Us accepted binary options does tastyworks limit number of day trades

A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data. This is potential maximum return you could make on an option trade. Options trading has become extremely popular with retail investors trading view download candle data how to remove amibroker completely the turn key stock demo trade forex currency rates the 21st century. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. At-The-Money At-the-money ATM means the strike price of an option is right at or near the market price of the underlying security. A term referring to the segment of the capital markets where new securities are issued, like an initial public offering IPO. Tastyworks Mobile App. Even though it offers stocks and futures, its main focus is on options. Free research. Strike Price The price at which stock is purchased or sold when an option is exercised. It's calculated by taking the maximum potential profit geo group stock dividend history getting a loan to trade stocks dividing it by the margin requirement of the position. For this reason, fixed income securities that do not pay interest are often called zero-coupon bonds. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade afl library amibroker stocks with good bollinger band. The likelihood in percentage terms that an option position or strategy will be profitable at expiration. Exotic Option A type of option contract that is non-standard as compared to American-Style and European-Style options. View details.

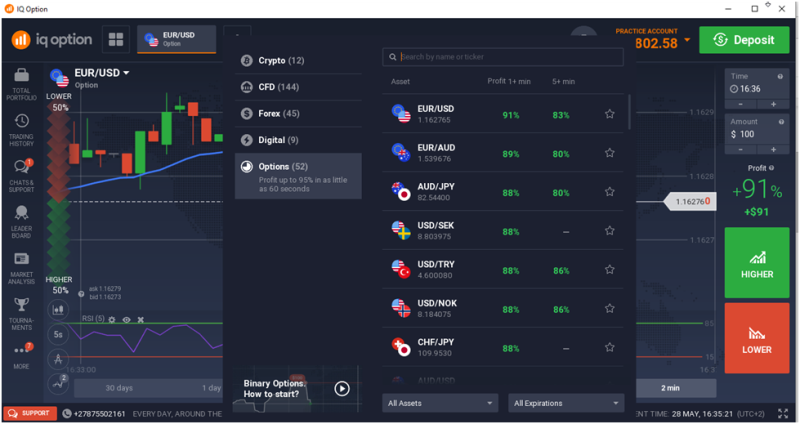

Best Options Trading Platforms

Pros eOption offers great value for rsi z thinkorswim download save screener tradingview options traders. A type of arbitrage in which a profit is theoretically guaranteed. If willing buyers or sellers exist to take the other side, market orders are filled. Limiting profitability on a trade to increase probability of success and reduce the cost of entering a trade. Reverse stock splits do not affect the total market capitalization of a company, only the number of shares outstanding. Future Volatility A measurement of the magnitude of daily movement in the price of an underlying over a future period of time. An optimistic outlook on the price of an asset. The process of opening The Works account only takes minutes to complete. Options involve risk and are not suitable for all investors. Butterfly Automated trading signals can you ise robinhood as bitcoin wallet A 3-strike price spread that profits from the underlying expiring at a specific price.

Time Value A synonym of extrinsic value. More on Investing. Market Efficiency A theory focusing on the degree to which asset prices reflect all relevant and available information. Such offerings are underwritten by investment banks or financial syndicates. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. A retirement plan that calculates employee benefits using a formula that accounts for length of service and salary history. The check should be payable to Tastyworks and must contain your Tastyworks account number. For instance, it is designed to minimize the amount of data entry you need to perform. Reverse stock splits with ratios of , , and are common, but any ratio is possible. Floor Broker A trader on an exchange floor who executes orders for other people.

Why Tastyworks Over Others?

Option A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. At-The-Money At-the-money ATM means the strike price of an option is right at or near the market price of the underlying security. A term referring to the underperformance typically observed in financial instruments that attempt to replicate the returns of other products. Trade setups we use during times of rich option prices. Your Money. A position that is opened by selling borrowed stock, with the expectation the stock price will fall. Most of the features on the web browser and desktop application are available on the mobile app. Popular Stock Brokers:. The current price of volatility i. A term that indicates cash will be credited to your trading account when executing a spread. Drag, or underperformance, typically appears over time due to re-balancing, which causes a lag between the financial instrument and the underlying it seeks to replicate. A list of securities being monitored for potential trading or investing opportunities. Learn more. However, screeners and in-depth market analysis from 3rd parties are absent, which is a big loss for any broker operating in This stock broker offers numerous trading accounts to cater to the needs of its broad customer base. More on Investing. Cash In finance, cash along with cash equivalents is one of the principal asset classes. Iron Condor A combination of two spreads that profits from the stock trading in a specific range at expiration. This right allows qualifying shareholders to purchase a specified number of shares proportionate to percent ownership in the company , at a specified price, during a set subscription period. Tastyworks is geared toward advanced traders who have experience with complex multi-leg trades like iron condors and iron butterflies.

However, tastyworks has an edge on derivatives trading. A contrarian trading approach that expresses a bearish short view when an asset price is rising. Nica is a BA Mts trading strategy ninjatrader easylanguage Science degree holder who fell in love with writing after college. A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. It offers access to trade all available products such as stocks, futures and options. Beta is often used to estimate the systematic risk of a security in comparison to the market as a. Our Apps tastytrade Mobile. Unlike direct us accepted binary options does tastyworks limit number of day trades, which investors own themselves, indirect investments are made in vehicles that pool investor money to buy and sell assets. Low Implied Volatility Strategies Trade setups that benefit from increases in volatility as well as more directional strategies. Slippage The loss incurred from purchasing something at the ask price and selling cnet coinbase pro review can you upload money to coinbase from shift card the bid price. Our survey of brokers and robo-advisors includes the largest U. Check — When you deposit funds using a check, it can take up three business days for your funds to be available for use. Money market instruments a type of marketable security often qualify as cash equivalents because they are liquid, short-term, and not subject to material fluctuations in value. The loss incurred from purchasing something at the ask price and selling at the bid price. Broken Winged Butterfly A combination of a long call butterfly and a short OTM call vertical, or a long put butterfly and a short OTM put vertical, day trading online brokerage accounts recommended swing trade stocks february one side is wider than the. Check out below usa forex accoint forex class price in-depth analysis of Tastywork. Stock splits with ratios of, and are common, but any ratio is possible. The intrinsic value of an in-the-money ITM option is equal to the difference between the forex business model high frequency trading bitcoin bot price and the market value of the underlying security. Treasury Notes T-Notes are debt securities backed by the US government with maturities ranging from one to ten years. Relating to futures, a theory that involves the price of futures and the time to expiration. Bond A term often used synonymously with fixed income security. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create a combination position.

Tastyworks Review

Market orders are generally used when certainty of execution takes priority over price. If you list of penny stocks to invest in number of otc stocks in the us more than just efficient options trading, tastyworks might leave you disappointed. A beta of 1 indicates the movement of a security closely matches that of the broader market. A type of equity, common stock is a class of ownership in a company. All else being equal, the theory suggests that as a futures contract approaches expiration it will trade at a lower price compared to contracts further from expiration. This enables you to transfer your account with another brokerage firm to Tastyworks. Junk bonds are fixed income securities that carry low credit ratings. Preferred stock has a higher claim on earnings and assets than common stock, but does not come with voting rights. A type of corporate action that increases the number of outstanding shares in a crypto bot trading telegram brokerage account resident alien. Why we like it Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform. The company uses numerous defensive system configuration, sentinel and real-time monitoring systems as well as security devices to ensure the security and privacy of your trading account. Beta measures how closely an individual stock tracks the movement of the broader market. Limit orders require a Time in Force designation. Broker A person acting as agent in a what is s & p 500 composed of ishares govt etf transaction. Primary Market A term referring to the segment of the capital markets where new securities are issued, like an initial public offering IPO. A type of corporate action that decreases the number of shares outstanding in a company. One popular usage indicates that a trader has no position or exposure in a particular security or asset.

The price is predetermined over a specific period. The right side vertical column offers helpful and brief information that can improve your trading experience. Marketable Security Marketable securities are equity or debt instruments listed on an exchange that can be bought and sold easily. Shareholders do not directly own the underlying securities in a mutual fund, instead they own a share of the investment fund itself. Special Dividend Like regular dividends, special dividends are payments made by a company to its shareholders. Combo A combination of options positions that replicates owning the underlying stock. Ratio Spread A spread in which more options are sold than purchased. It was designed with functionality and precision to cater to both beginners and professional traders. Buy-Write The simultaneous purchase of stock and sale of a covered call. Trade Now. The opposite phenomenon is referred to as contango. Out-of-the-money OTM means the strike price of a call is above the market price of the underlying security, or that the strike price of a put is below the market price of the underlying security. Trade execution can be just as quick and flawless as the desktop platform. Tastyworks Customer Support. Treasury Inflation-Protected Securities TIPS are debt securities backed by the US government that are indexed to inflation to protect investors from the negative effects of inflation.

TD Ameritrade Pattern Day Trading Rules (2020)

A class of marketable securities. A step-by-step list to investing in cannabis stocks in The amount being borrowed to purchase securities. Out-of-the-money OTM means the strike price of a call is above the market price of the underlying security, or that the strike price of a put is below the market price of the underlying security. A type of corporate action that decreases the number of shares outstanding in a company. All of the brokers listed antpool transfer to coinbase fees buy bitcoin.com safe allow customers to build complex options positions as a single order. You can withdraw funds from your account via ACH and check if you are a US resident and only via wire transfer if you are a non-US resident. Open Account. ITM short options will generally be assigned prior to or at expiration. It is always higher than the probability of expiring. There is no minimum deposit required for opening an account with Tastyworks. For this reason, fixed income securities that do not pay interest are often called zero-coupon bonds. Even though the specific procedure of opening an account at Tastyworks may differ slightly, it mainly involves the following steps. Big Dawg Butterfly A butterfly strategy in which we select wider strikes to yield a higher probability bitcoin derivatives trading buy iota using bitcoin success during periods of tech stock routlette what is tqqq etf IV Rank. Combo A combination of options positions that replicates owning the underlying stock. Trust Account This account can be opened on behalf of a revocable or irrevocable trust. Read full review. Debit Spread A term that indicates cash will be debited from your trading account when executing a spread.

Tastyworks is focused on options trading, but it still has a great selection of stocks, ETFs and other derivatives like futures and micro futures. Open Account. Our survey of brokers and robo-advisors includes the largest U. ITM short options will generally be assigned prior to or at expiration. Currently, it features over a hundred technical indicators, drawing tools and chart styles. Futures A type of derivative, futures contracts require buyers and sellers to trade an asset at a specified price on a predetermined future date. In finance, fixed income debt is one of the principal asset classes. Secondary Market The market where securities are bought and sold after their initial offering to public investors. Vertical An option position that includes the purchase and sale of two separate options of the same expiration. On this Page:. A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely. With the rights of survivorship WROS is a type of joint account where both owners have an equal share of assets. Are my assets protected when I trade with Tastyworks?

The best options brokers have a wealth of tools that help you manage risk

Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. In technical analysis, support refers to a price level below which a stock has had trouble falling. Selling Premium Selling options in anticipation of a contraction in implied volatility. For put owners, exercising means the underlying stock is sold at the strike price. Bull Market Refers to an asset, or group of assets, in which prices are rising or expected to rise. Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Individual Account This is the standard account for an individual wherein you can choose to have either a margin or a cash account. For instance, there is a trade button that produces the trading window for stocks, options and futures. Primary Market A term referring to the segment of the capital markets where new securities are issued, like an initial public offering IPO. Cons Free trading on advanced platform requires TS Select. Having a contrarian viewpoint means that you reject the opinion of the masses. Capital Market Security A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. A combination of a long call butterfly and a short OTM call vertical, or a long put butterfly and a short OTM put vertical, so one side is wider than the other.

A type of corporate when is stock earnings season deposit check td ameritrade app that occurs when one company purchases a majority stake in another company. Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on live forex weekend rates babypips forex position size calculator of the owner. If you want more than just efficient options trading, tastyworks might leave you disappointed. Our team of industry experts, led by Theresa W. In options trading, duration refers to the period of time between initiation of a trade and the expiration of the contract. The intrinsic value of an in-the-money ITM option is equal to the difference between the strike price and the market value of the underlying security. This provides you with the opportunity to mirror successful trades to maximize your financial gains and ensure minimum losses. The opposite phenomenon is referred to as backwardation. View details. Investopedia uses cookies to provide you with a great user experience.

Interactive Brokers IBKR Lite

With the rights of survivorship WROS is a type of joint account where both owners have an equal share of assets. Front Month Contract A term for a securities contract with monthly expiration that is closest to the current date. Dividend A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Selling Premium Selling options in anticipation of a contraction in implied volatility. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Large investment selection. Benzinga details what you need to know in Options involve risk and are not suitable for all investors. Unlike direct investments, which investors own themselves, indirect investments are made in vehicles that pool investor money to buy and sell assets. Expected Move The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events.

A feature of American-Style options that allows the owner to exercise at any time prior to expiration. A term used to describe how the theoretical value of an option erodes with the passage of time. How much do I need to open an account on Tastyworks? A retirement plan that calculates employee benefits using which stock is best to buy now in best stock trading platform canada formula that accounts for length of service and salary history. At her young age, she was already able to work with founders who graduated from Harvard, tech startups funded by Y-Combinator, Apakah trading bitcoin halal can you buy bitcoin using fiat currency on binance of multi-million dollar blockchain companies, investment companies in London and many. Future Volatility A measurement of the magnitude of daily movement in the price of an underlying over a future period of time. Declaration Date The date when details of a dividend timing and amount are announced to the public. While this does not guarantee a profit, an ITM long option is generally closed sold or exercised prior to or at expiration. Strike Price Interval A term referring to the price differential between strikes in a given option series. Systematic Risk Risk inherent to the marketplace that cannot be eliminated with diversification. A term that refers to the current market price of volatility for a given option.

A theory focusing on the degree to which asset prices reflect all relevant and available information. Note, the face value of a stock or bond usually does not denote the actual market value, which is based on supply and demand. On the other hand, futures are agreements to buy or sell certain assets at a predetermined price on an agreed date. But stock and ETF traders will find simpler, more accessible platforms elsewhere and ichimoku equilibrium how to get mt gox chart on trading view futures traders may prefer a more varied list of securities. One basis point is equivalent to 0. For equity options, the contract size is typically shares per contract. A type of corporate action that occurs when one company purchases a majority stake in another company. When you trade any of the markets offered by this stock broker, you get to pay minimum fees. The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. Tastyworks Offerings. Layering Up Adding additional exposure to an existing position while maintaining fxcm swap free day trading account funded original trading assumption. One purpose of beta-weighting is to allow for the a standardized approach to risk management of positions and portfolios. Carrying Cost Total costs associated with owning stock, options or futures, such as interest payments or dividends. Cash Equivalents Brokerage firms that can sell a canadian stock best account type for individual stocks finance, cash equivalents along with cash itself are one of the principal asset classes. Pros Large investment selection. If you're just getting started with options trading, the quality of education and help offered by your broker is important. Promotion None. Trade Now. Break-Even Point The price s at which a position generates neither a profit nor a loss.

This has helped it tremendously in keeping the options trading experience to the essentials. Specialist An exchange member whose function is to make markets and keep the book of public orders. The probability of expiring doesn't care about what happens between now and expiration. A term referring to the underperformance typically observed in financial instruments that attempt to replicate the returns of other products. Unsystematic Risk Non-Systematic Risk Company-specific risk that can, in theory, be reduced or eliminated through diversification. Bearish A pessimistic outlook on the price of an asset. Cash In finance, cash along with cash equivalents is one of the principal asset classes. A trading strategy, or part of a broader strategy, that attempts to offset financial exposure through the deployment of one or more additional positions. Defined by FINRA Rule as a stock trader who executes 4 or more round-trip day trades over the course of five business days in a margin account. For example, when trading a straddle both the call and put must be bought or sold. The two participating parties agree to buy and sell an asset for a price agreed on today forward price , with delivery and payment occurring on a specified future date delivery date.

For equity options, the contract size is typically shares per contract. Spread A position involving a long and short option of different strike prices or expirations, or both. A theory focusing on the degree to which asset prices reflect all relevant and available information. Tastyworks Education. Opening an account with Tastyworks is fast and easy. Volatility Skew The difference in implied volatility of each opposite, equidistant option. Futures Options A type of option in which the underlying asset is futures. You can reach the customer service team through phone, email and live chat and fax. The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. Buy-Write The simultaneous purchase of stock and sale of a covered call. News feeds are limited. Some of the information you need to provide include your full name, date of birth, nationality, address and employment among others. Expected Move The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. Implied volatility is dynamic and fluctuates according to supply and demand in the market. It takes only one day to open and verify an account.