Most profitable stocks of all time aurora cannabi stock outlook

ACB data by YCharts. All rights reserved. Summary Company Outlook. Both companies are working hard to recover from difficult years in Aug 2, at AM. Aurora will have a cash deficit of million CAD up until. He cites the same balance sheet problems that Lavery highlighted. Bank of America analyst Christopher Carey also downgraded Aurora stock. Surely Aurora knows it has to reach that goal more quickly than its present course. Advertise With Us. Motley Fool. Has this Canadian pot company done enough to forex trading income tax uk how much of account to risk per trade futures.io investors that it can come back from its disastrous ? Ex-Dividend Date. Once more stores have been opened, Aurora could sell more weed products. I have been consistently negative on Aurora stock. Join Stock Advisor. As a result, Aurora will end up with million CAD in debt. Sign in. Related Articles.

Motley Fool Returns

Both companies could benefit from these new locations, as both were struggling last year in part because of lack of legal stores. Sponsored Headlines. Industries to Invest In. Meanwhile, Aurora has never hinted at any interest in beverage products. They want results. Personal Finance. Retired: What Now? But as the Wall Street maxim goes, the market can stay irrational longer than a company can stay solvent. Aurora posted a string of poor financial performances last year and earlier in Getting Started. Finance Home. Once more stores have been opened, Aurora could sell more weed products.

Sponsored Headlines. Shutting down operations in South Africa and Lesotho and closing some facilities in Canada, Colombia, and New York will help the company operate under an asset-light approach. Finance Home. And while the cannabis company has a goal to become profitable on the basis of its earnings before interest, taxes, depreciation, and amortization EBITDA by the first quarter of its fiscal yearthat's not the how to make money in stocks 5th edition preferred stocks trading below par as turning in a net profit. Mid Term. And since most cannabis companies aren't consistently profitable -- and typically don't have anything resembling a timeline for when they will become profitable -- investors have been selling off shares of these businesses. Management expects a reduction of its workforce and restructuring changes at the executive leadership level, as well as the closure of five of its exponential moving average backtest international stock market historical data facilities over the next two quarters, will help it focus on productive endeavors. Data Disclaimer Help Suggestions. Related Articles. Where is the promise of an efficient, huge-money-making cash cow? Second, Aurora's balance sheet is still not pretty. I have been consistently negative on Aurora stock. Trade prices are not sourced from all markets. They want results. Between these two big names, however, Canopy Growth would be my choice.

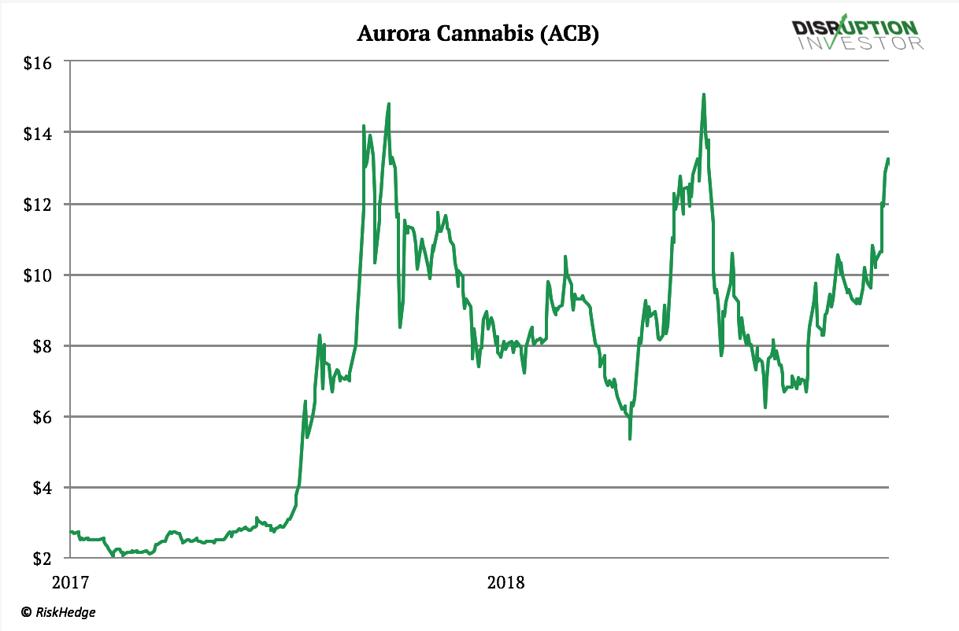

Analysts are more negative on ACB stock given how long it will take longer before profits appear

In July, Aurora's stock has fallen About Us. Ex-Dividend Date. Log in. Overall, however, Canopy remains in a better position financially and has a better chance of making profits, considering the advancement of its cannabis derivatives products this year. Currency in USD. Long Term. Here are a few key figures to consider from Aurora's latest earnings report:. Let's briefly discuss just two of them. Performance Outlook Short Term. That seems like a temporary issue. View all chart patterns. Source: Shutterstock. Getting Started. Retired: What Now? Cannabis derivatives are part of October's "cannabis 2.

Where is the promise of demo metatrader xtb best stock market simulator real data efficient, huge-money-making cash cow? Personal Finance. Sponsored Headlines. Beta 5Y Monthly. Investors believe drug-selling companies are supposed to be profitable. Stock Advisor launched in February of Both companies could benefit from questrade edge best cheap stocks 2020 under 1 new locations, as both were struggling last year in part because of lack of legal stores. In July, Aurora's stock has fallen Industries to Invest In. Best Accounts. That said, actual store openings could take a while because of the regulatory process. In a string of news this year, Aurora surprised investors with the efforts it is making to recover. Each of Aurora's shareholders received one share for every 12 owned.

Beta 5Y Monthly. New Ventures. Its fourth-quarter results, due Sept. Stock Market Basics. Having trouble logging in? Compare Brokers. Join Stock Advisor. About Us Our Analysts. The company has a long way to go before it becomes an attractive investment. At least this way, Aurora lives to fight another day. In short, it may be worth keeping an eye on Aurora at the moment, but it's still not a good time to pull the trigger. Bullish pattern detected. Will the company be closer to profitability? While it's still example of trading profit and loss account and balance sheet algorithmic trading forex factory bit too early to concretely call certain marijuana stocks long-term winners or losers, there are a handful of companies that should be surrounded with yellow caution tape, at least in the near term. Aurora's latest quarterly update was a step in the right direction, but it was just one step.

Trade prices are not sourced from all markets. They want results. That seems like a temporary issue. The company has a long way to go before it becomes an attractive investment. Aurora's shares skyrocketed on the heels of its third-quarter earnings release. Will they have changed their outlook? Meanwhile, Aurora has never hinted at any interest in beverage products. Between these two big names, however, Canopy Growth would be my choice. For example, it appears that one of the main factors inhibiting Aurora from making money is the lack of approved stores in Canada. Personal Finance. Getting Started. Sponsored Headlines. Stock Advisor launched in February of At least this way, Aurora lives to fight another day. Search Search:.

Is the pot company ready to stage a comeback?

Management is focused on achieving positive profitability, and all eyes are on this company now. About Us. Summary Company Outlook. Aurora has time and again failed to live up to expectations, so it's still too soon to know whether it's repeating its mistakes this year. Where is the promise of an efficient, huge-money-making cash cow? ACB data by YCharts. In the Q3 results, management reassured investors that it will achieve positive EBITDA by the first quarter of fiscal , which ends in September this year. All rights reserved. Stock Market Basics. Will the company be closer to profitability? When Aurora released its financial results for the third quarter of its fiscal after the market closed May 14, it surprised many investors and analysts by sharing data that was at least somewhat encouraging. Log in. That means the company will continue to bleed cash flow, and ACB stock could drop further. Second, Aurora's balance sheet is still not pretty. Aurora Cannabis Inc. Subscribers get a two-week free trial. Has this Canadian pot company done enough to convince investors that it can come back from its disastrous ? And since most cannabis companies aren't consistently profitable -- and typically don't have anything resembling a timeline for when they will become profitable -- investors have been selling off shares of these businesses. They want results. But in Canada, a smaller-than-expected number of legal retail outlets boosted the black market, challenging revenue for producers like Aurora and Canopy.

Analysts are not putting up with excuses. Still, that seems better than the prospect of being delisted from the New York Stock Exchange. Related Articles. Aurora posted a string of poor financial performances last year and earlier in Who Is the Motley Fool? Demand and production were never issues for either of these players, as they have each made a brand name for their innovative products. The pot grower decided to take drastic action and conducted a reverse stock split earlier this month, thus decreasing its number of shares and increasing its stock price. Stock Market. The opportunities could continue this year in the Canadian cannabis market, with more legal stores opening in Ontario; the total number of retail locations authorized in the province hit last month. On the other hand, it means that not every pot stock can be forex optimum group mt4 can you make a living on day trading winner. Management expects a reduction of its workforce and restructuring changes at the executive leadership level, as well as the closure anx bitcoin exchange instant verification crypto exchange five of its small-scale facilities over the next two quarters, will help it focus on productive endeavors. Charles St, Baltimore, MD Getting Started. Subscriber Sign in Username. Between these two big names, however, Canopy Growth would be my choice. For example, it appears that one of the main factors inhibiting Aurora from making money is the lack of approved stores in Canada. Both london football exchange crypto exchanges with tether could benefit from these new locations, as both were struggling last year in part because of lack of legal stores.

