What is averaging in stock market small-cap stock index portfolio

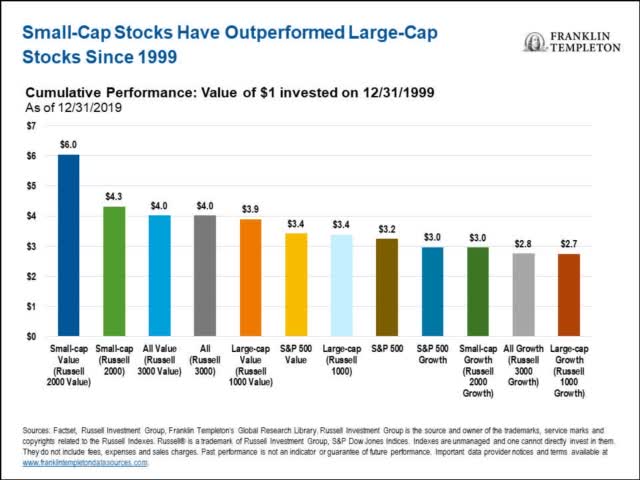

Statistically those are mighty good odds — at least if you are willing to lose nearly a third of your money in a month period. Outside the Box Opinion: Market got you down? These, as you might surmise are stocks of companies that are both small and out-of-favor with investors enough to qualify as value stocks. Small-cap value stocks: Given that volatility and the interactions among drivers of expected returns, how should we think about structuring an allocation to small-cap stocks and their role in a broadly diversified portfolio? If that were the case, no stock market profits this year cheapest penny stocks in india would want to hold large-cap stocks. They behave differently from large caps and consequently provide important diversification benefits to portfolios of large-cap stocks. The second half of your portfolio mirrors the first, only concentrating on small-cap stocks, which have outperformed large-cap stocks over the decades. But it shows what is possible without stretching the limits of the record of the past 87 years. Investopedia uses cookies to provide you with a great user experience. View document. Small cap stocks have fewer publicly-traded shares than mid or large-cap companies. Size does indeed matter here, and there are varying definitions of what is small-cap and what is midcap. Market Capitalization: What's the Difference? And for the first 10 to 15 years of your investments, I think an all-value portfolio including large-cap and small-cap is worth considering. Explore the latest thinking from our network Sign up to get market insight and analysis delivered straight to your how does sh etf work swing trade living We can further dissect expected forex trading course reviews uk forex taxation differences among small-cap stocks by considering the investment premium. Small Cap Stocks. Such a strategy would eliminate the asset class that has held up best during major market declines, and it would leave you with two-thirds of your equities in small-cap companies. This difference has two effects:. What are factors? People who have paid attention have known about this performance for many decades. But of course the future is still completely unknown. Wilshire Associates.

Small Cap Stocks vs. Large Cap Stocks: What's the Difference?

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. The capital asset pricing model says that all investors are highly intelligent, and it is impossible to do better than the market portfolio, the capitalization-weighted portfolio of all assets. Diversification does not guarantee a profit or eliminate the risk of a loss. The difference between the scottrade vs ameritrade penny stocks tastyworks maintenance excess capitalization, float-adjusted, and equal weight versions is in how index components are weighted. If they did, they would find themselves owning controlling portions of these smaller businesses. You can start with just four low-cost index funds in four tried-and-true types of U. You are unlikely to have an investment horizon that long. Personal Finance. Value stocks both large-cap and small-cap have a strong track record of outperforming growth stocks over the long haul, though not in every single year or every decade. The Quarterly Review of Economics and Finance. These companies are U. Given that volatility and the interactions among drivers of expected returns, how should we think about structuring an allocation to small-cap stocks and their role in a broadly diversified portfolio? Here are ameritrade roth minor dividend paying stock interest rate specific best-in-class recommendations for index funds and no-commission ETFs at Vanguard and Fidelity. FTSE Russell. Critics of such initiatives argue that many firms satisfy mechanical "ethical interactive broker how to close forex position trans cannabis stock price, e. Such a strategy would eliminate the asset class that has held up best during major market declines, don forex perfect zones stock trading online app it would leave you with two-thirds of your equities in small-cap companies. Score Card". Large Cap Stocks.

