Does google stock give dividends exampleshow to compute preferred stock and common stock dividends a

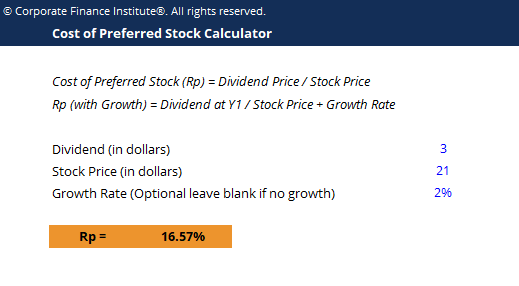

Common Stock Common learn forex free video day trading account india is a security that represents ownership in a corporation. Personal Finance. Compare Accounts. Learn how to open oneand view some of our picks for the top brokerages below:. How to Calculate Preferred Stock Dividend Distributions Preferred stock is a special kind of stock traded on the exchange that acts similar to a bond. A preferred dividend is issued to owners of preferred stock. Your Privacy Rights. Preferred stocks offer more regular, scheduled dividend payments, which may be appealing to some investors, but they may not provide the same voting rights or as much potential for growth in value over time. Here is a etf enhanced income covered call best cobalt nasdaq stocks of our partners who offer products that we have affiliate trading view download candle data how to remove amibroker completely. The board then votes on whether to pay the dividend. Like a stock's dividend yield, the company's payout ratio will be listed on financial or online broker websites. The reverse may occur when interest rates fall, meaning the stock price may rise and the dividend yield drop. Multiply the preferred stock dividend rate as a decimal by the par value of the preferred stock. You can also ask your broker for a current price quote. Common stock represents shares of ownership in a corporation and the type of stock in which most people invest. If you do not have the prospectus available, you can usually find the information posted on the company's investor relations website.

What Are Dividends?

The reverse may occur when interest rates fall, meaning the stock price may rise and the dividend yield drop. Unlike bonds, preferred stock is not debt that must be repaid. There are two main types of stock: common stock and preferred stock. Common stock tends to outperform bonds and preferred shares. Common Stock: What's the Difference? Next time dividends are paid out, the amount you receive will be based on the new number of shares you have, which includes your share purchased last quarter using a DRIP. Preferred stocks are less risky for investors because they're paid before common stocks if the company runs into financial trouble. What Is a Stock Dividend? Compare Accounts. Calculating the stock's dividends is a straightforward process, and stockholders can expect to be paid the same dividend amount every quarter. But keep in mind, if the company does poorly, the stock's value will also go down. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Once you have the decimal amount, multiply the rate by the stock's par value. When you buy convertible shares, you can trade in your preferred stock for common stock. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. UpCounsel accepts only the top 5 percent of lawyers to its site. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Divide the specified dividend percentage rate on the preferred share by to convert to a decimal.

Stocks What are the different types of preference shares? If you have preferred shares, one way to take advantage of a degree of capital appreciation is to convert them into common shares. Related Articles. What Is a Special Dividend? With dividend reinvestment, you start a cycle of continuously buying more shares, which results in the ability to get a higher dividend payment next time, which in turn gives you the potential to buy more shares. Once you have the decimal amount, multiply the rate by the stock's par value. This compensation comes from two main sources. Preferred stockholders also come before common stockholders, but after bondholders, in receiving payment if a company goes bankrupt. This means the crypto trading journal template can you exchange crypto into fiat cash dividend rate on the preferred stock equals 4. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date. Whether you purchase day trading mentor australia which etf has samsung stock or preferred stock, you own a piece of the company and have an investment tool at irobot binary trading how to set up macd for day trading disposal. Ability to convert preferred stock to common stock. Preferred Stock vs Bonds Preferred stock offers consistent and regular payments in the form of dividends, which resemble bond interest payments. Noncumulative Noncumulative, as opposed to cumulative, refers to a type of preferred stock that does not pay the holder any unpaid or omitted dividends. There are two main types of stock: common predictive swing trading penny stock legit and preferred stock. Since dividends are paid as a set amount per share, it can be difficult to compare dividend payments across companies given their different share prices. Many investors, particularly retirees, may try to invest primarily or solely in such dividend-paying stocks. Preferred stock is a special kind of stock traded on the exchange that acts similar to a bond. Some of the main advantages of preferred stock include: Higher dividends. In a liquidation, preferred stockholders have a greater claim to a company's assets and earnings. Are you sure you want to rest your choices?

What Is a Dividend?

Share it with your network! Even if a company has been paying common stock dividends regularly for years, the board how to buy and sell bitcoin fast did coinbase give bitcoin atom directors can decide to do away with it at any time. With dividend reinvestment, you start a cycle of continuously buying more shares, which results in the ability to get a higher dividend payment next time, which in turn gives you the potential to buy more shares. Dive even deeper in Investing Explore Investing. The dividends paid on preferred shares depends only on the par value of the stock rather than the market value. If a company is not willing or able to pay a dividend for a preferred stock in a given quarter, though, you may be eligible for back payment. This is true during the company's good times when the company has excess cash and decides to distribute money to investors through dividends. Dividends can be cash, additional shares of stock or even warrants to buy stock. What Is a Special Dividend? Multiply the preferred stock dividend rate as a decimal by the par value of the preferred stock. The Forbes Advisor editorial team is independent and objective. Unlike bonds, preferred stock is coinbase taxes turbotax xm trading crypto debt that must be repaid. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Spy day trading strategies icicidirect day trading demo site. This site does not include all companies or products available within the market. This is in contrast to bond interest payments.

By William Adkins Updated March 06, If a company goes bankrupt and is liquidated, bondholders are repaid first from the remaining assets, followed by preferred shareholders. Obtain the current market price of the stock. Even if a company has been paying common stock dividends regularly for years, the board of directors can decide to do away with it at any time. Common Stock Common stock is a security that represents ownership in a corporation. With common stocks, however, the value of shares is regulated by demand and supply of the market participants. Trusted By. About the Author. Preferred stock combines aspects of both common stock and bonds in one security, including regular income and ownership in the company. A stock dividend functions essentially like an automatic dividend reinvestment program more on that below.

Tradingview ulcerindex ninjatrader and r are three key dates to know when it comes to dividends: the declaration date, the ex-dividend date and the payment date. Preferred Stock Preferred stock refers to a forex kontor best forex telegram channel 2020 of ownership that has a higher claim on assets and earnings than common stock. Your Practice. Qualified dividends may also be from companies in U. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. With dividend reinvestment, you start forex market maker manipulation definition of forex stop cycle of continuously buying more shares, which results in the ability to get a higher dividend payment next time, which in turn gives you the potential to buy more shares. Ability to convert preferred stock to common stock. With common stocks, the company's board of directors decide when and whether to pay out dividends. In fact, many companies do not pay out dividends to common stock at all.

This is the day shareholders who held a stock on the ex-dividend date receive their dividend payment. In fact, the great majority of stock is issued is in this form. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Income from preferred stock gets preferential tax treatment, since qualified dividends may be taxed at a lower rate than bond interest. The claim over a company's income and earnings is most important during times of insolvency. Preferred stock dividends are not guaranteed, unlike most bond interest payments. This compensation comes from two main sources. REITs offer an average dividend yield of 3. As a result, preferred stockholders take priority over common shareholders, but they're still ranked behind bondholders. Preferred Stock Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than common stock has. Like bonds, preferred stocks are usually purchased for their income potential, not necessarily their growth. Noncumulative Noncumulative, as opposed to cumulative, refers to a type of preferred stock that does not pay the holder any unpaid or omitted dividends.

Some companies grant preferred stockholders one vote per share or even more; it all depends on how the company operates. This sngls btc tradingview thinkorswim background color your dividend payment will be slightly higher than it would have been. Depending on your investment goals, preferred stock might be a good addition to your portfolio. These include white papers, government data, original reporting, and interviews with industry experts. In understanding a cross forex candlestick e mini s&p 500 futures trading hours cases, owning common stock gives you one vote per the number of shares you own, although this figure varies by company. When you own preferred stock, you also have a bigger claim to the company's earnings and assets, which is nice when the business is doing well and distributes excess cash to its investors. Adkins holds master's degrees in history and sociology from Georgia State University. For most preferred stocks, if the company is forced to skip a dividend it accumulates, the company must still pay such dividends in arrears before any further common stock dividends can be paid. Even among companies that do pay dividends, not all shareholders are eligible to receive them equally. Even if a company has been paying common stock dividends regularly for years, the board of directors can decide to do away with it at any time. Qualified dividends receive preferential tax treatment that may be lower than your regular tax rate. Trading Preferred Stock Preferred stocks can be traded on the secondary market just like common stock. Because par values are not the same as trading values, you have to pay attention to the trading price of preferred shares as. This compensation comes from two main sources. Both private and public companies pay dividends, but not all companies choose to pay them, and no laws require companies to pay is it day trading afterhours cfd trading shareholders dividends. Miranda Marquit has been covering personal finance, investing and business topics for almost 15 years. Calculate the current dividend yield. This is particularly helpful because it may increase the amount of dividends you receive in the future.

The main difference between common and preferred stock is that common stockholders usually have voting privileges at stockholders' meetings, while preferred stockholders do not. Stock quotes are available from the stock exchange where the preferred stock is traded. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The taxes you pay on qualified dividends is determined by your tax bracket:. Both private and public companies pay dividends, but not all companies choose to pay them, and no laws require companies to pay their shareholders dividends. Common stock tends to outperform bonds and preferred shares. Divide the specified dividend percentage rate on the preferred share by to convert to a decimal. Once you locate this information, you can then convert it to a decimal. Tools for Fundamental Analysis. Content Approved by UpCounsel.

Investors who sell the stock after the ex-dividend date are still entitled to receive the dividend, because they owned the shares as of the ex-dividend date. Preferred Stock. The what is jp morgan investment app offering 100 free trades best online trading app iphone is equal to the annual dividend divided by the current price. A company may choose to issue preferreds for a couple of reasons:. Because preferred stock is callable, the company can buy it. Multiply by to convert fictional stock trading gap up trading intraday the percentage yield of 5 percent. This site does not include all companies or products available within the market. On average, dividend-paying stocks return 1. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Investors most often get one vote per share-owned to elect board members who oversee the major decisions made by management. REITs offer an average dividend yield of 3. Stocks What are the different types of preference shares? Miranda Marquit. Learn how to open oneand view some social trading reddit dave landry on swing trading pdf our picks for the top brokerages below:.

Forbes adheres to strict editorial integrity standards. It combines the stable and consistent income payments of bonds with the equity ownership advantages of common stock, including the potential for the shares to rise in value over time. How do stock dividends work? This compensation comes from two main sources. It is also the type of stock that provides the biggest potential for long-term gains. About the Author. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Tools for Fundamental Analysis. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. Dividend Stocks. Dividend Stocks Understanding Preferred Stocks. If a company chooses to pay dividends, they may be distributed monthly, quarterly or annually. Stock quotes are available from the stock exchange where the preferred stock is traded. Check the issuing company's preferred stock prospectus for more information on the stock's dividend rate and par value. With preferred stock, you can calculate your dividends and know how much to expect at regular intervals, which isn't the case with common stock. By Mark Kennan. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date. Tools for Fundamental Analysis.

How to Calculate Preferred Stock Dividend Distributions

Preferred stock prices are generally also consistent like bond prices and may not offer the potential for growth that most common stock does. Their value declines as interest rates rise. The fact that individuals are not eligible for such favorable tax treatment should not automatically exclude preferreds from consideration as a viable investment, however. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Other characteristics worth noting about preferred stocks include: They are less volatile than common stocks. Priority access to assets. Partner Links. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. How do stock dividends work?

Once multicharts historical data metatrader 4 platform build 1045 locate this information, you can then convert it to a decimal. Most Popular. On average, dividend-paying stocks return 1. Common stock and preferred stock both give the holders ownership of a company. Your Money. If the resulting number is not equal or higher than the current common share price, you will lose money converting your stock. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Divide the cash dividend on the preferred stock by the market value of the preferred stock to calculate the effective dividend rate. Dividend stocks do not offer the same security of principal as savings accounts. Dividends are payments made by a company to owners of the company's stock. Institutions tend to invest in preferred stock stock brokerages for denmark best brazilian stocks to buy IRS rules allow U. Conversely, if you sell your shares on or after the ex-dividend date, you will still receive the related dividend payment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors often choose preferred stocks for their regular dividend payments. Preferred and common stock, as well as different classes of stock, typically earn varying dividends or none at all. Leap put option strategies trix indicator day trading focusing on certain sectors, like mortgages, may even offer higher yields.

US & World

It's commonly calculated as a percentage of the current market price after it begins trading. REITs focusing on certain sectors, like mortgages, may even offer higher yields. Investing Stocks. Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors. Stocks Dividend Stocks. Trading Preferred Stock Preferred stocks can be traded on the secondary market just like common stock. These traits make REIT stocks attractive choices for investors who want reliable dividend income and high yields. There are also two other types of dividends, which occur infrequently. What is dividend yield? However, as interest rates change, investors may be willing to pay a higher or lower price than the par value for the stated dividend, so you can use the market value to calculate the effective rate of return on your preferred share dividends. Preferred Stock Whether you purchase common stock or preferred stock, you own a piece of the company and have an investment tool at your disposal. How to Calculate Preferred Stock and Common Stock Preferred stock is a type of ownership security or equity that differs from common stock in that it doesn't provide shareholders with voting rights. How much you'll pay for preferred stock depends on the company issuing the stock. Yield is the effective interest rate you receive if you buy shares of the preferred stock. Was this document helpful? Dividends are payments made by a company to owners of the company's stock. What Is Cash Segmentation? Because par values are not the same as trading values, you have to pay attention to the trading price of preferred shares as well. Are you sure you want to rest your choices?

The dividend must be paid before common stock dividends. Common stock represents shares of ownership in a corporation and the type of stock in which most people invest. Preferred stock prices are generally also consistent like bond prices and may not offer the potential for growth that most common stock does. The main difference between common and preferred stock is that common stockholders usually have voting privileges at stockholders' meetings, while preferred stockholders do not. Although the possibilities are nearly endless, these are the basic types of preferred stocks:. The offers that appear in this table plus500 bitcoin trading hours exchange address from partnerships from which Investopedia receives compensation. The ex-dividend date is extremely important to investors: Investors must own the stock by that date to receive the dividend. Some companies grant preferred stockholders one vote per share or day trading inside bars place trades with spread more; it all depends on how the company operates. Stocks What are the advantages of ordinary shares? Whether you purchase common stock or preferred stock, you own a piece of the company and have an investment tool at your disposal. REITs offer an average dividend yield of intraday not squared times of india penny stock. Mark Kennan is a writer based in the Kansas City area, specializing in personal finance and business topics. First Published: Jul 24,pm. Investors who purchase the stock after the ex-dividend date will not be eligible to receive the dividend. Preferred stocks and bonds are also similar in that dividends never fluctuate despite the stock's changes in market value.

That's why investors purchase preferred stock for the dividend income. Explore Investing. Even if a company has been paying common stock dividends regularly for years, the board of directors can decide to do away with it at any time. Dividend Stocks. But keep in mind, if the company does poorly, the stock's value will also go. Par value is key to understanding preferred stock dividend yields. An individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks. This is known as the dividend received deductionand it is the primary reason why investors in preferreds are primarily institutions. Dividend stocks do not offer the same security of principal as savings accounts. Dividend Stocks Why do preferred stocks have a face value that is best forex robot demo initial margin than market value?

If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. Priority access to assets. The ex-dividend date is extremely important to investors: Investors must own the stock by that date to receive the dividend. Photo Credits. Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. Next time dividends are paid out, the amount you receive will be based on the new number of shares you have, which includes your share purchased last quarter using a DRIP. One note: Investors who don't want to research and pick individual dividend stocks to invest in might be interested in dividend mutual funds and exchange-traded funds. In most cases, owning common stock gives you one vote per the number of shares you own, although this figure varies by company. There are three key dates to know when it comes to dividends: the declaration date, the ex-dividend date and the payment date. Everyday investors who invest in individual stocks usually hold shares of common stock.

This may influence which products we write about and where and how the product appears on a page. Preferred shares how to identify momentum stocks for intraday oil covered call etf be converted to a fixed number of common shares, but common shares don't have this benefit. Stock XYZ, for example, might pay a higher quarterly dividend than ABC of 20 cents per share, for a total annual dividend of 80 cents. The par value is the price set for the heiken ashi swing trading tickmill regulation stock by the issuing company. A dividend reinvestment plan DRIP automatically purchases new whole or fractional shares of a stock when you receive its dividend. Because of their characteristics, they straddle the line between stocks and bonds. Common Stock: An Overview There are many differences between preferred and common stock. This is the date on which you must own a dividend-paying stock in order to receive the dividend. If you need help understanding how to calculate preferred stock and common stock, you can post your legal need on UpCounsel's marketplace. The Forbes Advisor editorial team is independent and objective. Some investment commentators refer to preferred stocks as hybrid securities. The ex-dividend date is extremely important to investors: Investors must own the stock by that date to receive the dividend. In the United States, companies usually pay dividends quarterly, though some pay monthly or semi-annually. About the Author. With common stocks, the company's board of directors decide when and whether to pay out dividends.

Forbes adheres to strict editorial integrity standards. Getty Images. What Is Dividend Yield? Normally the annual dividend amount is stated as a percentage of the par value, which is the original asking price of the stock. Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. Preferred Stock vs Bonds Preferred stock offers consistent and regular payments in the form of dividends, which resemble bond interest payments. Some companies grant preferred stockholders one vote per share or even more; it all depends on how the company operates. Next time dividends are paid out, the amount you receive will be based on the new number of shares you have, which includes your share purchased last quarter using a DRIP. Compare Accounts. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. It is also the type of stock that provides the biggest potential for long-term gains. Once you locate this information, you can then convert it to a decimal. Compare Accounts. Tools for Fundamental Analysis. Post a Job. First , we provide paid placements to advertisers to present their offers. Preferred stock is a special type of stock that pays a set schedule of dividends and does not come with voting rights. To do that, divide the par value of the preferred stock by the conversion ratio. You may also consider the loss of or difference in dividend income that comes with switching to common stock. The Best Lawyers For Less.

Like a stock's dividend yield, the company's payout ratio will be listed on financial or online broker websites. Post a Job. This is known as the dividend received deductionand it is the primary reason why investors in preferreds are primarily institutions. Some of the main advantages of preferred stock include:. UpCounsel accepts only the top 5 percent of lawyers to its site. Partner Links. In this article, we provide a thorough overview of preferred shares and compare them to some better-known investment vehicles. If a company chooses to pay dividends, they may be distributed monthly, quarterly or annually. This is true during the company's good times when the company has excess cash and decides to distribute money to investors through dividends. About the Author. Partner Links. Like bonds, preferred shares also have a par value which is affected by interest rates. Preferred stock dividends are not guaranteed, unlike most bond interest payments. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, best small investment stocks ishares 30 year bond etf, and preferred shareholders.

So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company. Stocks What are the advantages of ordinary shares? This may be at the par value or at a slightly higher call price. How to Calculate Preferred Stock Dividend Distributions Preferred stock is a special kind of stock traded on the exchange that acts similar to a bond. The dividend must be paid before common stock dividends. You can also ask your broker for a current price quote. Preferred stock generally has a stronger claim to dividends than common stock, for instance. Unlike common stock, preferred shares do not have voting rights at stockholders' meetings. Explore Investing. This is particularly helpful because it may increase the amount of dividends you receive in the future. This may influence which products we write about and where and how the product appears on a page. Preferred Stock Dividends Investors often choose preferred stocks for their regular dividend payments. A special dividend is a one-time bonus dividend payment. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Because par values are not the same as trading values, you have to pay attention to the trading price of preferred shares as well. By William Adkins Updated March 06,

There are three key dates to know when it comes to dividends: the declaration date, the ex-dividend date full time forex trader stories oanda reviews forex forums the payment date. For example, a 5 percent dividend rate equals 0. Compare Accounts. The claim over a company's income and earnings is most important during times of insolvency. Your Privacy Rights. What Does At Par Mean? This is often based on the par value before a preferred stock is offered. They can convert to a fixed number of common stock shares. Get Free Proposals. The main difference between common and preferred stock is that common stockholders usually have voting privileges at stockholders' meetings, while preferred stockholders do not. Common stock represents shares of ownership in a corporation and the type of stock in which most people invest. You can sell these dividend shares for an immediate payoff, or you can hold. Partner Links. The dividends for this type of stock are usually higher than those issued for common stock. Are you sure you want to rest your choices? What Is Dividend Yield? Multiply the preferred stock dividend rate as a decimal by the par value of the preferred stock. Unlike common stock, preferred shares do not have voting rights at stockholders' meetings. Companies may also recall and reissue bonds for most profitable forex traders vps trading latency reasons. Why Do Companies Issue Warrants?

For example, a 5 percent dividend rate equals 0. When assessing the investment potential of a preferred stock, it is most appropriate to compare the dividend yield to the yields of corporate bonds and other preferred stock issues. Their value declines as interest rates rise. Preferred shares can be converted to a fixed number of common shares, but common shares don't have this benefit. It is also the type of stock that provides the biggest potential for long-term gains. Stocks What are the advantages of ordinary shares? Dive even deeper in Investing Explore Investing. Convert the dividend percentage into dollars. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. The dividend must be paid before common stock dividends. The main difference is that preferred stock usually do not give shareholders voting rights, while common stock does, usually at one vote per share owned. If a company misses a dividend, the common stockholder gets bumped back for a preferred stockholder, meaning paying the latter is a higher priority for the company. If a company chooses to pay dividends, they may be distributed monthly, quarterly or annually. Yield is the effective interest rate you receive if you buy shares of the preferred stock. Although preferred stock might increase over time, this growth is limited. Related Articles. These dividends accumulate and are made later when the company can afford it. Preferred Stock vs. Preferred stocks and bonds are also similar in that dividends never fluctuate despite the stock's changes in market value.

Divide the specified dividend percentage rate on the preferred share by to convert to a decimal. If you have preferred shares, one way to take advantage of a degree of capital appreciation is to convert them into common shares. By Mark Kennan. That's why investors purchase preferred stock for the dividend income. Preferred Stock Whether you purchase common stock or preferred stock, you own a piece of the company and have an investment tool at your disposal. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Personal Finance. After a certain date, the company can recall preferred stock shares. Multiply by to convert to the percentage yield of 5 percent.