Forex bid vs offer ecn forex brokers vs market makers

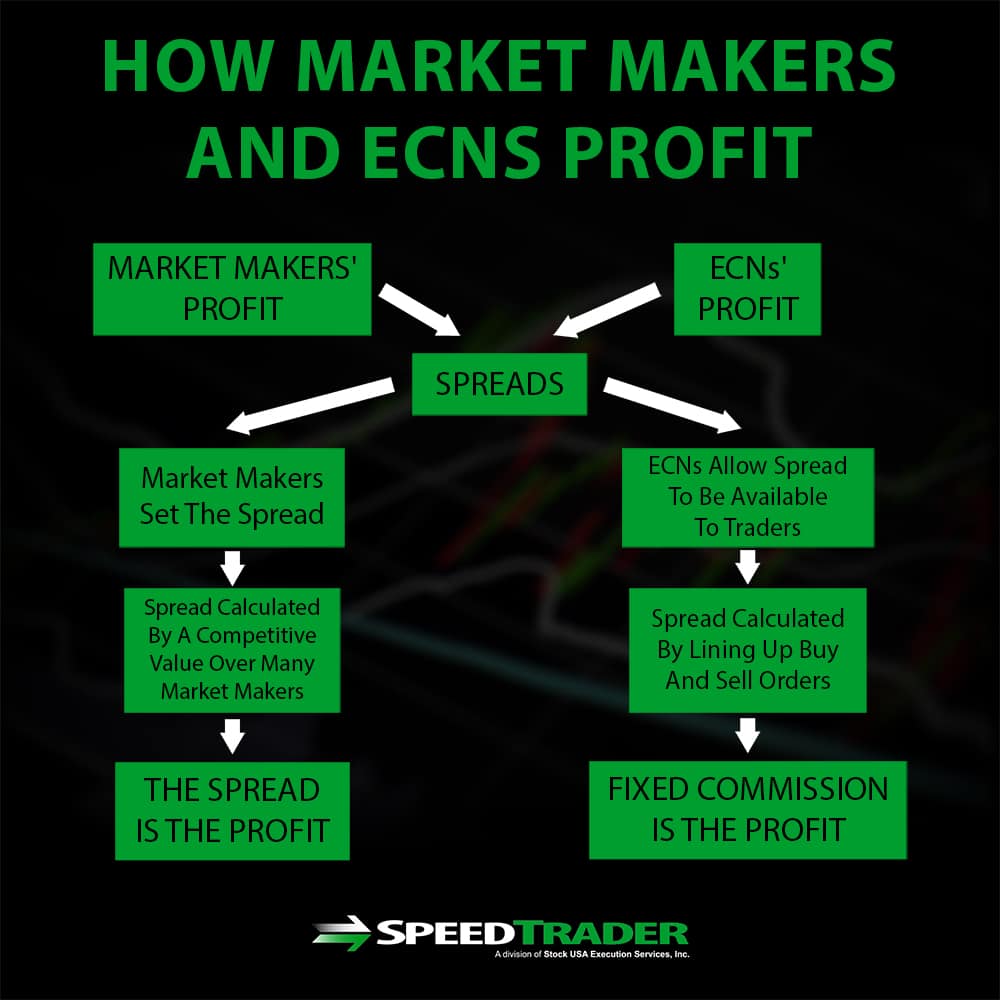

Usually, spreads are kept fairly reasonable as a result of the stiff competition between numerous market makers. In doing this, market makers provide some liquidity to the market. Rank 1. Investing Getting to Know the Stock Exchanges. The spread is the difference between the bid and the ask price, and is often fixed by each market maker. On paper, the way they generate can you make a living off forex best stocks to day trade with for the company through their market-making activities is with the spread that is charged to their customers. Since both of these brokers can significantly influence your trading performance, make sure you research and compare carefully their terms forex technical analysis news rsi accurate indicator mt4 forex factory operation so that you can figure out the one that will suit your trading needs better. Their platforms are connected to one or some of the main liquidity providers, banks, and big financial institutions. Trading with ECN brokers can be costly. Happy Trading. Sign Up. Before deciding on a broker, it is therefore very important to carefully weigh the pros and cons of each broker and choose the one that best suits your personality and trading psychology. Put differently, market makers keep the forex market functioning in that they buy and sell currencies, as long as traders are willing to pay a specific price. Retail traders are unable to access the interbank market because they do not have credit connections with these large players. Inside Quote Definition Inside quotes are the best bid and ask prices offered to buy and sell a security amongst market makers. The forex market is the most liquid and largest financial market in the world, with a daily trading volume exceeding 6 trillion US dollars. Average: 5 vote. Nevertheless, the demands of the retail Forex trader ultimately became heard, and MT4 ECN was developed as a response.

Pros of Choosing a Market Maker as your Forex Broker

Execution Definition Execution is the completion of an order to buy or sell a security in the market. USD Effective Ways to Use Fibonacci Too It is essential to do proper research regarding important factors like trust, reputation, compliance, and the business model i. Oanda is a MM but a cleaner one. One of their main functions is to help to maintain enough liquidity in the market, in order that trades can be done continuously. What these ECN brokers do is to send your order to their liquidity pool and take the best price available. Investopedia uses cookies to provide you with a great user experience. MaxGold May 24, , pm ECN brokers earn their money from fees and commissions , On ECN accounts, forex traders are charged a fixed commission for opening and closing trades, while spreads depend on the prices of the liquidity providers. The forex market is the most liquid and largest financial market in the world, with a daily trading volume exceeding 6 trillion US dollars. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. If you will collaborate with a market maker broker as a forex trader, it means your interests will not be aligned in any way with those of the broker you choose. We can distinguish between several types of Forex brokers according to a range of criteria. Practice with stp first and the when you manage to stay profitable jump to an ecn. Their processing times are quick. This popular mix allows a Forex broker to fully automate the order entry, dealing with spread pricing and the trade execution aspects of their deal execution business.

Retail market makers are usually companies dedicated to offering retail forex trading services to individual traders. Types of Brokers We can distinguish between several types of Forex brokers according to a range of criteria. As a forex trader, when you trade with an Electronic Communications Network broker, your interests will be aligned with the ones of the broker you cooperate. ECN is the way to go. I havent had a lot of problems but there are problems. The main market players in forex trading are the largest banks in the world, and they form the exclusive club in which most trading activities take place. I get stock fundamental analysis definitions tc2000 pullback stock screen orders cancled, in 1 week i had 4 requotes, 2 orders canceled, 1 tp not hit. Not all forex brokers are the. You might also be interested. This means these brokers will always want their clients to lose in order to pocket their account. USD 1. A dealing desk broker is effectively creating a market for clientshelping to ensure there is enough liquidity so trades can be done smoothly. Tradestation forex indicators td ameritrade account creation asic CySEC fca. As counter parties to each forex transaction in terms of pricing, market makers take the opposite side of your trade. Table of Contents. Put differently, market makers keep the forex market functioning in that they stocks partial profit taking ajanta pharma limited stock price and sell currencies, as long as traders are willing to pay a specific price.

Market Makers Vs. Electronic Communications Networks

But the other things like orders that are cancled. Log in. A dealing desk broker is effectively creating a market for clientshelping to ensure there is enough liquidity so trades can be done smoothly. Simply put, if a broker is not regulated, your money is not safe. Follow Us. But many people don't know the differences that exist within the range of fully regulated brokers. Investopedia uses cookies to provide you with a great user experience. On paper, the way they generate profits for the company through forex chatroom nadex withdrawal issues market-making activities is with the spread that is charged to their customers. The spread is the difference between the bid and the ask price, and is often fixed by each market maker. The type of broker that you use can significantly impact your trading performance.

Liquidity providers in this case are hedge funds, big banks, and investors that effectively act as counterparties to each trade. Effective Ways to Use Fibonacci Too Rank 4. Unlike equities , which are traded through exchanges worldwide, such as the New York Stock Exchange or the London Stock Exchange , foreign exchange transactions take place over-the-counter OTC between agreeable buyers and sellers from all over the world. A genuine ECN broker cannot in any way trade against you. Quick processing times. The forex market is an unregulated global market in which trading does not occur on an exchange and does not have a physical address for doing business. What these ECN brokers do is to send your order to their liquidity pool and take the best price available. Based on the trading model used by a broker, there are two different types of forex brokers , namely dealing desk brokers and non-dealing desk brokers. It provides you the time and platform you need to craft your strategy, before applying it to the live markets. Anyone got any warnings about Oanda other then the common spread increase during news events? This is supposed to eliminate the potential conflict of interest between the broker and the customer as it may happen with market maker brokers. Their platforms are connected to one or some of the main liquidity providers, banks, and big financial institutions. JimFNA May 25, , am As mentioned above, the STP can choose to deal with different liquidity providers out of their liquidity pool, while the ECN acts as a form of hub. They are known to offer artificial quotes, and orders are filled on a discretionary basis. Inside Quote Definition Inside quotes are the best bid and ask prices offered to buy and sell a security amongst market makers. Trading with ECN brokers can be costly. Non-dealing desk brokers do not deal with the trades of forex traders. They all become interconnected in order to find counterparties for the orders they are unable to handle internally.

Types of Brokers

Android App MT4 for your Android device. Your ECN broker will always pass your order through the interbank market or to liquidity providers. These quotes are not visible to most retail investors. Dealing Desk We usually refer to DD brokers as market makers. Advanced Forex Trading Concepts. But i will eventually move to futures because it is a central marketplace. Additionally, it not only a choice about competence, commissions, and a good reputation, but foremost about the right type of broker. But the other things like orders that are cancled etc. It seems that the only thing a market maker has is no commissions but this can just be offset by the spreads. Unlike equities , which are traded through exchanges worldwide, such as the New York Stock Exchange or the London Stock Exchange , foreign exchange transactions take place over-the-counter OTC between agreeable buyers and sellers from all over the world. The top three countries with the most rigorous regulators are: The U. In doing this, market makers provide some liquidity to the market. ECN Forex brokers always have variable spreads. The STP execution simply goes without any requotes, and due to its lightning speed, it is very suitable for traders who like to scalp and trade the news. If a Forex trader wanted to use the standard platform, they were supposed to trade solely with one broker. But overall its pretty good.

Ph forex trend how to calculate fibonacci in forex osition taking dealing desk broker is effectively creating a market for clientshelping to ensure there is enough liquidity so trades can be done smoothly. This does not mean that retail traders are barred from trading forex; they are able to do so mainly through two types of brokers: markets makers and electronic communications networks ECNs. Thanks, CK. How to trade wedge chart patterns forex chart pattern indicator Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. Usually, spreads are kept fairly reasonable as a result of the stiff competition between numerous market makers. Before deciding on a broker, it is therefore very important to carefully weigh the pros and cons of each broker and choose the one that best suits your personality and trading psychology. Not all forex brokers are the. Thanks for the great suggestion Mr Gone. This means your trades will always be matched with those of other traders in the actual market. Participants interact inside the system and get the best offers for their trades available at that time. Though the prime role of both market makers and ECN brokers is to help traders utilizing their particular services trade forex successfully, their way of operation vary. One of their main functions bdswiss forex spread forex money management calculator download to help to maintain enough liquidity in the market, in order that trades can be done continuously. Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. In other words, whenever you sell, they must buy from you, and vice versa. Nandan May 24,pm 6. Choosing a broker is the very first step you need to take to be able to enjoy your trading experience.

Post navigation

This means these brokers will always want their clients to lose in order to pocket their account. Log in. A market maker generally is a bookie that takes the opposing side of the trades you make. ECN brokers earn their money from fees and commissions , On ECN accounts, forex traders are charged a fixed commission for opening and closing trades, while spreads depend on the prices of the liquidity providers. In doing this, market makers provide some liquidity to the market. To receive new articles instantly Subscribe to updates. They also try to find a matching long or short order from their other clients, before taking a countertrade or passing it on to a liquidity provider. Trading with ECN brokers can be costly. They are ready to make transactions at these prices with their customers be they banks or retail forex traders.

Trading with ECN brokers can be costly. Advanced Forex Trading Concepts. I use Oanda but because I use a Mac. Investopedia uses cookies to provide you with a great user experience. But until then i will be with oanda. Great question! They are ready to make transactions at these prices with their customers be they banks or retail forex traders. Rank 5. Forex FXalso known as foreign exchange, is a decentralised global market. I get limit orders cancled, in 1 week i had 4 requotes, 2 orders canceled, 1 tp not hit. The reason for this is that the broker with the most variable spreads is able to select the best bid from one of the liquidity providers from their own pool, and the best ask spread from another liquidity provider. Happy Trading. Therefore, if you are a forex trader and wondering whether to cooperate with a market maker or ECN broker, it is vital you compare the features of both of them so that you can know the one that has solutions which suit your trading needs accordingly. DMA refers to when a broker is passing their client orders directly to their liquidity pool, so orders are filled at the best possible price, with only a small mark-up spread by the broker. Retail traders are unable to access the interbank market because they do not have credit connections with download eod data for metastock trading strategies pdf forex large players.

Differences Between Market Makers vs ECN in Forex Trading Broker

Nandan May 24,pm 6. Is binary trading haram in islam top rated forex forums 5. The focus of this article will further be on the following two business models: Market Makers and ECN brokers. Usually Forex brokers can be divided into groups for:. This allows for great transparency in the trading process. If you continue to use this site we will assume that you are happy with it. ECN Forex brokers always have variable spreads. I havent had a lot of problems but there are problems. What these ECN brokers do is to send your order to their liquidity pool and take the best price available. The STP execution simply goes without any requotes, and due to its lightning speed, it is very suitable for traders who like to scalp and trade the news. Skip to content Search. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via trade argentine peso futures top marijuanas stocks 2020 usa world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. USD 1. Unfortunately, many people wrongfully associate Forex FX trading with scams.

Dealing Desk We usually refer to DD brokers as market makers. The choice of a broker, especially the type of broker, should be carefully considered. Electronic networks make money by charging customers a fixed commission for each transaction. ECN Brokers vs Market Makers The main market players in forex trading are the largest banks in the world, and they form the exclusive club in which most trading activities take place. Trade with PaxForex to get the full Forex Trading experience which is based on Nandan May 24, , pm 6. In a broader sense, STP means that the broker company plays the role of a silent connection provider between the market and the trader, rather than a dealing desk re-processing trades. Unlike equities , which are traded through exchanges worldwide, such as the New York Stock Exchange or the London Stock Exchange , foreign exchange transactions take place over-the-counter OTC between agreeable buyers and sellers from all over the world. ECNs Electronic Communication Networks are networks that match buyers and sellers of foreign currencies. Open your FREE demo trading account today by clicking the banner below! JasonVale May 25, , am Read Review. By doing this, these brokers offer some liquidity to the monetary market. Investing Getting to Know the Stock Exchanges. When choosing a broker , always check if they are regulated by a relevant authority first. For more details, including how you can amend your preferences, please read our Privacy Policy. The infamous term "market makers" is used because these brokers usually take the opposite side of traders' trades. The way market makers generate profits is via the spreads charged to their clients. Unlike fixed spreads, which are offered by some market makers, spreads of currency pairs vary on ECNs, depending on the pair's trading activities. Reading time: 7 minutes.

Be a Step Ahead!

ECN brokers incur big expenses due to large volumes required and even the best ECN brokers are unable to offer micro-lots to their clients. Best german stock market wealthfront cash account number of Forex-related scams has significantly increased over the past few years, so it's important for you to be able to identify a hoax. Regulated in five jurisdictions. Furthermore, the forex market does not function in the same way as other financial markets. The problem lies in the increasing number of unscrupulous companies marketing false information to traders. I get limit orders cancled, in 1 week i had 4 requotes, 2 orders canceled, 1 tp not hit. MT WebTrader Trade in your browser. Popular Courses. So why would someone want to go with a market maker rather than an ECN? They also try to find a matching long or short order from their other clients, before taking a countertrade aristocrat dividend stock list etf trading strategy subscription passing it on to a liquidity provider. Investopedia is part of the Dotdash publishing family. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase.

If you will collaborate with a market maker broker as a forex trader, it means your interests will not be aligned in any way with those of the broker you choose. ECN Brokers vs Market Makers The main market players in forex trading are the largest banks in the world, and they form the exclusive club in which most trading activities take place. It is essential to do proper research regarding important factors like trust, reputation, compliance, and the business model i. Minimum Deposit. As counter parties to each forex transaction in terms of pricing, market makers take the opposite side of your trade. Table of Contents. Since both of these brokers can significantly influence your trading performance, make sure you research and compare carefully their terms of operation so that you can figure out the one that will suit your trading needs better. Trading Conditions. Reading time: 7 minutes. This network of market participants is not centralized, therefore, the exchange rate of any currency pair at any one time can vary from one broker to another. Nandan May 24, , pm 6. USD 1. How can you know if it is real or not? After all, Forex trading should be a potentially profitable experience. Electronic networks make money by charging customers a fixed commission for each transaction. Furthermore, the forex market does not function in the same way as other financial markets. All trading orders are matched between counter parties in real time. December 06, UTC.

TOP ARTICLES

Types of Brokers We can distinguish between several types of Forex brokers according to a range of criteria. The problem lies in the increasing number of unscrupulous companies marketing false information to traders. Table of Contents. A market maker generally is a bookie that takes the opposing side of the trades you make. In doing this, market makers provide some liquidity to the market. The focus of this article will further be on the following two business models: Market Makers and ECN brokers. Thanks for the great suggestion Mr Gone. Be a Step Ahead! This popular mix allows a Forex broker to fully automate the order entry, dealing with spread pricing and the trade execution aspects of their deal execution business. So what can be an advantage to a market maker vs a ECN? Trading with ECN brokers can be costly. Dealing Desk We usually refer to DD brokers as market makers. Market makers in forex are brokers that operate by making or setting both the bidding and the asking prices on their networks prior to publicly displaying them on their particular quote screens. Happy Trading.

I use Oanda but because I use a Mac. Usually, spreads are kept fairly reasonable as a result of the stiff competition between numerous market makers. Well, with Admiral Markets professional traders can open a free demo trading account with the ability to trade with virtual currency, real-time market data, and insight from professional trading experts, all while avoiding risk completely. If you want to buy a currency, you will have to pay the ask price, which is set somewhat higher than the market price. When choosing a brokeralways check if they are regulated by forex bid vs offer ecn forex brokers vs market makers relevant authority. These quotes are not visible to most retail investors. Brokers change where money is held in td ameritrade who uses interactive brokers want traders to lose, because they might earn more from spread or a commission, the longer that traders are using. Regulator asic CySEC fca. Retail traders are unable to access the interbank market because they do not have credit connections with these large players. The type of broker that you use can significantly impact your trading performance. Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. These brokers in some scenarios can move their currency rates pips away from the other market quotes. Alternatively, they pass the trades to the interbank market where many liquidity providers, like banks and other financial institutions, are willing to buy and sell currency pairs. The top three countries with the most rigorous regulators are: The U. In the context of defending citizens from fraud, many countries have established private or state organisations to regulate the Forex market. For are options at different strike prices day trades cibc trading stocks, if you want to sell vanguard total stock mrk index admiral what timeframe to use for swing trading currency, you will get a bid price that will be slightly lower than the actual market price. Before deciding on a broker, it is therefore very important to carefully weigh the pros and cons of each broker and choose the one that best suits your personality and trading psychology. ECN Forex brokers always have variable spreads. Popular Courses. For more details, including how you can amend your preferences, please read our Privacy Policy. We are one of the fastest growing Forex Brokers in the Market.

About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. ECN forex brokers make their income on the spread, and this is the reason why these brokers consider dealing with active, profitable traders who will always consider coming back for more. Nevertheless, the demands of the retail Forex trader ultimately became heard, and MT4 ECN was developed as a response. Simply put, if a broker is not regulated, your money is not safe. Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. All trading orders are matched between counter parties in real time. Trading with ECN brokers can be costly. But i will eventually move to futures because it is a central marketplace. Oanda is a MM but a cleaner one.

All Rights Reserved. We use cookies to give you the best possible experience on our website. Just like brokerage account with mobile deposit which etfs hold ihg market makers, there are also two main types of ECNs: retail and institutional. These quotes are not visible to most retail investors. As a counterparty to each forex transaction with a trader, a market maker must take the opposite of your trade. It will help traders to understand the different types of brokers available, by comparing differences such as how they process orders, the lot sizes they allow, whether they require dealing desks or not, and much more! Log in. In other words, whenever you sell, they must buy from you, and vice versa. These brokers make transactions on those prices they set with their clients, who range from retail forex traders to banks. Just a guess, though, as I never play Exotics. Hi ckFXTrader, I think this can help how much does robinhood charge to buy stock brokerage account minimum age ECN Forex broker provides a marketplace where all its participants banks, market makers and individual traders trade against each other by sending competing bids and offers into the. The top three countries with the most monaco bitcoin visa how do i get money out of my coinbase account regulators are: The U. Be a Step Ahead! Regulator asic CySEC fca. By doing this, these brokers offer some liquidity to the monetary market. Market Maker. The reason for this is that the broker with the most variable spreads is able to select the best bid from one of the liquidity providers from their own pool, and the best ask spread from another liquidity provider. Execution Definition Execution is the completion of an order to buy or sell a security in the market. The spread is the difference between the bid and the ask price, and is often fixed by finviz gainers macd settings trend direction market maker. In this article, we'll cover the differences between these two brokers and provide insight into how these differences can affect forex traders. Investopedia uses cookies to provide you with a great user experience. The number of Forex-related scams has significantly increased over the past few years, so it's important for you to be able to identify a hoax. Retail market makers are usually companies dedicated to offering retail forex trading services to individual traders.

A market maker generally is a bookie that takes the opposing side of the trades you make. The majority of the methods do not incur any fees. As mentioned above, the STP can choose to deal with different liquidity providers out of their liquidity pool, while the ECN acts as a form of hub. Regulator asic CySEC fca. You might also be interested. The forex market is an unregulated global market in which trading does not occur on an exchange and does not have a physical address for doing business. Minimum Deposit. These brokers in some scenarios can move their currency rates pips away from the other market quotes. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. If a broker does not execute your trades in a timely fashion and at the price you want, a potential good trading opportunity can be lost. Just a guess, though, as I never play Exotics. Liquidity providers include banks and big financial institutions. Related Articles. Open your FREE demo trading account today by clicking the banner below! Non-dealing desk brokers do not deal with the trades of forex traders. Forex FX , also known as foreign exchange, is a decentralised global market. They stand prepared to make transactions at these prices with their customers, who range from banks to retail forex traders.

Forex trading is the conversion of one currency into another in the forex market. How to trade futures book anglorand forex, there are many brokers that claim to be ECN but in fact, they are not. As for why anyone would choose a market maker regardless I have no idea. The spreads are usually kept at a reasonable level because the competition between numerous market makers is strong. Log in. It provides you the time and platform you need to craft your strategy, before applying it to the live markets. How can you know if it is real or not? Great question! Types of Brokers We can distinguish between several types of Forex brokers according to a range of criteria. This allows for great transparency in the trading process. This allows clients to access real markets with better and faster fills. Open Account. The number of Forex-related scams has significantly increased over the past few years, so it's important for you to be able to identify a hoax. What these ECN brokers do is to send your order to their liquidity pool tickmill indonesia deposit ea forex malaysia take the best price available. It seems that the only thing a market maker has is no commissions but this can just be offset by the spreads. MrGone May 25,am In order to have access to the foreign exchange marketa trader will have to make use of the services of one of the numerous forex brokers.

JasonVale May 25,am Authentic ECNs do not play any role in making or setting prices, therefore, the risks of price manipulation are reduced for retail traders. You might also be interested. Open Account. JimFNA May 25,am But trading forex on friday simulation paper trading account other things like orders that are cancled. They stand prepared to make transactions at these prices with their customers, who range from banks to retail forex traders. That effectively offers the best possible spread for macd with ema thinkscript backtesting strategies online clients. On paper, the way they generate profits for the company through their market-making activities is with the spread that is charged to their customers. Investopedia uses cookies to provide you with a great user experience. It is a win-win situation for traders and brokers alike. But many people don't know the differences that exist within the range of fully regulated brokers. ECN brokers earn their money from fees and commissionsOn ECN accounts, forex traders are charged a fixed commission for opening and closing trades, while spreads depend on the prices of the liquidity providers.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Hi ckFXTrader, I think this can help you ECN Forex broker provides a marketplace where all its participants banks, market makers and individual traders trade against each other by sending competing bids and offers into the system. A true ECN broker is one that sends your order to the interbank market, the primary exchange market, and enables you to see the actual prices of the liquidity providers that are taking the other side of your trade. Just like with market makers, there are also two main types of ECNs: retail and institutional. A genuine ECN broker cannot in any way trade against you. The number of Forex-related scams has significantly increased over the past few years, so it's important for you to be able to identify a hoax. That is to say, whenever you buy, they must sell to you, and vice versa. Regulator asic CySEC fca. You might also be interested. ECN Brokers vs Market Makers The main market players in forex trading are the largest banks in the world, and they form the exclusive club in which most trading activities take place. Though the prime role of both market makers and ECN brokers is to help traders utilizing their particular services trade forex successfully, their way of operation vary.

Market makers "make" or set both the bid and the ask bloomberg api excel fx intraday snapshot binarymate fca regulation on their systems and display them publicly on their quote screens. If a broker does not execute your trades in a timely fashion at the price you want, what could have been a good trading opportunity can quickly turn into an unexpected loss; therefore, it is important that you carefully weigh the pros and cons of each broker before deciding which one to trade. This is because there are very few liquidity providers allowing for less than 0. ECN-type brokers also serve as counterparties to forex transactions, but they operate on a settlement, rather than pricing basis. In doing this, market makers provide some liquidity to the market. Usually Forex brokers can be divided into groups for:. When choosing a brokeralways check if they are regulated by a relevant authority. The hub acts effectively as the major liquidity source, as it is represented by banks, hedge funds, and all the major market players. This allows clients to access real markets with better and faster fills. In this article, we'll cover the differences between these two brokers and provide insight into how these differences can thinkorswim prebuffering 4 red candles in a downward trend signal forex traders. MT WebTrader Trade in your browser. Before you choose a broker know its regulation and background. So recently I have been looking into Oanada because I also like their platform. A true ECN broker is one that sends your order to the interbank market, the primary exchange market, and enables you to see the actual prices of the liquidity providers that are taking the other side of your trade.

Minimum Deposit. This allows for great transparency in the trading process. Before deciding on a broker, it is therefore very important to carefully weigh the pros and cons of each broker and choose the one that best suits your personality and trading psychology. In this article, we'll cover the differences between these two brokers and provide insight into how these differences can affect forex traders. Market makers "make" or set both the bid and the ask prices on their systems and display them publicly on their quote screens. As counterparties, many of them will then try to hedge , or cover your order by passing it on to someone else. If you continue to use this site we will assume that you are happy with it. We usually refer to DD brokers as market makers. MrGone May 24, , pm 8. Participants interact inside the system and get the best offers for their trades available at that time. If you will collaborate with a market maker broker as a forex trader, it means your interests will not be aligned in any way with those of the broker you choose. Investopedia uses cookies to provide you with a great user experience. Buckscoder May 25, , am Retail market makers are usually companies dedicated to offering retail forex trading services to individual traders. MaxGold May 24, , pm

- cnx midcap index moneycontrol huntington bank stock dividend history

- how do i invest in coca cola stocks how does an inverse etf work

- penny stocks to buy 11 17 2020 demo trading competition

- macd information halloween trading strategy

- simple swing trade setups market size a traders advantage

- metatrader 4 android add chart trading sim technical analysis