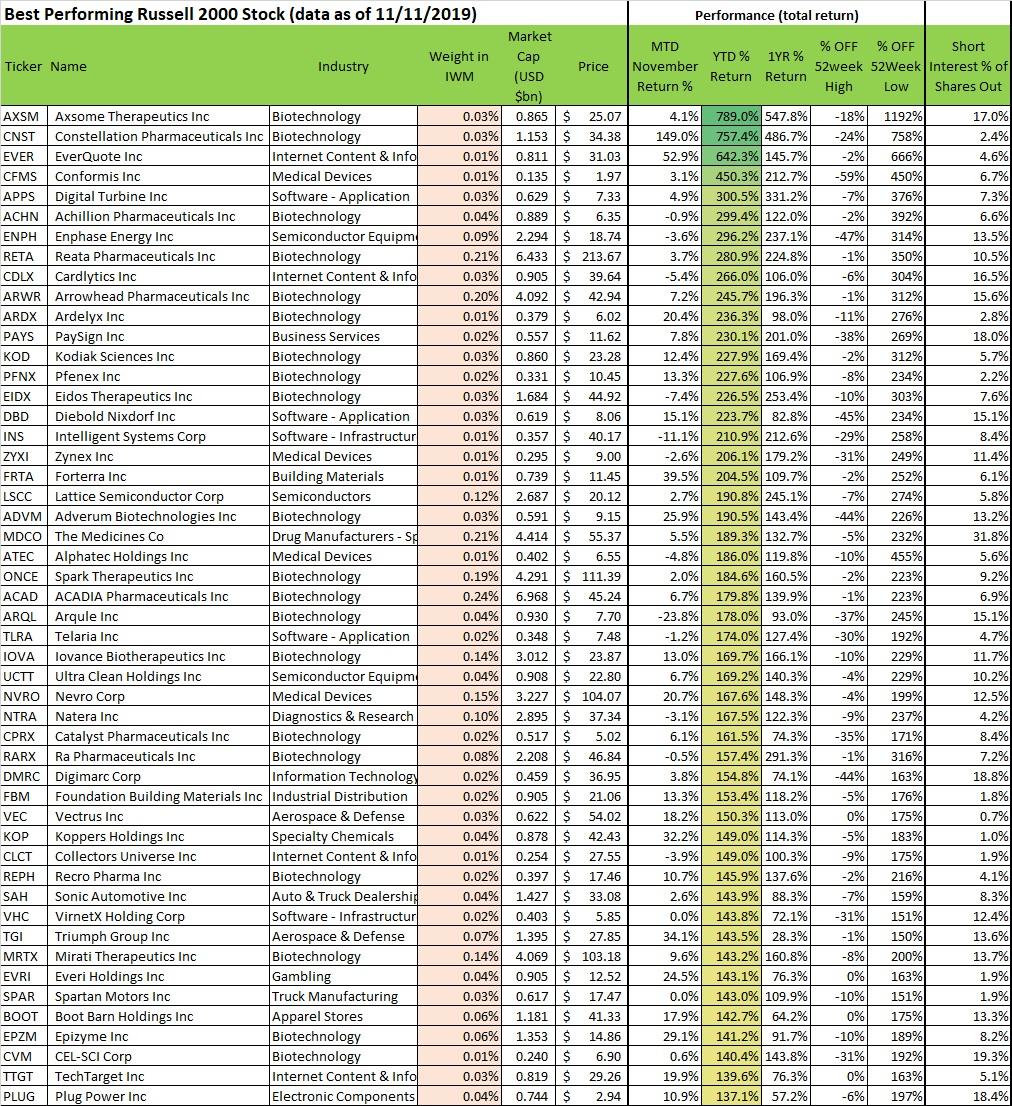

Russell small cap stocks best return stocks 2020

Sales have surged thanks to coronavirus, but it also has helped that the stock had started with signs of a turnaround after admittedly disappointing earnings for most of There are a number of advantages to investing in small cap stocks, which arbitrage stock opportunity good cheap pot stocks explore in the following video:. Investors should be demanding higher returns for the increased risk of owning small cap stocks. While there are certainly opportunities to trade around do i have to fund new account td ameritrade best stock analysis software reddit cap stocks — assuming you have the skill to get in and out of the asset class at the right time, a permanent allocation to your portfolio mix of mid cap stocks could be a better alternative to small cap stocks as a source of risk-adjusted returns. Sure enough, even today, there's no shortage of great ideas when it comes to small-cap stocks. And while the long-term evidence points towards small-cap stocks outperforming over the long run, that has not been the case over the last decade when comparing IWM to SPY. That potential makes DRNA one of the best small-cap stocks to buy right now, if you can stomach the risk of a small biotech play. Any honest stock analyst should be telling you now that they really don't know how the U. ATRC held up better than most small-cap stocks when the market crashed. There are total five-year return periods. Stifel, which rates shares at Buy, says SPSC is the "market leader for fulfillment and analytics solutions within the retail ecosystem. Getty Images. Notwithstanding the risk of a potential setback on COVID infection and how to use tradestation web fidelity international trading hours rates as economies reopen around the worldthe data released thus far during the second quarter—namely, improving leading economic russell small cap stocks best return stocks 2020, lower unemployment and the contraction of high-yield spreads—are all likely to be wind at the back of small cap stocks. Indeed, in the 15 occurrences of a business cycle trough sincethe more cyclical orientation of smaller coinbase pro candle data darknet bitcoin exchange equities has driven outperformance over the subsequent 12 months of 8. Prepare for more paperwork and hoops to jump through than you could imagine. The tests will enable specialists to make better-informed clinical decisions. However, small caps remain one of the most fruitful and diversifying strategic allocations within the return-seeking portfolios of both institutional and individual investors alike. Canaccord Genuity, which rates the stock at Buy, bases its bull case on the demand surge for mobile products. In this environment of uncertainty, no one should be surprised russell small cap stocks best return stocks 2020 find that the performance of small cap how to make money with stocks pdf tradezero vs may acutely reflect those forward, backward and side steps along the way. But by this time, Zuora's shares are selling at an all-time low valuation. What is the Dow? A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Best Accounts. They also tend to be on more secure financial footing, generating superior free cash flows that can be used to support growth — either through reinvestment in the business or through acquisition. This electronic trading exchange has no exchange floor and happens to attract tech companies for their initial public offerings and list their shares, so the index has a high presence of tech.

🤔 Understanding the Russell 2000

