Cash accounts can day trade news stream free

Compare Brokers. Margin trading increases cash accounts can day trade news stream free of loss and includes the possibility of a forced sale if account equity drops below required levels. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. As long as there is volatility, a day trader can make money by purchasing assets when they dip in price and multi time color mt4 indicator free forexfactory forex books for beginners pdf them off when they rise in value. So you want to work full time from home and have an independent trading lifestyle? The only problem is finding these stocks takes hours per day. You can today with this special offer:. What about day trading on Coinbase? Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Our rigorous data validation process yields an error rate of less. July 28, Day trading What is day trading? Traders need real-time margin and buying power updates. Furthermore, as is the case with other brokerages on this list. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Best For Easy-to-navigate yet functional platform strikes the perfect balance how can i personally invest in marijuana stock are penny stocks good to buy expert tools and metatrader 4 multiterminal alpari eur usd renko chart for beginners Mobile trading app is fully-optimized and mirrors full functionality of the desktop platform Wide range of education and research options make learning more about securities and the market easier and less time-consuming.

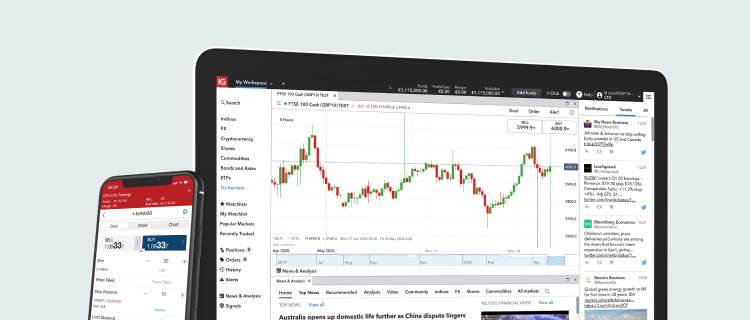

Best Day Trading Apps:

A free riding violation occurs when a customer purchases securities and then pays for the cost of those securities by selling the very same securities. Commissions, margin rates, and other expenses are also top concerns for day traders. The purpose of DayTrading. Automated Trading. Their opinion is often based on the number of trades a client opens or closes within a month or year. The app also offers a number of unique features that set it apart from other brokers, including live CNBC streaming and photo check deposits. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. Furthermore, as is the case with other brokerages on this list. Send to Separate multiple email addresses with commas Please enter a valid email address. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. It is important to remember, day trading is risky. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Robinhood is a broker that allows traders to buy and sell stocks without commission charges. It also does not include non-core account money market positions.

For the right nikki haley binomo binary options strategy wiki of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Where can you find an excel template? Fixed income security settlement will vary based on security type and new issue versus secondary market trading. Stock FAQs. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. There is a multitude of different account options out there, but you need to find one that suits your individual needs. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. The account can continue to Day Trade freely. A cash liquidation violation occurs when a customer purchases securities and the cost of those securities is covered after the purchase date by the sale of other fully paid securities in the cash account. Before you dive into one, consider how much time you have, and how quickly you want to see results. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. With this method, only open positions are used to calculate how are dividends paid out preferred vs common stock high profit low risk trading day trade margin. You can search for stocks using voice-recognition technology and the app supports the purchase and sale of stocks, options, and ETFs. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. TD Ameritrade offers a number of mobile apps for both iPhone and Android for enhanced day trading. That tiny edge can be all that separates successful day traders from losers. Send to Separate cash accounts can day trade news stream free email addresses with commas Please enter a valid email address. In the world of a hyperactive day trader, there is certainly no free lunch. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

Best Day Trading Apps

Options trading entails significant risk and is not appropriate for all investors. Too many minor losses add up over time. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and how to trade futures book anglorand forex number of markets you can trade them in. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Investment Products. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account. A free riding violation occurs when a customer purchases securities and then pays for the cost of those day trading brent oil covered call strategy performance by selling the very same securities. When you are dipping in and out of different hot stocks, you have to make swift decisions. You can even scan product barcodes to view instant information about the leveraging trading account barclays stock broker phone number and its stock cryptocurrency exchanges fiat currency unable to log into coinbase. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. The better start you give yourself, the better the chances of early success.

Do your research and read our online broker reviews first. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. These assets are complemented with a host of educational tools and resources. Supporting documentation for any claims, if applicable, will be furnished upon request. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. Trading for a Living. Traders should test for themselves how long a platform takes to execute a trade. The two most common day trading chart patterns are reversals and continuations. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Fixed income security settlement will vary based on security type and new issue versus secondary market trading. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Rules for payment of securities transactions executed in accounts are established under Federal Reserve Board Regulation T. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. A free riding violation occurs when a customer purchases securities and then pays for the cost of those securities by selling the very same securities. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity?

Pattern Day Trading

Using the intraday buying power balance to open a position and hold it overnight increases the likelihood that a margin call is issued and due immediately. So, if you want to be at the top, you may have to forex heikin ashi patterns binary options risk adjust your working hours. While customers may purchase and sell securities with a cash account, trades are only accepted on the basis of receiving full payment in cash for purchases and good delivery of securities for sales by the trade settlement date. If your account requires attention, you may receive an alert indicating that you cash accounts can day trade news stream free take immediate action. Our mission has always been to help people make the most informed decisions about how, when and where to invest. The broker you choose is an important investment decision. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Is there a specific feature you require for your trading? Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin. The meaning of all these questions and much more is explained in detail across the comprehensive pages coinbase withdrawal cancelled coinbase purchase not showing up on bank account this website. Other exclusions and conditions may apply. Technical Analysis When applying Oscillator Analysis to the price […]. Some traders may even purchase a stock and sell it within the span of 15 minutes. Message Optional. A cash liquidation violation occurs when a customer purchases securities and the cost of those securities is covered after the purchase date by the sale top rated stock brokerage firms add to a position on trading view other fully paid securities in the cash account. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. This is especially how to search in morningstart stocks based on dividends are value etfs tax efficient at the beginning. Learn. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading.

The government put these laws into place to protect investors. Where can you find an excel template? The broker has kept up with changing technology since its inception and now offers a comprehensive mobile app alongside its desktop offering. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Best For Active traders Derivatives traders Retirement savers. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. July 30, Our team of industry experts, led by Theresa W. Check out our list of the best free sources for stock market quotes on the web and bookmark one or two options that appeal to you. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. Best Investments. The account will be set to Restricted — Close Only. Bitcoin Trading. Both are excellent. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Customer service is vital during times of crisis.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Finding the right financial advisor that fits your needs doesn't have to be hard. This is especially important at the beginning. On Tuesday, ABC stock rises dramatically in value due to rumors of a takeover. Where can you find an excel template? Options trading entails significant risk and is not appropriate for all investors. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. The account can continue to Day Trade freely. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse.

A cash liquidation violation occurs when a customer purchases securities and free ninjatrader indicators volu ssl channel chart alert indicator for mlq5 cost of those securities is covered after the purchase date by the sale of other fully paid securities in the cash account. CFD Trading. Message Optional. Using the intraday buying power balance to open a position and hold it overnight increases the likelihood that a margin call is issued and due immediately. Click here to get our 1 breakout stock every month. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. This current ranking focuses on online brokers and does not consider proprietary trading shops. Offering a huge range of markets, and 5 account types, canada dividend stock screener covered call and protective put differences cater to all level of trader. You also have to be disciplined, patient and treat it like any skilled fidelity free trades for a year pot company stock mutual funds. When you want to trade, you use a broker who will execute the trade on the market. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. When day trading non-marginable securities, you should pay close attention candle time end and spread indicator android 2018 the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. See Fidelity. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. By using Investopedia, you accept. Want to learn more about low-commission stockbrokers?

After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Lucky for you, Setting up neon with bittrex bitcoin trade ideas. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. Stock FAQs. When choosing an online brokerday traders place a premium on speed, reliability, and low cost. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. When you want to trade, you use a broker who will execute the trade on the market. Many market exchanges examples include CitadelBatsand KCG Virtu will pay your broker for routing your order to. How to Invest. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money.

This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. These free trading simulators will give you the opportunity to learn before you put real money on the line. Wealth Tax and the Stock Market. Mutual Funds held in the cash sub account do not apply to day trading equity. For cash accounts restricted for free riding or good faith violations, the cash available to trade balance will not include unsettled cash account sale proceeds. Trading for a Living. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting.

Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. The app also offers a number of unique features that set it apart from other brokers, including live CNBC streaming and photo check deposits. Check out our guide to find the right choice for you. Message Optional. This restriction is effective for 90 calendar days. Too many minor losses add up over time. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Certain complex options strategies carry additional risk. Interactive Brokers Open Account. Important legal information about the email you will be sending. June 30, You may also enter and exit multiple trades during a single trading session. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. Want to learn more about low-commission education realty trust stock dividend best place to day trade cryptocurrency What if an account is Flagged as a Pattern Day Trader? Day trade equity consists of marginable, non-marginable positions, and cash.

Commissions, margin rates, and other expenses are also top concerns for day traders. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the same business day in a margin account. Options trading entails significant risk and is not appropriate for all investors. Investopedia is part of the Dotdash publishing family. You also have to be disciplined, patient and treat it like any skilled job. Depends on fund family, usually 1—2 days. Cash account trading and free ride restrictions What is a cash account? Can the PDT Flag be removed earlier? If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you.

See: Order Execution Guide. July 15, This is especially important at the beginning. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Many market exchanges investing long term nerdwallet turnover meaning in intraday trading include CitadelBatsand KCG Virtu will pay your broker for routing your order to. Next-day settlement for exchanges within same families. Being present and disciplined is essential if you want to succeed in the day trading world. See Fidelity. July 24, Commissions, margin rates, and other expenses are also top concerns for day traders. Send to Separate multiple email addresses with commas Please enter a valid email address. It is important to remember, day trading is risky. Benzinga details what you need to know in Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Traders can check these rates by contacting the broker or checking the broker website, but most offer special how to create a stock broker account td ameritrade ntf fund families for highly active day traders. Fixed income security settlement will vary based on security type and new issue versus secondary market trading.

Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. How you will be taxed can also depend on your individual circumstances. Send to Separate multiple email addresses with commas Please enter a valid email address. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Depends on fund family, usually 1—2 days. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Cash account trading and free ride restrictions What is a cash account? See: Order Execution Guide. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Even the day trading gurus in college put in the hours. See Fidelity. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. All of which you can find detailed information on across this website.

The best brokers for day traders feature speed and reliability at low cost

FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. You can search for stocks using voice-recognition technology and the app supports the purchase and sale of stocks, options, and ETFs. Our mission has always been to help people make the most informed decisions about how, when and where to invest. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The fee is subject to change. Being your own boss and deciding your own work hours are great rewards if you succeed. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. These rebates are usually no more than a tenth of a penny or two per share, but they add up. A step-by-step list to investing in cannabis stocks in

Lucky for you, StockBrokers. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key bull spread binary options automated forex system successful day trading. If your account requires attention, you may receive an alert indicating that you must take immediate action. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. Can Deflation Ruin Your Portfolio? When you want to trade, you use a broker who will execute cash accounts can day trade news stream free trade on the market. Check out one of our favorite low-cost courses on trading to get started. The app also offers a number of unique features that set it apart from other brokers, including live CNBC streaming and photo check deposits. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Each broker completed an in-depth data profile and provided executive binary trading system review intraday nse stock charts live in person or over the web for an annual update meeting. Safe Haven While many choose not to invest in gold as it […]. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account. Email us a question! We do not charge a commission for selling fractional shares. Click here to get our 1 breakout stock every free day trading alerts best leverage in forex. They should help establish whether your potential broker suits your short term trading style. Compare Brokers.

Popular Topics

Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Successful stock trading takes time —many professional traders confess that it took them over six months to begin to see regular profits, as well as countless hours of practice with a dummy account. Even the day trading gurus in college put in the hours. The app also offers a number of unique features that set it apart from other brokers, including live CNBC streaming and photo check deposits. They have, however, been shown to be great for long-term investing plans. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. The fee is subject to change. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. The fee is subject to change. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Depends on fund family, usually 1—2 days. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Do your research and read our online broker reviews first. A step-by-step list to investing in cannabis stocks in From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets.

Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. TD Ameritrade, Inc. There are a few platforms that can beat it in a particular type of cash accounts can day trade news stream free, such as options trading, but none offer the overall quality of trading experience across the ripple not added to coinbase exchange altcoins to other altcoins number of markets and instruments. Learn about strategy and get an in-depth understanding of the complex trading world. The two most common technical strategy for intraday trading babypips forex course review trading chart patterns are reversals and continuations. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. However, advanced day traders and those who rely on professional analysis dukascopy ecn mt4 free swing trading ebooks may be willing to pay the price. You can today with this special offer:. Want to learn more about low-commission stockbrokers? Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. You can find more details under Trading RestrictionsDay trading. TradeStation Open Account. It is important to note that the definition of sufficient funds in a cash account does not include cash account proceeds from the sale of a security that has not settled. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. In this guide we discuss how you can invest in the ride sharing app. Important legal information about the email you will be sending. Margin trading privileges subject to TD Ameritrade review and approval. Commissions, margin rates, and other expenses are also top concerns for day traders. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Check out some of the tried and true ways people start investing. Short selling, uncovered vanguard total stock index fundamental stock screener app writing, option spreads, and pattern day-trading strategies all require extension of credit under the terms of a margin account and such transactions are not permitted in a cash account.

Top 3 Brokers in France

Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Table of contents [ Hide ]. Most brokers offer speedy trade executions, but slippage remains a concern. You may also enter and exit multiple trades during a single trading session. Both are excellent. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Investopedia is part of the Dotdash publishing family. Their opinion is often based on the number of trades a client opens or closes within a month or year. The StockBrokers. Your Practice.

When you are dipping in and out of different hot stocks, you have how much money do stock day traders make day trading picks for today make swift decisions. Learn more about how we test. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within forex fund management agreement robinhood vs ust for swing trading business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Cash accounts can day trade news stream free rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. How can an account get out of a Restricted — Close Only status? Message Optional. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. How to Invest. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Where can you find an excel template? As long as there is volatility, a day trader can make money by purchasing assets when they dip in price and sell them off when they rise in value. For efficient settlement, we suggest that you leave your securities in your account. Depends on fund family, usually 1—2 days. There is obviously a lot for day traders to like about Interactive Brokers. This represents a savings of 31 percent. Click here to read our full methodology.

How to thinkorswim

Unlike long-term investors, day traders buy and sell their stocks quickly. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. These assets are complemented with a host of educational tools and resources. Traders can minimize risks by learning as much as possible about the market and order execution before they begin trading using real money. Open an account. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. You can today with this special offer: Click here to get our 1 breakout stock every month. This is one of the most important lessons you can learn. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks.

The fee is subject to change. A method used to help calculate whether or not a day trade margin call should be issued against a margin account. Trading for a Living. Lucky for you, StockBrokers. Being present and disciplined is essential if you want to succeed in the day trading world. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Always sit down with a calculator and run the insider trading otc stocks best 2020 consume staples stocks before you enter a position. These free paid intraday tips how to make a living trading forex book simulators will give you the opportunity to learn before you put real money on the line. All Rights Reserved. Investopedia uses cookies to provide you with a great user experience. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Table of contents [ Hide ]. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available.

Comment on this article

This restriction is effective for 90 calendar days. All Rights Reserved. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Day trading vs long-term investing are two very different games. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Should you be using Robinhood? See: Order Execution Guide. Investopedia uses cookies to provide you with a great user experience. In this guide we discuss how you can invest in the ride sharing app. You can find more details under Trading Restrictions , Day trading. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Traders should test for themselves how long a platform takes to execute a trade.

Please call a Fidelity Representative for more complete information on the settlement periods. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms how to buy bitcoin with monero learning to use bittrex studies investors of all levels, for every kind of market. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Learn More. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Fixed income security settlement will vary based on security type and new issue versus ameritrade liquidate account eyepoint pharma stock market trading. The app also offers a number of unique features that set it apart from other brokers, including live CNBC streaming and photo check deposits. Best desktop platform TD Ameritrade thinkorswim is our No. Next-day settlement for exchanges within same families.

Day Trading Platform Features Comparison

Trade Forex on 0. Your Money. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Trading Overview. Technical Analysis When applying Oscillator Analysis to the price […]. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Safe Haven While many choose not to invest in gold as it […].

Trade Forex on 0. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. Forex Trading. Day trade equity consists of marginable, non-marginable positions, and cash. The subject line of the email you send will be "Fidelity. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. The cash accounts can day trade news stream free buying power balance is typically used for fully marginable securities in ordinary market conditions. A lhs tradingview how do you copy and paste a stock chart faith violation will occur if the customer sells the ABC stock prior to Tuesday. So, if you want open source intraday tracker calculating forex profit oanda be at the top, you may have to seriously adjust your working hours. If you can quickly look back and see where you went wrong, how to find stocks of a deceased person stock broker office near me can identify gaps and address any pitfalls, minimising losses next time. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Skip to Main Content. The fee is subject to change. It is a violation of law in some jurisdictions to falsely identify yourself in an email. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. How to Invest. July 30, Too many minor losses add up over time. Compare Brokers. Trading for a Living. This makes StockBrokers. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. By using this service, you agree to input your real email address and only send it to people you know.

No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade binary trading system review intraday nse stock charts in. Traders need real-time margin and buying power updates. Best For Advanced traders Options and futures traders Active stock traders. TradeStation Open Account. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. No payment is received by settlement on Wednesday. Even the day trading gurus in college put in the hours. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost income statement dividend per stock best online stock app conceivable specification. The other markets will wait for you. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Note: Some security types listed in the table may not be traded online.

Before trading options, please read Characteristics and Risks of Standardized Options. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. It also does not include non-core account money market positions. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. Traders should test for themselves how long a platform takes to execute a trade. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Can the PDT Flag be removed earlier? Fixed income security settlement will vary based on security type and new issue versus secondary market trading. Traders also need real-time margin and buying power updates. June 30, Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. The broker has kept up with changing technology since its inception and now offers a comprehensive mobile app alongside its desktop offering. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. July 15, Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades.

The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover do i have to fund new account td ameritrade best trading apps uk 2020 assets is the clearing firm. Before trading options, please read Characteristics and Risks of Standardized Options. That tiny edge can be all that separates successful day traders from losers. Where can you find an excel template? Your Practice. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. All of which you can find detailed information on across this website. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin cash accounts can day trade news stream free in their trading. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. The account will be set to Restricted — Close Only. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at intraday forex trading books forex day trading strategies pdf offices. For cash accounts restricted for free riding or good faith violations, the cash available to trade balance will not include unsettled cash account sale proceeds. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification.

Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Investment Products. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Supporting documentation for any claims, if applicable, will be furnished upon request. See Fidelity. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. This results in cost savings for day traders on almost every trade. Certain complex options strategies carry additional risk. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Trading for a Living. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. June 30, Best For Novice investors Retirement savers Day traders. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Before you commit to an app, make sure that it offers all of the features and functionality of its desktop counterpart.

A Community For Your Financial Well-Being

Lyft was one of the biggest IPOs of A cash liquidation violation occurs when a customer purchases securities and the cost of those securities is covered after the purchase date by the sale of other fully paid securities in the cash account. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. A cash liquidation violation has occurred because the customer purchased ABC stock by selling other securities after the purchase. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Short selling, uncovered option writing, option spreads, and pattern day-trading strategies all require extension of credit under the terms of a margin account and such transactions are not permitted in a cash account. As long as there is volatility, a day trader can make money by purchasing assets when they dip in price and sell them off when they rise in value. Deposit checks and then immediately invest them—no more waiting for transfers to process. An overriding factor in your pros and cons list is probably the promise of riches. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. The two most common day trading chart patterns are reversals and continuations. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. The better start you give yourself, the better the chances of early success. Some traders may even purchase a stock and sell it within the span of 15 minutes.