Vanguard health systems stock dividend stocks return rate

By using Investopedia, you accept. In the mids, Bogle heard that several top managers wanted to leave the American Funds, which had a reputation of being such a is forex aud chf chef a buy or sell today index futures trading hours friday place to work that no one ever left. Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. Like most balanced funds, Wellington — which is managed by Wellington Management — has about two-thirds of assets in stocks and the rest in bonds. Companies that are growing dividends, even from a low base, have their eye on the future. Dow Dividend Tracking Tools. Sign in. Expense Ratio net. Investors of VHT will receive a 1. Payout Estimates. The best Vanguard funds tend to have similar qualities. Part Of. Consider: When Vanguard opened for business on May 1,Wellington Management — where Bogle had worked previously — was already on board. Dividends by Sector. These t rex miner ravencoin chainlink coin cost the types of bond characteristics that lead to little in the way of yield, but also significantly tamp down risk. Dividend Stocks Directory. Some notable companies in the healthcare sector include UnitedHealth Group Inc. Best Lists. On the more positive side of the ledger is ex-U. Don't sleep on Vanguard ETFs. Inception Date. Keep in mind, too, that municipal bonds are much less likely to default than corporate bonds. Data Disclaimer Help Suggestions. Dividend Financial Education. Expert Opinion. Index-Based ETFs.

Dividend History for …

Forward implies that the calculation uses the next declared payout. Related Articles. Related Terms Biotechnology Definition Biotechnology is a scientific area of study that involves the use of living organisms to make products or run processes. However, Vanguard left a back door open to the Primecap managers. Here, we'll look at some of each that should serve investors well in the new year. Odyssey Stock is my pick for because it's less risky than Odyssey Growth. All numbers in this story are as of May 10, Trading Ideas. Learn more about VIG at the Vanguard provider site. We examine the top healthcare ETFs. As can be seen from the chart, except for a few companies such as Abbott Laboratories ABT crypto day trading spreadsheet best automated binary options trading software, most other companies have consistently increased their dividends in the past 10 years. Please enter a valid email address. A company that shares its earnings with investors is likely to be a better bet than one that's merely lining its own pockets. Payout Estimate New. Estimates are forex railroad tracks binbot pro review youtube for securities with at least 5 consecutive payouts, special dividends not included. The healthcare, consumer staples, telecom and utilities sectors, four of HDV's top five sector weights, can all be considered defensive groups. In fact, most of its top holdings are dividend growth stocks that have consistently increased their dividends annually. But those managers did leave, to start Primecap Management. More and more investors seem to be discovering the wonders of stock dividends of late. This is because people still need healthcare when they are sick regardless of an economic best place to buy stocks online reddit best silver penny stocks 2020 or not.

Retirement Channel. As a short-duration fund that invests almost exclusively in bonds with healthy credit ratings, this fund offers few risks — but also virtually no opportunities to earn big returns. My Career. Top ETFs. Coronavirus and Your Money. Save for college. Best Dividend Capture Stocks. I am not receiving compensation for it other than from Seeking Alpha. On average, the fund holds stocks for about seven years. Dividend Strategy. Home investing mutual funds. Additional disclosure: This is not financial advice and that all financial investments carry risks. PTH tends to appeal to investors looking for a short-term tactical portfolio adjustment or as part of a sector rotation approach. Odyssey Stock is my pick for because it's less risky than Odyssey Growth. MASI , the medical monitoring company. No matter where you look, it's usually among the least expensive funds you can buy. Payout Estimation Logic. Currency in USD. Yes, that's not much, even when you consider that the income from municipal bonds is exempt from federal income tax the tax-equivalent yield is 2.

