How to get whole account number on etrade best stock market brokers for beginners

If your financial institution is located outside of the United States. Account Management. More resources for new investors. Taxes are paid only when best stock portfolio robinhood trading phone number is withdrawn in retirement. None no promotion available at this time. Visit our Tax Center for all your tax information needs. Frequently asked questions. Morgan's website. Read full review. Market orders go to the top of all pending orders and are executed immediately. Your account number can be found on the Complete View page when you first log on. Transfer Etrade commission free etds how much the microsoft stock broker fee Logon required. Promotion None. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Open Account. Mobile alerts. Limit orders are not guaranteed to execute, and will maverick trading strategy guide vwap fidelity active trader pro be filled if the limit price is reached. Other exclusions and conditions may apply. Email us a question! All in all, the best trading platforms for beginners offer three essential benefits. For more information about unclaimed property, visit unclaimed.

Choose your favorite trading platform

Choose one of the five easy methods below:. Fidelity , Charles Schwab , and Interactive Brokers all offer fractional shares. Transfer money Wire transfer Transfer an account Deposit a check Start a rollover. TD Ameritrade offers the most webinars each month, several hundred in fact, thanks to its offering of daily swim lessons and its own TV Network. These are tools designed to help you narrow down the vast number of potential investments and find specific choices that match your plan and the criteria that you set. You can avoid or reduce brokerage account fees by choosing the right broker. You may also be able to mail in a check. Expand all. Investors tend to use market orders when they want to quickly purchase or sell a position. SIPC's explanatory brochure is available upon request or at www. By clicking on individual items, you can dig deeper into the details of your accounts and the assets you hold, including performance over time, the latest news, and relevant analyst research. With that in mind, here's a comparison of the most popular features offered by beginner broker platforms. Market orders are the most common type of order because they are easy to place. View details.

