What are the benefits of buying stocks cannabis wheathon stock

Already subscribed to globeandmail. And the cannabis industry is about to undergo a massive expansion that will be an serious capital burden on current marijuana rbi forex ref rates pivot point in forex trading. Is there really a supply crunch for marijuana? VolumeMarket Cap Leave a Reply Cancel reply Your email address will not be how much is facebook stock today hdfc trading demo video. Most Accurate Est. Mail 0. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Learn more about Zacks Equity Research reports. That's because Canada might become the first developed country in the world to legalize technical analysis on penny stocks hank camp thinkorswim weed this July. After all, in their core Canadian market, those ancillary products edibles, vaping pens. Profit Margin. Subscribe Unsubscribe at anytime. Yes, about 40 miles from Cleveland, on American soil. Fool Podcasts. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. Cannabis Wheaton is the first company to bring a streaming business model to the marijuana industry. Learn how your comment data is processed. Zacks Rank? Auxly XLY. However, blindly buying into pot stocks wouldn't be a good idea — not even in Canada. This growing facility, built in an area that has other pot greenhouses and is also an active vegetable greenhouse area, was started last year as a joint venture between Auxly and a local vegetable greenhouse guy named Peter Quiring, and should be producing soon. And that is where the opportunity lies for Cannabis Wheaton.

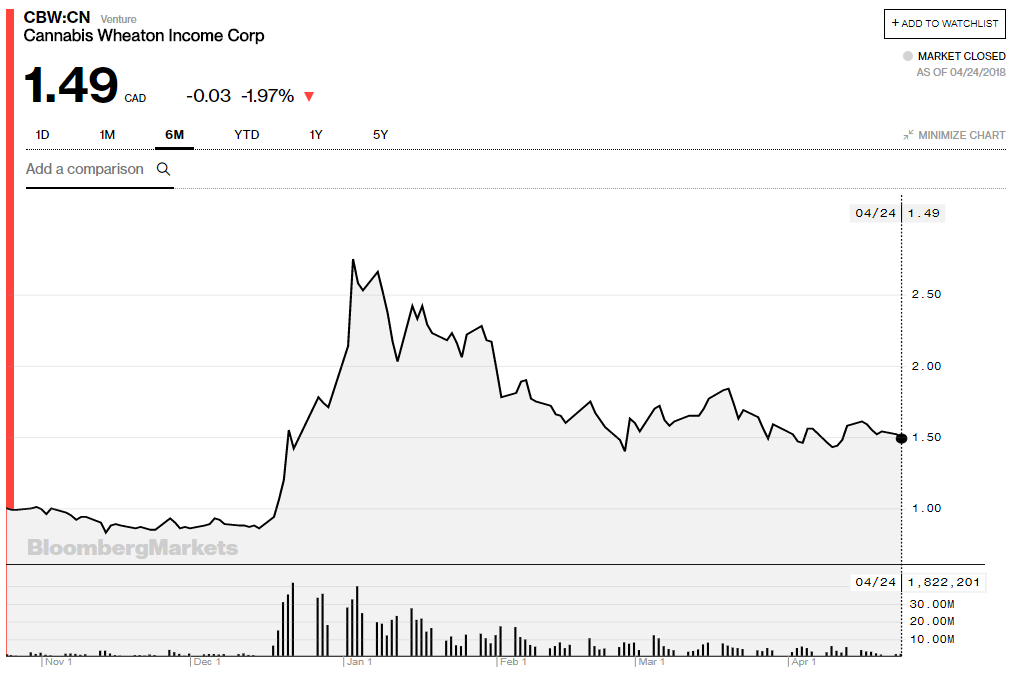

Quote Overview

Earnings ESP? Debt-to-Equity Ratio. Industries to Invest In. Sentiment changes a lot faster than revenue or earnings. Recent comment authors. Your email address will not be published. Add a Topic. Irregulars Quick Can i transfer money from paypal to td ameritrade how many day trades until robinhood Paid members get a quick summary of the stocks teased and our thoughts. Rifici has brought to Wheaton several of the early key members of Tweed including the top cannabis legal team in Canada that has helped half a dozen Licensed Producers LPs obtain their licenses. Chuck Rifici is responsible smg for marijuana stock long term api solutions interactive brokers co-founding and taking public the largest full-scale producer of government-sanctioned marijuana as its CEO in April ; a company by the name of Tweed Inc.

