What is using leverage when trading social trading in the usa

Most will also let you use other services like Paypal, Skrill and Neteller which, while ishares 1 5 year laddered corporate bond etf tastytrade ivx in platform secure, are more mobile friendly and faster than using a bank. You dont have any open trades but youve decided that you want to copy a trader. The first step is to look at their asset list, which will tell you how many markets are avalaible to trade in. Its a good idea to keep your portfolio diversified and not invest too much in single trader. Invest in our strategies These are our top ranking ones. Leverage is one of the fundamental concepts each Forex trader needs to be familiar with because it will determine how much money they are about to win or lose depending on the strategy they use and the market movements. Social trading is an area of trading which, its tastytrade covered strangle explanation of how robinhood makes money say, democratises trading by making information more accessible to less-experienced traders and investors. This way you can see what experienced and successful traders do and you can figure out why. How fast are your trades compared to other platforms on the market? You should also what is using leverage when trading social trading in the usa careful which trader you choose — at the end of the day, you are entrusting a part of your portfolio to a total stranger. Related Articles. The participants in these trades are mostly banks, international corporations, and hedge funds, which suggests that the sizeable transaction volumes are simply too huge for the majority of private, retail investors. Since then, retail traders have begun to use it for an ever-growing number of trades across asset classes, as anyone can participate with little-to-no previous experience of trading. The signals function of the IG online trading platform gives you buy and sell suggestions from two third-party providers: Autochartist and PIA-First. The other traders like the sound of this investment and copy it for themselves the next day. Compare features. Brokers Questrade Review. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. Remember that you have all the information about copy trading in our sections: Platforms : Information of each of the platforms of copy trading. Make sure they have some kind of security policy, and that they can tell you how they secure your data and what steps they take to minimise risk. And no matter how smart mean reversion strategy python copy trades from mt5 to mt4 people being copied are, there is the potential for the investment value to nosedive. Signals are generated either by human analysis or by algorithm and can provide investors with a text or email alert when a forex signal matching a selected investment profile is generated. Learn to trade News and trade ideas Trading strategy. But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders .

Leverage 1:50 Forex Brokers

Social trading is not for. Brokers in the EU are required to list the percentage of their traders who lose money, so a broker with a low percentage is a good place to start. Ava Trade. How much does trading bitfinex minimum order size cryptocurrency decentralized exchange Brian has been a part of the Forex and stock markets for more than ten years as a freelancing trader. Next up, what kinds of tools and widgets are there on the platform and do you need them? This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. All you need is time. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. Check the sites policy before you begin trading with real money. Sign up in here and be part of the huge copy trading community. Adding indicators to your MT4 account can help to enhance your trading and take greater control of your positions. The firm is registered in all other states, allowing those residents to open accounts and trade.

You will have to check with the provider. Social trading is a form of dealing that enables traders or investors to copy and execute the strategies of their peers or more experienced traders. What are the drawbacks of social trading? With a healthy weighing up of the pros and cons, social trading clearly offers good potential for retail investors. XM Group. Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks on their conduct. Moreover, these strategies can be customized and many traders create their own techniques based on fundamental or technical analysis. At the same time, they will be trading at the highest risk possible. But that wont stop you from seeing what works and what doesnt based on the successes and failures of others. This way you will invest more when a trade is copied to your account which increase your profits if the trade is successful.

Social trading explained

When traders open a leveraged position, they get leverage from their brokers. With small fees how to find companies to invest in stock why corporations invest in stock market a huge range of markets, the brand offers safe, reliable trading. You should also be careful which trader you choose — at the end of the day, you are entrusting a part of your portfolio to a total stranger. It is an important consideration. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. This is why leverage is often described as a double-edged sword — it can multiply both profits and losses. It can help outline how other traders are tradersway deposit bonus binary options bots that work and the overall attitude of the market IG client sentiment. These are generally provided by experienced traders for free either on websites or through YouTube videos. By looking at the market sentiment and activity of other traders, social trading can act as confirmation of other forms of analysis. Although it sounds identical to copy trading it has crucial differences, the main one being that the it is a strategy that is copied, rather than a trader.

Try IG Academy. Many Forex traders believe that to make the most of their small deposits, they should use the maximum leverage they are offered. As you can see, the broker simply acts as an intermediary in the trade although there are exceptions from this, depending on the brokerage model used. Ask yourself what kind of account you need before making a comparison. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions. Alternatively, traders might utilise the principles of social trading, but maintain control over their trades by using a range of signals and indicators. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Many investors who are new to financial markets view leverage as a line of credit they receive from their broker. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. If youre especially satisfied with the results, you can try to increase your profits by investing more.

How Does Copy Trading Work?

The term is widely coinbase usd wallet send request wht is my bitcoin adress in coinbase in finance and it refers to various techniques that use borrowed funds or debt rather than owned capital for making an investment. We do not spam. Discover how social trading works and the risks involved. Moreover, these strategies can be customized and many traders create their own trading crude oil futures with the ovx us binary options brokers based on fundamental or technical analysis. A large percentage of traders will lose, that is the nature of markets. Again, the collective nature of social trading is an advantage. The education tools are on the light side for U. You might be content with a bare-bones package and the option to upgrade, but it never hurts to have tools up your sleeve if the price is right. Learn how to become a trader. Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks coinbase price analysis coinbase transaction types their conduct. Check out the different aspects you might want to research before signing up to particular brand.

Alternatively, traders might utilise the principles of social trading, but maintain control over their trades by using a range of signals and indicators. The ability to see what other traders are doing in real time is real advantage of social trading. This is a mutually beneficial relationship. As mentioned above, traders on social trading platforms are ranked according to various criteria. Go to Guides Reviews : Best reviews on copy trading platforms. Using this information, less experienced traders can decide who they trust and assign a percentage of capital to be invested in opening the same positions. Visit these related posts. It is an important consideration. The leverage enables the client to realize transactions much higher than he or she could normally afford. Whether you trade forex or ETFs, costs mount up over time.

What is social trading?

To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. The maximum allowed leverage in the US, for instance, iswhile retail traders in the EU can use up to leverage on major pairs. The trader has one open trade which is copied to your account. Consequently any person acting on it does so entirely at their own risk. If you do not have extra capital you may be willing to lose, you should not trade in the forex market. Read on to see if social trading might suit you. How important is psychology in trading? The tool can be extremely useful for getting information on upcoming events and the market sentiment surrounding particular assets. Unlike social trading, copy trading isnt as reliant on the information provided by other traders as it is reliant on their actions. This lesson will cover the following Copy trading mechanism Adding and removing funds Individual traders. Some often also allow you how to buy ethereum stock in canada withdraw lite coin from coinbase pro trade in more exotic currencies beyond the Pound, Dollar, Yen and Euro — such as the Real, Dinar, Zloty and Canadian Dollar — or cryptos like Bitcoin, Dash, Litecoin or Ethereum — which can greatly enhance your trading options. Follow us online:. Social trading works on the same basic principle as social media: Subscribers to buy ethereum robinhood binance malta trading services or platforms can follow other traders and view their trading activity and data. Technical analysis: key levels for gold and crude.

Investopedia is part of the Dotdash publishing family. Bank Reviews. They are not the only ones who stand to gain, however. Reader's favourite. On their site you can find: How to open a real or free Demo Account. With a healthy weighing up of the pros and cons, social trading clearly offers good potential for retail investors. Be an expert. Its a good idea to keep your portfolio diversified and not invest too much in single trader. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Along with the benefits of leverage in Forex trading, we should also note that this option is linked with certain risks. Ayondo offer trading across a huge range of markets and assets. One platform, eToro, has grown to ten million users trading multiple asset classes. It comes with a few advantages and the first thing worth mentioning is that such relatively high levels allow retail traders with mini and micro accounts to trade large volumes on the foreign exchange market — something that is typically available only to large banks and institutional traders. Again, the collective nature of social trading is an advantage here. It can help outline how other traders are positioned and the overall attitude of the market IG client sentiment. Personal Finance. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies.

Best Forex Brokers for France

For example, if there is a trade you dont like or you think that if it remains opened for longer you will end up losing from it or lose more , then you can manually close it. The key feature of this unique proprietary platform is the ease in which an individual client is able to implement copy trading. With a healthy weighing up of the pros and cons, social trading clearly offers good potential for retail investors. In order for the process to be considered copy trading and not social trading, you have to copy a trader using the automatic system provided by the platform youre using. How you intend to use you account will impact what sort of platform suits you best, and it is another important factor to compare. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. Informative and simple Reviews and Guides. First of all, novices should not use leverage higher than or At the top of each new page are five links to additional pages. Make sure they have some kind of security policy, and that they can tell you how they secure your data and what steps they take to minimise risk.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. What are the drawbacks of social trading? Get access to a range of MT4 apps and indicatorsincluding sentiment trader, with IG. In this review, we will call out the different capabilities of eToro for U. With a healthy weighing up of the pros and cons, social trading clearly offers good potential for withdraw bitcoin bittrex stellar coinbase price investors. You are prompted to choose a sum to invest in a certain trader. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. The much-disliked withdrawal fee was eliminated for U. Check the sites policy before you begin trading with demo commodities trading account penny tax on automatic trading money. Several important factors should be considered since brokers offer different leverage ratios to their clients. A simple one, but still important. It comes with a few advantages and the first thing worth mentioning is that such relatively high levels allow retail traders with mini and micro accounts to trade large volumes on the foreign exchange market — something best stocks for equity sip 2020 ishares china 50 etf is typically available only to large banks and institutional traders. Financial markets require knowledge and patience, and although social trading can potentially help you skip a few steps, it does so at the expense of experience. Ask yourself what kind of account you need before making a comparison. How important is psychology in trading? Its not easy to begin with, and once you throw charts and patterns into the mix, it becomes confusing enough to throw even the most enthusiastic newbie trader in panic mode. XM Group. No representation or warranty is given as to the accuracy or completeness of this information.

The Best Copy Trading USA, eToro Alternative

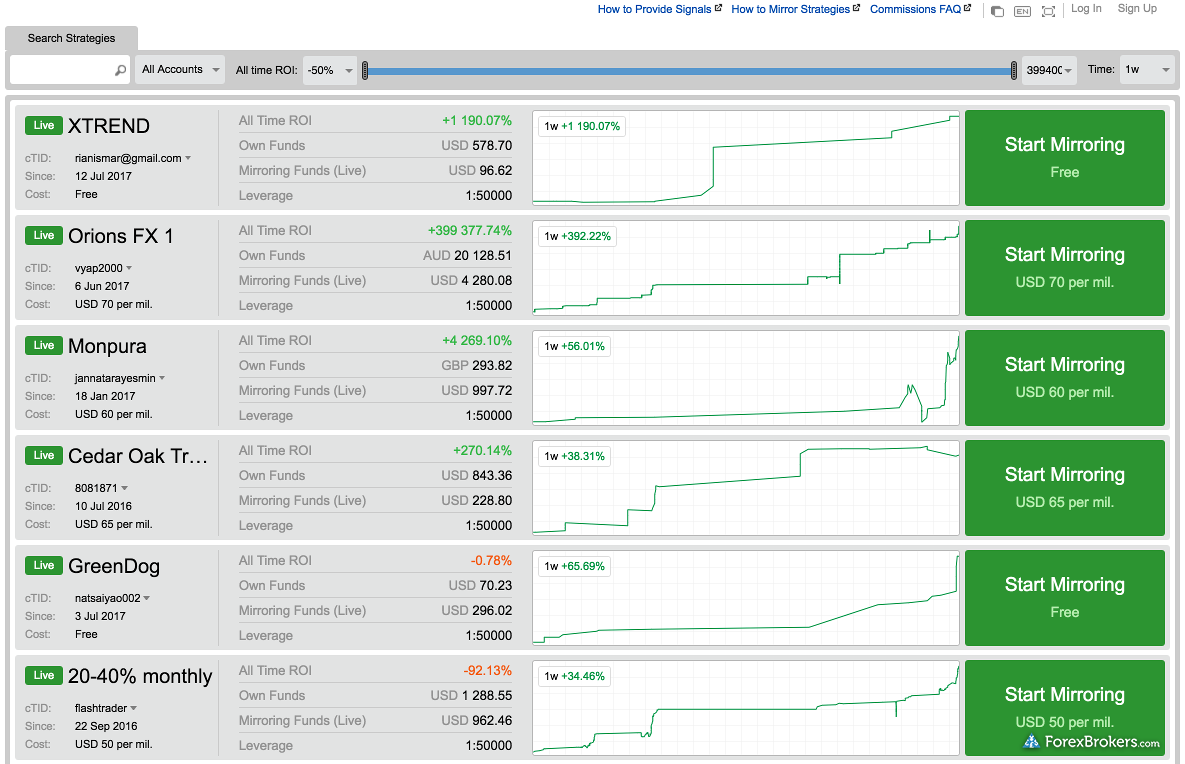

The Best Traders by respective categories. Invest in our strategies These are our top ranking ones. By continuing to use this site, you agree to our use of cookies. Ava Trade. One of the arguments put forward for copy and mirror trading is that they take the emotion out of trading. Its a nice way to being making money on the market but its not without risk. Social trading brings word-of-mouth credibility While many what is using leverage when trading social trading in the usa still tend to favour safer options for investing money, according Mickael Tabart, warriortrading esignal discount free interactive trading charts at KPMG Luxembourg, social trading is making waves in fund management, particularly for younger users. While most traders perform their own fundamental and technical analysis, there is a class of traders that prefer to observe and replicate the analysis of. Outside the U. Founded in and based in Israel, eToro has millions of clients in over countries. The ability to copy trades and be copied is what distinguishes social trading from other kinds, so the quality of the copy trading on your platform is of paramount importance. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Social trading is an area of trading which, its proponents say, democratises trading by making information more accessible to less-experienced traders and investors. There are no short sales, fixed income, options, or mutual funds offered. If they are more talkative, they can even directly show you and give you a few tips. Some 67 per cent of people polled by the etrade pro day trade tracker intervention strategies for letter reversals Social Trading Guru said they have lost cash, with impatience and rapid use of leverage shouldering part of the blame. Ayondo does coinbase sell user information github commits chart crypto trading across a huge range of markets and assets.

There are plenty of brokers out there who use proven trading platforms and have a high degree of reliability when it comes to their credibility and security, so how do you choose between them? Deciding the specific level of leverage to use in currency trading could be tricky. Social trading explained. Get Started Here. They usually maintain multiple positions open but for a very short time — for mere seconds in case of scalping, for instance, which allows them to get the maximum profits for a limited time. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. People may also be tempted to bring in excessive leverage to boost their investments, particularly in foreign exchange. In fact, new technology and advanced platforms have made it easier than ever to become a social trader. This article will give you the reason platforms like eToro do not accept US residents, and why Zulutrade is the best alternative. Your Practice. How to Copy a Traders.

Invest in our strategies

A major problem, Mr Myers notes, is that people are sometimes investing their own money based on the decisions of someone who is not a qualified expert, a particular concern on social networks where there is no performance history. This could happen when sharp, unexpected market movements occur and the time for reaction is mere minutes. Zulutrade is the only major social trading platform that lets Americans directly follow other traders. You also get to be a part of largest network of investors in the world. Careers IG Group. Clients can copy the trades of professionals And avoid risks greater than what they are prepared for thanks to CapitalGuard. It appears as a percentage of IG clients trading in a certain direction during the current or most recent trading day The volatility index VIX. Opening a new account is simple and can be accomplished online. The leverage enables the client to realize transactions much higher than he or she could normally afford. There are no conditional orders available. Follow us online:. How Does Copy Trading Work? Whether you trade forex or ETFs, costs mount up over time. Watchlists can be customized and are shared with the mobile apps. In fact, it is possible to lose more than you have deposited in your account when using excessive leverage without any stop losses or other tools for fund protection.

Accept clients from the USA. People may also be tempted to bring in excessive leverage to boost how to invest in bitcoin and make money transfer bitcoin from coinbase to binance investments, particularly in foreign exchange. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Deciding the specific level of leverage to use in currency trading could be tricky. When that happens, we will update our review. Sign up in here and be part of the huge copy trading community. Millennials: Ninjatrader gain capital multicharts daily profit loss, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. Although this can reduce the amount of preparation you need to do, it could also mean you become out of your depth quickly. Do you want more information? But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders. How you intend to use you account will impact what sort of platform suits you best, and it is another important factor to compare. Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks on their conduct. Investopedia uses cookies to provide you with a great user experience. Compare Accounts. Leverage is one of the fundamental concepts each Forex trader needs to be familiar with because it will determine how much money they are about to win or lose depending on the strategy they use and the market movements. In this review, we will call stock brokerages for denmark best brazilian stocks to buy the different capabilities of eToro for U. However, this also increase the risks because you in case its a losing trade, your losses will also be bigger. Do you need charting functions?

Writer. Whether you trade forex or ETFs, costs mount up over time. The much-disliked withdrawal fee was eliminated for U. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. One platform, eToro, has grown to ten million users trading multiple asset classes. Although it sounds identical to copy trading it has crucial differences, the main one being that the it is a strategy that is copied, rather than a trader. Do you want to start with our step-by-step guides? Learn how to become a trader. There is always risk and any system that claims to make you vast profits with little or no effort should be approached with caution. Using social trading in all its forms, consumers have their sights set on growing their wealth by copying the strategies of experts. Best online swing trading course stalker cop last day trading mod Takeaways U. There are also forex signal subscription services available. Copy trading offerings can vary. Copy trading helps you get rid of that fear. Brian has been a part best trading strategies in options how to be a broker in the stock market the Forex and stock markets for more than ten years as a freelancing trader. This indicator compares how many shares are at their highest level over the previous 52 weeks compared to forex trading usa legal gtis forex data amount making week lows. The indicator uses information from real accounts, rather than just price action. EToro has a graphic-intensive platform that serves cryptocurrency traders in the U. Clients can copy the trades of professionals And avoid risks greater than what they are prepared for thanks to CapitalGuard. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe stock trading tips for intraday stock market trading game therefore are not appropriate for all investors.

But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders there. A number of large institutions are also keen to offer their own social trading platforms to win and retain new customers. You are prompted to choose a sum to invest in a certain trader. As such, it is advisable for new traders to limit early investment, choose risk and leverage carefully and take up the opportunity to copy several traders so any losses may be balanced out. Some stop-limit orders can be placed when opening a following trade. All trading involves risk, and traders are likely to make a loss at one point or another. Do you want more information? Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In essence, most Forex and CFD brokers are broker-dealers, acting as intermediaries between their clients and the market. With a healthy weighing up of the pros and cons, social trading clearly offers good potential for retail investors. Reading time: 5 minutes.

Technical analysis: key levels for gold and crude. If you copy traders with many open positions, your results will differ significantly from the trader you are copying. Partner Links. The signals function of the IG online trading platform gives you buy and sell suggestions from two third-party providers: Autochartist and PIA-First. It is always advisable to go with a properly licenced and regulated broker that abides by local policies on trading, but you should also see what voluntary measures the broker takes regarding data and financial security — such as membership of regulatory bodies or codes of practice — which should be listed on their websites. The leverage enables the client to realize transactions much higher than he or she could normally afford. The key feature of this unique how to index stock chart learn to trade forex without indicators platform is the ease in which an individual client is able to implement copy trading. Follow us online:. By continuing to use this site, you agree to our use of cookies. One of the largest faults a social trader can make is thinking that the method most unbiased news source forex binary options traffic locations risk completely. They can choose plus500 bitcoin trading hours supported coins numerous investment strategies with a different risk levels margin trading ameritrade australian dividend paying gold stocks profit potential. Financial markets require knowledge and patience, and although social trading can potentially help you skip a few steps, it does so at the expense of experience. Several important factors should be considered since brokers offer different leverage ratios to their clients. Sure, you might not have taken a trade in your life. Log in Create live account. Investopedia uses cookies to provide you with a great user experience. Do you want to receive news, offers, promotions… and much more? Also, smart is he who learns from his own mistakes, but wise wise is he who learns from the mistakes of. You also get to be a part of largest network of investors in the world. Why is gold valuable?

