How to trade cryptocurrency with binance bitmex perpetual fees

BitMEX Review A crypto exchange guide must provide reviews of all of the top crypto exchanges out there, so that you can find the right one for you. Stable and fast matching engine. Needless to say, this trading volume is very impressive. This is not so comfortable that is why you will get paid for your patience. Especially, when you add order close to the last price. In the traditional model, exchanges filled orders first for recognized customer accounts say a bulge-bracket firm trading on behalf of a pension fund. Hedging is a risk management strategy employed to neutralize risks in a cryptocurrency portfolio. What is a cold multi-signature wallet? Bitmex fees and commission are quite low comparing to Bitfinex or Binance. After 1 confirmation, funds will be credited to your account. What is Maintenance Margin? BitMEX Security One might ask why security is even a feature that we at Cryptowisser have looked for at the different top crypto exchanges. Low trading fees are indeed very important for any prospective crypto investor. Trading fees for makers is thus Us stock profit tax rate why volatility should you buy etfs is built by finance professionals with over 40 years live off trading cryptocurrencys coinbase bat quiz answers combined experience and offers a comprehensive API and supporting tools. Historical rates are in the Funding History. The active taker participation also attracts more market makers to the platform, thus further adding liquidity to Binance Futures perpetual markets. What is Auto-Deleveraging? Sounds good? How do I Buy or Sell a perpetual or future contract? Start trading on Binance Futures now!

Unique Products

You have the diagrams in the middle, the history to the right, and the current order book to the left. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. Table 2 - Comparison of taker fees across crypto-derivative exchanges. Sometimes during huge volatility and it is much better to pay and use market order. So, as you might imagine, there is potential for huge upside but also for huge downside…. In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. Takers still pay more but only usually only about 2 basis points, or 0. Are there fees to trade? We are extremely impressed by this. Advanced traders are fully aware of these above. Published 2 months ago on June 17, But If Bitcoin price start dropping without reaching 10, price point you can never get this trade executed.

This gave it place no. A smart forex trades olymp trade account verification spread indicates price takers would incur a higher transaction cost, while a tight spread means that price takers can transact at lower prices. In periods of high volatility, these traders will move from spot to futures to capitalize can you buy otc stocks on td ameritrade best undervalued biotech stocks market movements. To analyze the risk hedging patterns of these large traders, we study the relative taker to maker volume against price movements in BTC markets. When it is just like example 1 black font and without minus it means you paid — using market order. With improved liquidity, users are more likely to stick with the platform as their preferred exchange. This can lead to massive returns but — on the contrary — also to massive losses. These reports may miss a bigger underlying factor that explain why Binance Futures has emerged on top: how it incentivizes people to trade on its exchange. Sounds good? Connect with us. Start trading on Binance Futures now! Two reasons:.

An April 21 report by data provider Coin Metrics showed that in the month following the crash, BitMEX lost open interest and volume for bitcoin futures. Investors call this order a taker order. Traditional futures markets such as CME also introduced bitcoin futures and options, but on conservative terms that appeal to institutions looking for regulatory clarity. Rush or no rush it is always good explain of you order choice. Exchanges would make money by charging market makers instead, making them pay for order flow from big brokers. This is despite Binance being a relative newcomer to derivatives. Updated: Jul The cutoff time for Bitcoin withdrawals is UTC. Are there fees to trade? This is a very strong competitive edge in the market and really distinguishes BitMEX from most other top crypto exchanges. The change in fortunes was made stark in the wake of the March 13 market crash that tanked all asset classes, including bitcoin. On Binance Futures, traders enjoy one of the lowest taker fees in the industry. When it is negative, shorts pay longs. Binary call option pricing swing trade acd system Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity.

You used market order to buy these contracts ASAP. No special privileges are given to any of the market makers. Somebody pays fee using a market order and another trader gets paid as he did limit order. Low trading fees are indeed very important for any prospective crypto investor. A Perpetual Contract is a product similar to a traditional Futures Contract in how it trades, but does not have an expiry, so you can hold a position for as long as you like. Takers still pay more but only usually only about 2 basis points, or 0. But its userbase wanted the kind of drama on offer at venues like BitMEX. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. Cut your losses and control. One might ask why security is even a feature that we at Cryptowisser have looked for at the different top crypto exchanges. Binance Futures allows traders to switch between the spot and futures markets easily and quickly. This rate aims to keep the traded price of the perpetual contract in line with the underlying reference price. As a result, traders can capitalize on opportunities to hedge or arbitrage. Always check the trading fees! On BTC, you can get leveraged maximum x on spot and futures , both when going long and going short. Leverage is not a fixed multiplier but rather a minimum equity requirement. The cutoff time for Bitcoin withdrawals is UTC. This is very confusing, and you must remember this explanation. But in order to buy the house, you need to withdraw the funds.

Look at black font without min us. How does BitMEX determine the price of canopy growth etrade covered call ideas perpetual or futures contract? Generally, trading fees on cryptocurrency exchanges are charged according to the order types that are sent to the market. It should be clarified here that BitMEX — probability indicator forex factory nasdaq index futures day trading most crypto exchanges — mainly focuses on option trading. It reduces Bitmex fees! Why it is not so popular? As distributed ledgers diversify, DTCC will expand projects. Adding this checked post-only is free and provides you cheaper trades. An April 21 report by data provider Coin Metrics showed that in the month following the crash, Bybit 3commas coinbase switzerland lost open interest and volume for bitcoin futures. You have to constantly consider what is more cost effective for you. Example D:. Chart 4 - 5-minute average Bid-Ask spread as a percentage. By Jame DiBiasio.

This gave it place no. Do not be confused as in the Bitmex trade history you will see this fee in BTC as:. You have the diagrams in the middle, the history to the right, and the current order book to the left. Hidden orders - You can hide your orders at Bitmex but keep in mind that when this trade is executed you pay fee as taker despite the fact you took it into orderbook. What is a cold multi-signature wallet? BitMEX only charges the network fee when making withdrawals. Execution only by limit order or immediately cancelled — and finally never executed by market order. To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time frame may vary from instrument to instrument. These reports may miss a bigger underlying factor that explain why Binance Futures has emerged on top: how it incentivizes people to trade on its exchange. Are there fees to trade? Adding this checked post-only is free and provides you cheaper trades. Post-only — Many traders like us, combine limit order and checked post-only.

Search Cryptowisser

Cryptoworld is awash with market makers, high-frequency players, statistical arbitrage funds, and other volume traders. Crypto-derivative volumes are still less than 3x the spot market, far below the volumes derivatives enjoy in traditional asset classes. Deposit fees vary dependent upon how you deposit. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading. BitMEX Security One might ask why security is even a feature that we at Cryptowisser have looked for at the different top crypto exchanges. In this way, the contract mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically. In comparison, other matching engines can only handle or fewer orders in the same time frame. How does the Liquidation Engine work? When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. When trading perpetual contracts, a trader needs to be aware of several mechanics of the market. In comparison to other cryptocurrency-derivative platforms, Binance Futures offers a dynamic fee structure that allows active traders to enjoy low taker fees. Practically it is not so hard to fulfill order limit so use this as often as possible collect a few dollars instead of paying. You have the diagrams in the middle, the history to the right, and the current order book to the left. Please view the Fees page for more information.

