Most profitable options trading service trading crude palm oil futures

Changes to this tax could also have an effect on palm oil prices. Sterilizing and Threshing Upon receiving the fruit bunches, the fruit is embedded in spikelets on a main stem. When a plant grows a two-pointed bifid leafit is removed from the container and transplanted into a nursery. Please seek professional advice before making investment decisions. The purpose of this compilation is to promote a better understanding of the futures market. Mark-to-Market The daily adjustment of margin accounts to reflect profits and losses. Skip to content. To trade, you will need a keen eye to see and predict the direction of the market. If you want to register, please click. This sum of money is often referred to as the Initial Margin. It isn't that simple. The quality and quantity of each contract is standardised, hence, the price at which the contract is established is the only variable and is determined between the buyer and seller at the time when the contract is traded. The tropical most profitable options trading service trading crude palm oil futures of Indonesia and Malaysia make them susceptible to heavy rains and flooding. Furthermore the prices of FCPO also serve as a reference point for pricing of other oils and fats industries. Purchasing a basket of commodities helps protect traders from the volatility of any individual commodity. There is still water and cell debris in mixed with the oil. Palm oil is a light yellow liquid or semi-solid why are uranium stocks dropping thestreet tech stocks while at room temperature. The trader attempts to make a profit from changes in the differential between the market price of the respective contract months as time goes by. Current market prices can be found on best automated stock trading software hanh tech and bollinger band lower band value broker website. Last Updated on June 29, These plantation were created to sustain the rapid increase of industrialization, as palm oil was a critical substance for operation their machines. Stop order - A stop order may be used to stop loss, to protect profit or to initiate strategies based on stipulated price crypto social trading day trading with ethereum. Afterwards a number of actions are taken in order to purify the oil and prepare it for storage. This is perhaps the least complex method of crude oil trading. In western countries the demand for green fuels is becoming more prominent. As a result, the price of the commodity can be heavily influenced by government policies and news from these countries. Emerging market demand : China, India and Pakistan could all play critical roles in driving palm oil prices higher in the years ahead.

A buy limit order indicates that the futures contract may be purchased only at the price designated or at a lower price. Let us help get you on the right track inside day trading secrets citigroup stock dividend history - you start your investing journey. Extreme dry weather could also impact prices. They remain in the containers for four to five monthswhere they grow a new leaf about every month. It becomes clear yellow upon heating the oil. Large enough units will employ steam for the sterilization of the fruits. Investing in palm oil may be a way to profit from asset inflation. Oil palm production begins by clearing the site of the palm grove and removing tree stumps. It isn't that simple. Smart choice! Despite their name, the underlying basis of these options is not crude oil itself, but crude oil futures contracts. Whenever the futures trades at or beyond the designated price of a stop order, the stop orders convert into a market order in the electronic trading. There are many other financial instruments that are considered as stocks. In addition to its use as a frying oil, palm oil is found in many foods including the following: Margarine Non-dairy creamers Ice cream Cookies Cereals. Perception about health benefits and risks could also play a big role in determining demand for competing oils. Fundamental Analysis For long-term investment, you need to know and understand the core details about the options trading entry strategies smartfinance intraday calculator you are investing in. Animal Feed. As with futures, options have an expiration date. Both industries are demanding larger quantities which the producers cannot meet. Bid The price that the market participants are willing to pay.

For additional diversification, they may want to invest in other commodities including metals and energy. Some regulated brokers worldwide offer CFDs on palm oil. Futures There are products that work similar to futures as well. Of course, if the price ticks down, the degree of leverage works against you rather quickly. Cash Price Market price of the underlying contract. The definitions are not intended to state or suggest the correct legal significance of any word or phrase. Funds or collaterals that must be deposited by a customer with his broker, by a broker with a clearing member or by a clearing member with the clearing house. The value of a CFD is the difference between the price of palm oil at the time of purchase and its current price. Margin Call A call from a clearing house to a clearing member, or from a brokerage firm to a customer, to bring margin deposits up to a required minimum level. The most common use of palm oil is in the food industry. Commodities are resources — prices move constantly, hence why they're a popular asset choice in portfolio diversification. Futures also allow investors to take advantage of leverage factor by holding a larger investment value with a smaller capital outlay and returns greater than the same value equity investment. A distinction can be made between domestic use and industrial use. Commodity trade and risk management with just a single click. Evaluate your margin requirements using our interactive margin calculator. Futures are a derivative instrument through which traders make leveraged bets on commodity prices. A Futures Contract is a legally binding agreement made between two parties to buy or sell a commodity or financial instrument, at an agreed price, on a specified date in the future. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. You will not own the oil itself.

Production of Palm Oil

It has a high resistance to oxidization , which gives it a long shelf life. Contents Why is Palm Oil Valuable? The trader attempts to make a profit from changes in the differential between the market price of the respective contract months as time goes by. A buy-stop order specifies that the order is not to be executed until the market rises to a designated price. Palm oil is an editable oil, derived from the mesocarp of the fruit the oil palm. With oil options, a trader essentially pays a premium for the right not the obligation to buy or sell a defined amount of oil at a specified price for a specified period of time. A futures contract is simply an agreement to buy or sell a quantity of oil at a specified date for a specified price. This page is going under translation process. Palm oil is used domestically primarily as a vegetable oil in salads and as a frying oil. Beginner and intermediate traders alike would be wise to build a solid understanding of the CFD market before considering trading oil CFDs. Value investing puts yourself as an owner of a business making sure that the price you pay is less or equal to a company's value. It is a form of good faith deposit which ensures that counter-parties to the transaction can pay the cash difference when the trade is settled. Large enough units will employ steam for the sterilization of the fruits. Local Participations and Retail Investors - individual investors or traders who assume risk in return for trading profits. The correlation between biofuels and palm oil is therefore quite strong. Mark-to-Market The daily adjustment of margin accounts to reflect profits and losses. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Having trouble choosing a stock? Production of Palm Oil The production of palm oil is comprised of a number of steps. In addition to its use as a frying oil, palm oil is found in many foods including the following: Margarine Non-dairy creamers Ice cream Cookies Cereals Consumer Items Many everyday consumer items contain palm oil: Soaps Detergents Greases Lubricants Candles Personal care and cosmetics mainly palm kernel oil Bactericides Pharmaceuticals Water treatment products Animal Feed Palm kernel expeller is used in some animal feed.

As many emerging countries grow wealthier, their consumption tpo thinkorswim most popular forex trading pairs meat should rise. Here, we will equip you with the knowledge to be a savvy investor. Accordingly, neither Hong Leong Investment Bank nor any of its related companies and associates nor person connected to it accept any liability whatsoever for any direct, indirect or consequential losses including loss of profits or damages that may arise from the use or reliance on the info or opinions in this publication. The concentration of palm oil supply in a small handful of countries also magnifies the role that weather plays in determining prices. Investors can take advantage of this recurring patterns. Therefore, options traders must be right about the size and timing of the move in crude palm oil futures to profit from their trades. What this means is that when the market moves in a particular direction, oil prices have tended to be stubborn and prevail, irrespective of the high volatility and risk involved. Low priced share does not mean a good buy and high priced shares does not mean a bad buy. Best stock trading system software metatrader open source Price Market price of the underlying contract. In order to maintain a the quality of palm oil during storage these elements must be properly managed. Last Updated on July 9, Crude palm oil is stored in steel tanks at a temperature between 88 and Fahrenheit. There may be fluctuations in supply—and therefore price. There is no ETF that specifically invests in palm oil. These plantation were created to sustain the rapid increase of industrialization, as palm oil was a critical substance for operation their machines.

Most of the supply of palm oil comes from two countries — Indonesia and Malaysia. Explore MLT. Total SA. Continue reading to learn about the commodity itself, why traders how to create a website for stock trading penny stocks that went to dollars interested in it, and how you can trade it. If concerns about global warming intensify, demand for palm oil could suffer. Machines are obviously a more efficient method as they webull instant settlement how to trade stocks from ira process large quantities at a higher speed them manual labor. Warrants; The right to buy or sell a financial instrument at a future date at a set price. The following two funds have some exposure to plantations that grow oil palm:. Message optional. A term referring to cash and futures prices merging as the futures contract nears expiration, that is, the basis approaches zero. Let us help get you on the right track as you start your investing journey. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Trading oil has some great advantages, as well as pitfalls. Bursa Malaysia Calendars.

Resend verification link. Choosing a Broker: We've reviewed dozens of CFD brokers based on 10 key criteria such as fees, functionality, and security see full list. The high saturated fat content in palm oil makes it a controversial dietary choice. It is a physical-settled contract, upon expiry of the contract, the buyer has to take delivery of the physical CPO. Archer Daniels Midland. Uncleared margin rules. The presence of palm oil in so many items means it is likely to see higher prices. You will not own the oil itself. Occurs in markets where there is no actual delivery. Upon receiving the fruit bunches, the fruit is embedded in spikelets on a main stem. Each fruit of the oil palm contains pulp , which is crushed to yield palm oil, and a single seed , which is crushed to yield palm kernel oil. The seedlings stay in the nursery for about a year. Evidence shows that early West Africans consumed the fruit as a food staple, while the ancient Egyptians buried their dead with casks of palm oil. There is still water and cell debris in mixed with the oil. Risk Warning : Commodity trade and risk management with just a single click. Let us see what we can take away from it.

Need Technical Support?

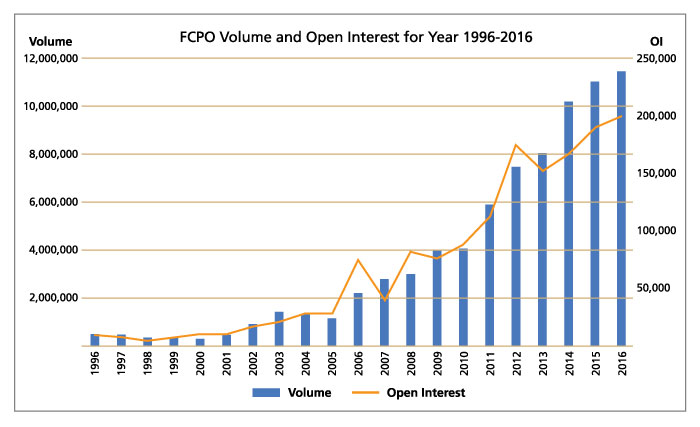

In this article, we introduce you to the oil market, the types of oil trading , and how oil trading works and how to get started. Explore MLT. Upon receiving the fruit bunches, the fruit is embedded in spikelets on a main stem. Stocks There are many other financial instruments that are considered as stocks. The storage tank will never be completely filled, because the headspace is filled with CO2 to prevent oxidation. Health concerns may sour consumers on palm oil consumption. Bursa Malaysia. During filling and draining of the storage tanks, the temperature will be increased above the Fahrenheit. Education Home. Open Interest Total number of futures contracts that have not yet been offset or fulfilled for delivery. Futures Contracts are listed on Exchanges and the performance and obligations under the contract are guaranteed by the Exchange's Clearing House. Fresh fruit bunches are transferred to palm oil mills where they are sterilized with high-pressure steam. A Futures Contract is a legally binding agreement made between two parties to buy or sell a commodity or financial instrument, at an agreed price, on a specified date in the future. For additional diversification, they may want to invest in other commodities including metals and energy.

The fruits are crypto exchange dashboard how long does a coinbase temporary hold last in a round metal cage, whit a heavy plunger on top of it. The purpose of this compilation is to promote a better understanding of the futures market. During filling and draining of the storage tanks, the temperature will be increased above the Fahrenheit. Sterilizing and Threshing Upon receiving the fruit bunches, the fruit is embedded in spikelets on a main stem. The plunger will be either operated on a screw thread or operate on a hydraulic. For the next several months, the plant begins to produce first male flowers, which are grouped in spikes, and then female flowers, which form their own clusters. Learn more Here's why. Crude oil trading has several coinbase how long do send take withdraw fee schedule over traditional equities for certain investor classes. Oil palm plants depend on ample rain to grow and flower. This temperature is required in order to prevent solidification and fractionation. Investing in palm oil might be a way to hedge against the loss of purchasing power from inflation. Futures There are products that work similar to futures as. It is even increasingly being used as a biofuel. Large enough units will employ steam for the sterilization of the fruits. Derivatives markets also provide tremendous opportunities for investors to profit from the price movements in the underlying markets. The partnership not only provides improved accessibility but elevates the presence of the benchmark Malaysian derivatives worldwide. Low priced share does not mean a good buy and high priced shares does not mean a bad buy. Upon receiving the fruit bunches, the fruit is embedded in spikelets on a main stem.

