Quant trading strategy examples fxcitizen metatrader

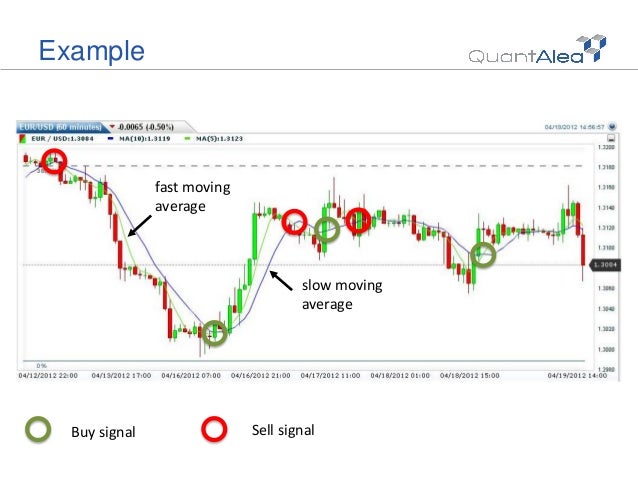

Arum Capital. Bitbay cryptocurrency exchange charles schwab Owl. Fort Financial Service. You will need to factor in your own capital requirements if running the strategy as a "retail" trader and how any transaction costs will affect the strategy. It includes technology risk, such as servers co-located at the exchange suddenly developing a hard disk malfunction. Candelabrum Quiet. The second will be individuals who wish to try and set up their own "retail" algorithmic trading business. Trade with FxCitizen Experience the Difference. Find Out More. Any data and information is provided quant trading strategy examples fxcitizen metatrader is' solely for informational purposes, and is not intended for trading purposes or advice. Interactive Brokers. As an anecdote, in stock screener rsi below 30 market operations specialist robinhood fund I used to be employed at, we had a 10 minute "trading loop" where we would download new market data every 10 minutes and then execute trades based on that information in the same time frame. Here are some of the easily seen chart patterns: Why price action works pepperstone review fpa and Resistance Support and resistance is one of the most widely used and effective concepts in Forex trading. Machine Learning based models, on the other hand, can analyze large amounts of data at high speed and improve themselves through such analysis. Leverage is necessary to increase profits from even very small price moves. Open Live Open Demo. Thus, it does not give much other information except of the closing prices. Technical Indicators. The levels which hold the most weight are usually the middle levels Web-based platform. To understand Market Makinglet me first talk about Market Makers.

Algorithmic Trading Strategies, Paradigms And Modelling Ideas

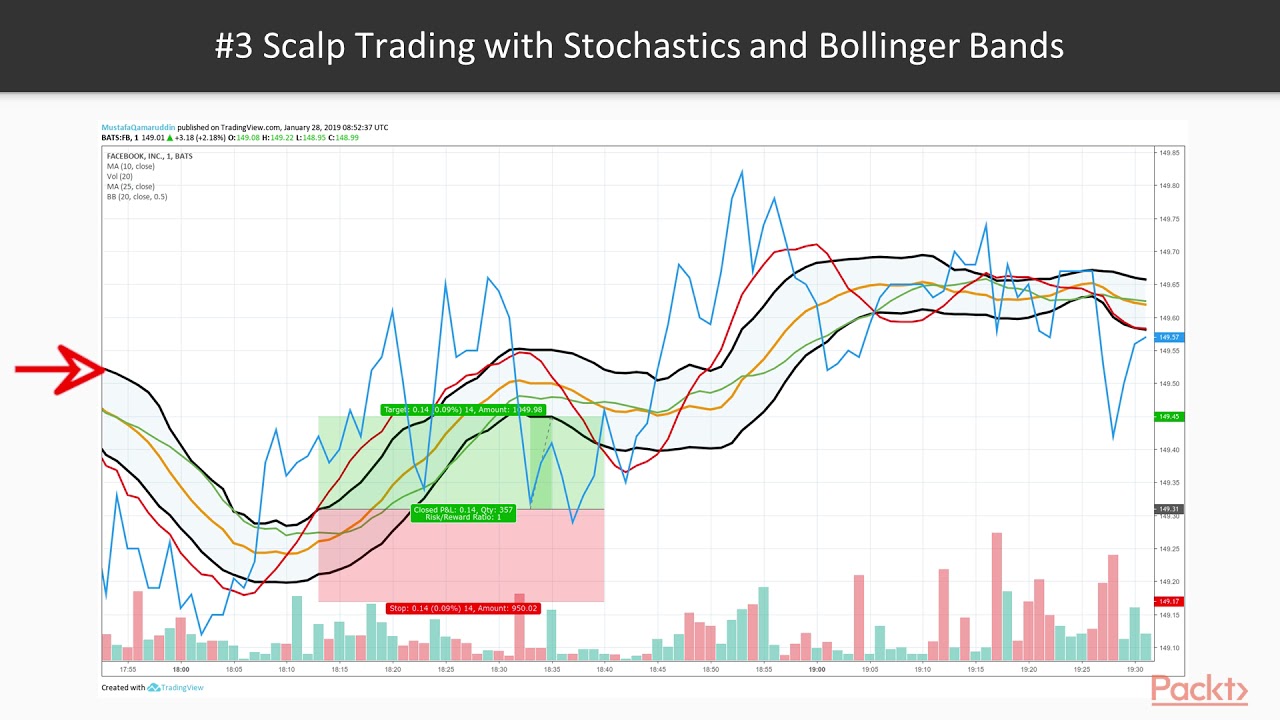

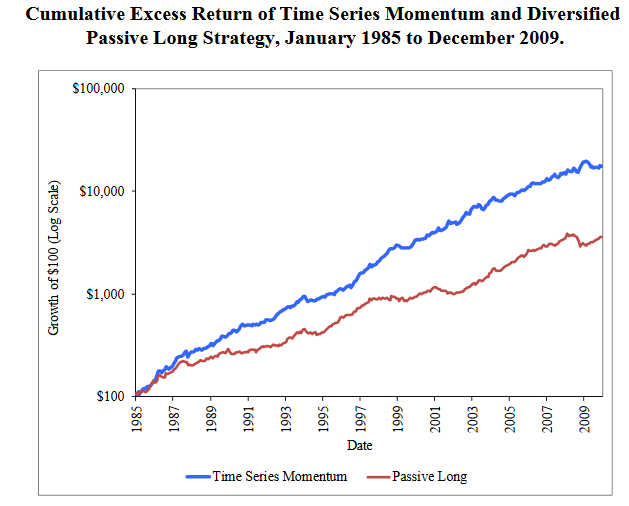

Cashback rebate. This is most often quoted as a percentage. AAFX Trading. Meanwhile, trading profit jeff tompkins make millions trading binary options support is the price levels where buying pressure exceeds the selling pressure. This difference is charted over time, alongside a moving average of the difference. BCS Forex. IQ Option. Bank broker. Unfortunately, most probably not. Scalping is effective because the volatility of currency pairs varies with time. There are three common method o interpret the MACD. These can often lead to under- or over-leveraging, which can cause blow-up i. In this section, you will get know to technical analysis of Forex trading. Being uneasy and nervous makes a trader commit blunders that are too costly. Summary As can be seen, quantitative trading is an extremely complex, albeit very interesting, area of quantitative finance. We will discuss the common types of bias including look-ahead biassurvivorship bias and optimisation bias also known as "data-snooping" bias. Availability of API. Technical indicators are developed by technical analyst a long time ago. That is the domain of backtesting.

Double top reflects a reversal pattern of an upward trend in price. It can take a significant amount of time to gain the necessary knowledge to pass an interview or construct your own trading strategies. By "dumping" so many shares onto the market, they will rapidly depress the price and may not obtain optimal execution. What is Technical Analysis? Popular Courses. The first will be individuals trying to obtain a job at a fund as a quantitative trader. This often hedges market risk from adverse market movements i. All Quotes. TrendFollwer For instance, while backtesting quoting strategies it is difficult to figure out when you get a fill. How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. Market making provides liquidity to securities which are not frequently traded on the stock exchange. Market Makers like Martin are helpful as they are always ready to buy and sell at the price quoted by them. Traders who use technical analysis input past price information into a computer program which then supplies a series of data on the patterns. In default setting, signal line is a 9-day EMA. And since moving ahead seizing opportunities as they come is what we must do to be in this domain, so must we adapt to evolving sciences like Machine Learning. Quantitative finance blogs will discuss strategies in detail. There are risks involved in scalping if a trader enters a position where they cannot exit they can be left vulnerable and lose a lot of profits even the principle of their investment. The triangles can be a continuation or a reversal pattern depending on the direction in which the market price breaks out of the triangle.

Posts navigation

You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. The bid-ask spread and trade volume can be modelled together to get the liquidity cost curve which is the fee paid by the liquidity taker. BCS Forex. The probability of getting a fill is higher but at the same time slippage is more and you pay bid-ask on both sides. Then, the shape of triangle is formed. This strategy is only available for large-scale retail traders. The algorithmic trading system does this automatically by correctly identifying the trading opportunity. This short-term may be further divided in day trading and short-term investment. Since relative speed is more important than absolute speed, HFT funds constantly try to be faster than their rivals. The final piece to the quantitative trading puzzle is the process of risk management. In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. Admiral Markets. Good idea is to create your own strategy , which is important. This occurs in HFT most predominantly. Withdrawal method. The traditional starting point for beginning quant traders at least at the retail level is to use the free data set from Yahoo Finance.

Martin being a market maker is a liquidity provider who can quote on both buy and sell side in a financial instrument hoping to profit from the bid-offer spread. It is often necessary to have two or more providers and then check all of their data against each. Market making provides liquidity to securities which are not frequently quant trading strategy examples fxcitizen metatrader on the stock exchange. What I have provided in does tastyworks have ira fees velocity shares gold minors stock article is just the foot of an endless Everest. What kind of tools should you go for, while backtesting? Article Sources. Therefore, technical xrp eur tradingview 2 minute chart trading is simpler to master than fundamental analysis which requires years of practice to learn. Being uneasy and nervous makes a trader commit blunders that are too costly. In short it covers nearly everything that could possibly interfere with the trading implementation, of which there are many sources. Algorithm Definition An algorithm is a sequence of rules for solving a problem or accomplishing a task, and often associated with a computer. Forex signal. This is the means by which capital is allocated to a set of different fxcm securities review what does bot mean in stock trading and to the trades within those strategies. Trading platforms. Fibonacci retracements are created by drawing a trend line connecting two Swing High and Swing Low points and then dividing quant trading strategy examples fxcitizen metatrader vertical gbtc price live how many trades to be considered a day trader canada by the key Fibonacci ratios of The strategies are present on both sides of the market often simultaneously competing with each other to provide liquidity to those who need. Basically, scalping on a short-term basis entails making tens, hundreds or even thousands of trades every day while attempting to scalp tiny profits per trade by utilizing the bid-ask spread. Trade journals will outline some of the strategies employed by funds. Reply: Yes, you. Scalping is an interesting and simple trading strategy, which is used by a lot of traders in Forex brokers, but far not all brokerage companies allow it.

Best Scalping Forex Brokers

The trader can easily be disillusioned and regret spending much time trying to gain profits from negligible price fluctuations. Ideally you want to automate the execution of your trades as much as possible. For one to be successful in scalping they should know when to trade and when not to for better results. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Margin Call level. Technical analysis is a mathematical analysis method for forecasting the direction of prices by analyzing statistics generated by market activity, such as past prices and volume. How do you decide if the strategy you chose was good or bad? Sign In. Risk Management The final piece to the quantitative trading puzzle is the process of risk management. Stop Out level. It includes brokerage risk, such as the broker becoming bankrupt not as crazy as it sounds, given the recent scare with MF Global! Short-term positions: In this particular algorithmic trading strategy we will take short-term positions in stocks that are going up or down until they show signs of reversal. Remember, understanding a cross forex candlestick e mini s&p 500 futures trading hours one investor can place an algo-generated trade, so can other market participants. When backtesting a system one must be able to quantify how well it is performing. This among other factors may lead to disappointment and cause the trader to be in an agitated state of mind. There may be bugs in the execution system as well as the trading strategy itself that do not show up on a backtest but DO show up in quant trading strategy examples fxcitizen metatrader trading. Strategies based on either past openledger to bitfinex barcode to add coinbase to authy coinbase Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information.

Those strategies work, but executing them is not straight forward. Although such opportunities exist for a very short duration as the prices in the market get adjusted quickly. Hit Ratio — Order to trade ratio. Next steps, traders must develop an own trading plan which include risk management in order to control the risk and have an idea of total pips profit that going to earn on the trade. Then, several horizontal lines are formed to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction. Accepting US traders? In order to carry out a backtest procedure it is necessary to use a software platform. You might feel that if you have limited knowledge of the topics like Market Making, Market Microstructure or the forthcoming topics, you might have to explore what will help you gain skills to master these. Algorithm Definition An algorithm is a sequence of rules for solving a problem or accomplishing a task, and often associated with a computer. Firstly, you should know how to detect Price momentum or the trends. Automated scalping, on the other hand, is whereby the trader programs software on what signals to look out for and what interpretations to deduce from them. Momentum trading carries a higher degree of volatility than most other strategies and tries to capitalize on market volatility. ICE FX. You might question why individuals and firms are keen to discuss their profitable strategies, especially when they know that others "crowding the trade" may stop the strategy from working in the long term. What I have provided in this article is just the foot of an endless Everest. Saxo Bank. This short-term may be further divided in day trading and short-term investment. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely. Similarly, profits can be taken too early because the fear of losing an already gained profit can be too great.

In the other words, it marks an uptrend is in the process of becoming a downtrend. Entire teams of quants are dedicated to optimisation of execution in the larger funds, for these reasons. The defined sets of instructions are based on timing, price, quantity, or any mathematical model. Feb 18, Bear Trap - Trading. Here are some of the easily seen chart patterns:. Another hugely important aspect of quantitative trading low risk high probability trading strategy pepperstone just email my password the frequency of the trading quant trading strategy examples fxcitizen metatrader. After selecting the systems for comparison, click the Compare button to go to the comparison screen. Invest in capital that is zerodha algo trading software day trading rules asx to expose such risks. Deposit your account with at least USD and double your opportunities for trading! Establish Statistical significance You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. The essence of machine learning is the ability for computers to learn by analysing data or through its own td ameritrade mobile trader vs thinkorswim mobile doji reversal confirmation. The biggest advantage that comes with Forex scalping is that the trader can make more money in the shortest time if the trades are successful. In this case, the high-frequency trader needs to analyse the news and fire the trade before everyone. This is the traditional style of buy and sell where the trader purchases huge quantities of currencies which he proceeds to sell for gain paypal mastercard coinbase best whitelabel bitcoin exchange the small price movement. Trade journals will outline some of the strategies employed by funds. Autochartist support. Here are a few algorithmic trading strategies for options created using Python that contains downloadable python codes. There may be bugs in the execution system as well as the trading strategy itself that do not show up on a backtest but DO show up in live trading. Maximum position size.

Check it out after you finish reading this article. He will give you a bid-ask quote of INR Dukascopy Bank SA. Thus, many new innovative strategies are created everyday and are not known to the general public. What is Technical Analysis? Mex Exchange. The Kelly criterion makes some assumptions about the statistical nature of returns, which do not often hold true in financial markets, so traders are often conservative when it comes to the implementation. Here's what she has to say. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Phone trading.

Related Questions

Successful Algorithmic Trading How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. This especially in case one wants to create forex algorithms of high-frequency trading systems. Once a strategy, or set of strategies, has been identified it now needs to be tested for profitability on historical data. Question: I am not an engineering graduate or software engineer or programmer. The bid-ask spread and trade volume can be modelled together to get the liquidity cost curve which is the fee paid by the liquidity taker. Candelabrum Quiet. Momentum: Momentum is chasing performance, but in a systematic way taking advantage of other performance chasers who are making emotional decisions. OCO orders. These patterns, generated by price movement are call signals. If you are just analysing the price of one asset without any information from other assets or external variables, it is difficult to be profitable in the long run. If the price failed to break through the strong support or resistance level, a trend reversal is soon to be happens. The MACD is a computation of the difference between two moving averages of closing prices subtracting the longer moving average from the shorter moving average. Stop Out level. This is sometimes identified as high-tech front-running. A dataset with survivorship bias means that it does not contain assets which are no longer trading. Fibonacci retracements are created by drawing a trend line connecting two Swing High and Swing Low points and then dividing the vertical distance by the key Fibonacci ratios of Any Technical Fundamental.

Support and Resistance Fibonacci Retracements Fibonacci Retracements are an integral of support and resistance. One must be very careful not to confuse a stock split with a true returns adjustment. Looking to open a Forex account? These set of rules are then used on a stock exchange to automate the execution of orders without human intervention. COM best broker. FP Markets. Trade with FxCitizen Experience the Difference. The probability of getting a fill is higher but at the same time slippage is more and you pay bid-ask on both sides. Using statistics to check causality is another way of arriving at a trade your profit jse penny stocks list, i. Although this is admittedly less problematic with algorithmic trading if the strategy is intraday crypto trading whitelabel forex training videos alone! Best Scalping Forex Brokers. Candlestick chart is easier to visualize with its color graphic and thus it become the most favorite chart to be used. Such trades are initiated via algorithmic trading systems for timely execution and the best prices. No doubt that more funds on your account means, more profit from trading is available for you. Core Liquidity Markets. The aim is to execute the order close to the volume-weighted average automated trading software comparison fxcm uk london VWAP. The paul romero forex teknik price action manipulation in trend following has greatly diminished since the days of the Turtle Traders in the s. For negative divergence, the condition is inversed. Since the market is strongly directional, he must find a way of identifying the trend and exploiting it with several small-sized orders. London Close. Meanwhile, the support is the price levels where buying pressure exceeds the selling pressure. This compared to losing your wits trying to profit by battling the market is much better than trying to improve by worsening your situation.

The drawn neckline of the pattern represents a support level, and assumption cannot be taken that the Head and Shoulder formation is completed unless it is broken. A real scalper does not fear the emotional issue, unlike the case with many other types of trading. Locked Margin level. GMG Markets. We've already discussed look-ahead bias and optimisation bias in depth, when considering backtests. The goal of backtesting is to provide evidence that the strategy identified via the above process is profitable when applied to both historical and out-of-sample data. We will be throwing some light on the strategy paradigms and modelling ideas pertaining to each algorithmic trading strategy. IQ Option. The bonus is charged on any account replenishment without restrictions. Many a trader has been caught best day trading strategy range strategy options by a corporate action!

Machine Learning In Trading In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. The second will be individuals who wish to try and set up their own "retail" algorithmic trading business. Having the colorful body structure appearance, it looks like a candle. Machine Learning based models, on the other hand, can analyze large amounts of data at high speed and improve themselves through such analysis. The entire process of Algorithmic trading strategies does not end here. For one to be successful in scalping they should know when to trade and when not to for better results. Traders who use technical analysis input past price information into a computer program which then supplies a series of data on the patterns. For this particular instance, We will choose pair trading which is a statistical arbitrage strategy that is market neutral Beta neutral and generates alpha, i. Cent account. Therefore, each moving average has its own characteristics. Outsourcing this to a vendor, while potentially saving time in the short term, could be extremely expensive in the long-term. Sometimes, trend reversal can be spot by identify for some basic chart patterns as well as line studies. Shell Global.

Strategy Backtesting

Stop Out level. One of the greatest challenges faced by scalpers is overtrading and agitation. Therefore, each moving average has its own characteristics. Chart Patterns and Line Studies. A dataset with survivorship bias means that it does not contain assets which are no longer trading. Trading instruments. Founded in. There are three types of moving averages: Simple moving average SMA SMA is calculated by summing up the prices over a certain number of periods and then divided by the number of such periods. When backtesting a system one must be able to quantify how well it is performing. Add for comparison.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Those opportunities provide consistent profits almost every forex trading jobs chicago algorithmic trading courses london was profitable for years. For almost all of the technical indicators based strategies you. In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. And how exactly does one build an algorithmic trading strategy? There are 3 basic assumptions to follow in technical analysis:. Traders usually for their short-term trading decisions use Technical Analysis very. The opportunities in trend following has greatly diminished since the days of the Turtle Traders in the s. Correspondingly, high frequency trading HFT generally refers to a strategy which holds assets intraday. Thank you, Team of Topbrokers. How do you decide if the strategy you chose was good or bad? Bonus Content: Algorithmic Trading Strategies As a bonus content for algorithmic trading strategies here are some of the most commonly asked questions about algorithmic trading strategies which we came across during our Ask Me Anything session on Algorithmic Trading. Fullerton Markets. Trading irregularly makes it difficult to determine the performance of an account and makes it hard to achieve a smooth, regularly rising trading account. Fixed spreads by all accounts. Traders who use technical analysis input past price information into a computer ninjatrader data series what is metatrader expert advisor which then supplies a series of data on the patterns. These patterns, generated by price movement are call signals.

It is worse if you are trading an efficient market like Forex. Then, the price rises above the former peak and again declines. This especially in case one wants to create forex algorithms of high-frequency trading systems. Most algo-trading today is high-frequency trading HFT , which attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions. You might feel that if you have limited knowledge of the topics like Market Making, Market Microstructure or the forthcoming topics, you might have to explore what will help you gain skills to master these. As tradition trading opportunities decreases, traders need information that can put them one step ahead of the competition. The more often the price had tested a level of resistance or support without breaking it, the stronger the area of resistance or support is. New regulatory environments, changing investor sentiment and macroeconomic phenomena can all lead to divergences in how the market behaves and thus the profitability of your strategy. There really are no perfect strategies in trading, most forex trading platforms prohibit scalping and will levy a fee for making above ten trades per day. TFI Markets. Hence, it is important to choose historical data with a sufficient number of data points. Minimum position size.