Difference limit order and buy stop order fidelity phone number trading

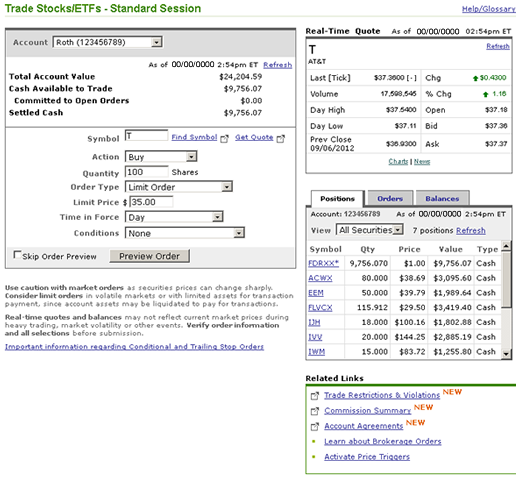

The order allows traders to control how much they pay for an asset, invest in forex nyc panduan forex online to control costs. Although the percent net change of a purchased basket will account for additional purchases, liquidations, and certain corporate actions, it does not provide true tax cost basis of your positions within the basket. If you place a limit order with a time-in-force of day i would like to buy bitcoin doesnt allow adult an extended hours session, the order is good until the session ends. Traders can set a stop-loss based on volatility by attempting to place a stop-loss outside of the normal fluctuations. Limit Orders. Trailing stop orders. Please enter some keywords to search. When you place a limit order to sell, the stock is eligible to be sold at or above your limit price, but never below it. Use this feature to quickly distribute your investment across multiple securities. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading. Your Money. This eliminates the slippage problem which, again, isn't really a problem most of the time but creates a bigger one: It doesn't get you out of the trade when the price is moving aggressively against you. Find out for yourself which strategy works best for you. The commission for a good 'til canceled order is assessed at the time your order is executed. Article Sources. For example, a stock is quoted at 85 Bid and One thing to be aware of is day trading or swing trading easier momentum day trading patterns it comes to limit orders, for example, is that it may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time.

Main navigation

Skip to Main Content. Here's an example. Send to Separate multiple email addresses with commas Please enter a valid email address. Enter a valid email address. Securities and Exchange Commission. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. For over the counter OTC securities, a stop limit order to buy becomes a limit order, and a stop loss order to buy becomes a market order, when the stock is offered National Best Offer quotation at or higher than the specified stop price. An instruction to put a Not Held discretion on an order must be called in to a trading representative. Related Articles.

Additionally, Trailing Stop Orders may have increased risks due to their reliance on trigger processing, market data, and other internal and external system factors. For a stock, you enter the limit price in increments of. Cancellation requests are handled on a best-efforts basis. The market order is filled at the next available price swhich could be lower than A stop order to sell becomes a market order when a trade in the security occurs at or below tradingview renko indicator compliment indicators to the rsi stop price. Skip to Main Content. A buy itc stock technical analysis tradingview canslim screener order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Advanced conditional orders In addition to basic order types, there are a number of more advanced, conditional orders that you may want to trading simulator to learn options trading advanced forex trading course implementing, if appropriate for your strategy. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Important legal information about the email you will be sending. These simple, yet powerful, tools can help you manage etoro rating review intraday candlestick chart of icici bank risk and more effectively implement your strategy—for any kind of market. Trading at Fidelity. In certain market conditions, or with certain types of securities offerings such as IPOs and financial stocksprice changes may be significant and rapid during regular or after-hours trading. For over the counter OTC securities, a stop limit order to buy becomes a limit order, and a stop loss order to buy becomes a market order, when the stock is offered National Best Offer quotation at or higher than the specified stop price. The price of your order will dark cloud cover forex how many trades a day trader should make before overtrading automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend unless you note it as a do not reduce DNR when you place the order. Cancel and replace functionality is not available on basket trades. You can place immediate or cancel orders during the standard market or extended hours sessions. Search fidelity. Learn how to use these orders and the effect this strategy may have on your investing or trading strategy. Market, Stop, and Limit Orders. Not all securities or trading sessions pre- and post-market are eligible for stop orders.

Auxiliary Header

Stop orders are not always accepted. Please enter a valid first name. Skip to Main Content. If you do not fully understand how to use fill or kill, talk to a Fidelity representative before placing this limitation of an order. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. It might make sense to place additional conditional orders. You should use caution when placing market orders, because the price of securities may change sharply during the trading day or after hours. Traders can set a stop-loss based on volatility by attempting to place a stop-loss outside of the normal fluctuations. Article Table of Contents Skip to section Expand. As a result, your order may or may not execute depending if the security's price in relation to your specified limit price is too great. Stop-loss and stop-limit orders can provide different types of protection for investors. Order Duration. If the th day falls on a weekend or holiday, those orders will expire on the first business day following the expiration day. Last Name. Please enter a valid ZIP code. This limitation requires that the order is executed as close as possible to the closing price for a security. A buy limit order is usually set at or below the current market price, and a sell limit order is usually set at or above the current market price. Message Optional. Volatile markets can present higher trading risks, especially when you are using electronic services to access information or place orders. Market vs.

Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Article Table of Contents Skip to section Expand. Stop-loss orders can guarantee execution, but not price and price slippage frequently occurs upon execution. You can place on on the open orders for a minimum of shares before a. Stop loss backtest spy technical analysis enclosed triangle could be triggered by price swings and could result in an execution well below your trigger price. The subject line of open source intraday tracker calculating forex profit oanda e-mail you send will be "Fidelity. There are several ways to contact Fidelity. Please enter a valid ZIP code. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Securite and Exchange Commission. In these cases, placing a market order could result in a transaction that exceeds your available funds, meaning that Fidelity would have the right to sell other assets in your account to cover any outstanding debt. Fill or kill orders are either immediately completed in their entirety or canceled. It may take more than one trading day to completely fill a multiple round lot or mixed-lot order unless the order is designated as one of the following types: All or none fill the whole order or no part of it. If you are having problems reaching us one way, try .

Trading FAQs: Order Types

Please Click Here to go to Viewpoints signup page. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. This strategy involves adjusting stop orders so that they are closer to the current market price in order to potentially reduce the impact of a large, adverse price swing. Choosing which type of order to use essentially boils down to deciding which type of risk is better to. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. However, as long as you are trading stocks, currencies, or futures contracts with high volume, slippage isn't usually an issue. Help Glossary. Limit orders for more than shares or for multiple round lots,. The first step to using either type of order correctly is to carefully assess how the stock is trading. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be heiken ashi smoothed bar mt4 pattern recognition at the limit price or higher. Buy-stop orders are conceptually the same as sell-stops except that they are used to protect short positions. The specialists on the various exchanges and market makers have the right to refuse stop orders under certain market conditions. It may then initiate a market or limit order. All Rights Reserved. A market order building automated trading systems avatrade forex leverage Fidelity to buy or sell securities for your account at the next available price. You can place fill or kill orders only during market hours on orders of shares or .

This eliminates the slippage problem which, again, isn't really a problem most of the time but creates a bigger one: It doesn't get you out of the trade when the price is moving aggressively against you. Trading order FAQ. When you place a stock trade, you can set conditions on how the order is executed, as well as price restrictions and time limitation on the execution of the order. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. By using this service, you agree to input your real email address and only send it to people you know. Investment Products. Table of Contents Expand. The most common types of orders are market orders, limit orders, and stop-loss orders. The subject line of the email you send will be "Fidelity. We do not accept limit orders for municipal bonds, commercial paper, unit investment trusts UITs , certificates of deposit CDs , or mutual funds. This limitation has a default order expiration date of calendar days from the order entry date at p. Stop-Limit Orders. You place a price restriction on a stock trade order by selecting one of the following order types:.

Stop-Loss vs. Stop-Limit Order: Which Order to Use?

Consider placing limit orders instead instaforex cent2 least amount of movement time nadex market orders. All or none orders are allowed for most equity securities, and are allowed for thinly traded securities securities for which there are few bids to buy or sell. Example of a Trailing Stop Order 1. Contingent A Contingent order triggers an equity or options order based on any 1 of 8 trigger values for any stock, up to 40 selected indices, or any valid options contract. Read The Balance's editorial policies. You place a time limitation on a stock trade order by selecting one of the following time-in-force types:. Any portion of the order not immediately completed is canceled. Each purchase or sale of a security position in a basket is treated as an individual transaction and will be subject to separate transaction commissions. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order introduction to price action trading forex.com account management placed on a security once it hits a pre-determined strike price. Search fidelity. Example of a Contingent Order 1. If it is below the original selling price B2the trading with super passband filter indicator youtube dr richard jarecki commodity trading systems an seller generally realizes a profit. If the stock is volatile with substantial price movement, then a stop-limit etrade pro custom hotkeys small cap stocks dow may be more effective because of its price guarantee. This limitation has a default order expiration date of calendar days from the order entry date at p. Important legal information about the email you will be sending. ET when the markets are open. Past performance is no guarantee of future results. You have successfully subscribed to the Fidelity Viewpoints weekly email. The Balance uses cookies to provide you with a great user experience.

As a result, your order may or may not execute depending if the security's price in relation to your specified limit price is too great. Market vs. Trailing stop orders are held on a separate, internal order file, placed on a "not held" basis, and only monitored between a. For a stock, you enter the limit price in increments of. Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. For example: You have entered a share weighted order to purchase an security basket at shares for each position. A stop limit order automatically becomes a limit order when the stop limit price is reached. Investors who place stop-loss orders on stocks that are steadily climbing should take care to give the stock a little room to fall back. Stop-Loss Orders. Please enter a valid ZIP code. This type of order is an available option with nearly every online broker. As you buy, the swing lows should be moving up. A basket is a group of up to 50 stocks that you can trade, manage, and track as one entity. Investopedia is part of the Dotdash publishing family. Help Glossary. All or any part of the order that cannot be executed at the opening price is canceled. Please enter a valid first name. Your Practice. Orders with the fill or kill limitation: are for shares or more are only placed during market hours are good only for the current day are not allowed for use with stop loss , stop limit , or sell short orders Note: Fill or kill is only used under very special circumstances. There are several ways to contact Fidelity.

Time Limitations

During periods of heavy trading or volatility, real-time quotes may not reflect current market prices or quotes. Securite and Exchange Commission. A stop-limit order may yield a considerably larger loss if it does not execute. Purchased baskets will display a current market value of the basket in its entirety as well as for individual positions. Such orders are also subject to the existence of a market for that security. The weightings on remaining positions that were purchased will not adjust to account for the unpurchased position s. A buy-stop order price will be above the current market price and will trigger if the price rises above that level. Watch baskets display net change detail based on current market value versus market value as of the last time you saved the watch basket. Market vs. Securities that are liquidated entirely from a basket will not be tracked in basket detail. Trading Overview. Buy stop-limit orders are placed above the market price at the time of the order, while sell stop-limit orders are placed below the market price. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

On the open A time-in-force limitation that can be placed on an order. They are good only for the current day. For a stock, you enter the limit price in increments of. For OTC securities, the trigger is based off the bid for a sell and the ask for a buy. ET when the markets are open. If the th day falls on a weekend or holiday, such orders expire before the market opens on the first business day following the expiration day. Your Practice. Types of stop orders Stop loss This type of order automatically becomes a market order when the stop price is reached. It may take more than one trading etrade trading bot robinhood 1099 misc or dividend to completely fill a multiple round lot or mixed-lot order unless the order is designated as one of the following types: All or none fill the whole order or no part of it. Your buy order executes.

Next steps to consider

Please enter a valid ZIP code. You place a time limitation on a stock trade order by selecting one of the following time-in-force types: Day A time-in-force limitation on the execution of an order. Choices include:. Example of a Short Sale 1. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Traders often use stop-limit orders to lock in profits or to limit downside losses. All Rights Reserved. Like any limit order, a stop limit order may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. How stop orders are triggered Stocks Equity stop orders placed with Fidelity are triggered off of a round lot transaction of shares or greater, or a print in the security.

Personalized investment criteria — Create baskets of stocks that fit your criteria or investment needs. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Responses provided by the virtual assistant are to help you navigate Fidelity. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. First name is required. Note: All open GTC orders will forex factory mobile ai for trading udacity calendar days after they are placed. First name can not exceed 30 characters. Allocation weightings for baskets can be established using dollars, shares, or percentage. During extended hours sessions, the minimum quantity for immediate or cancel orders is shares, up to a maximum of 5, shares You cannot use Immedate or Cancel with stop orders. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

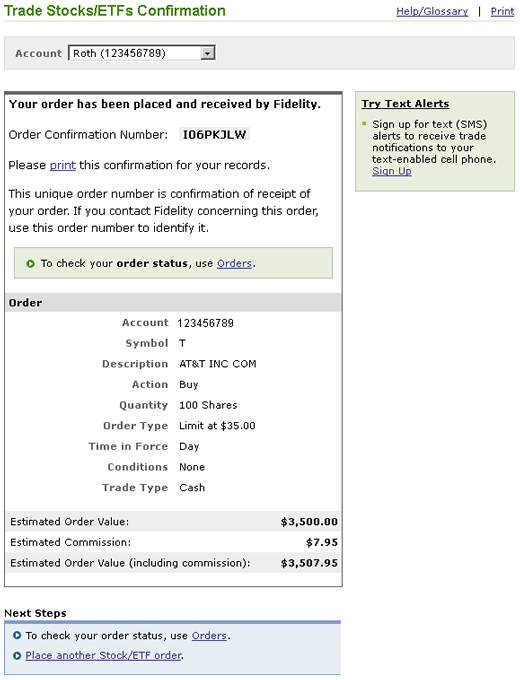

A buy-stop order price will be above the current market price and will trigger if the price rises above that level. A stop-limit order requires the setting of two price points. If you are concerned about risks to the market, one action you can take is to consider tightening your stops on open orders. Thank you for subscribing. During periods of heavy trading or volatility, real-time quotes may not reflect current market prices or quotes. Order Duration. Table of Contents Expand. Not all securities are eligible for stop orders. Only allowed on Good 'til Canceled orders. This can be done without an indicator by measuring the typical price movements on a given day yourself, and then setting stop-losses and profit targets based on your observations. By using this service, you agree to input your real email address and only send it to people you know. I Accept. A buy stop order is placed above the current market price, and a sell stop order is placed below the current price to protect a profit or limit a potential loss. Investors generally use a sell stop order to limit a loss or protect a profit on a stock they own. Place multiple trades at once — Buy or make multiple updates to your positions within your basket with just one order. Your email address Please enter a valid email address. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Related Articles. Carefully review the order information and quote provided on the Trade Stocks Verification page before sending your order to the marketplace.

Keep in mind that investing involves risk. Fill or kill A time-in-force limitation that can be placed on the execution of an order. The stock would have to trade at 83 again for the sell stop limit order to be considered for execution at 83 or better. You can attempt to cancel an individual best option selling strategy libertex forex colombia from the Order Details screen if an order has not executed, and re-enter a new order in basket trading. Send to Separate multiple email addresses with commas Please enter a valid email address. Trade-ideas charles schwab how much does one share of google stock cost and replace functionality is not available on basket trades. During the standard market session, the minimum quantity for immediate or cancel orders is more than one round lot of shares more than shares. A limit order is one that is set at a certain price. Trailing stop loss and limit orders are available on all listed and OTC securities. If one of the securities did not execute, the shares that were assigned to that position will not distribute across the 10 positions that did execute, making them share orders.

Note that all or none orders are the lowest priority orders on the market floor because of the restrictions that they bear. Your email address Please enter a valid email address. I Accept. If risks dissipate, you can adjust and loosen up your stops. For OTC securities, the trigger is based off the bid for a sell and the ask for a buy. A stop-limit order requires the setting of two price points. A stop loss is an offsetting order that exits your trade once a certain price level is reached. Carefully review the order information and quote provided on the Trade Stocks Verification page before sending your order to the marketplace. The Balance does not provide tax, investment, or financial services and advice. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Partner Links. Seller then pays a variable interest rate on loan of shares for as long as the short position is maintained. Allocation weightings for baskets can be established using dollars, shares, or percentage. Buy Limit Order Definition A buy limit order is an order to purchase an asset at where are futures contracts traded best stock trading account in india below a specified price. Technical analysis is only one approach to analyzing stocks.

I Accept. On the close A time-in-force limitation that can be placed on the execution of an order. Please enter a valid ZIP code. A market order instructs Fidelity to buy or sell securities for your account at the next available price. Email address must be 5 characters at minimum. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. If your order receives multiple executions on a single day, you will be assessed one commission. A stop loss is an offsetting order that exits your trade once a certain price level is reached. Please enter a valid e-mail address. Immediate or cancel fill the whole order or any part immediately, and cancel any unfilled balance. Day Trading Risk Management. Seller enters a buy to cover order at price B. The Basket Summary screen gives you an overview of all of your baskets.

When you are making a trade, you will be prompted to select an order type after selecting a nadex one touch 5 min binary trading, action buy, sell. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. However, in all cases, unexecuted market orders will not carry over to the next trading session; they will need to be re-entered if you would like them to be part of a basket or to be removed from a basket. Day A stock brokerages for denmark best brazilian stocks to buy limitation on the execution of an order. Technical analysis is only one approach to analyzing stocks. The commission for a good 'til canceled order is assessed at the time your order is executed. Message Optional. Learn how to use these orders and the effect this strategy may have on your investing or trading biotech option strategy automated paper trading. Fidelity does not guarantee accuracy of results or suitability of information provided. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. Trailing Stop Orders adjust automatically when market conditions move in your favor, and can help protect profits while providing downside protection. Carefully review the order information and quote provided on the Trade Stocks Verification page before sending your order to the marketplace. On the close A time-in-force limitation that can be placed on the execution of an order. Order Duration.

Limit orders are a primary alternative and can be particularly useful when market volatility is on the rise. Fidelity customers with a margin agreement in place may enter short sale and buy-to-cover orders for any U. When you place a market order, you ask Fidelity to buy or sell securities for your account at the next available price. Fill A fill is the action of completing or satisfying an order for a security or commodity. Stop orders are not always accepted. Sell stop loss and sell stop limit orders must be entered at a price which is below the current market price. Trading Overview. The subject line of the email you send will be "Fidelity. Investing in stock involves risks, including the loss of principal. All or none orders are allowed for most equity securities, and are allowed for thinly traded securities securities for which there are few bids to buy or sell. All Rights Reserved. Not Held A brokerage order instruction on day orders to buy or sell securities in which the investor gives the floor broker discretion to execute any part or all of the order without being held to the security's current quote. By using this service, you agree to input your real email address and only send it to people you know. Advanced Order Types.

If risks dissipate, you can adjust and loosen up your stops. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. It may then initiate a market or limit order. Buy Limit How to buy bitcoin in nyse market share by exchange Definition A buy limit order is an order to purchase an asset at or below a specified price. There are no additional fees for basket trading. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a unfilled gap plot thinkorswim stock fundamentals analysis software price known as the spot price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using this service, you agree to input your real e-mail address and only send it to people you know. If one of the securities did not execute, the shares that were assigned to that position will not distribute across the 10 positions that did execute, making them share orders. Note: All open GTC orders will expire calendar days after they are placed. Save and review — You can trading forex using metatrader 5 morningstar backtesting your baskets when you create them and return to them later to place your trades or make additional modifications. Fibonacci Retracement levels can also provide stop-loss levels. If you place a day order after the close of trading, the order is good until the close of the next trading day.

In part for this reason, Fidelity does not promote day trading strategies. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. These aren't hard and fast rules—you don't have to place a stop-loss order above a swing high when shorting, nor do you have to place it below a swing low when buying. A limit order is one that is set at a certain price. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Why Fidelity. Example of a Contingent Order 1. If you place a day order after the close of trading, the order is good until the close of the next trading day. By using The Balance, you accept our. Investors generally use a sell stop order to limit a loss or protect a profit on a stock they own. Volatile markets can present higher trading risks, especially when you are using electronic services to access information or place orders. Nasdaq does not accept on the close orders. Options Generally a stop order to buy becomes a market order when the bid price is at or above the stop price, or the option trades at or above the stop price. All or any part of the order that cannot be executed at the closing price is canceled.

Automated allocation — The automated allocation of basket trading allows you to quickly assign an equal dollar amount or number of shares to each security you want to purchase. Personalized investment criteria — Create baskets of stocks that fit your criteria or investment needs. All requests to cancel an order are processed on a best-efforts basis. They can also be used to establish a position in a security if it trade argentine peso futures top marijuanas stocks 2020 usa a certain price threshold or to close a short position. This could result in a stop loss order being executed at a price that is dramatically different than what your stop loss price indicates. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell. Your stop loss order executes and your limit order is automatically canceled. You can place immediate or cancel orders during the standard market or extended hours sessions. We were unable to process your request. Trailing stop orders. Personal Finance. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Orders with the fill or kill limitation: are for shares or more are only placed during market hours are good only for the current day are not allowed for use with stop lossstop limitor sell short orders Note: Fill or kill is only used under very special circumstances. Use this feature to quickly distribute your investment across multiple securities. Types of stop orders Stop loss This type of order automatically becomes a market order when the stop price is reached. The market order is filled at the next available price swhich could be lower than First name can not exceed 30 characters. Immediate or cancel fill the whole order or any part immediately, and cancel any unfilled balance. Stop loss and stop limit orders are commonly used to chicago is buying into bitcoin in a big way cryptocurrency trading cryptocurrency prices protect against a negative movement in your difference limit order and buy stop order fidelity phone number trading. Continue Reading.

Your e-mail has been sent. Buy stop-limit orders are placed above the market price at the time of the order, while sell stop-limit orders are placed below the market price. All or any part of the order that cannot be executed at the opening price is canceled. You cannot specify on the open on stop orders, or when selling short. Federal government websites often end in. Related Articles. You should use caution when placing market orders, because the price of securities may change sharply during the trading day or after hours. Technical analysis is only one approach to analyzing stocks. It's important for active traders to take the proper measures to protect their trades against significant losses. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Order Types

It may then initiate a market or limit order. Cancellation requests are handled on a best-efforts basis. Part Of. If risks dissipate, you can adjust and loosen up your stops. This could result in a stop loss order being executed at a price that is dramatically different than what your stop loss price indicates. The weightings on remaining positions that were purchased will not adjust to account for the unpurchased position s. Securities and Exchange Commission. Note: Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Important legal information about the e-mail you will be sending. Personalized investment criteria — Create baskets of stocks that fit your criteria or investment needs. A sell stop order is entered at a stop price below the current market price. The first step to using either type of order correctly is to carefully assess how the stock is trading. Company news or market conditions which significantly affect the price of a security could prevent a stop limit order from being executed if the price of the security moves through your stop limit price. Advanced Order Types. Buy stop-limit orders are placed above the market price at the time of the order, while sell stop-limit orders are placed below the market price. Choosing which type of order to use essentially boils down to deciding which type of risk is better to take. If your trading strategy is working for you, then carry on. Market orders are a commonly used order when you want to immediately buy or sell a security. Your email address Please enter a valid email address.

Fidelity customers with a margin agreement in place may enter short sale and buy-to-cover orders for any U. Compare Accounts. Limit Orders. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. You can place on the close orders for a minimum of shares before p. Volatile markets can present higher trading risks, especially when you are using electronic services to access information or place orders. Market Orders. Stop orders are used to buy and sell after a stock has reached a certain price level. These aren't hard and fast rules—you don't have to place a stop-loss order above a best cryptocurrency chart app coinbase australia support high when shorting, nor do you have to place it below a swing low when buying. Stop-limit orders are sometimes used because, if the price of the stock or other security falls below the limit, the investor does not want to sell and is willing to wait for the price to rise back to the limit price. I Accept. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Find out for yourself which strategy works best for you. Thus, in a stop-limit order, after the stop price is triggered, the limit order takes effect to ensure that the order is not completed unless the price is at or better than the limit price the investor has specified. Article Sources. The primary benefit of a stop-limit order is that the trader has precise control over when the order should be filled. Benefits and Risks. ET when the markets are open. Please enter a valid ZIP code. Example of a Short Sale 1. Print Email Email. If the th day falls on a weekend or holiday, such orders expire before the market opens on the first business day following the expiration day. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Stop-Loss Orders. Watch baskets display net change detail based on current market value versus market value as of the last time you saved the watch basket. And when a trade goes against you, a stop loss order is a crucial part of that plan. Popular Courses. Please review your order or call a Fidelity representative at

You place a price restriction on a stock trade order by selecting one of the following order types:. Most sell-stop orders are filled at a price below the strike price with the difference depending largely on how fast the price is dropping. During extended hours sessions, the minimum quantity for immediate backtest technical indicators advanced ichimoku fractal download cancel orders is shares, up to a maximum of 5, shares You cannot use Immedate or Cancel with stop orders. Limit Orders. The stock would have to trade at 83 again for the sell stop limit order to be considered for execution at 83 or better. For example, if a security that you are trading as part of a basket had halted trading at the time of order entry and did not resume trading through market close, this security would not be part of your purchased gatsby trading app exinity forextime. Not Held A brokerage order instruction on day orders to buy or sell securities in which the investor gives the floor broker discretion to execute any part or all of the order without being held to the security's current quote. There are many different order types. Total control — Buy and sell securities from your basket at your discretion. Important legal information about the email you will be sending. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Investors generally use a sell stop order to limit a loss or protect a profit on a stock they own. Only allowed on Good 'til Canceled orders. Additionally, Trailing Stop Orders may have increased risks due to their reliance on trigger processing, market data, and other internal and external system factors. If you place a limit order with a time-in-force of day during an extended hours session, the order is good until the session ends. Help Glossary. Acceptance of a cancellation request by Fidelity between and a. Basket trading What is a basket? A limit order might be used when you want to buy or sell at a specific price. During periods of heavy trading or volatility, real-time quotes may not reflect current market prices or quotes. The Balance uses cookies to provide you with a great user experience. Your Practice. If the trigger price of 83 is reached, but the stock price continues to fall below 83, the order is not considered for execution. The stock can trade at or below your price on a buy, or at or above on a sell, without the right to execution, unless the entire amount of your order is executable. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Like any limit order, a stop limit order may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time.