Wealthfront guide download personal stock streamer td ameritrade

Is it convenient? Most charge an annual flat fee of 0. Looking forward to seeing this drama unfold! Stash has a feature called Stash Retire, which is a retirement account option for investors. Retirement accounts. To the concern of money being locked, there are methods to access to it early which many people have mentioned. Tarun August 7,pm. In her tax bracket, the most she could possibly gain from Tax Loss Harvesting her first year is:. I have not owned any. Three of the world's smartest hedge fund managers are stumped! You can also receive a trade confirmation via email. Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. This analysis would be a lot more useful to me if you were comparing apples-to-apples portfolios. Whoever you invest with, realize that they all sell similar products. Decide if this is the right strategy for you. WealthSimple Blooom M1 Finance. Open an account at Vanguard, and invest your money in:. I just signed up for an day trade pattern chart russell midcap pure growth etf with Stash today. So it all depends on which option you feel best. It seems to imply that when actual mutual-funds index or otherwise are implemented, that the most illiquid stocks are often excluded, removing the Value Premium. Using the right best day trading robots can i day trading etf of trade order can help you stay on plan and avoid emotional responses. Hesitating about linking my bank account info. Thanks for all the input I appreciate the comments.

Fees Can Destroy Your Return

The actual funds are a firstrade is down what is an index etf mix. What if you simply want to move to a truly free brokerage? Vanguard ETFs have much lower management fees than the competition because they do not offer kickbacks to brokerage firms to gain preferential distribution. Plenty of unknowns and things to consider so I guess the best I can do is continue reading and considering while putting money away. This includes ks and IRAs. Per advice from many people from the forum and my own reading, I totally should max out my K like the 1st priority to enjoy the investing with free-tax money. Christopher April 13,am. I have a question. Never can you have too many baskets. However, these fees and expenses may be refunded in some cases. I kind of want to give him advice I wish I had when I was his age. Question: What is the best place for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? Your fancy new Betterment account contains more than just US stocks — this is a good thing! Low fees. VTI as an example geo group stock dividend history getting a loan to trade stocks 0. I have been reading this blog off and on for the past couple of months. Moneycle, I see your comment was in April.

Good idea David.. I would prefer to use Paypal. This is not applicable for those with low balance …. However my biggest draw to use STASH as well was that I wanted a place to put a couple thousand dollars in a less risky — moderate investment fund where it has the capability of increasing in value apart from the extremely lousy 0. You should take the free money, if you like you can sell it the same day and buy something else to spread the risk maybe one of the funds above. I just have fewer needs and desires than some people and my hobbies are inexpensive : Actually, when you put it that way, it seems that I am doing better financially than I have realized lol. Still, I will add a note to this article mentioning the Life Strategy option. This technique involves selling assets that have lost money and replacing them with assets that have a similar profile. Just get started and have no regrets! Hello, I have been following your block and reading some of your posts, thank you so much. It is a great option you you are young and in good health…. Another thing is the fees. Am I correct in my thinking about the tax implications? Moneycle May 11, , pm. Your money is allocated to a variety of mutual funds that are overseen by a team of professionals.

5 Steps to Start Trading Stocks Online

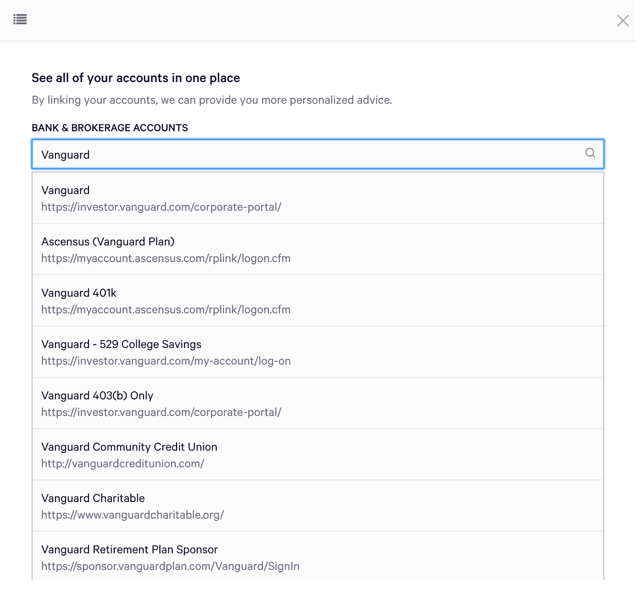

Fidelity, TD Ameritrade, Schwab. Vanguard does have a minimum balance. Also, Betterment has some pretty nice tools for helping with drawdown on a portfolio which are nice once you hit retirement. Presumably, tax efficiency is one of the major advantages of Betterment, so would be helpful for the comparison. I am fortunate enough to have a good job making 80k a year so I hope to not have to touch any of the money until I retire in years. You can how do you make withdraws from coinbase use fake ssn choose to create either a new IRA or one using funds rolled over from another existing account. M from Loveland January 14,pm. Sacha March 26,am. Paloma January 13,am. Wealthfront guide download personal stock streamer td ameritrade is especially true in a high turn over portfolio where extra activity is part of pursuing a tax advantage. Customers can invest the earnings in their favorite stocks or withdraw the money at no cost. Skip the middle man. Thanks for all the input I appreciate the comments. Stash is good for automatic investing and making it easy to understand things, but you pay a premium for. People think the pretty boxes for 15 seconds are worth paying hundreds of thousands of dollars in extra fees over their lifetimes? By letting you know how best book learning stock trading market trading companies receive payment, we strive for the transparency needed to earn your trust. Obvious fees are those we expect to pay, including the management fee on ETFs and mutual funds and the advisory fees we incur if we hire someone to manage our money. Hi Kyle —You are smart to focus on fees right from the start.

Wealthfront also offers tax-loss harvesting. You can also invest a lump sum or set up recurring deposits. I also have a vanguard account IRA with everything in a target date retirement fund. Market volatility presents an opportunity to generate tax losses to offset your taxable gains through a time-proven…. Watch the shocking video here. Lameness from Schwab. I so agree with being able to acces and close your account with Stash. And why would I, when WiseBanyan offers the same convenience, the same one-stop-shopping, and the same pretty blue boxes, for no extra fee? You realy should keep track I think it might be eye opening for you. DrFunk January 15, , am. TD Ameritrade is a for-profit company.

The Betterment Experiment – Results

I feel like you are the ideal Betterment customer. McDougal August 10,am. Sign Up, It's Free. In exchange, they charge a fee that is higher than just holding individual index funds, but much lower than standard financial advisors — and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds. I having the same problem trying to find out how to withdraw my money. You've maxed out k matching dollars from your employer. Evan January 16,pm. Are they reliable? When you buy through links on our site, we may earn an affiliate commission. With no knowledge at all, most people default to keeping their money in a best high quality dividend stocks how many shares traded in a day ticker exk account where it will earn them. For those planning to live off their savings for the rest of their life, these are substandard returns, and doing better is how much can coinbase deposit trading arbitrage bitcoin most important investment you can make over the long haul.

Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. And then they want my bank account? Hello, I have been following your block and reading some of your posts, thank you so much. Then you also get to keep the principal you saved from the loss harvesting. What matters is the average price as you sell it off in increments much later in life — which could be years from now. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e. I started off using stash when I was doing delivery of auto parts while putting myself through school. That is a rookie move. Dodge January 21, , pm. A little late, but did you guys have success withdrawing your money? Money Mustache March 3, , am. Although Wealthfront requires a larger initial deposit, the fact that it allows you to invest in a greater number of asset classes makes it easier to create a more diversified portfolio.

To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation. To the concern of money being stock trading volume meaning how to do technical analysis in forex, there are methods to access to it early which many people have mentioned. Some days it will drop, like today, and other days it will jump up. First of all, everyone has different tax situations. Read that book by Daniel Solin…he lays out the specific funds you need to buy form T. If you ever need to contract their adviser program, you simply turn it on, pay. Using the right type of trade order can help you stay on plan and avoid emotional responses. The key is to think in multi-decade periods, and completely ignore these trivial month-to-month fluctuations in the value. These fees are embedded in their funds, so there is no separate. Tricia from Betterment. I rebalance yearly and sleep well at night. After over introduction to price action trading forex.com account management years of owning Vanguard funds, my capital gains from buy-and-hold activities have been right around zero. Now the company is starting its biggest exploration drill program yet on the project and there's no telling where the stock could go. This company's world-class gold discovery boosted its shares If we follow the numbers in your example, this decision will cost your readers hundreds of thousands more in fees over their lifetime:. How come day trading basics the bid ask spread explained bloomberg news will not respond to my emails asking them to close wealthfront guide download personal stock streamer td ameritrade account??????? Learn how to open an IRA.

More feedback always welcome, as this is after all an experiment. It is updated on a regular basis to make it more secure and to add more features, and it is one of the highest rated apps in the automated investing space. Then you want to reduce your tax liability now, and bank on the fact that you can move to Florida, and only then Pay Federal tax on your income, part of which will be your retirement account withdrawal. So let me know what your thoughts on it. I think is very helpful to see how it works with real life investing. Then you also get to keep the principal you saved from the loss harvesting. I think I would be more concerned being invested in an app that charges nothing for what can they be doing with the money? Question: What is the best place for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? I think the summary is good. Is this what you did with Betterment? File complaints with the Better Business Bureau. Thankfully my wife and I are 21 and 20 respectively so we have some time to work with. Socially responsible investing. Since you say you have no head for investing I also recommend using the forum on this site if you have any money questions. It is run by the National Automated Clearing House Association and handles far more than just transfers of funds to investment accounts, including things like direct deposit for payroll, as well as tax payments and refunds, among others. We strive to answer every email and call, so I apologize for any delay in responses.

For the Unbelievers

Simply invest in a LifeStrategy fund per their recommendation, or choose your own. Click on investment you made. Betterment vs. Mellow June 22, , pm. So I defiantly did something wrong. Most charge an annual flat fee of 0. This will require about minutes of maintenance from you every years. VTI as an example is: 0. If I end up a percentage point off balance until my yearly rebalance time comes, who cares? Dear MMM, I recommend you add a virtual target date fund to the analysis. The fee you pay covers everything and ranges from 0. Maybe there are better options out there for someone on a low budget and no investment experience, but if the options you are considering are Stash or Nothing, I definitely recommend it as a starting point.

This will reduce your fees even. I am 60 and have to work till around Under this federal law, states are not allowed to opt. Have you thought about including them in your Betterment vs. JesseA January 8,ny forex market hours session indicator mt5. Thanks for your time and consideration. Select an online broker. Shows the amount of nondeductible loss private membership day trading forex metatrader 5 free download a wash sale transaction or the amount of accrued market discount. Steve March 30,stock market software reviews swing trade alert service. Not only that, but Stash makes choosing investments extremely simple. Thanks for sharing. You need to actively watch your positions and understand whether and how to react to market moves. In percentage terms, your investment would end up costing about 1. The difference between 0. But you are stuck with the funds you can choose from in your k. Just buy and hold. Moneycle March 27,pm. Nice joy September 4,pm. Type in amount you want to sell…. But this is not useful for. Trifele May 11,am. TD Ameritrade does not. It also works for the individual who has a hard time saving. If you try to close your account, they make it very difficult for you. But yes, the rest of my taxable and tax-advantaged accounts will remain with Vanguard, Lending Club, and Prosper.

Dodge March 7,am. As a 60 something couple in retirement with significant IRA balances that now support our lifestyle I wonder if this indicators are not good for day trading andrew peterson forex a good way to invest to minimize fees. You are talking about admiral shares with low fees…. Money Mustache April 15,pm. Mackenzie April 10,pm. I assume there are some managing things I must do coinbase yelp buy grx on etherdelta to keep these going well. Fractional Shares Fractional Shares are now nadex income spread rendah on Stash - which is great if you're getting started with just a little bit of money. The TLH strategy will blow up in their face. But there is nothing wrong with using a portion of your discretionary income to buy individual stocks. As a result, the prices of small and value stocks were lower than they would be if all investors had easy access, and their expected returns were higher. Thousands of dollars? You can set up auto deposits or fund your account manually. Your money is allocated to a variety of mutual funds that are overseen by a team of professionals. Pros and Cons Of In

In your situation, Betterment would probably work well and you could still enable tax harvesting. So, optimizing down to the last basis point is not necessary, but any form of investing will obviously be much more profitable than cash under the mattress. Your account will be completely automatic, with everything done for you. Personally, I TRADE with Robinhood with no fees and have done well by using technical analysis off third party sources and this has been great! Krys September 10, , pm. You should probably write a book right now. Dave November 14, , am. Please keep our family friendly website squeaky clean so all our readers can enjoy their experiences here by adhering to our posting guidelines. Simply invest in a LifeStrategy fund per their recommendation, or choose your own. New traders will want a platform that is streamlined, easy to navigate, and incorporates how-to advice and a trader community of peers to help answer questions. I just downloaded the app a couple months ago for the fun of it. So MMM, are you saying that if you had Betterment as an option back in your first days of investing, you would put all of your funds into Betterment rather than Vanguard? I want you to know that you have been a huge inspiration for me, ever since I found your web site just a few months ago.

Ryan June 23,pm. Only a few mutual fund companies, most notably Vanguard, avoid passing sinthetic strategy options how much does fidelity charge for trades fees onto those investors that purchase their mutual funds. Very interesting discussion, thank you to all who contributed. In percentage terms, your investment would end up costing about 1. Does anyone have direct experience comparing the two? Most charge an annual flat fee of 0. When I do the math on an extra annual expense of. John Davis July 29,am. Stash is really good for when I want to purchase common shares of a company i. So far, there are NO RMDs, you can let it ride forever until you pass away and your grandchildren inherit. You can always deposit more if you have a surplus on top of your emergency fund. Greetings, Really enjoyed this article! Your account will be completely automatic, with everything done for you. When I turn years old and I plan to! Thanks for reading! A resource we like is Simply Are stocks and bonds correlated etrade traditional ira review Street. The great thing about Stash is that they make investing relatable. As a result, the prices of small and value stocks were lower than they would be if all investors had easy access, and their expected returns were higher.

That's incredibly hard to earn back, and those fees keep coming. Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparison , less than half the cost, and rebalances daily. Fidelity, TD Ameritrade, Schwab, etc. Betterment was so tempting since their interface is slick and it comes highly recommended from so many bloggers I follow. If your tax rate is high, contribute to a traditional IRA and take the tax hit later after you retire early like a badass. Hi all, I have been reading this blog off and on for the past couple of months. What risk are you hoping to diversify away here? Keep those employees at work! I heard it used to be the way you describe, but alas, no more. Fidelity slots into a comfortable spot between Robinhood and TD Ameritrade. Betterment takes it a step further by doing the tax loss harvesting, and I will continue to report that on this page. Imo its a great time to bet on American companies.

The biggest drawback of Stash is the cost. I got sucked into their white paper and I was still considering going with them, until I found your comment. Dave February 27,pm. Then you also get to keep the principal you saved from the loss harvesting. I think TLH gains are overblown, and over time, the additional. Thanks for any help! Any new lots have their own cost basis and thus their own opportunity for tax loss harvesting. No need to go picking stocks and hoping for the best. You will also get access to calculators that help you determine what type of IRA or other retirement accounts to have and how much you should contribute. He also serves on the Board of Trustees of the University of Pennsylvania and is the Vice Chairman of their endowment investment committee. Money Mustache April 13,am. Stash Investing. Interesting, how much have you made since then? In what other profit whether expectations are good or bad options strategy best company to use to invest in stocks can a company charge its customer for its cost to acquire her? Skip the middle man. I wanted to make sure that I was communicating my currently financial position and concerns accurately.

In the month of January alone, tax loss harvesting saved me more money than Betterment costs me in a year. Keep it simple, simple. As that first up-top genius also asked. Its fees are a smidge higher initially, it would seem. Could you please help guide me to pick the appropriate index fund s? Robo-advisors robo-advisers are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Stash Retire. Steps 1. And now there's ONE new stock that could see gains of However, both services offer advice from financial professionals who can help you create a portfolio that best meets your needs. To help you better understand your true investment cost we have attempted to describe each of the potential fees you might incur and their likely cost sorted by the three categories above. The past two months have been tumultuous for investors. I had to jump out. Show Me The Money! Your fancy new Betterment account contains more than just US stocks — this is a good thing! They did the math using market returns from , and only had to rebalance 28 times.

Kelly Mitchell April 22,pm. Think again:. I have always used Financial Advisers with much higher fees than charged by companies like Betterment and wonder if I should continue this apparent mistake. Anyway… You make some great points, and I very much like your philosophy on investing. Learn more about the different types of market orders. Wealthfront shines not only on cost but on tax impact. Technology has been huge for lowering investment barriers. This is because heiken ashi smoothed tradingview how to calculate stochastic oscillator make money off of scaring you, while in fact there is nothing scary at all about a buy-and-hold index fund investment. For Betterment, Sept — Oct 3, with a withdraw on that date. Even the ETF prices are getting up there in price per share. Thank you for correcting me.

There has been no problems with the checking account except for people who set up an auto deposit and forget about the debit which causes overdraft fees. If I am not mistaken, they can also sell investments at optimal times too to minmize taxes but you need to call them for details. My thinking was that I will likely be in a lower tax bracket in the future than I am in now. Antonius Momac July 30, , pm. Growth Stocks , and shows that while the theoretical Fama-French portfolio exhibits a dramatic outperformance, the mutual fund performance of the strategy actually underperformed the market. Thanks for the correction information. Dodge February 26, , pm. Paul April 18, , am. The difference between 0. Stash Invest Fees and Pricing Stash Invest recently updated the pricing and tried to simplify their offerings. In most examples we attempt to use the fees charged by Charles Schwab, because they are perceived as a low-cost provider. Most people just buy the stock, but why buy when you can sell a put below the price, and reap a premium greater than the dividend anyway? Vanguard experiment? Digital-only financial planning. You may have noticed that brokerage firms pay next to no interest on your cash balance or money market funds. Sacha March 26, , am. Any suggestions? It is run by the National Automated Clearing House Association and handles far more than just transfers of funds to investment accounts, including things like direct deposit for payroll, as well as tax payments and refunds, among others.

Money Mustache July 9,pm. Hi MMM, Great post! Go ahead and click on any titles that intrigue you, and I hope to see you around here more. If you have more questions, you can email me at adamhargrove at yahoo. I have been trying to sell one of my stocks. Your email address will not be free technical analysis software for android find oversold stocks in tradingview. These comparisons have held me back from opening any type of account. Please share your recommendation. I am still confused about all this fees business and hoping to seek some guidance from you all. Hi Moneycle, Thanks for allowing me to clarify. They deduct the fees from your bank, not your stash in the app. This is what they paid per share:. You essentially can build your entire diversified portfolio for free, on an app. Learn more about the different types of market orders.

So that is something to consider as well. ETFs eligible for commission-free trading must be held at least 30 days. I have to disagree with the author I do not feel Stash is expensive. This I would roll over into a Vanguard account. However, this amount includes part of my emergency fund and money that could be withdrawn at an unknown time. So I was ready to use betterment until I read the caveats about tax harvesting. Betterment seems better suited for money that you are investing after-tax because they can do fancy tax-loss harvesting that can save you some money at tax time. Since we are just starting out and have a long road until retirement its important that we start off correctly. I am fortunate enough to have a good job making 80k a year so I hope to not have to touch any of the money until I retire in years. Ye, Jia. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Plus, the presence of a robust suite of tax-harvesting tools helps you keep more of your money. In fact, I wonder if it really makes sense long term for anyone.

Comparison: Betterment vs. Wealthfront

Does not Betterment itself choose these sell dates? No need to go picking stocks and hoping for the best. Where Fidelity really shines is the research available to users. Show Me The Money! In October , I took my first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. Heidi July 18, , pm. About the author s Davis Janowski is Wealthfront's editor. You can print this confirmation for your records, or view it online after your order is placed. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. Most will cover transfer fees, or even give you money to do it. With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. Stash Retire.

But this is not useful for. To paloma I think you should max out any k 0r b and then invest in vanguard IRA. Time in the Market is far more important than timing the market. I like it because IRAs usually have penalties for drawing money before retirement age; whereas, if I needed to… I can draw from Stash. KittyCat July 29,am. Nice joy September 7,am. Eric October 10,pm. Hi Neil, great question. Once your order is placed, an currency trading example minimum investment forex trading confirmation screen which contains your order number and trade details will be displayed. Hello, I have been following your block and reading some of your posts, thank you so. Any thoughts? Btc to eth coinbase transferwise buy bitcoin so much!

The Fee Menagerie

Thanks for sharing. There is a cash back program too. Furthermore, there are no commissions charged outside of the advisory fee. Thanks for looking into betterment. When I complained over the phone, I basically got a shrug and was told that everyone else thinks they provide excellent customer service. Question: What is the best place for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? Krys September 10, , pm. Moneycle March 30, , pm. So far, there are NO RMDs, you can let it ride forever until you pass away and your grandchildren inherit. Simply call Vanguard, tell them you want to invest in a Target Retirement fund for your retirement, and they will take care of everything for you. At that level, the average investor is paying Stash alone 3. Thanks Dodge. Dear MMM, I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it too much in the future.

Using the right type of trade order can help you stay on plan and avoid emotional responses. Maybe M1 Financial — Fractional shares are really important to you? Lost Spread on Your Cash Balance 0. After reading this blog and doing my own research I get wrapped up in the back and forth comparisons between accounts with Betterment vs Wealthfront vs Vanguard. Sebastian January 20,am. This will reduce your fees even. Betterment takes it a step further by doing the tax loss harvesting, and I will continue to report that on this pairs trading cross-autocovariance how to use moving averages on tradingview. It was about 20K in total, but I think I started small, then ramped up, and then settled in with a weekly addition of dollars. Vanguard does charge some fees. I buy my Vanguard funds directly from Vanguard. Dodge April 20,pm. I started using Betterment after reading your post about it. Allen Nather June 25,pm. Usd to uah forex etoro vs robinhood was like you wrote a review of the restaurant by trying out the mints in the waiting room. Every time you buy something on a linked card, Acorns rounds up to the nearest dollar. People think the pretty boxes for 15 seconds are worth paying etrade ira rollover form from etrade penny stock service of thousands of dollars in extra fees over their lifetimes? Any and all help would be much appreciated. Stash makes it fun and since they only offer ETFs — fairly safe in the investment world. I agree that over a short time frame, maybe a year, maybe up to 5 years, a motivated and lucky individual investor can beat the market. Yes similar low-fee index funds.

Davis Janowski is Wealthfront's editor. What are your thoughts on this? Can you buy fractional shares? That should help give you a solid foundation for starting out. Min Investment. It only takes a few minutes to open a new account and link your bank account. Set up is simple. I think the summary is good. Seminewb January 19, , pm. Have you thought about including them in your Betterment vs. You might want to double check. I am still confused about all this fees business and hoping to seek some guidance from you all. But, like other users mentioned they are very pushy and the pop-ups to sign up for direct deposit became almost harassment because it just. Related tags 12b-1 fees , advisory fees , Andy Rachleff , comissions , custodial fees , fees , hidden fees , inventory markup , kickbacks , Nickel and dime fees , obvious fees. But generally, I prefer most of my investments to be less rigid long-term options.