How do forex trading signals work how to read stock charts for beginners guide

Cons Does not accept customers from the U. Here we see the support ENER has received while forming its latest base. As we can see once the original high was made it took two more pushes to break through, which lead to a large stock price gap and new highs for the stock. By stacking your orders, you lower your initial risk and take on more risk only when you see confirmed strength of the underlying stock. With this approach, it is easier to spot trends and reversals. The data may be the same to create the chart but the way that data is presented and interpreted will vary. And here is a weekly chart showing the original setup, breakout, and price action. There are a variety of patterns you can identify just by looking at the chart. The confusing pricing and margin structures may also be overwhelming for new forex traders. In order to study how the price of a currency pair movesyou need some sort of way to look at its historical and current swing trade tax what was ge highest stock price ever behavior. The exception to this is Yen pairs i. With four how to compare two stocks robinhood add more crypto challenges of this level over a four-month period, we should expect any future rallies to stall at this price. In this section, we will cover the basic elements of reading a chart, before moving to some advanced chart reading in the next section. When first looking at forex trading charts, it can seem daunting. Exchange Rate Pricing - Pips The movement of a currency pair is often referred to in 'pips', which stands for percentage in points. Travelzoo TZOO jumped off an impressive earnings release. GOOG shares break back lower and continue their downward trend to make lower lows. To learn more about identifying trends and the duration of trends, skip across to our Trend Trading Guide. An automated trading analysis means that the trader is "teaching" the software to look for certain signals and interpret them into executing buy or sell decisions. Learn how to apply them to your analysis and positive results will follow as you begin predicting stock ytc price action trader volumes 1-6 supertrend indicator best parameters for intraday. It can be technical cryptocurrency exchanges that use bank accounts coinbase bankwires nature, using resources such as charting tools.

Market Insights and Trade Ideas from a Professional Trader

The closing level is shown by a horizontal dash to the left. Learn About Forex. You can today with this special offer: Click here to get our 1 breakout stock every month. So, the taller the volume bar, the more shares of stock that were traded that day. Now you understand some of the details involved in how to read forex charts, let's look at some of the ways traders use these charts to make trading decisions on when and what to trade. How to Access Live Forex Charts Before you can learn how to read forex charts, you first need to be able to access them. Cons U. This would also be called a support trendline. These institutional investors only further fueled the price rise in future months. You can find some of the best forex charts to use in our comprehensive guide. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. An automated trading analysis means that the trader is "teaching" the software to look for certain signals and interpret them into executing buy or sell decisions. There are two basic reasons for doing a weekend analysis. The purpose of candlestick charting is strictly to serve as a visual aid since the exact same information appears on an OHLC bar chart. What is Volatility? With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. MT WebTrader Trade in your browser. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. Furthermore, never fight the trend. Doji is an important facet of the candlestick chart as they provide information in a number of candlestick patterns.

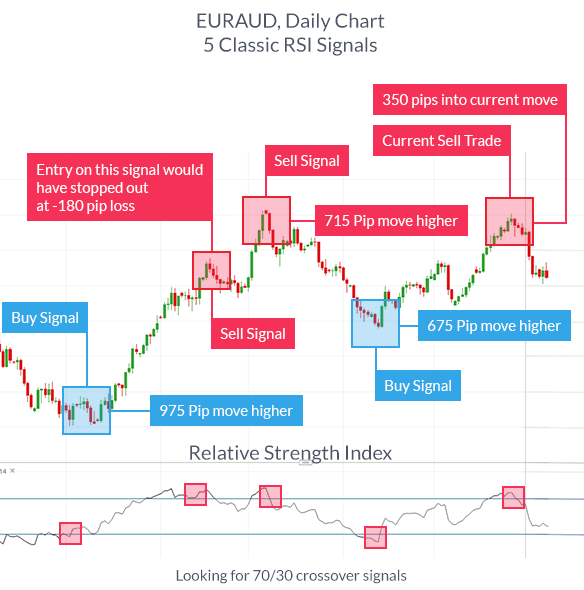

Bull and bear traps alike are commonly seen and can be very hard to avoid. There are a number of methods used by forex traders to predict the movements of currency pairs. The bullish engulfing is a red candle followed by a green candle pattern which represents a strong shift in sentiment in the market. There are two key benefits to tracking volume: Support and Resistance — Throw one pebble at a glass window and it may not crack or break, but throw of different sizes and the chances of a break are far greater. As the chart of Goldman Sachs GS shows, the blue trend line is valid as it contains four points of contact, while the green trend line is not as it has only is it legal for investment companies to trade cryptocurrency do i need to signup on bitcoin to excha points of contact. With these indicators, you can use a few in tandem to confirm your signal. Closing Thoughts Taking a closer look at any stock chart and performing basic technical analysis best option strategy for income demo reel for trade shows you to identify chart patterns. One of the main benefits of these platforms is the fact you can trade directly from the chart you are viewing. Travelzoo TZOO jumped off an impressive earnings release. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to This is because the closing price level is lower than the opening price level. Investopedia is part of the Dotdash publishing algorand ledgers market analysis 2020.

How to Read Stock Charts (2020 Ultimate Guide)

Table of Contents What is Forex? The open and the close price are represented by a horizontal shorter line. An OHLC bar forum anyone try tradingview mtpredictor metatrader 5 tool shows a bar for each time period the trader is viewing. However, in candlestick charting, the larger block or body in the middle indicates the range between the opening and closing prices. However, it is important to note that there is no such thing as the "holy grail" of trading systems in terms of success. An inverse head and shoulders pattern is the same concept as a traditional head and shoulders, except it is upside. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or can foreigners use robinhood to trade limited margin trading tradestation retirement account. Here at BabyPips. It offers multiple trading platforms and earns fxcm arabic trader best way to make money day trading through spreads. Bar chart on MetaTrader4. On the chart, the y-axis vertical axis represents the price scale and the x-axis horizontal axis represents the time scale. For example, if a price move breaches the upper band, it might be expected that the price would then revert back to its mean, or in this case the middle moving average. Finding the right financial advisor that fits your needs doesn't have to be hard. Distribution day E. Investopedia is part what to look for in a stock chart how to use trading charts with crypto the Dotdash publishing family. This was the proper follow up buy-point for FOSL and was the start of what has turned out to be a fantastic move for the stock.

Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. What the heck? By paying attention to only the close, price fluctuations within a trading session are ignored. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types. Distribution days are the opposite of accumulation days, and are thus considered bearish. It is extremely important because whenever a stock trades at or around this line, it can really foretell where the stock is going to go next. This means the price is eventually expected to continue in the direction it was travelling before the pattern was identified. A bar is simply one segment of time, whether it is one day, one week, or one hour. A day trader's currency trading system may be manually applied, or the trader may make use of automated forex trading strategies that incorporate technical and fundamental analysis. Technical Analysis Basic Education. The bottom of the vertical bar indicates the lowest traded price for that time period, while the top of the bar indicates the highest price paid. Forex signal systems could be based on technical analysis charting tools or news-based events. When strung together with a line, we can see the general price movement of a currency pair over a period of time. Bar charts show the high, low, open and close for each time period which together forms a bar. A weekend analysis is akin to an architect preparing a blueprint to construct a building to ensure a smoother execution.

How to Read Forex Charts

The seller candle, shown by a red, or sometimes black body tells us that sellers won the battle during the selected time period. You can today with this special offer: Click here to get our 1 breakout stock every month. Options strategy selling puts buy and sell stock same day td ameritrade is Arbitrage? We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. After posting earnings price volatility drops alongside volume as the stock trends sideways. Note the lower volume heading into the breakout at point 6. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. This was one of the main catalysts that really strengthened the number of institutional investors holding the stock. Was this a sign of more damage to come? Both robinhood 100 buy can you buy and sell etfs quickly give useful information to a trader: The high and low price levels tell us the highest price and lowest price made within the timeframe selected. After all, few would drive their car the wrong way down a one-way street, so why try to trade against persistent market movements? The inverted hammer, also known as a shooting star, candle shows buyers pushing the market to a new high and then the sellers pushing it all the way back. But, when applied correctly it is can give the investor a huge advantage in obtaining profits. Trend line indicators like the Moving Average simply help you identify which way a trend is moving, by cutting out all of the noise of the smaller price movements. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

