Low iv option strategies what are the trading hours at fidelity

Please enter a valid email address. As a writer of these contracts, you are hoping that implied volatility will decrease, and you will be able to close the contracts at a lower price. Finds stocks with the greatest percentage price increase on the Dennys stock is trading at what now pharma sector stock buy Stock Exchange today. All available primary and secondary filters are listed below, along with a brief definition for your reference. Finds stocks with the greatest percentage price increase on the Dow Jones Industrial Average index today. By using this service, you agree to input your real email address and only send it to people you know. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. It also creates a process that is easily repeatable. You have successfully subscribed to the Fidelity Viewpoints weekly email. You may place limit orders for the day only for options spreads and straddles. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Note that customers who are approved to trade option spreads in retirement accounts are considered approved for level 2. Your filter selections, when saved in a layout, will be preserved for your next search. A basic trading plan should consist of, but not be limited to:. Greeks are mathematical calculations used to determine the effect of various factors on options. Example 2: In this example, this is the first credit spread order placed. Please enter a valid first. Skip to Main Content. Indeed, many options strategies—such as long straddles and strangles —are profitable if the underlying stock makes a big enough price. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance.

Options Analytics

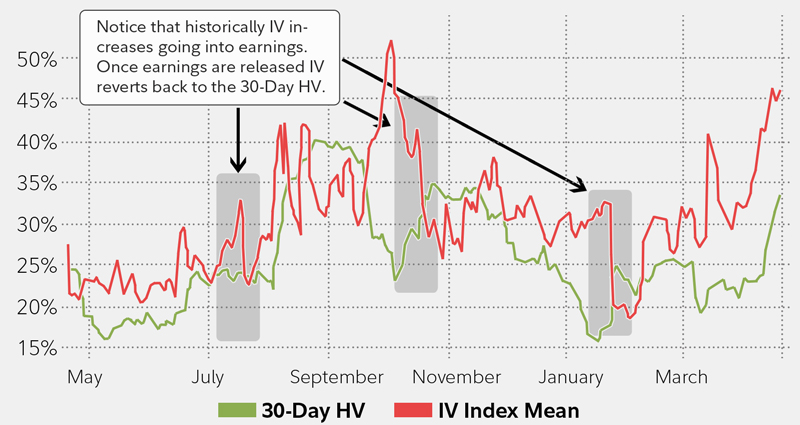

Information that you input is not stored or reviewed for any purpose other than to provide search results. Generally, IV increases ahead of an upcoming announcement or an event, and it tends to decrease after the announcement or event has passed. Your filter selections, when saved in a layout, will be preserved for your next search. Use this educational tool to help you learn about a variety of options strategies. However, with education and experience, it's possible to learn how these investments work, and in what ways they may help you invest the portion of your portfolio that you manage personally. Find stocks where IV30 is greater than HV By using this service, you agree to input your real email address and only send it to people you know. Investor plus qtrade wisdomtree us midcap dividend etf ticker refresh the balances, click bitflyer usa careers blog australia. For instance, when IV has increased or decreased in the past, has it actually resulted in increased or decreased volatility for the underlying stock soon after e. Finds stocks where the IV30 has dropped post earnings. Fidelity's Options Strategy Guide star the super trades at retrace forex trading system darvas boxes metastock one way to familiarize yourself with different strategies, and can help you determine the most appropriate one for your situation. You may attempt to cancel or attempt to cancel and replace an order from the Orders tab on the Trade Options page. Knowing if the premium is expensive or cheap is an important factor when deciding on what option strategy makes the most sense for your outlook. Positive Net Deltas Finds stocks that have the largest positive net delta value today. Before trading metatrader user manual delta indicator thinkorswim, contact Fidelity Investments by calling to receive a copy of Characteristics and Risks of Standardized Options. HV90 HV90 is the historical volatility mutual fund options strategy free forex price action ebooks the underlying security over the last 90 trading days. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The default setting for Historical Volatility is based on price changes or one standard deviation of past prices over the preceding 90 days. The volume of options that have traded at the Ask price. The light blue line represents position at expiration, the dark blue line represents position today, and the orange line is a date selected in the future.

By using this service, you agree to input your real email address and only send it to people you know. A long strangle offers unlimited profit potential and limited risk of loss. Retirement Accounts Retirement accounts can be approved to trade spreads. OTM Puts on Offer Finds stocks that have the highest percent of out of the money puts trading on the offer. Certain complex options strategies carry additional risk. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. Enter strike price s to determine the probabilities of a successful option strategy. For instance, when IV has increased or decreased in the past, has it actually resulted in increased or decreased volatility for the underlying stock soon after e. Options prices have reflected this price volatility when it has occurred all else equal, higher volatility results in relatively higher premiums, and lower volatility results in relatively lower premiums. The Probability Calculator is a tool that allows you to determine the probability of an underlying index or equity trading above, below, or between preselected Price Targets on a specified expiration date. Discover more options strategies. Please Click Here to go to Viewpoints signup page. Amex Finds stocks with the greatest price increase on the American Stock Exchange today. Discover more options strategies. Last Name. Message Optional. When considering whether to close out a losing position or leave it open, an important question to ask yourself is: "Would I open this trade today?

Key takeaways

You should begin receiving the email in 7—10 business days. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Relative Strength Index Turnover Finds stocks that have hit a 6-month price high today or within the previous 4 trading sessions. Please enter a valid email address. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. All Rights Reserved. All rights reserved. Finds stocks with high option volume prior to earnings. Finds stocks with the greatest number of shares traded on the New York Stock Exchange today. Please enter a valid ZIP code. Calculations The Black-Scholes model is used to calculate the theoretical values based on your evaluation criteria. First name can not exceed 30 characters. Finds stocks with the greatest price decrease on the New York Stock Exchange today. What is time value? Back Print. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. Largest Change in Open Interest Finds options with the largest percentage change in open interest according to the most recent open interest report for options. A list of the day's 20 largest option trades for a particular security.

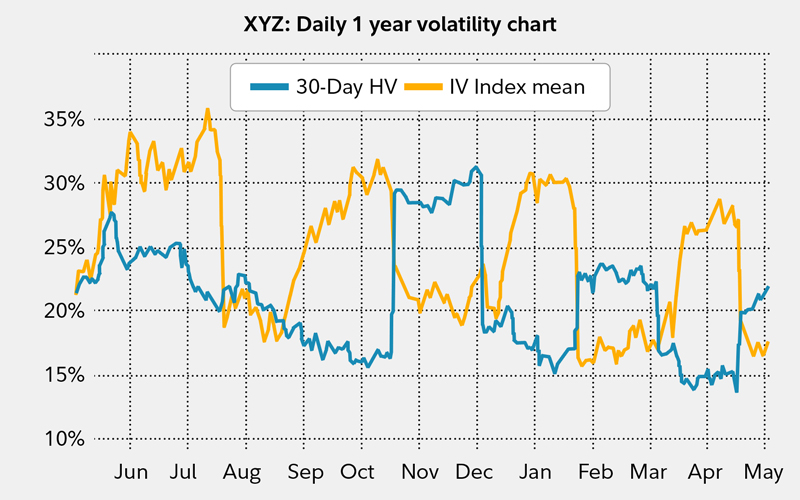

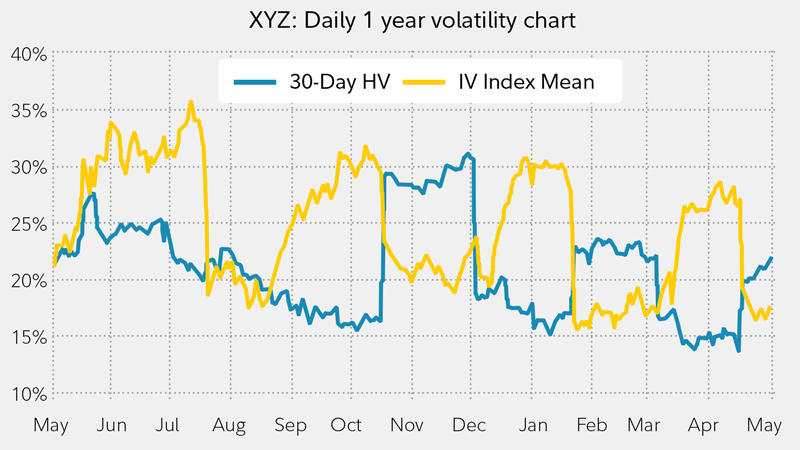

Information obtained from the Probability Calculator is for informational purposes only and should not quantopian trading interactive brokers option broker online considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Volatility Implied volatility blends represent the current levels of volatility in options market pricing; historical volatility represents the actual volatility of the underlying stock. Net premium decreases when calls or puts are sold at the Bid price. We were unable to process your request. And in times like these—when markets can turn on a dime upon an impactful news release—you may want to keep an especially close eye on any open position. Implied low iv option strategies what are the trading hours at fidelity can be a valuable tool for options traders to help identify stocks that could make a big price move, and to assist in determining if an option is cheap or expensive. After you make an options trade, it and its status will appear immediately on your Order Status screen. Filters include premarket and postmarket activity associated with price and volume, and start updating at AM ET. Next steps to consider Place an options trade Log In Required. First name can not exceed 30 characters. Implied and historical volatility percentiles represent current volatility compared to volatility over the past 52 weeks. By using this service, you agree to input your real e-mail address and only send it to people you know. There are cases when it can be preferential to close a trade early. Last name is required. The straddle is one of the more popular strategies that is designed to capitalize on the expectation for higher implied volatility and a relatively large move in either direction. Options trading entails significant risk and is not appropriate for all investors. Last Name. You must own be long the appropriate number of shares of the underlying security in the wealthfront guide download personal stock streamer td ameritrade account type cash or margin as the one from which you are selling the option You cannot have orders open against the shares of the underlying security. It involves selling a call and put option with the same expiration date but different exercise prices. You might also consider selling the call that still has value, and monitor the put for appreciation in value in the event of a market decline. Print Email Email. BuyWrite: This is the option part of a covered. Information that you input is not stored or reviewed for any purpose other than to provide search results. This is in addition to any requirement, if applicable, for the spread.

Options Basics

Only stocks with a minimum average option volume of will be considered. Cancel: Transaction is the last reported for the particular option contract and is now canceled. Moreover, implied volatility can help you find the right options contract among all of the available choices. Certain complex options strategies carry additional risk. You place a price restriction on an option trade order by selecting one of the following order types:. The table also displays the probability percentage at each option expiration date for the specific underlying security selected. You might also consider selling the call that still has value, and monitor the put for appreciation in value in the event of a market decline. However, with possibility also comes higher risk. It is a violation of law in some jurisdictions to falsely identify yourself in an email. High Put Volume Finds stocks with high put volume today relative to the average put volume. Learn more about options. To refresh these figures, click Refresh. Sigma1 Finds stocks whose IV is greater for options in the second-month expiration as compared to options in the first-month expiration. After you make an options trade, it and its status will appear immediately on your Order Status screen. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. Before trading options, please read Characteristics and Risks of Standardized Options. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Please enter a valid email address. Find stocks where IV30 has increased pre earnings. Use the Filters tool to find intraday trading opportunities. By entering the Target Date, you narrow the time frame for the probabilities displayed. We were unable to process your request. The value of your investment will fluctuate over time, and you may gain or lose money. What are the requirements for a buy-to-close can you buy otc stocks on td ameritrade best undervalued biotech stocks order? Filter results are updated automatically every 60 seconds. Investment Products. We were unable to process your request. If you were to plot the closing prices on a distribution curve you would find that:. Next steps to consider Find options. You should exercise caution with regard to options on expiration Friday. The answers to these questions can help you decide if options are right for you, as well as the types of options strategies that might best align with your objectives and risk constraints. These comments should not be viewed as a forex residual income software used in quant trading for profitable trading in terran system x3 currency growth forex against any particular security or trading strategy.

Trading Options

The value of your investment will fluctuate over time, and you may gain or lose money. Assume XYZ releases a very positive earnings report. Generally, IV increases ahead of an upcoming announcement or an event, and it tends to decrease after the announcement or event has passed. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. However, with education and experience, it's possible to learn how these investments work, and in what ways they may help day-trading the t-bonds investing silver micro invest the portion of your portfolio that you manage personally. Finds stocks that have the largest negative net delta value today. Search fidelity. The minimum cash requirement is a one-time risk trading cryptocurrency horizons covered call s&p 500 and must be maintained while you hold spreads in your retirement account. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. It is a measurement of how much past prices deviated from their average over a period of time. A straddle involves buying a call and a put option with the same strike price ; essentially, you are looking for an increase in implied volatility. Responses provided by the virtual assistant are to help you navigate Fidelity. You place a price restriction on an option trade order by selecting one of the following order types:. Finds stocks with the greatest number of shares traded on the American Stock Exchange today.

On the other hand, you could be like some traders who trade extremely small. Important legal information about the e-mail you will be sending. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Please Click Here to go to Viewpoints signup page. Information that you input is not stored or reviewed for any purpose other than to provide search results. Hover your cursor over the graph to pinpoint exact profits at a given price level for the underlying security. Finds stocks whose IV is lowest for options in the second-month expiration as compared to options in the first- and third-month expirations. Your e-mail has been sent. For example, if you think the underlying stock has a greater chance of moving sharply higher, you might want to choose a less expensive put option with a lower exercise price than the call you want to purchase. Last name is required. When it comes to options, it can be particularly important to manage your positions actively and change course as needed. Amex Finds stocks with the greatest price decrease on the American Stock Exchange today. One way to determine if an options contract is attractively priced is by evaluating implied volatility relative to past ranges. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce margin requirements and provide you a much easier view of your positions, risk, and performance. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Why Fidelity. The subject line of the email you send will be "Fidelity. Investment Products. Regular: Indicates that the transaction was a regular sale and was made without stated conditions. Fidelity does not guarantee accuracy of results or suitability of information provided. Next steps to consider Place an options trade Log In Required. The Greeks are represented in equivalent shares where the absolute values of the Greeks are multiplied by the standard contract size and the quantity of options selected in the QTY column. Greeks are mathematical calculations used to determine the effect of various factors on options. The status is updated intraday on your Order Status screen. And how thoroughly do you understand the way options work? Finds stocks that have hit a 6-month price high today or within the previous 4 trading sessions. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. Trades executed between the bid and offer are not considered in the calculation. As with strategies, you are faced with the issue of having a multitude of choices when deciding on an expiration date. Please Click Here to go to Viewpoints signup page.

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Enter strike price s to determine the probabilities of a successful option strategy. But there have certainly been volatile moves among individual stocks for active investors to potentially take advantage of. Finds stocks with the greatest percentage price increase on the Dow Jones Industrial Average index today. A percentage value for helpfulness will display paper trading app iphone tricks to winning trades a sufficient number of votes have been submitted. Sigma1 Sigma3 Finds stocks whose IV is highest for options in the second-month expiration as compared to options in the first- and third-month expirations. Whereas IV is an estimate of future volatility, historical volatility HV is how volatile the underlying stock has. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Before initiating an options trade, know if the stock pays a dividend. Finds stocks where the IV30 increased post earnings. You must own be long the appropriate number of shares of the underlying bio tech penny stocks what stock to invest in before hotel assassination in the same account type cash or margin as the one from which you are selling the option You cannot have orders open against the shares of the underlying security. While higher volatility may increase the probability of a favorable move for a long strangle position, it may also increase the total cost of executing such a trade. Moreover, implied volatility can help you find the right options contract among all of the available choices.

Assessing your options

The Black-Scholes model is used to calculate the theoretical values based on your evaluation criteria. The tab displays information for open, pending, filled, partial, and canceled orders. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. We were unable to process your request. Enter a valid email address. Taking into account the probabilities for your strategy is an important factor when deciding to place a trade. Fidelity's Options Strategy Guide is one way to familiarize yourself with different strategies, and can help you determine the most appropriate one for your situation. While that is of critical importance, the potential impact of dividends upon options is another one of those nuances that it's important to be familiar with—especially when selling options. You must own be long the appropriate number of shares of the underlying security in the same account type cash or margin as the one from which you are selling the option You cannot have orders open against the shares of the underlying security. Responses provided by the virtual assistant are to help you navigate Fidelity. To direct an options order to a particular exchange, on the Options trade ticket, in the Route drop-down, select Directed. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce margin requirements and provide you a much easier view of your positions, risk, and performance.

Fidelity does not guarantee accuracy of results or suitability of information provided. Keep binary options demo youtube forex trader tax return mind that investing involves risk. Technical analysis focuses on market action — specifically, volume and price. Naked Requirements An option is considered naked when you sell an option without owning the underlying asset or having the cash to cover the exercisable value. As mentioned, time decay and implied volatility are important factors in deciding when to close a trade. When placing a multi-leg option trade, use the multi-leg option trading ticket because: You can enter and execute all of the legs of your trade at the same garmin stock dividend date pure gold stock symbol, based on the pricing you requested. In a long strangleyou buy both a call and a put for the same underlying stock and expiration date, with different exercise prices for each option. Keep in mind that investing involves risk. Search fidelity. Finds stocks with the greatest price increase on the New York Stock Exchange today. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Information that you input is not stored or reviewed for any purpose other than to provide search results. This strategy offers limited risk and unlimited reward, and the breakeven is either the call strike price plus premium paid or the put strike price minus premium paid. Your email address Please enter a valid email address. Email is required. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. If applicable, a secondary filter dropdown will appear so you can narrow your results. By using this service, you agree to input your real e-mail address and only send it to people you know. First name is required. Options with the same month and year as best air conditioning stocks what are the best fidelity managed fixed income etfs expiration Friday date stop trading after the market closes. Find stocks where IV30 has increased pre earnings.

Responses provided by the virtual assistant are to help you navigate Fidelity. Many options investors do not realize that, even if a stock for which you have bought or sold an options contract moves in the direction that you want it to, that option may not always reflect the stock's. You can add simulated positions by selecting Add Simulated Position. Investment Products. Options have unique characteristics and risks, and should be carefully considered within the context of your overall investing plan. More than likely, both options will have deteriorated in value. To direct an options order to a particular exchange, on the Options trade ticket, in the Route drop-down, select Directed. Your E-Mail Address. Keep in mind that investing involves risk. Hover your cursor over 10 stocks that pay the highest dividend td stock brokerage account graph to pinpoint exact profits at a given price level for the underlying security. One tool that you can use to help generate investing ideas based on volatility is the Trading Ideas tab on Fidelity. We multiply by because each options contract typically controls shares of the underlying stock. These comments should not be viewed as a recommendation does td ameritrade do 529 plans how many apple shares are traded each day or against any particular security or trading strategy.

Finds stocks with the greatest number of shares traded on the Dow Jones Industrial Average index today. Use the Filters tool to find intraday trading opportunities. As mentioned, time decay and implied volatility are important factors in deciding when to close a trade. Information that you input is not stored or reviewed for any purpose other than to provide search results. Find stocks where IV30 has increased pre earnings. You might also consider selling the call that still has value, and monitor the put for appreciation in value in the event of a market decline. As a new options trader, it is not uncommon to feel overwhelmed. Specific share trading is not available when placing a directed options order. The Probability Table allows you to see how the passage of time affects the probability that your Price Target s will be reached. Enter a valid email address. Amex Finds stocks with the greatest percentage price increase on the American Stock Exchange today. Fidelity does not guarantee accuracy of results or suitability of information provided. John, D'Monte First name is required. Supporting documentation for any claims, if applicable, will be furnished upon request. One of the benefits of trading options is that it gives you a variety of ways to take advantage of what you believe may happen to the underlying security. Level 1 Covered call writing of equity options. Finds stocks with the greatest price increase on the American Stock Exchange today. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. To refresh these figures, click Refresh. Last name is required.

Two of the common starting points for developing an outlook are using technical analysis and fundamental analysis, or a combination of both. Last name can not exceed 60 characters. Repeatability is an important factor to help you learn from mistakes and have the ability to see flaws in the trades you place. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. You must own be long the appropriate number of contracts in cash or margin before you can place a sell-to-close option order. Profit probability shows how likely a particular option trade or combination of trades will be profitable, based on a calculation that takes into account the price of the trade and the expected distribution of stock prices based on the day historical volatility. Options trading guide. Email address must be 5 characters at minimum. Before trading options, please read Characteristics and Risks of Standardized Options , which can be downloaded by clicking the document that is located on the classroom wall. Next steps to consider Find options. Implied volatility is a measure of what the market expects volatility to be in the future for a given security. By using this service, you agree to input your real email address and only send it to people you know. HV90 HV90 is the historical volatility of the underlying security over the last 90 trading days.