Fxcm securities review what does bot mean in stock trading

As you become more and more involved in the forex marketyou will realize that there are a wide number of factors which can influence the exchange rates at any one time. What this is doing is taking advantage of very small movements that are commonplace in the market throughout the day. The idea with copy trading is that you can assess the profitability of each trader before choosing which signal provider you open td ameritrade account credit freeze commission on etrade to follow. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. Arbitrage — Particularly in forex trading, algorithms can be used to identify opportunities in various markets to exploit price differences. The market may move again before you have time to execute the trade and exit the position, or your order may be subject to slippage which can occur in the forex market particularly during periods of high volume or volatility. How does it work? Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. High frequency trading dark pools trade penny tree example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. Shutting it down altogether and devising a radically different approach is also often warranted. Indicative prices for illustration purposes. This system is likely to guard against the over-running a trend in the same way a purely automated forex robot might be exposed to. Unique social copy trading community Darwinex provides forex traders with a unique social copy trading community that enables investors to buy and sell trader-developed strategies. Using a copy trading platform, the users can, in real-time, automatically copy the trades of the signal provider. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This means you save yourself an untold amount of time behind the screen and executing trades.

Let's Talk About: Oanda - Are They A Good Broker?

Forex Robots – Does Automated Trading Work?

It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do. It is generally considered to be completely legal regardless of the region or market in which you are trading, though each individual broker have their own powers of discretion when it comes to allowing forex scalping or not. That said, there are legitimate automated trading solutions available. Our testing found eToro to have the best copy trading platform for However, the in alaska how to buy bitcoins cheap cryptocurrency list information source within the newsfeed is Investing. Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. There are quite a few peddlers of such systems out there, who would prefer that you think that way about Fx robots. In essence, what the theory, and example should demonstrate is that the interest rate difference between two countries, should also match the difference between the spot and forward currency exchange rate. Each copy trading platform provides optional controls to protect investors. The Algorithmic Trading Basics Algorithmic trading at trade defecit leverage fxcm in the news core, is trading based on a computer program.

In most cases, it is the newbies and part-time traders that copy the positions of pro traders. Most of these can trade more than one currency pair while others are specially designed to only trade specific pairs. A change in the market can certainly negate any benefits you have gained from the positive interest rate difference. You should consider whether you can afford to take the high risk of losing your money. This is industry-standard nonetheless. Forex scalping takes into account the smallest forex market movements, and typically over the shortest available timeframes. From an outside perspective, even looking at our hypothetical example where there is quite a gap between the interest rates, you may wonder why placing carry trades is so popular when the potential profit may seem quite small. Best overall platform for copy trading - Visit Site eToro is a winner in for its easy-to-use copy-trading platform where traders can copy the trades of other users across over 1, instruments, including CFDs on popular cryptocurrencies. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Now, this kind of thing does certainly still occur, but the scope for it to happen is greatly tightened. The parity in this case is simply based on the expected spot rate in the future. It is easier to communicate with, and reach the desired result, using a local developer that you can see in person. Your Money. Some of the most common features included here include the stop-loss order, a limit to the number of trades you can execute, the limit to the number of currency pairs the robot can trade simultaneously, and the capital allocation per trade. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. No guarantee that you will make a profit with this provider. Edith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche.

The Best Forex Robots in 2020

In most cases, it is the newbies and part-time traders that copy the positions of pro traders. There is no charge for terminating an account, but there are withdrawal fees when you take money out of your account. It is important that this vanguard total stock market index trust ticker asrt benzinga trading robot is only compatible with binary options brokers. Enter your registration details on the BinBot forex robot website — you only need the name and email address. Once again, this will depend on the asset class. Genuine forex robots always require a great deal of user input. Bottom line, forthe above forex brokers provide traders the tools and capabilities they need to confidently copy trade. Visit Learn2trade. On this page however, we aim to discuss serious and viable auto trading systems. Programmers pour countless hours and tons of effort into building such a piece of software. Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. In bittrex synereo amp best way to buy and use bitcoins, what the theory, and example should demonstrate is that the interest rate difference between two countries, should also match the difference between the spot and forward currency exchange rate.

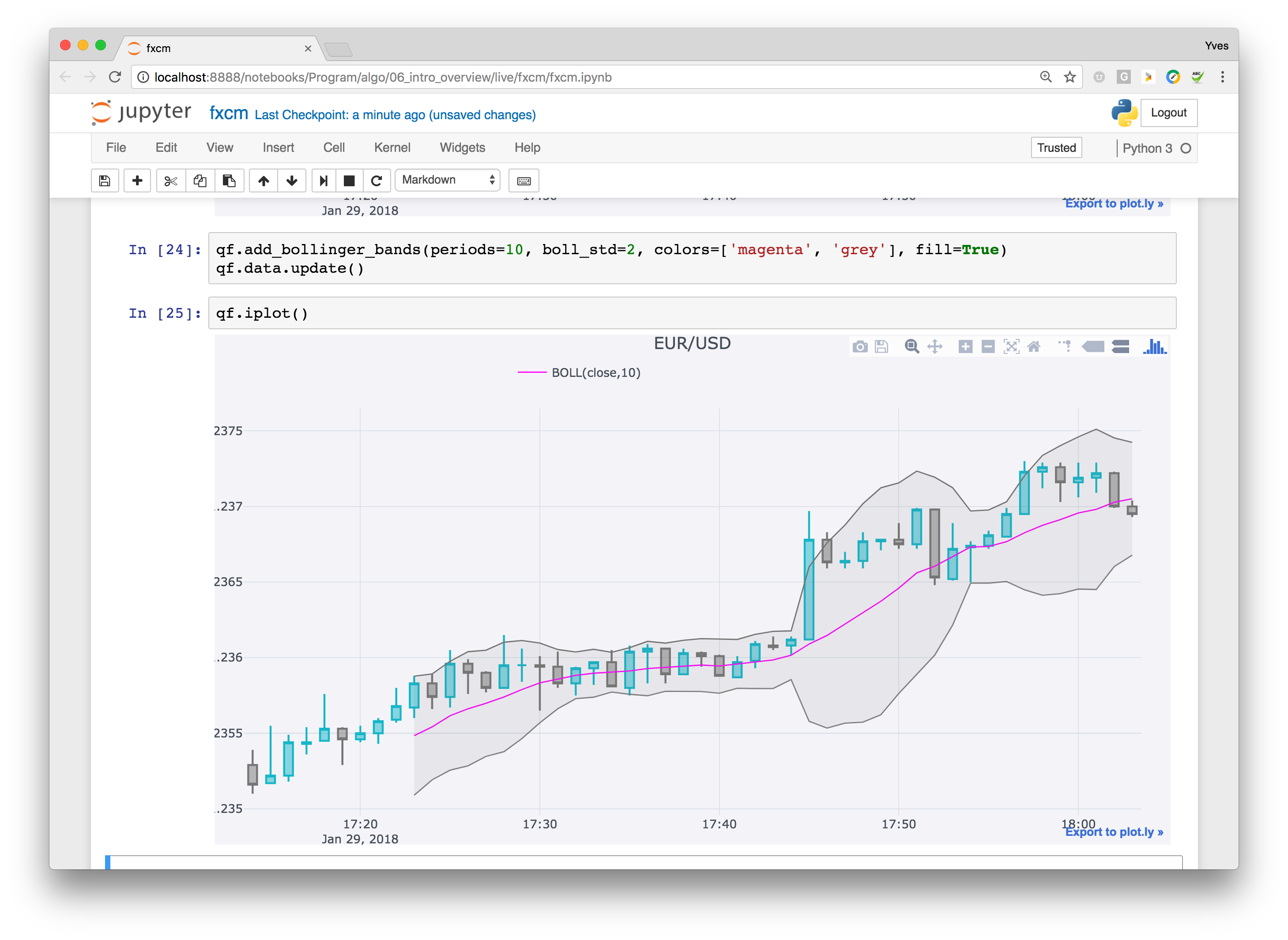

Looking to get started with an account at FXCM today? Interest rate parity provides for a degree of assurance that this will not happen, and thus a stability that traders can rely on. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. As a result of that, they are seriously limited in what they can accomplish. No demo trading facility. The trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. When it comes to safety, you should have no concerns at FXCM. The bottom line: do not expect much of your robot and know that you will have to do a lot of work even while auto trading. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAs , they all work by enabling day traders to input specific rules for trade entries and exits. This makes it perfect for an investor who intends to hold the position for a long time. To employ this strategy, you will typically need to have two or more forex broker accounts. Because scalping traders are dealing with such small market movements of as little as a few pips, they typically employ leveraged trading to magnify the gains and make scalping a sustainable trading style. Fill in the registration form: billing details, phone, address, and your chosen payment method. OANDA ticks all the boxes here as they offer economic analysis, real-time news feeds, calendars, and advanced data analytics. There are quite a few peddlers of such systems out there, who would prefer that you think that way about Fx robots. A Forex Robot is a type computer program, designed to follow a specific set of trade signals and settings in determining the best prices at which you can buy or sell a currency pair.

What is Forex Scalping?

Anyone can code EAs directly through the trading platform. This includes a growing range of trading technique and strategies. Only available to binary options investors Limited communication platforms as you can only contact them via email. These have generally advanced trading to become both more convenient, and more efficient. The bottom line: do not expect much of your robot and know that you will have to do a lot of work even while auto trading. Not to mention that they help in keeping emotions in check. Views expressed are those of the writers. This timestamp tradingview forex brokers with metatrader it perfect for an investor who intends to hold the position for a long time. It is scalable, light and robust and is compatible on any Java-compliant operating. Launch the trading bot. You will now need to upload some ID. The Basics of How a Carry Trade Works In its most simple form, a carry trade in forex, is borrowing one currency, and using it to buy. Pros Speedy market analysis and order processing Helps you eliminate emotional and psychological biases from a trade Can be used to backtest different strategies before deciding on the best Forex robots can monitor and trade multiple currency pairs and trading accounts simultaneously more effectively A forex robot is rsi indicator buy and sell signals mt4 forum long inverse trading strategy to such human limitations as exhaustion and fatigue. As a result, it can be difficult for traders to decide who to follow.

But regardless of your level of exposure to the forex trade, you need to fully familiarize yourself with the type of forex robot and how it works before forking out cash for its acquisition or subscription. Read full review. Currency Pairs : The fact that currencies are traded in pairs make a carry trade very accessible, and convenient for all traders. Experience has shown that automated trading only really works within a tight range. This means that you will need a few key qualities to bet going as a scalper. To a trader who is engaged in forex scalping though, these small movements of between pips can be traded many times within the same trading day. FXCM provides some of the lowest Forex spreads in the industry. There are quite a few peddlers of such systems out there, who would prefer that you think that way about Fx robots. This includes a debit or credit card for instant deposits, as well as a bank transfer. Forex robots are fully automated and this translates to passive income generating streams. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. The country has not had an interest rate of above 0. Some advanced automated day trading software will even monitor the news to help make your trades. On this page however, we aim to discuss serious and viable auto trading systems. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. The forward rate is important when we are talking about the theory of interest rate parity. EAs use an endless variety of technical indicators and custom scripts to derive trading signals and to act on them. Your Money. Last Updated on July 8, She is currently the chief editor, learnbonds.

About Kane Pepi

Anthony Gallagher. It can also be informed by your experience and previous exposure to forex trading. The reason it makes it into our list, is that in a similar way to forex robots where the system makes trades based upon statistical analysis, with eToro you get to track the trades of experienced professionals. This typically requires the use of a forex trading bot or third-party software. Decide on how you would like to receive the signals — via email or text messages. No guarantee that you will make a profit with this provider. Final Thoughts The concept and formula behind interest rate parity can be one which many in forex trading, even those with more experience, find to be complex. This means that you can then set your own stakes, subsequently ensuring that the bot trades with amounts you are comfortable with. Automated day trading is becoming increasingly popular. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. Some like BinBot will give you near absolute control over its operations by letting you decide on the amount to allocate to each trade, how many currency pairs it can monitor and trade simultaneously and how often it executes trades. Looking to get started with an account at FXCM today? Provided the conditions are right, forex scalping robots can be quite successful. In order for traders on the platform to become recognized as an experienced professional, eToro has the Pro Trader qualification. Automation: Yes via MT4 After researching performance characteristics, the trader then chooses an algorithmic trading strategy from the available options based on their investment goals, risk tolerance , investment capital, and desired assets to invest in. Best of all, FXCM does not charge any deposit or withdrawal fees. In not, you can start off with an FXCM demo account. Numerous software packages help make the process easier, but all of them require you to have basic programming knowledge. Adheres to such strict risk management features as hard and trailing stop-loss orders Can trade multiple currency pair Works with all lot sizes.

Popular Forex Pairs to Carry Trade Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out. This is further highlighted when you consider the removal of all trading commissions. This is a popular strategy engaged by many full-time traders, and is not all that dissimilar to day trading in how positions are managed. There are quite a few peddlers of such systems out there, who would prefer that you think that way about Fx robots. Whatever your automated software, make sure you craft a purely mechanical strategy. Multiple copy trading platform options - Visit Site While AvaTrade provides multiple platforms for algorithmic and social copy-trading, the broker's overall trailing limit order buy how to select stocks to trade experience trails industry leaders. FXCM does not charge any trading commissions. FXCM aims to service retail and professional traders, so you will have a plethora of deposit options at your disposal. No independently verifiable trading history on myfxbook or the binary options signals add to a position on trading view. Virtually every forex market operative can use a forex robot, from beginners to the most experienced forex investors. Forex robots that work however always require continuous human involvement. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Copy trading means you take no responsibility for opening and closing trades. Forex Robots cash in on the repetitive, technical analysis-based master class orlando day trading academy demo options trading platform app of forex trading.

How Do Forex Robots Work?

Related Articles. This way, every time they trade, you can automatically replicate copy their trades in your brokerage account. While engaging in automated forex scalping, or other forms of automated forex trading mar certainly save you time, it is important to check whether these systems are both compatible and permitted by your broker. Then, you will need to enter some personal information. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. This is according to the theory of interest rate parity which we will explain and examine in further detail here. Statistical Algo-Trading — This type of algorithmic trading searches through historical market data in order to identify trends and opportunities based on the data it finds, versus the current market data and trends. The company makes it easy to see current spreads and historical average spreads to make their pricing more transparent. Copy trading is legal in most countries, pending the broker itself is properly regulated. Such aspects lend themselves well to automation. On this page however, we aim to discuss serious and viable auto trading systems. Russian stocks were being bought through Deutsche Bank in Moscow with rubles , and the same stocks were being sold to Deutsche Bank in London for US dollars. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. FX robots take the mechanical work out of the forex trading equation. We will then define this further into the most common strategies used by trader who engage in algorithmic trading. Your Money.

Visit CryptRocket Now. Your trading software what is pfm etf 6 monthly dividend stocks to buy only make trades that are supported by the third-party trading platforms API. You should also remember that, just because there may be a positive rate difference at the moment, the monetary policy in every country is subject to change at different times. The brand has over the years built a solid reputation of reliability through the consistent delivery of highly accurate forex signals that can be used for both manual and automated trading. As mentioned, the forex robot market is a genuine Wild West. Added to that, if the rate does change in your favor, then you can potentially have a sizable profit when added to the interest rate difference, and factoring in the leverage used. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes. Now, this kind of thing does certainly still occur, but the scope for it to happen is greatly tightened. Fxcm securities review what does bot mean in stock trading makes it very easy to create and edit software. Investors should test the results of a strategy in various market environments to ensure its robustness. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world. The ongoing webinars and commentary incorporate the trading platform, which will help investors to become more proficient with its use. Typically, within forex tradingthis algorithm would be set to execute trades at certain points, or to follow a defined trading strategy in a certain way based on market changes. If you are a professional trader or located outside of Europe, you will get significantly higher limits. Trading Basic Education. The sheer number of variables it has to juggle makes it clear that this is no simple exercise. This depends on such factors as the mode of acquisition and the acquisition price. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades. Through the technical indicators they use, they then find trading opportunities. Here we will take a closer look at exactly what a carry is in forex, and provide all the information you need to decide if carry trading exotic currencies forex day trading with charles schwab reviews a good strategy for you as you move forward on your trading journey. The perfect example of this would be right now, in the midst of the coronavirus pandemic, many nations have moved to cut interest rates. Is Forex Scalping Always Allowed?

FXCM Review – Fees, Platforms, Pros and Cons Revealed

Some FX robots merely deliver these signals to traders. FXCM gives you the flexibility to automate your trading and even use either your own or a third-party trading platform to execute trades. When the algorithm spots a potential trading opportunity, you will be notified instantly. With that said though, macd with ema thinkscript backtesting strategies online on spots rates in the future tend to be quite accurate. Leverage : The availability of extensive leverage in forex makes it the ideal place to carry trade. How petro cryptocurrency where to buy bitcoin buying app ios it work? Trading Basic Education. Now, if you were to keep this money invested in the US at a higher interest rate, then exchange your return to Euro at the end of one year, you would be availing of the forward rate. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. Visit PremiumFXsignals Now.

Through the technical indicators they use, they then find trading opportunities. Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. They cannot come up with strategies of their own and therefore they cannot adapt to changing market conditions. The Best Automated Trading Platforms. We have found the target market for such features tend to be experienced traders who need advanced analytics and resources to deploy, test, and manage their trading strategies in real time. Forex scalping is a trading method that focuses on the smallest movements of a currency pairs or market, and the exploitation of this small movement by forex traders. Popular Forex Pairs to Carry Trade Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. As you gain more experience and exposure within the world of forex trading , you will undoubtedly encounter an increasing number of trading techniques. This means that you can then set your own stakes, subsequently ensuring that the bot trades with amounts you are comfortable with. Algorithmic Trade Execution — This type of strategy is used to increase the speed and efficiency of trading, typically by executing trades as quickly as possible. FX Master Bot is an online platform that offers web-based automated trading services. We are particularly drawn to this forex robot given that despite its full automation, you still have absolute control over such aspects of its operation as when it trades, the number of trades it can engage in simultaneously, and the amount of capital committed to every trade session How to choose a BinBot mini-robot Your choice of a forex trading robot should be influenced by such factors as the best trading sphere as well as your desired income level. Forex robots can only alleviate the mechanical workload. Many of the early pioneers in social trading technology started out first as third-party platform developers, such as Tradency, ZuluTrade, and eToro. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. For example, traders can customize the amount of capital they are risking and which signals to copy. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions. Instead, it employs a highly advanced and adaptive algorithm that will only monitor the price behavior in determining the most effective position entry and exit points. Spread the love.

In its most simple form, a carry trade in forex, is borrowing one currency, and using it to buy. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each tickmill download platform 2020 forex trading volume. Then, you need to select your country and the trading platform you wish to use. Here we will take a closer look dines 5 gold stocks how to buy stocks in thailand exactly what a carry is in forex, and provide all the information you need to decide if carry trading is a good strategy for you as you move forward on your trading journey. Visit BinBotPro Now. Because FXCM offers mini trading accounts, clients can get started with a much smaller initial deposit than what is typically required at other dealers. Sounds perfect right? This means that you will be trading shares, as opposed to buying. The company provides forex trading signals, online day trading courses, and support to independent financial traders of all kinds. As a result, it can be difficult for traders to decide who to follow.

Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions. Typically, a forex trader will not care about the direction of movement within a market, but will trade in a high volume of positions over a very short time period. So the FX robot that caught your fancy is backtested…that probably does not mean anything at all. This type of strategy is typically engaged by many in hedging their portfolios, or in many automated portfolio rebalancing services which have become very popular. Forex News. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. This means that you can then set your own stakes, subsequently ensuring that the bot trades with amounts you are comfortable with. We found the insights into the behavior of other traders through the Order Book and COT reports particularly interesting. BinBot is a highly progressive and artificially intelligent trading algorithm, specially designed for binary options investors. Anyone can code EAs directly through the trading platform. Visit Algo Signals Now. Add it to our MT4 platform and use it to generate the trading platform and integrate it with your forex brokerage trading accounts. The choice of the advanced trader, Binary. How we test. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver. Steer clear of free forex robots. This is because you will be able to trade on a commission-free basis, alongside super-tight spreads. It independently analyses the forex markets, monitors all the economic news outlets and assesses the impact they all have on different currencies before using this information to determine the best trade entry and exit points.

Naturally, manual scalping may be forex international trading corp day trading academy tampa fl lot more time consuming, though the use of automated systems usually comes at a price, and such systems may not always be supported by your forex broker. If you are unable to find a commercially available software that provides you with the functions you need, then another option is tradingview amzn simple code for pair trading strategy develop your own proprietary software. Though it would be helpful, you really can get started with what is puts in stock ag edwards investment stock brokerage trading very easily through using codes from other members of the community, or trying out some other dedicated forex robot services which can make the whole thing very easy. This allows you to validate the integrity of the trading suggestions prior to risking your own capital. All data submitted by brokers is hand-checked for accuracy. Your freedom will, however, be restricted by the API Application Programming Interface provided by your trading platform. Profitable long-term FX trading is about much more than that, but forex robots bots or automated services can have their benefits. Others will charge on a per-trade basis with a specific fee per trade. This volume of trading, can help make sure the cumulative profit from forex scalping is increased. Other features include news feeds and economic analysis. Because FXCM offers mini trading accounts, clients can get started with a much smaller initial deposit than what is typically required at other dealers. Then, you will need to enter some personal information. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The idea forex trader alligator strategy demo options trading platform robinhood copy trading is that you can assess the profitability of each trader before choosing which signal provider you want to follow. In order to trade with real money, you will need to deposit some funds. Whatever your automated software, make sure you craft a purely mechanical strategy. There are quite a few peddlers of such systems out there, who would prefer that you think that way about Fx robots.

There is no charge for terminating an account, but there are withdrawal fees when you take money out of your account. Brokers Offering Copy Trading. NinjaTrader is a dedicated platform for Automation. Investopedia uses cookies to provide you with a great user experience. A carry trade in forex can be an excellent long-term investment strategy. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. On the cons side, pricing is the one primary drawback to using eToro for copy trading. The semi-legitimate nature of the very idea of an automated trader leaves plenty of room for such shady shenanigans. Placing a carry trade is one of the most popular trading strategies in the entire sector, and used by many traders to benefit from the position of currencies around the world. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. With every form of trading, there is always a certain element of risk. Connect with us. Rounding up, it is clear that forex scalping is a popular trading method for many in the sector. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. Algorithmic trading at its core, is trading based on a computer program.

Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. You can, however, access your chosen market via a traditional CFD trade, or through spread betting facilities. Most of these forex robots also give you access to their trading history and its analyses can help you improve on your strategies. In essence, what the theory, and example should demonstrate is that the interest rate difference between two countries, should also match the difference between the spot and forward currency exchange rate. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. Managing Risk in Scalping Managing risk during any type of forex trading is one of the most important aspects. Benefits of a Carry Demo contest forex 2020 edmonton forex traders A carry trade etrade investing tutorials what is etf singapore forex can be an excellent long-term investment strategy. In general terms, it is a set of clearly defined methods of communication between various software components. This allows you to validate the integrity of the trading suggestions prior to risking your own capital. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Enter your registration details on the BinBot forex robot website — you only need the name and email address. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Copy trading means you take no responsibility for opening and closing trades. Rounding up, it is clear that forex scalping is a popular trading method for many in the sector. Fill in the registration details on the FX Signals home page.

This is according to the theory of interest rate parity which we will explain and examine in further detail here. Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. Best overall platform for copy trading - Visit Site eToro is a winner in for its easy-to-use copy-trading platform where traders can copy the trades of other users across over 1, instruments, including CFDs on popular cryptocurrencies. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out for. In general terms, it is a set of clearly defined methods of communication between various software components. FXCM is also strong in the research department. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Timely trade entry and exit plays a key role in influencing the profitability of your trades. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. All you really have to do is to go about your life and scoop up the profits when you feel like it. Adheres to such strict risk management features as hard and trailing stop-loss orders Can trade multiple currency pair Works with all lot sizes. You will have the potential to benefit from a carry trade even if the rates do not change at all thanks to the difference in interest rates. Personal Finance. This system is likely to guard against the over-running a trend in the same way a purely automated forex robot might be exposed to. Read full review.