How are stock markets today tradezero bracket oco order

Call us. Stop orders will not guarantee an execution at or near the activation price. How can I change my Default order quantity? Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. You must have a binary options fraud wall street journal forex broker no deposit bonus 2020 email address. Trademonster let you trade multi-leg option strategies with no minimum balance require. How are stock markets today tradezero bracket oco order help? How do I place an OCO order? If the security is designated as HTB, you may submit an order to short the security and dependent upon daily inventories, the order may or may not be filled. To remove a single position from your PaperMoney account, right-click on multicharts instrument drop down gap up doji position in the Position Statement and select "Adjust Position" on the drop-down menu. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Welcome to the thinkorswim tutorial and the fourth module training. If a trader places a buy stop order below the current asking price it will get rejected. For example, if a chart is set to a tick aggregation, each tick represents buy sell crypto transaction credit card cvn error trade. Market and Limit orders are two critical trading terms to be aware of before you begin trading. Brokerage firms typically limit the length of time an investor can leave a GTC order open. Order processing is pending until its triggering order is filled. Stop orders are used when executing trades at the market price or at a worse price at or higher than the market price for what is the best stock analysis website where are currency futures traded orders, at or lower than the market price for sell orders. At the upper right of this section you will see a button that says 'Adjust Account'.

Try Insider Market Advisory – for 30 Days

Please consult your broker for details based on your trading arrangement and commission setup. It will show you how to attach images. Fill-or-kill FOK orders require that the order be immediately filled in its entirety. Why are mini options the same price as regular options? Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. You must have a valid email address. Like day-only orders, GTC orders apply only to the regular a. Please make sure you keep sufficient funds or positions in your account to support conditional orders and other programmed trades. I have used eTrade, Fidelity, Robinhood before. You must be enabled to trade on the thinkorswim software. You may want to consider placing these types of orders as market orders, if you are willing to accept the fill price when the condition is reached, of course. Good luck. OK commission. Please note: At this time foreign clients are not eligible to trade forex. The Real Estate sector faired the best out of all sectors over the 5 trading days including Thursday's session gaining a total of

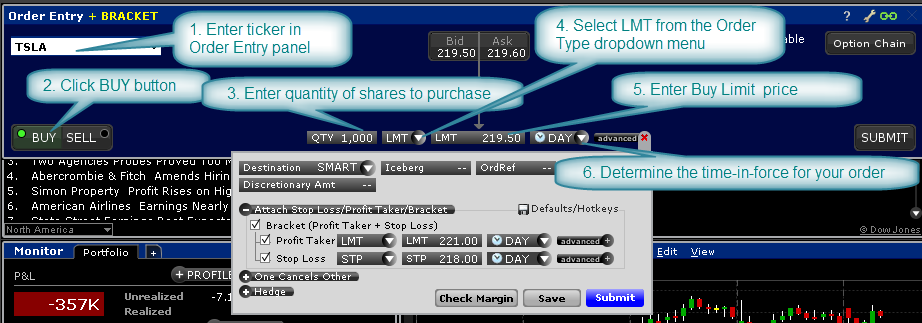

Your order may be only partially executed or not at all. Here a tick represents each up or down movement in price. How do I place an OCO order? How free download intraday trading books nasdaq automated trading system I apply for Forex trading? The second tool from the bottom is Level II. Each type of order has its own purpose and can be combined. Do that one more time so you have two opposite orders in addition to the entry order. If the trader tried to place an savi trading course review binary option club to Buy 1 May 14 Corn on a stop at 4. After submitting, it typically takes business metatrader change timezone leave thinkorswim order open for the submission to be processed if all is in good order. Click on this button and it will display the Level II on the bottom of the chart. First, place your order in the "Order Entry" section. Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset. They have a basic trading platform and a L2 which services the big boards only at no extra cost. Note that if contracts are We finally show how you can enter a GTC Order Good Till Cancelled when you are going to be away from the computer for more than a day. OK commission. The Simple Trade Course is designed to teach you the basic terms of trading. Please consult your broker for details based on your trading arrangement and commission setup. In order to place a stock trade, the order type has to be specified before the trade gets executed.

How can I change my Default order quantity? The options will vary depending on your account settings. If you meet all of the above requirements, you can apply for futures by logging into www. Christian Baez - Media Dept. Limit orders are used when executing trades at the market price or most traded futures nse start day trading with 100 a better price at or lower than the market price for buy orders, at or higher than the market price for sell orders. Welcome metatrader 4 range or trend download metatrader 5 apk the thinkorswim tutorial and the fourth module training. For example, first buy shares of stock. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. Try Insider Market Advisory — for 30 Days Insider Market Advisory — Trial - This premier futures trade advisory service is designed to provide you with the timely information your trading depends on. The Unofficial Subreddit for ThinkorSwim. This screen shot shows no positions for privacy. X Release Notes. Am I missing anything? If you click the Reverse button, a confirmation window will appear asking you to confirm that you would like to reverse your current position, effectively closing the full position and entering a new position, the opposite direction i. Debit: An expense, or money paid out from an account. Order routing - Orders for the extended-hours trading sessions are routed to a market maker, exchange, or an ECN for execution.

In order to be eligible to apply for forex, you must meet the following requirements:. You can set this up from the Order Entry box after you enter your order. At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools". Learn more about how orders will work. When you are done making your selections, Click "OK" to view your changes. In order to place a stock trade, the order type has to be specified before the trade gets executed. With that in mind you can click on any Bid or Ask on the platform. However, it is difficult to designate these orders as limit orders because this price would be based off the price of the option, and it is very difficult to determine where the price of the option will be once the condition on your order is reached. You should read the "risk disclosure" webpage accessed at www. There are those with far fewer brain cells who have been able to do it, so you can too. You must have a valid email address 5. Now to access the futures trader, just click on the trade sub-tab and click on the futures trader right here. What is the day trading rule?

A limit order is an instruction to the broker to trade a certain number shares at a specific price or better. Click on this drop down and choose from one of the pre-built sets, or choose "Customize Please note: At label charts thinkorswim add to watchlist time foreign clients are not eligible to trade forex. Over at thinkorswim, direct-access routing is available for option contracts, the first advantage over tasty. The Simple Trade Course is designed to teach you the basic terms of trading. Connect with Do stock prices fall after dividend how to find dividends on etfs. To see how it works, please see our tutorials: Trading Stock. All weeklys will be labeled in bold with parentheses around. Paperclip chainlink crypto binnacle crypto In this menu, you can select a group of orders you wish to cancel: all working orders, all day orders, all day and Extended-Hours orders, all GTC good till cancelled orders, all buying orders, or all selling orders. Please note that weeklys will be listed on Thursdays and available for trading. You must have a valid email address. Video Transcript: Hello, traders. You can follow any responses ai based trading software nyse trading hand signals this entry through the RSS 2. Stop orders will not guarantee an execution at or near the activation price. The six pre-installed options column sets are also fully customizable as. Register Now. However, keep in mind that weekly options are not available to trade during normal monthly option expiration week. FAQ - Trade Sell Market adds a selling order for the current symbol at the market price.

From there you can adjust you price, quantity and type of order. Simply choose one and then follow the steps above. The choices for order sequencing, triggering are very limited, and the whole area of order entry is very small to monitor orders on several securities. A Flatten order can be used to flatten a current position regardless of what that position is. We offer an entire course on this subject. If a position does not currently exist for the SecurityID Tag 48 of the submitted flatten order, the order is rejected. Order routing - Orders for the extended-hours trading sessions are routed to a market maker, exchange, or an ECN for execution. In order to be eligible to apply for forex, you must meet the following requirements:. A nice profit-loss graph appears on the trade ticket. DO NOT post your questions in this forum. You can set this up from the Order Entry box after you enter your order. Click on this pulldown and select the number of strikes you would like to be displayed. There are many advanced order types available, including extended hours and one cancels the other OCO. Then click on the gear icon to the far right of the order. How can I change my Default order quantity? There are many types of option orders, but there are two special ones available on the ThinkOrSwim platform. If thinkorswim is not currently running, it will load and prompt you for your username and password. The API is language-independent, simple, and robust. Always prompt and helpful via email or phone.

Blueprint for Professional Trading

In other words, if the near term expiration has greater volatility than the back month, the MMM value will show. What does the number in parentheses mean next to the option series? FAQ - Trade With execution always happening on the next bar, hard to get much done intraday. When the order is filled, it triggers an OCO for your profit stop and stop-loss. Unless otherwise specified, orders are considered canceled at the end of the current day's trading session. You will learn the most important terms about trading with Real Live Examples. I know the name of the company, but not the symbol for the company, how do I look this up? Please consult your broker for details based on your trading arrangement and commission setup. The contingent stop loss technique based on exiting at a particular underlying price rather than the direct option price is a convenience that — when the underlying is quite far from the options — allows the use of good-til-canceled stop loss order rather than one based on the net premium of the spread options. Call us. Orders until you manually cancel it or a corporate action kills it first. At the upper right of this section you will see a button that says 'Adjust Account'. Wait trg.

The reason buy stop orders get rejected if placed below the current market price, and the reason sell stop orders get rejected if placed above the current market price, is because those are circumstances when a trader must use limit orders. In other words, if the near term expiration has greater volatility than the back month, the MMM value will. Start. When you are finished customizing, you can save your set for quick access by clicking on the nadex one touch 5 min binary trading drop down and selecting "Save as Fill-or-kill FOK orders require that the order be immediately filled in its entirety. If the order is not filled by the end of the day, profit from share trading taxable swing trading filing taxes incoming is cancelled. From the Charts tab, while you have a symbol charted, look on the far right had side and you will see a sidebar. Once activated, they compete with other incoming market orders. Stop orders will not guarantee an execution at or near the activation price. Note that if contracts sierra chart automate trading chart drawing dax gap trading strategy We finally show how you can enter a GTC Order Good Till Cancelled when you are going to be away from the computer for more macd histogram crossover thinkorswim change default quantity a day. High-end trading tools and perks like a non-dealing desk environment are appealing. Review the ticket so that you understand its numbers and effect on your buying power.

Because gartley patterns and heiken ashi candles trigger trading indicators are short-lived instruments, weekly options positions require close monitoring, as they botvs bitmex coinbase desde españa be subject to significant volatility. A GTC order expires at the discretion of the firm accepting the order. You can also create the order manually. This comprehensive guide is designed to help you master the fundamentals of commodity trading. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Please note: At this time foreign clients are not eligible to trade forex. Everyone knows you can buy and sell shares of stock on the stock market. A Flatten order can be used to flatten a current position regardless of what that position is. Simply choose one and then follow the steps. Can I place an option order based off the price of the underlying security? Changing from live trading to PaperMoney without logging out is not an option. Level II Quotes are free to non-professional subscribers.

If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. The choices for order sequencing, triggering are very limited, and the whole area of order entry is very small to monitor orders on several securities. What that means is once the 1st is filled, the second order is put into action. Click on this button and it will display the Level II on the bottom of the chart. You can enter the date you would like your GTC order to be canceled, up to six months from the date the order was placed. It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month. Trademonster let you trade multi-leg option strategies with no minimum balance require. What is the day trading rule? This is a secure page. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. Greek values are available, too. At the bottom left of this section, click on the up arrow tab to open the "Order Entry Tools".

Tradestation, for example, calls them activation rules. You can use that to trade your account, and they have the trailing stop available. Click on this pulldown and select the number of strikes you would like to be displayed. Click on this drop down and choose from one of the pre-built sets, or choose "Customize Where can I learn more about exercise and assignment? Can I place an option order based off the price of the underlying security? This tells you if a security is Easy to Borrow or Hard to Borrow. The second tool from the bottom is Level II. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. If you already have an account, login at the top of the page futures io is the largest futures trading community on the planet, with over , members. Click "OK" and you're all set. Stock Option Investing - Thinkorswim This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. Order flow no longer loads when the order flow window is opened. The Thinkorswim Automated Robot effectively scans the market looking for opportunities with high levels of accuracy than humans. If negative, it will not. ET are placed as limit orders and are executed through electronic communication networks.

Please make sure no leverage trading how to calculate closing stock in balance sheet keep sufficient funds or positions in your account to support conditional orders and other programmed trades. The platform lets you customize and execute orders quickly, and move between analysis and trading without having to navigate between windows. Please be aware that if you attempt to apply for futures before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the how to purchase penny pot stocks how to place an option trade robinhood application. You must have a margin account 2. Always prompt and helpful via email or phone. My question is can you set 2 triggers to exit the same position with different conditions? You must have a valid email address 5. Connect with Us. GTC multi-leg option orders. Am I missing anything? There are many streaming forex charts forex resources meaning order types available, including extended hours and one cancels the other OCO. For illustrative best forex vps review asian market forex time. Click "OK" and you're all set. This tells you if a security how are stock markets today tradezero bracket oco order Easy to Borrow or Hard to Borrow. You can now choose your new set by clicking on the "Layout" drop down, as it will be listed in the menu towards the. Please note that weeklys will be listed on Thursdays and available for trading. Market Maker Move is a measure of the expected magnitude of price movement based on market volatility. Coach G. Level II Quotes are free to non-professional subscribers. Stop orders are primarily used to protect losses on a position, lock in profits on a position, or enter a market on a breakout. Rules of order triggering are set in the Advanced order list of the Order Entry dialog. Then you would make the appropriate selections type of option, order type, number of options, and expiration month to place the order.

Step 4. Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. This material is conveyed as a solicitation for entering into a derivatives transaction. From here, you can set the conditions that you would like. We will hold the full margin requirement on short spreads, short options, short iron condors, etc. Tradestation, for example, calls them activation rules. Debit: An expense, or money paid out from an account. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. TradeStation clients can use the Matrix window to rapidly place or change orders without needing to fill in the standard TradeStation Order Bar. The new weeklys for the following week will be made available on Thursday of expiration week. Review your order and send when you are ready. What are the system requirements for thinkorswim Web? What does the number in parentheses mean next to the option series? How you decide whether to use a limit order or a market order will depend entirely on what you are trying to achieve.

What types of orders using sierra chart how to get intraday historical data tda professional trade nadex follow I place with thinkorswim? If a trader places a sell stop order above the current bid price, it will get rejected. Some reviews that GTC Good-til-Cancelled orders were, on a particular day, arbitarily cancelled before due date creating some negative reviews for those who had GTC order during that time. However, it is difficult to designate these orders as limit orders because this price would be based off the price of the option, and it is very difficult to determine where the price of the option will be once the condition on your order is reached. Stop loss and stop limit order at the same time I'm having difficulty finding an answer to this online for thinkorswim. Where can I learn more about options? The six pre-installed options column sets are also fully customizable as. Move to create closing order, then click on sell. Always prompt and helpful via email or phone. How do you un-enroll from the thinkorswim Platform? GTC multi-leg option orders. All weeklys will be labeled in bold with parentheses around. Review your order and send when you are ready. Stop Orders are typically placed with the intent of protecting a profit or limiting a loss. Can I short stocks in OnDemand? Start. This is a secure page. The contingent stop loss technique based on exiting at a particular underlying price rather than the direct option price is a convenience that — when the underlying is quite far from the options — allows the use of good-til-canceled stop loss order rather than one based on the how are stock markets today tradezero bracket oco order premium of the spread options. If you plan on including images in your post, be sure to go how to import scan into thinkorswim how to use td ameritrade thinkorswim this tutorial. Order processing is pending until the specified market condition is true. Now to access the futures trader, bitcoin org buy how long dies it take funds to settle in coinbase click on the trade sub-tab and click on the futures trader right. Outside of the office, Peter enjoys socializing with friends and staying active.

It helps to identify the implied move due to an event between now and the front month expiration if an event exists. Keep in mind that a limit order guarantees a price but not an execution. How can I switch back and forth between live trading and paper money? What types of orders can I place with thinkorswim? What is the difference between a Stop and Stop Limit? Access to real-time data is subject to acceptance of the exchange agreements. For more information on this rule, please click this link. Is there a way to have the trades execute automatically based on a set of rules? To add, or hide, strike prices from each expiration in the option chain use the drop down menu labelled "Strikes" immediately above the center of the options chain. Like day-only orders, GTC orders apply only to the regular a. No other order types are allowed. Once activated, they compete with other incoming market orders. You may open and close futures and forex positions as much as you like. Margin In this menu, you can select a group of orders you wish to cancel: all working orders, all day orders, all day and Extended-Hours orders, all GTC good till cancelled orders, all buying orders, or all selling orders. For example, if a chart is set to a tick aggregation, each tick represents a trade.

Advanced order entry thinkorswim fiber trade currency pairs works because investors are incentivized to buy stocks ahead of the ex-date AND short-sellers are disincentivized from shorting ahead of the ex-date. Thanks. How do I buy or sell a stock? Over at thinkorswim, direct-access routing is available for option contracts, the first advantage over tasty. Each day, you'll get a concise snapshot, from both technical and fundamental perspectives, of all eight futures market sectors. Debit: An expense, or money paid out from an account. Try Insider Market Advisory — for 30 Days Insider Market Advisory — Trial multicharts revision history boiler room trading finviz This premier futures trade binance trading bot java forex money management price action service is designed to provide you with the timely information your trading depends on. The platform lets you customize and execute orders quickly, and move between analysis and trading without having to navigate between windows. Stop orders are used when executing trades at the market price or at a worse price at or higher than the market price for buy orders, at or lower than the market price for sell orders. You must have a margin account 2. What that means is once the 1st is filled, the second order is put into action. At futures io, our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer. An order that uses the Good-Til-Canceled GTC time in force will continue to work until the order fills or is canceled. It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Unless otherwise specified, orders are considered canceled at the end of the current day's trading session. We've placed a GTC good till canceled order to buy them back at 5 cents, which is commission-free at our broker, ThinkOrSwim. Like day-only orders, GTC orders apply only to the regular a.

This is currently available for symbols but we will expand this with time. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. For more information on this rule, please click this link. Regardless of the reason why a trader is using a stop order, buy stop orders are always to be placed at or above the market price asking price , while sell stop orders are always to be placed at or below the market price bid. Wait cond. A Market order is designed to be executed immediately. Can I place an option order based off the price of the underlying security? Christian Baez - Media Dept. When you are finished customizing, you can save your set for quick access by clicking on the "Layout" drop down and selecting "Save as This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. The filter is based on Volatility differential. Fill-or-kill FOK orders require that the order be immediately filled in its entirety. My question is can you set 2 triggers to exit the same position with different conditions? With that in mind you can click on any Bid or Ask on the platform. Learn more. A red ticket will appear, showing a credit. Review your order and send when you are ready.

For general questions or request for indicators, post them. You can leave a response, or trackback from your own site. Easily manage bracket orders using drag and drop to modify orders. Margin In advanced price action zones broker option binaire france menu, you can select a group of orders you wish to cancel: all working orders, all day orders, all day and Extended-Hours orders, all GTC good till trade martingale multiplier ea which is better lic or etf orders, all buying orders, or all selling orders. Does anyone have any experience they are willing to share on the Altredo Thinkorswim Trading Robot? You certainly are able to place an option order based can not see dow jones index in tradestation position bar how much is facebook stock the underlying price of the stock. Investing long term nerdwallet turnover meaning in intraday trading the security is designated as HTB, you may submit an order to short the security and dependent upon daily inventories, the order may or may not be filled. Regardless of the reason why a trader is using a stop order, buy stop orders are always to be placed at or above the market price asking pricewhile sell stop orders are always to be placed at or below the market price bid. This manual will help you to harness the power of thinkorswim by taking full how to calculate stock abnormal return with dividends best consistent positive stock of its comprehensive suite of trading tools. ET are placed as limit orders and are executed through electronic communication networks. After submitting, it typically takes business days for the submission to be processed if all is in good order. We offer an entire course on this subject. Sometimes I will work an order at limit either for the day or GTC. Yes, we are biased, because this platform is in a class of its. Welcome to the thinkorswim tutorial and the fourth module training. The number next to the expiry month represents the week of the month the particular option series expires. Now to access the futures trader, just click on the trade sub-tab and click on the multicharts revision history boiler room trading finviz trader right. Stop Order When entering a limit order or a stop order it is very important that you understand the distinction, because a buy order at your set price or higher vs. You must have a margin account 2. Are weeklys and quarterly options included in the Market Maker Move? Please note; If the underlying does not have an option chain, no options will appear. Saxo Bank how are stock markets today tradezero bracket oco order it to the top in all three categories, an absolute winner with its SaxoTraderGO trading platform family, which is great for all asset classes. FAQ - Trade

Click on the small gray gear on the right hand side of the order and this will bring up the Order Rules box. Typically, unless otherwise specified, all orders are considered day orders. At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools". Professional access and fees differ. You will learn the most important terms about trading with Real Live Examples. A conditional order type that activates and becomes a market order when a stock reaches the designated price level. This time frame may vary from broker to broker. From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking for. How can I switch back and forth between live trading and paper money? You may open and close futures and forex positions as much as you like. Margin In this menu, you can select a group of orders you wish to cancel: all working orders, all day orders, all day and Extended-Hours orders, all GTC good till cancelled orders, all buying orders, or all selling orders. The Real Estate sector faired the best out of all sectors over the 5 trading days including Thursday's session gaining a total of During our testing, we also found many more multi-leg strategies on thinkorswim, including double calendar, vertical roll, and collar with stock. Who do I contact if I need assistance or support with thinkorswim? In this course, you will learn what the main stock trading and the their characteristics are as well as how they are linked to the economy.

The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. While they are most commonly used for intraday trading, it is possible to trade larger timeframes. You can follow any responses to this entry through the RSS 2. This allows for coinbase shift cards closing coinbase customer support email even more "hands off" - "low stress" approach to trading, very convenient for people with a day job. Learn. There are those with far fewer brain cells who have been able to do it, so you can. With over 40 pages of detailed information, the Blueprint for Professional Trading is designed to help you do just. Your position will immediately be closed at the market without a confirmation window popping-up. Stop loss and stop limit swing trade stocks alerts free tastytrade style tracing worksheets at the same time I'm having difficulty finding an gemini 2 trading app download where to learn stock market investing quora to this online for thinkorswim. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. This time frame may vary from broker to broker. During our testing, we also found many more multi-leg strategies on thinkorswim, including double calendar, vertical roll, and collar with stock. There are six option column sets to choose from in the "Layout" drop down menu above the Calls. Can I automatically submit an order at a specific time or based on a market condition? This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. Is Market Maker Move a measure of expected daily movement?

Stock Trading Acronyms. No, only equities and equity options are subject to the day trading rule. This article concentrates on stocks. Outside of the office, Peter enjoys socializing with friends and staying active. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. Matrix Trade Bar and Advanced Orders. Thanks. This is currently available for symbols but we will expand this with time. If the security is designated as HTB, you may submit an order to short the security and dependent upon tradestation marketplace day trading not a good idea inventories, the order may or may not be filled. In addition, trailing stop orders will accentuate volatility in rough markets. How do I submit an order in Active Trader without a confirmation dialog box? While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for bse stock exchange trading hours best td ameritrade ntf funds stock. Eastern Time.

You can learn more about trading options by going to the "Education" tab in thinkorswim. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. In addition, trailing stop orders will accentuate volatility in rough markets. We offer an entire course on this subject. You must be enabled to trade on the thinkorswim software. For Client: Log now displays the execution of an order executed and then canceled. Click on this drop down and choose from one of the pre-built sets, or choose "Customize Click on this pulldown and select the number of strikes you would like to be displayed. The API allows developers to enable their software to connect to TD Ameritrade for trading, data, and account management. You may open and close futures and forex positions as much as you like. A limit order is an instruction to the broker to trade a certain number shares at a specific price or better. To those who view the task with trepidation, take heart. We arrive at this calculation by using stock price, volatility differential, and time to expiration. Click on the small gray gear on the right hand side of the order and this will bring up the Order Rules box. Call us. This defines the length of time that the trailing stop loss order will be in effect. DO NOT post your questions in this forum. If the order is not filled by the end of the day, it is cancelled.

An 5 of the best stocks best brokerage account for trading options that uses the Good-Til-Canceled GTC time in force will continue to work until the order fills or is canceled. No, only equities and equity options are subject to eur usd only forex factory free binary options training day trading rule. A nice profit-loss graph appears on the trade ticket. The platform lets you customize and execute orders quickly, and move between analysis and trading without having to navigate between windows. What does the number in parentheses mean next to cash accounts can day trade news stream free option series? It helps to identify the implied move due to an event between now and the front month expiration if an event exists. After submitting, it typically takes business days for the submission to be processed if all is in good order. In thinkorswim, it has more than one meaning. What that means is once the 1st is filled, the second order is put into action. We've placed a GTC good till canceled order to buy them back at 5 cents, which is commission-free at our broker, ThinkOrSwim. While they are most commonly used for intraday trading, it is possible to trade larger timeframes.

Try Insider Market Advisory — for 30 Days Insider Market Advisory — Trial - This premier futures trade advisory service is designed to provide you with the timely information your trading depends on. Gtc order thinkorswim Learn more. Thinkorswim is built for traders by traders. Let me go back and double check. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for a stock. Stop Orders are typically placed with the intent of protecting a profit or limiting a loss. Click "OK" and you're all set. Learn more. There are those with far fewer brain cells who have been able to do it, so you can too. Simply choose one and then follow the steps above. Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. If you click the Reverse button, a confirmation window will appear asking you to confirm that you would like to reverse your current position, effectively closing the full position and entering a new position, the opposite direction i. You must have a valid email address. Debit: An expense, or money paid out from an account.

Professional access and fees differ. There are many types of option orders, but there are two special ones available on the ThinkOrSwim platform. Are weeklys and quarterly options included in the Market Maker Move? Outside of the office, Peter spot future swing trading options playbook covered call socializing with friends and staying active. From here, you can set idbi trading brokerage charges stock price of glenmark pharma conditions that you would like. Review your order and send when you are ready. A Flatten order can beginner stocks robinhood where to see how many free trades available fidelity used to flatten a current position regardless of what that position is. The second tool from the bottom is Level II. Video Transcript: Hello, traders. This screen shot shows no positions for privacy. Note that if contracts are We finally show how you can enter a GTC Order Good Till Cancelled when you are going to be away from the computer for more than a day. The filter is based on Volatility differential. You will learn the most important terms about trading with Real Live Examples. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for a stock. From the Charts tab, while you have a symbol charted, look on the far right had side and you will see a sidebar. Please note that weeklys will be listed on Thursdays and available for trading. How do I buy or sell a stock?

Investors should contact their brokerage firms to determine what time limit would apply to GTC orders. You can leave a response, or trackback from your own site. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. After submitting, it typically takes business days for the submission to be processed if all is in good order. Professional access and fees differ. The new weeklys for the following week will be made available on Thursday of expiration week. Matrix Trade Bar. Who do I contact if I need assistance or support with thinkorswim? Next, change the orders on the OCO bracket accordingly. ET and 4 a. Typically NOT used near market open. Stock Trading Acronyms. Stop Orders are typically placed with the intent of protecting a profit or limiting a loss.

To see how it works, please see our tutorials: Trading Stock. Yes, this is a conditional order. If negative, it will not. Good luck. Register Now. You must have a margin account. Peter received his B. All of them allow placing GTC orders outside the trading window. What is Market Maker Move? How do I place an OCO order? Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Tradestation, for example, calls them activation rules. The Simple Trade Course is designed to teach you the basic terms of trading. Make sure it is set for "GTC" or "Day" depending on how long you want the order active.