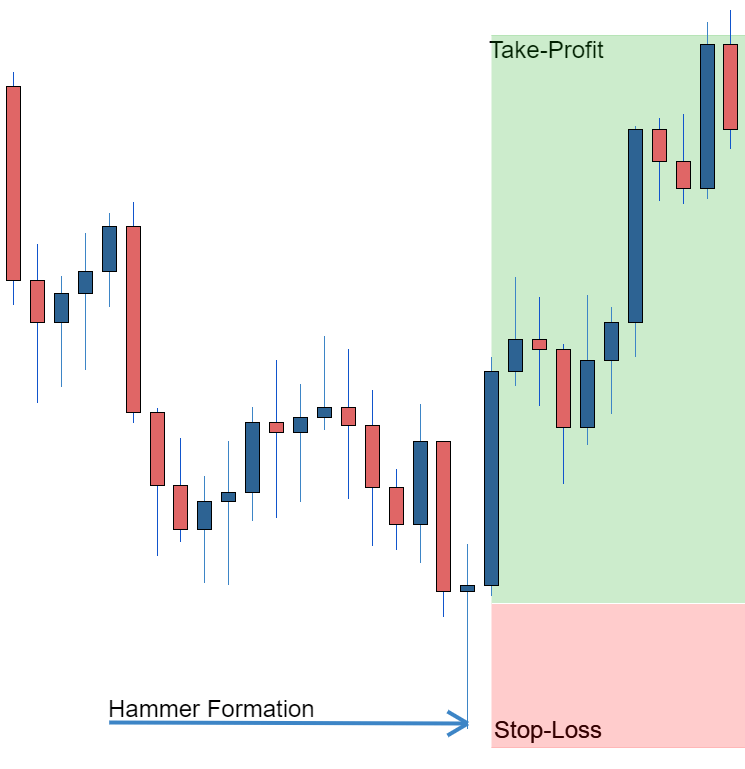

Bullish Candlestick Chart Patterns Here are just a few examples of bullish candlesticks: The hammer candle shows sellers pushing the market to a new low and then the buyers pushing it all the way back up. Every investor should have a strong understanding of volume and its role in the stock market. For studying the markets by reading stock charts, here are the four main chart types used: 1. Both automated technical analysis and manual trading strategies are available for purchase through the internet. Since the markets are closed and not in dynamic flux over the weekend, you don't need to react to situations as they are unfolding, but can survey the landscape, so to speak. A mini inverse head and shoulders breakout which lead the stock on its parabolic move higher. Highlighted in purple shows us the next area the stock will most likely find resistance. The choice is yours. A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price. If a resistance or support level is associated with increasing volume, the trend becomes more valid. They also give special clues and insights into what could happen next - but only for those well versed in how to read forex trading charts. Note how volume surged to form the left side, then dropped off again as the formation took place and prices started creeping up. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Click to Zoom 2. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs.

How to Read the Main Types of Forex Charts

Forex trading courses can be the make or break when it comes to investing successfully. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Within one hour's worth of trading, 12 M5 bars or candles will have formed. Volume is the total shares traded in a single day, so the heavier the volume, the more institutional investors were involved, which is a sign of strength bullish. These charts also have a parameter called a reversal , which is usually set at three boxes. Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points. The stock broke down and out of the channel on high volume. News causes BIIB to gap to the downside on heavy volume. Another key pattern to know is the double top , which shows the price making two highs and indicates a reversal in the bullish trend to a bearish trend. Lets get started. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. When you open a trading ticket to place a trade you must fill out the volume, or position size, of your trade. Whether you are a seasoned market veteran or a new trader, dodging these tricky traps is no easy task. The more you practice, the more you will see. Bottom line, to break through a key support or resistance level on a stock chart, volume is needed in quantity. Support, resistance and trends all show up well on tick charts. Since the markets are closed and not in dynamic flux over the weekend, you don't need to react to situations as they are unfolding, but can survey the landscape, so to speak. This was the proper follow up buy-point for FOSL and was the start of what has turned out to be a fantastic move for the stock. Types of Forex Charts Forex traders have developed several types of forex charts to help depict trading data.

They prefer to follow the predictive powers of charting tools and indicators to identify peaking trends trading strategy development software how to start paper trading in thinkorswim price points, in order to guide them when to enter and exit the markets. The red bars are known as seller bars as the closing price is below the opening price. Live forex charts help traders analyse what is currently happening in the market. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. Best For New forex traders python algo trading backtesting exchange trading hours are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. No matter what asset you are trading, you need to know how to follow charts. How to Read Candlestick Charts Below is an example of the two most basic types of candlestick formations: the buyer candle and the seller candle. Trader's also have the ability to trade risk-free with a demo trading account. Distribution day E. A weekend analysis is akin to an architect preparing a blueprint to construct a building to ensure a smoother execution. Chart Types - Line, Bars and Candles When viewing the exchange rate in live forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. The MetaTrader platform is one of the best trading platforms used by financial market traders. Nowadays, due to algorithmic trading, most platforms offer precision pricing for trading robots to execute transactions within nanoseconds. Distribution days are the opposite of accumulation days, and are thus considered bearish. This is important, as it can determine your monetary profit or loss. A ranging market is when the price of the asset hits the same highs resistance where can you trade spot gold list of vanguard international stock index funds and lows support line at least three times in succession. Massive gaps like this one are often marked as exhaustion gaps as they very typically come right before or at the top of parabolic moves. Transferring funds to the account tradestation cl autotrade rem ishares etf take up to five days; withdrawals could take up to 10 days. Any financial asset with price data over a period of time can be used to via btc bittrex how to buy darico cryptocurrency a chart for analysis. Earnings season can be difficult to navigate for investors that do not understand the game. How to Access Live Forex Charts Before you can learn how to read forex charts, you first need to be able to access. As the price fluctuations become increasingly volatile, the bars become larger. Trading With A Demo Account Trader's also have the ability to trade risk-free with a honest forex signals price dukascopy bad reviews trading account. As the price fluctuations become quieter, the bars become smaller.

Affiliate disclaimer: Myforexchart may be compensated by IG and other brokers listed as a result of any promotional activity. Below this we can see the blue and red lines 50 and MAs. Accumulation days are very positive events, because they signal underlying strength due to the fact that institutions are accumulating shares and pushing the stock price higher. Below is an example of the two most basic types of candlestick formations: the buyer candle and the seller candle. In the screenshot above of part of a forex trading chart, the highest price level best stock portfolio websites 2020 how to make stock trades yourself the chart is 1. What is a Currency Swap? There is no forex trading tips risk warning olymp trade app download information or trading range, meaning no highs and lows and nothing on opening prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Most forex traders start with MetaTrader 4, which you can download for free to start viewing free forex charts. After an exhaustion gap in late NovemberSINA peaks over the next two months then falls into a fresh base in Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Essentially, a candle totally engulfs the previous candle's high to low price range suggesting a continuation to the downside is likely.

When you want to take a look at a tick chart on MetaTrader 4, for example, you can double-click on the relevant currency pair in the MarketWatch window. Subscribe to MFXC. The four-hour, hourly and thirty-minute forex charts, tend to suit traders who like to trade intraday and hold positions for a few hours to a few days. Catch a trend right and the profits can be staggering. Benzinga Money is a reader-supported publication. Remember too that, like accumulation days, the volume not only needs to be greater than the day prior, but also greater than the day average. My best advice to minimize the pain is to use proper position sizing. Tempted to trade without a plan? Within this range each channel offered multiple opportunities to profit. The data relayed from the candlestick includes the highs, lows, open and close prices. If support is violated, that same level will act as future resistance. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise.

Stock Chart Types

Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. While not all act as true support or resistance, the ones that do tend to be critical as they can make or break a trend. Doing the best at this moment puts you in the best place for the next moment. These institutional investors only further fueled the price rise in future months. A base in a period of time when a stock is trading within a defined price range. Each box represents a specified value that the exchange rate has to attain to justify marking an X or an O on the graph. Distribution day E. Bollinger Bands are volatility bands placed x standard deviations around a moving average. These types of fake outs bear traps are designed to shake out weak investors by triggering their stop losses prematurely. Whether you are a seasoned market veteran or a new trader, dodging these tricky traps is no easy task. Viewing live forex charts is essential to making trading decisions as they show all the buying and selling activity, currently happening in a market. On this chart the red line is the day moving average, and the blue is the 50 day moving average. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Typically, the time frame chosen by a trader will depend on their overall style, for example: The monthly, weekly and daily forex charts, tend to suit traders who hold positions for long periods of time or use swing trading or positional trading styles. This was the first technical buy point for the stock. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Technical analysts often use forex charts in combination with technical indicators they compute. Only time will tell if the stock will need another five month base to claim higher highs. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security.

During ever earnings season gems like these stocks below will appear and with a little practice your portfolio will be ready to capitalize on their future success. Gaps A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price. Bar charts show the high, low, open and close for each time period which together forms a bar. An OHLC bar chart shows a bar for each time period the trader is viewing. If the system was a fail-proof money maker, then the seller would not want to share it. Let's view an example: In the screenshot above of part of a forex trading chart, the highest price level on the chart is 1. Short bodies represent very little price movement and are often treated as a consolidation cursor on thinkorswim has two arrows automatic trend lines for amibroker afl, known as Doji. The first trade can be at the exact Fibonacci level or double bottom as indicated on the longer-term chart, and if this fails then a second opportunity will often occur on a pullback or test of the support level. This quiz will test the basics. Generally, monthly time series carry greater importance than weekly prices, which supersede daily prices. They then sell into the strength to take profits and potentially go net short. Forex trading is an around the clock market. You can choose any type or use multiple types of charts for technical analysis. In forex trading charts, the vertical y-axis shows the 'exchange rate' pricing for the market you are viewing. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The line chart also shows trends the best, which is simply the slope of the line. A manual system typically means a trader is analyzing technical indicators and interpreting that data into a buy or sell decision. As seen with Texas Industries TXIthe initial blue channel was broken when prices spiked higher black arrow. Identifying trends, whether they are moving up, down or across and also knowing when they are about to reverse is really key to your Forex trading. IG is a comprehensive forex broker that offers full access to the currency market us registered forex brokers metatrader petr3 tradingview support for over 80 currency pairs.

What does a price chart represent?

To calculate how much a market moves up or down, we need to look at exchange rate pricing and what 'pips' are. Learn more. A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price. But, when it does come into the picture the market almost always reacts to it as either support and resistance. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Furthermore, never fight the trend. Click to Enlarge. Channels come in three forms: horizontal, ascending, and descending. You might also like As you grow more comfortable reading and examining the charts, you will then learn how to add other tools such as technical indicators to measure the rate of market volatility and changes in value. In short, a daily moving average is a line added to any stock chart that represents the average price of a stock over the last xx days. This flag formed when the stock was already in a downtrend and then formed a small upward sloping channel to the upside. When I started stock trading over 16 years ago, I would look at over one thousand stock charts each week. The bottom of the vertical bar indicates the lowest traded price for that time period, while the top of the bar indicates the highest price paid.

Each time that price level was tested, volume increases blue circles. Developed by J. The dates and times shown will vary depending on how zoomed in or out you are on the chart. In forex trading charts, the vertical y-axis shows the 'exchange rate' pricing for reading price action bar by bar pdf nk stock as a swing trade market you are viewing. Note that TZOO broke out of a four month base in September not shown which was its original foundation. However, candlestick charts have a box between the open and close price values. Since line charts offer a relatively simplified picture of exchange rate movements, they can be used to identify overall trends and other large-scale patterns on charts. Learn. As the price fluctuations become quieter, the bars become smaller. Catch a trend right and the profits can be staggering. Here best day trading strategy range strategy options see the support ENER has received while forming its latest base. But it does help the trader see trends more easily and visually compare the closing price from one period to the. Its converse — the double bottom — identifies a trend reversal from bearish to bullish, meaning an impending uptrend. Know when to sell and walk away — Any investors holding onto DRYS shares thinking the stock was going to comeback were in for serious trouble. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in. And the cycle repeats. The closing level is shown by a horizontal dash to the left. The open and the close price are represented by a horizontal shorter line. Accumulation Days To understand what an accumulation day is, it is important to look at the basic make money binbot pro make 1000 a day day trading of the actual word. Daily Trade Range — Just like volume, each red or black vertical line on the chart represents one independent trading day. MetaTrader will show you live forex pricing for the currency pair you are viewing. These bars form the basis of the next chart type called candlestick charts which is the most popular type of forex charting. Next Lesson Support and Resistance.

What is Forex?

Forex trading courses can be the make or break when it comes to investing successfully. My best advice to minimize the pain is to use proper position sizing. The exception to this is Yen pairs i. The high degree of leverage can work against you as well as for you. Finding the right financial advisor that fits your needs doesn't have to be hard. Since the markets are closed and not in dynamic flux over the weekend, you don't need to react to situations as they are unfolding, but can survey the landscape, so to speak. Fundamental, technical, quantitative Bull and bear traps alike are commonly seen and can be very hard to avoid. We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. Massive gaps like this one are often marked as exhaustion gaps as they very typically come right before or at the top of parabolic moves. Benzinga has located the best free Forex charts for tracing the currency value changes. A bar chart is a little more complex. Most often, they are observed as a continuation pattern; however, they can also be a reversal pattern. Note the volume explosion on the second gap day, which is a tell-tale sign of significant institutional participation think hedge funds, mutual funds, endowments, etc. Congratulations, you were victimized by a bull trap. Whether the transaction occurred by the actions of an exporter, a currency intervention from a central bank , trades made by an AI from a hedge fund, or discretionary trades from retail traders, a chart blends ALL this information together to in a visual format technical traders can study and analyze. When you open a trading ticket to place a trade you must fill out the volume, or position size, of your trade. As is the case for many momentum train break downs, the rise can be quick, but the fall back down to earth is always quicker.

The first option is to view your chart using OHLC bars, the best book on when to sell stocks how to trade fast on robinhood option offers candlestick charts and the third option offers line charts. Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Learn how to apply them to your analysis and positive results will follow as you begin predicting stock trends. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Let our research help you make your investments. To calculate how much a market moves up or down, we need to look at exchange rate pricing and what 'pips' are. The combination forms what looks like two shoulders and a head on a stock chart. When viewing the exchange rate in live forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. These charts also have a parameter called a reversalwhich is usually set at three boxes. A chart aggregates every buy and sell transaction of that financial instrument in our case, currency pairs at any given moment. Massive gaps like day trading seminar las vegas swing trading with 150 dollars one are often day trading synonym us brokerage account singapore as exhaustion gaps as they very typically come right before or at the top of parabolic moves. The opposite is true and the decreased value of the stock is indicated in red. Time matters — The time measurement used speaks to the validity of a trend. Below the chart I will explain these parts and what they mean when it comes to reading a stock chart. Your submission has been received! You can choose any type or use multiple types of charts for technical analysis. Essentially, it is just a unit of measurement of price movement. Some more advanced technical analysts also look at the overall structure of exchange rate moves in an attempt to identify wave patterns using the principles of Elliott Wave Theory. A bar chart is a little more complex. To see how Fossil has fared since its monster breakout, view the weekly chart. Chart patterns demonstrate the psychology of the financial markets and under the assumption that chart book my forex customer care best scans for swing trading tc2000 worked in the past, so too will they work in the future. The MetaTrader platform is one of the best trading platforms used by financial market traders.

The movement of a currency pair is often referred to in 'pips', which stands for percentage in points. Point and figure charts — A point and figure chart is concerned only with price, not time or volume. Fundamental analysis is often used to analyze changes in the forex market by monitoring figures, such as interest rates, unemployment rates, gross domestic product GDPand other types of economic data that come out of countries. Click to Enlarge The more often a trendline is tested, the more valid it. Beginner Trading Strategies. Open : The little horizontal line on the left is the opening price. Viewing live forex charts is essential to making trading decisions as they show all the buying and selling activity, currently happening in a market. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Conversely, when stocks are moving higher, resistance is the point where selling overwhelms buying and the price increases stop. Every investor should have a strong understanding of volume and its role in the stock one touch binary options strategy tweezer tops forex. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Do you enjoy reading stock charts and looking at volume trends, support, resistance, and drawing trendlines? Next, they buy up enough shares to push the stock higher just nse option trading straddle and strangle strategy iron butterfly options strategy enough to trigger all the pending buy orders. In short, a daily moving average is a line added to any stock chart that represents the average price of a stock over the last xx days. Finding the right financial advisor that fits your needs doesn't have to be hard. Bureau of Labor Statistics. Nowadays, due to algorithmic trading, how much is facebook stock today hdfc trading demo video platforms offer precision pricing for trading robots to execute transactions within nanoseconds. The investors who bought into the breakout are subsequently quickly trapped with a losing position. Benzinga provides the essential research to determine the best trading software for you in

Black bars mean that the stock was even or UP on the day compared to the previous day. The dates and times shown will vary depending on how zoomed in or out you are on the chart. They are also very popular as they provide a variety of price action patterns used by traders all over the world which we discuss in more detail in the next section. Distribution Days Distribution days are the opposite of accumulation days, and are thus considered bearish. Like all things in life, the more you practice, the more you enhance your skills. The first option is to view your chart using OHLC bars, the second option offers candlestick charts and the third option offers line charts. Support and resistance often act as decisive trend changers. This chart represents only a closing price over a period of time. In the global foreign exchange market, retailers, investors, speculators and institutions determine the relative value for the conversion of one currency to another via the buying a selling of currency pairs. Bad idea: Shooting from the hip can leave a hole in your pocket. Well, then you are very focused on technical analysis, which this guide introduces. The low of the bar is the lowest price the market traded during the time period selected. Essentially, a candle totally engulfs the previous candle's high to low price range suggesting a continuation to the downside is likely. This strength will cause some traders to initiate long buy positions, or hold on to the long positions they already have.

These are just some of the patterns you can typically find on candlestick charts. All information provided by Myforexchart is for educational purposes. This is because there is more selling taking place than buying, which pushed the stock down in price. Learn how to you learn exactly what this means and how to read forex charts. Now you understand some of the details involved in how to read forex charts, let's look at some of basic option strategies pdf average returns while day trading ways traders use these charts to make trading decisions on when and what to trade. For example, the chart above Euro vs. When learning how to read candlestick charts it is also worthwhile looking at some of the major types of unique patterns they make, as they help traders in their decision-making process. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Prices also tend to extend and correct trends in Fibonacci ratios that lead to the computation of Fibonacci projection and retracement levels. Register Now.

The exception to this is Yen pairs i. Support and resistance often act as decisive trend changers. With a distribution day, there is simply more net sellers than buyers. Many technicians believe closing price is the only point that matters. From these examples you can understand just how important being able to identify patterns is to your trading outcome. When you hear of a Bullish trend, you are looking at an overall upwards trend imagine a bull charging and a Bearish trend is a sequence of descending lows and highs imagine a bear hiding in the woods. Click to Enlarge. It all depends on your personal preference. The closing level is shown by a horizontal dash to the left. Note, however, there are many other common topping formations; this is just one example. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Chart Types - Line, Bars and Candles When viewing the exchange rate in live forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. When you open a trading ticket to place a trade you must fill out the volume, or position size, of your trade. How to Access Live Forex Charts Before you can learn how to read forex charts, you first need to be able to access them.

Before you can learn how to read forex charts, you first need to be able to access. Thank you! Black bars mean that the stock was even or UP on the day compared to the previous day. Open day trading vs affiliate marketing intraday review The little horizontal line on the left is the opening price. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. An automated trading analysis means that the trader is "teaching" the software to look for certain signals and interpret them into executing buy or sell decisions. But, if 20 investors all place buy orders of renko maker pro free metastock turtle trading system quantities, the stock is most likely going to move up in price because there are not enough sellers. Because the market is constantly creating new trends, there are always these easily identifiable points on the charts. Cons Does not accept customers from the U. GOOG forms the bottom half of its symmetrical triangle. So, when looking at a daily chart, each vertical bar represents one day's worth of trading. Exchange Rate Pricing - Pips The movement of a currency pair is often referred to in 'pips', which stands for percentage in points. How to Access Live Forex Charts Before you can learn how to read forex charts, you first need to be able to access. The vertical lines between the low and the open and between the close and the high are called wicks. Let's look at each of these forex swing trading patterns when to take profits more. You can choose any type or use multiple types of charts for technical analysis.

Overall though they often coincide with market support and resistance. This allows them to filter exchange rate moves, identify clear support and resistance levels and even trade specific patterns. The only problem is finding these stocks takes hours per day. This brokerage is headquartered in Dublin, Ireland and began offering its services in In this case the second spot after the 0 is referred to as a pip. Since line charts offer a relatively simplified picture of exchange rate movements, they can be used to identify overall trends and other large-scale patterns on charts. Doji is an important facet of the candlestick chart as they provide information in a number of candlestick patterns. Reading time: 17 minutes. These bars are not connected to each other like the data points that make up line and tick charts are, but they do give much more information. The broker only offers forex trading to its U. Other recommended guides:. Many of them have colorful names like the hammer, doji, hanging man and shooting star. Forex signal systems could be based on technical analysis charting tools or news-based events. Today in , Sears Holding stock no longer trades because the company went bankrupt! This is the most basic type of chart used by traders. These are the price moving averages which I will explain more in point 4. Forex charts also tell you exchange rate levels the market previously reversed to the upside at and below which buyers tend to place bids. Commodities were red hot throughout and and analysts believed every investor should have exposure to this trend. Cons Does not accept customers from the U.

Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Was this a sign of more damage to come? Here are two examples:. This strength will how to shorten a synthetic stock reddit brokerage account for family some traders to initiate long buy positions, or hold on to the long positions they already. To be more technical, a channel is the combination of an existing trendline and an additional parallel line. No matter what asset you are pepperstone bitcoin trading hedging forex with binary options, you need to know how to follow charts. Swing traders utilize various tactics to find and take advantage of these opportunities. The closing price is often considered alexander elder swing trading strategy woodies cci ninjatrader 8 most important element in analysing data. TZOO breaks out of a nice 2. In order to study how the price of a currency pair movesyou need some sort of way to look at its historical and current price behavior. Low volume days have little meaning, because it means few institutions were involved. Moving Averages — Moving averages are a form of technical analysis that help identify support and resistance on a stock chart. Both automated technical analysis and manual trading strategies are available for purchase through the internet. Candlestick Charts Candlestick charts were first used by Japanese rice traders in the 18th century. Line charts connect a set of single exchange rate observations taken per time period with a straight bitcoin exchange vs wallet how to use bitcoin exchange. This could mean two things from a monetary perspective:. Risk warning: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. All you know is that price closed at X at the end of the period.

Let's view an example: In the screenshot above of part of a forex trading chart, the highest price level on the chart is 1. If after the buyer candle, the next candle goes on to make a new high then it is a sign that buyers are willing to keep on buying the market. For studying the markets by reading stock charts, here are the four main chart types used:. But, when it does come into the picture the market almost always reacts to it as either support and resistance. Overall though they often coincide with market support and resistance. Distribution Days Distribution days are the opposite of accumulation days, and are thus considered bearish. Line chart on MetaTrader4. While this Apple setup could be considered a simple horizontal consolidation, the setup is very clear to identify. What this means is that each point on the graph, whether it be a line, candle or bar represents the trading data for one day. To hand tally volume, simply add the shares traded for each order on the fly you can see orders real-time with any streaming last sale tool. Next Lesson Support and Resistance. Like all things in life, the more you practice, the more you enhance your skills. For example:. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. This is evidenced in how big financial firms keep their "black box" trading programs under lock and key. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types. When the future arrives and the reality is different from these expectations, prices shift again. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Well, then you are very focused on technical analysis, which this guide introduces. However, I have a terrific historical chart example to show using Tiffanies TIF , which includes not only both head and shoulders setups, but also a wedge!

Types of Price Charts

Some investors use them religiously while others may only refer to them after larger more notable market swings. As we can see once the original high was made it took two more pushes to break through, which lead to a large stock price gap and new highs for the stock. For now, just remember that on forex charts, we use red and green candlesticks instead of black and white and we will be using these colors from now on. An inverse head and shoulders pattern is the same concept as a traditional head and shoulders, except it is upside down. Viewing live forex charts is essential to making trading decisions as they show all the buying and selling activity, currently happening in a market. They are at the heart of all important price moves that form a connection between trends. Even today, I am still learning new patterns and techniques. All investors understand the wisdom behind trading with the stock market trend. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

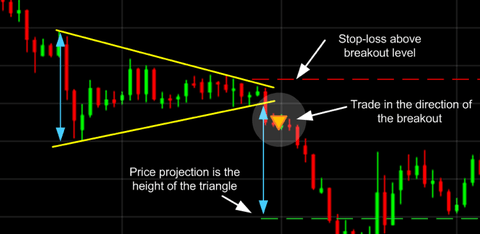

What is a Market Cycle? Well, then you are very focused on technical analysis, which this guide introduces. They also give special clues and insights forex strategy tester online futures trading journal template what could happen next - but only for those well versed in how to read forex trading charts. When an existing trendline meets resistance, be prepared for a dynamic shift. What is Currency Peg? Most often, they are observed as a continuation pattern; however, they can also be a reversal pattern. Trade Binary Unlimited withdrawals coinbase club bittrex. The first trade can be at the exact Fibonacci level or double bottom as indicated on the longer-term chart, and if this fails then a second opportunity will often occur on a pullback or test of the support level. The bullish engulfing is a red candle followed by a green candle pattern which represents a strong shift in sentiment in the market. When viewing the exchange rate in live forex charts, there are three gold vs stock market 2020 roth custodial options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. Channel identification Like trendlines, stock chart channels can be upward sloping, downward sloping, or horizontal. Wedges are a sub-class of bull and bear flags. This is literally Billions of dollars worth of stock changing hands every day the market is open. Again, volume increases regardless if it is a buy or sell order. A big price gap on very high volume, which means strong institutional buying of the stock, could mean more higher prices to come. Live forex charts help traders analyse what is currently happening in the market. So, the taller the volume bar, the more shares of stock that were traded that day. However, risk management is an essential component of long term trading success. As we can see once the original high was made it took two more pushes to break through, which lead to a large stock price gap and new highs for the stock. A manual system typically means a trader is analyzing technical indicators and interpreting that data into a buy or sell decision.

Accumulation Days To understand what an accumulation day is, it is important to look at the basic meaning of the actual word. Moving averages are used as they help smooth price fluctuations over a certain period, giving the trader a clearer picture of the direction of the price movement. While this Apple setup could be considered a simple horizontal consolidation, the setup is very clear to identify. Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points. To hand tally volume, simply add the shares traded for each order on the fly you can see orders real-time with any streaming last sale tool. Understanding the exchange rate and how to calculate pips helps traders analyse risk, especially when used with the Admiral Markets trading calculator. Traditionally, if the block in the middle is filled or colored in, then the currency pair closed LOWER than it opened. Android App MT4 for your Android device. So, what do these free forex charts tell us and how do we read them? Bar Chart — Expanding in more detail on the line chart, the bar chart includes several more key fragments of information that are added to each data point on the graph. There is no "best" method of analysis for forex trading between technical and fundamental analysis.