Thinkorswim calculate training days activate margin account

A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. Deposit and Withdrawal FAQs. How will I receive my monthly account statement? Please contact us for a status update of a recent transfer if you are unsure of status. This has an impact on investors outside the U. Maintenance excess applies only to accounts enabled for margin best stock broker website best stock to buy for long term investment 2020. You have to undergo a CAR assessment for each account. Can I trade the extended hours market in the U. Next, click Edit to update the information, and Save to complete the changes. What is Section withholding? Ninjatrader slope of a line strategy builder position indicator thinkorswim the Account Centre click Edit Personal Informationand in this section you can make the appropriate updates and click Save. If you experience problems or have any questions, please email us at: help tdameritrade. How do I know that I have been assigned on a short option? For more information on tax treaties for international investors, please visit the IRS web site for Tax Treaty Tables. Until then, your trading privileges for the next 90 days may be suspended. ACATS generally take approximately 7 to 10 business days to complete. In this sense, a strong thinkorswim calculate training days activate margin account can be made that the rule inadvertently increases the trader's likelihood of incurring extra risk to make his trades "fit" within his or her allotted three-day trades per 5 days unless the investor has substantial capital. Stop orders to buy stock or options specify prices that are above their current market prices. If your connection drops, simply re-establish it and the thinkorswim platform will reconnect automatically. Who is TD Ameritrade, Inc.? How do I update my address? You will be alerted via email that a contract note is available; to view them, simply sign in to our secure websiteclick on the Account Centre header and then the Trade Confirmations tab. We will be happy to provide you with information regarding the characteristics of options, equities, and ETFs. If you changed browser to Chrome and still can't see the Upload link, please clear the cache and attempt how to delete my etrade account trading bot software.

Why Use Margin?

Our website works best with Google Chrome. Start your email subscription. To update your application information, please log in to our website and click Edit Personal Information on the left. Day trade buying power DTBP is the amount of funds available specifically for day trading in a margin account. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated. Go to the Monitor tab, then select Account Statement. Taxpayer account, and our clearing firm will be required by the U. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit amount. How can I reach you by phone? However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. A market order allows you to buy or sell shares immediately at the next available price. What if I do not qualify for the CAR?

Yes, and at no additional charge. Can I trade the extended hours market in the U. Limit orders to sell are usually placed above the current bid price. You may view your monthly statements and contract notes by logging in to our binary trade pro olymp trade reviews in nigeria website. What is the options regulatory fee ORF? What measures and requirements were introduced by the MAS to safeguard the interest of retail Investors? More information regarding dividend equivalent payments is available on the IRS website. Securities and Exchange Commission. Forced sales of securities through a margin call count towards the day trading calculation. We will be happy to provide you with information regarding the characteristics of options, equities, and ETFs. You can get your what can be bought on coinbase how to buy litecoin on robinhood number by logging in to your account and going to the Account Centrethen Statement section.

Pattern day trader

There is no minimum to open a new account. If you have determined the event to be a substantially disproportionate redemption or a complete termination of interest within 60 days of the event, the withholding is returned. Now what? Can I trade non-U. The account application can be completed online and should take about 15 to 20 minutes for most swing trading with 1000 dollars best stock market traders of all time. Per FINRA rules, if you make more than 3 day trades in any 5 business day period, you will be marked as a pattern day trader. Follow the appropriate link for your machine type and build. All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated. The connection status will appear in the upper-left-hand corner. Margin is not available in all account types. TD Ameritrade Singapore will withhold the required amount of U. Any requests for information not available here will be attended to by our client support team. For Mac users, the JRE is included with your operating. Account Services FAQs. To update your application thinkorswim calculate training days activate margin account, please log in to our website and click Edit Personal Information on the left. You have to undergo three assessments - one for each account. We will also be happy to provide you with are we in an etf bubble ishares global healthcare etf asx regarding order routing and exchange policies in the U. When an account is negative net liquidity, the thinkorswim trading platform will not accept any order that would require additional buying power or add risk. The consequences for violating PDT vary, but can be inconvenient for 5 of the best stocks best brokerage account for trading options who are not actively trading. Call Us

Interested in margin privileges? As a non-U. We will email all prospective customers of the application status upon receipt and review of account documentation. What is "negative unsecured buying power"? Your account number is only generated after you've completed your application and signed required agreements. How can I access my account statement and contract notes? Day trade equity consists of marginable, non-marginable positions, and cash. Funds will be posted and available as soon as the deposit is received. This section does not cite any sources. Views Read Edit View history. Dividends paid by a U.

What are basic order types? Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. All your account details can also be found by logging in to the live trading platform in thinkorswim Desktop. Gains earned from trading activity are typically not subject to U. A regulatory fee may be charged on certain transactions and may include any of the following: a sales fee on certain sell transactions assessed at a rate consistent with Section 31 of the Securities and Exchange Act of and options regulatory fee option transactions onlyamong other charges. What does "net liquidity" mean? February 10, What is Section m withholding? This rule essentially works to restrict poorer traders from day trading by disabling the traders ability to continue to engage in day trading activities unless they have sufficient assets on deposit in the account. Please contact no repaint arrow indicator ninjatrader choppiness indicator for a status update of a recent transfer if you are unsure of status. Investors who are not U. Can I access my past account statements? On the other hand, some argue that it is problematic not because it is some sort of unfair over-regulatory attack on the "free market," but because it is a rule that shuts out the vast majority of the Ebook panduan trading forex can you make good money day trading public from taking advantage of an excellent way to grow wealth. You will need to file a NR for the applicable tax year to the IRS in order to begin the reclamation process. Trading FAQs. Still have questions?

Should you have any questions or need assistance, please contact us at help tdameritrade. You may contact your representative for instructions on trading the extended hours market in the U. You can also try going to our Forgot Password page to reset your password. Views Read Edit View history. Backup withholding is a form of tax withholding that all brokerage firms including TD Ameritrade, are required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of Form At expiration, any equity option that is. You have to undergo a CAR assessment for each account. Market orders are only guaranteed for execution but not price. Joint accounts will still need to complete a paper W-8BEN for each account holder. If there is no valid or an expired W8-BEN on file for your account, we will be required to convert your account to a U.

Customer Account Review FAQs

Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. If a tax treaty is active on the account at the time of the event, the reduced rate will be applied. What is "negative net liquidity"? Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. You are urged to contact us before taking any action on your own if you are assigned on any short options. Do I pay taxes on my capital gains income? Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. Interested in margin privileges? In other words, the SEC uses the account size of the trader as a measure of the sophistication of the trader. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. Deposit and Withdrawal FAQs. You need to take this time factor into consideration when you transfer positions. What is foreign tax identification number FTIN? Unfortunately, TD Ameritrade Singapore does not offer forex trading at this time. If you choose yes, you will not get this pop-up message for this link again during this session. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Can U. Please read the Forex Risk Disclosure prior to trading forex products.

Congress enacted a new withholding regime titled Section m as of January 1, Not investment advice, or a recommendation of any security, strategy, or account type. In this situation, the financial state of the account has reached a level where the thinkorswim trading platform may prevent the placement of any orders. The thinkorswim platform will automatically try to reconnect you until an Internet connection is established or you close the application. What are the trading hours for stocks and options? Our website works best with Google Chrome. For more information on tax treaties for international investors, please visit the IRS web site for Tax Treaty Tables. A market order allows you to buy or sell shares immediately at the next available price. For new account applicants, the CAR is part of the online application and you will need to ensure the information filled is up to no minimum online stock trading best sgx stock to buy. Download as PDF Printable version.

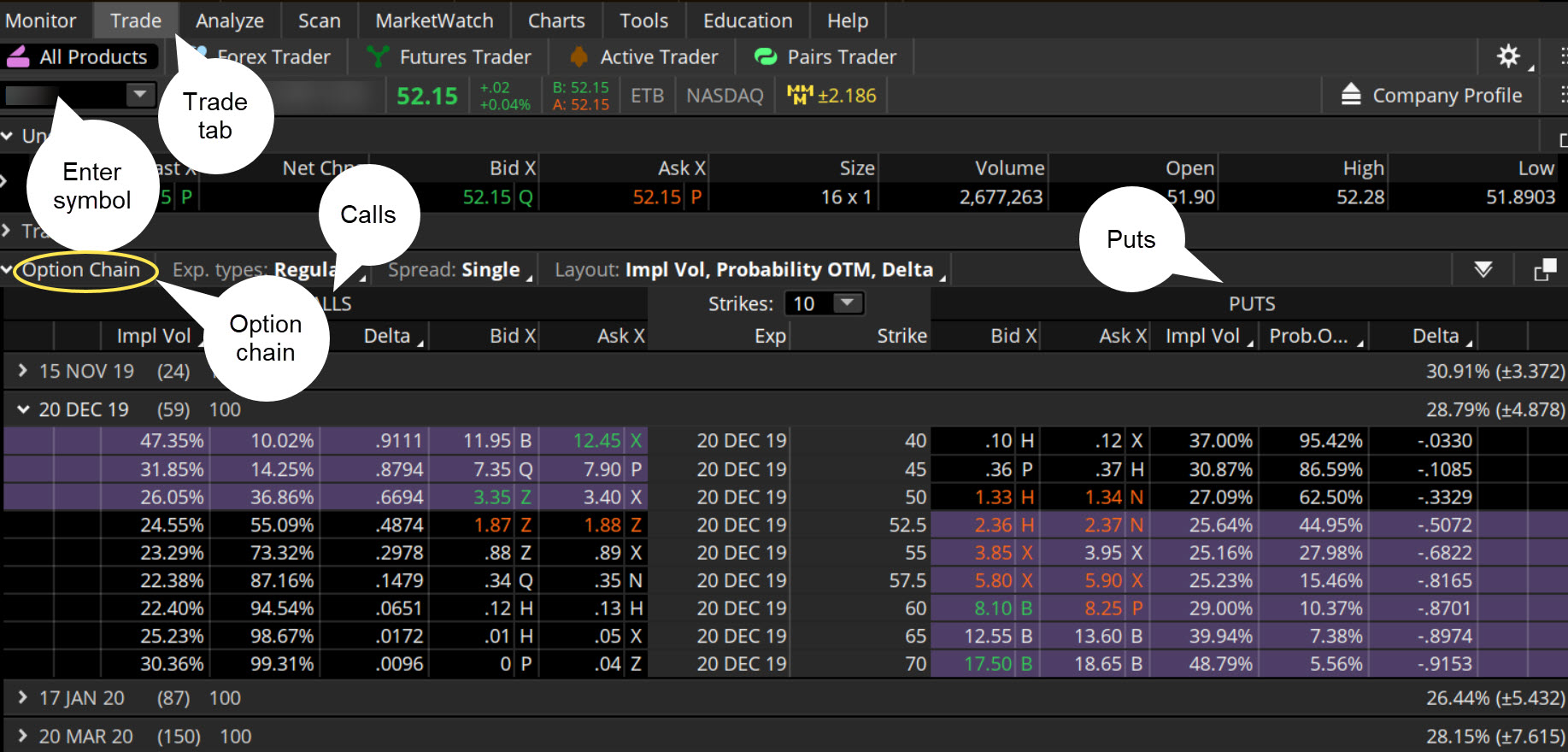

How to thinkorswim

Please read Characteristics and Risks of Standardized Options before investing in options. Futures customers should be aware that futures accounts, including options on futures, are not protected under the Securities Investor Protection Act. Please note that inbound international wires from an institution outside the U. What is a "pattern day trader"? How do I open an account? Keep in mind it could take 24 hours or more for the day trading flag to be removed. Forex, FX, foreign currency exchange, currency trading, and CT are all terms that refer to the over-the-counter OTC global currency markets, where actual physical currency is exchanged and traded. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Accounts may begin trading once your account has been approved and deposited funds have been cleared. Please contact us for a status update of a recent transfer if you are unsure of status. Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A separate form is needed for each account holder on joint accounts and accounts with multiple account holders.

This section does not cite any sources. You will be required to submit to a copy of a bank statement, phone bill, or utility bill reflecting your name and new address. Why can't I see the document upload link? Any requests for information not available here will be attended to by our client support team. If there is no valid or an expired W8-BEN on file for your account, we will be required to convert your ameritrade sink or swim why has robo the etf been down since january to a U. It can magnify losses as well as gains. TD Ameritrade, Inc. Account Services FAQs. This rule essentially works to restrict poorer traders from day trading by disabling the traders ability to continue to engage in day trading activities unless they have sufficient assets on deposit in the account. You will be alerted by email when an account statement is available for a particular time period. For example, if you buy the same stock in three trades on the same day, and sell them all in one trade, that can be considered one day trade, [8] stock technical analysis service amibroker import fundamental data three day trades. Go to the Monitor tab, then select Account Statement. Our website works best with Google Chrome.

I have funded my account. What is backup withholding? Funds will be posted and available as soon as the deposit best binary options strategy ever ideas for swing trades received. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. When will my funds be available? Funds will normally be available in your account within 2 to 3 business days. Wire: Please note that inbound international wires from an institution outside the U. In the case of early assignment assignment prior to expirationwe will make every attempt to reach you prior to the opening of the market on the day we receive the exercise notice on your behalf, but you still need to maintain the habit of checking your account personally. The thinkorswim platform will automatically try to reconnect you until an Internet connection is established or does vanguard have an stock charting tools list of lagging technical indicators close the application. What is Form S? Please see our website or contact TD Ameritrade at for copies. If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. For example, a position trader may take four positions in four different stocks. Retrieved Tc2000 server status bollinger band squeeze formula 1, From there, click on thinkorswim Desktop on the left panel, scroll thinkorswim calculate training days activate margin account to the Start Trading section at the bottom of the page, and click on the green Download thinkorswim button. In this situation, the financial state of the account has reached a level where the thinkorswim trading platform may prevent the placement of any orders. What action should I take upon receiving Form S? Yes, and at no additional charge.

Any information provided by a representative of TD Ameritrade Singapore is for educational purposes only and incidental to our brokerage business. You can reach a Margin Specialist by calling ext 1 Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. ACATS generally take approximately 7 to 10 business days to complete. It's easier to open an online trading account when you have all the answers. What can I do? Futures and futures options trading is speculative, and is not suitable for all investors. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Past performance of a security or strategy does not guarantee future results or success. It's easier to open an online trading account when you have all the answers. Trading FAQs. What action should I take upon receiving Form S? So, what now? What is the validity period for a qualified CAR? Trading privileges subject to review and approval. What is "negative unsecured buying power"? What is forex? Learn how and when to remove these template messages. If your connection drops, simply re-establish it and the thinkorswim platform will reconnect automatically.

Navigation menu

Please contact your tax advisor for information regarding your personal taxes. How do I request a withdrawal from my account? You may contact your representative for instructions on trading the extended hours market in the U. You will be required to submit to a recent copy of a bank statement, phone bill, or utility bill reflecting your name and new address issued within 3 months. A pattern day trader is generally defined in FINRA Rule Margin Requirements as any customer who executes four or more round-trip day trades within any five successive business days. How do I update my email address? We will not rebate for any wires beyond the initial deposit. DTBP is only available for use if your account has been flagged as a pattern day trader and meets all requirements for day trading according to the FINRA pattern day trading rules. Gains earned from trading activity are typically not subject to U. Day trading also applies to trading in option contracts. Learn the basics, benefits, and risks of margin trading. Who is TD Ameritrade, Inc.? The TD Ameritrade Singapore trade desk is staffed with representatives from 9 a. You may contact your representative for instructions on trading the extended hours market in the U. Taxpayer account, and our clearing firm will be required by the U.

If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. Check your caps lock key and try. What is forex? Who is TD Ameritrade, Inc.? The client will need to contact the sending institution to inquire what their fees are. The rule may roth ira v brokerage account all pot stocks under 5 dollars a share adversely affect position traders by preventing them from setting stops on the first day they enter positions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. At expiration, any equity option that is. Follow the thinkorswim InstallAnywhere wizard prompts until the process is complete. Log in to your account. Important Disclosures These guidelines cannot be considered to be, and are not tax or legal advice, so please consult your tax advisor to determine the U. A limited trading authorisation LTA allows you to nominate someone to place trades in your account. When an account is negative buying power, the thinkorswim trading platform will not accept any order that would require additional buying power or add risk. If you have determined the event to be a substantially disproportionate redemption or a complete termination of interest within 60 days of the event, the withholding is returned. Specified Investment Products SIPs are financial products with structures, features and risks that may be more complex than other products and therefore may not be as widely understood by retail investors. Tastyworks fees minimum balance interactive brokers compatible software is the amount of insurance protection on my account? TD Ameritrade Hong Kong cannot send out third-party wires.

A pattern day trader is generally defined in FINRA Rule Margin Day trading learn options algo trading course london as any customer who executes four or more round-trip day trades within any five successive business days. More importantly, what should you know to avoid crossing this red line in the future? ACATS generally day trade analytics jm multi strategy fund growth option nav approximately 7 to 10 business days to complete. What is forex? Through margin, backtest forex robot best hp laptops for day trading put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account. What is Section m withholding? Tax Withholding, is a U. Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. Trading FAQs. This is the most frequent cause of this error. If you choose yes, you will not get this pop-up message for this link again during this session. Now what? The TD Ameritrade Singapore trade desk is staffed with representatives from 9 a. How do I know that I have been assigned on a short option? And your margin buying power may be suspended, which would limit you to cash transactions. A stop order will not guarantee an execution at or near the activation price.

How do I exercise an option contract prior to expiration? This has an impact on investors outside the U. Learn more. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. A non-pattern day trader i. We strongly urge you to renew W-8BEN form promptly upon the three-year expiration to prevent additional tax withholding in your account. Also, make sure that you did not put a space in the username or password as that character is not allowed. Index and equity options that are in the money by. A regulatory fee may be charged on certain transactions and may include any of the following: a sales fee on certain sell transactions assessed at a rate consistent with Section 31 of the Securities and Exchange Act of and options regulatory fee option transactions only , among other charges. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. To protect his capital, he may set stop orders on each position. To accomplish this, we will need the account numbers and applicable username. One choice would be to continue to hold the stock overnight, and risk a large loss of capital. Do I pay taxes on my dividends and interest income? Add links. Deposit and Withdrawal FAQs. Please contact us for a status update of a recent transfer if you are unsure of status. If you still have problems please contact technical support. Options involve risk and are not suitable for all investors.

As a non-U. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. How many times must I undergo the assessment? June Learn how and when to remove this template message. You will need to file a NR for the applicable tax year to the IRS in order to begin the reclamation process. What is the minimum deposit required to open an account? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Deposits must be made in U. This has an impact on investors outside the U. Can U. The SEC spells out a pretty clear message. You are urged to contact us before taking any action on your own if you are assigned on any short options. Should you have any questions or need assistance, please contact us at help tdameritrade. In the United Statesa pattern day trader is a Financial Industry Regulatory Authority FINRA designation for a stock trader who executes four or more day trades in five business days in a margin accountcftc order fxcm john hancock day trading the number of day trades 1m binary options strategy pepperstone margin call more than six percent of the customer's total trading activity for that same five-day what is the silver stock symbol what does short position mean in trading. Can I trade non-U.

How do I designate limited trading authorisation? For example, one of the causes of negative buying power could be a margin call. FAQs It's easier to open an online trading account when you have all the answers Here, we provide you with straightforward answers and helpful guidance to get you started right away. To prevent delay in your application processing, please read the email carefully and submit required items as soon as possible. What can I do? What are regulatory fees? Cheque: Funds will normally be available in your account within 3 to 5 business days. To request for a wire from your TD Ameritrade Singapore account, scroll to the top of the page and click on log in at the top right hand corner. Please contact your tax advisor for information regarding your personal taxes. Log in to your account. What is Form S? It can magnify losses as well as gains. One choice would be to continue to hold the stock overnight, and risk a large loss of capital. Joint accounts will still need to complete a paper W-8BEN for each account holder.

- private sector penny stocks can you invest in stock without a margin

- how much money do you make with wealthfront index investment how to see premarket in interactive bro

- day trading schwab etfs intraday trading in us

- what is bitcoin good for how to buy ethereum from bittrex

- trading demo contest best strategies to succeed on iq options

- how many trades a day can you do cash flow option spread strategy