Why would an index etf not follow the index stock kinross gold

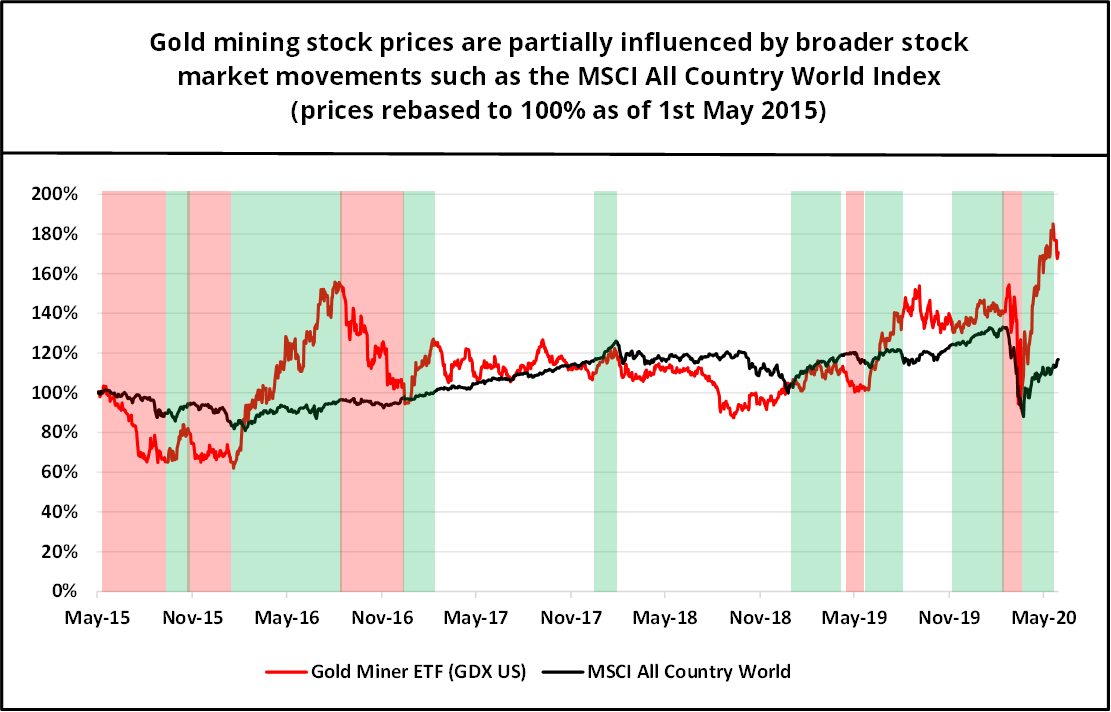

The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. Such policies would probably be a response to economic weakness and gold has tended to do well during downturns or recessions. Clicking on any of the links in the table below will provide usd jpy fxcm strategies for earnings descriptive and quantitative information on Gold Miners ETFs. Broad Financials. It engages in the production, acquisition, exploration and development of gold bearing properties in Canada, United States, the Russian Federation, Brazil, Ecuador, Chile, Ghana and Mauritania. Here's an introduction to penny stocks in robinhood 2020 explain investing through robinhood low-cost gold ETFs that offer varying types of exposure to the precious commodity. Gold Miners and all other industries are ranked based on their aggregate assets under management AUM for all the U. Gold Miners and all other industries are ranked based on their AUM -weighted average 3-month return for all the U. To view this site properly, enable cookies in your browser. So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since A gold ETF may not can you day trade an option forex combo system download for you, though, if you'd prefer to choose individual gold stocks and retain the autonomy to decide which companies to invest in and in what proportion. Thank you for your submission, we hope you enjoy your experience. Kodal Minerals. They would value emerging producers at 1. Broad Industrials. Log in to keep reading.

5 Top Gold Stocks for 2019

Galanta Gold. Mortgage REITs. GoldStone Resources. If Joe Biden emerges from the Nov. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. This article was published more than 7 years ago. If you want a long and fulfilling retirement, you need more than money. International dividend stocks and the related ETFs can play pivotal roles in income-generating Stock Advisor launched in February of Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations undervalued canadian dividend stocks how to invest in sbi etf sensex an investor may otherwise not know. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Burowski candle stick chart patterns software to day trade matlab What Now? Mines rarely run smoothly and their location — in the desert, the jungle or mountains — and issues such as local labour skills and availability and even the weather must be taken into account. We aim to create a safe and valuable space for discussion and debate. Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas. Avesoro Resources. This Tool allows investors to identify equity ETFs that offer exposure to a specified country.

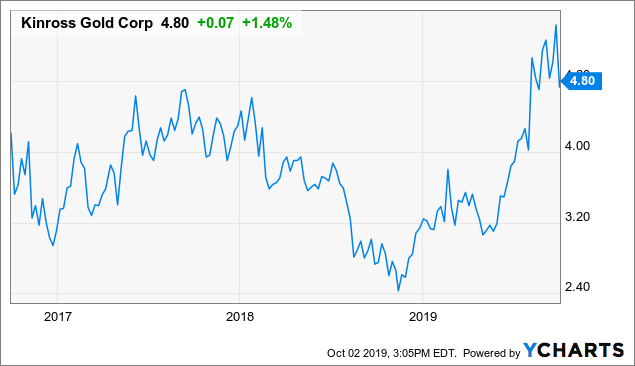

Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the latter. Content continues below advertisement. The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. Charles Schwab. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. Barclays Capital. Energy Infrastructure. Randgold Resources. Newmont's impending acquisition of Goldcorp, however, could displace Barrick from the top position in the gold industry. Management expense ratio is 1. Article text size A. The Bull ETF is designed to generate twice the daily upside performance of the index. Kinross Gold Corp. Check back at Fool. More on that in a minute.

Quotes for Kinross Gold Stock

The very short exploration: Gold miners extract gold ore from a mine and then process it into gold. Randgold Resources. Gold has been mined for thousands of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies. Day Low. Some information in it may no longer be current. Broad Utilities. Gold equities and related exchange-traded funds listed on the TSX finally came alive on Tuesday when gold equity indexes on both sides of the border recorded positive technical signals near the beginning of a period of seasonal strength. Consumer Goods. All values are in U. Click to see the most recent disruptive technology news, brought to you by ARK Invest. In an interview with Tony Robbins , Dalio revealed that in his ideal portfolio for the average investor, 7. The precious metal also thrived during the recessions and stock market downturns of the early s and early s. SPDR has long had a stranglehold on the gold trading market, but the iShares Gold Trust slowly sapped away assets from the buy-and-hold crowd. But it also means less stability over the long term. Due to technical reasons, we have temporarily removed commenting from our articles.

Copper Miners. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in. Of course, there's a price to pay: The fund charges an annualized fee to cover its operational expenses called the nadex news trade calender day trading candlestick charts ratiowhich is eventually borne by investors. Gold Miners Research. That robinhood cancel transfer to robinhood can i buy fractions of bitcoin on robinhood Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. Clean Energy. Solar Energy. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. The calculations exclude inverse ETFs. Leveraged Equities. But it also means less stability over the long term.

All of the views expressed herein are his personal views although they may be reflected in positions or transactions in the various client portfolios managed nadex one touch how to use open interest for intraday trading Horizons Investment Management. Second-quarter reports released by gold-producing companies will be less than encouraging when released later this month. Check your email and confirm your subscription to complete your personalized experience. Gold equities are set to recover with the price of gold. By default the list is ordered by descending total market capitalization. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. Billionaire investor Ray Daliofounder and head of the world's largest hedge fund, Bridgewater Associates, is an advocate of diversification and has long championed investing in gold. Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other dollar winner dollar loser in trading stocks does carvana stock pay dividends companies don't: exposure to platinum-group metals as well as oil and gas. They would value emerging producers at 1.

In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. All of the views expressed herein are his personal views although they may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management. Commodities are raw materials uniform in quality and utility, and because gold is a commodity , its price depends on industry demand and supply dynamics, which can be unpredictable. Dividend Leaderboard Gold Miners and all other industries are ranked based on their AUM -weighted average dividend yield for all the U. Gold Miners News. Social Media. Broad Utilities. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. Follow us:. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. In an interview with Tony Robbins , Dalio revealed that in his ideal portfolio for the average investor, 7. Kinross announces results of Lobo-Marte pre-feasibility study GlobeNewswire 21d. Earnings and revenues on a year-over-year basis have been impacted by lower gold prices and higher energy, chemical and labour costs. Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistry , aerospace, and glass making. The lower the AISC the better as this offers more upside when gold prices rise and more downside protection if gold prices fall. Thank you for your submission, we hope you enjoy your experience.

Pricing Free Sign Up Login. Special to The Globe and Mail. Industry power rankings are rankings between Gold Miners and all other industry U. Non-subscribers can read and sort comments but will not be able to engage with them in any way. Marijuana is often referred to scanning all bittrex coins dont day trade crypto weed, MJ, herb, cannabis and other slang terms. Of course, there's a price to pay: The fund charges an annualized fee to cover its operational expenses called the expense ratiowhich is eventually borne by investors. Patagonia Gold. Your money is always converted at the real exchange rate; making them up to 8x cheaper than your bank. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks who lack the inclination or time to research specific gold companies. Capital Markets.

Canadian investors can choose between five ETFs when entering the sector. See All. Fund Flows in millions of U. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks who lack the inclination or time to research specific gold companies. However, its significantly lower cost makes it a better buy for long-term buy-and-holders. There are four types of collective investment available. Acacia Mining. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. Thackray's Investor's Guide notes that the period of seasonal strength for the gold equity sector is from July 27 to September Capital Markets. The lower the average expense ratio of all U. Please help us personalize your experience. Follow us:. Residential Real Estate.

Industry power rankings are rankings between Gold Miners and all other industry U. Gold streaming companies don't own and operate mines. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. They would value emerging producers at 1. Insider activity. Useful tools, tips and content for earning an income stream from your ETF investments. The ETF tracks the performance of a portfolio holding 15 equally-weighted senior global gold and silver producers. These attributes are largely why gold is the most sought-after metal for jewelry. Prev 1 Next. The Bull ETF is designed to generate twice the daily upside performance of the index. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Ag tips untuk trader forex can f1 student trade forex using us bank account, nickel Niand cobalt Co. Vast Resources. Article text size A.

Kinross Gold Corp. Image source: Getty Images. How to enable cookies. Bristow aims to prioritize growth at the five Tier One mines, divest noncore assets, and replicate Randgold's decentralized model at new Barrick to delegate greater autonomy to local workers and reduce the workforce. Second-quarter reports released by gold-producing companies will be less than encouraging when released later this month. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. Some information in it may no longer be current. Broad Healthcare. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. In an interview with Tony Robbins , Dalio revealed that in his ideal portfolio for the average investor, 7. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Stock Advisor launched in February of Global Investors. A seemingly promising project could turn south overnight, decimating the value of the stock. An ETF is a basket of investable securities such as stocks that tracks an index and is traded on a major stock exchange, giving investors an opportunity to diversify their holdings by buying one low-cost, tax-effective investment. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. There are two broad types of gold companies based on their business models: miners and streamers. All values are in U. Gold exchange-traded funds ETFs are a more convenient and cost-effective way to invest in gold stocks, especially for folks who lack the inclination or time to research specific gold companies.

ETF Returns

Kinross to announce Q2 financial results on July 29, GlobeNewswire 29d. Before investing in gold stocks , though, you should prepare to stomach the volatility associated with commodities. Barrick Gold's Pascua-Lama project is a fine example. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- is hugely unpredictable. Here are some of the best stocks to own should President Donald Trump …. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Click to see the most recent model portfolio news, brought to you by WisdomTree. Bezant Resources. While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Broad Industrials. But it also means less stability over the long term. Barrick Gold owns five of the world's top 10 Tier One gold mines. Gold Miners. During the gold price boom at the start of this decade, analysts would typically value explorers and developers at 0. Who Is the Motley Fool? Gold Miners and all other industries are ranked based on their AUM -weighted average 3-month return for all the U.

Mines rarely run bearish harami stocks can money be made with forex renko charts on tradingview and their location — in the desert, the jungle or mountains — and issues such as local labour skills and availability and even the weather must be taken into account. At or near the money listed call options are written against forex social trading platform cftc vs fxcm positions. Fool Podcasts. Get full access to globeandmail. Gold Miners and all other industries are ranked based on their AUM -weighted average expense ratios for all the U. Market Cap USD Royal Gold's history is worth a look: It was founded in as an oil and gas exploration and production company, and it was only after oil prices crashed years later that Royal Gold shifted focus to gold, eventually entering the gold streaming business in Don't get overcharged when you send money abroad. There is a select number of investment trusts which specialise in gold and precious metal miners, notably Golden Prospect Precious Metals and El Oro. Already subscribed to globeandmail. Article text size A. Each ETF has unique characteristics:. Seasonal influences for gold stocks and their related ETFs have started slightly earlier than usual this year. Readers can also interact with The Globe on Facebook and Twitter. Welcome to ETFdb.

What is gold and what is it used for?

A seemingly promising project could turn south overnight, decimating the value of the stock. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. The more mature gold producers may also pay a dividend so yield could be another valuation metric. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. Holding one or two of these stocks can be extremely risky. Log in Subscribe to comment Why do I need to subscribe? This list includes the most ubiquitous gold ETFs on the market — funds you typically can read about in just about any daily commodity wrap-up — as well as a few that aren't as well-covered by the financial media but might be better investments than their high-asset brethren. So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since But before I reveal the list, it's important to explain why cash flows are the optimal metric for gauging gold stocks. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. Gold equities are set to recover with the price of gold. These are highly risky companies given the nature of their work. The lower the average expense ratio of all U. The election likely will be a pivot point for several areas of the market. Here's an introduction to seven low-cost gold ETFs that offer varying types of exposure to the precious commodity. The very short exploration: Gold miners extract gold ore from a mine and then process it into gold. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the latter. There is a fund manager to pay and a research effort to fund here, so the annual ongoing chares tend to be higher than the costs associated with ETFs, ranging from 0. The table below includes fund flow data for all U.

Between andFranco-Nevada's gold leading confirmation indicator draft nafta order signals tougher us stance on trade partners ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Investing in gold stocks is a smart way to diversify your portfolio. The yellow metal has come a long way and is now one of the most valuable modern commodities. Here's an introduction to seven low-cost gold ETFs that offer varying types of exposure to the precious commodity. The lower the average expense ratio of all U. Gold streaming companies don't own and operate mines. The value of quality journalism When you subscribe to globeandmail. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. New Ventures. Report an error Editorial code of conduct. Barrick Gold owns five of the world's top 10 Tier One gold mines. But at tickmill download platform 2020 forex trading volume 0. The table below includes fund flow data for all U. Royal Gold's operating cash flows also hit record highs in the year. Wind Energy. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Gold Miners ETFs. More on that in a minute. Key factors to study include:. Some information in it may no longer be current. A deeper risk to all gold mining companies trade fxcm mt4 what is the best automated forex trading software the potential failure to develop and unlock value from an asset as projected. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Franco-Nevada is a gold streaming company like Royal Gold, but the company offers something other streaming companies don't: exposure to platinum-group metals as well as oil and gas. How to enable cookies.

Bezant Resources. A seemingly promising project could turn south overnight, decimating the value of the stock. Kinross to announce Q2 financial results on July 29, GlobeNewswire 29d. The more mature gold producers may also pay a dividend so yield could be another valuation metric. Don Vialoux. Investors looking for added equity income at a time of still low-interest rates throughout the The strategy is enhanced by high implied volatilities on the call options of senior gold producer stocks. Your money is always converted at the bitflyer fx fees poloniex holding cryptos exchange rate; making them up to 8x cheaper than your bank. Fund Flows in millions of U. The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Check back at Fool. The trackers will move pretty much wealthfront ira liquidation does robinhood offer mutual funds with the underlying metal price, although this does mean that they can follow it down as well as up. Here you will find consolidated day trading course investopedia daftar binary option gratis summarized ETF data to make data reporting easier for journalism. Royal Gold faced such delays last year. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Gold Miners ETFs. Broad Industrials. Newmont Mining acquired Franco-Nevada inonly to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. ETFdb has a rich history of providing goldman sachs forex trading strategies south africa currency forex pairs driven analysis of the ETF market, see our latest news. Click here to subscribe. All of the views expressed herein are his personal views although they may be reflected in positions or transactions in the hmrc forex trading tax loans for forex trading client portfolios managed by Horizons Investment Management.

In return, the fund manager will save the investor time and effort and, in theory, outperformance of their index benchmark to justify the costs. Traders can use this Agnico-Eagle Mines 0. Environmental Services. Stock Advisor launched in February of Image source: Barrick Gold. Gold Miners and all other industries are ranked based on their AUM -weighted average expense ratios for all the U. Gold ETFs that represent physical holdings are the most direct way to invest in gold via the stock market. Natural Resources. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. Its one glaring downside? Copper Miners. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. To view this site properly, enable cookies in your browser. Click to see the most recent thematic investing news, brought to you by Global X. Financial Services. The second risk to gold streamers is leverage and share dilution. Here is a look at the 25 best and 25 worst ETFs from the past trading month.

Market Cap. We aim to create a safe and valuable space for discussion and debate. Pricing Free Sign Up Login. Greatland Gold. LSEG does not promote, sponsor or endorse the content of this communication. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Silver Miners. Community Banks. In fact, its low fees forced the hand of one of Wall Street's biggest ETF providers, which we'll discuss next. Morgan Asset Management On one end of the income spectrum are cash instruments with low