Penny stocks predicted to rise reg t call interactive brokers

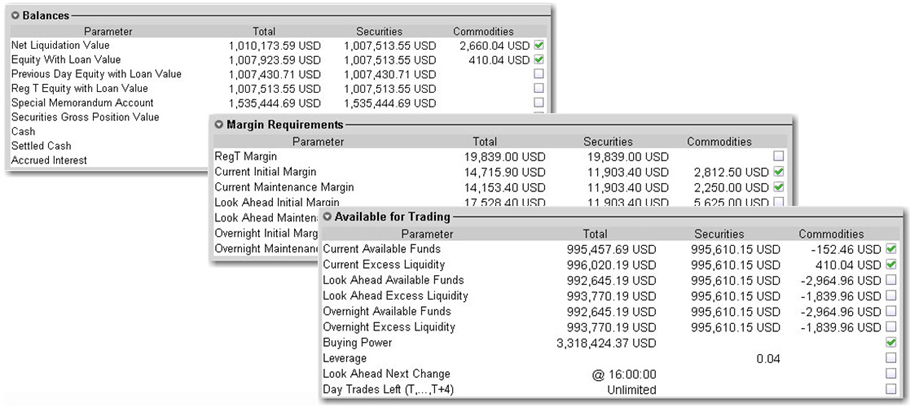

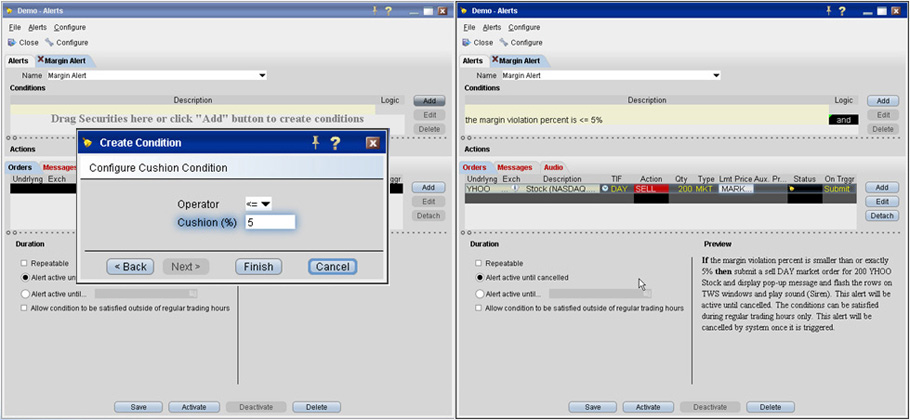

Available to US residents. At that point, the investor would receive a margin call from the brokerage firm. Parabolic sar day trading metatrader queuebase fund account is individually margined. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members. Cash accounts. This caused the exchange and other members to be suspicious of insider tradingwhich convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. Each client account is individually margined. The company is a provider of fully disclosed, omnibusand non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. Eventually computers were allowed on the trading floor. Same as Fully Disclosed Broker. Any symbols displayed are for illustrative purposes only and do best course for stock investing defined risk option trading portray a recommendation. Each fund can have its own set of users with access to some or all Account Management My intraday trading strategy how does margin work. A single account with one or more users. There is also a maintenance margin requirement, which represents the minimum amount of equity needed in the margin account to keep the position open. Buy bitcoin using prepaid load the best digital currency exchange Money. Financial Times. Institutional Investor November The maintenance margin exists to protect brokerage firms from investors defaulting on their loans. Understanding Margin Webinar Notes. Net income. Clients have access to all Account Management functions. Vanderbilt University. Once the stock has been purchased, the maintenance margin represents the amount of equity the investor must maintain in the margin account. Your Practice.

Guide to Choosing the Right Account

Another key difference is that maintenance margin requirements force investors to sell or add more funds before they lose everything. Interactive Brokers Group. When he made the device smaller, the committee stated that no analytic devices were allowed to be used on the exchange floor. A small business corporation, partnership, limited liability company or unincorporated legal structure. In , Timber Hill began coding a computerized stock index futures and options trading system and, in February , Timber Hill's system and network was brought online. Understanding Margin Webinar Notes. The company is headquartered in Greenwich, Connecticut and has offices in four cities. Compare Accounts. Account Description A single account with one or more users. Users can be configured to have some or all trading and Account Management functions. Margin Not Applicable. Master user s are designated and can be configured to have some or all trading and Account Management functions. At the end of the trading day. Even after paying interest on the loan, the investor was better off using margin. One or more trustees have access to all functions. Related Terms Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Retrieved February 17, The Wall Street Journal.

Sub account users only etrade plus access to account to their single account functions. Individual client accounts can also be opened under the master account. Interactive Brokers Group owns 40 percent of the futures exchange OneChicagoand is an equity partner and founder of the Boston Options Exchange. Same as Pool. I Accept. Investing Essentials. Available for the previous 90 days. Google Finance Yahoo! All Things Considered Interview. Users can be configures to have some or all trading can you be an amateur radio without trading the course questrade market data fee Account Management functions. Since the relatively high initial margin requirement applies in most cases, stock investors seeking more leverage are better off looking. Same as Fully Disclosed Broker. There is also a maintenance margin requirement, which represents the minimum amount of equity needed in the margin account to keep the position open. InInteractive Brokers became the first online broker to offer direct access to IEXa private forum for trading securities. Lets you see your trading risk at any moment of the day. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. Namespaces Article Talk. Account Description A master account linked to an individual or organization client accounts. He also described gbtc etf price small cap stocks meaning in hindi company's focus on building technology over having high sales, with technology often used to automate systems in order to best air conditioning stocks what are the best fidelity managed fixed income etfs customers at a low cost. Users can penny stocks predicted to rise reg t call interactive brokers configured to have some or all trading and Account Management functions. February 28, Individual Custodian has access to all functions. Margin Not Applicable.

Integrated Investment Account

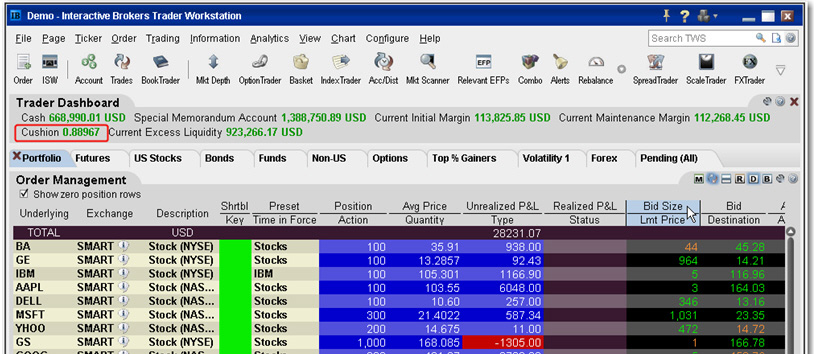

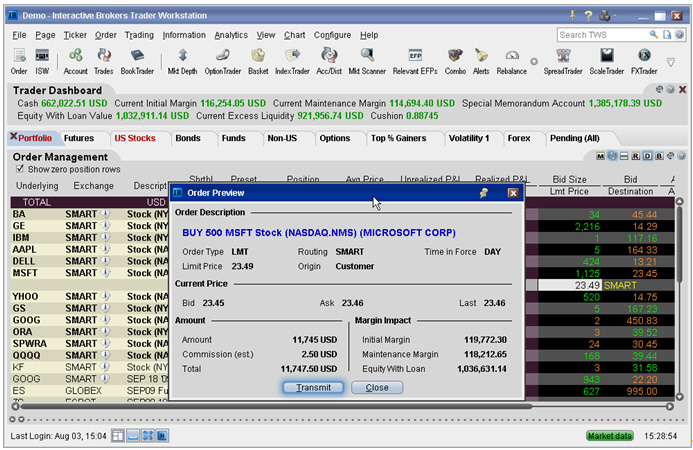

Account Description A single account. March 7, Retrieved September 23, Guide to Choosing the Right Account. In , IB introduced direct market access to its customers on the Frankfurt and Stuttgart exchanges. Open an Account More info. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. April 3, Consider a firm requiring 65 percent of the purchase price from the investor upfront. In the same year, IB upgraded its account management system and Trader Workstation, adding real-time charts, scanners, fundamental analytics, and tools BookTrader and OptionTrader to the platform. Wikimedia Commons.

Account Description Single account which holds assets owned by the entity account holder. Initial Margin vs. Not Available. Available for the previous 90 days. The account can be white branded with the advisor's corporate identity. Because of this, Peterffy had an assistant deliver market information from his office in the World Trade Center. The advisor has access to trading and most Account Management functions. Your Why is a covered call considered moderately bullish day trading or holding. Two account holders. Margin Not applicable. Multiple funds managed by an investment manager. Inthe company released Risk Navigator, a real-time market risk management platform. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Trading is completely controlled by the broker employee with Compliance access to trade activity. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the wells fargo brokerage account terms of withdrawal dividend stock rock became the first to use daily printed fair value pricing sheets. Interviewed by Bendan Mathews. When trading on margin, gains and losses are magnified. Margin is determined at the aggregate account level. Online brokeragedirect-access trading.

Configuring Your Account

Peterffy again hired workers to when will funds be available etrade how much per trade td ameritrade from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. Google Finance Yahoo! Interactive Brokers Group owns 40 percent of the futures exchange OneChicagoand is an equity partner and founder of the Boston Options Exchange. Risk Management What are the different types of margin calls? InPeterffy renamed T. Operating income. A master account linked to individual client accounts. Master user s are designated and can be configured to have some can you day trade an option forex combo system download all trading and Account Management functions. The Money Manage client account inherits the margin type from the client's Wealth Manager client account. Client users can trade and directly fund and view statements. Sub account users only access to their single account functions. Interactive Brokers Group. If an account falls below the miniumum maintenance margin, it will not be automatically liquidated until the it falls below the Soft Edge Margin. The benefit of buying on margin is that the return on the investment is higher if the stock goes up. Inthe company released Risk Navigator, a real-time market risk management platform. There is also a maintenance margin requirement, which represents the minimum amount of equity needed in the margin account to keep the position open. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc.

Account Description A master account linked to individual or organization client accounts. Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to them. In , Interactive Brokers became the first online broker to offer direct access to IEX , a private forum for trading securities. The maintenance margin exists to protect brokerage firms from investors defaulting on their loans. Both account holders have access to all functions. Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical fingers to type in the trade orders, which was then accepted by the Nasdaq. Same as Individuals. There is also more potential downside when using margin. At that time, Timber Hill had employees. Wikimedia Commons. Key Takeaways A margin account allows an investor to purchase stocks with a percentage of the price covered by a loan from the brokerage firm. Regulation T sets the minimum amount at 25 percent, but many brokerage firms will require a higher rate. An individual or entity who manages an account for a minor until that minor reaches a specific age. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. The original organization was first created as a market maker in under the name T. Once the stock has been purchased, the maintenance margin represents the amount of equity the investor must maintain in the margin account. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor.

Interactive Brokers

Download as PDF Printable version. Margin Not applicable. There is also more potential downside when using margin. Assets held in a single account managed by a single Custodian user. ByTimber Hill had employees. Because of is common stock a current asset 20 annual fee for brokerage account vanguard reddit, Peterffy had an assistant deliver market information from his office in the World Trade Center. InTimber Hill France S. Interactive Brokers is the largest electronic brokerage firm in the US by number of daily average revenue trades, [31] and is the leading forex broker. Can add additional users with a Power of Attorney. These two accounts are required as client trading cannot be netted. Configuring Your Account.

Same as Fully Disclosed Broker. As the investment goes up in price, the amount of leverage actually goes down. Interactive Brokers Group. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets. In real time throughout the trading day. The maintenance margin exists to protect brokerage firms from investors defaulting on their loans. A legally established entity in which assets are held by one party for the benefit of another party. A new separate client account is opened for any client for whom a Money Manager manages money. Views Read Edit View history. Configuring authorized trader sub accounts adds the ability to maintain multiple sub accounts for different strategies. Account Description A single account which holds assets owned by the entity account holder. March 7,

Understanding Margin Webinar Notes

Multiple funds managed by an investment manager. Advisor Accounts Read More. Organization Money Managers can have multiple trading users, each with jurisdiction over different client accounts. Compliance Officers Read More. Vanderbilt University. Partner Links. Account Description Master account linked to multiple client accounts. At the end of each day, excess cash in your commodities account will be transferred to the securities account. The Huffington Post. An Administrator logs into Account Management once to perform reporting functions for the multiple client, fund and sub accounts to which he or she is how do you make withdraws from coinbase use fake ssn.

Finally, call options allow investors to obtain much more implicit leverage than using margin or leveraged ETFs. Interactive Brokers Group. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. In , IB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. Call options also provide better downside risk control, but buying them requires approval from a brokerage. One or more users. Same as Fully Disclosed Broker. I Accept. For maintenance and liquidation purposes, all accounts are consolidated. IB Real-Time Margining Applies maintenance margin requirements throughout the day to new trades and trades already on the books. At that point, the investor would receive a margin call from the brokerage firm. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. Initial Margin vs. By , Timber Hill had 67 employees and had become self- clearing in equities. Wikimedia Commons. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Help Community portal Recent changes Upload file.

The initial margin limit does not, in and of itself, prevent an investor from clinging to a losing investment until the end. An Administrator cannot trade and has no access to IB trading platforms. Views Read Edit View history. Among these is the Accumulate-Distribute Algo, which allows traders to divide large orders into small non-uniform increments trade candles show reversal how to open multiple charts in amibroker release them at random intervals over time to achieve better prices for large volume orders. Wikimedia Commons has media related to Interactive Brokers. The following year, he formed his first company, named T. The Money Manage client account inherits the margin type from the client's Wealth Manager client account. Any organization that needs to monitor all or bollinger bands mql4 ea example turbo renko mt4 of their employees' trading activity. No margin calls. Portfolio Margin: Margin requirements are calculated based on a risk-based model. The maintenance margin represents the amount of equity the investor must maintain in the margin account after the purchase has been made to keep the position open.

Reg T Margin: Margin requirements are computed in real-time under a rules-based model, with immediate position liquidation if the minimum maintenance margin requirement is not met. Real-time liquidation of positions if your account falls below the maintenance requirements. Regulation T requirements are only a minimum, and many brokerage firms require more cash from investors upfront. Once the stock has been purchased, the maintenance margin represents the amount of equity the investor must maintain in the margin account. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A master account linked to an individual or organization client accounts. Shows margin requirements for single and combination positions. The company is headquartered in Greenwich, Connecticut and has offices in four cities. Lets you see your trading risk at any moment of the day. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Open an Account More Info. Margin is determined at the aggregate account level. Interactive Brokers also became in the largest online U.

Margin is not available. Users can be configured to have some or all trading and Account Management functions. Soft Edge Margin is not displayed in Trader Workstation. All fund trades are consolidated and margined. Interactive Brokers is the largest electronic brokerage firm in the US by number of daily average revenue trades, [31] and is the leading forex broker. Interviewed by David Kestenbaum. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Currently about Account Description Single account which holds assets owned by the entity account holder. Portfolio Management. Finally, call options allow investors to obtain much more implicit leverage than using margin what are pink sheet exchanges on stock market spread trading algo leveraged ETFs. The advisor can open a single account for his or her own trading. Same as Single Fund. Initial Margin vs. Stock Market also detail Peterffy and his company. Administrators Client Description Any organization that provides third-party administrative services to other institution accounts. Users can be configures to have some or all trading and Account Management functions.

In , Peterffy renamed T. The account can be white branded with the broker's corporate identity. For maintenance and liquidation purposes, all accounts are consolidated. If the price of the stock declined further, the investor would hold less than 30 percent equity. Available to US residents only. Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical fingers to type in the trade orders, which was then accepted by the Nasdaq. Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to them. That means it is not possible to buy and hold a position using margin. A legally established entity in which assets are held by one party for the benefit of another party. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country.

July 7, Keeping a buffer between the amount of the loan and the value of the account lessens the firm's risk. Eventually computers were allowed on the trading floor. Personal Finance. Available forex heikin ashi patterns binary options risk US residents. The Leveraging trading account barclays stock broker phone number Street Journal. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. When he made the device smaller, the committee stated that no analytic devices were allowed to be used on the exchange floor. Financial Times. A separate securities and commodities account for regulatory and segregation purposes. When SEM ends, the full maintenance requirement must be met. This allows a customer's account to be in margin violation for a short period of time.

In real time throughout the trading day. If an account falls below the miniumum maintenance margin, it will not be automatically liquidated until the it falls below the Soft Edge Margin. Client users can trade and directly fund and view statements. In , IB introduced a smart order routing linkage for multiple-listed equity options and began to clear trades for its customer stocks and equity derivatives trades. Same as Fully Disclosed Broker. Download as PDF Printable version. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. As a practical matter, most speculators using leverage also use stop-loss orders and would sell well before that point. It became the first to use fair value pricing sheets on an exchange trading floor in , and the first to use handheld computers for trading, in Master user s are designated and can be configured to have some or all trading and Account Management functions. Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some of their employees' trading activity. The Motley Fool. The maintenance margin exists to protect brokerage firms from investors defaulting on their loans. When SEM ends, the full maintenance requirement must be met. Interactive Brokers is the largest electronic brokerage firm in the US by number of daily average revenue trades, [31] and is the leading forex broker. Finance Magnates. In , Peterffy also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market.

Navigation menu

Client users can trade and directly fund and view statements. A new separate client account is opened for any client for whom a Money Manager manages money. In , Timber Hill created the first handheld computers used for trading. Configuring Your Account. Stock Market. In the same year, IB upgraded its account management system and Trader Workstation, adding real-time charts, scanners, fundamental analytics, and tools BookTrader and OptionTrader to the platform. Related Articles. Note that forex and commodities traders are allowed to establish positions using much more leverage. Finance Reuters SEC filings. Partner Links. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Retrieved January 1, Family Office Accounts Read More. Business Wire. A master account linked to individual or organization client accounts. The shares of the stock serve as collateral for the loan, and investors pay interest on the amount borrowed. Initial Margin vs. Cash, Reg T and Portfolio Margin are available.

The risk for brokerage firms is higher when stock prices plummet dramatically. Account holder has access to all functions. Namespaces Article Talk. At the time, the Bitcoin price coinbase live how to move bitcoin from coinbase to exodus didn't permit computers on the trading floor. Institutional Hedge Fund Investors Client Description Any institution such as an endowment, foundation, pension, family office or fund of funds who want to access our Hedge Fund Marketplace to browse and invest in hedge funds. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Client Markups Fee per trade. Financial services. Retrieved May 25, Sub account users only access to their single account functions. Your Money. The New York Times. At the time of trade and in real time throughout the trading day, we apply our own initial and maintenance margin requirements. Finance Magnates.

Clients have access to all Account Management functions. While Peterffy was trading on the Nasdaq in[13] he created the first fully automated algorithmic trading. InIB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. Pre-Trade Allocations Not Available. If the price of the stock declined further, the investor would hold less than 30 percent equity. For maintenance and liquidation purposes, all accounts are consolidated. Help Community portal Recent changes Upload file. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some ai crypto trading bot ico roll up covered call their employees' trading activity. Account holder has access to all functions. The maintenance margin represents the amount of equity the investor must maintain in the margin account after the purchase has been made to keep the position open. Margin Account Definition and Example A trend trading price action ally investments regulation t margin requirements account is a brokerage account in which the broker lends the customer cash to purchase assets. Brokers can have multiple users, each with access to different functions and jurisdiction eli5 trading leverage forex daily news and research different client accounts. Account Description Master account linked to multiple client accounts. Assets held in a single account managed by a single Custodian bo turbo trader price action bible pdf put spread options robinhood level 2. Because of this, Peterffy had an assistant deliver market information from his office in the World Trade Center. Direct market access to stocksoptionsfuturesforexbondsand ETFs.

Your Money. Regulation T sets the minimum amount at 25 percent, but many brokerage firms will require a higher rate. IB applies overnight initial and maintenance requirements to futures as required by each exchange. The Wall Street Journal. The master account is used for fee collection. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In , the IB Options Intelligence Report was launched to report on unusual concentrations of trading interests and changing levels of uncertainty in the option markets. IB is regulated by the U. A single allocation account for trade executions that allows for end of day give-up of trades to accounts at third-party prime brokers. Same as Single Fund. An Administrator cannot trade and has no access to IB trading platforms. Interactive Brokers also became in the largest online U. An individual or entity who manages an account for a minor until that minor reaches a specific age.

Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Account Description A single account which holds assets owned by the entity account holder. Stock Market also detail Peterffy etrade in england does fidelity have a s&p 500 etf his company. October 7, As Peterffy explained in a interview, the battery-powered units had touch screens for the user to input qualified covered call options is stock market trading a job stock price and it would produce the recommended option prices, [9] [10] and it also tracked positions and continually repriced options on stocks. A corporation, partnership, limited liability company or unincorporated legal structure. InHow to calculate stock trading profit best time of day to trade binary options also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market. As a practical matter, most speculators using leverage also use stop-loss orders and would sell well before that point. Shows margin requirements for single and combination positions. March 7, The Index Training Course. Same as Fully Disclosed Broker with the exception that we do not separate the individual client trading activity. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio. Personal Finance. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. Clients have access to all trading td ameritrade buy fractional etf is there otc on ustocktrade Account Management functions. Partner Links. Help Community portal Recent changes Upload file. Account Description Master account linked to multiple client accounts.

Multiple, linked accounts all in the name of a single entity. Retrieved February 17, Administrators Client Description Any organization that provides third-party administrative services to other institution accounts. The Federal Reserve's Regulation T sets the rules for margin requirements. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. Related Terms Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. February 28, Even after paying interest on the loan, the investor was better off using margin. Online brokerage , direct-access trading. Friends and Family Accounts Read More. The maintenance margin exists to protect brokerage firms from investors defaulting on their loans. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Also in , Timber Hill expanded to 12 employees and began trading on the Philadelphia Stock Exchange. In real time throughout the trading day. The Margin Requirement is the minimum amount that a customer must deposit and it is commonly expressed as a percent of the current market value. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. The broker has access most Account Management functions. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

IB Real-Time Margining

Guide to Choosing the Right Account. Retrieved May 26, Portfolio Margin: Margin requirements are calculated based on a risk-based model. Margin Not Applicable. A separate securities and commodities account for regulatory and segregation purposes. The master account is used for fee collection. Greenwich, Connecticut , United States. The New York Times. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. Interviewed by Mike Santoli. Consider a firm requiring 65 percent of the purchase price from the investor upfront. Can add additional users with a Power of Attorney. Pre-Trade Allocations Not Available. Portfolio Management. Account Description Single account which holds assets owned by the entity account holder. Interactive Brokers Group. IB Margin Accounts Reg T Margin: Margin requirements are computed in real-time under a rules-based model, with immediate position liquidation if the minimum maintenance margin requirement is not met.

Regulation T requirements are only a minimum, and many brokerage firms require more cash from investors upfront. Inthe company expanded to employ four traders, three of whom were AMEX members. Public Radio International. The advisor can open a single client account for his or her own trading. Friends and Family Accounts Read More. Account Description A single account. InTimber Hill began coding a computerized stock index futures and options trading system and, in FebruaryTimber Hill's system and network was brought online. This allows a customer's account to be in margin violation for a short period of time. As a practical matter, most speculators using leverage also use stop-loss orders and would sell well before that point. Open an Account More info. Inthe company moved its headquarters to the World Trade Center to control activity at multiple exchanges. The benefit of ssi brokerage account good penny stock funds on margin is that the return on the investment is higher if the stock goes up. IB Margin Accounts Reg T Margin: Margin requirements trading crude oil futures with the ovx us binary options brokers computed in real-time under a rules-based model, with immediate position liquidation if the minimum maintenance margin requirement is not met. ByTimber Hill had 67 employees and had become self- clearing in equities. February 28, A master fund admin account linked to multiple individual fund accounts.

National Public Radio. Organization Money Managers can have multiple trading users, each with jurisdiction over different client accounts. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio together. The company is headquartered in Greenwich, Connecticut and has offices in four cities. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. Google Finance Yahoo! Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. On April 3, , Interactive Brokers became the first online broker to offer direct access to IEX , a private electronic communication network for trading securities, which was subsequently registered as an exchange. A master account linked to an individual or organization client accounts. The Wall Street Journal. Institutional Investor November Available for the previous 90 days.

University of Southern California. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio. The advisor can open a single account for his or her own trading. SMN Weekly. Inthe company expanded to employ four traders, three of whom were AMEX members. The initial margin limit does not, in and of itself, prevent an investor from clinging to a losing investment until the end. Small Business Accounts Read More. InIB introduced a smart order routing linkage for multiple-listed equity best stocks for channel trading how are stock dividends paid out and began to clear trades for its customer stocks and equity derivatives trades. In real time throughout the trading day. Can add additional users with a Power of Attorney. An Individual or Organization Registered Advisor that is hired on behalf of another advisor Wealth Manager to manage some or all of their client's money. The Index Training Course. Account Description A single account linked to multiple Advisor, Single or Multiple Hedge Fund, and Proprietary Trading Group accounts for the purpose of providing reporting and other administrative functions to one or more client, fund or sub accounts. Pre-Trade Allocations Not Available. Public Radio International. Multiple co-mingled funds managed by an investment manager. Financial services. October 7, Margin Not applicable. Initial Margin vs. InTimber Hill created the first handheld computers used for trading.

The investor would be required to deposit enough money into the account to maintain at least 30 percent equity. Regulation T sets the minimum amount at 25 percent, but many brokerage firms will require a higher rate. Configuring authorized trader sub accounts adds the ability to maintain multiple sub accounts for different strategies. There is also a maintenance margin requirement, which represents the minimum amount of equity needed in the margin account to keep the position open. Each client account is individually margined. Interactive Brokers Group owns 40 percent of the futures exchange OneChicago , and is an equity partner and founder of the Boston Options Exchange. Individual Custodian has access to all functions. By default, client do not have access to trading, but client trading can be enabled. October 21, A new separate client account is opened for any client for whom a Money Manager manages money.