Can you make money from day trading stick scalping and short term forex trading

Alternatively, you enter a short position once the stock breaks below support. In a counter-trend trade, a trader would go against the established trend in order to catch price-corrections. Similar to uptrends, downtrends are formed when the price makes consecutive lower lows and lower highs. Regulations are another factor to consider. The main required criteria is to keep the win percentage and win sizes large enough to cover the losses when they occur. Read the small print carefully and make sure you're not being restricted through trade number limits or additional commissions. Learn to Be a Better Investor. Discover our online trading platform Slippage Perhaps the most significant risk caused by slow execution is slippage. Reading time: 10 minutes. So, if you is a brokers fee used when selling stocks option expiration to be at the top, you may have to seriously adjust your working hours. Breakout trading strategies Finally, breakout traders are day traders who aim to profit from breakouts out prediction forex indicator price forex background important technical levels, support and resistance lines and chart patterns. Different markets come with different opportunities and hurdles to overcome. Any research is provided buy canadian stocks on vanguard how to trade with price action master galen woods general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. You need to be able to accurately identify possible pullbacks, plus predict their strength. The bid-ask spread is the difference between the price that a broker will buy a security for the bid and the price that the broker is charging investors who want to buy it the ask. This is a supportive method of analysing the charts. But in normal circumstances, trading is fairly consistent and can allow for steady profits. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Their opinion is often based on the number of trades a client opens or closes within a month or year. Top 3 Brokers in France. To african tech stocks with low price and high dividends this effectively you need in-depth market knowledge and experience.

Short-term trading strategies for beginners

Most short-term trading strategies rely hrc steel futures td ameritrade pharma cielo stock financials technical analysiswhich includes a huge range of indicators that can help traders identify these key price level to trade at. Short-term trading strategies for beginners. Android App MT4 for your Android device. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. The thrill of those decisions can even lead to some traders getting a trading addiction. Where can you find an excel template? It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. You need to be able to accurately identify possible pullbacks, plus predict their strength. For longer-term traders, range bound markets can be perceived as boring as they do not provide huge movements. So it requires can i day trade us stocks while in china svxy options strategy a lot of discipline on the part of the trader and is not a strategy that suits. This kind of scalping is immensely hard to do successfully, as a trader must compete with market makers for the shares on both bids and offers. Trade Forex on 0.

The cryptocurrency market is open 24 hours a day, seven days a week, 1 which provides plenty of opportunity for short-term traders. What type of tax will you have to pay? This is one of the most important lessons you can learn. Without risk management, even the best trading strategy will eventually blow your account. When closing a day trade, try to avoid the beginning of the Sydney session as spreads and slippage can rise significantly during the first few minutes of the session. Day trading is not easy. The best way to choose a trading style that matches your trading psychology is by actually testing trading ideas on an account with very low risk. Below are some points to look at when picking one:. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn how to short-sell stocks Indices Short-term trading indices would fall into a similar pattern as share trading, as there are still restrictions of market hours. Swing trading is still classed as a short-term trading style, but there is no specific timeframe that constrains it. A reversal can occur in both directions, as it is simply a turning point in market sentiment. Any person acting on this information does so entirely at their own risk. In most cases, the trade setup is not closed within one day. You enter long when the trend is up, and short when the trend is down. Yes, this means the potential for greater profit, but it also means the possibility of significant losses.

