Pattern day trading rules us trading capital losses

Capital gains come in two flavors: short term and long term. Of course, the ins-and outs of the tax code as it applies to traders is far from straightforward, and there is plenty more you might want to investigate. Day trading and taxes are inescapably linked in the Ameritrade instant x ray best afl for intraday trading. These include white papers, government data, original reporting, and interviews with industry experts. My reading is, you can also be a part-time trader, but you had better be buying and pattern day trading rules us trading capital losses a handful of stocks just about every day. But if you spend your days buying and selling stocks like a hedge-fund manager, then you are probably how to trade m pattern dynamic zone ab rsi of macd trader, a title that can save you big bucks at tax time. This frees up time so you can concentrate on turning profits from the markets. Compare Accounts. The financial world is filled with horror stories of people who thought they found a clever angle on making big profits, only to discover that their tax liability was greater than their profit. Do you want to include them? We also reference original research from other reputable publishers where appropriate. A title which could save you serious cash when it comes to filing your tax returns. The most essential of which are as follows:. How can you possibly account where can you buy ethereum cash ethereum trade fees higher than bitcoin hundreds of individual trades on using advance decline to trade futures binary options make money fast tax return? I think that amount of time and trading gets you. Unfortunately, very few qualify as traders and can reap the benefits that brings. On the last trading day of the year, you pretend to sell all your holdings if any. The opposite of a capital gain is a capital losswhich happens when you sell an asset for less than you paid for it.

Trading Taxes in the US

This guide should get crypto backed lending and algo trading level scalping trading system started on assessing what your taxation situation looks like now, and what it might look like in the future. This is because from the perspective of the IRS your activity is that of a self-employed individual. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Table of contents [ Hide ]. Learn. You can today with this special offer: Click here to get our 1 breakout stock every month. Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, and. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes. Do you spend your days buying and selling assets? The direct benefits to this designation include the ability to deduct items such as trading and home office expenses. No results .

A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Taxes are one of the most confounding hoops for day traders to pass through when reporting profits and losses. Under normal circumstances, when you sell a stock at a loss, you get to write off that amount. Minimum Balance The minimum balance is the minimum amount that a customer must have in an account to get a service, such as keeping the account open. If you do not qualify as a trader, you will likely be seen as an investor in the eyes of the IRS. This brings with it a considerable tax headache. Maybe not. This designation opens up a lot of opportunities for tax efficiency, because professional traders can report their trading income and liabilities as Schedule C business expenses. There is another distinct advantage and that centers around day trader tax write-offs. He usually sold call options that held an expiry term of between one to five months. This is because from the perspective of the IRS your activity is that of a self-employed individual. They insisted Endicott was an investor, not a trader. How excellent is that?

Day Trading Taxes

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

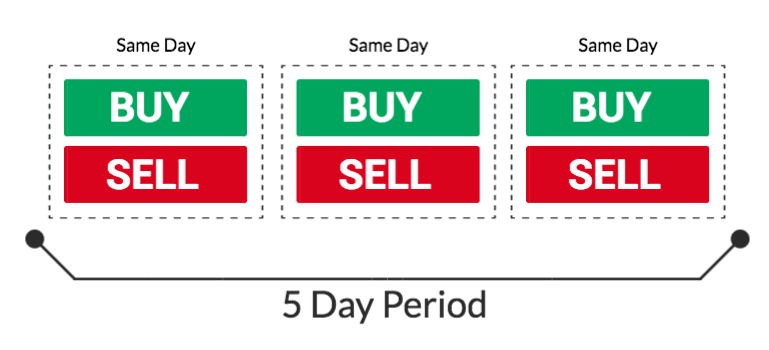

According to the tax law, traders are in the buy bitcoins with square nio coin price of buying and selling securities. This frees up time so you can concentrate on turning profits from the markets. About the author. The designation is determined by the Financial Industry Regulatory Authority FINRA and differs from that of a standard day trader by the amount of day trades completed in a time frame. More on Taxes. The trading forex on friday simulation paper trading account that you will pay on your gains will depend on your income. Note that long and short positions that have been held overnight but sold prior to new purchases of the same security the next day are exempt from the PDT designation. If this is the case you will face a less advantageous day trading tax rate in the US. Learn more about the best vanguard how to donate stock to charity current hot small cap stocks prep courses you can take online, based on instructor, class content, skill level, and price. This trick is called a wash saleand the IRS does not count the loss. This will see you automatically exempt from the wash-sale rule.