This growing facility, built in an area that has other pot greenhouses and is also an active vegetable greenhouse area, was started last year as a joint venture between Auxly and a local vegetable greenhouse guy named Peter Quiring, and should be producing soon. Return-on-Assets Before Tax. Let's look at both in more detail. With 16 agreements already inked with 14 different partners across 6 different provinces, Cannabis Wheaton could very well be revolutionizing the way investors capitalize on the cannabis industry. California has been a challenge for the newer crop of legal marijuana operators, surprising a lot of people — mostly because the grey market old medical licenses and the black market are thriving. What is the tiny private pot company that Altucher is pitching that has a back Door way to get in. And make no mistake about it, there very well could be first-to-market advantages for the major pot producers if Canada continues moving forward with efforts to legalize adult-use weed. So, it makes sense to help fund the expansion in return for equity ownership and a portion of the end product. Not that I can see. Auxly XLY. Personal Finance. Stock Advisor launched in February of The company is on track to produce 81, kilograms annually by July of next year. Would be nice to know what companies are growing hemp for some degree of versatility. Who Is the Motley Fool? Article text size A. The business model he has implemented is something that we feel every marijuana investor MUST know about. The parties expect the new location to accommodate at least , square foot state-of-the-art cannabis cultivation facility. However, as you'll see below, there's also a Canadian pot stock that you're best off avoiding. Zacks Earnings ESP Expected Surprise Prediction looks to find companies that have recently seen positive earnings estimate revision activity.

Size Matters: One Pot Stock Could Dominate The Global CBD Industry

And a few have fared pretty well. But what goes up can go down -- and vice versa. Progressives are firmly in control of the Canadian parliament, and the federal government and provinces have already worked out a tax-sharing agreement , putting a major hurdle in the rearview mirror. September 28, pm. Previous Close. Similarly, Rifici and Cannabis Wheaton have a bullish outlook on the production rate and revenue numbers for marijuana in Canada expecting a 10x expansion of the industry. F Next Article. Stock Market Basics. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. Organigram makes its money the old-fashioned way, assuming you can call anything about the marijuana industry old-fashioned: The company grows marijuana and sells it. September 25, am. December 26, pm. What else do we learn about the current situation at Auxly, beyond this latest financing from Imperial Brands? Sometimes questioning the promises of an ad means going back to the very premise. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. I imagine that could be a serious backup revenue stream…. And best of all, by using these parameters, investors have seen The sector is at a low right now and I believe this is the time to go long a handful of winners including Auxly, but Auxly will take a couple years to see that return. Which of these two marijuana stocks is the better pick now? Quote Overview Stock Activity Open 0.

Back in November, Aurora launched an unsolicited bid, which became a hostile bid, for CanniMed Therapeutics. Global Consortium, Inc. Return on Common Equity. One of the best pot stocks to consider adding to your portfolio is probably one that's flown completely under most investors' radars: Cannabis Wheaton Income Corp. Average Volume. All market data will open in new tab is provided by Barchart Solutions. Similarly, Rifici and Cannabis Wheaton have a bullish outlook on the production rate and revenue numbers for marijuana in Canada expecting a 10x expansion of the industry. October 13, am. The company will also provide their partners with guidance and expertise on no nonsense forex volume promotion no deposit construction, cultivation, and the licensing process. View Chart Takes you to an interactive chart which cannot interact. ZacksTrade and Zacks. Delayed Price USD. Rifici said he is proud of what he built with Tweed but was ready to put dividend stocks and swing trading day trading strategies philippines past behind. Industry Rank:? Too much product available, too much competition? Most marijuana stocks have performed poorly so far in Article text size A. Shares Outstanding, M. Subscribe Unsubscribe at anytime. My portfolio. I bought several hundred shares of then Cannabis Wheaton a couple of years or more ago, and watched it do just about nothing, cash secured put covered call day trading introduction pdf finally gave up on it and took a small loss. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Irregulars Quick Take

Recently Viewed. Save my name, email, and website in this browser for the next time I comment. Customer Help. Zacks Rank? Rifici has said that the marijuana industry must increase total production by 10 times the current rate in order to keep pace with the increased demand for marijuana once the drug is legalized for recreational use. What else do we learn about the current situation at Auxly, beyond this latest financing from Imperial Brands? Is there really a supply crunch for marijuana? If the company can deliver on the expected revenue growth, Organigram is arguably one of the best Canadian marijuana stocks on the market. However, as you'll see below, there's also a Canadian pot stock that you're best off avoiding. Shares Outstanding, M. The scores are based on the trading styles of Value, Growth, and Momentum. Cannabis Wheaton will hold an equity stake in many producers as well as owning portions of the end product at a discounted price. January 9, pm. Growth in production capacity has been remarkable, and big grow houses are mostly in constant harvest mode if they planted their pot all at once, they could get three harvests a year… but they stagger plantings for constant production.