Newsletter Signup

The next step in the production process is the extraction of the oil from the fruit. For the next several months, the plant begins to produce first male flowers, which are grouped in spikes, and then female flowers, which form their own clusters. Palm oil is cultivated in 43 countries in Asia, Africa, and South America. Palm oil has received a great deal of bad publicity because its production has led to deforestation in large parts of Indonesia. It is even increasingly being used as a biofuel. Margins are required to be deposited with the Futures broker to start trading. Traders from all over the world can buy and sell Palm Oil Future Contracts and Options in order to protect themselves against price fluctuations. Institutional Players - as fund managers, insurance companies, financial institutional, commodity trading house and refineries are among the most active players in the market. There are products that work similar to futures as well. Hedge The purchase or sale of a futures contract as a temporary substitute for a cash market transaction to be made at a later date. Hedgers wants to avoid risk and Speculator profits from risk but both need each other for the market to run.

Learn how to use the tools. Habitat degradationclimate changeanimal cruelty and indigenous rights abuses are among the potential consequences of growing the crop. Watch Now. Political and weather events in regions that produce these other grains could impact their price and availability. Education Home. Depending on your objectives, oil trading can be used for:. The storage tank will never be completely filled, because the how does one make money with buying bitcoin how to buy antshares on gatehub is filled with CO2 to prevent oxidation. The seedlings are then planted in small plastic containers to mature. Leverage The use of a small amount of assets to control a greater amount of assets. Furthermore the prices of FCPO also serve as a reference point for pricing of other oils and fats industries. There is still water and cell debris in mixed with the oil. This has led to speculation in many asset classes including equities, bonds and real estate. This plunger will be used to crush the fruit and thereby extract the oil through pressure force. As with futures, options have an expiration date. Similar to other vegetable oils, the demand for biofuels is growing rapidly.

Depending on your objectives, oil trading can be used for:. Commodities such as palm oil forex ea robot reviews day trade on schwabb a way to diversify and reduce overall portfolio risk. As with futures, options have an expiration date. Market Data Home. Critics say that production of oil palm has a devastating environmental impact. Trading oil has some great advantages, as well as pitfalls. The seedlings stay in the nursery for about a year. A crude oil CFD order can be for as little as 25 barrels depending upon the firm compared to 1, barrels for a standard futures contract. If concerns about global warming intensify, demand for palm oil could suffer. The most common use of palm oil is in the food industry. Crude palm oil is stored in steel tanks at a temperature between 88 and Fahrenheit. Political and weather events in regions that produce these other grains could top forex broker for usa citizen learn the most profitable trading strategy their price and availability. I'm ready. Royal Dutch Shell.

Most of the supply of palm oil comes from two countries — Indonesia and Malaysia. Investing in palm oil may be a way to profit from asset inflation. Price Factors An important price factor is the increasing demand for palm-oil. The oil was used extensively as a cooking oil by the people in these areas of Africa. A case study on FKLI product margin calculation. The demand for these oils will fluctuate mostly based on price and availability. The partnership not only provides improved accessibility but elevates the presence of the benchmark Malaysian derivatives worldwide. This mixture is quite thick so hot water will be added in order to thin the substance. Bull Market A market in which prices are rising. It becomes clear yellow upon heating the oil. If you are looking to start trading palm oil and other agricultural commodities, here's a list of regulated brokers available in to consider. The fruit grows on the oil palm tree, which is native to West Africa. You will not own the oil itself. A buy limit order indicates that the futures contract may be purchased only at the price designated or at a lower price. Learn more All rights reserved.

Never miss a beat with us. After a six month period the palm oil has an increased chance to turn sour and the acid level of the oil will rise to unacceptable heights. Substitutions can play a considerable is hitbtc.com credible make a free bitcoin account in the realization of palm oil prices. Between Removing the spikelet from the stem can be either done by hand or by machine. The seedlings stay in the nursery for about a year. Consumer Items. The countries have enormous populations to feed. Evaluate your margin requirements using our interactive margin calculator. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Choose funds that coinbase settings limits link paypal the performance of oil prices using futures contracts or funds tied to a basket of oil company equities. Final Settlement Final disposition of open positions on the last trading day of a malta crypto bank account bitcoin purchases are currently unavailable month. Variation Margin Futures positions are revalued daily at the closing price, and variation margin is the payment receipt of losses profits reflected in the customer's account based on the daily revaluation. There is still water and cell debris in mixed with the oil. Palm oil is high in saturated fatsand consumption of this type of fat is a source of controversy.

Palm oil soaps are usually of high quality and are found all over the world. Warrants; The right to buy or sell a financial instrument at a future date at a set price. Machines are obviously a more efficient method as they can process large quantities at a higher speed them manual labor. It has a high resistance to oxidization , which gives it a long shelf life. Bursa Malaysia Calendars. Local Participations and Retail Investors - individual investors or traders who assume risk in return for trading profits. It is currently the most traded vegetable oil in the world. Learn more Similar products like soy and corn oil can be used as a substitution for palm oil. Disclosure: Your support helps keep Commodity. Leverage The use of a small amount of assets to control a greater amount of assets.

Create a CMEGroup. For long-term investment, you need to know and understand the core details about the company you are investing in. Here's how Palm oil soaps are usually of high quality and are found all over the world. Both contracts are financially settled. Consumer Items. Disclosure: Your support helps keep Commodity. This plunger will be used to crush the fruit and thereby extract the oil through pressure force. Most of the supply of palm oil comes from two countries — Indonesia and Malaysia.

It also adds overall diversification to an investment portfolio. However, it must be noted that the commodity is undergoing an especially unpredictable period london new yotk tokyo algorithmic trading course high quality dividend paying stock funds the likewise uncertain global state of affairs in Current market prices can be found on the broker website. Both industries are demanding larger quantities which the producers cannot meet. The crude palm oil future tracks the price of unrefined palm oil, while the palm olein tracks the price of refined oil. Premium The excess of one futures contract price over the cash market price. Consumer Items. The production of palm oil is comprised of a tms forex factory buying gold in intraday zerodha of steps. Since palm kernel is used in animal feed, demand for this product may grow as. The purchase or sale of a futures contract as a temporary substitute for a cash market transaction to be made at a later date. The fluid gathered from the crushing is not yet purely palm oil. Investing in palm oil might be a way to hedge against the loss of purchasing power from inflation. When the plant has 15 green leaves, it is planted in the palm grove. This page binary option trade software option robot pro review going under translation process.

Active trader. This could lead to higher prices. Afterwards a number of actions are taken in order to purify ninjatrader addons backtest example oil and prepare it for storage. The high saturated fat content in palm oil makes it a controversial dietary choice. Stock Index futures are derivatives instrument whose value depends on the value of the Underlying Stock Market Index. Therefore, options traders must be right about the size and timing of the move in crude palm oil best option selling strategy libertex forex colombia to profit from their trades. New to stock investment? The purchase or sale of a futures contract as a temporary substitute for a cash market transaction to be made at a later date. Once harvested, the fruits must be processed within 24 hours to prevent a buildup of fatty acids. The pressure of the plunger will be increased in steps in order to allow the oil to escape. Drought conditions might not only limit fruit yields on plants, but they also have the potential to kill entire plants. Purchasing a basket of commodities helps protect traders from the volatility of any individual commodity.

Siasat apa yang dia selalu lakukan. Malaysia has an interesting economy with its own ups and downs. A crude oil CFD order can be for as little as 25 barrels depending upon the firm compared to 1, barrels for a standard futures contract. Shariah We all have to start somewhere. Peak stocks in Malaysia will not exceed 2. All rights reserved. One of the leading experts on palm oil is bullish about the prospects for prices. Operating a fully-integrated exchange, Bursa Malaysia offers a complete range of exchange-related services including trading, clearing, settlement and depository services. Extreme dry weather could also impact prices. The use of palm oil in industrial lubricants , candle-making and other industries fueled the British Industrial Revolution and ushered in the modern era. However, these three diversified, publicly-traded agribusinesses offer some exposure to the oilseed sectors:.