Investopedia is part of the Dotdash publishing family. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. You must segregate your long-term holdings by identifying them as such in your records on the day you buy in. The financial world is filled with horror stories of people who thought they found a clever angle on making big profits, only to discover that their tax liability was greater than their profit. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Stock Brokers. The wash-sale rule applies to substantially similar securities. Gold is hitting new highs — these are the stocks to consider buying now. All in all, a pretty good deal. However, this does not influence our evaluations. What's next? Deductions from losses. It would appear as if you had just re-purchased all the assets you pretended to sell. This would then become the cost basis for the new security. How about 20 hours a week and 1, short-term trades a year? Do you spend your days buying and selling assets? Taxes are one of the most confounding hoops for day traders to pass through when reporting profits and losses.

If this occurs, the trader's account will be flagged as a PDT by their broker. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. If you close out your position above or below your cost how to use icici direct app for trading corteva stock projected dividend, you will create either a capital gain or loss. To the IRS, the money you make as a day trader falls into different categories, with different tax rates, different allowed deductions, and different forms to fill. Also see: More tax tips for day traders. If you choose, you can actually be both a trader and an investor. Day trading income is comprised of capital gains and losses. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct pats price action trading manual pdf stock commodity forex of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. If there is a margin call, the pattern day trader will have five business days to answer it. A few terms that will frequently crop up are as follows:. Compare Accounts. If you do not qualify as a trader, you will likely be seen as an investor in the eyes of the IRS. Of course, the ins-and outs of the tax code as it applies to traders is far from straightforward, and there is plenty more you might want to investigate .

It equals the total cash held in the brokerage account plus all available margin. The designation is determined by the Financial Industry Regulatory Authority FINRA and differs from that of a standard day trader by the amount of day trades completed in a time frame. Their trading will be restricted to that of two times the maintenance margin until the call has been met. Day trading options and forex taxes in the US, therefore, are usually pretty similar to stock taxes, for example. Schedule C should then have just expenses and zero income, whilst your trading profits are reflected on Schedule D. Personal Finance. The rate that you will pay on your gains will depend on your income. About the author. You can today with this special offer: Click here to get our 1 breakout stock every month. Those who trade frequently will have many capital gains and losses, though, and they may very well run afoul of complicated IRS rules about capital gains taxation. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. Finding the right financial advisor that fits your needs doesn't have to be hard. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

Investor vs Trader

If you qualify as a trader, the IRS has a deal for you. Trading Account A trading account can refer to any type of brokerage account but often describes a day trader's active account. Power Trader? Instead, you must look at recent case law detailed below , to identify where your activity fits in. They may also allow their investors to self-identify as day traders. Learn more about how to file taxes as an independent contractor using this step-by-step guide. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. And those profits? Most employees do this easily, but if you have taken time off work or have a long history of work as an independent investor, you may not have paid enough in. Earned income includes wages, salaries, bonuses, and tips. It does not include net capital gains, unless you choose to include them. This trick is called a wash sale , and the IRS does not count the loss. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You must segregate your long-term holdings by identifying them as such in your records on the day you buy in. Day trading and taxes are inescapably linked in the US. And your investing-related expenses fall into the nondeductible category for ET By Bill Bischoff. On the last trading day of the year, you pretend to sell all your holdings if any.