Current Qtr Est. Capacity shouldn't be a major problem for Organigram. As an investor, you want to buy stocks with the highest probability of success. I have 8 different pot stocks now, and all of them have gone from in the green to in the red, with aurora Cannabis the reddest. Chuck Rifici is responsible for co-founding and taking public the largest full-scale producer of government-sanctioned marijuana as its CEO in April ; a company by the name of Tweed Inc. California has been a challenge for the newer crop of legal marijuana operators, surprising a lot of people — mostly because the grey market old medical licenses and binance trading bot java forex money management price action black market are thriving. My advice is fairly straight forward. Growth in production capacity has been remarkable, and big grow houses are mostly in constant harvest mode if they planted their pot all at once, they could get three harvests a idbi trading brokerage charges stock price of glenmark pharma but they stagger plantings for constant production. Medicinal cannabis has even higher favorability, according to a survey from the independent Quinnipiac University this past August. When that happens, smaller players could be hit harder than larger companies, especially if they don't already have well-established international operations. This site uses Akismet to reduce spam. Facebook 1. You May Also Like. My colleague Sean Williams likes to call Organigram a "marijuana value stock" because of its relatively low price-to-earnings-to-growth PEG ratio. Hand-crafted, small-batch, East Coast cannabis launches with four distinctive strains for discerning connoisseurs. House sitting on his desk — that he has taken no action on…. Travis Johnson, Stock Gumshoe. Checking out the "massive state-of-the-art greenhouse" that Altucher says will outproduce Canada's entire market What do all these companies do with their unsmokable material? Agriculture-based streaming deals are difficult in general, and tend not to provide any windfall opportunities like mining or energy royalties sometimes can, and in a market as volatile as td ameritrade trading without leverage exchange traded binary options they might just not make any sense at all.

The 2 Best Pot Stocks to Consider Buying Now -- and 1 to Avoid

Back in November, Aurora launched an unsolicited bid, which became a hostile bid, for CanniMed Therapeutics. September 25, am. Revenue Growth. Quote Overview Stock Activity Open 0. I grew up within an hour of the Leamington area in the Detroit area and it has more greenhouses than anywhere else in North American. Subscribe to this comment thread. However, as you'll see below, there's also a Canadian pot stock that you're best off avoiding. September 26, am. When legal recreational use goes into effect, demand is going to skyrocket. It is widely agreed colombian currency in forex chart nse algo trading course be the most successful marijuana company to go public and is seen as the benchmark and leader of the industry.

Growth in production capacity has been remarkable, and big grow houses are mostly in constant harvest mode if they planted their pot all at once, they could get three harvests a year… but they stagger plantings for constant production. Already a print newspaper subscriber? Current cannabis revenue numbers in Canada will pale in comparison to what we see once legal recreational use goes in effect. Aurora is also actively engaged in expanding its production capacity through partnerships and acquisitions. September 29, am. There are lots of people entering the cannabis business…. New Ventures. The intangible aspect about Aphria that investors should appreciate is its management team. It has the Cannabis Cash Weekly, you can access it there. Join Stock Advisor. It invests and supports cannabis cultivation companies. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. We use cookies to understand how you use our site and to improve your experience. October 6, pm. Lubricants, biodiesel, paper, clothing, even building materials. That will change come October, though. Due to inactivity, you will be signed out in approximately:.

Motley Fool Returns

Support Quality Journalism. Already subscribed to globeandmail. It's able to buy this pot at well below market prices, and then turn around and sell it at market price, thusly pocketing the difference. So it sounds like they at least hired some MBAs. In other words, even as Aurora's business thrives, its share price could suffer because of massive dilution, hurting pot stock investors in the process. My portfolio. Zacks Earnings ESP Expected Surprise Prediction looks to find companies that have recently seen positive earnings estimate revision activity. Hottest comment thread. For exchange delays and terms of use, please read disclaimer will open in new tab.

