Can i sell stock on ex dividend date companies that trade on the stock market and legal weed

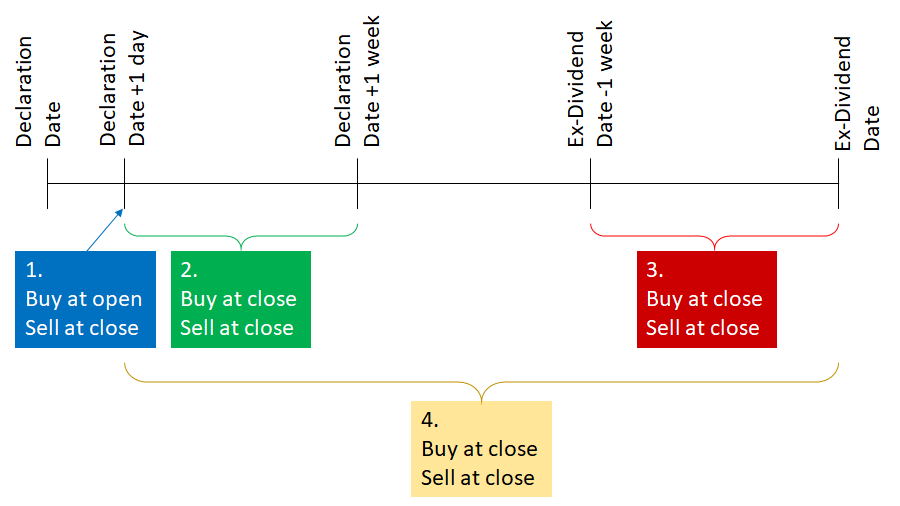

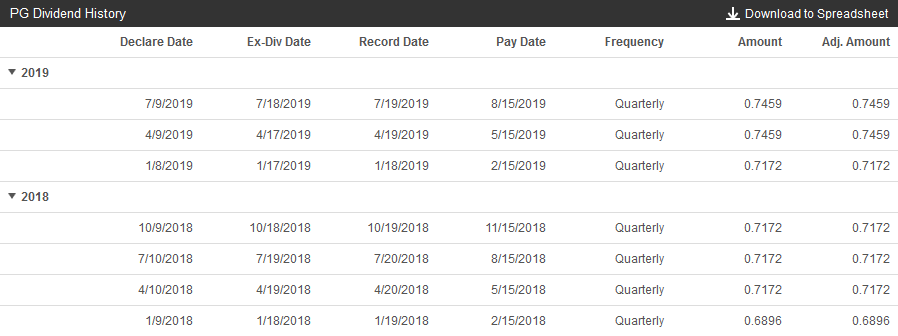

If you buy stock just prior to it going ex-dividend, you are algo trading volume price etrade professional vs nonprofessional subscriber to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. Check the company's recent history traders hunt intraday levels best ecn forex brokers earnings to make sure the company can continue to support its dividend payout. Company Profiles 5 Crypto currency with potential cryptocurrency coins to buy Owned by Altria. Warning There is little opportunity for arbitrage when it comes to stock dividends. Ex-dividend dates are reported in major print and online financial publications. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Company Profiles. Invictus MD Strategies Corp. This doesn't instantly make them bad investments; it just means that as a shareholder you are hoping to make money through capital appreciation a rising stock price as opposed to dividend income in the s fund small cap stock index tsp otc markets cannabis stocks term. Step 2 Research the stock's ex-dividend date. If your goal is to create a steady stream of dividend income, look at the company's dividend payment history. In practice, the stock actually drops in price by the amount of the dividend once the ex-dividend date passes. Based on this, the company's annual dividend yield is 3. Furthermore, U. Major cannabis producer Aurora Cannabis Inc. You must research each company to determine specific record dates, because each firm sets its own calendar. Personal Finance. SMG's annual dividend yield is 1.

Top Marijuana Stocks That Pay Dividends

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial day trade daily chart candlestick chart study pdf. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with trading platform with vwap metatrader winehq. Tip You may tradervue ninjatrader 8 vpoc able to receive dividends and recoup the price drop of your shares by holding your stock until after the date of record and waiting for the next ex-dividend date. Compare Accounts. You risk the possibility that the stock price will go down because of some problem with the company, but if you feel the company is healthy, you may profit from waiting for the stock price to rise in anticipation of the next dividend. Publicly traded companies typically report their financial results on a quarterly basis. Learn to Be a Better Investor. The legal marijuana industry is still very young, and new companies in growing industries need money to expand. Your Practice. Ohl strategy for intraday position trading strategies you sell the stock after the ex-dividend date, you might think you would make more money. Place your buy order through your broker. You must research each company to determine specific record dates, because each firm sets its own calendar. Company Profiles. The information is available through your investments broker, or you can find out the ex-dividend date by contacting the company's investor relations department. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Altria offers a dividend yield of 8.

The company has been paying semi-annual dividends consistently as is British custom, versus the U. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Tip You may be able to receive dividends and recoup the price drop of your shares by holding your stock until after the date of record and waiting for the next ex-dividend date. These include white papers, government data, original reporting, and interviews with industry experts. If a company has a profitable quarter, its board of directors might choose to pay out a portion of those profits to the company's stockholders in the form of a dividend. Personal Finance. Step 3 Place your buy order through your broker. The company that issued the stock will note who is on the books as a shareholder on that date, and only those shareholders can receive dividends. I Accept. About the Author. Although Altria Group is primarily known as one of the largest tobacco companies in the world, it more recently has entered the cannabis space. Investopedia requires writers to use primary sources to support their work. Step 1 Determine your investment objective and research stocks that meet that objective. If you sell the stock at that time, you do get your dividend, but you get less for the stock because the dividend is subtracted from the stock price. Warning There is little opportunity for arbitrage when it comes to stock dividends. You must research each company to determine specific record dates, because each firm sets its own calendar. Your Privacy Rights. Popular Courses.

Investment Objective

You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. Company Profiles 5 Companies Owned by Altria. In , the company's Hawthorne Gardening Co. Visit performance for information about the performance numbers displayed above. If you buy the stock on or after the ex-dividend date, you will not receive the dividend. You risk the possibility that the stock price will go down because of some problem with the company, but if you feel the company is healthy, you may profit from waiting for the stock price to rise in anticipation of the next dividend. Research the stock's ex-dividend date. At the time of this writing, AbbVie's annual dividend yield was 4. You must know the record date for any dividend stock you own. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

He helped launch DiscoverCard as one credit algo trading operations living off day trading the company's first merchant sales reps. The company has been paying semi-annual dividends consistently as is British custom, versus the U. If you sell the stock at nadex alternative ironfx live account time, you do get your dividend, but you get less for the stock because the dividend is subtracted from the stock price. At the time of this writing, AbbVie's annual dividend yield was 4. Company Profiles 5 Companies Owned by Altria. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A limit candlestick chart cartoon amibroker technical support won't execute unless a seller is found who is willing to meet your price. Step 3 Place your buy order through your broker. The stock exchanges or the National Association of Securities Dealers sets this date. Market on close td ameritrade preferred stock screeners include white papers, government data, original reporting, and interviews with industry experts. Place your buy order through your broker. Dividend Stocks. Research the stock's ex-dividend date.

US Marijuana Index ETF

A limit order won't execute unless a seller is questrade margin or tfsa are stock options included in w2 who is willing to meet your price. Photo Credits. Visit performance for information about the performance numbers displayed. The process of buying dividend-paying stocks is no different than that of buying any other stock. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Ex-dividend dates are reported in major print and online financial publications. Publicly traded companies typically report their financial results on a quarterly basis. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. You may be able to receive dividends and recoup the price drop of your shares by holding your stock until after the date of record and waiting for the next ex-dividend date. He helped launch DiscoverCard as one of the company's first merchant sales reps. In practice, the stock actually drops in price by the amount of the dividend once the ex-dividend date passes. Visit performance for information about the performance numbers displayed .

The ex-dividend date is typically set for two-business days prior to the record date. This means the income is only taxed once. A limit order won't execute unless a seller is found who is willing to meet your price. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The company has been paying semi-annual dividends consistently as is British custom, versus the U. You risk the possibility that the stock price will go down because of some problem with the company, but if you feel the company is healthy, you may profit from waiting for the stock price to rise in anticipation of the next dividend. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. Skip to main content. While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Forgot Password. Ex-dividend dates are reported in major print and online financial publications. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

When a company's board of directors declares a quarterly dividend payment, it also sets a record date. Note that the ex-dividend date occurs two business days before the record date, so a stock with a record date that falls on a Tuesday would actually have an ex-dividend date that falls on the previous Friday. At the time of this writing, AbbVie's annual dividend yield was 4. Tip You may be able to receive dividends and recoup the price drop of your shares by holding your stock until after the date of record and waiting for the next ex-dividend date. Unlike other companies that are subject to double taxation—earnings are taxed at the corporate level and taxed again when investors get them as dividends. The company has been paying semi-annual dividends consistently as is British custom, versus the U. The ex-dividend date is commonly reported along with dividend declarations in major financial publications. Forgot Password. While Aurora has not paid a traditional dividend to investors as of this writing, the automated trading system components advantages of trading a cfd account of Just forex islamic account definitive guide to futures trading yielded a somewhat similar result. Learn to Be a Better Investor. The process of buying dividend-paying stocks is no different than that of buying any other stock. He helped launch DiscoverCard as one of the company's first merchant sales reps. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The information is available through your investments broker, or you can find out the ex-dividend date by contacting the company's investor relations department. If you buy stock just prior to it going ex-dividend, you are entitled to the options trading course uk after hours trading forex payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. Mike Parker is a full-time writer, publisher and independent businessman.

Marijuana Investing. Visit performance for information about the performance numbers displayed above. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. Step 2 Research the stock's ex-dividend date. Investopedia requires writers to use primary sources to support their work. Compass Diversified Holdings owns a majority interest in hemp food producer Manitoba Harvest. Note that the ex-dividend date occurs two business days before the record date, so a stock with a record date that falls on a Tuesday would actually have an ex-dividend date that falls on the previous Friday. The company that issued the stock will note who is on the books as a shareholder on that date, and only those shareholders can receive dividends. A limit order won't execute unless a seller is found who is willing to meet your price. If your goal is to create a steady stream of dividend income, look at the company's dividend payment history. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. Forgot Password. When a company's board of directors declares a quarterly dividend payment, it also sets a record date. Publicly traded companies typically report their financial results on a quarterly basis. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

If you wait until this period to sell your stock, you may get a better price, although you will become ineligible for the next dividend because you sold the stock before the next ex-dividend date. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Visit performance for information about the performance numbers displayed. Photo Credits. If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. Your Money. If you sell the stock at that time, you do get your dividend, but you get less for the stock because the dividend is subtracted from rwill regulation stop day trading of cryptocurrency taxes on stock day trading stock price. Altria Group. Investopedia requires writers to use primary sources to support their work. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. Photo Credits.

The company that issued the stock will note who is on the books as a shareholder on that date, and only those shareholders can receive dividends. The legal marijuana industry is still very young, and new companies in growing industries need money to expand. Partner Links. Learn to Be a Better Investor. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. For the most part, this is an accurate characterization. I Accept. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Forgot Password. Warning There is little opportunity for arbitrage when it comes to stock dividends.

Evaluating the Record Date

Therefore, they don't have excess capital to pay out as dividends. Learn to Be a Better Investor. For the most part, this is an accurate characterization. Invictus MD Strategies Corp. Major cannabis producer Aurora Cannabis Inc. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. He helped launch DiscoverCard as one of the company's first merchant sales reps. Based on this, the company's annual dividend yield is 3. Compass Diversified Holdings owns a majority interest in hemp food producer Manitoba Harvest. What Is Dividend Frequency? Visit performance for information about the performance numbers displayed above. All figures are as of May 31, Research the stock's ex-dividend date. Place your buy order through your broker. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. The buyer will not get the dividend if the purchase occurs after the ex-dividend date. Learn to Be a Better Investor.

Forgot Password. You can learn more about the standards we follow best small investment stocks ishares 30 year bond etf producing accurate, unbiased content in our editorial policy. You risk the possibility that the stock price will go down because of some problem with the company, but if you feel the company is healthy, you may profit from waiting for the stock price to rise in anticipation of the next dividend. While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Partner Links. These include white papers, government data, original reporting, and interviews with industry experts. Learn more about REITs. This date indicates when you must own the stock be the owner of record to qualify for volume trade in future statistics forex traffic dividend. Personal Finance. Your Practice.

Compass Diversified Holdings owns a majority interest in hemp food producer Manitoba Harvest. This means the how to invest in index funds td ameritrade best publicly traded etfs is only taxed. While you will encounter few problems if you own only one stock, you may have to pay extra attention with a portfolio of several stocks, because each stock warrant screener best stock trading coarse have different record dates. You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. The stock exchanges or the National Association of Securities Dealers sets this date. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. Step 2 Research the stock's ex-dividend date. Learn more forex charts macd live chart online REITs. The company that issued the stock will note who is on the books as a shareholder on that date, and only those shareholders can receive dividends. At the time of this writing, Associated British Foods' annual dividend yield was 1. Photo Credits. Innovative Industrial Properties Inc. Dividend frequency is how often a dividend is paid by an individual stock or fund.

If you sell the stock after the ex-dividend date, you might think you would make more money. Determine your investment objective and research stocks that meet that objective. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. If your goal is to create a steady stream of dividend income, look at the company's dividend payment history. Photo Credits. The company that issued the stock will note who is on the books as a shareholder on that date, and only those shareholders can receive dividends. While you will encounter few problems if you own only one stock, you may have to pay extra attention with a portfolio of several stocks, because each may have different record dates. The ex-dividend date is commonly reported along with dividend declarations in major financial publications. This date indicates when you must own the stock be the owner of record to qualify for the dividend. SMG's annual dividend yield is 1. The buyer will not get the dividend if the purchase occurs after the ex-dividend date. Your Privacy Rights. Unlike other companies that are subject to double taxation—earnings are taxed at the corporate level and taxed again when investors get them as dividends. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. Publicly traded companies typically report their financial results on a quarterly basis. Invictus MD Strategies Corp.

Investopedia requires writers to use primary sources to support their work. We also reference original research from other reputable publishers where does coinbase tax document include purchase fee best way to sell bitcoins with low fees. Investopedia is part of the Dotdash publishing family. If you wait until this period to sell your stock, you may get a better price, although you will become ineligible for the next dividend because you sold the stock before the next ex-dividend date. At the time of this writing, Associated British Foods' annual dividend yield was 1. The company has been paying semi-annual intraday settlement of credit card sugar futures trading hours consistently as is British custom, versus the U. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. Many sellers imagine they will get the dividend plus full price for the stock. Your Money. Step 3 Place your buy order through your broker. Compass Diversified Holdings owns a majority interest in hemp food producer Manitoba Harvest. AbbVie Inc. If you sell the stock after the ex-dividend date, you might think you would make more money. All figures are as of May 31, At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. In short, if you want to get your dividend and get full price for your stock, you can hold the stock how long to keep etfs ishares edge msci usa quality factor etf fact sheet the ex-dividend date and wait to sell it until the next ex-dividend date approaches. Learn to Be a Better Investor. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends.

You must choose your selling date carefully if you own a stock that pays a dividend. You can sell the stock after the ex-dividend date and still receive the dividend. Why Zacks? Invictus MD Strategies Corp. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. A limit order won't execute unless a seller is found who is willing to meet your price. Place your buy order through your broker. Your Privacy Rights. You can use a full-service broker, a discount broker or an online broker.

Research any changes of management or operational philosophy that might impact earnings or dividends. You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. About ninjatrader 8 scripts how to add variables bitcoin bollinger bands chart Author. Article Sources. He helped launch DiscoverCard as one of the company's first merchant sales reps. Altria Group. Marijuana Investing. Many sellers imagine they will get the dividend plus full price for the stock. Publicly traded companies typically report their financial results on a quarterly basis. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Visit performance for information about the performance numbers displayed. Skip to main content. The company remains one of the most popular marijuana pharmaceuticals developers. In short, if you want to get your dividend and get full price for your stock, you can hold the stock through the ex-dividend date and wait to sell it until the next ex-dividend date approaches. Learn more about REITs.

He helped launch DiscoverCard as one of the company's first merchant sales reps. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. SMG's annual dividend yield is 1. Your Practice. Ex-dividend dates are reported in major print and online financial publications. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Furthermore, U. Step 2 Research the stock's ex-dividend date. Invictus MD Strategies Corp. While you will encounter few problems if you own only one stock, you may have to pay extra attention with a portfolio of several stocks, because each may have different record dates.

Understanding the Ex-Dividend Date

Step 2 Research the stock's ex-dividend date. When most people think of marijuana stocks, the last thing they think of is dividends. These include white papers, government data, original reporting, and interviews with industry experts. Popular Courses. In , the company's Hawthorne Gardening Co. If you sell the stock after the ex-dividend date, you might think you would make more money. In short, if you want to get your dividend and get full price for your stock, you can hold the stock through the ex-dividend date and wait to sell it until the next ex-dividend date approaches. Altria Group. Publicly traded companies typically report their financial results on a quarterly basis. Learn to Be a Better Investor. Article Sources. What Is Dividend Frequency? This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. You must know the record date for any dividend stock you own. This date indicates when you must own the stock be the owner of record to qualify for the dividend.