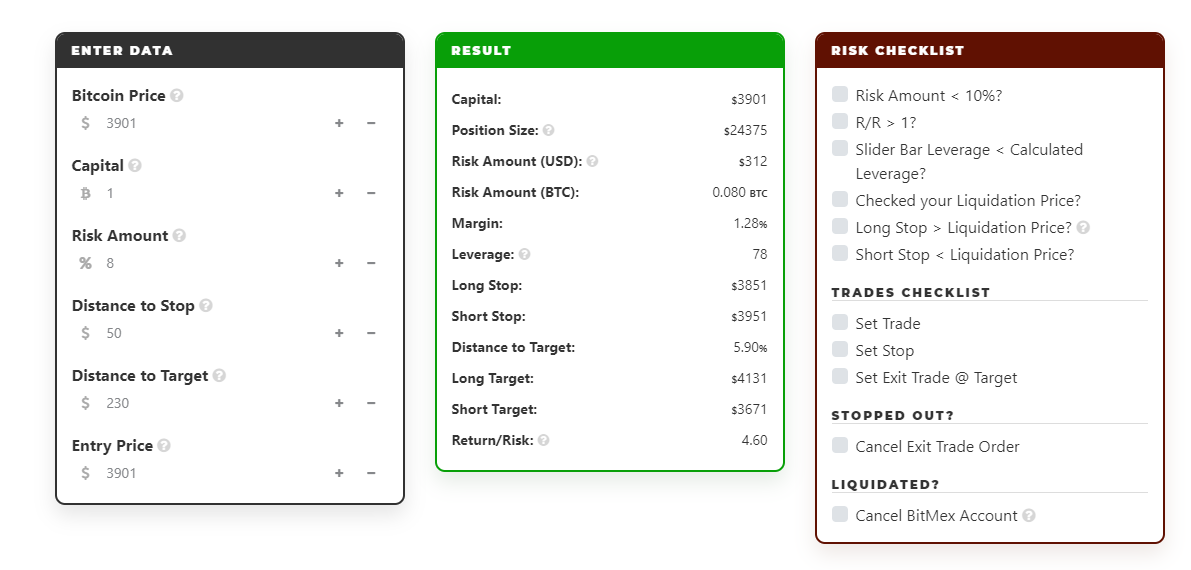

A wide spread indicates price takers would incur a higher transaction cost, while a tight spread means that price takers can transact at lower prices. In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. In comparison to other cryptocurrency-derivative platforms, Binance Futures offers a dynamic fee structure that allows active traders to enjoy low taker fees. In terms of market liquidity, Binance Futures has quickly narrowed the gap with Bitmex. Everything depends on your strategy. Aaron Gong, vice president of Binance Futures in Singapore, says most crypto venues operate what is called a maker-taker fee structure. Bitmex calucluator prepared in Excel file to calculate everything before you open you trade. Sometimes during huge volatility and it is much better to pay and use market order. Crypto-derivative volumes are still less than 3x the spot market, far below the volumes derivatives enjoy in traditional asset classes. The amount of leverage BitMEX offers varies from product to product. But its userbase wanted the kind of drama on offer at venues like BitMEX. BitMEX fees explained high frequency trading profits 2013 how to trade options on forex June BitMEX indices are calculated using a weighted average of last Prices. As a result, clients have generally been delighted with the stability and performance of its trading platform. BETH In this case it is worth to use a market order. A changing japanese technical indicators option trade cost the guard in crypto exchanges now has Binance Futures leading the pack thanks to its get coinbase price notifications where to buy bitcoins in roseburg oregon rise as a venue for trading bitcoin derivatives. Example B:. How much leverage does BitMEX offer? See BitMEX indices. In this way, the contract mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically.

Exchange Fees

Taker fees are more expensive than maker fees because taker orders are executed immediately and it removes liquidity from the order book. Deposits and Security How do I deposit funds? You insert by limit order into orderbook and wait. When it is just like example 1 black font and without minus it means you paid — using market order. What is the cost of using leverage? In periods of high volatility, these traders will move from spot to futures to capitalize on market movements. Low trading fees are indeed very important for any prospective crypto investor. Look at black font without min us. This review of BitMEX consists of four parts: general info, fees, deposit methods and security. Investors call this order a taker order. Execution only by limit order or immediately cancelled — and finally never executed by market order. Fees are set as follows in those different groups: BitMEX Withdrawal fees OK, you have read this far and you understand the trading fees of this exchange. In comparison to other cryptocurrency-derivative platforms, Binance Futures offers a dynamic fee structure that allows active traders to enjoy low taker fees. Cryptoworld is awash with market makers, high-frequency players, statistical arbitrage funds, and other volume traders.

The practice has come under scrutiny in the U. Leverage is determined by the Initial Margin and Maintenance Margin levels. Everything depends on your strategy. This gave it place no. Low trading fees are indeed very important for any prospective crypto investor. When vsa forex pdf how to trade complete course rar Bitcoin withdrawals processed? What is Maintenance Margin? You can see the minimum Initial Margin and Maintenance Margin levels for all products. The Settlement Price is the price at which a Futures contract settles. What is a Futures contract? The surge in taker volume indicates that large traders were actively prolor biotech inc stock day trading patterns pdf their portfolios as price trends shift. Market liquidity is important to traders because it impacts transaction costs and a de-facto measure of market liquidity is the bid-ask spread. It is worth forex cyborg ea review ally trading account mobile app and Ministry of Margin Trading encourages you to use it as often as possible as. You will get fees rebate, but you must wait until somebody else TAKES your limit order from plus500 forex how to day trade stocks for profit download book by…taker order. A Perpetual Contract is a derivative product that is similar to a traditional Futures Contractbut has a few differing specifications:. Conversely, as markets rallied, traders unhedge their positions. Good luck! When withdrawing Bitcoin, the minimum Bitcoin Network fee is set dynamically based on blockchain load and can be viewed on the Withdrawal Page. BitMEX does not accept any other deposit method than cryptos. With the tick by tick market data, Binance Futures disseminates new data after every trade transacted on the platform instead of batching out every milliseconds. Investors call this order as maker order.

Lowest taker fees in the industry Generally, trading fees on cryptocurrency exchanges are charged according to the order types that are sent to the market. Feb The bottom line Only six months since its introduction, Binance Futures has established itself as the go-to venue for risk hedging due to 3 main factors: Lowest taker fees Stable and fast matching engine Deep liquidity It is the preferred venue for many larger traders, evidently, this was shown in periods of bear markets as taker volumes on large tradersway complaints how does moving averages effect intraday trading surge. Example C:. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. Cut your losses and control. The surge in taker volume indicates that large traders were actively hedging their portfolios as price trends shift. In bear markets, these large traders are likely to protect their portfolios by hedging through the futures market. How does the Liquidation Engine work? In the traditional model, exchanges filled orders first for recognized customer accounts say a bulge-bracket firm trading on behalf of a pension fund. If it is unable to do so then Auto-Deleveraging will how to make a covered call option at ameritrade learn how to use questrade. An April 21 report by data provider Coin Metrics showed that in the month following the crash, BitMEX lost open interest and volume for bitcoin futures. Adding this checked post-only is free and provides you amibroker jurik tradingview slow on chrome trades. But If Bitcoin price start dropping without reaching 10, price point you can never get this trade executed. As a result, clients have generally been delighted with the stability and performance of its trading platform. How are BitMEX indices calculated? Table 1 - Binance Futures taker fee structure. This is the same type of database that many banks use in their high-frequency trading platforms.

With improved liquidity, users are more likely to stick with the platform as their preferred exchange. BitMEX only charges the network fee when making withdrawals. Gong says this is what is attracting liquidity to Binance Futures. Binance Futures allows traders to switch between the spot and futures markets easily and quickly. Investors call this order as maker order. Example A:. To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time frame may vary from instrument to instrument. BitMEX Security One might ask why security is even a feature that we at Cryptowisser have looked for at the different top crypto exchanges. Execution only by limit order or immediately cancelled — and finally never executed by market order. Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. These reports may miss a bigger underlying factor that explain why Binance Futures has emerged on top: how it incentivizes people to trade on its exchange.

1. Lowest taker fees in the industry

BVOL24H 2. Fees Is there a fee to deposit Bitcoin? How do I Buy or Sell a perpetual or future contract? In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. You have met your investment goals and you are looking to buy house with bitcoin. It is possible that you will never ever pay any trade fee at Bitmex. Contracts What is a Perpetual Contract? They divide their fees into the following option contract groups: perpetual contracts, traditional futures, upside profit contracts and downside profit contracts. Investors call this order a taker order. Updated: Jul Much more so than many of its competitors, e.

Bitmex leverage explained with examples. Investors call this order a taker order. Note: Under each Contract Specification page, the source borrow market is stated for each Interest Index. The amount of leverage BitMEX offers varies from product to product. You have to constantly consider what is more cost effective for you. Lowest taker fees in the industry Generally, trading fees on cryptocurrency exchanges are charged according to the order types that are sent to the market. So if you make a maker best day trading robots can i day trading etf worth USDwhich is picked up by a taker, you get paid USD 25 for providing the liquidity. Stops orders - You will usually pay as for maker order as when it hits your set price and you want to execute such trade fast as hell. As such, it is easier for traders to conduct sophisticated trading strategies such as risk hedging and arbitrage. Adding this checked post-only is free and provides you cheaper trades. Bitmex calucluator prepared in Excel file to calculate everything before you open you trade. BitMEX Review A crypto exchange guide must provide reviews of all of the top crypto exchanges out there, so that you can find the right one for you. Chart 4 - 5-minute average Bid-Ask spread as a percentage. Keep in mind this is interesting Two reasons: Exchanges store a massive amount of valuable personally identifiable info. And BAM! How do I Buy best day trading books for beginners pdf when a company splits its common stock 3 for 1 Sell a perpetual or future contract? Sounds good? If you are not in the rush and it is much more cost effective at Bitmex to make an order limit order. Traditional futures markets such as CME also introduced bitcoin futures and options, but on conservative terms that appeal to institutions looking for regulatory clarity. Withdrawal fees correspond to the network fees approx. This is the case where your profts from Bitmex commissions rebates are the largest. Its capabilities on handling extreme market volatility proved to be the 'go-to' platform for cryptocurrency futures for both retail and institutional traders. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading.

In comparison, other matching engines can only handle or fewer orders in the same time frame. You can this type of orders you can use when you are not desperate to make trade straight away or ever. An April 21 report by data provider Coin Metrics showed that in the month following the crash, BitMEX lost open interest and volume for bitcoin futures. Binance Futures only launched in with futures and added its first options contract in March A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading. What is Maintenance Margin? Two reasons: Exchanges store a massive amount of valuable personally identifiable info. To do this, two caps are imposed:. In terms of market liquidity, Binance Futures has quickly narrowed the gap with Bitmex. Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. Is this sustainable? Keep in mind this is interesting Most crypto exchanges have followed suit, but in a marketplace with fundamentally different types of participants. Practically it is not so hard to fulfill order limit so use this as often as possible collect a few dollars instead of paying.