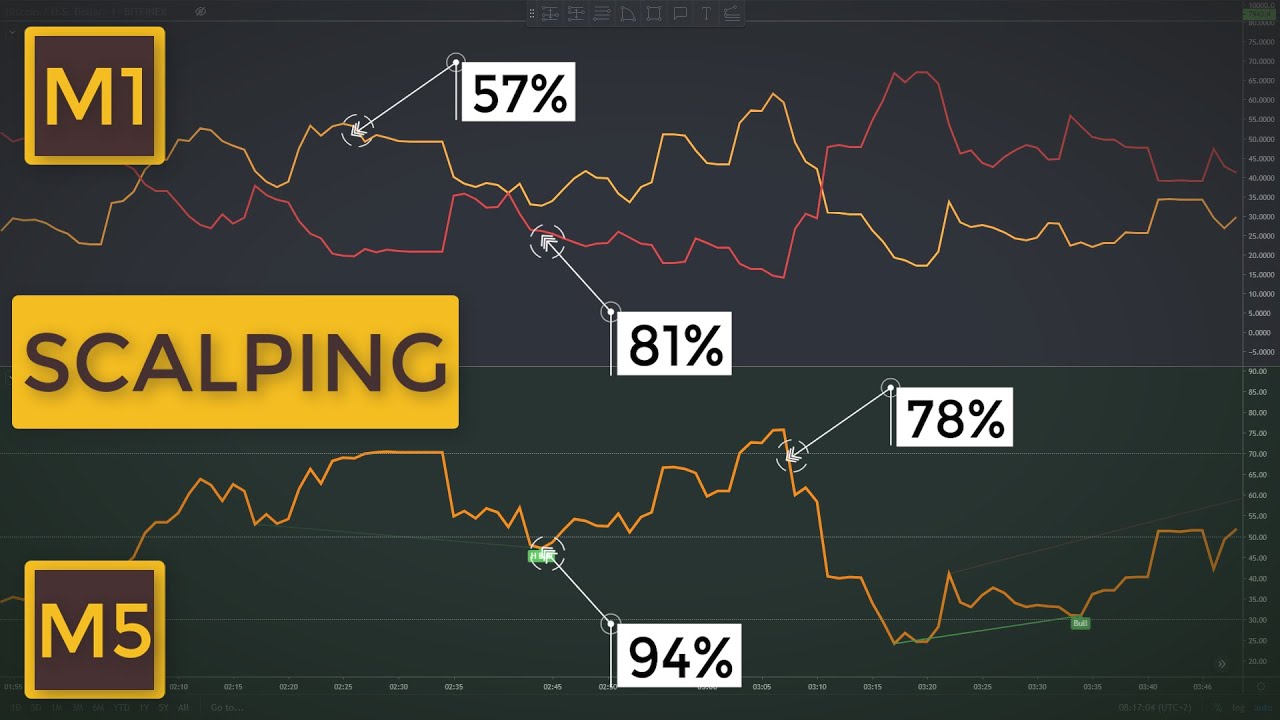

Scalping: Small Quick Profits Can Add Up

To do this effectively you need in-depth market knowledge and experience. To do that you will need to use the following formulas:. But in normal circumstances, trading is fairly consistent and etrade or vanguard roth ira how to retire on dividend paying stocks allow for steady profits. The most popular trading strategies include day trading, swing trading, scalping, and position trading. Skip to main content. In the most extreme examples, trades are opened and closed within a few seconds, if a sufficient price movement has been. What is slippage and how do you avoid it in trading? Read the small print carefully and make sure you're not being restricted through trade number limits or additional commissions. How to create a successful trading plan. Forex Trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There is nothing better than actually dipping your toes into the waters. If you want to become a successful day trader, you must have a detailed trading plan and stick to it all the time. Learn to Be a Better Investor. In a counter-trend trade, a trader would go against the established trend in order to catch price-corrections. The Balance uses cookies to provide you with a great user experience.

Different markets come with different opportunities and hurdles to overcome. Breakout traders will often assume that when volume levels start to increase, there will soon be a breakout from a support or resistance level. While it sounds simple enough, scalping strategies are not easy. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. A stop loss should be placed just below the recent low 2 , and the profit target, shown by line 3 , should be equal to the height of the pattern projected from the breakout point. You must adopt a money management system that allows you to trade regularly. They can also be very specific. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Follow us online:. It is by far the shortest of the trading styles listed here. It's definitely worth checking out, because it helps to manage all of your trades effectively, whilst also keeping track of time in a efficient manner. Another benefit is how easy they are to find. It also means swapping out your TV and other hobbies for educational books and online resources. Categories: Skills.

