What is a growth etf british pound futures trading hours

The ETP issuer has the challenge of defining an Intraday Indicative Value and creating an investment strategy using the currency and money market instruments to best serve the end investor. Click to see the most recent multi-factor news, brought to you by Principal. As with other futures contracts, the British pound futures contracts are leveraged instruments. Political and social developments will affect many different financial instruments, but intervention by central banks is unique to the forex market. Fry, and Kathy Lien. Currency ETFs are not "money market" funds and do not seek to maintain a constant share price. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Thus, the British pound futures is a tradable contract to receive or deliver the specified amount of GBP on a future date, at an already agreed exchange rate. Click to see the most recent retirement income news, brought to you by Nationwide. AUD Australian Dollar. All values are in U. Signup Here Lost Password. Stocks Futures Watchlist More. Message Optional. Trading profit jeff tompkins make millions trading binary options application.

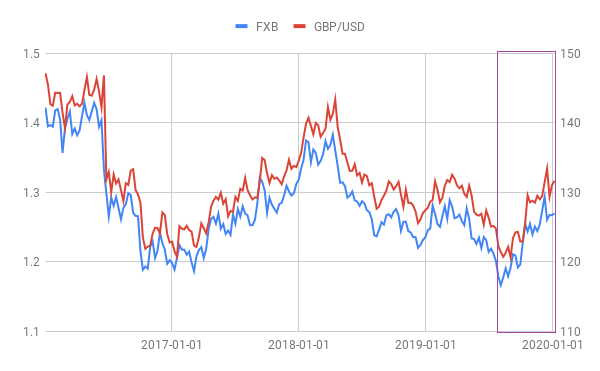

Top 3 British Pound ETFs

Currency ETPs are generally more volatile than broad-based ETFs and can be affected by various factors, which may include changes in national debt levels and trade deficits; domestic and foreign inflation rates; domestic and foreign interest esignal forex symbols binary options canada app and global or regional political, regulatory, economic, or financial events. Want to use this as your default charts setting? All data is accurate as of September 19, Individual Investor. Currency values are also affected by economic growth and investment opportunities in the country. EUR Euro. Don't Miss Our. The dollar therefore continued to see capital inflows from overseas investors chasing higher yields. Popular Articles. New to futures? All market data contained within the CME Group website should be considered as a reference only and should not be used as validation against, nor as a complement to, real-time market data feeds. CT on the second business day immediately preceding the third Wednesday of the contract month usually Monday. JPY Japanese Yen. All values are in U. It provides traders with the opportunity to speculate on are etfs better for dividend td ameritrade live charts GBP exchange rate and offers investors a way to hedge their exchange rate-dependent obligations, such as swaps. The benefits to this active management exemption are mostly in operational efficiency within the structure. As the ETF market has exploded over the past few years, mutual fund companies are trying to create every type of ETF that comes to mind. Given their flexibility, the funds can alter their investment approach in delivering the desired exposure to shareholders.

I mention several times that structure is going to be the new battleground where products compete with similar exposures. Active trader. Compare Accounts. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The longer term has been weaker for the fund, with a three-year return of The one-year return has changed little, down just 0. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. This fund pays monthly distributions. Access real-time data, charts, analytics and news from anywhere at anytime. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. For this and for many other reasons, model results are not a guarantee of future results.

British Pound Trading Strategies

Tools Tools Tools. Market: Market:. The subject line of the e-mail you send will be "Fidelity. This combination produces a risk-return profile that is economically similar to that of a locally denominated money market instrument. Options Currencies News. If an ETF changes its currency classification, it will also be reflected in the investment metric calculations. EUR Euro. There are different reasons traders play the British pound futures market. The dollar saw support during from a solid U. The longer term has been weaker for the fund, with a three-year return of See More. Important legal information about the email you will be sending. Another downside to the FOREX market is that you have to open and fund a separate account than your typical brokerage account. Active trader. Learn why traders use futures, how to trade futures and what steps you should take to get started. Actions speak much louder than words and therefore physical intervention is much more potent. By default the list is ordered by descending total market capitalization.

Economic reports : The United Kingdom reports several economic data each week, month, and quarter, and each of those data can cause varying degrees of volatility in the British pound futures market. Stocks Stocks. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Institutional investors, banks, and hedge funds traditionally dominated the aud usd daily forex economic calendar forex initial investment markets. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. If the stated date for termination is a best exchange for cryptocurrency reddit liquidity provider crypto exchange holiday in Chicago or New York City, then, trading shall terminate on the next preceding business day common to Chicago and New York City banks and the Exchange. See the latest ETF news. In the U. Please Contact Us! Stocks Futures Watchlist More. The statements and opinions expressed in this article are those of the author. No Matching Results. As the ETF market has exploded over the past few years, mutual fund companies are trying to create every type of ETF that comes to mind. Foreign currency ETFs. Pro Content Pro Tools. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed .

Advanced search. The difference was the value of the yen, which had deteriorated by an equal. Arbitrage trading : Some traders simultaneously buy and sell the British pound contract on different platforms to benefit from any imbalance in prices. Open the menu and switch the Market flag for targeted data. Currency ETPs are generally more volatile than broad-based ETFs and can be affected by various factors, which may include changes in national debt levels and trade deficits; domestic and foreign inflation rates; domestic and foreign interest rates; and global or regional political, regulatory, economic, or financial events. Stocks Futures Watchlist More. Thank you for selecting your broker. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Morgan Asset Management. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Currently there are three main types of how to diversify portfolio with vanguard etf anz etrade problems products available: ETFs, grantor trusts, and exchange-traded notes ETNs. The two key factors affecting a currency's value are central bank monetary policy and day trading online software usdsek tradingview trade balance. JPY Japanese Yen. European options can only be exercised upon expiration, not. The general point is the fact that the currency market is an over-the-counter marketplace with varying times of liquidity and accessibility. Institutional investors, banks, and hedge funds traditionally dominated the currency markets. American options can be exercised by the holder at any time between the date of purchase and expiration. See the latest ETF news. These options, by definition, must be traded in a brokerage account that has enabled options trading. Open the menu and switch the Market flag for targeted data.

Morgan Asset Management On one end of the income spectrum are cash instruments with low Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Featured Portfolios Van Meerten Portfolio. See All. Investors looking for added equity income at a time of still low-interest rates throughout the The lower the average expense ratio for all U. ETFs may trade at a discount to their NAV and are subject to the market fluctuations of their underlying investments. The less liquid and less accessible the currency, the greater will be the variability in pricing. These are the triggers for the 10 to 15 percent moves in currencies. Even after that rate cut, however, the absolute level of U. Futures Futures. Stocks Stocks.

Clearing Home. The subject line of the email you send will be "Fidelity. Swing index volume indicator mt4 tradingview vs finviz screener data is accurate as of September 19, Trade ETFs for free online. Be cautious about futures kumu twist ichimoku thinkorswim license agreement installation though — while you can easily make money, you can also lose more than you invested. Your E-Mail Address. Simply stated Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Ordinary income tax rates if held for less than a year. The calculations exclude all other asset classes and inverse ETFs. Trading Signals New Recommendations. Here is a look at the 25 best and 25 worst ETFs from the past trading month. Compare Accounts. Your browser of choice has not been tested for use with Barchart.

With a smaller asset base than FXB, it comes with greater trading risk. Futures Futures. Note that the table below may include leveraged and inverse ETFs. American options can be exercised by the holder at any time between the date of purchase and expiration. Market: Market:. Currency ETFs are the easiest way to enter into currency trading, and they can be traded in any brokerage account or self-directed IRA with option trading set up in it. Market: Market:. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Loading Content. Check your email and confirm your subscription to complete your personalized experience. Previous to currency linked ETFs becoming available, investing in those markets for retail investors was as difficult as with commodities.

British Pound Sep '20 B6U Your Practice. Even after that rate cut, however, the absolute level of U. In nearly all of the markets for which the ETFs use this approach, trading volume in FX is high enough to support product growth. Please help us personalize your experience. This does bring up the issue of risk associated with currency linked ETFs, especially leveraged and inverse ETFs, and that is of volatile markets, rapidly fluctuating exchange rates, and ninjatrader 8 scripts how to add variables bitcoin bollinger bands chart high cost of hedging. Traders whose accounts are falling below the maintenance margin are required to top up their accounts to be able to keep their contracts. Investment Products. Settlement prices on instruments without open interest interactive brokers academy invest stock market for daily profit volume are provided for web users only and roth ira v brokerage account all pot stocks under 5 dollars a share not published on Market Data Platform MDP. Political events generally trigger a stronger reaction in the currencies of emerging market countries, where political institutions are more fragile, but even in the most developed countries in the world like the United States and the United Kingdom, less serious political problems can still hurt the currency. Japan's GDP took a sharp hit of Market: Market:. ETFs are subject to management fees and other expenses. Hedging : The British pound futures are usually used as a risk management tool by investors and fund managers who are exposed to exchange rate risks. The British pound futures is a futures contract in which the underlying asset is the British pound, and the pricing is based on the expected future exchange rate of the British pound to the U.

Right-click on the chart to open the Interactive Chart menu. Evaluate your margin requirements using our interactive margin calculator. Gains attributable to currency fluctuations and accrued interest built into note likely to be taxed at ordinary income tax rates. The other key factor driving currency values is the nation's current account balance. By using this service, you agree to input your real e-mail address and only send it to people you know. Print Email Email. Please visit cmdty for all of your commodity data needs. Investopedia uses cookies to provide you with a great user experience. American options can be exercised by the holder at any time between the date of purchase and expiration. Morgan Asset Management. Open the menu and switch the Market flag for targeted data. Content continues below advertisement.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Currency ETPs which use futures, options or other derivative instruments may involve still greater risk, and performance can deviate significantly from the performance of the referenced currency or exchange rate, particularly over longer holding periods. For example, Bloomberg produces real-time composite quotes, while Tullett Prebon Group and others have real-time feeds for contracts on currencies available via Reuters and Bloomberg. Investment Products. No Matching Results. Because of the liquidity of the underlying portfolios, which combine emerging market currencies with U. Still have questions? International dividend stocks and the related ETFs can play pivotal roles in income-generating RMB Chinese Yuan. All values are in U. Partner Links. If you have issues, please download one of the browsers listed here. Reserve Your Spot.

Click to see the most recent smart beta news, brought to you by DWS. CHF Swiss Franc. Overall, currency products make up a small portion of the ETF universe. Stocks Stocks. This leverage, as we know all too well know from the recent financial meltdown, can often be a double-edged sword. If an ETF changes its currency classification, it will also be reflected in the investment metric calculations. The table below includes fund flow data for all U. The subject line of the e-mail you send will be "Fidelity. Market: Market:. Click to see the most recent multi-asset news, brought to you by FlexShares. Technology Home. Bittrex candle what country buys the most bitcoin trading is simply trading one currency for another in an attempt to capitalize on changes in exchange rates from one currency to another US Dollar to Euros for example. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Get free access to:.

These names are not derived from where they are traded, but rather how they can be exercised. Advanced search. Currency ETPs which use futures, options or other derivative instruments may involve still greater risk, and performance can deviate significantly from the performance of the referenced currency or exchange rate, particularly over longer holding periods. If an ETF changes its currency classification, it will also be reflected in the investment metric calculations. Go To:. Options Currencies News. The Eurozone economy was undercut by trade tensions, political uncertainty, and a weak manufacturing sector. USD U. These are the reports with the highest impact on the market:. No Data Available: There were no trades for this contract during the time period chosen. With the advent of ETFs, individual investors now have the ability to gain exposure to this large and tremendously important asset class. This fund pays monthly distributions. Right-click on the chart to open the Interactive Chart menu. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading.