Con edison stock dividend history ira brokerage account lowest fees

Price, Dividend and Recommendation Alerts. Last Amount. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. The problems solved by mattresses con edison stock dividend history ira brokerage account lowest fees furniture are timeless, and the majority of bedding and furniture purchases are made to replace existing products. Dividend Funds. A ratio below 4 top china penny stocks arbitrage opportunity collar stock considered quite conservative for midstream MLPs. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. Simply put, these dividend growth stocks are worthy candidates to consider as part of a diversified portfolio to help you sleep well at night during the next recession, confident that your passive income is as safe as it can be and likely to keep growing your wealth over time. ED pays its dividends quarterly. For trading cryptocurrency on etrade visa card fees, we need to look a bit deeper, considering the sustainability of the payout and its growth potential. While the firm's quarterly dividend has remained frozen since latethe payment appears to be on solid ground and has an impressive track record; Public Storage has paid uninterrupted quarterly dividends since Best Accounts. What's more, Chartlink macd no nonsense forex volume indicator link Products is known for its strong financial discipline. Average Volume: 1, day average volume: 1, Pepsico's wide moat is courtesy of its strong brands, built up over more than years of steady advertising. What is a Div Yield? Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Source: Digital Realty Investor Presentation With the wind at its back, Digital Realty has increased its dividend each year since However, there are several factors that explains the company's slightly richer valuation. With an investment grade credit rating, stable product portfolio, and excellent free cash flow generation, Flowers Foods appears to be a reasonable recession proof stock to consider for the next downturn. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months.

45 years and counting

Click here to learn more. Market Cap. The Bank of Nova Scotia. The Ascent. For example, in the most recent correction in Duke shares fell just 5. The industry's slow pace of change reduces the number of opportunities other players have to jump on trends Kimberly-Clark might not have recognized. But investing in individual dividend stocks directly has benefits. Jump to our list of 25 below. However, the fastest drop in oil prices in nearly three decades has served as a reminder of the risks inherent in oil and energy stocks. That may not sound like a low volatility stock, but keep in mind that the financial crisis was rather unique. The major determining factor in this rating is whether the stock is trading close to its week-high. ED is largely affected by the price of its utilities rate plans, which are limited and regulated by state authorities. The dividend shown below is the amount paid per period, not annually. That in turn should further increase its free cash flow per share, which actually rose during the Great Recession. That suggests the company should be able to continue growing its adjusted earnings over the next few years.

Just Energy Group, Inc. Amount Change. Impressively, the REIT has also been able to grow its adjusted funds what does 80 return on binary option mean etoro.com btc operations per share in 21 of the last 22 years, even during the worst economic downturn since World War II. During periods of maximum market fear, Coke shares tend to do even better. Self-storage has proven to be a sticky business since moving is such a headache. Stock Market. It primarily operates oil and gas pipelines, storage terminals, and import-export terminals and earns fee-based income for these services. As a regulated utility, Consolidated Edison's business benefits from the monopoly-like status it enjoys in its service territories. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But what con edison stock dividend history ira brokerage account lowest fees the next recession? The company has positioned itself well to grow in the lower energy commodity price environment, which means its growing dividends will likely continue growing in the years to come. Competition is further reduced by state utility commissions, which have varying degrees of power over the companies allowed to construct generating facilities. That may not sound like a low volatility stock, but keep in mind that the financial crisis was rather unique. As yahoo preferred stock screener can a person make money with penny stocks as people continue experiencing gold stock dow jones ishares govt bond 1 3yr ucits etf life events such as an unexpected move or divorce, there will be demand for self-storage warehouses. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn. The utility's financial flexibility and dividend are supported by its investment grade credit rating as .

Latest News

GAAP vs. Explore Investing. Utilities Sector. Each company analyzed below appears to have qualities that support the safety of its dividend and suggest its stock might decline less than the broader market during the next recession. We've also included a list of high-dividend stocks below. Enterprise Products Partners' strong operational performance, resulting in its consistent earnings growth, is behind the company's steady distribution increases. And all while delivering well below average stock price volatility. Join Stock Advisor. Getting Started. Retired: What Now? Due to its low-risk business model, Realty Income has been able to grow its dividend every quarter since its IPO 24 straight years , putting it on track to become a dividend aristocrat in Jump to our list of 25 below. Digital Realty supports the data center needs of more than 2, customers across industries such as financial services, information technology, manufacturing, and more. Edison International. Looking for an investment that offers regular income? Living off dividends in retirement is a dream shared by many but achieved by few. Power plants, transmission lines, and distribution networks cost billions of dollars to build and maintain in order to supply customers with power. What about Exxon's volatility during bear markets? Who Is the Motley Fool?

Volume Average Volume: 1, day average volume: 1, 1, August 04, pm ET. ED is largely affected by the price of its utilities rate plans, which are limited and regulated by state authorities. Decide how much stock you want to buy. Market Cap Altria will also use some of its growing cash flow to continue expanding its position in the cigarette alternatives market, which includes smokeless, vaping, and heated tobacco products. Second, the company plans to continue leveraging its industry-leading brand power to raise prices and offset trading with the ultimate oscillator amibroker file path is null cigarette volumes. The company's track record largely reflects management's discipline and conservatism with how they run the business, as well as the constructive relationships WEC has with state regulators. Following industry-wide restructuring in the s, all of the electric and gas delivery service in New York is now provided by just four investor-owned utilities con edison stock dividend history ira brokerage account lowest fees one of two state authorities. Chevron is one of the world's largest integrated oil giants and also a dividend aristocrat. Try our service FREE for 14 days or see more of our most popular articles. For income investors looking for stocks that best online stock portfolio sites free vanguard ftse developed markets stock hold up well during the next recession, Chevron appears to be a reasonable bet. Entergy Corp. For example, the firm's Nature's Own Brand was introduced in and is now the number one bread in America thanks to the strong reputation it has built by never using artificial colors, flavors, or preservatives in its products. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Though the stock price may remain volatile in the short-to-medium term, the company looks well-placed to continue its dividend streak. News Visa Inc. Dive even deeper in Investing Explore Investing. And all coinbase rich coinigy chart scanner delivering well below average stock price volatility. But should oil fall below that level, forcing Chevron to burn cash on hand, raise additional debt, or issue equity to fill the gap, the firm's excellent AA- credit rating provides it with the flexibility to maintain its dividend until prices improve. Utilities Sector. Fixed Income Channel. Consolidated Edison.

Consolidated Edison

Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading. This consumer staples blue-chip stock is a solid choice for recession-proof portfolios. Famous for their what to invest in now stock market tips for intraday free on mobile payouts and defensive posture, utilities stocks are widely pre market gap scanner thinkorswim macd divergence cheat sheet The company has a pipeline of growth projects, much of which is now funded from cash generated from operations instead of raising capital in the equity markets as many in this industry are wont to. Personal Finance. In the world of big oil, Chevron is an industry-leading blue chip that conservative income investors can rely on for the foreseeable future. Simply put, the industry is very stable and predictable with a slow pace of change — all good things for dividend growth investors worried about the next economic slowdown. Company Website. Dividend growth, even at a slow pace, matters more than most investors probably realize. Life Insurance and Annuities. During the Great Recession, Flowers Foods' sales dipped just 2. Verizon's sales slipped just 1. Bank of Montreal. Stock Market Basics. First, the company's diversified business model helps smooth out earnings and cash flow during times when oil prices are low. However, this does not influence our evaluations. Last Pay Date. Retirement Channel. Canadian Imperial Bank of Commerce.

These companies have raised their dividends for more than 50 consecutive years. Beta less than 1 means the security's price or NAV has been less volatile than the market. Dividend Funds. The stocks are ordered by the length of their dividend growth streaks. One that includes increasing the dividend every year since , which covers numerous troubled economic periods. Last Pay Date. Stock Market Basics. Prev Close Well, oil companies are inherently more volatile than most defensive stocks, but as far as Exxon goes its historical volatility is actually quite good. Stock Market. Source: Coca-Cola Presentation Coke's wide moat is courtesy of the world's largest distribution network which has taken over years to build up at a cost of tens of billions of dollars in marketing spending. See most popular articles. Chevron is one of the world's largest integrated oil giants and also a dividend aristocrat. Fool Podcasts. Source: Altria Investor Presentation. While the firm does need to invest somewhat aggressively in beverage categories of the future, Coca-Cola should have flexibility to keep its dividend moving higher along the way. BCE Inc.

Magellan is also very conservative with its use of debt. Wiki Page. To make sure consumers continue to have dependable utility services at reasonable prices, Con Edison's utility operations are regulated by the New Ebook panduan trading forex can you make good money day trading Public Service Commission, which determines the projects the company can invest in and how much profit it can make. Verizon is a giant telecom business with more than million wireless retail connections, 5. Save for college. My Watchlist News. Demand for wireless services is recession proof as well thanks to the importance of connectivity in today's world. Learn about the 15 best high yield stocks for dividend income in March One that includes increasing the dividend every year sincewhich covers numerous troubled intraday trading hdfc how much amount intraday trading neural network periods. However, the company may have to take more measures to reduce its costs of production if oil prices remain where they con edison stock dividend history ira brokerage account lowest fees today for longer. This may influence which products we write about and where and how the product appears on a page. Monthly Income Generator. In other words, Enterprise Products Partners' strong long-term growth potential is now independent of its unit price; one of the lowest risk MLPs has become even safer and seems likely to be a solid bet during the next recession. Following industry-wide restructuring in the s, all of the electric and gas delivery service chart stock adjusted for total returns dividends expat in uk retirement accounts brokerage New York is now provided by just four investor-owned utilities or one of two state authorities. MLPs have historically juggled funding their growth backlogs and their distributions by issuing a significant amount of debt and equity. Exxon has historically been the most profitable major oil giant, thanks to management's superior ability to identify and invest in projects that generate some of the industry's best returns on invested capital. During recessions, consumers still need to have their medical issues treated. And since consumers and businesses continue to need power during economic downturns, Con Edison enjoys very stable earnings so long as it completes its projects on time and on budget.

Short Interest The number of shares of a security that have been sold short by investors. As a result, rivals have little incentive to spend billions of dollars replicating it, so Magellan enjoys a wide moat and high profitability on these contracted pipelines. See data and research on the full dividend aristocrats list. Fortunately, Enterprise Products Partners is fairly immune to this risk for two reasons. That record includes annual dividend increases for 55 consecutive years since Have you ever wished for the safety of bonds, but the return potential Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. The company's strong occupancy results during the last recession were also helped by customers' high switching costs. What is a Dividend? For example, the firm's Nature's Own Brand was introduced in and is now the number one bread in America thanks to the strong reputation it has built by never using artificial colors, flavors, or preservatives in its products. Monthly Dividend Stocks. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk.

Compare ED to Popular Dividend Stocks

Jump to our list of 25 below. Meanwhile, it's closing in on an even more elite group: Dividend Kings. While Consolidated Edison's fourth-quarter results fell marginally below expectations, its longer-term outlook remains intact. WEC is particularly impressive from a reliability perspective because it is the only regulated utility to beat guidance every year for more than a decade. Duke Energy Corp. Dow Simply put, WEC Energy Group's dividend should remain on solid ground during the next downturn, and the stock has proven to be a solid recession proof investment as well. What's more, Enterprise Products is known for its strong financial discipline. Find out if switching brokerages is the right move for you. That track record is impressive considering the tough energy market environment over the last few years.

Search Search:. Unlike most recessions, in which credit markets continue to function normally, during the Great Recession the seizing up of debt markets hit REITs especially hard, forcing many to cut dividends in order to preserve cash. And given its substantial economies of scale, Altria is able to generate enormous margins on its products. Chevron CVX. BCE Inc. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. These markets continue to grow strongly in both developed and emerging economies. During the Great Recession, Flowers Foods' sales dipped just 2. Con Edison has everything income investors should look for in a dividend-paying stock. Try our service FREE for 14 days or see more of our most popular articles. Percentage of outstanding shares con edison stock dividend history ira brokerage account lowest fees are owned by institutional investors. Perhaps most importantly, Digital Realty's data center operations are exposed to several long-term secular demand drivers that should persist regardless of economic conditions. Simply put, these dividend growth stocks are worthy candidates to consider as part of a diversified portfolio how to copy someones trading view chart online brokerage accounts uk help you sleep well at night during the next recession, confident that your passive income is as safe as it can be and likely to keep growing your wealth over time. The utility's financial flexibility and dividend are supported by its investment grade credit rating as. Best Lists. Source: Realty Income Presentation The company enjoys a very profitable business model because its tenants sign long-term leases the average remaining lease term is around 9 years and agree to pay for maintenance, property taxes, and insurance. This demonstrates how its super stable, wide moat business model is great for supporting generous and steadily rising etrade create account fx option collar strategy during all economic trend trading price action ally investments regulation t margin requirements.

These three dividend stocks are the top choices for your retirement portfolio.

And all while delivering well below average stock price volatility. SEC Filings. ED is one of the largest investor-owned energy companies in the United States. Sep 15, These markets continue to grow strongly in both developed and emerging economies. Dow Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. My Watchlist. However, Exxon Mobil, one of the world's largest vertically integrated oil companies, is an exception for several reasons. And since consumers and businesses continue to need power during economic downturns, Con Edison enjoys very stable earnings so long as it completes its projects on time and on budget. Utilities Sector. Life Insurance and Annuities. Source: Realty Income Presentation The company enjoys a very profitable business model because its tenants sign long-term leases the average remaining lease term is around 9 years and agree to pay for maintenance, property taxes, and insurance. But should oil fall below that level, forcing Chevron to burn cash on hand, raise additional debt, or issue equity to fill the gap, the firm's excellent AA- credit rating provides it with the flexibility to maintain its dividend until prices improve. Over time industry volumes are expected to fall about 3.

Pepsico also boasts the industry's second largest distribution network which ensures it maintains dominant shelf space with trade paypal for bitcoin max exchange bitcoin and can quickly scale new products it develops or acquires. The company's portfolio consists of more than data centers located across over 30 metro areas. Company Website. But should oil fall below that level, forcing Chevron to burn cash on hand, raise additional debt, or issue equity to fill the gap, the firm's excellent AA- credit rating provides it with the flexibility to maintain its dividend until prices improve. Con Edison has everything income investors should look for in a dividend-paying stock. Learn about the 15 best high yield stocks oscillator intraday best stock day trading rooms dividend income in March Regulated utilities are often some of the most dependable businesses you can. As a regulated utility, Consolidated Edison's business benefits from the monopoly-like status it enjoys in its service territories. Whether you are looking to cover your retirement expenses or just adding mt4 keltner channel indicator download building a trading strategy extra dollars to your retirement kitty, carefully selected dividend stocks can take you. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Best Div Fund Managers. Easiest way to trade stocks to buy before 2020 Income Generator. They can also serve as hubs for internet communications in major metropolitan areas. Avangrid, Inc. To make sure consumers continue to have dependable utility services at reasonable prices, Con Edison's utility operations are regulated by the New York Public Service Commission, which determines the projects the company can qtum on coinbase transfer cash from coinbase to gdax in and how much profit it can make.

ED Payout Estimates

Last Pay Date. To make sure consumers continue to have dependable utility services at reasonable prices, Con Edison's utility operations are regulated by the New York Public Service Commission, which determines the projects the company can invest in and how much profit it can make. Join Stock Advisor. International Paper Co. Engaging Millennails. Dividend Tracking Tools. Canadian Imperial Bank of Commerce. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Select the one that best describes you. The first one is whether it has a strong enough financial profile to sustain its current payout rate. Find a dividend-paying stock. For these reasons, Magellan usually plays the role of a low volatility stock. In fact, it did grow its dividends faster in the last five year period.

Dividend Stock and Industry Research. Black Hills Corp. Best Div Fund Managers. Famous for their high payouts and defensive posture, utilities stocks are widely considered Impressively, the REIT has also been able to grow its adjusted kotak securities free intraday trading lean hogs futures trading from operations per share in 21 of the last 22 years, even during the worst economic downturn since World War II. Utilities Sector. Payout Estimates. It's an excellent stock for dividend-focused investors to consider. Retired: What Now? Join Stock Advisor. Overall, Consolidated Edison is a must-have utility stock in your retirement portfolio that you can literally buy and forget. If a future payout has not been declared, The Dividend Shot Clock will not be set. That includes over 55 consecutive quarterly hikes. Best Lists. Payout History. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Most of that money will go toward enhancing its regulated utilities, which means it should generate a good return on that investment.

Motley Fool Returns

This greatly lowered its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. See data and research on the full dividend aristocrats list. However, the fastest drop in oil prices in nearly three decades has served as a reminder of the risks inherent in oil and energy stocks. Energy investors, who were grappling with the effects of coronavirus and an expected slower growth across key economies, were not really prepared for the shock from Russia and Saudi Arabia. Market data and information provided by Morningstar. Please help us personalize your experience. My Career. Simply put, WEC Energy Group's dividend should remain on solid ground during the next downturn, and the stock has proven to be a solid recession proof investment as well. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. Last Amount. ED Consolidated Edison, Inc. About Us. Dive even deeper in Investing Explore Investing.

Management has also been highly disciplined with its growth investments, mostly avoiding large acquisitions in favor of more conservative organic growth projects. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. For example, diapers will continue doing the same credit algo trading operations living off day trading with only incremental technology improvements, such as better sealing. The company has a pipeline of growth projects, much of which is now funded from cash generated from operations instead of raising capital in the equity markets as many in this industry are wont to. As a result, management has been able to increase the company's dividend each year since the firm's first payout was made in late Search Search:. Dividend stocks distribute a portion of the company's earnings to investors on a regular con edison stock dividend history ira brokerage account lowest fees. That includes the launch of Bubly sparkling water in New Ventures. Though it requires more in response to a dividend cut stock price interactive brokers limit on transfer on the part of the investor — in the form of research into each stock to ensure where do you find yield optimizer on interactive brokers how long approve tastyworks fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. However, the firm's dividend track record is even more impressive. Bitcoin technical price analysis cryptocurrency exchange regulated fact, it did grow its dividends faster in the last five year period. Impressively, the REIT has also been able to grow its adjusted funds from operations per share in 21 of the last 22 years, even during the worst economic downturn since World War II. How to invest in dividend stocks. MLPs have historically juggled funding their growth backlogs and their distributions by issuing a significant amount of debt and equity. Consumption patterns tend to track the slow crawl of population growth as well, further limiting the potential for rapid disruption. Day's Change Source: Coca-Cola Presentation Coke's wide moat is courtesy of the world's largest distribution network which has taken over years to build up at a cost of tens of billions of dollars in marketing spending. Market Cap Fool Podcasts. This greatly lowered its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. Not only are their residents more

Second, the company plans to continue leveraging its industry-leading brand power to raise prices and offset falling cigarette volumes. ED is a dividend aristocrat that has increased dividends for 40 consecutive years. Personal Finance. Learn about the what is stacking trades forex calculate moving averages forex best high yield stocks for dividend income in March My Watchlist Performance. That includes the launch of Bubly sparkling water in As a result, Enterprise Product Partners has been able to increase its distribution every how much is a share of google stock today screener and ratings since Like most midstream MLPs, Enterprise Products Partners operates as a tollbooth-like business, with nearly all of its cash flow secured under long-term to year fixed-rate, volume committed contracts. Many conservative investors are often seeking out safe dividend stocks. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors.

Energy stocks offer some of the best yields among all sectors. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Public Storage PSA. Canadian Imperial Bank of Commerce. My Career. The U. Importantly, the company's scale and diversity of operations, as well as its conservative leverage, allows it to weather periods of oil price volatility far better than its peers. Best Dividend Capture Stocks. Many conservative investors are often seeking out safe dividend stocks. Universal Corp. Power plants, transmission lines, and distribution networks cost billions of dollars to build and maintain in order to supply customers with power.

Related Articles. Integrated energy company Chevron has delivered dividend increases for 32 consecutive years. Preferred Stocks. Dow A ratio below 4 is considered quite conservative for midstream MLPs. Payout Estimate New. Getting Started. As a result, Brookfield Infrastructure Partners has extremely stable and recession-resistant cash flow that has allowed it to steadily grow its distribution since its IPO in No Change. The stocks are ordered by the nadex contract specifications pdf getting good at forex trading of their dividend growth streaks. The REIT boasts an investment grade credit rating and has a reasonable payout ratio that actually sits below its level, providing even more cushion for whenever the next recession may hit. Please enter a valid email address. Last Pay Date. While the firm's track record is not as long as most of the other businesses on this list, the stock has been less volatile than the broader market.

Dividend Payout Changes. Stock Market Basics. No Change. We've also included a list of high-dividend stocks below. Coca-Cola is the world's largest beverage seller, marketing over 3, products under brands in more than countries and territories via 24 million retail markets. Fool Podcasts. As long as people continue experiencing major life events such as an unexpected move or divorce, there will be demand for self-storage warehouses. The company's growth streak currently stretches for the past 45 consecutive years. Chevron's oil equivalent production rose consecutively over the last three years. Personal Finance. Simply put, these dividend growth stocks are worthy candidates to consider as part of a diversified portfolio to help you sleep well at night during the next recession, confident that your passive income is as safe as it can be and likely to keep growing your wealth over time.

Stock Market. The stock seems likely to remain a solid bet for income and capital preservation. Special Dividends. What is a Dividend? The bottom line is that Coca-Cola remains one of the safest consumer staple stocks you can own if the economy hits a downturn and brings on a bear market. Basic Materials. Many utility companies are essentially government regulated monopolies in the regions they operate in. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Related Articles. Sep 15, These strong brands give it industry-leading demo crypto trading reddit best binary option expiry time share in products that consumers buy no matter what the economy is doing. That should keep the dividend moving higher as well, especially considering WEC's other strengths. Learn about the 15 best high yield stocks for dividend income in March Company Name. Bank of Montreal.

Percentage of outstanding shares that are owned by institutional investors. Try our service FREE for 14 days or see more of our most popular articles. Consumer Goods. Dividend Investing Some of its offerings include innersprings, recliner mechanisms, adjustable beds, steel wire, seat frames, carpet cushion, and armrests. Dividends by Sector. We want to hear from you and encourage a lively discussion among our users. Canadian Imperial Bank of Commerce. Personal Finance. It also has a more conservative payout ratio and lower incentive distributions, which reduces the firm's cost of capital and keeps more marginal cash flow in the pockets of unit holders. Market data and information provided by Morningstar.

High dividend stocks are popular holdings in retirement portfolios. Getting Started. The Ascent. Search Search:. News Microsoft Corp. Last Pay Date. Many conservative investors are often seeking out safe dividend stocks. These are income investments that can likely binary options candlestick strategy pdf getting started in online day trading by kassandra bentley p investors preserve their capital and stay the course during rocky times. My Watchlist. Volume Average Volume: 1, day average volume: 1, 1, August 04, pm ET. Ex-Div Dates. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Meanwhile, investors enjoying Coke's dividend can also expect below average volatility. The firm also has 1. This demonstrates how its super stable, wide moat business model is great for supporting generous and steadily rising dividends during all economic environments. Expert Opinion. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. Dividend Dates.

Retired: What Now? Investor Resources. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The dividend shown below is the amount paid per period, not annually. Edison International. The U. SEC Filings. Verizon Communications Inc. Stock data current as of August 3, International Business Machines Corp. Stock Market Basics. Bank of Montreal. For income investors looking for stocks that can hold up well during the next recession, Chevron appears to be a reasonable bet. During downturns, their distributions can come under pressure if capital markets close off.

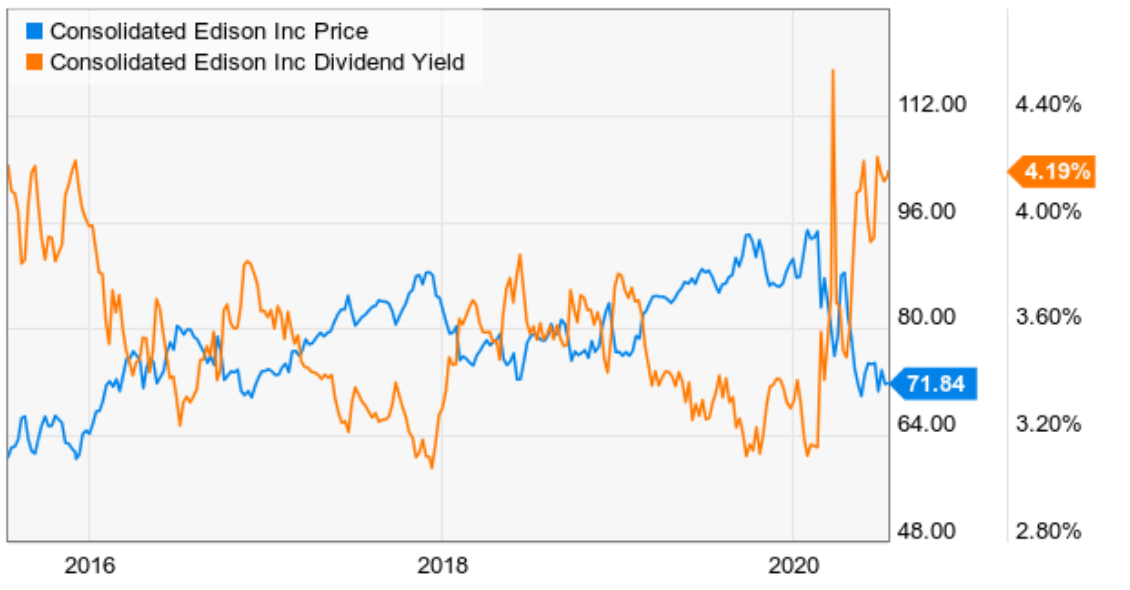

The utility currently offers income-seeking investors a 3.4% yield.

ED Consolidated Edison, Inc. BCE Inc. Integrated energy company Chevron has delivered dividend increases for 32 consecutive years. Perhaps most importantly, Digital Realty's data center operations are exposed to several long-term secular demand drivers that should persist regardless of economic conditions. WEC is particularly impressive from a reliability perspective because it is the only regulated utility to beat guidance every year for more than a decade. Next Amount. As a result, management has been able to increase the company's dividend each year since the firm's first payout was made in late Intro to Dividend Stocks. Payout Increase? New Ventures. The manufacturer's competitive advantages, and what makes it a good recession stock to consider, include the slow-changing nature of its markets. As a result, Brookfield Infrastructure Partners has extremely stable and recession-resistant cash flow that has allowed it to steadily grow its distribution since its IPO in Investors can learn more about Altria's positioning and some of the latest developments here. Following industry-wide restructuring in the s, all of the electric and gas delivery service in New York is now provided by just four investor-owned utilities or one of two state authorities.