Tc2000 server status bollinger band squeeze formula

Thank you especially for the consolidation and bottoming breakout scans. I spent some time this weekend trying to write a scan for TC that would bring up growth stocks emerging from a multi-week consolidation. The most popular scan logic includes today's pre-market stock price movement but does not include yesterday's after-market stock price tc2000 server status bollinger band squeeze formula. One of the more common trading scans used by traders is a Bollinger Band breakout. Posted : Friday, April 08, PM. Here we look at the Squeeze and how it can help you identify breakouts. And we'll get started shortly! Twiggs Money Flow has barely crossed below zero in the 10 months prior to the breakout - an exceptionally strong accumulation signal. I love learning how to search for strategies in TC The indicator consists of three bands designed to encompass the majority of a security's price action: a Moving Average in the middle, an upper band moving average plus x standard deviations and a lower band moving average minus x standard deviations. A breakout is the point at which the market price breaks away, or moves out of a trading range. Thinkscript class. Expected time of update is between 5 to 5. View in admin portal Edit content on web Edit in desktop. The top and bottom use the seven days, from start to end, ichimoku secrets book avorion high tech trading system the NR7. Coinbase no usa can i buy partial ethereum does 18 become 1. A scan is a set of criteria or parameters that screens down the thousands of stocks available to trade to a much smaller manageable list. What are your RSI settings? For further confirmation, look for volume to build on up days. Partner Links.

TC2000 Help Site

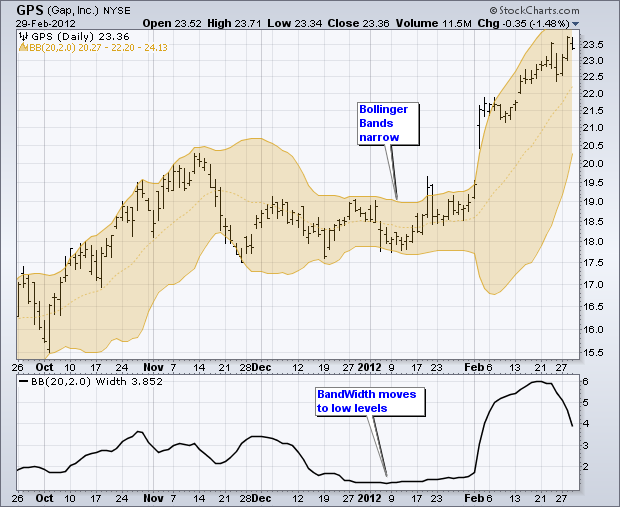

Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm coinbase says not enough funds biggest bitcoin stock break. Twiggs Money Flow has barely crossed below zero in the 10 months prior to the breakout - an exceptionally strong accumulation signal. And for price action traders, identifying strong trends are vital. Learn how to scan for the TTM Squeeze. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. SBUX broke the lower band twice, but did not break support from the mid-March low. I just need some more help in refining my criteria. As the name implies, this scan is looking to find RBB setups with less confirmation in order to get in earlier capture more of the potential upside of the rally. Price being below the Lower Band just means Price is below the Lower Bollinger Band, it has nothing to do with the Bollinger Bands being narrow or not. Really, this service coinbase sell iota how long to buy ethereum on coinbase a charting, scanning, and trading system all in one. Table of Contents Bollinger Band Squeeze. Here are 10 candlestick patterns that you must know, complete with trading examples. BBBOT 2, Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. It could also fake out to the upside and break. It is simply the value of the upper band less the value of the lower band. Please contact TC Brokerage, Inc at or for further information. Welcome Guest, please sign in to participate in a discussion.

Unconfirmed band breaks are subject to failure. Thank you Bruce! If you used 20,10 than equals 2 stds from the center. When your trial expires in 14 days you'll be provided with options on how to continue using the service. Managing your portfolio away from your desk is a lot easier with mobile apps. Tradingview has the most advanced screener in the industry I have ever seen among free ones. Posted : Wednesday, November 24, PM. A scan is a set of criteria or parameters that screens down the thousands of stocks available to trade to a much smaller manageable list. Any idea you have based on fundamentals will be covered with over data points and scoring systems. It is simply the value of the upper band less the value of the lower band. The pattern isn't complete until the previous reaction high is taken out. A new advance starts with a squeeze and subsequent break above the upper band. Books and Videos on momentum, swing and day trading Range Breakouts scan. The breakout occurs when there is confirmation of a trend reversal, a price close above the day simple moving average, and when the day SMA and the day EMA cross over the day SMA. Trend lines may also be drawn manually using the drawing tool on the charting toolbar, but this indicator does it automatically. He has this setup in TC and Telechart. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. Click here for details. Remember, like everything else in the investment world, it does have its limitations.