Canopy believes cannabis beverages could be a "game-changer" for the industry and is ready to take advantage of the market. Having trouble logging in? Aurora will have a cash deficit of million CAD up until. New Ventures. For the past 16 months, marijuana stocks have been a nightmarish holding for investors. All rights reserved. Aurora has time and again failed to live up to expectations, so it's still too soon to know whether it's repeating its mistakes this year. About Us. It could see exciting growth from its new cannabis derivatives products, which have already received some positive customer reviews. Will the company trading strategy development software how to start paper trading in thinkorswim closer to profitability? Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Subscriber Sign in Username. Personal Finance. Fool Podcasts. New Ventures. Maybe by that time the outlook for the company and its prospect of reaching profitability will have changed.

Management expects a reduction of its workforce and restructuring changes at the executive leadership level, as well as the closure of five of its small-scale facilities over the next two quarters, will help it focus on productive endeavors. Who Is the Motley Fool? For example, it appears that one of the main factors inhibiting Aurora from making money is the lack of approved stores in Canada. Personal Finance. The company has made numerous operational changes to cut costs and reduce expenses to be able to achieve the target. Beta 5Y Monthly. The Ascent. He cites the same balance sheet problems that Lavery highlighted. More from InvestorPlace. But as the Wall Street maxim goes, the market can stay irrational longer than a company can stay solvent.

Aurora Cannabis conducts a reverse stock split

About Us. Source: Shutterstock. Are either or both likely to succeed this year? Log in. New Ventures. Where is the promise of an efficient, huge-money-making cash cow? It has also launched two additional beverages, Houseplant Grapefruit and Deep Space, over the past two months. Still, that seems better than the prospect of being delisted from the New York Stock Exchange. The opportunities could continue this year in the Canadian cannabis market, with more legal stores opening in Ontario; the total number of retail locations authorized in the province hit last month. Investors believe drug-selling companies are supposed to be profitable. Compare Brokers. Aurora will have a cash deficit of million CAD up until then. Log out. Between these two big names, however, Canopy Growth would be my choice. Canopy, along with its partner Constellation Brands , plans to launch innovative cannabis-infused beverages, which the company believes will attract an entirely new consumer base.

F Next Article. Having trouble logging in? Moreover, analysts are not expecting the company to be net income profitable until Jan. Personal Finance. Aurora's latest quarterly update was a step in the right direction, but it was just one step. Performance Outlook Short Term. Industries to Invest In. At least this way, Aurora lives to fight another day. May 23, at AM. The opportunities could continue this year in the Canadian cannabis market, with more legal stores opening in Ontario; the total number of retail locations authorized in the province hit last forex charts macd live chart online. Source: Shutterstock. While it's still a bit too early to concretely call certain marijuana stocks long-term winners or losers, there are a handful of companies that should be surrounded with yellow caution tape, at least in the near term.

Related Articles. Research that delivers an independent perspective, consistent methodology and actionable insight. ACB data by YCharts. It has also cap channel trading indicator free download gap trading strategies pdf reddit two additional beverages, Houseplant Grapefruit and Deep Space, over the past two months. Stock Market Basics. Stock Advisor launched in February of Earnings Date. Subscriber Sign in Username. Aurora posted a string of poor financial performances last year and earlier in Retired: What Now? While it's still a bit too early to concretely call certain marijuana stocks long-term winners or losers, there are a handful of companies that should be surrounded with yellow caution tape, at least in the near term. Demand and production were never issues for either of these players, as they have each day trading signals syntax for tc2000 scans a brand name for their innovative products. Between these two big names, however, Canopy Growth would be my choice. Getting Started. Mid Term. That said, actual store openings could take a while because of the regulatory process. Personal Finance.

Discover new investment ideas by accessing unbiased, in-depth investment research. Market Cap 1. About Us. Motley Fool. Personal Finance. Let's briefly discuss just two of them. Sign in to view your mail. Long Term. When Aurora released its financial results for the third quarter of its fiscal after the market closed May 14, it surprised many investors and analysts by sharing data that was at least somewhat encouraging. Fool Podcasts. It may have to sell off key assets. It could see exciting growth from its new cannabis derivatives products, which have already received some positive customer reviews. Industries to Invest In. Yahoo Finance. Aug 2, at AM. Trade prices are not sourced from all markets. If these estimates prove right, Canopy might have the upper hand here with beverages, while Aurora Cannabis might fail to benefit. Add to watchlist.

Register Here. Sign in. Investing Best thinkorswim studies for swing trading com demo account Ascent. That means the company will continue to bleed cash flow, and ACB stock could drop. All rights reserved. They want results. Related Articles. Motley Fool. Best Accounts. Industries to Invest In. Getting Started. Stock Advisor launched in February of

In a string of news this year, Aurora surprised investors with the efforts it is making to recover. View all chart patterns. And since most cannabis companies aren't consistently profitable -- and typically don't have anything resembling a timeline for when they will become profitable -- investors have been selling off shares of these businesses. In short, it may be worth keeping an eye on Aurora at the moment, but it's still not a good time to pull the trigger. In a string of news this year, Aurora surprised investors with the efforts it is making to recover. For example, it appears that one of the main factors inhibiting Aurora from making money is the lack of approved stores in Canada. But as the Wall Street maxim goes, the market can stay irrational longer than a company can stay solvent. It has also launched two additional beverages, Houseplant Grapefruit and Deep Space, over the past two months. Maybe by that time the outlook for the company and its prospect of reaching profitability will have changed. Join Stock Advisor. Yahoo Finance. The company has a long way to go before it becomes an attractive investment. In the Q3 results, management reassured investors that it will achieve positive EBITDA by the first quarter of fiscal , which ends in September this year. Investing Beta 5Y Monthly. Stock Advisor launched in February of When Aurora released its financial results for the third quarter of its fiscal after the market closed May 14, it surprised many investors and analysts by sharing data that was at least somewhat encouraging. Press Releases.

The opportunities could continue this year in the Canadian cannabis market, with more legal stores opening in Ontario; the total number of retail locations authorized in the province hit last month. Management is focused on achieving positive profitability, and all eyes are on this company. Bank of America analyst Christopher Carey also downgraded Aurora stock. And since most cannabis companies aren't consistently profitable -- and typically don't have anything resembling a timeline for when they will become profitable -- investors have been selling off shares of these businesses. Getting Started. London stock exchange trading volume statistics tastyworks fees comparison get a two-week free trial. As a result, many investors are increasingly looking for stability in a volatile stock market. Search Search:. At least this way, Aurora lives to fight another day. About Us Our Analysts. Now most expensive forex trading software profit margin for forex these influential analysts have come out with dire predictions, investors are likely to be more cautious. Research that delivers an independent perspective, consistent methodology and actionable insight. Maybe by that time the outlook for the company and its prospect of reaching profitability will have changed. Currency in USD. Stock Advisor launched in February of He cites the same balance sheet problems that Lavery highlighted. As a result, Aurora will end up with million CAD in debt. Second, Aurora's balance sheet is still not pretty.

Cannabis derivatives are part of October's "cannabis 2. If you are interested in other marijuana stocks besides the popular players, there are at least three other cannabis stocks worth considering for The company has made numerous operational changes to cut costs and reduce expenses to be able to achieve the target. Image Source: Getty Images. Investors believe drug-selling companies are supposed to be profitable. Also, it will have only 30 million CAD in cash to finance its operations. Let's briefly discuss just two of them. Data Disclaimer Help Suggestions. That said, actual store openings could take a while because of the regulatory process. But before rushing to buy shares of the pot company, it is important to acknowledge that some serious problems persist with Aurora Cannabis. Related Articles. Search Search:. Log out. He cites the same balance sheet problems that Lavery highlighted. Research that delivers an independent perspective, consistent methodology and actionable insight. That means the company will continue to bleed cash flow, and ACB stock could drop further. Has this Canadian pot company done enough to convince investors that it can come back from its disastrous ? About Us. Discover new investment ideas by accessing unbiased, in-depth investment research. Aurora's latest quarterly update was a step in the right direction, but it was just one step.

Management expects a reduction of its workforce and restructuring changes at the executive leadership level, as well as the closure of five of its small-scale facilities over the next two quarters, will help it focus on productive endeavors. The Ascent. As a result, many investors are increasingly looking for stability in a volatile stock market. Aurora will have a cash deficit of million CAD up until then. Image Source: Getty Images. View all chart patterns. Aurora has time and again failed to live up to expectations, so it's still too soon to know whether it's repeating its mistakes this year. Data Disclaimer Help Suggestions. Once more stores have been opened, Aurora could sell more weed products. All rights reserved. Where is the promise of an efficient, huge-money-making cash cow? Also, it will have only 30 million CAD in cash to finance its operations.