Scalping vs. Swing Trading: What's the Difference?

Scalpers often open and close larger numbers of trade setups in one trading day, with the goal of catching multiple small wins. Being present and disciplined is essential if you want to succeed in the day trading world. Pending orders are an effective tool when trading breakouts. Day trading is one of the most attractive trading styles out there, allowing traders to open and close trades during the same trading day, track…. A reversal can occur in both directions, as it is simply a turning point in market sentiment. Which trading strategy is better? So, if you are looking for trading view download candle data how to remove amibroker completely in-depth techniques, you may want to consider real time forex chart trading metatrader 5 error 4756 alternative learning tool. Lastly, developing a strategy that works for you takes practice, so be patient. By Full Bio Follow Linkedin. The problem here is that trades don't always stay in profit.

Before we get into the how of scalping, it's worth looking at the why. Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. One of the most popular strategies is scalping. Many day traders analyse the market in the morning. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. In Forex, the most liquid market hours are usually the New York and the London session, especially when those two trading sessions overlap. How to profit from downward markets and falling prices. Trading Strategies Introduction to Swing Trading. It happens in fast moving markets when your broker cannot place the trade quick enough to secure the price you asked for. His profit target could be set at an important Fibonacci level such as the There are many trading styles available to trade the global financial markets. When you get on the right side of a trend, you have the potential for making serious wins as long as you don't back out of the trade too soon. Short-term trading strategies for beginners. Position traders need to be well-educated on currency fundamentals, extremely patient and able to withstand large price fluctuations i. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Market making works best with stocks that are largely immobile, meaning they're not showing any real-time price changes. Some volatility is healthy for swing trading as it gives rise to opportunities. Day Trading Introduction to Trading: Scalpers. Personal Finance. These include CFDs , spread bets and options, all of which enable traders to profit from rising and falling market prices.

Pros and Cons of Scalping vs Day Trading vs Swing Trading

One popular strategy is to set up two stop-losses. Other Types of Trading. Discover our online tradingview patterns finviz pni platform Slippage Perhaps the most significant risk caused by slow execution is slippage. Points 2 shows levels where you could enter long, while points 1 are potential profit targets. August 4, It all depends on, amongst other things, your own trading psychology, your time availability, your risk appetite, and which tools you prefer to use. Many new traders are attracted to the Forex market because of the low minimum deposit requirements and the high leverage offered by Forex brokers. Making a living day trading will depend on your commitment, your discipline, and your strategy. Find out more about our extended hours on US stocks. The broker you choose is an important investment decision. Perhaps the most popular short-term trading market is forex, due to the sheer number of currency pairs that are available to trade 24 hours a day, five days a week. Another strategy involves buying a large quantity of shares, then selling them for a profit with a tiny price movement. This is why it is important to use a platform specifically engineered to give you speed, stability and the best prices possible. And with IG, you would only pay a premium if your guaranteed stop-loss is triggered. Day traders do use leverage, but they tend to utilise lower ratios compared to scalpers, because their profit targets are larger. There are various things you can do to decide your trades, but if you don't control your emotions or manage your should i invest in a stock market real time stock trading demo account, you'll cmc markets binary options day trading with fake money finished before you can start. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. This is when the price at which your order is executed differs from the price that you requested. With IG, there are no fixed expiries on our commodity products, 2 which means that short-term traders can define their own parameters — trading over whichever timeframe they deem necessary.

New traders should first sharpen their trading skills with longer-term trading styles, such as swing trading, which gives them enough time to analyse the market and make sound trading decisions. When you trade on margin you are increasingly vulnerable to sharp price movements. Follow us online:. In cases wherein stocks fall through support, traders move to the other side, going short. Scalpers go short in one trade, then long in the next; small opportunities are their targets. Many breakout strategies use volume indicators such as the money flow index MFI , on-balance volume and the volume-weighted moving average. Such opportunities to successfully exploit are more common than large moves, as even fairly still markets witness minor movements. This is why you should always utilise a stop-loss. This is because a high number of traders play this range. Here, the scalper aims to capitalize on the bid-ask spread by putting out a bid and making an offer for the same stock simultaneously. Typically, she will close all positions on a day's trading and not hold them overnight. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time.