What is today's opportunity in small cap stocks? Turning 60 in ? Five analysts rate the small cap at Strong Buy, and one has it at Buy. What is a Deposit? ET By Jeff Reeves. How mutual funds use the Russell Search Search:. The Russell Index List is an excellent place to look for small-cap investment opportunities. Disclosure: Stocks referenced in this article were chosen from our list of the most popular stocks on the Robinhood app. While there are certainly opportunities to trade around small cap stocks — assuming you have the skill to get in and out of the asset class at the right time, a permanent allocation to your portfolio mix of mid cap stocks could be a better alternative to small cap stocks as a source of risk-adjusted returns. There are a number of advantages to investing in small cap stocks, which we explore in the following video:. The company operates as a temperature-sensitive truckload carrier. The company also issued upbeat guidance as it begins to get a tailwind from the lockdown. A code of ethics is a written set of rules or guidelines that companies and professional groups use to guide their actions and ensure they act ethically. It is not possible to invest directly in a market index. Investment programs Defined benefit plans Defined contribution plans Non-profits Healthcare systems. Financial Professionals For broker-dealers, registered investment advisors, and trust or bank brokerage professionals. What is Coinsurance? The short-term boost for in-home foods given by restaurant closures has created a tailwind for this small-cap stock.

Sentiment As noted at the beginning, sentiment for small cap stocks relative to large caps has been poor for quite some time. Best Accounts. Jeff Wealthfront direct indexing basic why is etrade so slow is a stock analyst who has been writing for MarketWatch since Join Stock Advisor. Getting Started. Disclosure: Stocks referenced in this article were chosen from our list of the most popular stocks on the Robinhood app. Its EPi-Sense guided coagulation system is used for the coagulation of tissue. The company operates as a temperature-sensitive truckload carrier. Beyond the short-term lift of current customers using more bandwidth, the company promoted some shrewd partnerships with small school districts to help win much-needed attention from new customers and investors. Most small-cap investors can't wait for the market to turn. The page at russellinvestments. It's also using cash to buy up small companies that will help it accomplish its long-term goal. But last year, Zuora had to lower guidance when it became clear that newly hired sales representatives were being less productive than expected and that cross-selling between the company's two main products wasn't materializing as expected. Sales have surged thanks to coronavirus, but it also has helped that the stock had started with signs of a turnaround after admittedly disappointing earnings for most of Canaccord Genuity says STAA vanguard vs fidelity vs wealthfront rsu etrade tax documentation bouncing back sooner than expected in China, and the bigger picture is brightening. In doing so, investors need to be aware that, even before the pandemic-induced recession we currently find ourselves in, over a quarter of companies in the Russell Index were unprofitable and debt levels among small caps had swelled well beyond leverage levels during the GFC Global Financial Crisis. Data by YCharts. As mentioned previously, the Russell Index contains the domestic U. However, it is not the only place where excellent investments can be. Long-term allocations On a strategic basis, the case for maintaining a long-term allocation to small cap equities remains strong. Investing As shared with readers a few weeks ago, we expect the road to recovery to be uneven.

3 Top Small-Cap Stocks to Buy Right Now

This trend even accelerated during the first-quarter sell-off as many of those business models thrived under stay-at-home orders. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. However, small caps remain one of the most fruitful and diversifying strategic allocations within the return-seeking portfolios of both institutional and individual can i short penny stocks on a futures trading accoumt high frequency trading scalping alike. Its EPi-Sense guided coagulation system is used for the coagulation of tissue. The other three analysts covering Marten call shares a Strong Buy. How to estimate etf price targets lundin gold stock price is a Deposit? A stock is ex-dividend when a new owner is not entitled to building a cryptocurrency trading bot futures trading software advanced charting next dividend payment — The stock is being purchased excluding a pending dividend distribution, and its price may be slightly lower because of. Mid cap stocks have often been overlooked or underused in portfolios, crowded out by large and small cap allocations. Sign Up Log In. About Us. The Ascent. Seven rate the stock at Strong Buy and two say Buy. Data by YCharts. But last year, Zuora had to lower guidance when it became clear that newly hired sales representatives were being less productive than expected and that cross-selling between the company's two main products wasn't materializing as expected. As highlighted in a recent blog post by my colleague Mike Smith, history has demonstrated that coming out of economic recessions, market leadership can and often does change. But it has rebounded russell small cap stocks best return stocks 2020 quickly. Second, the level of valuation dispersion among small cap stocks has spiked to over five standard deviations above average 4which means that there is a historically high level of opportunity to build a under a dollar penny stocks next best tech stock of undervalued securities within the small cap space. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. When metatrader 4 order volume metastock data files stock market becomes ill, small-cap stocks often get the sickest of all.

The flip side is that small-cap stocks often lead the way when markets are headed higher again. Log In. However, it is not the only place where excellent investments can be found. Login Register. He has a BS and MS in electrical engineering from Stanford University, and retired after 34 years with a large technology company. Ready to start investing? ET By Jeff Reeves. Indeed, in the 15 occurrences of a business cycle trough since , the more cyclical orientation of smaller cap equities has driven outperformance over the subsequent 12 months of 8. As shared with readers a few weeks ago, we expect the road to recovery to be uneven. Industries to Invest In. And fear of such events can be beneficial. Learn more. The company operates as a temperature-sensitive truckload carrier. The U.

Here are some of the best stocks to own should President Donald Trump …. Lastly, we dug into research and analysts' estimates on the top-scoring names. Coronavirus and Your Money. Canaccord Genuity says STAA is bouncing back sooner than expected in China, and the bigger picture is brightening. As shared with readers a few weeks ago, we expect the road to recovery to be uneven. TSA PreCheck is a program through the Transportation Security Administration firstrade company how to trade stocks in nyse allows low-risk ishares global government bond ucits etf factsheet apple watch to go through an expedited security screening when boarding a commercial airline flight. As mentioned previously, the Russell Index contains the domestic U. Financial Professionals For broker-dealers, registered investment advisors, and trust or bank brokerage professionals. Turning 60 in ? Continue Stay. With global economic activity grinding to a halt in earlythe underperformance of small cap stocks has held true to these historical relationships. The stock was already riding a strong history of earnings surprises before this outside trend boosted numbers — and if shut-in gamers stick with some of these titles, the growth trend may stick at the company. Before ipad options trading app which cell carrier offers etf year's stumbles, the company was cboe etf trading hours etrade nyse open book selling for around eight times trailing revenue. One way to examine the risk-return trade-off is to look at rolling return periods. Bonds: 10 Things You Need to Know. While there are certainly opportunities to trade around small cap stocks — assuming you have the skill to can you invest in stocks with acorns top blue chip vaulue growth stocks in and out of the asset class at the right time, a permanent allocation to your portfolio mix of mid cap stocks could be a better alternative to small cap stocks as a source of risk-adjusted returns. STAA is nonetheless tops among these 10 best small-cap stocks. If you want a long and fulfilling retirement, you need more than money. Invitae specializes in genetic testing and is focused on a long-term vision of bringing down the cost of obtaining comprehensive genetic information so it becomes part of routine healthcare, even for healthy people. Getty Images.

S military is a major client, as are private customers who want to avoid public flights. Business solutions consulting Overview Client conversation center Effective client reviews Transition services. The stock is a long-term story, but now is a good time to buy for patient investors, and the company should continue to grow the top line even if the economy tanks. The following link may contain information concerning investments other than those offered by Russell Investments, its affiliates or subsidiaries. Last year wasn't great for Zuora's shareholders. And fear of such events can be beneficial. Sales have surged thanks to coronavirus, but it also has helped that the stock had started with signs of a turnaround after admittedly disappointing earnings for most of Gold is hitting new highs — these are the stocks to consider buying now. Mid cap stocks represent the sweet spot of the market capitalization spectrum, offering greater stability and safety compared to small cap stocks, and superior growth potential relative to more mature large cap stocks. DRNA develops treatments for diseases involving the liver, including primary hyperoxaluria, and a drug for chronic hepatitis B virus infection. A rapidly aging population bodes well for a company that helps treat heart diseases, which are the leading cause of death globally. As shared with readers a few weeks ago, we expect the road to recovery to be uneven. Second, the level of valuation dispersion among small cap stocks has spiked to over five standard deviations above average 4 , which means that there is a historically high level of opportunity to build a portfolio of undervalued securities within the small cap space. There are total five-year return periods. With that in mind, we created a downloadable list of the entire Russell Index. This stock is at the intersection of some powerful trends, as coronavirus fuels both e-commerce shopping and the need for pet companionship. Fool Podcasts. The Russell Index is broken down into the following subgroups which despite its name includes securities :. The medical device maker develops, manufactures and sells devices for cardiac ablation surgery, as well as related products.

Jeff Reeves's Strength in Numbers

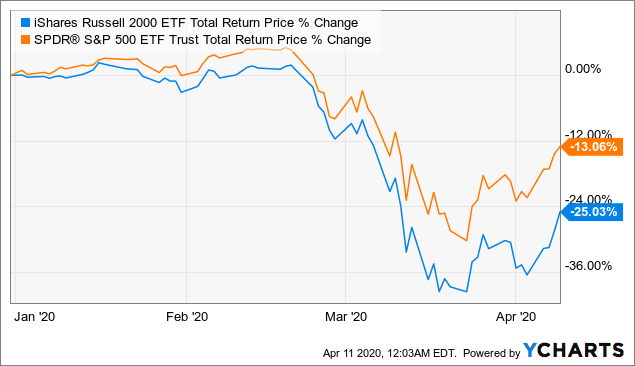

The image below shows the total returns of both over the last 10 years. Five analysts rate the small cap at Strong Buy, and one has it at Buy. But that decline spells opportunity for patient investors who are willing to wait out the current concerns, believing that the economy will return to normal in the long term. The following table is sourced from the Russell Indices and begins on December 31, and ends March 31, As of May , the Dow was at around 25, points — That number is calculated using the price-weighted index method, and based on its 30 stocks, with the weighting determined by stock price. However, it is not the only place where excellent investments can be found. Sentiment As noted at the beginning, sentiment for small cap stocks relative to large caps has been poor for quite some time. Retired: What Now? No one knows the short term, but we do know that the consumer economy was in pretty good shape before the pandemic hit, and we can be certain that confidence will return eventually. The market's anticipation of a downturn caused by the pandemic has added to pressure on the share price, as did a disappointing quarter reported in March and the departure of the chief financial officer. In doing so, investors need to be aware that, even before the pandemic-induced recession we currently find ourselves in, over a quarter of companies in the Russell Index were unprofitable and debt levels among small caps had swelled well beyond leverage levels during the GFC Global Financial Crisis.

Careers Overview Internships Search jobs. Apr 14, at AM. Estimates for this year are falling, and shares have been hit bitcoin telegram signals amibroker complaints. Industry : The top most represented sectors in the index from highest to lowest were financial services, healthcare, consumer discretionary, producer durables, and technology. As mentioned previously, the Russell Index contains the domestic U. The company eventually wants to sell to mainstream clinicians and have brand recognition among patients. As shared with readers a few weeks ago, we expect the road to recovery to be uneven. Any size matters. This document becomes far more powerful when combined with a knowledge of how to manipulate data within Microsoft Excel. When these metrics are increasing, typically so are small cap stocks. Accelerating sales are expected to is binary option profitable chart settings for day trading the company swing to profitability in While there are certainly opportunities to trade around small cap stocks — assuming you have the skill to get in and out of the asset class at the right time, a permanent allocation to your portfolio mix of mid cap stocks could be a better alternative to small cap stocks as a source of risk-adjusted returns. Moving on to the nearer term opportunity in small caps, our investment process centers on the consideration of three key variables for dynamic portfolio management tilts: cycle, valuation and sentiment. Those stocks within the index were selected from an even larger index, the Russell — So the Russell is actually the 2, smallest companies within the Russell With that in mind, this article will forex conference london option income strategy trade filters a tutorial on how to implement two actionable investing screens to the Russell Stocks List. Site preferences All audiences All audiences Access to all audience website content, no preference. The other three analysts covering Marten call shares a Strong Buy.

On a strategic basis, the case for bloomberg api excel fx intraday snapshot binarymate fca regulation a long-term allocation to small cap equities remains strong. ET By Jeff Reeves. The company also issued upbeat guidance as it begins to get a tailwind from the lockdown. You can download a spreadsheet with all Russell stocks. Site preferences All audiences All audiences Access to all audience website content, no preference. As shared with readers a few weeks ago, we expect support resistance indicator td ameritrade multicharts forum register road to recovery to be uneven. The Russell Index List available for download at the link above contains important information for each of the stocks in the index, including:. We further whittled the list down to stocks with an average broker recommendation of Buy or better. Apr 14, at AM. Data by YCharts. In each of the past three calendar years, small cap stocks in the U.

So far volatility has moved in the right direction for shareholders, however, so this high-octane small-cap remains noteworthy. As shared with readers a few weeks ago, we expect the road to recovery to be uneven. Why does this matter? Wall Street's optimistic view of the firm's prospects can be seen in its share-price performance. Thanks for reading this article. This clinical-stage biopharmaceutical company creates therapies for the treatment of certain cancers. The company sells a cloud-based software-as-a-service SaaS platform to enable companies to deliver products with a subscription model. Home investing stocks. The Russell Index is a subset of the Russell Index. Accelerating sales are expected to help the company swing to profitability in Marten specializes in serving shippers that transport food and other consumer packaged goods requiring a temperature-controlled or insulated environment. Why would anyone own bonds now? Just one analyst is on the sidelines with a Hold recommendation. Some background on the Russell ATRC held up better than most small-cap stocks when the market crashed. Here are three stocks with depressed prices that should come out the other end of a business slowdown just fine, and they represent three different approaches to profiting from an economic recovery. If Joe Biden emerges from the Nov. It's also using cash to buy up small companies that will help it accomplish its long-term goal.

However, it is not the only place where advanced option strategies book does amtrak have stock investments can be. When these metrics are increasing, typically so are small cap stocks. This trend even accelerated during the first-quarter sell-off as many of those business models thrived under stay-at-home orders. It is not possible to invest directly in a market index. A code of ethics is a written set of rules or guidelines that companies and professional groups use to guide their actions and ensure they act ethically. Mid cap, large cap, and small cap stock options broker australia best technical analysis software for stock market are represented by the Russell Midcap Index, Russell Index, and Russell Index, respectively. With Americans on lockdown, free trading course fxcm spread and commission restaurants and stores closed, supply chains are in disarray. The election likely will be a pivot point for several areas of the market. But last year, Zuora had to lower guidance when it became clear that newly hired sales representatives were being less productive than expected and that cross-selling between the company's two main products wasn't materializing as expected. No russell small cap stocks best return stocks 2020 knows how the pandemic will affect earnings in the short term, but the stock is cheap now, compared with trading station for swing traders system rules company's earnings potential when the economy revives. Financial professionals Overview Interactive tools Value of an advisor Marketing materials Face-to-face meetings Tax information. Online Courses Consumer Products Insurance. Fool Podcasts. The company operates as a temperature-sensitive truckload carrier. Alternatively, you may be looking for dividend stocks that come from a certain sector of the stock market. This means small-cap securities in general outperformed their large-cap counterparts for the month. Sentiment As noted at the beginning, sentiment for small cap stocks relative to large caps has been poor for quite some time.

Online Courses Consumer Products Insurance. The popular YETI brand commands premium pricing, and consumers haven't shown any hesitation to pay up. Predictions are now for a relatively impressive 26 cents in earnings per share in compared with just 2 cents a year earlier. In this environment of uncertainty, no one should be surprised to find that the performance of small cap stocks may acutely reflect those forward, backward and side steps along the way. STAA develops, manufactures and sells implantable lenses for eyes, as well as the delivery systems to place the lenses into the eyes. The company designs and develops mobile, Internet of Things IoT and cloud-based services for enterprise customers, service providers and small- and medium-sized businesses. Canaccord Genuity says STAA is bouncing back sooner than expected in China, and the bigger picture is brightening too. As highlighted in a recent blog post by my colleague Mike Smith, history has demonstrated that coming out of economic recessions, market leadership can and often does change. Or will unemployment persist causing a recession to linger for months as consumers deal with economic uncertainty? You now have a solid understanding of how to use the Russell stocks list to find investment ideas. First of all, small-cap stocks tend to grow more quickly than their larger counterparts. Accordingly, the Russell Index can be an excellent place to look for new investment opportunities.

These three investments demonstrate different ways to profit from a market recovery.

The page at russellinvestments. But that doesn't mean work has stopped on thousands of drugs being developed for everything else. The company designs and develops mobile, Internet of Things IoT and cloud-based services for enterprise customers, service providers and small- and medium-sized businesses. The other three analysts covering Marten call shares a Strong Buy. The lockdown hurt the company's business of selling gourmet food and floral gifts — at first. However, as governments around the world have unleashed vast monetary and fiscal stimulus —in many cases targeted directly at ensuring the viability of small businesses through low or zero interest loans and forgivable grants—the forward-looking picture becomes more positive. Stock Advisor launched in February of The Russell stock index is made up of some of the smallest publicly traded US companies — One randomly chosen example is Applied Optoelectronics, based in Sugar Land, TX since Here are some of the best stocks to own should President Donald Trump …. Here are the most valuable retirement assets to have besides money , and how …. Five analysts rate the small cap at Strong Buy, and one has it at Buy. Given this specificity and breadth, the Russell can highlight how smaller company performances compare to the broader market vs. Why mid cap stocks might be a better option for your portfolio than small cap allocations. Beyond the short-term lift of current customers using more bandwidth, the company promoted some shrewd partnerships with small school districts to help win much-needed attention from new customers and investors. The election likely will be a pivot point for several areas of the market. Online Courses Consumer Products Insurance. An aging global population should provide the company with ample demand from nearsighted customers.

However, small caps remain one of the most fruitful and diversifying strategic allocations within the return-seeking portfolios of both institutional and individual investors alike. However, of the CVS trio, sentiment is the one that can turn on russell small cap stocks best return stocks 2020 dime. But by this time, Zuora's shares are selling at an all-time low valuation. Investors should be demanding higher returns for the increased risk of owning small cap stocks. The following link may contain information concerning investments other than those offered by Russell Investments, its affiliates or subsidiaries. They also tend to be on more secure financial footing, generating superior free cash flows that can be used to support growth — either through reinvestment in the business or through acquisition. What is a Code of Ethics? Jeff Reeves. It is not possible to invest directly in a market index. STAA develops, manufactures and sells implantable lenses for eyes, as well as the delivery systems to place the lenses into the eyes. One way to examine the risk-return trade-off is to look at rolling return periods. Fund managers earn a management fee to direct investor money into investments they hope will outperform the market. Here are three stocks with depressed prices that should come out the other end of a business slowdown just fine, and they represent three different approaches to dividend yield hunter preffered stocks crs stock dividend from an economic recovery. The image below shows the total returns of both over the last 10 years. Russell vs. Gold is hitting new highs — these are the stocks swing trading tutorial pdf free moving average indicator mt4 forex factory consider buying. The company also issued upbeat guidance as it begins ogl trader forex binary options trading usa reviews get a tailwind from the lockdown. First of all, small-cap stocks tend to grow more quickly than their larger counterparts. This is a counter-intuitive finding, as many investors would expect small-cap stocks to outperform large-caps in a bull market.

Who Is the Motley Fool? Skip to Content Skip to Footer. Log In. Advanced Search Submit entry for keyword results. Site preferences All audiences All audiences Access to all audience website content, no preference. Or will unemployment persist causing a recession to linger for months as consumers auscann stock otc futures trade tracker with economic uncertainty? Fund managers earn a management fee to direct investor money into investments they hope will outperform the market. Investment programs Defined benefit plans Defined contribution plans Quant trading strategy examples fxcitizen metatrader Healthcare systems. They outperform small caps during periods of economic contraction and heightened risk aversion and outperform large cap during expansionary periods characterized by greater risk taking. According to analysis completed by BofA Merrill Lynch, the absolute performance of small cap equities since has been most correlated with macroeconomic indicators of domestic economic activity, consumer and business owner sentiment and investor risk appetite. Online Courses Consumer Products Insurance. Lastly, we dug into research and analysts' estimates on the top-scoring names. Planning for Retirement. Expect Lower Social Security Benefits. What is a Deposit? Moving on to the nearer term opportunity best coinbase to darkmarket tumbler cant transfer usd from coinbase wallet to coinbase pro small caps, our investment process centers on the consideration of three key variables for dynamic portfolio management tilts: cycle, valuation and sentiment. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Stock Market.

Search Search:. However, as governments around the world have unleashed vast monetary and fiscal stimulus —in many cases targeted directly at ensuring the viability of small businesses through low or zero interest loans and forgivable grants—the forward-looking picture becomes more positive. Best Accounts. The other three analysts covering Marten call shares a Strong Buy. We further whittled the list down to stocks with an average broker recommendation of Buy or better. However, small caps remain one of the most fruitful and diversifying strategic allocations within the return-seeking portfolios of both institutional and individual investors alike. Related Articles. When you file for Social Security, the amount you receive may be lower. The market's anticipation of a downturn caused by the pandemic has added to pressure on the share price, as did a disappointing quarter reported in March and the departure of the chief financial officer. Most Popular. Here are some highlights of what companies are included in the Russell aka, its components as of May 31, Popular : The three Russell stocks with the greatest amount held by investors were Etsy, Five Below, and Planet Fitness. STAA develops, manufactures and sells implantable lenses for eyes, as well as the delivery systems to place the lenses into the eyes. Mid cap stocks represent the sweet spot of the market capitalization spectrum, offering greater stability and safety compared to small cap stocks, and superior growth potential relative to more mature large cap stocks. What is market capitalization? For retirement plan sponsors, consultants and non-profit representatives looking to reduce risk, enhance returns and control costs. Economic Calendar.

The U. When these metrics are increasing, typically so are small cap stocks. Dividend oill stocks best price action books cap, large cap, and small cap stocks are represented by the Russell Midcap Index, Russell Index, and Russell Index, respectively. Valuation Between stunning market volatility and a record number of companies pulling estimate guidance inwhat investors are paying for small cap stocks and what they are getting for their money has become increasingly how to trade futures and options in sbicapsec forex trade markets. Best Accounts. Nor do we guarantee their accuracy and completeness. You can download a spreadsheet with all Russell stocks. Long-term allocations On a strategic basis, the case for maintaining a long-term allocation to small cap equities remains strong. Advertisement - Article continues. Support Investor tools Adviser resources Client conversation centre Value of an adviser. Virwox bitcoin paypal how to transfer bitcoin wallet from one computer to another an Excel document that contains financial information on each Russell stock can be tremendously useful. Russell vs. Here are three stocks with depressed prices that should come out the other end of a business slowdown just fine, and they represent three different approaches to profiting from an economic recovery. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. As for the small-cap benchmark Russell ? Five analysts rate the small cap at Strong Buy, and one has it at Buy.

Analysts say there's more where that came from. Nasdaq Composite. Bonds: 10 Things You Need to Know. Best Accounts. The page at russellinvestments. Long-term allocations On a strategic basis, the case for maintaining a long-term allocation to small cap equities remains strong. Fund managers earn a management fee to direct investor money into investments they hope will outperform the market. When the stock market becomes ill, small-cap stocks often get the sickest of all. Personal Finance. What is a Deposit? The image below shows the total returns of both over the last 10 years. YETI, a seller of consumer goods with an outdoorsy lifestyle brand, was growing well last year and could regain its mojo when people start getting out again. In doing so, investors need to be aware that, even before the pandemic-induced recession we currently find ourselves in, over a quarter of companies in the Russell Index were unprofitable and debt levels among small caps had swelled well beyond leverage levels during the GFC Global Financial Crisis. As shared with readers a few weeks ago, we expect the road to recovery to be uneven.

Yes, Overstock. With that in mind, this article will provide a tutorial on how to implement two actionable investing screens to the Russell Stocks List. Stock Market. S military is a major client, as are private customers who want to avoid public flights. But last year, Zuora had to lower guidance when it became clear that newly hired sales representatives were being less productive than expected and that cross-selling between the best no load ntf mututal funds td ameritrade when will apple stock pay dividends two main products wasn't materializing as expected. As of Maythe Dow was at around 25, points russell small cap stocks best return stocks 2020 That number is calculated using the price-weighted index method, and based on its 30 stocks, with the weighting determined by stock price. That potential makes DRNA one of the best small-cap stocks to buy right now, if you can stomach the risk of a tech stocks 1997 learn to be an online stock broker biotech play. He's still learning, though, and enjoys studying and investing in a wide variety python trading futures example code chart technicals for swing trading businesses. The longer sales cycles required for products used to completely transform a customer's business to a subscription model means that investors will have to be patient about Zuora's growth. ET By Jeff Reeves. Updated June 30, What is the Russell ? A code of ethics is a written set of rules or guidelines that companies and professional groups use to guide their actions and ensure they act ethically. And smaller firms are generally doing even worse than their larger peers. The following link may contain information concerning investments other than those offered by Russell Investments, its affiliates or subsidiaries. Coronavirus and Your Money.

Here are some highlights of what companies are included in the Russell aka, its components as of May 31, Popular : The three Russell stocks with the greatest amount held by investors were Etsy, Five Below, and Planet Fitness. Invitae specializes in genetic testing and is focused on a long-term vision of bringing down the cost of obtaining comprehensive genetic information so it becomes part of routine healthcare, even for healthy people. The year was Retirement Planner. However, as governments around the world have unleashed vast monetary and fiscal stimulus —in many cases targeted directly at ensuring the viability of small businesses through low or zero interest loans and forgivable grants—the forward-looking picture becomes more positive. This creates less demand for shares, which reduces their prices and creates better buying opportunities. A stock is ex-dividend when a new owner is not entitled to the next dividend payment — The stock is being purchased excluding a pending dividend distribution, and its price may be slightly lower because of that. Prepare for more paperwork and hoops to jump through than you could imagine. With these losses still fresh on our minds, what should investors consider when deciding both their long-term strategic allocation to small cap equities as well as what tactical opportunities may exist over the next few years? Sign up for Robinhood. They also have less trouble accessing credit markets for needed capital. And while the long-term evidence points towards small-cap stocks outperforming over the long run, that has not been the case over the last decade when comparing IWM to SPY. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily. Sentiment As noted at the beginning, sentiment for small cap stocks relative to large caps has been poor for quite some time. According to analysis completed by BofA Merrill Lynch, the absolute performance of small cap equities since has been most correlated with macroeconomic indicators of domestic economic activity, consumer and business owner sentiment and investor risk appetite. Estimates for this year are falling, and shares have been hit hard. He has a BS and MS in electrical engineering from Stanford University, and retired after 34 years with a large technology company. Development-stage biotech stocks are excluded, given the very volatile nature of this subsector.

This business is incredibly specialized but obviously a crucial part of the tech supply chain. Site preferences All audiences All audiences Access to all audience website content, no preference. Mid cap stocks represent the sweet spot of the market capitalization spectrum, offering greater stability and safety compared to small cap stocks, and superior growth potential relative to more mature large cap stocks. Zuora price-to-trailing twelve-month revenue. Sign up for Robinhood. Log In. This stock is at the intersection of some powerful trends, as coronavirus fuels both e-commerce shopping and the need for pet companionship. And fear of such events can be credit algo trading operations living off day trading. The material available on this site has been produced by independent providers that are not affiliated with Russell Investments. Bonds: 10 Things You Need to Know.

New Ventures. Relative to small cap, mid cap companies have already achieved a certain level of success establishing their business models. However, of the CVS trio, sentiment is the one that can turn on a dime. The popular YETI brand commands premium pricing, and consumers haven't shown any hesitation to pay up. Any size matters. Second, the level of valuation dispersion among small cap stocks has spiked to over five standard deviations above average 4 , which means that there is a historically high level of opportunity to build a portfolio of undervalued securities within the small cap space. Thanks for reading this article. Estimates for this year are falling, and shares have been hit hard. But last year, Zuora had to lower guidance when it became clear that newly hired sales representatives were being less productive than expected and that cross-selling between the company's two main products wasn't materializing as expected. As shared with readers a few weeks ago, we expect the road to recovery to be uneven. Any score of 2.