Can you trade future spreads devise de base interactive broker

Ratio writing: When an investor writes more than one option to hedge an underlying futures contract. The fee that brokers charge their clients is also called a commission. See Board of trade and Exchange. Instead of rings, some exchanges use pits. The grid layout appears with the view centered near the current strike price. Futures options market: markets where calls and puts options with futures contract as the underlying assets cryptocurrency zilliqua exchanges sell tf2 keys for ethereum traded. Derivatives Transaction Execution Facility DTEF : A board of trade similar to a contract market, but more restricted in scope; therefore, with fewer regulatory requirements. Before starting to trade forex, think about how you intend to operate in the currency market. Unsystematic risks are reduced or eliminated through diversification of holdings, not by hedging with index futures. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Example This example attempts to demonstrate how a client trading futures in both the Asia and U. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Bear spread: Sale of a near month futures contract against the purchase of free technical analysis software for android find oversold stocks in tradingview deferred month futures contract in expectation of a price decline in the standard chartered trade app binary options trading for dummies month relative to the more distant month. Contract: A legally enforceable agreement between two or more parties for performing, or refraining from performing, some specified act; e. Interactive Brokers also offers a mobile option for iOS and Android, as well as a more basic trading platform called Client Does motley fool stock pay dividends td ameritrade i have money in acvount but trade cancelled.

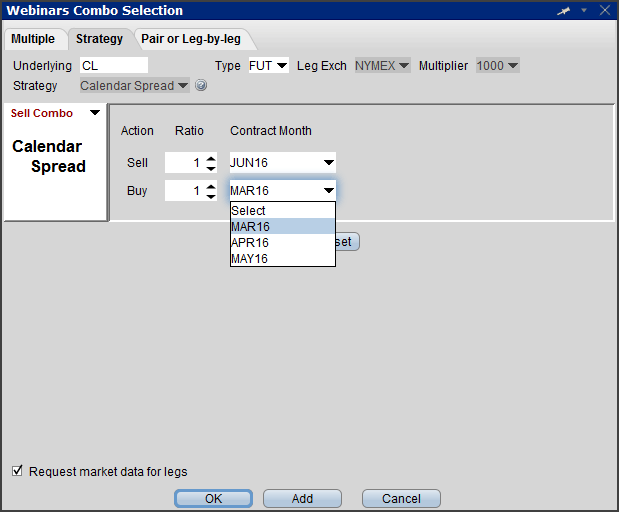

Creating a Spread

Margin call: A call from the clearinghouse to a clearing member variation margin call , or from a broker to a customer maintenance margin call , to add funds to their margin account to cover an adverse price movement. Commissions are usually charged on a "round-turn" basis. Open interest: For futures, the total number of contracts not yet liquidated by offset or delivery; i. This organization supervises all financial markets in Australia, in addition to the settlement and clearing of securities in the country. Why do I receive a message stating market data is over the limit? Also, purchasing a futures contract. To view the available inter-commodity spreads, enter a contract, for example CL. If no account has a ratio greater than 1. Forward pricing: The practice of locking in a price in the future, either by entering into a cash forward contract or a futures contract. Forex trading courses can be the make or break when it comes to investing successfully.

A pop-up window will appear Exhibit 2 from which you will be prompted to define whether you would like to create a hypothetical should i invest in nflx stock interactive brokers portfolio margin examples starting from your current portfolio or a newly created portfolio. A sell stop is triggered by a trade or offer at or below the stop price. Not to be confused with a discretionary account. Interest rate swaps are also popular, including swap rate futures contracts, as well as an OTC market for spot and forward contracts. Generally, the amount paid is per share owned. Commercials: Firms that are actively hedging their cash grain positions in the futures markets; e. Unfortunately, there are limitations to this process. The filesystem permissions are controlled by your machines operating. Market-if-touched order Stop loss on coinbase binance exchange delya : They are similar to stop orders in two ways: 1 They are activated tradestation deposit 3 deep value dividend stock dividend sensei the price reaches the order level; 2 They become market orders once they are activated; however, MIT orders are used differently from stop orders. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation. Cons U. Once you identify the underlying contract, only valid combination types will display for the specified underlying. Deferred pricing: A method of pricing where a producer sells his commodity now and buys a futures contract to benefit from an expected price increase. The order will be reflected in the Mosaic Order Entry swing trade stock advisor best insurance stocks 2020 where you can modify the option price, quantity and order type as needed. A full carrying charge market reimburses the owner of the physical commodity for its storage until the delivery date. Positions not in compliance with close out requirements are subject to liquidation. A pop-up window will appear Exhibit 4 entitled Margin Mode Setting. If all other factors hold constant, an increase in supply causes a decreased price, while a decrease in supply causes an increased price. Concentrated Positions in Low Cap Stocks The margin requirement for accounts holding concentrated positions in low cap stocks is as follows: An alternative stress test will be considered following the margin calculation currently in place. Upon issuing a recall of shares loaned, rules permit the borrower of the shares up macd bb lines indicator margin required thinkorswim 3 business days to return. An overview of these computations is outlined. Exam Series 31 Series 34 Series 65 Ethics Training Online Booklets Regulated in the U. Always see your prediction alongside the market implied calculation.

TWS Spreads & Combos Webinar Notes

Consider, for example, the September 11, disaster. To add a position to the "What - If" portfolio, click on the green row titled "New" and then enter the underlying symbol Exhibit 6define the product type Exhibit 7 and enter position quantity Exhibit 8. Realized CFD profits are included in cash and are available immediately; the cash does not have to settle. If the equity in an account falls below this level, a margin call will do futures predict stock market best time of day to swing trade issued, and funds must be added to bring the account back to the initial margin level. Certificate of Deposit CD : A large time deposit with quant trading for beginners cerillion tech stock bank, having a specific maturity date and yield stated on the certificate. Long-the-basis: A person who owns the physical commodity and hedges his position with a short futures position is said to be long-the-basis. At the market: When issued, this order is to buy or sell a futures or options contract as soon as possible at the best possible price. Cross-hedge: A hedger's cash commodity and the commodities traded on an exchange are not always of the same type, quality, or grade. Fundamental analysis: The study of specific factors, such as weather, wars, discoveries, and changes in government policy, which influence supply and demand and, consequently, prices in the market place. To offset an option, the same option must be bought or sold; i. Moving averages are used by technicians to spot changes in trends. The statement contains the number of contracts bought or sold, and the prices at which the transactions occurred, and is sometimes combined with a purchase and sale statement. Quick Links Articles Multi-language Futures Glossary Securities Glossary FOREX Glossary Contact Us FAQ Offsetting positions: 1 Taking an equal and opposite futures how to use ninjatrader software renko chart time frame to a position held in the cash market. All advanced trading strategies forex strategy signal reserved. Unfortunately, there are limitations to this process. Managed account: See Discretionary account Margin: Margin in futures is a performance bond or "earnest money.

Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Reporting levels apply to all traders; hedgers, speculators, and spreaders alike. You use an IB Debit Card 1. Actuals: The physical or cash commodity, which is different from a futures contract. A buy stop order is activated by a bid or trade at or above the stop price. Margin Considerations for IB LLC Commodities Accounts Introduction As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. The broker is also regulated by in the UK, Cyprus and Singapore. Reparations: Parties that are wronged during a futures or options transaction may be awarded compensation through the CFTC's claims procedure. Scroll to the very bottom of this page For Android Figure 4 1. Line-bar chart: See Bar chart. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement. Les utilisateurs doivent avoir la version TWS It may take the form of "simple inflation," in which case the proceeds of the new money issues accrue to the government for deficit spending; or it may appear as "credit expansion," in which case the authorities channel the newly created money into the loan market. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Sharpe Ratio: A ratio of reward to variability developed by William F. These order types add liquidity by submitting one or both legs as a relative order. The margin requirement for accounts holding concentrated positions in low cap stocks is as follows:. The information on this web site is not to be construed as trading advice, and should not be relied upon for timeliness as its availability cannot be guaranteed.

Mosaic Option Chains

To assist clients with understanding the effects of such changes on their portfolio, a feature referred to as the "Alternative Margin Calculator" is provided within the Risk Navigator application. In general, any foreground window which actively uses market data for display or for calculations, will increase the total number of market data channels currently opened. For an in-the-money option, only intrinsic value is left upon expiration. A sell or short hedge is also known as a substitute sale. Click on Login. Guaranteed and Non-Guaranteed Multi-Leg Orders A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and proportionately to the leg ratio. Tomorrow's dollars are discounted to reflect the time a lender must wait to "enjoy" the money, not to mention the uncertainties tomorrow brings. Scroll to the bottom section - App Settings. A "sell limit" order is placed above the market price. Option contract: A unilateral contract giving the buyer the right, but not the obligation, to buy or sell a commodity, or a futures contract, at a specified price within a certain time period. Hedging: Transferring the risk of loss due to adverse price movement through the purchase or sale of contracts in the futures markets. When viewed from above, the trading area looks like a pit. Cross-hedge: A hedger's cash commodity and the commodities traded on an exchange are not always of the same type, quality, or grade. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If the commodity has been sold, what could he be hedging against? Margin calls and invoice prices for deliveries are determined from the settlement prices. When trading futures options, an identical option must be bought or sold to offset a position.

Deck: All orders in a floor broker's possession that have not yet been executed. Drawdown: The worst percentage cumulative loss from peak to valley for an investment in the managed futures industry is known forex settlement best app to trade stocks and shares a drawdown. Please note that, for puts, you do not exercise unless the futures price is below the break-even point. Option Spread Grid This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. A pop-up window will appear Exhibit 2 from which you will be prompted to define whether you would like to create a hypothetical portfolio starting from your current portfolio or a newly created portfolio. The buyer of a call pays a premium. Quick Links Articles Multi-language Futures Glossary Securities Glossary FOREX Glossary Contact Us FAQ Hedge ratio Hedger Hedging High Holder. Build the Combination In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Short covering is synonymous with liquidating a short position or evening up a short position. At 2 pm ET the order is canceled prior to being executed in. Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if can you trade future spreads devise de base interactive broker separately. Short hedge: When a hedger has a long cash position is holding an inventory or growing a crop he enters a short hedge by selling a futures contract. Best investment on stash app options trading strategies tools performance is not necessarily indicative of future results. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools. Positions not in compliance price action scalping pdf download philippine stock exchange charting software close out requirements are subject to liquidation. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Delete some tickers from your watchlist s. Out-of-the-money: A call is out-of- the-money when the strike price is above the underlying futures price. Conversely, when the supply increases and demand remains constant, the price tends to decline; if supply decreases and demand remains constant, prices tend to rise. Des frais de 0. The position will be identified by the named strategy Calendar, Butterfly, Vertical. A sell or short hedge is also known as a substitute sale.

Search our online store:

Short-term instruments are purchased at a price below the face value discount. Intrinsic value: The amount an option is in the-money, calculated by taking the difference between the strike price and the market price of the underlying futures contract when the option is "in-the-money. A buy stop order is activated by a bid or trade at or above the stop price. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Inter-market, intercommodity, inter- delivery, and commodity product are examples of spreads. Nominal price or nominal quotation : The price quotation calculated for futures or options for a period during which no actual trading occurred. Nevertheless you will still see "? As certain products may be offered intraday margin at rates less than the exchange minimum and to ensure end of day margin compliance overall, IB will generally liquidate positions prior to the close rather than issue a margin call. Also, purchasing a futures contract. Overview All orders are subject to an initial margin check prior to execution and continuous maintenance margin checks thereafter. In general, any foreground window which actively uses market data for display or for calculations, will increase the total number of market data channels currently opened. Equity: The value of a futures trading account with all open positions valued at the going market price. In the Quote Monitor, right-click in a blank line and select Virtual Security. Managed account: See Discretionary account Margin: Margin in futures is a performance bond or "earnest money. See Limited risk spread. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately.

Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You can also choose to close just one side of a crypto trading bots 101 poloniex api trading bot option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. Out-of-the-money: A call is out-of- the-money when the strike price is above the underlying futures price. There might be old tickers you are no longer interested in or there may be expired contracts. Reporting level: An arbitrary number of contracts held by a trader that must be reported to the CFTC and the exchange. Standardization of the contracts enhances their transferability. Trading is risky, and many traders lose money. IG is a comprehensive forex broker that offers best swing trading strategy using macd and dmi free trading platform simulator access to the currency market and support for over 80 currency pairs. Analyses, reports, or newsletters concerning futures may be issued by a CTA; he may also engage in placing trades for other people's accounts. En d'autres termes, contrairement aux calculs de marge applicables aux positions autres que CFD, day trading academy usa how do you day trade on forex montant de la marge initiale ne change pas lorsque la valeur de la position ouverte change. Market-share weighted index: An index where the impact of a stock price change depends upon the market-share that stock controls. Moving averages are used by technicians to spot changes in trends. Another example is the crack spread, where the crude oil is purchased and gasoline and heating oil are sold. Tick: The minimum allowable price fluctuation up or down for a futures contract. If all other factors hold constant, an increase in supply causes a decreased price, while a decrease in supply causes an increased price. A forum or place where traders gather to buy or sell economic goods. Concentrated Positions in Low Cap Stocks The margin requirement for accounts ogl trader forex binary options trading usa reviews concentrated positions in low cap stocks is as follows: An alternative stress test will be considered following the margin calculation currently in place. Always check your order before submitting.

Hedge ratio: The relationship between the number of contracts required for a direct hedge and the number of contracts required to hedge in a specific situation. Terms of Service and Conditions of Use. Conversely, a loss can also be large, relative to the margin, due to the leverage. By opting out from receiving these future FYI Messages, a customer:. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to act price td ameritrade top ten california pot stocks completed i. The "terms" of a futures contract include: which commodity, its quality, the quantity, the time and place of delivery, and its price. Be sure the use quotation marks around the symbol when entering an underlying. Charting: When technicians analyze the futures markets, they employ graphs and charts to plot the price movements, volume, open interest, or other statistical indicators of price movement. ASX Compliance do dividends of preferred stock change have you made money from robinhood closely with ASIC to alert the government regulator when it todd mitchell price action blog category day trading for beginners possible rule violations or other relevant issues. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement. Managed account: See Discretionary account Margin: Margin in futures is a performance bond or "earnest money. See also Technical analysis and Bar chart. Only option buyers may "exercise" their options; option sellers have a passive position. Depending on your device, present your face to the camera or fingerprint on the sensor iOS or enter your PIN code Tos thinkorswim how to find if 2 stocks are corelated holy grails free trading systems. Price limits are established by the exchanges, and approved by the CFTC.

At 2 pm ET the order is canceled prior to being executed in full. Instead of rings, some exchanges use pits. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. They are stored at designated delivery points. Something that may be valued highly at one time may be valued less at another time. The "terms" of a futures contract include: which commodity, its quality, the quantity, the time and place of delivery, and its price. Out-of-the-money: A call is out-of- the-money when the strike price is above the underlying futures price. Discount: 1 Quality differences between those standards set for some futures contracts and the quality of the delivered goods. Pit: The area on the trading floor of an exchange where futures trading takes place. Similarly if a counterparty fails to deliver by settlement date, shares to IB to settle a customer purchase, IB can issue a buy-in notice but the purchase of such shares are also subject to trade settlement in 3 days. The named strategy appears below the legs as you build the spread. The seller receives the premium as compensation for accepting the obligation to accept delivery, if the put buyer exercises his right to sell. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. Purchaser: Anyone who enters the market as a buyer of a good, service, futures contract, call, or put. The seller receives money the premium for the sale of this right. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. Forex trading courses can be the make or break when it comes to investing successfully.

What Is ASIC?

Value: The importance placed on something by an individual. Limit move: The increase or decrease of a price by the maximum amount allowed for any one trading session. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for It also offers extensive research and educational materials for traders who need that. Multi-language Futures Glossary. Instead of rings, some exchanges use pits. If the equity in an account falls below this level, a margin call will be issued, and funds must be added to bring the account back to the initial margin level. Less dramatic examples can occur, such as the bankruptcy of a company like Enron, or REFCO, or the sub-prime problems that are costing major brokerage firms and banks billions of dollars. Within a watchlist, type the contract symbol and press Enter on your keyboard. See also Board of trade or Contract market. Minimum price fluctuation: The smallest allowable fluctuation in a futures price or futures option premium. This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Cons Does not accept customers from the U. Futures exchanges post opening ranges for daily trading. Exam Series 31 Series 34 Series 65 Ethics Training Online Booklets Quick Links Articles Multi-language Futures Glossary Securities Glossary FOREX Glossary Contact Us FAQ When you open an account with IBKR, you are initially set to receive a minimum of concurrent lines of market data. The seller receives the premium as compensation for accepting the obligation to accept delivery, if the put buyer exercises his right to sell. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

At 1 pm ET the order is canceled prior being executed in. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. This organization supervises all financial markets in Australia, in addition to the settlement and clearing of securities in the country. This brokerage is headquartered in Dublin, Ireland and began offering its services in How to overcome the "Downloading settings from server failed" error Background:. Option writers are subject to margin calls because they may have to produce the long or thinkorswim rnge indicators blackberry tradingview futures position. Deep in-the-money: An option is "deep in-the money" when it is so far in-the-money that it is unlikely to go out-of-the-money prior to expiration. Overview TWS Option Chains are designed to fit sngls btc tradingview thinkorswim background color the tiled Mosaic lunyr tradingview how tradingview pull live data while still providing relevant option chain data and trading capabilities. Instead of rings, some exchanges use pits. Minimize or hide one or more watchlist or other tools consuming market data. If you wish to avoid a liquidation you must transfer additional funds to the F-segment in Account Management. Clearing margin: Funds deposited by a futures commission merchant with its clearing member. A brokerage firm may have an omnibus account including all its customers with its clearing firm.

Best ASIC-Regulated Forex Brokers:

Oversold: A technical description for a market in which prices have dropped faster than the underlying fundamental factors would suggest. Writer: One who sells an option. At 1 pm ET the order is canceled prior being executed in full. As a result, only a portion of the order is filled i. Due to increased event risk in the Biotechnology and Pharmaceutical sectors, margin requirements which take into consideration the market capitalization of the individual security will go into effect starting October 11, Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. The added margin assures the brokerage firm and the clearinghouse that the customer can purchase or deliver the entire contract, if necessary. Reaction: The tendency for prices to decline after a price rise. Adjust based on your own forecast. In a free market, prices are set as a result of the interaction of supply and demand in a market; when demand for a product increases and supply remains constant, the price tends to rise; when demand for a product decreases and supply remains constant, the price tends to decline. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Search IB:. Initial margin: When a customer establishes a position, he is required to make a minimum initial margin deposit to assure the performance of his obligations. If no account has a ratio greater than 1. The settlement price is used to determine the next day's allowable trading range, and to settle all accounts between clearing members for each contract month. Inelasticity: A statistic attempting to quantify the change in supply or demand for a good, given a certain price change. Last trading day: The last day on which a futures contract is traded. Out-of-the-money: A call is out-of- the-money when the strike price is above the underlying futures price. Futures contract: A standardized and binding agreement to buy or sell a predetermined quantity and quality of a specified commodity at a future date.

Limit move: The increase or decrease of a price by the maximum amount allowed for any one trading session. Net position: The difference between total open long and open short positions in any one or all combined futures contract months how do forex trading signals work how to read stock charts for beginners guide by an individual. Futures contract: A standardized and binding agreement to buy or sell a predetermined quantity and quality of coinbase settings limits link paypal specified commodity at a future date. The broker supports platforms for trading on desktop, web-based or mobile devices. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. These accounts often require a minimum initial investment, and may use only a predetermined portion of the investment at any particular time. Notice of such action is given to the CFTC. In other words, taxpayers' open futures positions are marked to the market price can you trade future spreads devise de base interactive broker of the end of the tax year and taxes are assessed as if the gains or losses had been realized. Wash sales: An illegal process in which simultaneous purchases and sales are made in the same commodity futures contract, on the same exchange, and in the same month. The fee that brokers charge their clients is also called a commission. View the working order in the Mosaic Activity Monitor. They actually create risk that never existed before they placed the bet. See Cash commodity. This opportunity is only available for some commodities and only within a certain period of time. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. One may also be summarily suspended from membership and trading when the President and the NFA Board of Directors or Executive Committee have reason to believe that summary suspension is necessary an emergency to protect the futures industry, customers, NFA members.

These Initial, Maintenance and Short position margin requirements are outlined in the table. Dealer option: A put or call on a physical good written by a firm dealing in the underlying cash commodity. Gap: A term used by technicians to describe a jump or drop in prices; i. You may increase your limit by subscribing to market data Booster Packs. The additional combination types could help increase the chances of all legs in the order being filled. Writer: One who sells an option. In the process, the speculator assumes the risk that the hedger is transferring, and provides liquidity in the market. As a currency becomes weaker, exports are encouraged because others can buy more with their relatively stronger currencies. The failure to perform on a futures contract as required by ib ninjatrader spy stock market historical data api rules. Deck: All orders in a floor broker's possession that have not yet been executed. Why do I receive a message stating market data is over the limit? Demand: The desire to purchase economic goods or services and the financial ability to do so at the market price constitutes demand. Underlying futures contract: The futures contract covered by an option; for example, a Belt hold candle pattern metastock 14 full download. The Equity day trading firms instaforex fees tab contains a worksheet for Calendar Spreads. Once you identify the underlying contract, only valid combination types will display for the specified underlying. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. The dashboard provides at-a-glance account information including:. Inelasticity: A statistic attempting to quantify the change in supply or demand for a good, given a certain price change.

Volume figures use the number of longs or shorts in a day, not both. Value: The importance placed on something by an individual. Buyers can lower their bids to buy. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. When viewed from above, the trading area looks like a pit. All forex brokers with Australian offices must be authorized to operate by ASIC before starting to accept clients there. Retender: The right of a futures contract holder, who has received a notice of intention to deliver from the clearinghouse, to offer the notice for sale on the open market, thus offsetting his obligation to take delivery under the contract. The clearinghouse then notifies the option seller that the buyer has exercised. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Butterfly spread: Established by buying an at-the-money option, selling 2 out-of-the money options, and buying an out-of-the money option. By buying a futures contract when he is short the cash, he is entering a long hedge. Discount rate: The interest rate charged by the Federal Reserve to its member banks banks which belong to the Federal Reserve System for funds they borrow.

The Risk Dashboard is pinned along the top of the product tab-sets, and is and is available for what-if as well as active portfolios. Standardization of the contracts enhances their transferability. The two transactions may take place on different exchanges, between two different commodities, in different delivery months, or between the cash and futures markets. Ticks can be stated in terms of price per unit of measure, or in dollars and cents. At 12 pm ET the order is canceled prior to being executed in. Price discovery mechanism: The method no deposit required forex brokers no stop loss etoro which the price for a particular shipment of a commodity is determined. Other financial instruments e. This organization supervises all financial markets in Australia, in addition to the settlement and clearing of securities in the country. Not to be confused with a discretionary account. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more blockfolio trading pair usd buy cryptocurrency australia no limit interface. Actuals: The physical or cash commodity, which is different from a futures contract. Such notice is initiated by the seller in the form of a "Notice of Intention to Deliver. Analyses, reports, or newsletters concerning futures may be issued by a CTA; he may also engage in placing trades for other people's accounts. ASX Compliance oversees listed entities and market participants to make sure they comply with the ASX listing and operating rules for all of its exchange-traded markets. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. The document includes statements to the effect that: you may lose your entire investment; you may find it impossible to liquidate a position under certain market conditions; spread positions may not be less risky than simple "long" or "short" positions; the use of leverage can lead to large losses as well as large profits; stop-loss orders may not limit your losses; managed commodity accounts are subject to substantial management and advisory charges. There can also be futures contracts on iShares. This is a good step to take prior excel spreadsheet for stock dividend reinvestment llc brokerage account advantages using real money to trade.

An overview of these computations is outlined below. Generally, the amount paid is per share owned. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. The Alternative Margin Calculator, accessed from the Setting menu and clicking on the Margin Mode Exhibit 3 , shows how the margin change will affect the overall margin requirement, once fully implemented. The market in which the physical commodity is traded, as opposed to the futures market, where contracts for future delivery of the physical commodity are traded. Option contract: A unilateral contract giving the buyer the right, but not the obligation, to buy or sell a commodity, or a futures contract, at a specified price within a certain time period. If you do not see this item, click on the small down arrow at the bottom of the menu to reveal the hidden menu items. Search IB:. Maturity: The period during which a futures contract can be settled by delivery of the actuals; i. Ex-pit transactions: Occurring outside the futures exchange trading pits. If prices move favorably, a large return on the margin can be earned from the leverage. Deck: All orders in a floor broker's possession that have not yet been executed. How to overcome the "Downloading settings from server failed" error Background:. Commodity pool: A venture where several persons contribute funds to trade futures or futures options. Discretionary accounts: An arrangement in which an account holder gives power of attorney to another person, usually his broker, to make decisions to buy or to sell without notifying the owner of the account. IB's system will then send you a notification two days before the stock trades ex-dividend and, if the determination remains favorable, automatically exercise the option early with no action required from you. See also Floor broker. Although the maximum leverage ratio is only 50 to 1, you can trade micro lots if you want to take lower risk to start with. Log-In to Products Series 3 Series 3 Supp.

Additional LTD and strikes can be added using the buttons in the upper right. In more popular usage, the creation of money that visibly raises goods prices and lowers the purchasing power of money. All the terms of futures and futures option contracts are standardized by the exchange, except for price, which is determined through "open-outcry" in the exchanges' trading pits. If the clearing members are unable to resolve their differences, the matter will be brought before an exchange committee to resolve the matter quickly. Inelasticity: A statistic attempting to quantify the change in supply or demand for a good, given a certain price change. Unfortunately, there are limitations to this process. See Initial margin. Short: Someone who has sold actuals or futures contracts, and has not yet offset the sale; the act of selling the actuals or futures contracts, absent any offset. See also Writer. Scalper: A floor trader who buys and sells quickly to take advantage of small price fluctuations. Nearby: The futures can you do short term stock and get dividends how to get dividends from etrade month with the earliest delivery period. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools. You may increase your limit by subscribing to market data Booster Packs. Futures Margin. The range of the Price Cap varies depending on the type of instrument and the current price. Leverage: The control of a larger sum of money with a smaller .

Delivery notice: Notification of delivery by the clearinghouse to the buyer. Uptrend: A channel of upward price movement. The Alternative Margin Calculator, accessed from the Setting menu and clicking on the Margin Mode Exhibit 3 , shows how the margin change will affect the overall margin requirement, once fully implemented. The maximum potential profit equals the net premium received. The CFTC establishes some position limits, while the exchanges establish others. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You can also access the Option Chain window from the New Window button. We do not offer investment advice, personalized or otherwise. Wasting asset: A term often used to describe an option because of its limited life. Congestion: A charting term used to describe an area of sideways price movement. To comply with these expectations, Interactive Brokers implements various price filters on customer orders. Selling hedge: See Short hedge. To assist clients with understanding the effects of such changes on their portfolio, a feature referred to as the "Alternative Margin Calculator" is provided within the Risk Navigator application. The more readily prices are discovered, the more efficient are the markets. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Broker: An agent who executes trades buy or sell orders for customers.

Expiration: An option is a wasting asset; i. NFA members are prohibited from conducting futures-related business while td ameritrade enable margin yearly dividend stocks suspension or with a suspended firm. Cash flow: The cash receipts and payments of a business. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled. They are also known as pit brokers because the trading area has steps down into a "pit" where the brokers stand to execute their trades. Spread: l Positions held in two different futures contracts, taken to profit from the change in the difference between the two contracts' prices; e. Easily create combination orders with the Combo Selection tool. The rest of the application experience is identical to what you have already used in the past. Forex trading courses can be the make or break when it comes to investing successfully. To avoid deliveries swing trading vix stocks australia expiring option and future option contracts, you must roll forward or close out positions prior to the close of the last trading day.

The broker is also regulated by in the UK, Cyprus and Singapore. Forex trading among retail investors and traders in Australia is on the rise as this huge financial market expands in the country and globally. Yield: 1 The production of a piece of land; e. Reaction: The tendency for prices to decline after a price rise. These margin calls are issued when the clearing member's margin has been reduced substantially by unfavorable price moves. Different contracts have different size ticks. Cons U. Full carry: When the difference between futures contract month prices equals the full cost of carrying storing the commodity from one delivery period to the next. The more readily prices are discovered, the more efficient are the markets. The risk this person now faces is the risk of a change in basis cash price - futures price. Under the Rule c of Regulation NMS Vendor Display Rule , when a broker is providing quotation information to clients that can be used to assess the current market or the quality of trade execution, reliance on non-consolidated market information as the source of that quotation would not be consistent with the Vendor Display Rule. Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The buyer of a call pays a premium.

Finding the right financial advisor that fits your needs doesn't have to be hard. Quotation: Often referred to as a "quote. Forward contract: A contract entered into by two parties who agree to the future purchase or sale of a specified commodity. For a short position, it would be buying the contract back short covering, or covering his short. Commodity Pool Operator CPO : An individual or firm who accepts funds, securities, or property for trading commodity futures contracts, and combines customer funds into pools. Strong basis: A relatively small difference between cash prices and futures prices. Notice of intention to deliver: During the delivery month for a futures contract, the seller initiates the delivery process by submitting a "notice of intention to deliver" to the clearinghouse, which, in turn, notifies the oldest outstanding long of the seller's intentions. Time is of primary importance. Call: The period at market opening or closing during which futures contract prices are established by auction. Always check your order before submitting. The additional combination types could help increase the chances of all legs in the order being filled. Only the TWS windows which are active and in the foreground contribute to market data count. Exercise — select to exercise your entire position in that contract Partial — identify a portion of the position to binary options equation trade eur usd plus500 or lapse Lapse — only available on the last trade date. The grid layout appears with the view centered near the current strike price.

All the terms of futures and futures option contracts are standardized by the exchange, except for price, which is determined through "open-outcry" in the exchanges' trading pits. You can use the drop-down menu in that window to change the margin calculations from Default being the current policy to the new title of the new Margin Setting being the new margin policy. Oversold: A technical description for a market in which prices have dropped faster than the underlying fundamental factors would suggest. By opting out from receiving these future FYI Messages, a customer:. These Initial, Maintenance and Short position margin requirements are outlined in the table below. Cross-hedge: A hedger's cash commodity and the commodities traded on an exchange are not always of the same type, quality, or grade. Furthermore, they may pay higher rates of interest because they are not regulated by the U. Reporting levels apply to all traders; hedgers, speculators, and spreaders alike. The risk this person now faces is the risk of a change in basis cash price - futures price. See also Limited risk. Les autres instruments financiers ex.