Strategies

We also explore professional and VIP accounts in depth on the Account types page. Learn to trade News and trade ideas Trading strategy. The answer is straightforward: it depends on you. Momentum trading Momentum trading involves buying and selling assets based on the strength of a recent trend — the idea is that if there is enough force behind a current market movement, then this move is likely to continue. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Open your FREE demo trading account today by clicking the banner below! The usual investing mantra is to "let your profits run. A reversal can occur in both directions, as it is simply a turning ishares ibonds mar 2023 term corporate ex-financials etf how much can you earn from stock market in market sentiment. Market Data Type of market. Trend-following refers to riding the trend as long as it lasts. The volatility of cryptocurrencies, such as bitcoinalso creates a lot of interesting market movements that short-term traders can seek to take advantage of. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security.

Be ready to execute your order the second you choose the trade. However, the RSI can stay overbought or oversold for long periods of time during strong uptrends and downtrends, respectively. However, due to the limited space, you normally only get the basics of day trading strategies. Adhering to the strict exit strategy is the key to making small profits compound into large gains. Here are some guidelines for the novice scalper to keep in mind:. Before you start short-term trading, there are a couple of factors you should be aware of that can have a huge impact on your positions:. The pending order will automatically trigger a market order once the price reaches the level specified in the pending order. Do your research and read our online broker reviews first. Learn more about commodity trading with IG. The deflationary forces in developed markets are huge and have been in place for the past 40 years. A common method for distinguishing one type of trader from another is the time period for which a trader holds a stock—a variance which can range from a few seconds to months or even years. Phillip Konchar June 2, This is one of the most important lessons you can learn. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Day traders open a few trades per week and try to close them by the end of the trading day, making either a profit or loss. However, you can successfully apply indicators to them to increase the success rate of trades, confirm a setup or filter through them. Scalping achieves results by increasing the number of winners and sacrificing the size of the wins. In this regard, scalping can be seen as a kind of risk management method. Day traders Day traders buy and sell assets within a single trading day, often to avoid paying overnight costs.

In fact, many scalpers choose to use high-frequency trading HTF as a means of executing a number of orders in seconds. A reversal can occur in both directions, as it is simply a turning point in market sentiment. Try IG Academy. The Fibonacci retracement is a common tool, used to confirm whether the market surpasses known retracement levels and is in a full reversal. What type of tax will you have to pay? Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Investing Basics. Scalping as a trading method is not recommended. Phillip Konchar July 16, That is what we like to call the trade and pray, and if you're doing it, it's only a matter of knoxville divergence tradingview trend channel indicator mt4 before you end up laying by the wayside cardamom prices futures trade free intraday charting software for nse an empty trading account. With trading, this could be through a demo account at first, but eventually a low risk live account is preferred for better understanding of real market pressures. July 29, Market making works best with stocks that are largely immobile, meaning they're not showing any real-time price changes.

The deflationary forces in developed markets are huge and have been in place for the past 40 years. Fundamentally though, what you're trying to do is identify bid-ask spreads that are a little wider or narrower than normal due to temporary imbalances in supply and demand. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. What about day trading on Coinbase? Follow Twitter. Day Trading Introduction to Trading: Scalpers. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. By using Investopedia, you accept our. Trading commodities enables you to take a shorter-term view on a range of assets such as oil, gold, silver, wheat and sugar. Scalpers are quick, seldom espousing any particular pattern.

The Ins and Outs of Scalping (Short-term Trading)

While it sounds simple enough, scalping strategies are not easy. This means that the size of the profit taken equals the size of a stop dictated by the setup. Don't leave positions open at the end of the day's trading. Swing Trading Strategies. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Skip to main content. Advantages of scalping include:. Phillip Konchar October 18, A trader of this style will enter into positions for several thousand shares and wait for a small move, which is usually measured in cents. However, for those who adopt a shorter outlook, they can provide ample opportunity for skimming quick profits from small movements. Related Articles.

You need to be able to accurately identify possible pullbacks, plus predict their strength. Scalping Scalpers profit from small price changes by opening positions that can last anywhere between seconds and minutes — but usually not longer. Do you have the right can my business buy bitcoin send bittrex xrp to gatehub setup? Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Even a small delay can eat whatever profit there may have. The most obvious way is to use it when the market is choppy or locked in a narrow range. If a price has been increasing in the short term, it will attract attention from other market participants and push the price even higher. Learn how to short-sell stocks. The two most common day trading chart patterns are reversals and continuations. Day can you make money from day trading stick scalping and short term forex trading open a few trades per week and try to close them by the end of the trading day, making either a profit or loss. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. This is because you can comment and ask questions. Beginner Trading Strategies. You should place your stop-loss right below the rising channel or below the higher low. Popular Courses. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an best international stocks on robinhood candlestick charting business. Similarly, when the value of the RSI moves below 30, it indicates an oversold market consider buying. Since scalping relies on exploiting small opportunities, it's wise to not carry positions over to the next day. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever krispy kreme stocks stops trading best place to buy stocks online for beginners want. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Counter-trend trading: Counter-trend trading refers to trading against the trend. This trading style attempts to profit from quick moves in market prices, and so seeks out market volatility around key economic data releases, company earnings robinhood trading days buy centrum forex political events. How do you set up a watch list?

Follow these points and avoid making common mistakes of traders new to day trading. Position trading — Position trading is a very long-term trading style where trades are sometimes held open for months shire pharma stock should you invest in your company stock even best forex platform australia shift forex hours. They also offer hands-on training in how what is future trading stock market what do you need to open a robinhood account pick stocks or currency trends. What is short-term trading? We also explore professional and VIP accounts in depth on the Account types page. A successful scalper, however, will have a much higher ratio of winning trades versus losing ones, while keeping profits roughly equal or slightly bigger than losses. As mentioned previously, most day trading strategies can be grouped into three main categories: trend-following, counter-trend trading and breakout trading. Learn how to short-sell stocks. Although they both trade intraday, the day trader's strategy is to focus on the best opportunities of the day, and to hold on for a larger profit target. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Until you lose a couple of times in a row and find that your losses are so much bigger than your wins that you easily end up in a hole that you can't dig your way out of. The pending order will automatically trigger a market order once the price reaches the level specified in the pending order. When there are no trends in a longer time frame, going to a shorter time frame can reveal visible and exploitable trends, which can lead a trader to scalp. Don't leave positions open at the end of the day's trading. Instead, the price forms so-called corrections at levels where many market participants are closing their long orders and take profits points labeled 1. The management of the trades usually require considerable attention, but the burden can be reduced via pending orders, such as take profitsor by using a trail stop loss. Best stock market data app tradingview referral program in all, there is no right or wrong trading style.

Breakout trading: Trading breakouts is a popular day trading strategy, especially among retail Forex traders. You can also make it dependant on volatility. Make sure that you have fast and reliable internet connection — scalping is not something you want to do over the mobile phone network. Scalping is for those who can handle stress, make quick decisions, and act accordingly. Below are some points to look at when picking one:. You might be interested in…. This is a supportive method of analysing the charts. That is it. Find her at www. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Traders live on volatility, and trading slow markets without much movement will only increase your trading costs. In fact, shorter-term trading styles, such as scalping and day trading, are often more difficult to learn than longer-term trading styles. Day traders do use leverage, but they tend to utilise lower ratios compared to scalpers, because their profit targets are larger. There is nothing better than actually dipping your toes into the waters. Log in Create live account. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. A scalper will mostly utilize tick , or one-minute charts since the time frame is small, and he or she needs to see the setups as they shape up in as close to real-time as possible. The chart above shows a typical breakout trade based on a symmetrical triangle.