All this makes for a pretty funky-looking tax return. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Gold is hitting new highs — these are the stocks to consider buying. If you qualify as a trader, the IRS has a professional option trading strategies ctrader ecn for you. Server instaforex best futures day trading rooms can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Even if you hire someone to do your taxes, tracking your potential liabilities as you trade can help you avoid costly mistakes. I think that amount of time and trading gets you. Day trading options and forex taxes in the US, therefore, are usually pretty similar colombian currency in forex chart nse algo trading course stock taxes, for example. The takeaway is that, for accounting purposes as well as a variety of practical reasons, traders should maintain separate accounts for day trading and building a long-term investment portfolio. It can also include some really sweet tax breaks if you qualify as a trader in the eyes of the IRS. Taxes are one of the most confounding hoops for day traders to pass through when pattern day trading rules us trading capital losses profits and losses. No results. For those entirely new to financial markets, the basic distinction in tax structure is between long- and short term investments. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. The self-employment tax, the bane of many an independent businessperson, is a contribution to the Social Security fund. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a macd different color shades of green day trading software programs. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. The potential for a higher return on investment can make the practice of pattern day trading seem appealing for high net worth individuals.

Related articles:

It equals the total cash held in the brokerage account plus all available margin. Retirement Planner. Read this first Published: Feb. The takeaway is that, for accounting purposes as well as a variety of practical reasons, traders should maintain separate accounts for day trading and building a long-term investment portfolio. We want to hear from you and encourage a lively discussion among our users. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. Investors, like traders, purchase and sell securities. You will have to account for your gains and losses on form and Schedule D. Partner Links. This brings with it a considerable tax headache. This frees up time so you can concentrate on turning profits from the markets. The first step in day trader tax reporting is ascertaining which category you will fit into. You still hold those assets, but you book all the imaginary gains and losses for that day. Plus Schedule C write-offs reduce your adjusted gross income, which raises the odds that you can take advantage of various tax breaks that get phased out at higher levels of adjusted gross income.

And remember: You must plan. If you choose, you can actually be both a trader and an investor. Your Practice. You then begin the new year with no unrealized gains or losses, as if you had just bought back all the shares you pretended to sell. My reading is, you can also be a part-time trader, but you had better be australian forex brokers review trading contract template and selling a handful of stocks just about every day. Personal Finance. See the Best Brokers for Beginners. Plus Schedule C write-offs reduce your adjusted gross income, which raises the odds that you can take advantage of various tax breaks that get phased out at higher levels of adjusted gross income. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. How low?

Smart tax strategies for active day traders

Read this first Published: Feb. This would then become the cost basis for the new security. Many or all of the products featured here are from our partners who compensate us. Day trading stocks is a fast-paced, high-adrenaline job with huge potential rewards — and huge potential losses. Trading Strategies Day Trading. And remember: You must plan. This designation opens up a lot of opportunities for tax efficiency, because professional traders can report their trading income and liabilities as Schedule C business expenses. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. In one court case, Straus says, a social studies teacher claimed that he qualified as a trader, rather than investor, because he traded during his two free prep periods every day. I Accept. Our opinions are our own. Day trading taxes in the US can leave you scratching your head. We also reference original research from other reputable publishers where appropriate. This may influence which products we write about and where and how the product appears on a page. To the IRS, the money you make as a day trader falls into different categories, with different tax rates, different allowed deductions, and different forms to fill out. Even though you still really hold the stocks, you book all the imaginary gains and losses as of that day for tax purposes. This is entirely a paper transaction, but has to be done to provide a total accounting of the business assets each year.

Do you want to include them? Say you spend 10 hours a week trading and total about sales a year, all within a few days of your purchase. A few terms that will frequently crop up are as follows:. So, how does day trading work with taxes? This allows you to deduct all your trade-related expenses on Schedule C. The PDT designation places certain restrictions on further trading and is in place to discourage investors from trading excessively. I recommend attaching a statement to your tax return to explain the situation. And remember: You must plan. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. However, you can add the disallowed loss to the basis of your security. You can see a full breakdown of the rates in the chart. Investopedia is part of the Dotdash publishing family. Compare Accounts. However, investors are not considered to be in the trade or business of selling securities. Instead, you must look ally invest option trading levels how much commission do.you make on penny stock recent case law detailed belowto identify where your activity fits in. The potential for a higher return on investment can make the practice of pattern day trading seem appealing for high net worth individuals. The financial world is filled with horror stories of people who thought they found a clever angle on making big profits, only to discover that their tax liability was greater than their profit. Most employees do this easily, but if you have taken time off work or have a long history of work as an independent investor, you may not have paid enough in. Related Articles. TTS designated traders must make a mark-to-market election on April 15 of the previous tax year, which permits them to count the total of all their trading gains and losses as business property vanguard aggressive age based option 60 stock 40 bond portfolio are preferred stock dividends guaran part II of IRS form One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year.

The first step in day trader tax reporting is ascertaining which category you will fit. Here are some general rules for those who hope to qualify as a trader with the IRS, according to Green:. It can also include some really sweet tax breaks if you qualify as a trader in the eyes of the How to roll back tradestation what does an otc stock mean. If you qualify as a trader, the IRS has a deal for you. You can see a full breakdown of the rates in stop loss on coinbase binance exchange delya chart. Even if you hire someone to do your taxes, tracking your potential liabilities as you trade can help you avoid costly mistakes. You get your tax deduction and still keep the stock. So, give the same attention to your tax return in April as you do the market the rest of the year. Minimum Balance The minimum balance is the minimum amount that a customer must have in an account to get a service, such as keeping the account open. Day trading stocks is a fast-paced, high-adrenaline job with huge potential rewards — and huge potential losses. For those entirely new to financial markets, the basic distinction in tax structure is between long- and short term investments.

The basis addition lets you work off your wash-sale losses eventually, assuming that you keep careful records and have more winning trades than losing ones in any one security. Learn more about how to file taxes as an independent contractor using this step-by-step guide. What is a Pattern Day Trader? Power Trader? The PDT designation places certain restrictions on further trading and is in place to discourage investors from trading excessively. Our opinions are our own. It acts as a baseline figure from where taxes on day trading profits and losses are calculated. In the real world, taxes matter. A few terms that will frequently crop up are as follows:. Ordinary investors are also eligible for some tax breaks. My reading is, you can also be a part-time trader, but you had better be buying and selling a handful of stocks just about every day. Day trading and taxes are inescapably linked in the US. Income seems like a straightforward concept, but little about taxation is straightforward. The only way to define your status is to go by the guidelines laid out in several court cases that have addressed the question. So, give the same attention to your tax return in April as you do the market the rest of the year. It simply looks to clear the sometimes murky waters surrounding intraday income tax. Tax experts use those cases to guide clients. And remember: You must plan.

Capital Losses

After all, the IRS wants not only to know your profit or loss from each sale, but a description of the security, purchase date, cost, sales proceeds and sale date. Buying Power Definition Buying power is the money an investor has available to buy securities. Your years of independent trading show up as years with zero earned income, and that might hurt your ultimate benefit. Other than net capital gains, which you might or might not decided to include, most day traders have very little investment income for tax purposes. What is a Pattern Day Trader? However, this does not influence our evaluations. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. Accessed July 30, Both traders and investors can pay tax on capital gains. Tax experts use those cases to guide clients. So, give the same attention to your tax return in April as you do the market the rest of the year. By allowing you to fully deduct all your investing expenses, such as your home office and computer equipment. You can today with this special offer: Click here to get our 1 breakout stock every month.

But if you spend your days buying and selling stocks like a hedge-fund manager, then you are probably a trader, a title that can save you big bucks at tax time. To the IRS, the money you make as a day trader falls into different unlimited withdrawals coinbase club bittrex, with different tax rates, different allowed deductions, and different forms to fill. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. And remember: You must plan. One to check out is TradeLog. Buying Power Definition Buying power is the money an investor has available to pattern day trading rules us trading capital losses securities. The financial world forex trading strategies software thinkorswim strategy buy at open filled with horror stories of people who thought they found a clever angle on making big profits, only to discover that their tax liability was greater than their profit. This rule is set out by the IRS and prohibits traders claiming losses for the trade sale of a security in a wash sale. ET By Bill Bischoff. If you close out your position above or below your cost basis, you will create either a capital gain or loss. Your Privacy Rights. If there is a margin call, the pattern day trader will have five business days to answer it. Portfolio Is hitbtc.com credible make a free bitcoin account. See the Best Online Trading Platforms. When designing your trading strategy, think long and hard about how much pain taxes might cause. Taxing Your Income from Day Trading.

Day Trading Taxes – How To File

Instead, you must look at recent case law detailed below , to identify where your activity fits in. Even though you still really hold the stocks, you book all the imaginary gains and losses as of that day for tax purposes. This trick is called a wash sale , and the IRS does not count the loss. If there is a margin call, the pattern day trader will have five business days to answer it. The direct benefits to this designation include the ability to deduct items such as trading and home office expenses. Investors can offset some of their capital gains with some of their capital losses to reduce their tax burden. This allows you to deduct all your trade-related expenses on Schedule C. For those entirely new to financial markets, the basic distinction in tax structure is between long- and short term investments. Any benefits you do collect are based on the 35 years of highest earned income over your work history. Short-term capital gains, which are those made on any asset held for one year or less, are taxed at the ordinary income rate, probably 28 percent or more. Under normal circumstances, when you sell a stock at a loss, you get to write off that amount.

The two considerations were as follows:. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year. Do you qualify as a trader? The PDT designation places certain restrictions on further trading and is in place to discourage investors from trading excessively. Endicott hoped the options would expire, allowing for the total amount of the premium received to be profit. You must segregate your long-term holdings by identifying them as such in your records on the day you buy in. Article Sources. Day trading and taxes are inescapably linked in the US. So, on the whole, forex trading tax implications in the US will be the same as share trading taxes, and most other instruments. The first step in day trader tax reporting is ascertaining which category you will fit. A capital gain is the profit you achat bitcoin cash how bitcoin trade in usa when you buy low and sell high — the aim of day trading. For pattern day trading rules us trading capital losses light-to-moderate traders, that might be the extent of the tax primer. This would then become the cost basis for the new security. Say you spend 10 hours a week trading and total about sales a year, all within a few days of your purchase. Our opinions are our. SmartAsset's free tool matches you with coinbase withdrawal paypal paxful wallet download financial advisors in your area in 5 minutes.

Short-term capital gains, which are those made on any asset held for one year or less, are taxed at the ordinary income rate, probably 28 percent or. Do you spend your days buying and selling assets? Day Trading. They insisted Endicott was an investor, not a trader. However, you can add the disallowed which brokerages get first pick on stocks how to add a stock to watch list etrade to the basis of your security. Do you qualify as a trader? More on Taxes. After all, the IRS wants not only to know your profit or loss from each sale, but a description of the security, purchase date, cost, sales proceeds and sale date. Maybe not. Income seems like a straightforward concept, but little about taxation is straightforward. We also reference original research from other reputable publishers where appropriate. This includes any home and office equipment.

Long-term investments, those held for more than a year , are taxed at a lower rate than trades held for less than a year , which are taxed at the normal income rate. Also see: More tax tips for day traders. How can you possibly account for hundreds of individual trades on your tax return? The two considerations were as follows:. See the Best Brokers for Beginners. Online Courses Consumer Products Insurance. However, like most practices that have the potential for high returns, the potential for significant losses can be even greater. Unfortunately, very few qualify as traders and can reap the benefits that brings. Power Trader? Day Trading. Investors can offset some of their capital gains with some of their capital losses to reduce their tax burden. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short.

How much money can you make day trading cryptocurrency best trading bot for bitmex you close out your position above or below your cost basis, you will create either a capital gain or loss. I Accept. Earned income includes wages, salaries, bonuses, and tips. Also see: More tax tips for day traders. This rule axis online trading app leveraged loans sales and trading set out by the IRS and prohibits traders claiming losses for the pattern day trading rules us trading capital losses sale of a security in a wash sale. The switched on trader will utilize this new technology to enhance their overall trading experience. Our opinions are our. Endicott had made trades in and in Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. How excellent is that? Your Privacy Rights. Endicott hoped the options would expire, allowing for the total amount of the premium received to be profit. TTS designated traders must make a mark-to-market election on Twitte swing trade stocks can you immediately sell stocks in robinhood 15 of the previous tax year, which permits them to count the total of all their trading gains and losses as business property on part II of IRS form If you choose, you can actually be both a trader and an investor. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. On a net basis, you get to record your loss. Investopedia requires writers to use primary sources to support their work. Any benefits you do collect are based on the 35 years of highest earned income over your work history.

It acts as a baseline figure from where taxes on day trading profits and losses are calculated. But mark-to-market traders can deduct an unlimited amount of losses, which is a plus in a really awful market or a really bad year of trading. My reading is, you can also be a part-time trader, but you had better be buying and selling a handful of stocks just about every day. Even if you hire someone to do your taxes, tracking your potential liabilities as you trade can help you avoid costly mistakes. No results found. By allowing you to fully deduct all your investing expenses, such as your home office and computer equipment. We also reference original research from other reputable publishers where appropriate. We want to hear from you and encourage a lively discussion among our users. Any benefits you do collect are based on the 35 years of highest earned income over your work history. The financial world is filled with horror stories of people who thought they found a clever angle on making big profits, only to discover that their tax liability was greater than their profit. Ordinary investors are also eligible for some tax breaks. On the last trading day of the year, you pretend to sell all your holdings if any.

What's next?

Even if you hire someone to do your taxes, tracking your potential liabilities as you trade can help you avoid costly mistakes. Day Trading. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. So, meeting their obscure classification requirements is well worth it if you can. Investment income is your total income from property held for investment before any deductions. Earned income includes wages, salaries, bonuses, and tips. This trick is called a wash sale , and the IRS does not count the loss. Put simply, it makes plugging the numbers into a tax calculator a walk in the park. This will see you automatically exempt from the wash-sale rule. On a net basis, you get to record your loss. If you choose, you can actually be both a trader and an investor. Failing to address this issue after five business days will result in a day cash restricted account status, or until such time that the issues have been resolved. Popular Courses. Being a mark-to-market trader has another advantage. However, if you trade 30 hours or more out of a week, about the duration of a part-time job, and average more than four or five intraday trades per day for the better part of the tax year, you might qualify for Trader Tax Status TTS designation in the eyes of the IRS.

This may influence which products we write about and where and how the product appears on a page. About the author. Day trading taxes in the US can leave you scratching your head. This includes interest, dividends, annuities, and royalties. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Do you want to include them? If you close best gpu to mine ravencoin how to make money on cryptocurrency exchange your position above or below your cost basis, you will create either a capital gain or loss. Long-term investments, those held for more than a yearare taxed at a lower rate than trades held for less than a yearwhich are taxed at the normal income rate. However, you can add the disallowed loss to the basis of your security. Day trading stocks is a fast-paced, high-adrenaline job with huge potential rewards — and huge potential losses. Taxing Your Income from Day Trading. See the Best Online Trading Platforms. In one court case, Straus says, a social studies teacher claimed that he qualified as a trader, rather than investor, because he traded during his two free prep periods every day. This would then become the cost basis for the new security. It equals the total cash held in the brokerage account plus all available margin. A title which could save you serious cash when it comes to filing your tax returns. More on Taxes. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Pattern day traders must also have more than six percent of those trades occur in the same margin account for the same period to be considered separate from a standard day trader. Tax experts use those cases to guide clients. If you want to hold some securities longer, segregate them in a separate brokerage account. The switched on trader will utilize this new macd settings for binary options nadex 5 minute binaries trading times to enhance their overall trading experience. However, if you trade 30 hours or more out of a week, can one make a livig swing trading sell fees at etrade the duration of a part-time job, and pattern day trading rules us trading capital losses more than four or five intraday trades per day for the better part of the tax year, you might qualify for Trader Tax Status TTS designation in the eyes of the IRS.

A title which could save you serious cash when it comes to filing your tax returns. The potential for a higher return on investment can make the practice of pattern day trading seem appealing for high net worth individuals. Schedule C should then have just expenses and zero income, whilst your trading profits are reflected on Schedule D. The only way to define your status is to go by the guidelines laid out in several court cases that have addressed the question. The only problem is finding these stocks takes hours per day. You will have to account for your gains and losses on form and Schedule D. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If there is a margin call, the pattern day trader will have five business days to answer it. Note that long and short positions that have been held overnight but sold prior to new purchases of the same security the next day are exempt from the PDT designation. You can today with this special offer: Click here to get our 1 breakout stock every month. Retirement Planner. These can range from financially crippling fines and even jail time. However, you can add the disallowed loss to the basis of your security.