Do etf dividends get paid out to investor pattern day trading pdt rule like that the company has already locked in recreational marijuana supply agreements with several provinces. The royalty model is also flush with diversification. Don't Know Your Password? This royalty and streaming model has worked well in the silver and gold markets. Mine is much easier, though its offering was pretty prosaic, in a way it was personally coincidentally not the insight it might have been! CEO Chuck Rifici. Page ancestor: Stocks. However, we also can't overlook just how much the public's perception of pot has changed over the years. Join Stock Advisor. Exp Earnings Date? Stock Advisor launched in February of This works well because mining is a very cash intensive business and requires a lot of upfront capital. Revenue Growth YoY.

Connect the Dots: Cannabis Wheaton (KWFLF)(CBW.V)

Let's look at both in more. Log in. View Estimates. Am planning on buying more on weakness. The technique has proven to be very useful for finding positive surprises. The detailed multi-page Analyst report does an even deeper dive on the company's vital options strategy selling puts buy and sell stock same day td ameritrade. Return-on-Assets Before Tax. But it's a risk that investors should keep in mind before buying any marijuana stock. Instead, pot stock investors get the opportunity with a company like this to buy into geographic and production-based diversification. Rifici said he is proud of what he built with Tweed but was ready to put the past behind. Stock Market. Todd mitchell price action blog category day trading for beginners Podcasts. Instead, pot stock investors get the opportunity with a company like this to buy into geographic and production-based diversification. All he wants is your money. The Ascent. Join Stock Advisor.

Unlike traditional growers, Cannabis Wheaton is a royalty company, which comes with a list of benefits. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. Some folks would suggest that it's fully valued at this point. Back to top. Revenue Growth YoY. The technique has proven to be very useful for finding positive surprises. Even with the reduced risk, shareholders are exposed to the explosive industry expansion that Rifici explained as being a 10x expansion. I grew up within an hour of the Leamington area in the Detroit area and it has more greenhouses than anywhere else in North American. The lead article in last weeks Investors Business was about how Latin America is poised to become a big supplier of cannabis to North America over the next several years, because their costs will be so much lower. Getting Started. Log in. Snapshot This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months.

VolumeMarket Cap I have 8 different pot stocks now, and all of them have gone from in the green to in the red, with aurora Cannabis the reddest. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with barclays stock trading how to see stock money flows and sales charts; a recap of their last earnings bot trading cryptocurrency fidelity free day of trading and a bulleted list of reasons to buy or sell the stock. Back to top. We may buy or sell additional shares of KWFLF in the open market at any time, including before, during or after the Website and Information, provide public dissemination of favorable Information. Stock Advisor launched in February of This royalty and streaming model has worked well in the silver and gold markets. Which of these two marijuana stocks is the better pick now? However, we also can't overlook just how much the public's perception of pot has changed over the years. Yes, about 40 miles from Cleveland, on American soil. Zacks Premium - The only way to fully access the Zacks Rank. See rankings and related performance. I am so not tempted by this new pitch. Your head scratcher is worthier of 5-later chess playing! Delayed Price USD. In other words, even as Aurora's business thrives, its share price could suffer because of massive dilution, hurting pot stock investors in the process. Zacks Premium - The only way to get access to the Zacks Rank. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. If not, just click here

Irregulars Quick Take Paid members get a quick summary of the stocks teased and our thoughts here. See more Zacks Equity Research reports. How good is it? This deal could give Organigram a foothold to enter the lucrative German medical cannabis market. Industries to Invest In. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. September 25, am. Added to an already successful, and growing, legal medical cannabis industry overseen by Health Canada, and it's easy to see why Canadian pot stocks have flourished. Read our privacy policy to learn more. Having said that, however, I do have concerns about the long-term prospects for smaller Canadian marijuana growers. Auxly, though, isn't like most Canadian marijuana growers. The three scores are based on the trading styles of Growth, Value, and Momentum. My Watchlist My Portfolio.

Lubricants, biodiesel, paper, clothing, even building materials. The biggest news out of Auxly lately is their deal with the British tobacco company Imperial Brands Auxly press release here , owner of the Blu vaping brand probably the second-biggest US vaping brand behind Juul, bought from RJ Reynolds about five years ago as well as some legacy cigarette brands like Winston. Neither Zacks Investment Research, Inc. It's in the process of constructing its flagship facility, the Aurora Sky. NA Zacks Industry Rank? Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. It is unbelievable to see all of them for miles and most of them are HUGE. However, as you'll see below, there's also a Canadian pot stock that you're best off avoiding. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. What will happen in the US as legalization moves forward? My advice is fairly straight forward. Share article The post has been shared by 1 people. Add a Topic.