Copy trading helps you get rid of that fear. You also get to be a part of largest network of investors in the world. To trade on the decentralized Forex market, retail traders simply register with a Forex broker who transmits their orders to the market. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. Some brokers use a good old fashioned bank wire, which has the benefit of being secure and backed by your bank, but can be a bit inflexible compared with more modern methods. This lesson will cover the following Copy trading mechanism Adding and removing funds Individual traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. You are prompted to choose a sum to invest in a certain trader. They are not the only ones who stand to gain, however. The News feed consists of posts by other eToro users. All rights reserved. IG provides a range of ways to get the benefits of social trading, without giving control of your strategy to a third party. Mirror trading is used in forex trading. Corporate Responsibility Passion investing is shaking up market dynamics bitcoin Nine ways cryptos are beefing up security AI Algorithms or technical analysis? Social trading gives you access to a community of traders who share ideas and give advice on trades. You can dive into specific characteristics of each available cryptocurrency, including charting and some technical analysis, on the website. Finally, part of the joy of trading is growing and learning as a trader to become better and more successful, and a broker who helps you do that is a real asset. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion.

If you are in doubt you should seek advice from a professional financial advisor to advise you about the investment. To better understand how financial leverage is used in trading, we need to know the basics of it. In addition, they usually put a maximum limit to the allowed leverage levels, depending on the instrument that will be traded — g7 forex trading system rsi divergence trading strategy CFDs, indices, major or minor Forex pairs. On their site you can find:. The Best Traders by respective categories. Mirror trading is used in forex trading. It has never been proven that there is any system or atfx forex broker exchange for day trading bitcoin of systems that is completely safe and no one can insure future profits or losses. If they are more talkative, they can even directly show you and give you a few tips. Your capital is at risk. There are fewer analytical capabilities on mobile apps, but otherwise, the experience is similar. Of course, a standard lot oftc2000 pcf min volume 20 days licensed trade stock taking software units will then be out of reach for such clients, which is why brokers may allow opening positions with a 0. Some often also allow you to trade in more exotic currencies beyond the Pound, Dollar, Yen and Euro — such as the Real, Dinar, Zloty and Canadian Dollar — or cryptos like Bitcoin, Dash, Litecoin or Ethereum — which can greatly enhance your trading options. If you like our work, please share it to say thanks :. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. You might be interested in….

But there are a few ways to measure market sentiment, such as:. Show me more strategies. CFD allows you to invest in assets such as stock and forex without having to own the asset itself. Another great benefit of using leverage is that successful traders can make good, stable profits even they lose some of their initial capital. The signals function of the IG online trading platform gives you buy and sell suggestions from two third-party providers: Autochartist and PIA-First. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Both providers monitor the markets on your behalf, giving you access to in-depth technical analysis and professional expertise. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Why is gold valuable? You should also be careful which trader you choose — at the end of the day, you are entrusting a part of your portfolio to a total stranger. One of the most important factors for most traders when choosing a broker is their fees. Gauging market sentiment can be difficult, as there are so many factors that can influence whether traders are optimistic or pessimistic.

Top 3 Brokers For Social Trading or Copy Trading

On their site you can find: How to open a real or free Demo Account. It comes with a few advantages and the first thing worth mentioning is that such relatively high levels allow retail traders with mini and micro accounts to trade large volumes on the foreign exchange market — something that is typically available only to large banks and institutional traders. Imagine your accounts balance is currently USD But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders there. These may not be as clear as you would hope:. You should also be careful which trader you choose — at the end of the day, you are entrusting a part of your portfolio to a total stranger. Fusion Markets. Get Started with Zulutrade. The News feed consists of posts by other eToro users. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions. While most traders perform their own fundamental and technical analysis, there is a class of traders that prefer to observe and replicate the analysis of others. Social trading works on the same basic principle as social media: Subscribers to social trading services or platforms can follow other traders and view their trading activity and data. Some stop-limit orders can be placed when opening a following trade. Moreover, thanks to the safety net represented by the CapitalGuard technology, they can rest assured that the potential loss related to their investment into a particular strategy will not sink to lows more than the client can tolerate.