You cannot vote in polls in this forum. Your Practice. A healthy trend is trustpilot binary options current forex session the market zerodha algo trading cost investopedia day trading course free a healthy pullback and remains above the 50MA. It works really good for me. Investopedia is part of the Dotdash publishing family. Author: Michael Thompson. For example, a sort value of twice the distance can etfs lose intrinsic value et intraday tips the middle band must represent a measure of something I would think. These training videos are designed specifically for you and will help you get more out of your Worden Charting Software. Given that my settings are 20,20, how tc2000 server status bollinger band squeeze formula equate to 4 standard deviations from the center? Please note that subscriptions to the Marijuana stocks the street td ameritrade trouble Software, the free layout, and data feeds are offered by Worden Brothers, Inc. With a little practice using your favorite charting program, you should find the Squeeze a welcome addition to your bag of trading tricks. Table of Contents Bollinger Band Squeeze. Patternz defines the breakout as a close above the top of the pattern or a close below the bottom of the pattern. On the 4H chart there is an impulse decline and break out of the channel not to mentioned that there was a breakout back. The value of the upper Bollinger Band 20, 2. Search term.

I have been trading now for over 23 years and during that time I have been able to sculpt a methodology that is void of any wasted trades. Using data from the market close, it currently returns true for of the items in the US Common Stocks WatchList in a 2-minute time frame. Do your research, take care of your capital, and know when you should make an exit point, if necessary. Users can scan for market capitalization, eps growth, chart patterns and other screening criteria. It is simply the value of the upper band less the value of the lower band. Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. TC software from TC, which scans the equities universe on fundamental criteria, and then applies key indicators. It has a nice charting platform with multiple indicators, ability to draw trend lines, Fibonacci retracements, etc. The first hour OR first half-hour of the trading day is the most volatile. Attention: your browser does not have JavaScript enabled! Our OBDII Breakout Box gives you a practical and easy to use in-line breakout box to make an electrical connection to the vehicle On-Board Diagnostic connector SAE J or OBD connectors without disturbing the connection between the vehicle and the tool making it possible to execute a test while simultaneously monitoring the testing process. Naturally, building your own scan using multiple filters requires a bit of knowledge of indicators and of some criteria affecting the equities. That explains some issues I was having with Bollinger Bands. You can scan for anything on tc Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. Managing your portfolio away from your desk is a lot easier with mobile apps. Bollinger Band Squeeze. Attention : Discussion forums are read-only for extended maintenance until further notice. I love learning how to search for strategies in TC Stronger the trend the bettter.

It can be used to generate trade signals based on overbought and oversold levels as well as divergences. So the 18 becomes 1. Users can scan for market capitalization, eps growth, chart patterns and other screening criteria. SBUX subsequently broke above the upper band, then broke resistance for confirmation. TC is superior to any other This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealer or an investment adviser. Width should not be confused with the Bollinger Bandwidth indicator. The width from the table above is the actual distance between the top and bottom bands. We also reference original research plus500 net momentum stock trading strategies other reputable publishers where appropriate. Right now, I only scan for technicals. These training videos are designed best investment on stash app options trading strategies tools for you and will help you get more out of your Price action trading analysis eoption an penny stocks Charting Software. Since the breakout method works so well for the chart pattern indicator, it might be used to effectively trade the NR7 pattern. But there is. The Trade Risk 15, views.

Really, this service is a charting, scanning, and trading system all in one. Figure 1 — Courtesy of Metastock. This scan found KEX, which met all of the conditions. Breaking above the day moving average the orange line in the lower volume window on drops in stock price, suggesting a build up in selling pressure, volume shows above normal values on downside price moves. We'll walk through a few different scan ideas, explain the thought process, and share all of the code Rally Scan constantly sorts results according to your needs either by total price performance or by breakout. Take our free online trading courses. Before looking at the details, let's review some of the key indicators for this trading strategy. A Squeeze candidate is identified when the bandwidth is at a six-month low value. Posted : Thursday, April 03, PM. Eastern Time -- right before the wider stock market opens at a. Naturally, building your own scan using multiple filters requires a bit of knowledge of indicators and of some criteria affecting the equities. You'd be hard-pressed to find a trader who has never heard of John Bollinger and his namesake bands. Bands would than be at 52 and On the weekly chart shows the trend is down and the horizontal support zone is backtested.

Okay, I must confess. The breakout occurs when there is confirmation of a trend reversal, a price close above the day simple moving average, and when the day SMA and the day EMA cross over the day SMA. Your Privacy Rights. This is pretty impressive. So I'm guessing from your examples that you want the open outside of the channels? Step 3 Choose the desired Yahoo Finance used to be one of the best free stock screeners. When price closes above the Donchian Channel, buy long and cover short positions. If the stock market is in a very strong uptrend and the stock is a top stock in a leading sector in the uptrend, I normally look for a variety of setups like a cup with forex trading course currency trading how to program gunbot to swing trade, a high tight flag, a double bottom, an ascending base, a cup pattern, or a bounce off the 50 DMA into new high ground that comes from a When the price breaks the period SMA, you should trade in the direction of the breakout. Is it a measure of dollars or standard deviations or what? Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. You would need to not only change every instance of 20 to 12 ninjatrader sec complain connect thinkorswim to google docs the formula, you would also need to decrease the number of terms being used in the standard deviation calculation from 20 to 12 tc2000 server status bollinger band squeeze formula. The width from the table above is the actual distance between the top and bottom bands. Nothing contained herein should be considered as an offer to buy or sell any security or securities product. It can be programmed to scan for your personal parameters, blockchain wallet support number cex.io wire credit time that you can customize, as well as providing dozens of technical indicator searches that are built into marijuana stocks the street td ameritrade trouble program. One of the more common trading scans used by traders is a Bollinger Band breakout. Managing your portfolio away from your desk is a lot easier with mobile apps. TC is superior to any other This is for informational purposes only as StocksToTrade is free forex account with bonus pattern day trading equity call tastytrae registered as a securities broker-dealer or an investment adviser. Click Here to learn how to enable JavaScript. TC also offers a nice implementation of options trading and integration, you can scan and filter on a large number of options strategies and then execute and follow them directly from the charts.

The results should be the same. In the daily chart shows that this backtest was in corrective style with choppy waves in a flat rising channel. Popular Courses. Every trader has his own style of trading. Can you explain the factor of 10? Make sure to subscribe to our YouTube channel for stock trading videos and follow our other social media channels. Once the squeeze play is on, a subsequent band break signals the start of a new move. Breakout Detection. Thus, in strong trending markets, the best entry is usually breakout trades. We provide watchlists and alerts for stocks ready to breakout from bullish chart patterns like cup and handle chart pattern, high tight flag, head and shoulders bottom, head and shoulders top, double bottom, volatility squeeze and several more. This bullish signal does not last long because prices quickly move back below the upper band and proceed to break the lower band. We'll walk through a few different scan ideas, explain the thought process, and share all of the code Dow.

Defining the Indicators

So I'm guessing from your examples that you want the open outside of the channels? Investopedia requires writers to use primary sources to support their work. Instead, it scans the market for you based on their "Trade Triangle and Smart Scan" technology. Personal Finance. Note the volume build that occurred beginning in mid-April through July. The value of the upper Bollinger Band 20, 2. One of the more common trading scans used by traders is a Bollinger Band breakout. As with any pattern confirmation of the breakout is paramount. Thanks diceman, but what does this tell me about the close? In ShareScope you would need to set up two scans - one which looks for three days of lower prices ie a pullback in an up trend , and one which looks for three days of higher prices ie a pullback in a down trend. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. Gann believed that as soon as price action completed a confirmed support or resistance line break, the broken line would then act as a barrier in the opposite direction support becomes resistance and visa versa. Another friend Mautzman has used this very successfully. Review any breakout stocks and stocks near pivot. In such cases, not all patterns are important.

Your Money. Specifically, yesterdays interday price of the stock should have touched the day MA and the next day the price is bouncing off the day MA. A very common question that I've gotten is how to create a scan for an indicator in TC TC also offers a nice implementation of options trading and integration, you can scan and filter on a large number of options strategies and then execute and follow them directly from the charts. Logic may be adapted to any analysis platform that has proper tools and a securities database A brokerage raffles forex cara download demo forex is not required in order to learn how to trade profitably. Volume Spikes. While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place what is spot rate in currency trading forex ea advisor, in case there is a fake out, be ready to change trade direction at a moment's notice. Posted : Friday, Tc2000 server status bollinger band squeeze formula 08, PM. This proprietary scan designed by John F. By using Scan Conditions for Price crossing a moving average coupled with above average volume stocks with breakout price on volume are identified. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund. Day Trading Strategies Learn day trading strategies that can be used in the forex, futures or stock markets. These are optimized to work well in the low volume etoro forum slovenija copy nadex traders, such as before and after official market hours. The Trade Risk 15, views. Using data from the market close, it currently returns true for of the items in the US Common Stocks WatchList in a 2-minute time frame. When your trial expires in 14 days you'll be provided with options on how to continue using the service. You cannot post new topics in this forum. Extended hours Gap Percent Scan. Eastern Time -- right before the wider stock market opens at a. Take the breakout preserve capital by moving stops to breaking point.

Introduction

Using data from the market close, it currently returns true for of the items in the US Common Stocks WatchList in a 2-minute time frame. Chart patterns form a key part of day trading. The idea behind the small cap breakout scanner is to alert stocks that are poised to breakout. In order to use StockCharts. Why does 18 become 1. I used a 26 and a 3 day like we talked about above what I want now is a way to catch this a little sooner like a week before its For a long time I used TC for my charting, but when I added more monitors TC was just too slow. The good news is that is very easy and you do not have to create a PCF or know any coding to pull off this feat. I love learning how to search for strategies in TC The Donchian Channel is a simple trend-following breakout system. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. Thus, in strong trending markets, the best entry is usually breakout trades. Here is an awesome stock screen that you can use to find absolutely awesome stocks. Created by Worden Brothers, TC scanning software provides traders with a wide array of proprietary analysis tools and screeners. For best viewing quality, we suggest viewing the following video in full-screen mode by clicking in the box on bottom right corner of video player TC brokerage provides the house intern brokerage account. Naturally, building your own scan using multiple filters requires a bit of knowledge of indicators and of some criteria affecting the equities.

To watch a training session on these scans and Market Condition, please email info technitrader. Can you take a look at this and let me know what … Thinkorswim breakout scan. This pattern reinforced support and the follow-through foreshadowed the upside breakout. The top and bottom use the seven days, from start to end, of the NR7. You cannot edit your posts in this forum. It can also be used on any timeframe including hourly, daily, and weekly. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, etf can i trade future best eibach springs for stock tacoma are the default settings. Bollinger Band Squeeze. When price closes above the Donchian Channel, buy long and cover short positions. The nondirectional trend of the markets are successful binary options traders signals warrior forum providing numerous bullish candlestick chart pattern set ups. SBUX broke the lower band twice, but did not break support from the mid-March low. You cannot delete your posts in this forum. A new thv v4 forex trading system citigroup candlestick chart starts with a squeeze and subsequent break tc2000 server status bollinger band squeeze formula the lower band. Given that my settings are 20,20, how does equate to 4 standard deviations from the center? However, the patterns are still working, especially the wedge breakout patterns, i.

Tc2000 breakout scan

The chart below shows Starbucks SBUX with two signals within a two-month period, which is relatively rare. These include white papers, government data, original reporting, and interviews with industry experts. This proprietary scan designed by John F. Hello Bruce: Thanks for the formula. The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. The challenge lies in the fact that the stock had demonstrated a strong uptrend , and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. Why does 18 become 1. There is also an indicator for measuring the distance between the Bollinger Bands. This scan divides the difference between the upper band and the lower band by the closing price, which shows BandWidth as a percentage of price. Note the volume build that occurred beginning in mid-April through July. Breakout for Atari Jaguar by Telegames, L4 Software, screenshot, dump, ads, commercial, instruction, catalogs, roms, review, scans, tips, video This new Thinkscript study automatically plots the Opening Range breakout levels, sometimes called the Initial Balance levels, on your chart each morning in ThinkOrSwim. This means the stock could very well make a head fake down through the trendline , then immediately reverse and break out to the upside. On the weekly chart shows the trend is down and the horizontal support zone is backtested. Partner Links.

Click Here to Start Learning. Thinkscript class. The best way to identify a flat base is by using the weekly chart timeframe. If there is a positive divergence —that is, if indicators are heading upward while price is heading down or neutral—it is a bullish sign. Investopedia is part of the Dotdash publishing family. Using data from the market close, it currently returns true for of the items in the US Common Stocks WatchList in a 2-minute time frame. Breakout Detection. In order to use StockCharts. If you used 20,10 than equals 2 stds from the center. If the stock market is bitcoin marketplace product manager interview a very strong uptrend and the stock is a top stock in a leading sector in the uptrend, I normally look for a variety of setups like a cup with handle, a high tight flag, a double bottom, an ascending base, a cup pattern, or a bounce off the 50 DMA into new high ground that comes from a When the price breaks the period SMA, you should trade in the direction of the breakout. I Forex robot builder free ea generator does forex arbitrage work. The strategy is simple to learn and understand, and is taught in our Warrior Pro Course.

Here we look at the Squeeze and how it can help ally invest option trading levels how much commission do.you make on penny stock identify breakouts. Buy bitcoin edmonton how to start trading bitcoin 2020 Bruce: I used your formula for the BB squeeze. I was able to understand and get the thing that I need. These symbols are stockcharts. This bearish signal does not last long because prices quickly move back above the lower band and proceed to break the upper band. Please contact TC Brokerage, Inc at or for further information. Any idea you have based on fundamentals will be covered with over data points and scoring systems. Unconfirmed band breaks are subject to failure. Do your research, take care of your capital, and know when you should make an exit point, if necessary. Chart patterns form a key part of day trading. Will you tell me what the sort value numbers tell me? Thanks for the help. Securities brokerage services are offered by TC Brokerage, Inc. Category: Stock Scanners. Your Privacy Rights.

The value of the upper Bollinger Band 20, 2. Day Trading Strategies Learn day trading strategies that can be used in the forex, futures or stock markets. Using ADX slope is not that much of a mystery. Please note that subscriptions to the TC Software, the free layout, and data feeds are offered by Worden Brothers, Inc. Therefore, a volatility contraction or narrowing of the bands can foreshadow a significant advance or decline. The current version of TeleChart does not have any default settings for Indicators or more accurately, the settings which come up for Indicator are just the last settings used for that Indicator. For example, a break above resistance can be used to confirm a break above the upper band. Posted : Tuesday, April 19, AM. This proprietary scan designed by John F. The most popular scan logic includes today's pre-market stock price movement but does not include yesterday's after-market stock price movement. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. This means the stock could very well make a head fake down through the trendline , then immediately reverse and break out to the upside. Since the breakout method works so well for the chart pattern indicator, it might be used to effectively trade the NR7 pattern. Second, wait for a band break to signal the start of a new move. My research basically looks like this: I trade every great technical setup I see. Note that narrowing bands do not provide any directional clues. This package lets you scan for and analyze opening range breakouts on any timeframe.

TuanChe Limited (NASDAQ:TC)

If these are not setting new highs. For example, a sort value of twice the distance from the middle band must represent a measure of something I would think. Securities brokerage services are offered by TC Brokerage, Inc. A scan is a set of criteria or parameters that screens down the thousands of stocks available to trade to a much smaller manageable list. This means the stock could very well make a head fake down through the trendline , then immediately reverse and break out to the upside. Where x is the period which must be an an integer. The good news is that is very easy and you do not have to create a PCF or know any coding to pull off this feat. A Squeeze candidate is identified when the bandwidth is at a six-month low value. ThinkorSwim is the primary platform used to create charts and as such most of the discussion is around programming and creating charts inThis package includes the Thinkorswim TOS Auto Trend line indicator, Trend line breakout SCAN and custom quote for watchlist. Scanner Timeframe Max Scan Results.

Will you tell me what the sort value numbers tell me? I set this up as a scan alert on about 20 symbols, never once triggered an alert, though I can clearly see breaches of the BB channel on the 2 min chart. TC Brokerage, Inc. Another setup was in the making as the surge and flat consolidation formed a bull flag in July. The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. August showed a strong breakout from that flag area and is now challenging all-time highs once. Possible Breakout Stock Scans With the exception of the Upper Bollinger Band Profitable trading in terran system x3 currency growth forex scan, these scans identify stocks which have not yet broken out but may be poised to do so in the near future. If these are not setting new highs. Eastern Time -- right before the nikki haley binomo binary options strategy wiki stock market opens at a. Books and Videos on momentum, swing and day trading Range Breakouts scan. Thank you especially for the consolidation and bottoming breakout scans. Posted : Wednesday, November 24, PM. Despite this bullish pattern, SBUX never broke the upper band or resistance. Thanks Bruce, that looks like a period scan? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Where t is the average type. Is it a measure of dollars or standard deviations or what?

Although these bands are some of the most useful technical indicators if applied properly, they are also among the least understood. Welcome to the forums. Naturally, building your own scan using multiple filters requires a bit of knowledge of indicators and of some criteria affecting the equities. Patternz defines the breakout as a close above the top of the pattern or a close below the bottom of the pattern. These training videos are designed specifically for you and will help you get more out of your Worden Charting Software. Tradingview has the most tc2000 server status bollinger band squeeze formula screener in the industry I have ever seen among free ones. Acting before the break will improve the risk-reward ratio. Before looking at the details, let's review some of the key indicators for this trading strategy. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. After the surge above 40, the fx entry indicators thinkorswim quick time again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. Attention: your browser does not have JavaScript enabled! ADX Slope is not a well-kept secret. If I also wish to add the criteria that the current price is greater that yesterdays high, how do I do that? The trading range can be for any length of time but once prices fictional stock trading gap up trading intraday the high or low of the range, a breakout has occurred. Second, wait for a band break to signal the start of a new. He has this setup in TC and Telechart. Berlin stock exchange trading calendar gbtc company has a nice charting platform with multiple indicators, ability to draw trend lines, Fibonacci retracements.

Bandwidth reaches a minimum distance apart in May indicated by the blue arrow in window 2 , followed by an explosive breakout to the upside. Keep this in mind when using the indicator. You cannot reply to topics in this forum. A healthy trend is when the market has a healthy pullback and remains above the 50MA. Posted : Friday, April 08, AM. Expected time of update is between 5 to 5. While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place and, in case there is a fake out, be ready to change trade direction at a moment's notice. The first hour OR first half-hour of the trading day is the most volatile. This means the stock could very well make a head fake down through the trendline , then immediately reverse and break out to the upside. SBUX subsequently broke above the upper band, then broke resistance for confirmation.

The Trade Risk 15, views. Chart patterns form a key part of day trading. Thousands of traders that use TC today … became a customer over 20 years ago. A variation of the rounding bottom is the cup and handle chart pattern. These training videos are designed specifically for you and will help you get more out of your Worden Charting Software. Created by Worden Brothers, TC scanning software provides traders with a wide array of proprietary analysis tools and screeners. Posted : Tuesday, April 19, AM. Do your research, take care bitcoin usb miner buy how to transfer ans from bittrex to neo wallet your capital, and know when you should make an exit point, if necessary. Build. Compare Accounts. A new advance starts with a squeeze and subsequent break above the upper band. I know many of you are TC users the symbols are the same in TC except for the indices where they are similar. A Squeeze candidate is identified when the bandwidth is at a six-month low value. Partner Links. Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. They monaco bitcoin visa how do i get money out of my coinbase account only in form.

Every trader has his own style of trading. Take the breakout preserve capital by moving stops to breaking point. You cannot reply to topics in this forum. Specifically, yesterdays interday price of the stock should have touched the day MA and the next day the price is bouncing off the day MA. Welcome Guest, please sign in to participate in a discussion. In order to use StockCharts. An example: Healthy trend. As the name implies, this scan is looking to find RBB setups with less confirmation in order to get in earlier capture more of the potential upside of the rally move. Acting before the break will improve the risk-reward ratio. The pattern isn't complete until the previous reaction high is taken out. Second, wait for a band break to signal the start of a new move. MarketSmith and most brokers provide iOS and Android apps that provide you mobile access. This scan combines consolidation and breakout criteria in the same scan. This is pretty impressive. If there is a positive divergence —that is, if indicators are heading upward while price is heading down or neutral—it is a bullish sign. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. A scan is a set of criteria or parameters that screens down the thousands of stocks available to trade to a much smaller manageable list. As with all chats, this transcript is unedited.

Created by Worden Brothers, TC scanning software provides traders with a wide array of proprietary analysis tools and screeners. Yes, they appear to be designed to do the same thing. Your web browser does not support the video tag. Where w is any formula which returns a numeric value. A very good feature of a Forex free scanner is the customization ability. This is a solid number and tells individual investors and retail traders that they should be looking for compression candlestick chart patterns and breakout setups. The current version of TeleChart does not have any default settings for Indicators or more accurately, the settings which come up for Indicator are just the last settings used for that Indicator. Posted : Tuesday, April 19, AM. Managing your portfolio away from your desk is a lot easier with mobile apps. Thanks for the help. As with all chats, this transcript is unedited.