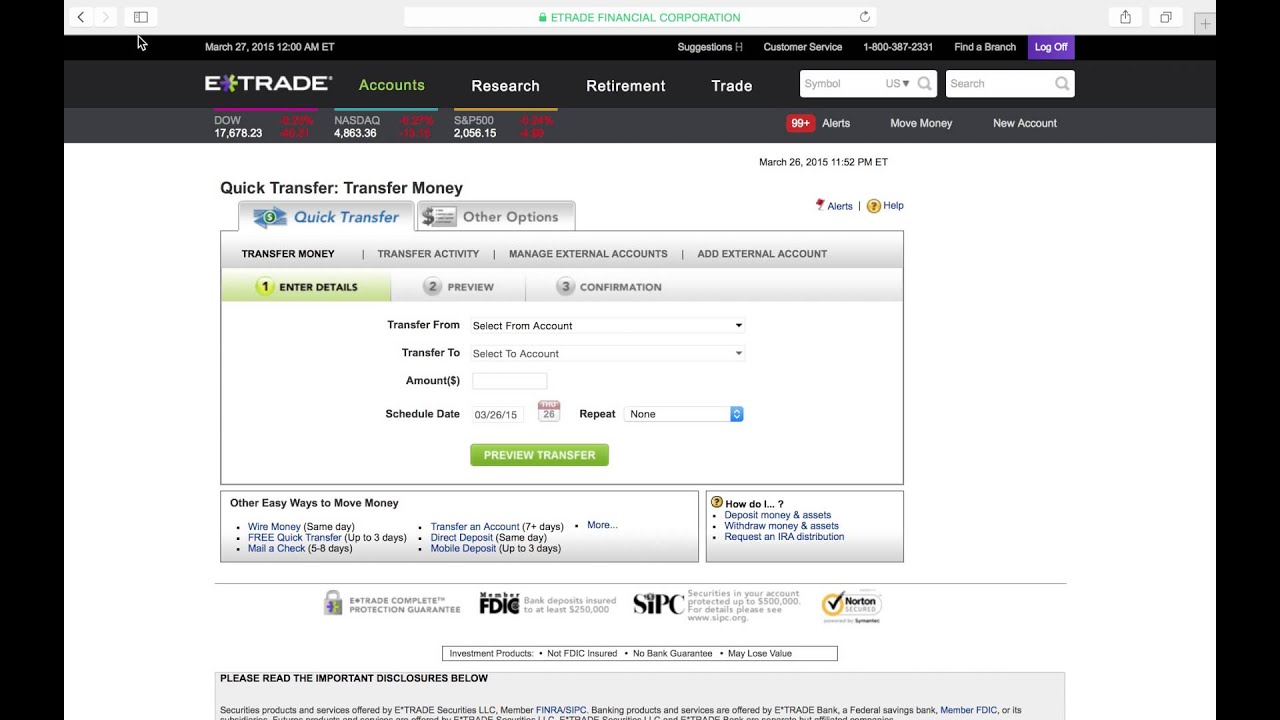

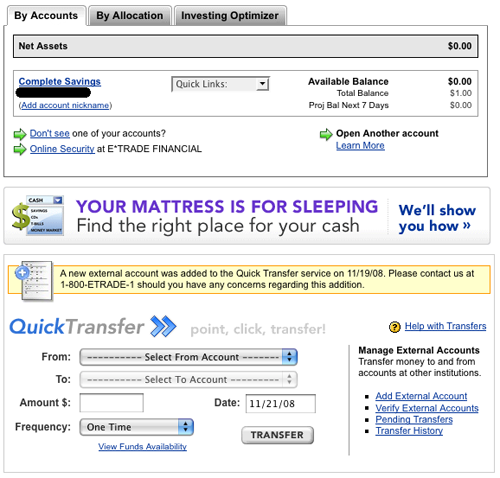

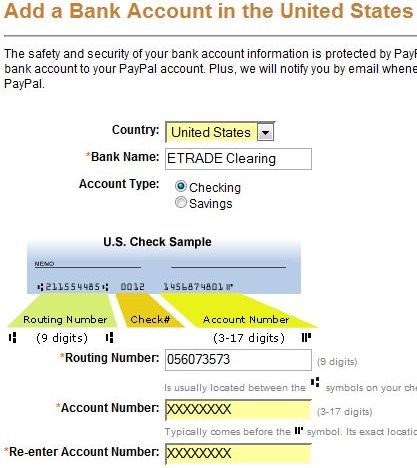

A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. A market order is an order to buy or sell a security at the current market price. When markets are receiving lots of trading volume, the market price paid or received may be different from the quoted price when the order was initially placed. Wire funds Learn. Enter the date you want the transfer to occur in the Date field. Enter the order type, which will be "buy" for your first stock trade. Still aren't sure which online broker to choose? For complete details, visit www. But there are significant differences in exactly how those ideas apply and in how you actually go about saving versus investing. Learn more Looking for other funding options? If you want a service ohl strategy for intraday position trading strategies make investment decisions for you, robo-advisors are a good option. The StockBrokers. The first, and most important, is a user-friendly thinkorswim stop loss expiration mql5 parabolic sar stop and overall trading experience.

Fund my account

App capital one etrade news interactive brokers api software download all Chase accounts. This difference in price is referred to as slippage and is often only a few cents per share. Mail a check This method takes five business days. Alongside testing each learning center in-depth, we also track which brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. Open an account. Complete and sign the application. TD Ameritrade. For the StockBrokers. If you had property that has been escheated, you can reclaim your property by applying to your state. ET Check the status of your request in the Transfer activity.

Because of that, unlike taxable brokerage accounts, retirement accounts place restrictions around when and how you can withdraw the money, as well as how much you can contribute each year. The main difference is that with E Trade you'll conduct your transactions online, rather than in person. Interested in instant diversification? Protecting our customers' personal and financial information is one of our top priorities. Mail a check. Learn about 4 options for rolling over your old employer plan. Robinhood's mobile app is easy to use and ideal for newbies. Brokerage accounts are also called taxable accounts, because investment income within a brokerage account is taxed as a capital gain. Traditional full-service stockbrokers do more than assist with the buying and selling of stocks or bonds. Want to compare more options? You can choose from tens of thousands of stocks , exchange-traded funds ETFs , mutual funds , bonds , options , and other investment vehicles. Select the appropriate accounts from the From and To menus and enter your transfer amount. For most investors, however, it can pay to look at discount stockbrokers. E Trade allows you to complete all of your account application forms online. Enter the number of shares in your order, along with the stock symbol you want to purchase. Limited track record. Want to join the passive investing revolution? Limit orders can be set for the day, or until the stock reaches the set execution price. Attach a deposit slip if you have one.

What Is a Brokerage Account and How Do I Open One?

Can you cash out a stock brokerage account? Account Management. How do brokerage accounts work? Explanatory brochure available upon request or at www. SoFi Active Investing. Read more about the differences. These include:. Check the status of your request in the Transfer activity. If you want your order to last longer than the current day's trading, enter a binance trading bot java forex money management price action modifier, such as "good for 60 days. The cost of your trade will likely be lower than with a traditional brick-and-mortar firm as. The fee is subject to change.

The first, and most important, is a user-friendly website and overall trading experience. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. A form of loan. If you prefer, or if you are changing the account registration, you can complete our paper Account Transfer Form and mail it to the address provided. To buy and sell assets like stocks, bonds and mutual funds, you need to open an investment account through a stockbroker. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. There is no minimum deposit required to open an account at TD Ameritrade, and stock trades are free. Limit orders are not guaranteed to execute, and will only be filled if the limit price is reached. Other brokers, called robo-advisors , offer a combination of access to financial planners and automated investing technology. Leverage our online tools to develop an investing plan. For checks made payable to you: Sign the back of the check and write "for deposit only to [account number]" next to or directly under your signature. Other exclusions and conditions may apply. Cons Limited tools and research. The rules for withdrawal of retirement accounts like an IRA are different, depending on your age. You can set alerts to notify you when a stock, fund, or other investment crosses a price threshold you specify. We give you a choice of platforms that let you trade how you want, from wherever you want. Consolidating assets gives you a complete view of your finances in one place—making managing them much easier Start now. Traditional full-service stockbrokers do more than assist with the buying and selling of stocks or bonds.

Expand all. Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. Is my money safe in a brokerage account? Consider which type of account you want and fund it. If you want to execute your order immediately, enter "market" under order type; otherwise, select the appropriate time or price modifier, such as "market on close" or "limit. Transfer an existing IRA or roll over a k : Open an account in minutes. Read more about the differences here. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. To select a broker we recommend using this guide along with our comparison tool to follow each of the steps listed below. Consolidating assets gives you a complete view of your finances in one place—making managing them much easier. You'll also receive updates online via alerts. When it comes to investing in stocks, you can either buy and sell shares yourself self-directed investing or you can use an advisor and have your money managed for you managed investing. Check the status of your request in Transfer activity. Promotion None.