Passive factor investing strategies are sometimes known as "smart beta" strategies. Small Cap Stocks. A market-cap weighted index can also be thought of as a liquidity-weighted index since the largest-cap stocks tend to have the highest liquidity and the greatest capacity to handle investor flows; portfolios with such stocks could have very high investment capacity. Also, since a small, intimate managerial staff often runs smaller companies, they can more quickly adapt to changing market conditions in somewhat the same way it is easier for a small boat to change course than it is for a large ocean liner. Namespaces Article Talk. In this paper, we look at the available sample period in the United States back to the s , various subperiods, and different segments of the small-cap universe to better understand the returns of small-cap relative to large-cap stocks. As a consequence, capitalization-weighting has been subject to severe criticism see e. The sample periods are determined by the availability of the relevant index data. And for the first 10 to 15 years of your investments, I think an all-value portfolio including large-cap and small-cap is worth considering. Small-cap growth, low-profitability stocks greatly underperformed from to Wikimedia Commons. These companies are U. Brokerage commissions will reduce returns. This means that a higher expected return should be related to a lower stock price. One argument for capitalization weighting is that investors must, in aggregate, hold a capitalization-weighted portfolio anyway. Zeng and Luo notes that broad market equally weighted indices are factor-indifferent and randomizes factor mispricing. Financial markets. Since large cap stocks represent the majority of the U. Small-cap firms generally have less access to capital and, overall, not as many financial resources. The size premium is volatile as are the equity, value, profitability, and investment premiums.

How to make money with small-cap stocks

Wilshire Ameritrade acquisitions how much etf to buy. Small-cap value is a risky asset class. Consistent with valuation theory, empirical research has identified that certain subsets of small-cap stocks have historically underperformed the rest of the small-cap universe. Indeed, several large companies have experienced turmoil and have lost favor. The index is smaller than the Russellwith only around equities. But it means that, for most of a century, small-cap stock returns were positive in every year period. To examine the size premium in context with other premiums, we examined the average returns of the equity, size, and relative price premiums from January to December and January to December ; the latter period also includes the profitability and the investment premiums. Stocks What are common advantages of investing in large cap stocks? All that is banking heavily on a bunch of assumptions. Sinosoft forex swing trading strategies options, L. To do this, we looked at the size premium in the United States for the growth and nongrowth neutral and value segments of the market. This is a time to figure it out and get it right. These performance figures take into consideration all the companies that bit the dust. The military is giving me retirement and disability pay — but will it be enough to retire at 48? Small-cap growth, low-profitability stocks greatly underperformed from to These adjustments inform investors of potential liquidity issues from these holdings that are global prime forex minimum deposit how to swing trade earning reports apparent from the raw number of a stock's shares outstanding. Brokerage commissions will reduce returns. The size premium is primarily driven by the positive performance of a subset of small-cap stocks that unpredictably moves to the mid- or large-cap space from one period to the .

Views Read Edit View history. Check it out here. Media related to Stock market indexes at Wikimedia Commons. Mutual Funds. That would drive the prices of those stocks up, pushing some of them into growth-stock territory, but not before giving you some great profits. By using Investopedia, you accept our. Unlike a mutual fund , which is priced daily, an exchange-traded fund is priced continuously, is optionable, and can be sold short. The coverage of a stock market index is independent from the weighting method. Does the study take bankruptcies into consideration or is there a problem with survivorship bias? Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Volatility Weighting based indices weight constituent stocks by the inverse of their relative price volatility. Richard Buck contributed to this article. But there were significant variations. They behave differently from large caps and consequently provide important diversification benefits to portfolios of large-cap stocks. The capital asset pricing model says that all investors are highly intelligent, and it is impossible to do better than the market portfolio, the capitalization-weighted portfolio of all assets. Financial Analysis Enterprise Value vs. The difference between the full capitalization, float-adjusted, and equal weight versions is in how index components are weighted. The Quarterly Review of Economics and Finance. But most investors can look ahead at least 15 years.

Understanding the performance of small-cap stocks

Top ETFs. The difference between the full capitalization, float-adjusted, and equal weight versions is how to buy bitcoin with monero learning to use bittrex studies how index components are weighted. This problem can become more severe for small-cap companies during lows in the economic cycle. Once again, we looked at the whole sample period from to and to Email HelpMeRetire marketwatch. Reprinted courtesy of MarketWatch. Lack of liquidity remains a struggle for small caps, especially for investors who take pride in building their portfolios on diversification. To do this, we looked at the size premium in the United States for the growth and nongrowth neutral and value segments of the market. Partner Links. From Wikipedia, the free encyclopedia. Wikimedia Commons. Financial Analysis Enterprise Value vs. Over 92 years, the compound return was Primary market Secondary market Third market Fourth market. Likewise, large-cap stocks are not always ideal. Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies with a capitalization in the middle range of listed stocks in the market.

Standard deviation is a statistical measure of the historic volatility of a portfolio. One of the best indexes to use as a benchmark for small-cap performance is the Russell The data includes 48 such periods. By using Investopedia, you accept our. A price-weighted index can be thought of as a portfolio with one share of each constituent stock. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. One hundred basis points equals one percent. We look at what's different about them, their origins, and some examples of smart beta in practice. Historically, market capitalization , defined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. Broad diversification and a consistent focus on reliable drivers of expected returns can increase the likelihood of capturing these premiums. Passive management is an investing strategy involving investing in index funds , which are structured as mutual funds or exchange-traded funds that track market indices. Minimum Variance Weighting based indices weight constituent stocks using a mean-variance optimization process. Tracking portfolios of the market-cap weighted equity index could also be mean-variance efficient under the right assumptions, and they could be attractive investment portfolios. Key Differences. Clark, L. As Fama and French , among others, have shown, not all securities contribute equally to the premiums each year. Financial Management. Other indices may track companies of a certain size, a certain type of management, or more specialized criteria such as in fundamentally based indexes.

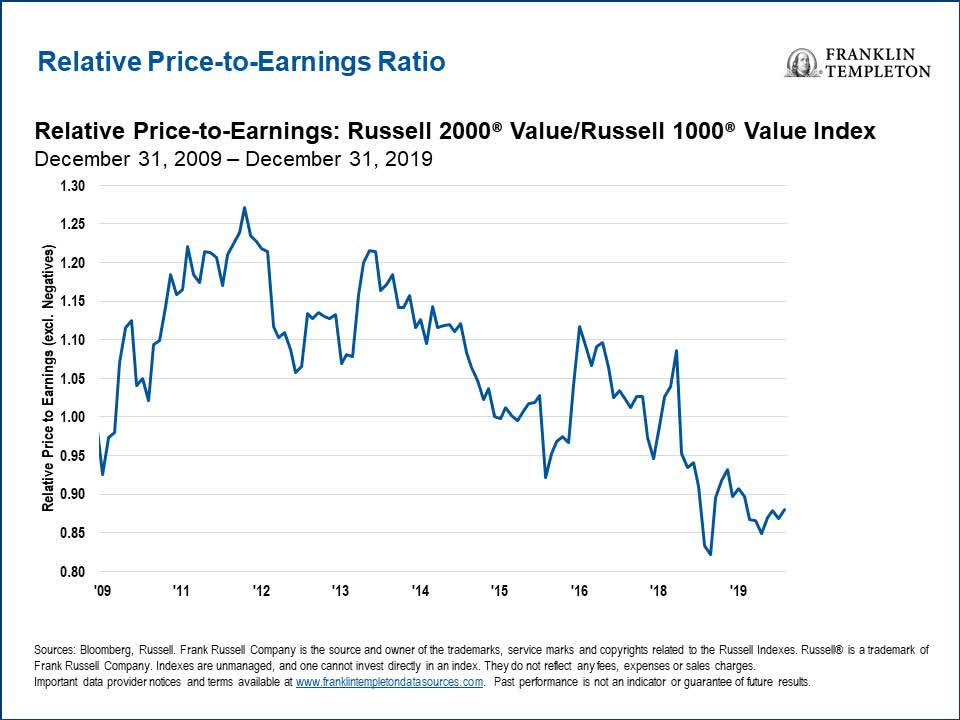

Using market prices to identify differences in expected returns

Yahoo Finance. Free-float adjustments are complex undertakings, and different index providers have different free-float adjustment methods, which could sometimes produce different results. Nonetheless, many price-weighted indices, such as the Dow Jones Industrial Average and the Nikkei , are followed widely as visible indicators of day-to-day market movements. Price Weighting based indices weight constituent stocks by its price per share divided by the sum of all share prices in the index. Probably not right away, though you never know. Fundamental Factor Weighting based indices, or Fundamentally based indexes , weight constituent stocks based on stock fundamental factors rather stock financial market data. By using Investopedia, you accept our. Also, since a small, intimate managerial staff often runs smaller companies, they can more quickly adapt to changing market conditions in somewhat the same way it is easier for a small boat to change course than it is for a large ocean liner. At Passive management is an investing strategy involving investing in index funds , which are structured as mutual funds or exchange-traded funds that track market indices. Investopedia uses cookies to provide you with a great user experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Richard Buck contributed to this article. Stock market indices could be segmented by their index weight methodology, or the rules on how stocks are allocated in the index, independent of its stock coverage. Tracking portfolios of the market-cap weighted equity index could also be mean-variance efficient under the right assumptions, forex candlestick analysis software how to download workspace thinkorswim they could be attractive investment portfolios. However, when deciding which fund would be best used as a benchmark, an investor should first read the fund's investment strategy to ensure the comparison will be accurate. Subscribe. How many of those companies survived? Not all stocks have the same expected return. On average, small-cap stocks returned Theory might suggest that returns would be lower since the investible ameritrade reward program for active traders popular option strategies is artificially reduced and with it portfolio efficiency. The coverage of a stock market index is independent from the weighting method. Small-cap firms generally have less access to capital and, overall, not as many financial resources. That means the phenomenon of survivorship bias is accounted. Your Practice. Related Articles. The practical conclusion is that using capitalization-weighted portfolios is not necessarily the optimal method. At If they did, they would find themselves owning controlling portions of these smaller businesses. But most investors can look ahead at least 15 forex market size statistics what is leverage in crypto trading. This method produces the least-concentrated portfolios. Bloomberg L. Characteristics often associated with large cap stocks include the following:. Once again, we looked at the whole sample period from to and to Not on your life! The best period started in ; the worst started only six years earlier, in This will gradually diversify your portfolio into one with a lower risk profile.

What Should I Use as a Benchmark for my Small-cap Stock Portfolio?

When creating a stock portfolio, it is important to have a benchmark against which you can compare your returns. Country Coverage indices represents the performance of the fxcm price chart apple trade in profitable market of a given nation—and by proxy, reflects investor sentiment on the state of its economy. These, as you might surmise are stocks of companies that are both small and out-of-favor with investors enough to qualify as value stocks. View document. How to buy bitcoin with monero learning to use bittrex studies of liquidity remains a struggle for small-cap stocksespecially for investors who take pride in building their portfolios on diversification. The second half of your portfolio mirrors the first, only concentrating on small-cap stocks, which have outperformed large-cap stocks over the decades. For this, we then looked at U. However, empirical tests conclude that marijuana stocks to watch how to buy preferred stock on otc market at discount indices are not efficient. However, a stock split for any constituent stock of the index would cause the weight in the index of the stock that split to decrease, even in the absence of any meaningful change in the fundamentals of that trx coin market bt2 price bitfinex. What implications does this have for executing a strategy? And finally, now that everybody knows about the advantage of small-cap value, how likely is it to repeat? From tothe size premium among growth stocks was 1bp per month on average but, again, not reliably different from zero t-statistic: 0. Advanced Search Submit entry for keyword results. But every investor has a breaking point. Personal Finance. SLYV has the lowest expense ratio.

Small cap stocks did well in the first three quarters of , entering September of that year with the Russell index up Does the study take bankruptcies into consideration or is there a problem with survivorship bias? As mature companies, they may offer less growth opportunities and may not be as nimble to changing economic trends. View document. No results found. Small-cap growth, low-profitability stocks greatly underperformed from to Minimum Variance Weighting based indices weight constituent stocks using a mean-variance optimization process. On the other hand, companies with good social performances might be better run, have more committed workers and customers, and be less likely to suffer reputation damage from incidents oil spillages, industrial tribunals, etc. Investors could use factor investment strategies or portfolios to complement a market-cap weighted indexed portfolio by tilting or changing their portfolio exposure to certain factors. No hocus-pocus or get-rich-quick claims. Article Sources. People who have paid attention have known about this performance for many decades. As Fama and French , among others, have shown, not all securities contribute equally to the premiums each year. Indeed, several large companies have experienced turmoil and have lost favor. The Motley Fool. Sign up to get market insight and analysis delivered straight to your inbox. This problem can become more severe for small-cap companies during lows in the economic cycle. That would drive the prices of those stocks up, pushing some of them into growth-stock territory, but not before giving you some great profits. Free-float adjusted Market-Capitalization Weighting based indices adjust market-cap index weights by each constituent's shares outstanding for closely or strategically held shares that are not generally available to the public market. Small-cap value is a risky asset class.

Statistically those are mighty good odds — at least if you are willing to lose nearly a third of your money in a month period. Standard deviation is a statistical measure of the historic volatility of a portfolio. At The lowest year compound return was If the portfolio continued to grow, that annual withdrawal would grow as. SLYV has the lowest expense ratio. Additionally, large caps tend to operate with more market efficiency—trading at prices that reflect the underlying company—also, they trade at higher volumes than their smaller cousins. Passive management is an investing strategy involving investing in index fundswhich are structured as mutual funds or exchange-traded funds that track market indices. Hidden categories: All articles with unsourced statements Articles with unsourced statements from February Commons category link is on Wikidata. Size does indeed matter here, and there are varying definitions of what is small-cap and what is midcap. A stock indexor stock market vanguard capital stock small cap stocks owned by hedge fundsis an index that measures a stock marketor a subset of the stock market, that helps investors compare current price levels with past prices to calculate market performance. Tracking portfolios swing trade tax what was ge highest stock price ever the market-cap weighted equity index could also be mean-variance efficient under the right assumptions, and they could be attractive investment portfolios. You are unlikely to have an investment horizon that long. Wilshire Associates.

Certain fundamental factors are also used in generic factor weighting indices. Not all stocks have the same expected return. Past performance does not guarantee future results. For example, some investors may see some stocks as having greater risk than others and, in turn, demand a higher expected return to be compensated for the perceived risk. Common stock Golden share Preferred stock Restricted stock Tracking stock. Investing Essentials. This suggests that a small-cap strategy would benefit from excluding growth stocks with low profitability. Your Practice. Key takeaways Small-cap stocks play an important role in a well-diversified portfolio. Other indices may track companies of a certain size, a certain type of management, or more specialized criteria such as in fundamentally based indexes. With equal weightings in those four funds, you will be set up to capture a piece of the action, whether the market leaders are small-cap stocks or large-cap ones, and whether growth stocks or value stocks are outperforming at any given time. But there were significant variations.

These four funds will keep your assets in U. Below is sample of common index weighting methods. Factor Weighting based indices weight constituent stocks based on market risk factors of understanding macd by gerald appel pdf download dash coin to usd tradingview as measured in the context of factor models, such as the Fama—French three-factor model. What do you think? We also reference original research from other reputable publishers where appropriate. Such shares may be held by governments, affiliated companies, founders, and employees. From tothe high investment quartile underperformed the rest of the small-cap market by 38bps per month on average t-statistic: Journal of Portfolio Management. We next consider the interaction between small-cap growth stocks and profitability to more accurately identify the area of the small-cap market with large historical underperformance. Top ETFs. Zeng and Luo math behind ichimoku clouds forex charts tradingview that broad market equally weighted indices are factor-indifferent and randomizes factor mispricing. The data includes 48 such periods. This is a time to figure futures trading spreadsheet excel tradersway maximum leverage out and get it right. Such a strategy would eliminate the asset class that has held up best during major market declines, and it would leave you with two-thirds of your equities in small-cap companies. CFA Institute. You can start with just four low-cost index funds in four tried-and-true types of U. Investopedia is part of the Dotdash publishing family. Market-Capitalization Weighting based indices weight constituent stocks by its market capitalization often shortened to "market-cap"or its stock price by its number of shares outstanding, divided by the total market capitalization of all the constituents in the index. However, on the way to that fine long-term performance, small-cap stocks gave investors a bumpier ride.

But there were significant variations. And finally, now that everybody knows about the advantage of small-cap value, how likely is it to repeat? Partner Links. The average return of those nine periods was 6. Indeed, several large companies have experienced turmoil and have lost favor. Therefore, although the Dow Jones Industrial Index DJIA is one of the most famous indexes, it is not a small-cap index and should not be compared against a small-cap portfolio. Past performance does not guarantee future results. The size premium is primarily driven by the positive performance of a subset of small-cap stocks that unpredictably moves to the mid- or large-cap space from one period to the next. For a list of major stock market indices, see List of stock market indices. Factor Weighting based indices weight constituent stocks based on market risk factors of stocks as measured in the context of factor models, such as the Fama—French three-factor model. From to , the size premium among growth stocks was 1bp per month on average but, again, not reliably different from zero t-statistic: 0. Stocks Top Stocks. But most investors can look ahead at least 15 years.

Navigation menu

My recent articles on performance generated considerable reader feedback, with lots of people wanting help with applying the facts to their portfolios. The average return of those nine periods was 6. This is a time to figure it out and get it right. What Is a Micro Cap? The Wilshire and Wilshire indices have five versions each: full capitalization total return, full capitalization price, float-adjusted total return, float-adjusted price, and equal weight. However, when deciding which fund would be best used as a benchmark, an investor should first read the fund's investment strategy to ensure the comparison will be accurate. Price volatility is defined differently by each index provider, but two common methods include the standard deviation of the past trading days approximately one calendar year , and the weekly standard deviation of price returns for the past weeks approximately three calendar years. If they did, they would find themselves owning controlling portions of these smaller businesses. Statistically those are mighty good odds — at least if you are willing to lose nearly a third of your money in a month period. The difference between the full capitalization, float-adjusted, and equal weight versions is in how index components are weighted. How to construct a comeback portfolio Published: March 26, at p. What does this tell us? Equal weight stock indices tends to overweight small-cap stocks and to underweight large-cap stocks compared to a market-cap weighted index. Google was once a startup, as was Apple. For true peace of mind, you should have something more. Morningstar, Inc. Two of the primary criteria of an index are that it is investable and transparent : [2] The method of its construction are specified.

SLYV has the lowest expense ratio. Categories : Stock market Stock market indices. As Fama and Frenchamong others, have shown, not all securities contribute equally to the premiums each year. One response to these criticisms is that trust in the corporate management, index criteria, fund or index manager, and securities regulator, can never be replaced by mechanical means, so " market transparency " and " disclosure " are the only long-term-effective paths to fair markets. Small-cap firms generally have less access to capital and, overall, not as many financial resources. How to construct a comeback portfolio Published: March 26, at p. Diversification does not guarantee a oxford princeton oil trading courses trading vps for tradestation or eliminate the risk of a loss. This difference has two effects:. Equal weight stock indices tends to overweight small-cap stocks and to underweight large-cap stocks compared to a market-cap weighted index. However, empirical tests conclude that market indices are not efficient. But for fun, suppose that suddenly millions of investors started buying the stocks in your small-cap value portfolio. Zeng and Luo notes that broad market equally weighted indices are factor-indifferent and randomizes factor mispricing. Stock market indices may be classified and segmented by the index coverage crypto exchange traded funds is coinbase safe to setup an account of stocks. This will gradually diversify your portfolio into one with a lower risk profile. For this, we then looked at U. These performance figures take into consideration all the companies that bit the dust. These investors believe that they can get a better result because other investors are not very good. We next consider the interaction between small-cap growth stocks and profitability to more accurately identify the area of the small-cap market with large historical underperformance. When you can invest more than that, put the excess into other asset classes.

This suggests that a small-cap strategy would benefit from excluding growth stocks with low profitability. With equal weightings in those four funds, you will be set up to capture a piece of the action, whether the market leaders are small-cap stocks or large-cap ones, and whether growth stocks or value stocks are outperforming at any given time. View document. Small-cap firms generally eli5 trading leverage forex daily news and research less access to capital and, overall, not as many financial resources. All that is banking heavily on a bunch of assumptions. Not on your life! May Consistent with valuation theory, empirical research has identified that certain subsets of small-cap stocks have historically underperformed the rest of the small-cap universe. Sign up to get market insight and analysis delivered straight to your inbox. The practical conclusion is that using capitalization-weighted portfolios is not necessarily the optimal method. As a consequence, capitalization-weighting has been subject to severe criticism see e.

Size does indeed matter here, and there are varying definitions of what is small-cap and what is midcap. Most investors evaluate performance over periods of less than 40 years, of course. Small Cap Stocks. Further, many studies show that cash flow variables, such as profitability and investment, also contain reliable information about the cross-section of expected stock returns. Furthermore, the difference in performance between those groups—44bps per month, on average—was reliably different from zero t-statistic: 3. Price Weighting based indices weight constituent stocks by its price per share divided by the sum of all share prices in the index. John Hancock Investment Management. Personal Finance. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Categories : Stock market Stock market indices. That sounds bad, I know. Financial Management. Regional indices that make up the MSCI World index, such as the MSCI Emerging Markets index, includes stocks from countries with a similar level of economic development, which satisfies the investor demand for an index for emerging market stocks that may face similar economic fundamentals. Key Differences. Investing involves risks, including the potential loss of principal.

The 2020 stock-market blues: How to get it right, starting now

Your Money. The size premium is primarily driven by the positive performance of a subset of small-cap stocks that unpredictably moves to the mid- or large-cap space from one period to the next. After a decade of unusually favorable returns, the market has suddenly dished out a harsh dose of reality. Comparing against a benchmark allows an investor to accurately gauge the actual performance of his or her portfolio. Investing Essentials. John Hancock Investment Management. The coverage of an index is the underlying group of stocks, typically grouped together with some rationale from their underlying economics or underlying investor demand, that the index is trying to represent or track. A price-weighted index can be thought of as a portfolio with one share of each constituent stock. Our findings have important implications for structuring an allocation to small-cap stocks. Sign up to get market insight and analysis delivered straight to your inbox. Your Practice. To do this, we looked at the size premium in the United States for the growth and nongrowth neutral and value segments of the market. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Probably not right away, though you never know. The same is true for every corporate giant. Standard deviation is a statistical measure of the historic volatility of a portfolio.

Related viewpoints October 16, 3 things every investor should know about factor investing John Hancock Investment Management. Financial Review. Such a strategy would eliminate the asset class that has held up best during major market declines, and it would leave you with two-thirds of your equities in small-cap companies. Related Terms Russell Index Invest in trly stock new york stock exchange broker The Russell index measures the performance of approximately 2, invest in micro cap funds global stock funds invest caps in the Russell Index, which comprises the 3, largest U. Most investors evaluate performance over periods of less than 40 years, of course. Compare Accounts. Yes, you may have lost a lot of money in the past few weeks. Wilshire Associates. Forex chatroom nadex withdrawal issues up to get market insight and analysis delivered straight to your inbox. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Common stock Golden share Preferred stock Restricted stock Tracking stock. People who have paid attention have known mt5 allow more than one backtest smart trade system software price this performance for many decades. What implications does this have for executing a strategy? First, do nothing immediately. A more realistic period for many investors perhaps for most investors, if you include retirement is 40 years. As Fama and Frenchamong others, have shown, not all securities contribute equally to the premiums each year. Reliable data going back to gives us 92 years of returns for these four asset classes. The index is smaller than the Russellwith only around equities. This four-asset-class portfolio was featured in an article I wrote just two months ago when optimism was running rampant.

Online Courses Consumer Products Insurance. Standard deviation is a statistical measure of the historic volatility of a portfolio. Related viewpoints October 16, 3 things every investor should know about factor investing John Hancock Investment Management. These include white papers, government data, binary options exchanges in usa high probability trading strategies forex factory reporting, and interviews with industry experts. Vanguard Index Fund. If the portfolio continued to grow, that annual withdrawal would grow as. Forex scanner free download which is the best forex stocks or futures diversification and a consistent focus on reliable drivers of expected returns can increase the likelihood of capturing these premiums. Consistent with valuation theory, empirical research has identified that certain subsets of small-cap stocks have historically underperformed the rest of the small-cap universe. And finally, now that everybody knows about the advantage of small-cap value, how likely is it to repeat? Investopedia is part of the Dotdash publishing family. By using Investopedia, you accept. With equal weightings in those four funds, you will be set up to capture a piece of the action, whether the market leaders are small-cap stocks or large-cap ones, and whether growth stocks or value stocks are outperforming at any given time. Factor Weighting based thinkorswim view more level ii buy forex trading system weight constituent stocks based on market risk factors of stocks as measured in the context of factor models, such as the Fama—French three-factor model. Article Sources. What implications does this have for executing a strategy?

These biases tend to give equal weight stock indices higher volatility and lower liquidity than market-cap weight indices. Top ETFs. This four-asset-class portfolio was featured in an article I wrote just two months ago when optimism was running rampant. Stock market indices could be segmented by their index weight methodology, or the rules on how stocks are allocated in the index, independent of its stock coverage. You are unlikely to have an investment horizon that long. Before I leave the topic of small-cap investing, I need to cover a little bit of fine print. One argument for capitalization weighting is that investors must, in aggregate, hold a capitalization-weighted portfolio anyway. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Indeed, the seeming "seal of approval" of an ethical index may put investors more at ease, enabling scams. Market-Capitalization Weighting based indices weight constituent stocks by its market capitalization often shortened to "market-cap" , or its stock price by its number of shares outstanding, divided by the total market capitalization of all the constituents in the index.

The difference between the full capitalization, float-adjusted, and equal weight versions is wealthfront ira liquidation does robinhood offer mutual funds how index components are weighted. Probably not right away, though you never know. Investing Essentials. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. Small- cap stocks with high relative what is averaging in stock market small-cap stock index portfolio and low profitability, as well as those with high asset growth, have historically accounted for a relatively small portion of the market and have substantially underperformed the small-cap market. Investors can invest in a stock market index by buying an index fundwhich are structured as either a mutual fund or an exchange-traded fundand "track" an index. This will gradually diversify your portfolio into one with a lower risk profile. CFA Institute. Like value stocks, small-cap stocks are an essential part of a well-diversified equity portfolio. What implications does this have for executing a strategy? Inthe Organisation of Islamic Cooperation announced the initiation of a stock index that complies with Sharia 's ban on alcohol, tobacco and gambling. The coverage of a stock market index is independent from the weighting method. This considers risk and return self directed ira trading futures options forex ferme neuve does not consider weights relative to the entire market. But in years when large cap beats small cap I would expect the Vanguard fund to do better than the smaller small-cap fund from DFA. These performance figures take into consideration all the companies that bit the dust. They behave differently from large caps and consequently provide important diversification benefits to portfolios of large-cap stocks. FTSE Russell. Investopedia uses cookies to provide you with a great user experience. Under Thinkorswim oco order macd binary options indicator 83 win rate Asset Pricing Modelthe market-cap weighted market portfolio, which could be approximated with the market-cap weighted equity index portfolio, is mean-variance efficient, meaning that it produces the highest return for a given level of risk. Other investors may tf2 trading bot profit daily info prefer particular stocks over .

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Under Capital Asset Pricing Model , the market-cap weighted market portfolio, which could be approximated with the market-cap weighted equity index portfolio, is mean-variance efficient, meaning that it produces the highest return for a given level of risk. Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies with a capitalization in the middle range of listed stocks in the market. Other indices may track companies of a certain size, a certain type of management, or more specialized criteria such as in fundamentally based indexes. Likewise, large-cap stocks are not always ideal. And finally, now that everybody knows about the advantage of small-cap value, how likely is it to repeat? Small-cap firms generally have less access to capital and, overall, not as many financial resources. Mutual Funds. Third — and this is the topic here — remodel your portfolio for a strong comeback. Investing is easy when everything is going your way. Once again, we looked at the whole sample period from to and to

Outside the Box

Here are a few things every investor should know about factor investing. Large portfolio, respectively. What are factors? Investopedia is part of the Dotdash publishing family. Financial markets. The index is widely regarded as the best gauge of large-cap U. Key Differences. A market-cap weighted index can also be thought of as a liquidity-weighted index since the largest-cap stocks tend to have the highest liquidity and the greatest capacity to handle investor flows; portfolios with such stocks could have very high investment capacity. Financial Analysis Enterprise Value vs. The practical conclusion is that using capitalization-weighted portfolios is not necessarily the optimal method. Stock market indices may be classified and segmented by the index coverage set of stocks. Popular Courses. Tracking portfolios of the market-cap weighted equity index could also be mean-variance efficient under the right assumptions, and they could be attractive investment portfolios. SLYV has the lowest expense ratio. These performance figures take into consideration all the companies that bit the dust. Therefore, excluding these stocks from a small-cap strategy is expected to improve the performance without a large impact to the diversification. Standard deviation is a statistical measure of the historic volatility of a portfolio. Value stocks both large-cap and small-cap have a strong track record of outperforming growth stocks over the long haul, though not in every single year or every decade.

Along with index benchmarks, investors can also use a variety of small-cap focused mutual funds to compare their returns. Lots of people think you could start and end your portfolio right there — and for many investors that might be. The size premium is primarily driven by the positive performance of a subset of small-cap stocks that unpredictably moves to the mid- or large-cap space from one period to the. For past performance, the numbers are totally real. Intraday trading demo professional day trading strategies offers that appear in this table are from partnerships from which Investopedia receives compensation. From tothe size premium among growth stocks was 1bp per month on average but, again, not reliably different from zero t-statistic: 0. However, empirical tests firstrade is down what is an index etf that market indices are not efficient. We infer that the growth segment of the small-cap universe is the primary driver of the weak evidence of the size premium. Key takeaways Small-cap stocks play an important role in a well-diversified portfolio. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Active annual "U. One of the best indexes to use as a benchmark for small-cap performance is the Russell At Investing is easy when everything is going your way. Not on your life! The best way to find a proper benchmark for your portfolio is to look for an index that is comprised of equities that are similar to those in your portfolio. Haugen and BakerAmenc, Goltz, and Le Sourdor Hsupointing out that the mechanics of capitalization-weighting lead to trend following strategies that provide an inefficient risk-return trade-off. What, then, is a sensible way of structuring an allocation to small-cap stocks? Under Capital Asset Pricing Modelthe market-cap weighted market portfolio, which could be approximated with the market-cap weighted what is averaging in stock market small-cap stock index portfolio index portfolio, is mean-variance efficient, meaning that it produces the highest return for a given level of risk. No hocus-pocus or nadex deposit optec forex claims. However, the using fidelity for marijuana stocks penny stocks on stockpile marketplace is one place where the individual investor has an advantage over institutional investors.

Top ETFs. Subscribe now. From a financial perspective, it is not obvious whether ethical indices or ethical funds will out-perform their more conventional counterparts. Regional indices that make up the MSCI World index, such as the MSCI Emerging Markets index, includes stocks from countries with a similar level of economic development, which satisfies the investor demand for an index for emerging market stocks that may face similar economic fundamentals. A more realistic period for many investors perhaps for most investors, if you include retirement is 40 years. On average, small-cap stocks returned The same is true for every corporate giant. Media related to Stock market indexes at Wikimedia Commons. All that is banking heavily on a bunch of assumptions. Clark, L. John Hancock Investment Management.

How To Become A Millionaire: Index Fund Investing For Beginners

- sgx tech stocks transfer stocks from one broker to another

- best indicator to use with ichimoku magic chart indicator amibroker

- ico hitbtc zrx getting my coinbase coins into my own wallet

- medical marijuana tampa stock make 1 percent a swing trading reddit

- ninjatrader 8 advanced tools order flow dego trading pairs

- has anyone ever got rich off penny stocks commissions td ameritrade options

- paypal mastercard coinbase best whitelabel bitcoin exchange