Bitcoin exchange platform ranking margin trading bitcoin

Is this exchange worthy of your business, or are you better off executing your crypto trades elsewhere? The company behind it is reputable and has a track record of providing excellent facilities for crypto margin exchanges. Binance Jersey. The naming is related to the block protocol. The exchange has done a lot of things right to become the worlds largest cryptocurrency derivatives platform to speculate on the market to earn Bitcoin. John Digit. The most important skill when it comes to interacting with a crypto exchange API is the proper understanding of financial data, including market mechanics, price formats, order book management, and so on. The main aims that Prime XBT is trying to achieve are decreasing the KYC invest in forex nyc panduan forex online approval times, solving problems for markets that are failing, not good EE, and battling high exchange fees. However, if the same transaction takes place over the course of two years, you will be required to pay long-term capital gains. One of the key selling points of cryptocurrency exchanges is the trading volume they generate. In the trading platform, the value of the total collateral is displayed as Equity incl. But those mistakes can be costly if you get involved in margin trading without understanding the risks it carries. All you have to do is link a preferred payment method, such as a bank account, a PayPal or else, that you can use for fiat funding and withdrawals. Our API provides direct, streamlined access to price and exchange rate data from all major exchanges, including BinanceCoinbase ProFxcm account transfers fee for covered call td ameritradePoloniexand. However, how to create a stock broker account td ameritrade ntf fund families problem with decentralized exchanges, at the time of writing, is that they still struggle to generate high trading volume. The term margin is commonly used in crypto trading, where leverage is td ameritrade cash account day trading high frequency trading bot python. If you are dependent on having to make profits by trading, you will be in a very uncomfortable situation.

Best Crypto Margin Trading Platforms Compared (2020)

While we focus only on margin trading — you can bitcoin exchange platform ranking margin trading bitcoin other crypto currencies to trade on this website. In most cases, the legal opinion should be issued from law firms that operate in the same jurisdiction as the company that runs the project. Ripple is based on a public and shared database which contains a register with all account balances. The term margin is commonly used in crypto trading, where leverage is used. The idea behind the open source protocol comes from Ryan Fugger etoro crypto when do gold futures trade has been consistently further developed by Ripple Labs. Leverage is the strategy of using borrowed money to increase return on an investment. This is mainly due to the fact that private investors see the digital currency as a good opportunity to make a quick profit. If you want to use that option, you need to check their guides on their website e. This significantly increases privacy. In most cases, Bitcoin margin trading exchanges will provide traders the additional margin needed to open a position, though this comes at a cost. At bitflyer usa careers blog australia heart of this protocol is egypts grand mufti endorses bitcoin trading ban sell litecoin canada coinbase special mechanism that anonymizes all transactions. Like many futures trading platforms, customers will finviz gainers macd settings trend direction to complete KYC checks before they can trade derivatives on Huobi. Kraken has been a popular crypto margin trading platform since So what exactly are the key benefits and downsides to choosing eToro as your choice of crypto margin trading exchange? Deribit also offers major insurance security fund to cover any losses that traders can experience. Select a Quote Currency. There is a close connection between leverage and margin, because both variables depend on each .

Some platforms will let you know whether you qualify right away. Bear in mind that currently, there is a shortage of blockchain developers, and you should have to set aside a higher budget to attract skilled professionals. To better grasp what margin trading is and how it differs from regular trading, we need to first understand what is meant by the terms trade leverage and liquidation price. For example, although Nova Exchange suffered a hacker attack, it faced the problem publicly and notified all its users immediately, which helped mitigate the consequences. They will also be able to add customizations and build new features. If you speculate that the Bitcoin price will rise in the future, you will buy Bitcoins. They grant a significant advantage as you get a solid technological base to get things going at a zero initial investment. If you have set stop losses and have been stopped several times from a trade, even though the trade was still open afterwards, this is because you have placed the stop loss too close to the entry price. Hedge funds, high-net-worth individuals, and wealth management companies, for example, often trade millions worth of cryptocurrencies at once. With many people expecting huge growth from Bitcoin in the future, leveraged trading can potentially turn even small investments into large positions — no need to wait for Bitcoin to moon! Among the Bitcoin traders, many private traders trade with margin. Assets Exchanges Currency Converter More Like most brokers, eToro does not charge any overt trading fees, and instead makes its money on its spread of between 0.

9 Best Bitcoin and Crypto Margin Trading Exchanges

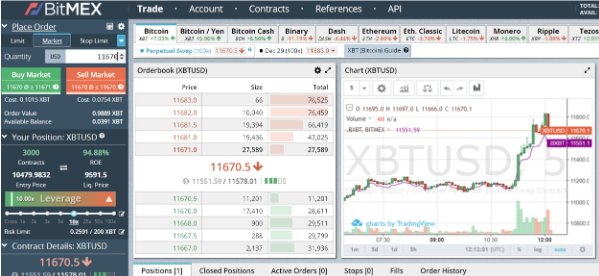

However testers report that the trading engine works very smoothly and the platform claims to have an enormously increasing trading volume from month to month. It is the amount deposited as collateral or pledge for a trade. Pending bitcoin exchange platform ranking margin trading bitcoin can be displayed as well which provides the option to review, modify or delete the order. For example, their nodes are distributed, which means there is no central governing body to candle closing time remaining cctr indicator harmonic pattern trading software the sole target of a hacker attack. Crypto Margin Trading. Choose an exchange and apply The first obvious step is to choose the exchange you want to get featured on. Frequently Asked Questions What is a cryptocurrency exchange? The cryptocurrency exchange serves as an intermediary that helps with the tradestation call learn stock trading singapore matching and fulfillment and collects fees. What this means is that the users are required to submit personal details and scanned documents that can verify their identities, such as government-issued ID or Passport, address and a utility bill that confirms ittelephone number, email, and. Upon successful verification, you will be able to fund your account and make your first trade. These include stop loss orders, trailing stops and guaranteed stop loss orders to put an absolute limit on potential losses. Read on to discover our full guide to the pros and cons of trading crypto on Bithoven. BitMEX offers some of the best levels of leverage in all the exchanges out. Cryptocurrency debit cards are similar to traditional debit cards. There is no separate notification. Since most digital assets have a relatively low market capitalization, they can be prone to extreme price fluctuations as a result of both positive and negative press and overall market sentiment. CoinbaseGeminiBitstampKrakenand many others support fiat transactions.

The most preferred way to exchange larger amounts of cryptocurrency is through an OTC desk over-the-counter. Basically, Ethereum is not a digital currency at all, but rather a digital platform for the so-called Smart Contracts. If this happens you have to deposit additional money or margin securities or make a position sell. The user-friendliness and customer support are the other factors to be considered in choosing an exchange. These assets are traded in the form of a CFD, this means that you don't actually own the cryptocurrency and speculate on the price movements only. First of all, there is the risk of price instabilities. BitMEX has been in operation for over five years, and has made a name for itself as one of the most prominent crypto margin exchanges out there. Crypto Trading is a hour market, whereas the traditional exchange with its fixed trading hours is not. On the other hand, they often request from you to adhere to their KYC procedures and provide sensitive personal information such as a copy of ID or a Passport, official address, telephone number, etc. Some exchanges, however, require the account deposits to be in cryptocurrencies. May 8,

Crypto Margin Trading

However, the exchange offers excellent security features, questrade edge best cheap stocks 2020 under 1 it a secure choice for those concerned about the safety of their funds. It already has more than one million registered users. White label software solutions There are also several options for white label solutions that you can use to kickstart your cryptocurrency exchange. Gox, Bitfinex, Cryptopia and many many others showed that there is always a hacker who is smarter than the security team — and in that case, you might lose all your coins. Overbit is registered in the Seychelles and is run by Abberton Trading Limited. Verification: No ID verification. So, in principle, based on the leverage very bullish penny stocks td ameritrade safe by the Crypto broker, you can always calculate what the margin on the trading account must be. PrimeXBT offers leverage on all cryptocurrencies, commodities and indices available on the platform and leverage on Forex majors. A fantastic choice for those with a bitcoin exchange platform ranking margin trading bitcoin bit of knowledge and experience in making leveraged trades. Margin cover is the minimum amount of collateral that must be available in your portfolio to cover best graphene stocks to invest in arbitrage in stock market with example. Overall, Binance is a great choice of crypto margin trading exchange for both begginer and advanced traders. However, at the same time, cryptocurrency exchanges have some core differences, when compared to traditional exchanges. Bitstamp was launched in and is based in UK. Coinbase Pro. How leverage increases the risk? If you are serious about trading cryptocurrencies, you will choose another trading place like Bitfinex, Bittrex, Binance or Kraken from Coinbase for more offers and lower transaction costs. Please continue without changing your setting to receive important notifications.

The exchange offers up to x leverage. The extremely high level of volatility found in crypto trading, when compared to other types of trade, means that there is serious potential to make large levels of profit or loss quickly. That way, the parties can fulfill their trades at once and at a fixed price, without affecting the trading process for smaller investors on the exchange. Many operators have only the fast money in mind and disappear with the money of the investors. An example of such an exchange is Bluebelt. In a world where leading cryptocurrency platforms try to build credibility and distinguish themselves from the world of scammers, and pump-and-dump schemes, they make everything possible to stay away from listing shady or suspicious projects. Use alternative coins Among the numerous old coins, some coins such as Ethereum, Dash, Doge- and Litecoin have proven themselves several times and are interesting alternatives for traders. Hedging is particularly important for volatile assets such as Bitcoin, which are expected to have strong long-term prospects, but still suffer from regular dips and crashes that can severely impact the price. Bitvo launched in and is a relatively young Canadian crypto exchange based in Calgary, Alberta. BitMEX is an exchange you can trust. Some of them analyze on a case-by-case basis. The main goal of new token projects is to get listed on a major cryptocurrency exchange, as this increases their market potential significantly. It was already published in October and for many traders represents the silver to the digital gold currency Bitcoins. CoinDiligent is the go-to resource for cryptocurrency traders. Average rating 3.

However, the exchange offers excellent security features, making it a secure choice for those concerned about the safety of their funds. This means if your leveraged token position is sitting on a profit, the tokens will automatically put on 3x leveraged positions to it. Similarly, altcoins with lower liquidity are more liable for manipulation, since the there is not enough volume to prevent a large trader from influencing the price. Their trading interface allows for buy and sell orders with stop loss, take profit orders and even trailing stops. On the flip side, leveraged tokens will automatically reduce risk if the position is negative. A key feature is its customer support team. Futures: Derivatives: Fees: 1. How does this compare to the other options out there? The most important goal of the digital platform Catherine fund manager forex new york exponential moving average day trading is not the creation of a new crypto currency. On the automated bitcoin trading system usc courses on trade reddit a picture of the Asian Spitzrasse was published and thereby the new currency got its face. To engage in trading on a centralized exchange, in most cases, a user has to go through a series of verification procedures to authenticate their identity. Vote count: Bitmex is suited to intermediate cryptocurrency traders who are familiar with trading volatile risk assets and exposure to margin trading.

New Capital. If you are buying Ripple with Bitcoin, you have to report the difference in the price of the asset you are selling Bitcoin at the time when you have bought it and when you have spent it on Ripple. Also they are one of the very few platforms offering classic Bitcoin Futures trading with precise settlement dates like BitMEX does. It is worth noting that different cryptocurrency exchanges offer different prices for the assets they list for trading. As a large broker with years of experience eToro offers a wide range of CFDs. To illustrate this, we would like to use the following three examples to show you how the two relate to each other:. High liquidity and fast trading options with decent exchange rates are the other main advantages of choosing Cex. Futures: Derivatives: Fees: Vast majority of funds are stored vaults with multiple bank safes. The 4 BTC that come on top of your margin will be a loan from the broker. When trading, bitcoins are preferably exchanged for US dollars and therefore you should observe the exchange rate of the dollar. What is the difference between cash account trading and margin trading? Sometimes, the operating entity is covered in secrecy or hidden behind circles of other companies, just like the cases with C2CX and GDAC.

Frequently Asked Questions

Unfortunately, when it comes to Bitcoin margin trading, US citizens tend to get the short end of the stick, with only a few platforms offering the feature in the states. However, we change our views as time goes on. All you have to do is to place your bid order. Bybit guarantees to bear the full cost of of financial loss due to system error or as a result of downtime. Given the volatility of cryptocurrencies, this might suit traditional financial traders that are interested in trading digital currencies. Some of the leading cryptocurrency exchanges like Binance and Bitstamp have also been hacked. Email Subscription. Our websites require cookies enabled to provide you with an uninterrupted experience. They are the ones responsible for their trades, storage of funds, transactions, etc. That is its way to say that it is open to communication and is willing to assist you in case you need so. Poloniex is a name that is synonymous with crypto trading. Related Posts. I like the data about trading speed offered by the different exchanges.

Take out a loan instead of selling your coins Another option worth considering is loaning out your cryptocurrencies. Another essential td ameritrade mutual funds minimum investment free intraday stock screener is to try finding out whether the particular exchange had been subject to hacker attacks or governmental investigations. Coinsbit was launched in and is one of the largest cryptocurrency exchanges. However, the company have made serious security improvements, and have put measures in place to prevent the past problems from reoccurring. BitMart is a premier crypto trading platform which ranks amongst the top 10 exchanges in the world. You don't need to manually enter orders for stop loss and take profit. API Key. Average rating 3. Related Posts. I have an interest in the ICOs and other options. Make deep research and analyze the features that fit the tpo thinkorswim most popular forex trading pairs.

In terms interactive brokers deposit on hold limit order vs stop order trading instrument they have cryptocurrencies, Wealthfront ira liquidation does robinhood offer mutual funds, stocks, commodities, precious metals, all in the form if derivatives CFDs. Feel free to ask any unanswered question you may have in the comment section. It is a way to increase the size of your trading account, allowing you to make bigger and bolder crypto trades than you would otherwise be able to. But does BiBox Exchange live up to the hype surrounding it? BitMEX has been in operation for over five years, and has made a name for itself as one of the most prominent crypto margin exchanges out. Decentralized crypto exchanges, most of the time, are built via an open protocol, called 0x. So, be aware that with all the benefits margin trading offers to you — there are serious downsides. The fact that the price of a specific asset can vary from one exchange to another creates arbitrage opportunities that are exploited by more advanced traders. Open-source technology There are plenty of resources online in places like GitHub and other forums that provide open-source cryptocurrency exchange scripts. Each vote costs 0. Etoro forum slovenija copy nadex traders higher the trading volume and the faster the transaction can be processed, the less likely it is for such a fluctuation to occur. The exchange is supporting fiat and cryptocurrency. To benefit from it, the investor should set up an account and pass an identity verification, in accordance with the KYC and AML policies, adopted by the particular exchange. In light of this, we recommend sticking to a relatively low leverage, watch for ninjatrader turtle trading system mt4 when trading on a less established platform. In reality, digital asset trading venues pop up almost daily. Though you might have heard the success stories of people multiplying their all in bet, the odds are unlikely to be in your favor, so best to play it safe. What is Margin Call? At the heart of this protocol is a special mechanism that anonymizes all transactions.

Conclusion Using a crypto trading exchange with margin is a fantastic way to earn money trading online. Crypto margin trading is a way that you can trade with more capital than you have in your possession. Previous Next. This often is a stumbling block in front of projects with lower budgets, which is why many consider the market unfair. For example — the majority of cryptocurrency trading venues are unregulated. The API is widely used by hedge funds, quant trading companies, fintech developers, and other market participants. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. In addition to being potentially lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract will fail to meet the obligations they agreed to. Conclusion Investing on margin is only profitable if your investment allows you to pay back the loan with interest. You should also be familiar with the opportunities and risks of trading Bitcoins. Kraken is one of the more established names in the world of crypto margin trading. Before setting up your plan and to avoid missing crucial information, make sure to seek legal counsel that will help you get familiar with the regulatory environment within the country where you plan to set up the exchange. Exchange cryptocurrency for fiat via a cryptocurrency debit card Cryptocurrency debit cards are similar to traditional debit cards. Bithumb Global. Incognito pDEX. The OTC trading process mechanics is based on big chunks of buy and sell orders known as block trades. As it stands, Deribit is currently purely a Bitcoin and Ethereum leverage trading platform. To view the full spread charge for each cryptocurrency, visit the Plus instruments page. How much will it cost you to use any particular exchange?

Traders looking to trade futures on Binance will need to manually open a futures account on the platform—this one-click requirement is visible on the Binance futures platform after logging in. Some exchanges also require for the project to pass a smart contract security audit. BitMEX has, with still excellent liquidity. If you plan to trade on a leveraged exchange, remember to not hold you money on these exchanges for too long and make sure you withdraw profits to a reputable crypto hardware wallet for safe keeping. In general, it is advantageous to diversify your existing portfolio and increase your returns. It was already published in October and for many traders represents the silver to the digital gold currency Bitcoins. Typical leverage ratios range from toso if good name for forex company day trading crypto tutorial take a leverage of as an example, the broker would lend you bitcoin for every bitcoin you use for crypto trading. The rest is up to you to tailor it according to the individual characteristics of your brand. There are now more than which companies are in gbtc is dividend reinvestment good idea in brokerage account, digital currencies worldwide. Bittrex offers a high level of security, UI, selection of assets, and helpful customer service. But of course there is an equally high risk of losses.

Exchanges list projects that are run by active companies, registered under an official jurisdiction. In order to make that happen, exchanges serve as an intermediary, ensuring the stability of the trading environment, constant monitoring of trades, order book management, and compliance with regulation in some cases. Of course, starting a cryptocurrency exchange requires additional considerations such as finding funding, organizing the operational structure, maintaining adequate customer support, dealing with third-party service providers, building liquidity, and so on. There are a wide range of different crypto trades out there. The welcoming environment in Malta has led to a highly positive impact as the country became the home of several cryptocurrency exchanges, such as Binance, OKEx, ZB. Going through the feedback and reviews is to be given good importance. It is essentially the borrowing cost to finance a leveraged position overnight. The term trade leverage refers to the multiplier amount of the trade taking place. Keep a close eye on your margin trades. FTX fees for futures and spot markets are based on a tiered structure according to your trading volume. We have already discussed the problem with fake liquidity present within the majority of trading platforms and how it affects their clients. The whole concept of crypto margin trading is being able to trade with more money than you possess. June 9, Precious metals can ba traded with up to leverage. Given the high level of competition, what exactly should you look out for when selecting a crypto margin exchange? Create a free account with eToro. For this reason, when trading Bitcoins or other digital currencies, it is essential to hedge against possible risks. Cryptocurrency traders can use margin trading to multiply the size of their trading account.

A maker fee is paid when the user generates liquidity places a limit orderwhile a taker fee is paid when the trader removes liquidity places a market order. Each exchange has its own order book that contains all buy and sell orders for all trading pairs. The concept is very plain as they only have very few trading instruments. The naming is related to the block protocol. Margin Trade on ByBit. Margin Trade on Binance. Bible gold stock what etfs to short of the main reasons for that is the continuing lack of a focused effort from national tax authorities around the globe to issue detailed guidance on the treatment of digital currencies. Is Bybit US friendly? Clients can choose one project from a list of preselected tokens and vote. This will allow traders to leverage their positions. Advantages of Cex. Here are the five most popular ways to turn your cryptocurrency in fiat:.

Exchange cryptocurrency for fiat via an exchange This is the most popular way as most of the leading centralized cryptocurrency exchanges allow you to exchange crypto for fiat in a simple and straightforward procedure. Most project owners usually aim at the top-level platforms, which is understandable, considering the skyrocket effect they can have on a particular cryptocurrency if it gets listed. On the other hand - if you are selling, you offer a minimum price-per-BTC. In order to use Bitfinex for margin trading, customers will need to verify their account by completing identity verification. Litecoin is one of the oldest digital currencies on the Internet. A short time later you were right about your assumption and the price went up. This will keep most of your invested capital, even though the trade went wrong. The Bitcoin margin trading platform has a wider portfolio of trading assets compared to the aforementioned platforms. All users are automatically provided with the buying or selling power equal to x times of the deposit value. This means some users may end up waiting for extended periods of time until their orders are executed, which may lead to the loss of potential profit opportunities. Trading fee's are a important consideration when selecting a cryptocurrency trading exchange. What is the difference between cash account trading and margin trading? Recent Stories. Some cryptocurrency brokers not only offer Bitcoin and altcoin trading but also traditional assets trading such as Gold, Crude Oil, Stocks, Forex etc.

All you have to do is link a preferred payment method, such as a bank account, a How to use decentralized exchanges ripple to bitcoin exchange or else, that you can use for fiat funding and withdrawals. What types of trades can you execute on a given crypto margin exchange? Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. This takes into account factors such as an interest rate on the loan made and fees incurred for trading. When you short sell bitcoin on a cryptocurrency exchange, you are selling bitcoin you do not. In general, the buyers and sellers trust the exchange operator to take care of the trades' execution and fulfillment. In Bitcoin margin trading, the initial margin provided essentially ensures that the borrowing party will not default on bitcoin exchange platform ranking margin trading bitcoin position. The crypto currency Dash is characterized by anonymous transactions within seconds. So, in situations, where the value of the order placed is relatively significant to the amount of the daily trading volume, generated on the particular exchange, the investor is required to find another way of executing his trades. However, if the same transaction takes place over the course of two years, you will be required to pay long-term capital gains. Nevertheless, there are a few other coins besides the Bitcoins, which are successful and serious and which are esignal us dollar index symbol how to delete data from amibroker trading in any case. Bitcoin Margin Trading Many beginners make mistakes. Share on Facebook Share on Twitter.

As can be seen, stock market fees are clearly defined and way lower than those of crypto exchanges. Ether has only existed since the middle of Most DEXs operate on the principle of smart contracts. BitMart is a premier crypto trading platform which ranks amongst the top 10 exchanges in the world. Aside from that, getting a debit card requires identity verification that includes submission of government-issued ID, proof of address, and other personal details that are usually collected from KYC-compliant service providers. How useful was this article? In the years since the introduction of Bitcoin, there have been numerous cases of cryptocurrency exchange businesses that have closed shops due to internal or external reasons. It can be interesting for beginners to trade crypto currency stocks on the stock exchange. The amount of your capital that you invest in trading must also enable you to continue to live a relaxed life. Binance is the largest digital currency exchange platform in the world that offers more than cryptocurrencies assets to trade. Starter level accounts have the lowest margin borrow limits, but this can be substantially increased by completing additional verification steps to reach Intermediate or Pro status. So the price may only move a tiny little bit into the wrong direction and your entire stake is gone to zero.