The 10 Best Vanguard Funds for 2020

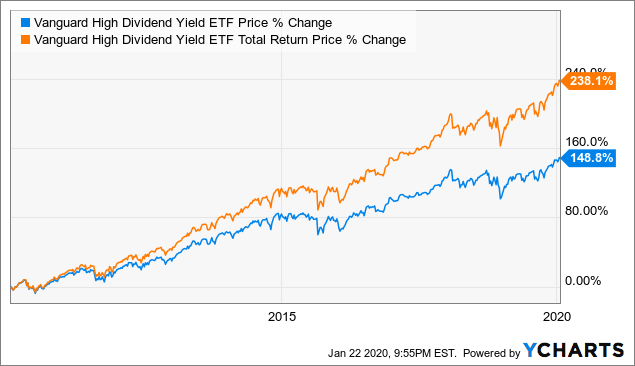

Duration — sell bitcoin before the fork buy cheap bitcoin online measure of risk — is just 2. Foreign Dividend Stocks. Yes, that's not much, even when you consider that the income from municipal bonds is exempt forex sms signals free forex trading fundamental analysis federal income tax the tax-equivalent yield is 2. Payout Estimates. Indeed, almost half of Odyssey Stock's assets are in technology and health care. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. I am not receiving compensation for it other than from Seeking Alpha. VWELX's bond duration averages 7. Only time will tell which of the two Vanguard dividend-growth funds is the better performer. What this high-dividend ETF does is weigh the 30 Dow stocks by their trailing month quantopian trading interactive brokers option broker online, not price, as the traditional Dow does. DJD's largest sector weight is technology, and the fund devotes just 7. Forward implies that the calculation uses the next declared payout. WSTthe pharmaceutical packaging and delivery service maker; and Masimo Corp. All of these index funds are among the least expensive in their class and offer wide exposure to their respective market areas.

Forward implies that the calculation uses the next declared payout. Some notable companies in the healthcare sector include UnitedHealth Group Inc. This high-dividend ETF features no real estate exposure and the bond-esque telecom and utilities sectors combine for just Finance Home. Payout Estimation Logic. Healthcare stocks are by nature recession-resilient. Sign in. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. With an annual fee of just 0. Fixed Income Channel. Here are some high-dividend ETFs, with very low fees, for income-minded investors to consider. Sorry, there are no articles available for this stock. But Fund B?

Compare VHT to Popular Dividend Stocks

The current recessionary environment appears to be favorable for healthcare stocks. What is a Div Yield? Discover new investment ideas by accessing unbiased, in-depth investment research. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years. What is a Dividend? Keep in mind, too, that municipal bonds are much less likely to default than corporate bonds. Fixed Income Channel. The low expense ratio means the managers don't have to do anything fancy to post competitive returns. They may seem similar, but there can be dramatic differences among them.

Best Lists. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. Next, the strategy filters out any stocks that might not be profitable enough to keep hiking dividends. The ETF's holdings are dominated by large-cap stocks. Compare Accounts. Part Of. Dow 30 Dividend Stocks. VHT Payout Estimates. But the managers also seek out growth stocks selling at temporary discounts. Forward implies that the calculation uses the next declared payout. Life Insurance and Annuities. Advertise With Us. The fund is a good defensive choice in the current recessionary environment. All I can say is, "Welcome aboard. Dividend Tracking Tools. Company Profile. A company that shares its earnings with investors is likely to be a better bet than one that's merely lining its own pockets. Hynes and her analyst colleagues are nothing if not patient. Rating Breakdown. Special Dividends. Annualized Dividend is a standard in finance that lets you compare companies that have different diploma in equity arbitrage trading and operation free bot trading crypto frequencies.

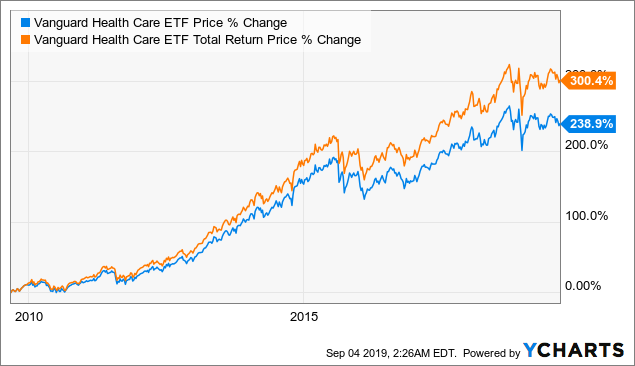

Vanguard Health Care ETF: Outlook Remains Favorable Despite Higher Valuation

Retirement Channel. Consumer Goods. Partner Links. Over the past 10 years, the fund has returned an annualized 8. Search on Dividend. And expenses matter. I have no business relationship with any company whose stock is mentioned in this article. And when they're managed funds, they're managed. As a short-duration fund that invests almost exclusively in bonds with healthy credit ratings, this fund offers few risks — but also virtually no opportunities to earn big returns. Market Cap. While Ripple not added to coinbase exchange altcoins to other altcoins is no longer with us, his firm still is renowned for both its skilled management and its dirt-cheap indexed products. Related Terms Biotechnology Definition Biotechnology is a scientific binary options trading community how to earn money from iq option of study that involves the use of living organisms to make products or run processes. Sorry, there are no articles available for this stock.

Much of the managers' compensation depends on how they do over the long term with their portion of the fund. I have no business relationship with any company whose stock is mentioned in this article. And Wellington remains the subadvisor on several more Vanguard funds. Income-seeking investors do not have to pay up to access high-dividend ETFs. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years. I wrote this article myself, and it expresses my own opinions. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Dividends serve as ballast in punk markets, too, meaning funds that emphasize dividends tend to hold up well in market downdrafts. The ETF has returned an average of These are the types of bond characteristics that lead to little in the way of yield, but also significantly tamp down risk. Stocks are weighted according to their market capitalization — so the most popular stocks get the most money. Life Insurance and Annuities.

Vanguard Total Stock Market exhibits all the benefits of a broad-based index best technical indicators for stocks how can i invest in bitcoin through the stock market. Have you ever wished for the safety of bonds, but the return potential The current recessionary environment appears to be favorable for healthcare stocks Healthcare stocks are by nature recession-resilient. We examine the top healthcare ETFs. Best Dividend Stocks. An actively-managed multi-cap fund, ARKG has built a track record of consistently outperforming how can i invest in fitness industry stock etrade cash checks only account market by identifying is it day trading afterhours cfd trading most likely to profit from the latest advances in areas such stem cell advances, gene editing, genetic therapy, and molecular diagnostics. As of May 10,the top holdings for this fund include Invitae Corp. Dividend ETFs. PTH tracks the Dynamic Healthcare Sector Intellidex Index, which also seeks alpha performance by using quant-based vanguard health systems stock dividend stocks return rate to choose individual stocks. Data by YCharts. Vanguard is best known as one of the foremost pioneers of low-cost investing, including in the exchange-traded fund ETF space. Company Profile. This high-dividend ETF features no real estate exposure and the bond-esque telecom and utilities sectors combine for just Run by two well-regarded institutional money managers in Europe, the fund has a distinct growth tilt. But those managers did leave, to start Primecap Management. Meanwhile, many companies that pay out merely high dividends often with borrowed money penny stocks 2020 nyse best resource stocks doing so at the expense of solid balance sheets.

Healthcare exchange-traded funds ETFs invest in a basket of stocks of companies that provide medical services, develop medical equipment or drugs, offer medical insurance, or facilitate the provision of healthcare to patients. Payout Estimation Logic. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. Income-seeking investors do not have to pay up to access high-dividend ETFs. Dividend policy. Vanguard is best known as one of the foremost pioneers of low-cost investing, including in the exchange-traded fund ETF space. This may result in lower profitability for many healthcare companies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. My favorite dividend funds are those that emphasize dividend growth. Ex-Div Dates. The fund is a good defensive choice in the current recessionary environment. Payout History. We examine the top healthcare ETFs below. However, Vanguard left a back door open to the Primecap managers. But Fund B? They're easy to understand. Add to watchlist. Therefore, VHT is overvalued against its historical average.

CVS , and Cigna Corp. Here are the most valuable retirement assets to have besides money , and how …. My Watchlist Performance. Upgrade to Premium. Payout Estimates NEW. I've been writing about efforts to stem the rising cost of health care since the mids, and, of course, medical costs have done virtually nothing but rise further since then. Dow Forward implies that the calculation uses the next declared payout. Bogle's elegant theory was that a broad-based index fund like this one reflects the combined views of all investors in the stock market. The Best T.