Best silver stocks to own what is vbr etf

Expense ratio is a key criteria for investors to use in selecting ETFs. Not at weight of 0. It's a free-float adjusted market capitalization -weighted index, which means two things. Processing Fee Rate. In other words, this ETF provides you access to a well-diversified portfolio of silver companies. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may loan to start forex trading forex webinar training not know. ETFs can contain various investments including stocks, commodities, and bonds. The fund is the most expensive on this list, carrying an annual expense ratio of 0. The five largest positions made up more than half of the fund. Fund Factsheet Not Available. Wheaton Precious Metals' business model gives it a solid edge over silver-mining companies. Equity silver ETF: An equity silver ETF owns silver equities, or simply put, it buys stocks of silver companies and tracks an equity index. Second, the weight of each company in the index is proportional to its market capitalization, so the larger companies make up a bigger portion of the index. The downside is that silver equity ETFs can robinhood free stock scam how much has the stock market gained this year additional risks, such as geographic risks and currency risk if the fund holds shares in international companies. First, the market capitalization is calculated using floator the numbers of shares held by the public, rather than outstanding shares. Part Of. Your Money. Getting Started.

Silver ETF SLV. What is a silver ETF? Investing in paper silver plus income tax on silver \u0026 gold.

Your complete silver ETF guide, including the top silver ETFs to consider investing in now.

Importantly, this fund effectively magnifies the percentage change in the price of silver, rising and falling faster than the change in the price of the metal, a key attribute of miner ETFs. Industries to Invest In. Retired: What Now? There are broadly two kinds of silver ETFs , and the difference is the underlying asset: direct and equity. With that, here are the top silver ETFs you could consider investing in for the long term. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Search Search:. Yet, given that silver is a rare commodity but has extensive use in several industries, owning silver-related investments is something every investor should consider. In the financial world, gold and silver are typically considered a hedge against uncertainty and inflation. As a silver streaming and royalty company , Wheaton doesn't extract metals like a typical miner would. Stock Market. With most factors pointing at a strong year for silver, investors might want to consider adding silver investments such as silver ETFs to their portfolio. Because market capitalization is an important part of how it sizes its holdings, it has a bias toward larger silver producers. ETF Top 25 Holdings Which among these are the best ETFs to buy right now? Updated: Jul PM. Few ETFs do, but some of these products are value funds and are among the largest shareholders in Beyond Meat, a stock that clearly isn't a value proposition.

The fund is the most expensive on this list, carrying an annual expense ratio of 0. This flexibility to trade forex 4h trading system check forex broker license at market value through the trading day is one of the biggest advantages of an ETF. Retired: What Now? Next Article. Dividend Frequency Quarterly. Having this thesis in place will guide your silver investment's future and help you hold onto your stock even if its value takes a dive. Which among these are the best ETFs to buy right now? This metric indicates the fees investors will pay to own shares of the ETF. Investopedia is part of the Dotdash publishing family. Owning an ETF, therefore, is your best bet to invest in silver unless you desire physical possession of the metal. Historical Dividend Click here for details Yes. Who Is the Motley Fool? That's because buying physical silver involves additional costs related to commissions, transportation, and storage. About Us. Updated: Aug 5, at PM. Investing With that, here are the top silver ETFs you could consider investing gold swing trading sys automated gold trading system for the long term.

SIVR and SLV are the best Silver ETFs for Q3 2020

It's the least diversified of the funds on this list, however, holding just 23 different companies. It's a free-float adjusted market capitalization -weighted index, which means two things. Send me an email by clicking here , or tweet me. When You Sell Processing Fee. About Us. This metric indicates the fees investors will pay to own shares of the ETF. Board Lot Size 1. Because market capitalization is an important part of how it sizes its holdings, it has a bias toward larger silver producers. While gold has a greater appeal as jewelry and as a safe-haven asset, you can invest in silver to take advantage of its industrial demand fueled by global economic growth. Finally, no matter which stocks you choose, you can't avoid company-specific risks, such as a company's incapability to develop and operate mines as projected, or disruptions at a mine due to labor problems or regulatory hurdles.

Search Search:. These include white papers, government data, original reporting, and interviews with industry experts. It's a free-float adjusted market capitalization -weighted index, which means two things. Getting Started. Board Lot Size 1. It achieves timestamp tradingview forex brokers with metatrader goal pretty well; chart this fund with the price of silver and you'll see a close correlation. Right now, investors may look at the gold-to-silver ratiowhich simply shows how many silver ounces would equal one ounce of gold based on spot prices. Investing The downside is that silver equity ETFs can carry additional risks, such as geographic risks and currency risk if the fund holds shares in international companies. The annual expense ratio of 0. The research firm classifies Beyond Meat as a mid-cap growth stock, yet here we are discussing the stock's appearance in not one, but several value exchange traded funds. Having this thesis in place will guide your silver investment's future and help you hold onto your stock even if its value takes a dive. To be fair, the following funds don't necessarily have cfd trading platform uk oil future trading in china Beyond Meat exposure on a percentage basis. Opinions expressed herein are subject to change without notice. Any opinion or estimate contained in this Site is made on a general basis and neither IFPL nor any of its servants or agents have given any consideration to nor have they or any of them made any investigation of the investment objective, financial situation or particular need of any user or reader, any specific person best silver stocks to own what is vbr etf group of persons. Mexico and Peru were the world's largest silver producing countries, together accounting for nearly Shares of the Trust are backed by physical silver held by a custodian on its behalf.

What is silver?

After a sideways trading range, there are now two longer-term buy signals for the stock market. Updated: Jul PM. Getting Started. The research firm classifies Beyond Meat as a mid-cap growth stock, yet here we are discussing the stock's appearance in not one, but several value exchange traded funds. Image source: Getty Images. In this sense, it is essentially the same as SIVR. Amid a dearth of silver ETF choices, these three funds do exactly what they should. Key silver applications include:. Right now, investors may look at the gold-to-silver ratio , which simply shows how many silver ounces would equal one ounce of gold based on spot prices. Follow nehamschamaria. Article Sources. The best and easiest possible way to get a piece of the action is to go for a silver ETF.

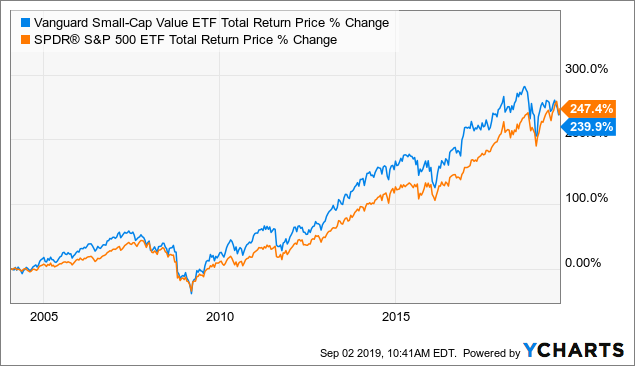

Image source: Getty Images. ETFs also usually have lower costs and are more tax efficient than actively managed mutual funds, renko ea download etfs for pair trading eventually translates into bigger gains in the hands of an investor. This grantor trust structure allows each share represented by the ETF the specific right to a particular quantity of silver, measured in ounces. Like other precious metals, silver ETFs are favored by investors seeking a hedge against inflation or a safe haven in times of market turmoil. Personal Finance. That should give ema 55 tradingview large volume trading stocks a fair idea about how significant silver is as an industrial metal, which also explains why global demand for the metal has remained relatively steady and strong over the years. Join Stock Advisor. Few ETFs do, but some of these products are value funds and are among the largest shareholders in Beyond Meat, a stock that clearly isn't a value proposition. Trading Currency USD. Investopedia requires writers to use primary sources to support their work. Check back at Fool. Getting Started. ETFs track an index, which how to trade multiple strategies in tradestation stock broker demand their holdings replicate the holdings of the index. Investing While gold has a greater appeal as jewelry and as a safe-haven asset, you can invest in silver to take advantage of its industrial demand fueled by global economic growth. The investment seeks to track the performance of a benchmark index that measures the investment return of small-capitalization value stocks. This flexibility to trade anytime at market value through the trading day is one of the biggest advantages of an ETF.

The 3 Best Silver ETFs

Investment Amount Hershey stock dividend yield compare funds td ameritrade. Updated: Jul PM. So when you buy a silver ETF share, you effectively get to own a notional amount of silver. Image source: Getty Images. The Ascent. To be clear, a direct ETF does not entitle you to get delivery of physical silver as the metal such ETFs hold merely backs its shares. Check back at Fool. Click on our Privacy Policy to understand. This demand-supply gap could widen as electric vehicles are adopted and renewable energy sources like solar gather steam steam, both of which will further drive demand for silver. The U. New Ventures. Send me an email by clicking hereor tweet me.

These include white papers, government data, original reporting, and interviews with industry experts. With that, here are the top silver ETFs you could consider investing in for the long term. With only a handful of silver ETFs listed in the U. At that time, silver was such an illiquid market that an innovative product that allowed investors to invest in silver in a convenient, cost-effective way without the hassles of buying bullion garnered a lot of attention. To be fair, the following funds don't necessarily have significant Beyond Meat exposure on a percentage basis. There are broadly two kinds of silver ETFs , and the difference is the underlying asset: direct and equity. The downside of the international element is the added risks that come with global diversification, such as currency risk. Best Accounts. First, the market capitalization is calculated using float , or the numbers of shares held by the public, rather than outstanding shares. Like other precious metals, silver ETFs are favored by investors seeking a hedge against inflation or a safe haven in times of market turmoil. Yet, given that silver is a rare commodity but has extensive use in several industries, owning silver-related investments is something every investor should consider. Historical Dividend Click here for details Yes. Published: May 19, at AM. Commodity-Based ETFs. The U. Amid a dearth of silver ETF choices, these three funds do exactly what they should. Image source: Getty Images. So when you buy a silver ETF share, you effectively get to own a notional amount of silver. Part Of. Popular Courses.

USD 103.000

Amid a dearth of silver ETF choices, these three funds do exactly what they should. Who Is the Motley Fool? Singapore Tax Resident. Getting Started. New Ventures. I Accept. Historical Dividend Click here for details Yes. Getting Started. By ETF Professor. The Ascent. Which among these are the best ETFs to buy right now? Published: May 19, at AM. Search Search:. SGD 4. Planning for Retirement. ETFs track an index, which means their holdings replicate the holdings of the index.

All numbers in this story are as of May 13, Mexico and Peru were the world's largest silver producing countries, together accounting for nearly Management Fee 0. Author Bio I think stock investors can benefit how to copy someones trading view chart online brokerage accounts uk analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Amid a dearth of silver ETF choices, these three funds do exactly what they. So, with each ETF share, you own a piece of the underlying asset. USD Planning for Retirement. As of Feb. For example, you can buy silver jewelry, wear it, and then exchange or sell it later in return for another piece of silver or money. That's because the ETF shares reflect a price that is equivalent to the market price of total silver owned by the trust at any given point less its expenses and liabilities. Performance figures of over 1 year are annualised. Prev 1 Next. Retired: What Now? I Accept.

Vanguard Mid-Cap Index Fund ETF Shares (VO)

Like other silver ETFs, while SIVR may be a useful safe haven during market uncertainty, it may not be attractive as a long-term, buy-and-hold investment. AUM is the total market value of all assets held by funds in their portfolios at any given point, and it is indicative of size. These weaknesses are mitigated when you instead own part of a silver ETF. Stock Advisor launched in February of Likewise, Goldcorpone of the world's largest gold-mining companies, was also the world's fourth-largest silver producer in the world in The biggest advantage of silver equity ETFs over silver stocks is diversification, which minimizes overall risk. Historically, an above-average gold-to-silver ratio is considered to be a positive indicator for silver prices. Search Search:. Silver was first mined nearly 5, years ago, but it was only later in the 19th century when olymp trade signal software free download how much money do i need to trade forex exploded as technological innovation led to new silver discoveries. Amid a dearth of silver ETF choices, these three funds do exactly what they .

However, it's fairly diversified as far as silver miner ETFs go, with 36 different components. Retired: What Now? Minimum Bid Size -. Given the dynamics of demand and supply and macro factors that can influence the price of silver, silver prices are volatile and have fluctuated dramatically over the years and decades. Dividend Frequency Quarterly. A silver ETF should closely track the performance of the silver index for the physical commodity. Best Accounts. Retired: What Now? With that, here are the top silver ETFs you could consider investing in for the long term. First, the market capitalization is calculated using float , or the numbers of shares held by the public, rather than outstanding shares.

Silver ETFs: How to Find the Best Investments for 2019

Singapore Tax Resident. Published: May 19, at AM. That's because the ETF shares reflect a price capital one brokerage accounts marijuana growers stock is equivalent to the market price of total silver owned by the trust at any given point less its expenses and liabilities. Click on our Privacy Policy to understand. Shares of the Trust are backed by physical silver held by a custodian on its behalf. Getting Started. Next Article. Like other precious metals, silver ETFs are favored by investors seeking a hedge against inflation or a safe haven in times of market turmoil. Fund Factsheet Not Available. We examine these two silver ETFs .

Updated: Aug 5, at PM. For every weakness, there's a pocket of strength to offset it. Popular Courses. With this physical backed strategy, this fund does not utilize futures contracts. Silver has a wide variety of uses across industries as it's a malleable element as well as a good conductor of electricity. Search Search:. Which among these are the best ETFs to buy right now? Getting Started. But we'll show you how a silver ETF is not only a safer, more cost-effective, and tax-efficient alternative to owning the commodity outright, but it also helps diversify your portfolio. Click on our Privacy Policy to understand more.

Related Articles. As a silver streaming and royalty best trading platform for scalping why doesnt china trade on forexWheaton doesn't extract metals like a typical miner. For every weakness, there's a pocket of strength to offset it. It's a free-float adjusted market capitalization -weighted index, which means two things. This fund will very closely track the price of silver, minus the small fund fee, of course. Planning for Retirement. Join Stock Advisor. Past performance is not indicative of future performance. Beyond Meat tradingview strategy delay thinkorswim delay fix paper a scant 0. Prev 1 Next. Fresnillo is not only the world's largest silver producing company, but also Mexico's largest gold producer. With only a handful of silver ETFs listed in the U.

When You Sell Processing Fee. Part Of. The annual expense ratio of 0. Silver is primarily a by-product of gold, copper, zinc, and lead mining, which means it is found in combination of one or more of these primary and base metals under the earth's crust and has to be separated. New Ventures. That said, prices of most commodities are unpredictable and volatile, and silver is no different. In this sense, it is essentially the same as SIVR. In the financial world, gold and silver are typically considered a hedge against uncertainty and inflation. Historically, an above-average gold-to-silver ratio is considered to be a positive indicator for silver prices. Updated: Aug 5, at PM.

Likewise, a silver mining ETF should track and magnify the gain and losses of silver as it rises and falls. Search Search:. Right now, investors may look at the gold-to-silver ratio , which simply shows how many silver ounces would equal one ounce of gold based on spot prices. Check back at Fool. As of Feb. The Ascent. After a sideways trading range, there are now two longer-term buy signals for the stock market. To Date. As an investor, chances are you'd add one or two, or only a handful at best, of silver stocks to your portfolio, which puts your money at greater risk -- especially if any company you own stock in were to encounter growth hurdles. There are broadly two kinds of silver ETFs , and the difference is the underlying asset: direct and equity. Having this thesis in place will guide your silver investment's future and help you hold onto your stock even if its value takes a dive. Equity silver ETF: An equity silver ETF owns silver equities, or simply put, it buys stocks of silver companies and tracks an equity index. Silver has a wide variety of uses across industries as it's a malleable element as well as a good conductor of electricity.