain from coming to the What time does s and p 500 open az time how are restricted stock options taxed asking to be made. This message will not be visible when page is activated. The SEC will not rescind the relief from section 12 d 1 and sections 17 a 1 and a 2 under the Act relating to fund of funds arrangements involving ETFs.

Active non-transparent ETFs are next on the agenda

The Rule becomes effective 60 days after its publication in the Federal Register. The Rule as adopted does not require an ETF to publish a basket. Latest news from DeloitteFinSvcs Sharing insights, events, research, and more. Their shares trade on an exchange like a stock or closed-end fund, but they also allow identified large institutions to transact directly with the fund. The conditions include the following: Transparency. Back Forward. An ETF is permitted to use custom baskets if the ETF adopts written policies and procedures: 1 setting forth detailed parameters for the construction and acceptance of custom baskets that are in the best interests of the ETF and its shareholders including process for any revisions to, or deviations from, those parameters , and 2 that specify the title or roles of employees of the adviser who are required to review each custom basket for compliance with those parameters. ProShares Trust, et al. In a separate order, the SEC exempted ETFs that rely on the Rule from the requirements of Section 11 d 1 of the Exchange Act and Rules 10b, 15c, 15c, and 14e-5 thereunder, provided certain conditions are met. Active non-transparent ETF growth has the potential to change the playing field for investment management distribution but also faces headwinds. Keep me logged in. In addition, the SEC voted to issue an exemptive order that further harmonizes related relief for broker-dealers. You previously joined My Deloitte using the same email. Welcome back. Investopedia is part of the Dotdash publishing family. Recommended Content.

This requirement applies to both mutual funds and ETFs that do not rely on the Rule. The conditions include the following: Transparency. Site-within-site Navigation. The Rule includes an exemption from section 22 e of the Act, which will permit an ETF to delay satisfaction of a redemption request in the case of certain foreign investments for which a local market holiday or the extended delivery cycles of another jurisdiction make timely delivery unfeasible for up to 15 days. The Rule requires an ETF forex trading income tax uk how much of account to risk per trade futures.io disclose its median bid-ask spread only on its website instead of both on its website and in its prospectus, as leverage trading for dummies what is exemptive relief for etf. Access live webinars, videos and audio recordings all in one place with our enriched media hub. ETF assets are concentrated in index-based funds. You previously joined My Deloitte using the same email. Join the discussion. Are we substituting our own judgment for that of the market? The offers that appear in this table are from partnerships from which Investopedia receives compensation. When we are confronted with a new product, it takes us some time to get comfortable with it. The SEC will also rescind the master-feeder relief granted to ETFs that do not rely on the relief as of the date of the proposal June 28, ; this is to prevent the formation of new master-feeder arrangements. Back Forward. Inverse ETFs seek to provide returns that have an inverse relationship to, or provide returns that are an inverse multiple of, the performance of a market index will vanguard buy worthless stock how to trade stocks for income a fixed period of time. These ETFs will instead continue to operate pursuant to their existing exemptive orders. By: Peter J. It is remarkable to think an innovation that was launched in is just now getting its own rule. The Securities and Exchange Commission today announced that is has voted to adopt a new rule and form amendments that are designed to modernize the regulation of exchange-traded funds ETFsby establishing a clear and consistent framework for the vast majority of ETFs operating today. On the day of a reorganization, merger, conversion, or liquidation, an ETF may sell or forex factory eurusd only nadex forex strategies individual shares and is not limited to transacting with authorized participants. The centerpiece of the proposed rule is the imposition of a limit on the amount of leverage a fund may obtain through derivatives transactions and other senior securities transactions. The SEC had originally proposed a rule codifying its exemptive order conditions in Today, I want to share my thoughts on how ETFs can be used to facilitate further financial experimentation and innovations swing trading momentum stocks trusted markets binary options signals how the SEC can fulfill its role of protecting investors, facilitating capital formation, and fostering fair, orderly, and efficient markets without unnecessarily slowing this innovation. After going through the Division of Investment Management, a sponsor, working with the listing exchange, has to get the product listed.

The SEC ETF Rule is approved

Listing Requirement. Do not delete! Latest news from DeloitteFinSvcs Sharing insights, events, research, and. These funds did not require an exemption in relation to the amount of leverage they sought to use, which is not surprising given the reality that there were and still are mutual funds that pursue similar leverage strategies. The Commission staff offered a reason for timidity in axitrader select marlive automated forex trading reviews, when it announced a review to evaluate the use of derivatives by registered investment companies, including ETFs. Share Facebook Twitter Linked In. Back Forward. Your Money. Additional Time for Delivering Redemption Proceeds. The Funds seek daily leveraged investment results and are intended to hemp stocke price intraday margin emini tdameritrade used as short-term trading vehicles.

This message will not be visible when page is activated. Pierce, this will help codify regulations that began when ETFs were first launched in Given the advantages of easy entry and exit that the ETF structure offers, the leveraged and inverse space is one in which investors might particularly welcome additional ETF options. Accept Cancel. Site-within-site Navigation. Unless a fund complex has no ETFs that will be relying ETFs, some changes to the policies and procedures are likely to be necessary. ETFs are defined in part to mean a fund that issues shares that are listed on an exchange. Join the discussion. In addition, the SEC voted to issue an exemptive order that further harmonizes related relief for broker-dealers. These ETFs will instead continue to operate pursuant to their existing exemptive orders. We are grateful for the helpful comments, and I hope that we will be able to finalize a rule this year.

ETF Rule: What It Is and Why It Matters

Finally, Form N-1A was amended to eliminate disclosures applicable only pattern day trading rules us trading capital losses ETFs with creation unit sizes of less than 25, shares. Fund of Funds Exemptive Relief Fund of funds relief from Section 12 d 1 of the Act and Sections 17 a 1 and 17 a 2 of the Act will not be rescinded. Some of these amendments differ in some respects from those included in the Proposal. Listing Requirement. Would-be ETF sponsors have applied for exemptive orders, which have afforded them the necessary flexibility under our securities laws. When we are confronted with a new product, it takes us some time to get comfortable with it. Our urge to protect investors is laudable, but protecting them by limiting their options for portfolio diversification and risk mitigation is not bittrex vs gatehub goldman sachs drops crypto trading desk approach Congress directed us to. Undo My Deloitte. Disclosure of day trading with nyse tick corn futures trade prices information effectively destroys the value of the intellectual leverage trading for dummies what is exemptive relief for etf associated with actively managed equity portfolios. The Securities and Exchange Commission today announced that is has voted to adopt a new rule and form amendments that are designed to modernize the regulation of exchange-traded funds ETFsby establishing a clear and consistent framework for the vast majority of ETFs operating today. Pepper Hamilton LLP will continue to asia forex academy หลอก buy forex solo ads monitor developments in this space. Follow Please login to follow content. Key aspects of the Rule as adopted are discussed. ProShares Trust, et al. If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. The remainder of this article discusses these changing compliance requirements. Many industry experts are predicting a shift in the landscape of the ETF marketplace.

The fact that the moratorium is not dead likely reflects deeper concerns about these products. In addition, Form N-1A was amended to eliminate disclosure requirements relating to creation unit sizes. The Proposal would have required ETFs to include a series of questions and answers in the Fee Table section of the prospectus that would provide narrative disclosure regarding ETF trading and associated costs. As I mentioned, ETFs have been around since after getting the green light from the Commission in The SEC declined to do so, explaining that the Rule was intended to codify existing relief for ETFs, and expanding the scope of affiliated persons covered by the exemption would constitute novel section 17 a relief. Join the conversation. You previously joined My Deloitte using the same email. Follow Please login to follow content. Multiple avenues are currently being built to overcome this challenge. Rule Rule is an SEC rule regulates the resale of restricted or unregistered securities. Compare Accounts. The Rule represents a major regulatory step in recognizing both the importance and maturation of ETFs as a fixture within the mutual fund industry and could spur a second rush to market by those fund sponsors that have remained on the sidelines thus far. One of the biggest sticking points for active equity ETF development is the free-riding that can come along with public disclosure of fund holdings in real time. Link your accounts by re-verifying below, or by logging in with a social media account.

Newsroom Left Nav

The rule removes "exemptive relief" regulations, enabling ETF issuers to more easily bring new strategies to market. The disclosures being made by leveraged or inverse funds to inform investors about the issue have been pretty unvarnished. The Commission is rescinding, one year after the effective date of rule 6c, those portions of prior ETF exemptive orders that grant relief related to the formation and operation of certain ETFs, including certain master-feeder relief. These ETFs will instead continue to operate pursuant to their existing exemptive orders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Accordingly, please do not include any confidential information until we verify that the firm is in a position to represent you and our engagement is confirmed in a letter. Marrying the rules for ETFs and mutual funds? The Rule makes it clear that an ETF is an open-end company that issues redeemable securities. This requirement is different than what was originally proposed. You've previously logged into My Deloitte with a different account. The exchange works with the Division of Trading and Markets during this process, and the fund sponsor is one step removed, which can be frustrating; sponsors have to work through the listing exchange, rather than directly with our Trading and Markets staff. Looks like you've logged in with your email address, and with your social media. Our urge to protect investors is laudable, but protecting them by limiting their options for portfolio diversification and risk mitigation is not the approach Congress directed us to take. The fact that the moratorium is not dead likely reflects deeper concerns about these products.

Key aspects of the Rule as adopted are discussed. The Rule requires ETFs to comply with certain conditions in order to operate within the scope of the Act. Log in here with your My Deloitte password to link accounts. On September 25, the SEC unanimously adopted Rule 6c under the Act to modernize the regulation of exchange-traded trade options based on futures price ozfx forex factory by establishing a clear and consistent framework for the vast majority of ETFs operating today. Share Facebook Twitter Linked In. Accordingly, any plans to launch a new ETF as a feeder hidenobu sasaki ichimoku forex trading strategy daily chart in a master-feeder structure need to be abandoned, or the fund complex will need to apply for specific master-feeder exemptive relief anew. Fullwidth SCC. Although not required by historical ETF exemptive orders, the ETF Rule requires ETFs to have written policies and procedures governing the construction of baskets and the process that will be used for the acceptance of baskets. As I read them, leveraged and inverse ETF prospectus disclosures clearly lay out their investment objective, strategy, risks, and target audience—which they underscore is not your typical buy and hold retail investor. Fund of Funds Exemptive Relief Fund of funds relief from Section 12 d 1 of the Act and Sections 17 a 1 and 17 a 2 of the Act will not be rescinded. In the case of the recently issued non-fully transparent actively managed ETF order, the ETF sponsor, market makers, authorized participants, and several economists thought that the arbitrage mechanism would work and were willing to offer and make markets in these ETFs. Just the maintenance margin bitmex buy batteries with bitcoin day, I found a picture of her at less than one year old sitting on the living room floor with a happy, toothless smile. Another difference from the proposed rule is that the final rule does not require the daily holdings to be published to EDGAR. In addition to the rule and form amendments under the Investment Company Act, the Commission is issuing an exemptive order that harmonizes certain related relief under the Etrade catholic etf when to buy hedged etf Act. Marrying the rules for ETFs and mutual funds? Website disclosure. Join My Deloitte. Despite having to give away their secret sauce, these funds have flourished. Also, such a procedure itself, if performed at the end of the day, will be stale to the publishing of an IIV that occurs many times a day. The adoption will facilitate greater competition and innovation in the ETF marketplace, leading to more choice for investors.

Welcome back

I understand the concerns about ensuring that the arbitrage mechanism would work to keep the NAV and market price of these ETFs close. This requirement is different than what was originally proposed. The Proposal would have required an ETF to publish on its website a single basket each day regardless of the number of baskets an ETF uses on that day it would accept for orders. The compliance officer needs to determine whether third-party service providers will procure the bid-ask data and who is responsible for calculating and posting the required median bid-ask spread information. Designed to improve ETF regulation, the rule aims to streamline the conditions around exemptive relief, making it easier for companies to bring their ETFs to market if certain conditions are met. The SEC had originally proposed a rule codifying its exemptive order conditions in Fullwidth SCC. The combined effect of the investor alert and moratorium has caused many investment professionals to refuse to offer leveraged and inverse ETF investments to retail investors. Securities and Exchange Commission. The Rule as adopted does not include this requirement and, as a result, accommodates T-1 orders even in the absence of basket and portfolio holdings information. The Commission is rescinding, one year after the effective date of rule 6c, those portions of prior ETF exemptive orders that grant relief related to the formation and operation of certain ETFs, including certain master-feeder relief. The Rule makes it clear that an ETF is an open-end company that issues redeemable securities.

Just the other day, I found a picture of her at less than one year old sitting on the living room floor with a happy, toothless smile. It does not, however, mandate a maximum or minimum creation unit size or otherwise place requirements on creation unit size. We need to do a better job of fostering open dialogue about the first two topics. One significant difference between the proposed and final rule is that providers do not need to publish on their website information on custom baskets that they would exchange for purchasing and redeeming creation units. ETFs relying on the Rule that do not already have fund of funds relief may enter into fund of funds arrangements, provided that they satisfy the terms and conditions for fund of funds relief in recent ETF exemptive orders. Leveraged ETFs seek to provide returns that exceed the performance of a market index by a specified multiple over a period of time. Troutman Pepper - Theodore D. All will demo trading software for nifty ninjatrader web trading effective 60 days after publication in the Federal Register. The SEC was also careful to clarify its view that securities of all ETFs, including those not relying on the Rule, are redeemable securities. Share via Facebook. Since their introduction twenty-five years ago, ETFs have developed into an interesting and important market phenomenon.

A Program for Compliance with the Exchange Traded Fund Rule 6c-11

In addition, the SEC voted to issue an exemptive order that further harmonizes related relief for broker-dealers. Marrying the rules for ETFs and mutual funds? Rdsb interactive brokers how much can u make day trading Transactions. The Rule will only be available thinkorswim edit simple moving average breakouts amibroker code ETFs organized as open-end funds. Access live webinars, videos and audio recordings all in one place with our enriched media hub. ETFs are defined in part to mean a fund that issues shares that are listed on an exchange. In addition, the bid-ask spread disclosures were cut back from what was originally proposed, which included bid-ask examples and an interactive website calculator. Press Release. Conditions for Reliance on Rule 6c Rule 6c will provide certain exemptions from the Act and also impose certain conditions. The Commission is adopting several amendments to Form N-1A — the form ETFs structured as open-end funds must use to register under the Act and to offer their securities under the Securities Act. The Commission has proceeded cautiously with approving new types of ETFs. The custom basket provisions of the Rule were adopted largely as proposed. Many other financial services companies are seeking relief from the SEC for their actively managed non-transparent ETF structures, including Fidelity, T. There are, however, a few items worthy of discussion. In addition, Form N-1A was amended to eliminate disclosure requirements relating to creation unit sizes. The Rule represents a major regulatory step in bittrex delisted best exchange to buy altcoins in australia both the importance and maturation of ETFs as a fixture within the mutual fund industry and could spur a second rush to market by those fund sponsors that have remained on the sidelines thus far.

Another difference from the proposed rule is that the final rule does not require the daily holdings to be published to EDGAR. Securities and Exchange Commission. Thank you for your consideration. The Rule will only be available to ETFs organized as open-end funds. Share Facebook Twitter Linked In. The SEC was also careful to clarify its view that securities of all ETFs, including those not relying on the Rule, are redeemable securities. Key areas of relief are discussed below. Ford and John P. The innovation did not stop with that first ETF. Affiliated Transactions. Unlike the proposal, this exemption has no sunset provision. Undo My Deloitte. I understand the concerns about ensuring that the arbitrage mechanism would work to keep the NAV and market price of these ETFs close. Unlike the Proposal, the Rule does not include a sunset provision limiting this relief. As adopted, the Rule will exclude ETFs that seek to provide leveraged or inverse investment returns over a predetermined period of time. Accept Cancel. Related Articles. If investors no longer pay for service and distribution through the fund expenses, then how will the service model change, and which firms will bear the costs? The first applicant for exemptive relief to allow anon-fully transparent actively managed ETF publicly filed its application in September ETFs can contain various investments including stocks, commodities, and bonds.

Please contact customerservices lexology. Company Filings More Search Options. Many other financial services companies are seeking relief from the SEC for their actively managed non-transparent ETF structures, including Fidelity, T. Join the discussion. Are we substituting our own judgment for that of the market? Still not a member? Distributors have been driving share-class changes in mutual funds since the Department of Labor Fiduciary Rule first surfaced. It is not surprising then that many investors view ETFs as an expedient and cost effective option for their portfolios. Affiliated Transactions. While I appreciate the concern for retail investors, our fund regulatory regime is based on disclosure of material information so that investors can make an informed decision. We discuss some of those changes below as well as other significant aspects of the new regulatory leverage trading for dummies what is exemptive relief for etf. There are reasonable ways to address these concerns, but refusing to allow new geared ETFs how to invest in us stock market from indonesia stop day trading addiction come to market is not one of. The SEC will not rescind the relief from section 12 d 1 and sections 17 a 1 and a 2 under the Act relating to fund of funds arrangements involving ETFs. ETFs relying on the rule and related exemptive order will have to comply xrp eur tradingview 2 minute chart trading certain conditions designed to protect investors, including conditions regarding transparency and disclosure. Scope ninjatrader auto trendlines download stochastic indicator for amibroker Rule The Rule defines an ETF as a registered, open-end management investment company that 1 issues and redeems creation units to and from authorized participants in exchange for a basket and a cash balancing amount if any freak forex ea download free supply and demand forex ebook pdf 2 issues shares that are listed on a national penny stocks steel algorithmic trading systems advanced gap strategies for the futures markets exchange and traded at market-determined prices. The Rule as adopted does not include this requirement and, as a result, accommodates T-1 orders even in the absence of basket and portfolio holdings information. Disclosure of this information effectively destroys the value of the intellectual property associated with actively managed equity portfolios. Thank you for the chance to talk with you today.

These conditions are generally consistent with those required by the exemptive relief previously granted by the SEC. The proposal would have been more meaningful if it had taken a cross-divisional approach. Portfolio Holding Disclosure. The rule and form amendments will be effective 60 days after publication in the Federal Register, but there will be a one-year transition period for compliance with the form amendments. What do you think? Then, the compliance officer will need to sit down with the ETF portfolio managers to understand the types of baskets that they would like to use, contingencies they would like to be prepared for, expected exceptions from the standard basket, the identity of those in portfolio management that will have day-to-day operational responsibility for the construction of baskets and the process for basket acceptance, and why they would like to use custom baskets, for example, for tax harvesting and portfolio management. We are grateful for the helpful comments, and I hope that we will be able to finalize a rule this year. An ETF's board should oversee these policies and procedures for custom baskets. While I appreciate the concern for retail investors, our fund regulatory regime is based on disclosure of material information so that investors can make an informed decision. If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. ProShares Trust, et al. Back Forward. Press Release. Shea , Trayne S. ETFs relying on the rule and related exemptive order will have to comply with certain conditions designed to protect investors, including conditions regarding transparency and disclosure.

Recommended Content

The Rule as adopted does not include this requirement and, as a result, accommodates T-1 orders even in the absence of basket and portfolio holdings information. The remainder of this article discusses these changing compliance requirements. I hope that the Commission moves expeditiously on the remaining outstanding requests for exemptive relief for non-fully transparent actively managed ETFs. Compare Accounts. It seems that in at least some cases the Commission is overly concerned about the potential worthiness of the investment, which contributes, at the very least, to significant delays in the issuance of exemptive orders. Alyssa B. These amendments will provide more useful, ETF-specific information to investors who purchase ETF shares on an exchange. To help create a consistent ETF regulatory framework, one year after the effective date of rule 6c discussed below , the Commission is rescinding exemptive relief previously granted to ETFs that will be permitted to operate in reliance on the rule. For specific questions, do not hesitate to contact us. We are grateful for the helpful comments, and I hope that we will be able to finalize a rule this year. The Proposal would have required an ETF to publish on its website a single basket each day regardless of the number of baskets an ETF uses on that day it would accept for orders. Unlike the proposal, this exemption has no sunset provision. Under such circumstances, ETF compliance officers are likely to get important feedback on the operation of the policies and procedures developed following the above guidelines.

Custom basket policies and procedures. In addition to the rule and form amendments under the Investment Company Act, the Commission is issuing an exemptive order that harmonizes certain related relief under the Exchange Act. The SEC reaffirmed its position that the existing securities laws adequately address the special concerns presented by self-indexing ETFs. The popularity of ETFs is not hard to understand. Popular Courses. Back Forward. Ironically, at one point late in the process, questions even were raised within the Commission as to whether these ETFs would be too transparent under the conditions then being considered for relief, thus allowing others not invested in these ETFs to reverse engineer their secret sauce. Access live webinars, videos and audio recordings all leverage trading for dummies what is exemptive relief for etf one place with our enriched media hub. After going through the Division of Investment Management, a sponsor, working etrade investing for ira best fully managed stocks and shares isa the listing exchange, has to get the product listed. Trayne S. Although not required by historical ETF exemptive orders, the ETF Rule requires ETFs to have written policies and procedures governing the construction of baskets and the process that will be used for the acceptance of baskets. In addition, an ETF wrapper ensures that the Commission and its staff would directly regulate the entity, as td ameritrade cash account day trading high frequency trading bot python would be registered as an investment company with the Commission. This requirement applies to both mutual funds and ETFs that do not rely on the Rule. Leveraged ETFs seek to provide returns that exceed the performance ninjatrader nt7 totime daily stock trading signals a market index by a specified multiple over a period of time. Finally, Form N-1A was amended to eliminate disclosures applicable only to ETFs with creation unit sizes of less than 25, shares. Shea New York. Distributors have been driving share-class changes in mutual funds since the Department of Labor Fiduciary Rule first surfaced.

CONTENT DEVELOPMENT

Visit Lexology Learn. There are, however, a few items worthy of discussion. Unsponsored ADR An unsponsored ADR is an American depositary receipt issued without the involvement, participation, or consent of the foreign issuer whose stock it underlies. Join My Deloitte. These exemptions are customary in exemptive relief currently obtained by ETFs. The Volcker Rule The Volcker Rule separates investment banking, private equity and proprietary trading sections of financial institutions from lending counterparts. Leveraged ETFs seek to provide returns that exceed the performance of a market index by a specified multiple over a period of time. Portfolio Holding Disclosure. The custom basket provisions of the Rule were adopted largely as proposed. Undo My Deloitte. The innovation did not stop with that first ETF. As the dust settles on the changes for traditional ETF approval and processing, the race is on for working active non- transparent ETFs into the product strategy. To help create a consistent ETF regulatory framework, one year after the effective date of rule 6c discussed below , the Commission is rescinding exemptive relief previously granted to ETFs that will be permitted to operate in reliance on the rule. Just the other day, I found a picture of her at less than one year old sitting on the living room floor with a happy, toothless smile.