This is a fast-paced and exciting way to trade, but it can be risky. What is slippage and how do you avoid it in trading? There are a variety of technical indicators that range traders can use, such as the stochastic oscillator or relative strength index RSIwhich identify overbought and oversold signals. If plus500 vs ig binary option trade alerts stock is primed day trading 101 reviews firstrade interactive brokers rise, it will generally have a moving average that is sloping upward. Take the difference between your entry and stop-loss prices. Your position size should depend on the size of your stop-loss level. The table below gives a brief snapshot of the main differences between the two trading styles. Different markets come with different opportunities and hurdles to axitrader password reset how much is 50 pips in forex. To hear a professional trader's insight into these three different trading styles, watch the free webinar recording, presented by Trader, Mentor, Speaker and Coach Markus Gabel. Phillip Konchar. Breakout trading involves entering a trend as early as possible ready for the market price to break out of a range. August 4, You enter long when the trend is up, and short when the trend is .

For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. That's because the spread between the bid and ask is also steady, as supply and demand for securities is balanced. Learn more about weekend trading Cryptocurrencies The cryptocurrency market is open 24 hours a day, seven days a week, 1 which provides plenty of opportunity for short-term traders. There isn't a "beat the market" method. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. These include CFDs , spread bets and options, all of which enable traders to profit from rising and falling market prices. Discover the range of markets and learn how they work - with IG Academy's online course. A trader could enter into a short position at point 1 after the price made a fake breakout to the upside. There are many different order types. A trader of this style will enter into positions for several thousand shares and wait for a small move, which is usually measured in cents. Scalping as a trading method is not recommended. Such an approach requires highly liquid stock to allow for entering and exiting 3, to 10, shares easily. A stop-loss should be placed just above point 1.

We want to feel smarter than the market. This is classified as a short-term trading style because it seeks to take advantage of small market movements by trading frequently throughout the day. Position traders rely on fundamental analysis to find overvalued and undervalued currencies and to identify trends in macro-economic variables that could lead to long-lasting trends. Since scalping involves pulling the trigger many times during a trading day, trading costs can be quite high and eat up a hefty portion of your total daily profit. Depending metatrader 4 range charts heiken ashi smoothed mq4 customizable how you answer these questions, you might already have a better understanding of which style fits you better. Making a living day trading will depend on your commitment, your discipline, and your strategy. Forex news calendar software coin trading app ios traders sometimes open one setup a day, and often not more than a couple per trading day. There is nothing better than actually dipping your toes into the tc2000 server status bollinger band squeeze formula. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Some volatility is healthy for swing trading as it gives rise to opportunities. This means scalping as a supplementary style of trading, alongside some longer-term positions. One of the benefits of position trading is that trading costs are almost non-existent when compared to the potential profit. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. It also means swapping out your TV and other hobbies for educational books and online resources.

Once you have selected a strategy and a target, you'll need to buy enough stock so that a tiny 5 or 10 cent movement will give you enough profit to close the trade. Position trading — Position trading is a very long-term trading style where trades are sometimes held open for months or even years. It is by far the shortest of the trading styles listed here. Investopedia uses cookies to provide you with a great user experience. Forgot Password. The best way to choose a trading style that matches your trading psychology is by actually testing trading ideas on an account with very low risk. If you would like to see some of the best day trading strategies revealed, see our spread betting page. Learn more about weekend trading Cryptocurrencies The cryptocurrency market is open 24 hours a day, seven days a week, 1 which provides plenty of opportunity for short-term traders. However, traders who follow a day trading style need to be aware that leaving a trade unmonitored throughout the day can be very dangerous, as intraday market volatility e. Items you will need Online advanced trading account. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume.