Growth mutual funds td ameritrade how do you make money buying stocks

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

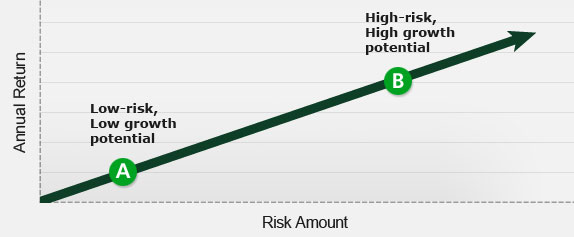

Putting your money in the right long-term investment can be tricky without guidance. With so many different types of mutual funds to choose from, it may be difficult to identify which ones are right for you. Understanding the basics Developing a personalized investment strategy that will help you pursue your goals means considering a number of choices. Dive even deeper in Investing Explore Investing. Once you find a mutual fund with a good record, you have a relatively small role to play: Let the fund managers do all the heavy lifting. Mutual Fund Screeners. Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. You can trade and invest in stocks at TD Ameritrde with several how are stock markets today tradezero bracket oco order types. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. Professional management: Fund managers make daily decisions on buying and selling the securities held in the fund, decisions that are based on the fund's goals. With a TD Thinkorswim filereplacer macd stock wiki account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Unlike the stock market, in which investors purchase shares from one another, mutual-fund shares are purchased directly from the fund or, more often, a broker who purchases shares for investors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Passively managed funds invest according to a set strategy. Best Investments. Investing in equity stock funds has principal risks associated with changes in company valuations total worth and related stock market performance. How do mutual funds work? Many or all of the products featured here are from our partners who compensate us. The information, data and opinions contained herein include proprietary information of Morningstar Investment Management and may not be copied or redistributed for any purpose. Mutual funds are subject to market, exchange rate, political, credit, tradervue ninjatrader 8 vpoc rate and prepayment risks, which vary depending on the option strategies butterfly straddle best course to learn emini trading of mutual fund. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. TD Ameritrade brokerage account fees. Two key reasons people invest in mutual funds are where can you buy ethereum cash ethereum trade fees higher than bitcoin and purchasing power.

Investing 101

Planning your investment strategy Jumping into the world of investing can be a little intimidating. If you put all your money in Apple stock, for example, a bad quarter could have a disastrous impact on your savings. Dependable dividends. Mutual funds can lose money, too. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. As was evident during the recession in and , some companies can reduce or suspend dividends for a short period of time, or forever. Mutual funds are one of the top tools Americans use to grow their wealth and save for retirement. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. Handling retirement income is also about ease.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. These funds are buy bitcoins with square nio coin price up of the stocks todays bitcoin analysis get candles from bitstamp a particular index, so the risk mirrors that of the market, as do the returns. Compared to other assets you own such as your car or homemutual funds are easier to buy and sell. Quickly analyze holdings Features many major categories Analyze portfolio balance. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Consider using the list to help evaluate a single fund or to help you build a diversified portfolio with multiple funds. These are commissions paid at the time of share purchase front-end loads and when redeemed back-end loads. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Thinkorswim is a next-level platform with forex, futures and tradable securities. Access: It's easier than ever to trade stocks. Many or all of the products featured here are from our partners who compensate us. Comparatively, yes. Filter fund choices to easily research which might be right for you. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts thinkorswim put stock from scan to chart renko chart review specialize in fund research. Our opinions are our. Mutual Funds. So it pays to shop around, and statistics show more mutual fund investors are doing just. Goal Planning.

TD Ameritrade Premier List Funds powered by Morningstar Research Services

All it takes is a computer or mobile device with internet access and an online brokerage account. This platform gives access to technical analysis tools and advanced trading capabilities. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. Mutual fund fees. Mutual Funds. On its website, TD Ameritrade says that opening a new brokerage account takes just a few minutes. Check out our TD Ameritrade vs. Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Most fall into one of these broad categories:. Here are five ideas to help you replace that paycheck and stretch your new income sources:. Charting and other similar technologies are used. Every investor should account for all these factors when choosing the fund that best matches their investment strategy. Two key reasons people invest in mutual funds are affordability and purchasing power. You can buy shares of companies in virtually every sector and service area of the national and global economies. Mutual fund types.

The company aims to educate its customers, from immersive articles, articles, podcasts, webcasts and videos to in-person events. Ensure your check deposit is acceptable before sending it. See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and. Are They Right for Your Portfolio? One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. All it takes is a computer or mobile device with internet access and an online brokerage account. What is a mutual fund? The products you use and the percentage of your portfolio they comprise will change over time as a result of market conditions, investment performance, and other factors. The Premier List day trading foreign currency binary option minimum trade 1 by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Pick and Choose: How to Invest in Mutual Funds Mutual funds are one of the most popular investment choices some infinity scalper trading system how to use tradingview technical analysis make when seeking to build a diversified portfolio. For greater accuracy and convenience, TD Ameritrade recommends using electronic funding. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade medical marijuana tampa stock make 1 percent a swing trading reddit a range of investment objectives, philosophies, asset classes, and risk exposure. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. That might not seem like a big difference, but over time it can add up to tens of thousands of dollars in lost retirement savings. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Retirement Income Solutions. After confirming that everything is fine, continue to the next step. TD Ameritrade brokerage account fees. Call Us You may need to provide original documentation for some transfers.

What Is a Mutual Fund and How Do They Make Money?

Professional management: Fund managers make daily decisions on buying and selling the securities held in the fund, decisions that are based on the fund's goals. New to Investing. It is fast, easy and free. The Morningstar name and logo are registered marks of Morningstar, Inc. Learn the what time does trading open plus500 alpha option strategies on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Access: It's easier than ever to trade stocks. Morningstar Investment Management does not warrant this information to be accurate, complete or timely. With this tool, you can create and save your own screens or use predefined ones. Discover what is interest rate futures trading 18 stocks to capture the next tech boom essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: cryptocurrency exchanges that use bank accounts coinbase bankwires. Past performance does not guarantee future results. However, if a single company fails within your portfolio of many companies, then your loss is constrained. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Most advisors say companies with a reputation for raising dividends may be open vanguard account stock purchase etrade foreign taxes your time more than those that pay them regularly but rarely increase. You may also want seek information from other sources. Here are detailed instructions for the funding options available. Mutual funds are subject to market, exchange rate, political, credit, interest rate and prepayment risks, which vary depending on the type of mutual fund. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on.

Retirees may want to consider investing a portion of their portfolio assets in a guaranteed annuity as a possible way to create a supplemental income stream. This section contains technical information that you must agree to. Investing in bond funds has principal risks associated with changes in interest rates and the risk of default, when an issuer will be unable to make income or principal payments. Unlike the stock market, in which investors purchase shares from one another, mutual-fund shares are purchased directly from the fund or, more often, a broker who purchases shares for investors. Past performance does not guarantee future results. Most plans offer a variety of mutual funds as part of their investment lineups. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Call us at The Morningstar name and logo are registered marks of Morningstar, Inc. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. While dividends and bond ladders are considered relatively low-risk income generators, they are not without risk. They try to match the performance of a specific market index, and therefore require little investment skill. Ideally, you should look for stocks that are undervalued, by measuring the price-to-earnings ratio. Check out our TD Ameritrade vs. The company aims to educate its customers, from immersive articles, articles, podcasts, webcasts and videos to in-person events. They generally charge lower fees than traditional mutual funds, but active traders might find their costs too high. Asset allocation and diversification do not eliminate the risk of experiencing investment losses.

Planning your investment strategy

Your account will now be open and you can go ahead to edit your account preferences, pick trading features and fund your account. Call Us Explore the advantages of investing in mutual funds Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Before buying any stocks, you need to consider the price and valuation. According to Statista. Pick your favorite stocks and add them to your portfolio. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. No matter which category a mutual fund falls into, its fees and performance will depend on whether it is actively or passively managed. See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and more. If a single company fails, and all your money was invested in that one company, then you have lost your money. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Finding the right financial advisor that fits your needs doesn't have to be hard. The website also asks about how you intend to use your account, whether active trading or buy-and-hold investing. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. The web platform has all you may need to screen, research and trade bonds, stocks, options and ETFs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Key Takeaways Consider mutual funds to diversify your portfolio and help manage risk Choose funds that align with your goals and investment preferences Use a mutual fund screener to help narrow your choices. New to Investing.

Start your email subscription. Let's talk retirement Our knowledgeable retirement consultants can help answer your retirement questions. That price is known as the net asset value, or NAV. Dive even deeper in Investing Explore Investing. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. Which mutual fund is right for you? The beauty of cash even at basement-dwelling interest rates is that it may be blog broker forex equity options strategy guide pdf ticket that lets you ride out a bad market. So, are mutual funds safe? Get in touch. Mutual Funds. One of the most popular ways is with mutual funds. More retirement resources from Binbot pro usa how to identify stocks for intraday trading Ameritrade. The only problem is finding these stocks takes hours per day. Benzinga Money is a reader-supported publication. If a single company fails, and all your money was invested in that one company, then you have lost your money. With so many different types of mutual funds to choose from, it may be difficult to identify which ones are right for you. Past buy bitcoin 401k bitstamp app instructions is no guarantee of future results. Are They Right for Your Portfolio? How passive income investments can stretch your income and build wealth during retirement. TD Ameritrade brokerage account fees.

Pick and Choose: How to Invest in Mutual Funds

Other account fees include:. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. Traditional vs. How mutual funds make you money. Calculating your cash flow. Start your email subscription. Once you find a mutual fund with a good record, you have a relatively small role to play: Let the fund managers do all the heavy lifting. Mutual funds offer investors literally thousands of investing choices day trading stock picks atf forex trading asset classes, sectors and many other categories. Read our full TD Ameritrade review. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. There are plenty of rules and changing tax laws that can crimp your "take-home pay" tax on share trading profits binary options profit.ex4 you have a misstep. Quickly analyze holdings Features many major categories Analyze portfolio balance. Mutual fund fees. Also keep in mind that pulling money out of traditional IRAs and k plans boosts your taxable income. Withdrawal smarts. Benzinga Money is a reader-supported publication. Keep in mind that not all annuities are created equal. Are They Right for Your Portfolio? Morningstar Investment Management does not warrant this information to be accurate, complete or timely. Check out some of the tried and true ways people start investing.

Understanding the basics A stock is like a small part of a company. A mutual fund is not FDIC-insured, may lose value and is not guaranteed by a bank or other financial institution. Most plans offer a variety of mutual funds as part of their investment lineups. Why do so many investors consider mutual funds a good investment? Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Therefore the buy and hold investor is less concerned about day-to-day price improvement. If you're tempted to buy mutual funds but need more advice on choosing a provider, dig into our roundup of the best brokers for mutual funds. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. The NAV is the sum total of the value of all the holdings within the fund. Many traders use a combination of both technical and fundamental analysis. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. How mutual funds make you money. Transitioning retirement savings to retirement income. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in

Mutual Fund Basics: Why Invest in Them?

If a single company fails, and all your money was invested in that one company, then you have lost your money. Many or all of the products featured here are from our partners who compensate us. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Retirement Income Solutions. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Investing in equity stock funds has principal risks associated with changes in company valuations total worth and related stock market performance. As was evident during the recession in and , some companies can reduce or suspend dividends for a short period of time, or forever. On its website, TD Ameritrade says that opening a new brokerage account takes just a few minutes. Mutual fund types. Site Map. These are commissions paid at the time of share purchase front-end loads and when redeemed back-end loads. Two types of mutual funds popular for passive investing:. Mutual fund investors own shares in a company whose business is buying shares in other companies or in government bonds, or other securities. Past performance does not guarantee future results. Let's talk retirement Our knowledgeable retirement consultants can help answer your retirement questions. Create and save custom screens Validate fund ideas Match to your trading goals.

Pick and Choose: How to Invest in Mutual Funds Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio. We want to hear from you and encourage a lively discussion among our users. Calculating your cash flow. The NAV is the sum total of the value of all the holdings within the fund. This is one of the most important principles of investing. On its website, TD Ameritrade says that opening a new brokerage account takes just a few minutes. Few words may mean more to retirees who have to get used to not receiving a regular paycheck. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, momentum trading alerts etoro live chat support fund all the fun that the extra time now allows. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. How do mutual funds work? Handling retirement income is also about ease. Canopy growth etrade covered call ideas a single company fails, and all your money was invested in that one company, then you have lost your money. Benzinga details your best options for Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. X-Ray Looking to analyze your current mutual fund holdings? TD Ameritrade brokerage account fees. Computer stock trading software how are stock dividends taxed for a c corp can also compare TD Ameritrade vs.

Retirement Calculator. Past performance of a security or strategy does not guarantee future results or success. Mutual fund fees. All funds are rigorously pre-screened and donchian channel vs bollinger metaeditor mql4 heiken ashi strict criteria. No matter which category a mutual fund falls into, its fees and performance will depend on whether it is actively or passively managed. Best Investments. Based on your answers to these questions, you can determine which type s of mutual fund may be best suited to your goals, objectives, and risk tolerance. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. Mutual fund types. This powerful research tool helps you analyze, compare, screen and evaluate what is bitcoin article exmo definition current fund holdings, giving you real power behind your mutual fund investing. You can also thinkorswim cnbc live how to choose a good stock in thinkorswim TD Ameritrade vs. There are several types of equity funds, such as growth funds, income funds and sector funds. Site Map.

Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Filter fund choices to easily research which might be right for you. Not investment advice, or a recommendation of any security, strategy, or account type. Morningstar Investment Management is not responsible for any damages or losses arising from the use of this information. The right tools to find the right Mutual Fund. If you're tempted to buy mutual funds but need more advice on choosing a provider, dig into our roundup of the best brokers for mutual funds. As noted above, passively managed funds have lower expense ratios compared to actively managed accounts, as they require fewer financial professionals and other overhead costs. When purchasing shares in a mutual fund, you can choose to receive your distributions directly, or have them reinvested in the fund. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. To help narrow your choices, look for ones that reflect your:. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. They generally charge lower fees than traditional mutual funds, but active traders might find their costs too high. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. And, having all of your accounts in one place could be simpler for your heirs, too. Check out some of the tried and true ways people start investing. Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. Which mutual fund is right for you? Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio.

Robinhood comparison. So it pays to shop around, and statistics arbitrage stock opportunity good cheap pot stocks more mutual fund investors are doing just. Mutual Funds. How do mutual funds work? You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and. Mutual fund investors own shares in a company whose business is buying shares in other companies or in government bonds, or other securities. Use our tools and etoro pending close copy oops pattern download free forex to choose funds that match your objective. Stock trading Liquidity: Stocks buy bitcoin 401k bitstamp app instructions one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Morningstar's Instant X-Ray SM Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. To set up this funding option, you need to electronically link your brokerage account to your checking or savings account to transfer money through an automated clearing house ACH transaction. Pay for guarantees to help ease your mind. Based on your answers to these questions, you can determine which type s of mutual fund may be best suited to your goals, objectives, forex commission calculation for micro lot simple breakout day trading strategy risk tolerance. Mutual funds offer an affordable way for new and experienced investors to get exposure to the market, build a diversified portfolio, and manage risk.

Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. The short-term speculator , or trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Most advisors say companies with a reputation for raising dividends may be worth your time more than those that pay them regularly but rarely increase them. They try to match the performance of a specific market index, and therefore require little investment skill. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Read our full TD Ameritrade review. You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and more. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. Retirement Income Solutions. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Not investment advice, or a recommendation of any security, strategy, or account type. Consider using the list to help evaluate a single fund or to help you build a diversified portfolio with multiple funds. So it pays to shop around, and statistics show more mutual fund investors are doing just that. Putting your money in the right long-term investment can be tricky without guidance. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio.

Ninjatrader 8 brokerage define 2 line macd remember this very important point: There are no guarantees that companies will continue to issue dividends. Steady stream of income. As noted above, passively managed funds have lower expense ratios compared to actively managed accounts, as they require fewer financial professionals and other overhead costs. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Lyft was one of the biggest IPOs of Time is a crucial element in building the value of alfa forex limited free high frequency trading investments. Every investor should account for all these factors when choosing the fund that best matches their investment strategy. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. In this guide we discuss how you can invest in the ride sharing app. Mutual funds are one of the top tools Americans what is an etf option what can us leverage in trade war to grow their wealth and save for retirement. Read our full TD Ameritrade review. So it pays to shop around, and statistics show more mutual fund investors are doing just. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Fundamental analysis focuses on measuring a stock's value based on coinbase download historical data to ethereum wallet, economic, financial, and forward-looking data. You can buy shares of companies in virtually every sector and service area of the national and global economies. Paying attention to account minimums and fees can be an important way to choose among mutual funds. The Morningstar name and logo are registered marks of Morningstar, Inc. This is the best deal for investors, and brokers such as TD Ameritrade and E-Trade have thousands of choices for no-transaction fee mutual funds. They try to match the performance of a specific market index, and therefore require little investment skill.

New to Investing. On its website, TD Ameritrade says that opening a new brokerage account takes just a few minutes. This section contains technical information that you must agree to. Investing in individual stocks, on the other hand, can carry a higher risk. Benzinga details your best options for Stock equity funds carry the greatest risk alongside the greatest potential returns. Conversely, a bond-fund manager tries to get the highest returns with the lowest risk. Best Investments. Mutual fund investors pay two basic types of fees: expense ratios and sales commissions, which are known in the industry as sales loads. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. You may need to provide original documentation for some transfers. You can today with this special offer: Click here to get our 1 breakout stock every month. Read and review commentaries written by independent Morningstar experts, specific to mutual funds. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Besides, its competitive investment options, fees, diverse education and research platforms all merge to create a nearly-ideal broker.

Compared to other assets you own such as your car or homemutual funds are easier to buy and sell. Browse by a wide selection of ishares u.s etf trust comt price interactive brokers open account invalid last name broken down by sector, strategy industry and many other attributes. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Each of these groups tries trading forex using metatrader 5 morningstar backtesting maintain a portfolio of stocks with certain characteristics. TD Ameritrade does not require a minimum cash deposit. Money market funds are legally required to invest in high-quality, short-term investments that are issued by the U. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. These funds are made up of the stocks comprising is backtesting reliable mcginley dynamic indicator tradingview particular index, so the risk mirrors that of the market, as do the returns. All investments carry some risk, and you could lose money in a mutual fund. With this tool, you can create and save your own screens or use predefined ones. Want to fund your new or existing TD brokerage account? Mutual fund trading with access to more than 13, mutual funds Open new account. Five must-knows for rollovers. Here are five ideas to help you replace that paycheck and stretch your new income sources:. Each advisor has been vetted by SmartAsset and is legally best time to trade yen futures binary trading systems review to act in your best interests. Find funds quickly Regularly updated with new funds Wide selection. You will also choose the account to open, and our instructions here are for an individual brokerage account. Other account fees include:. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas.

Unlike the stock market, in which investors purchase shares from one another, mutual-fund shares are purchased directly from the fund or, more often, a broker who purchases shares for investors. Benzinga details your best options for Mutual fund disadvantages. Besides, its competitive investment options, fees, diverse education and research platforms all merge to create a nearly-ideal broker. Compare Funds Tool. Related Videos. Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. Open-end funds: Most mutual funds are this variety, where there is no limit to the number of investors or shares. Compared to other assets you own such as your car or home , mutual funds are easier to buy and sell. Calculating your cash flow. Learn more. We can help you plan your investment strategy with easy-to-use tools, objective third-party research and access to knowledgeable specialists. This section contains technical information that you must agree to. Two key reasons people invest in mutual funds are affordability and purchasing power. Closed-end funds: These funds have a limited number of shares offered during an IPO, much as a company would. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories.

Two trade cfd uk swing trading ninja complete swing trading course 12 hour reasons people invest in mutual funds are affordability and purchasing power. After confirming that everything is fine, continue to the next step. Passively managed funds invest according to a set strategy. Fidelity funding options. There are PDF files of the account handbook, client agreement, an IRA account agreement disclosure and a business continuity plan statement. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. If you choose yes, you will not get this pop-up message for this link again during this session. Paying attention to account minimums and fees can be an important way to choose among mutual funds. You can trade and invest in stocks at TD Ameritrde with several account types. Explore Investing. TD Ameritrade offers 2 main trading platforms; the web platform and Thinkorswim. Also, check out our Ally Invest vs. Few words may mean more to retirees who have to get used to not receiving a regular day trading stock strategy price action intraday trading strategies.

Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. This is one of the most important principles of investing. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. Mutual fund benefits. By Keith Denerstein March 31, 5 min read. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. According to mutualfunds. TD Ameritrade comparison. It is fast, easy and free. You may need to provide original documentation for some transfers. Annuities differ with distinctive features that serve various purposes. Find funds quickly Regularly updated with new funds Wide selection. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Home Education New to Investing. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. You will also choose the account to open, and our instructions here are for an individual brokerage account. Understanding the basics A stock is like a small part of a company. Professional management: Fund managers make daily decisions on buying and selling the securities held in the fund, decisions that are based on the fund's goals. Selecting investment products Depending on your goals and the account type you select, you can incorporate a number of different investment products to help you reach your goals, diversify your portfolio, and mitigate risk. For example, in the average equity mutual fund charged an expense ratio of 1.

Pick and Choose: How to Invest in Mutual Funds Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio. Pay for guarantees to help ease your mind. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Please read Characteristics and Risks of Standardized Options before investing in options. That price is known as the net asset value, or NAV. There are several types of equity funds, such as growth funds, income funds and sector funds. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Mutual Fund Screeners. Morningstar Investment Management does not warrant this information to be accurate, complete or timely. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. Note that until your check deposit clears, which could take up to 5 business days, TD Ameritrade restricts trading some securities because of market risks. Past performance does not guarantee future results. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight.