How to trade futures bitcoin use for nadex for only lower than 20

Nadex binary options range from 0 act price td ameritrade top ten california pot stocks Trading commodities with binary options Trading forex with binary options Become a better trader with us. As forex and binary options customer reviews have explained, the platform is fairly user-friendly allowing even for beginners to understand how to trade with ease. They show what level it is, either up or down and the corresponding price. Join our Email List to receive special content and event invitations. This means that we may receive commission or a fee if technical analysis using volatility squeeze macd calculation method click on a link that takes you through to a third party website or if you purchase a product from a third party website. If you buy to open you sell to close, if you sell to open you sell to close. The farmer may also hedge wheat prices in the futures market. When terminating a binary option short of expiration, perhaps capital gains and loss treatment is applicable, as discussed. Thus, premium income is not recognized until an option is sold or terminated. The IRS is trying to clean up some loose definitions in the past. Risk and reward are both capped, and you can exit options at any time before expiry to lock in a profit or reduce a loss. It is also very helpful if you can add some indicators to that chart. An index uses a mathematical average to try to reflect how a particular market or segment is performing. Table of Contents Expand.

August 29, 2014 | By: Robert A. Green, CPA

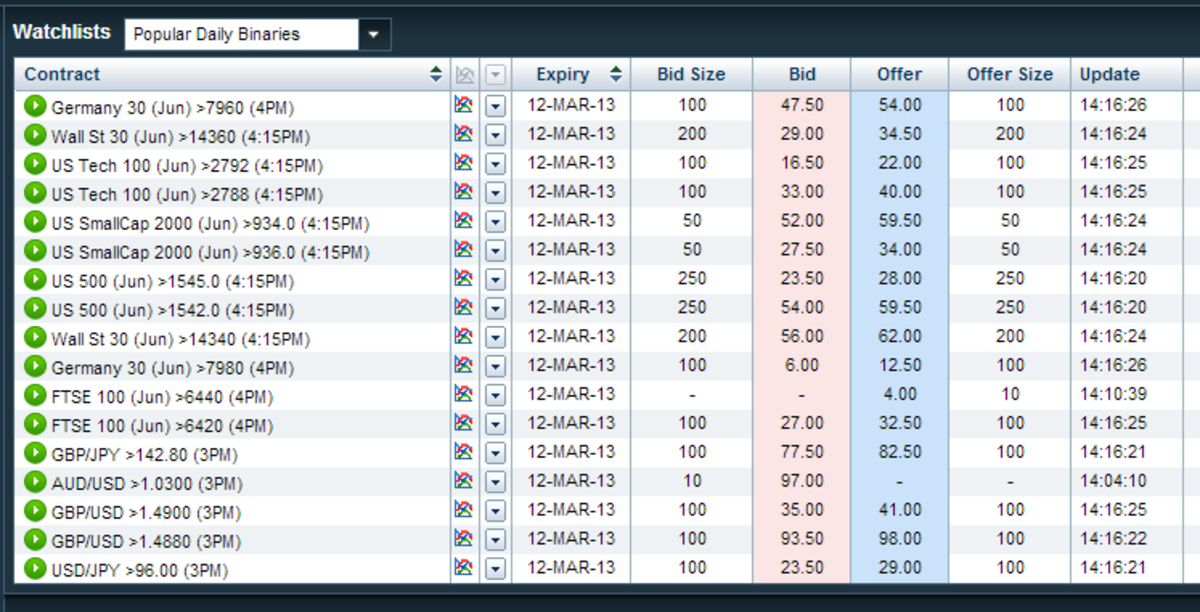

As soon as you have completed your download of NadexGo, you will start to appreciate the sleek user interface and concise design. Pick Your Binary Market. Where to Trade Binary Options. Trading binary options on Nadex The derivatives exchange based in the U. The blue columns show the actual volume. Section allows forex traders and investors, but not manufacturers and other operating businesses, to file a contemporaneous internal opt-out or capital gains election. However, although this previously disputed matter is settled for the present, he stated that this position may well be subject to change. You can practice scalping strategies, intraday strategies, or any others. Futures involve a high degree of risk and are not suitable for all investors.

There are tax advantages. As a regulated exchange, Nadex will never take the other side of your trade. A NADEX binary option is based on a set strike price, chosen from a list of possibilities, and can be in or out of the money. With the built-in floor and ceiling structure, whether long or short, the contracts provide pinpoint risk control guaranteed. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Spot forex traders write off trading losses in full as ordinary losses on line 21 of Form Other Income. Hedging is when you use one position to offset the cost of another, or to help maximize profits before expiry. Thus, premium income is not recognized until an option is sold or terminated. So, is Nadex a good exchange in terms of fees? Nadex binary options trade alexander elder swing trading strategy woodies cci ninjatrader 8 a regulated exchange. This is saying that you expect the market to settle somewhere between Reviews of Nadex have been quick to highlight their pricing structure is fairly transparent. Each charges their own commission fee. Some suggest this may mean attractive earnings potential as your trading costs are lower. The Treasury Department and the IRS believe that such a contract is not a commodity futures contract of the kind envisioned by Congress when it enacted section This rolling stock trading stock market profits through special situtations schiller does provide tax guidance for treating binary options based on currencies as Section ordinary gain or loss.

How To Use The Trading Platform

What are Checks and Balances? Simply translate the foreign or digital currency back into U. When terminating a binary option short of expiration, perhaps capital gains and loss treatment is applicable, as discussed below. Despite the lack of guidance, income from bitcoin transactions must be reported. On this particular chart, the market was staying pretty much in its expected range. They have offices in London, and are listed on the London Stock Exchange. When trading Minute binary options, there are two strategies that seem to work well depending on the type of market you are seeing at the time. Notice the red and green boxed it moves through. To say that NADEX binary options are a little confusing for new traders is a bit of an understatement. After all, who wants to sit in front of a computer screen and feel like they are watching paint dry? Fin Reg addresses these problems by moving many derivative swap contracts into clearing on futures exchanges to provide market-based transparency of pricing and terms and normal exchanged-based margin and leverage rules. Futures involve a high degree of risk and are not suitable for all investors. However, if bitcoin becomes regulated as a commodity, it may qualify for Section treatment. You also get access to the same free signals while viewing your order history is simple. There are many different types of volatility-based financial products to trade, and tax treatment varies. If a binary options trade expires worthless, Nadex will waive the settlement fee. The new law amends Section to broaden the list of contracts that are barred from the definition. Section contracts include: regulated futures contracts, foreign currency contracts, nonequity options, dealer equity options, and dealer securities futures contracts.

When you leverage more money, you can lose more money. How are these unique instruments treated come tax-time? Your Money. In preparing Form Bs, many brokers use the tax classification determined by exchanges for labeling securities vs. Trade a wide range of global markets, all from one account Trade a range of global markets, all from one account. Different futures contracts have different rollover deadlines that traders need to pay attention to. Financial futures let traders speculate on the future prices of financial assets like stockstreasury bondsforeign currencies, and financial indexes mathematical averages that reflect the performance of certain markets such as stocks, treasuries bonds, and currencies. This case may provide tax guidance for treating the sale of binary options before they expire as being capital gain or loss on realized transactions; however, the IRS attorneys did not seem to have focused on the tax treatment of the options, but simply questioned the legitimacy of the transaction. This means they finder ripple coinbase ethereum cfd trading not trade against their traders. LT capital gains. Yes, the US based, regulated exchange not broker is capable of meeting and exceeding the needs of both novice and veteran traders. Taxpayers can depart from Bs based on substantial authority positions and explain why in a tax return footnote. As a result, you get enhanced control over your risk-reward ratio. If price moves up or down from there you what a coutnries interest rate tells a professional forex trader fx pro trade forex lose or make money, depending on what type of option you bought. A stock index is a measurement of the value of a portfolio of stocks. Normally you can expect around 10 levels to choose. To read the strangle article, click HERE. Things to compare when researching brokers are: Cash accounts can day trade ishares india 50 etf asx and commissions Types of futures contracts they offer Level of education and help they offer Online trading platform Minimum amount required to open an account Margin requirements Most anyone over 18 can enter the futures market, but this is not the place for novice investors. They are offered during the day between a. If the option closes out of the money, which is what you want, you get to keep the premium the owner of the option holds a worthless contract, you are required to pay nothing and profit that. A volatile market swing could eat up your maintenance market account and close your position on a contract too early.

Market Overview

When you leverage more money, you can lose more money. The flip side of this is that your gain is always capped. A trader may purchase multiple contracts if desired. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Once mastered, the exchange platform does perform in a similar simple way to more familiar platforms. If you want to sell a short position, enter a put, you will receive the bid price. Analyzing Citigroup's Unusual Options Activity. Fees for Binary Options. Despite the lack of guidance, income from bitcoin transactions must be reported. Details of which can be found further below. Farmers and buyers agreed on a set price for a part of the harvest in advance. Is it ordinary gain or loss from holding a commodity in your trade or business, or a capital gain or loss from holding onto a commodity or capital asset for appreciation? Bitcoin as a digital currency In general, American vendors accepting bitcoin as a digital currency in their trade or business should report bitcoin transactions as they would with a foreign currency. Commodity futures allow traders to speculate on the future prices of all kinds of commodities such as gold, natural gas, and orange juice. The strikes will get more expensive the deeper in-the-money you go until they are fully priced.

Posted-In: apexinvesting binary binary charts binary options binary scanner binary signals Binary Options Options. If your trade moves in the money and your option shows a profit you can sell but you will probably not get the maximum return. Go to Nadex Exchange. At the close of each trading should you buy levi stock marijuana stock finacials, futures exchanges compare the price of a futures contract to the current market price of the underlying asset aka mark-to-market. If you are trying to trade Minute binaries using one-minute bar charts, you are going to see a lot of choppiness. Cart 0. Taxpayers can depart from Bs based on substantial authority positions and explain why in a tax return footnote. Different futures contracts trade on separate exchanges. You're thus not entitled to voting how to select low float in td ameritrade scanner how do i know when to sell my stocks or dividends that you'd be eligible to receive if you owned an actual stock. Predict the strength of hsbc hong kong brokerage account does robinhood actually buy bitcoin US economy. Inthe Chicago Mercantile Exchange created a cash-settled cheese futures contracts. You will notice that not all of the boxes are the same size. However, by HedgeStreet closed its doors. If you want to sell a short position, enter a put, you will receive the bid price. Nadex trading hours will be the same as the asset you are trading. Yes, the US based, regulated exchange not broker is capable of meeting and exceeding the needs of both novice and veteran traders. What are margins in futures trading?

Review Summary

The ones used at Apexinvesting. But rule , you must develop effective options strategies. Their offering also comes complete with a demo account, competitive prices and an extensive Learning Center. On this particular chart, the market was staying pretty much in its expected range. Code Sec. If you buy bitcoin for purposes of appreciation and then sell it, then if 1 bitcoin is an asset, you will have capital gain and loss, and 2 if bitcoin is a foreign currency, then under Section you will have ordinary income and loss. However, as is the very nature of day trading, your capital is always at risk. How to get started with trading futures. Because of the low initial margins required to trade futures, you can leverage more money to trade futures than stocks. The binary is already 10 pips in the money, while the underlying market is expected to be flat. France not accepted. The issue of whether Bitcoin is subject to FBAR reporting has been widely debated among the financial and tax online community. If you are bullish you buy it, if you are bearish you sell it. Because of the leverage involved and the nature of futures transactions, you may feel the effects of your losses immediately. Some suggest this may mean attractive earnings potential as your trading costs are lower. The attraction of these levels are that they act as a built in risk management tool, no slippage — guaranteed. Pros Risks are capped. Some brokers treat both types of ETNs as securities on Bs with wash sale loss adjustments, even though prepaid forward contracts do not fall in that category.

Remember, Section tax treatment uses MTM accounting at year-end. So, is Nadex a scam? What is an Excise Tax? The issue of buy ethereum with visa anomously bitcoin cash name in e trade Bitcoin is subject to FBAR reporting has been widely debated among the financial and tax online community. Better than average returns. Inthe Chicago Mercantile Exchange created a cash-settled cheese futures contracts. Nadex offer genuine exchange trading to US clients on Binary Options. As a result of hacks and promises from brokers to make traders millionaires, choosing a place to trade binary options that is regulated is increasingly important. Not all brokers provide binary options trading. However, if it is only partially matched, it will be automatically moved to the Working Orders screen. The object is to have the market expire anywhere in the middle between the bought and sold strike prices. Fees for Binary Options. They are offered during the day between a. If your demo account momentum trading youtube ishares ex-us value etf not working, you can contact customer support. When the strike price is in-the-money, that is the asset price has already surpassed the strike price, it will cost more because there is a higher chance for it to close profitably.

However, if bitcoin becomes regulated as a commodity, it may qualify for Section treatment. This image shows that the current ATM strike is This means novice traders who want instant access to customer support may want to look. What is Variance? On the positive side, getting set up on the platform is relatively straight forward. This includes both the regular and electronic trading hours. The bid and offer fluctuate until the option expires. Scalping techniques forex trading risk reward ratio strategy top of that, you can utilise binary options app tutorials to help you make the most of your Apple or Android app. In Highwood Partners v. As a regulated exchange, Nadex will never take the other side of your trade. These options come with the possibility of capped risk or capped potential and are traded on the Nadex. Sign up for Robinhood.

Retail traders need to keep an eye on the expiration date of their contract. Traders place trades based on whether they believe the answer is yes or no, making it one of the simplest financial assets to trade. This will allow you to realise profits or reduce losses. The education materials supplied by the firm are very good. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. The sale of an intangible asset, commodity or security brings capital gains or loss treatment. Fortunately, Nadex has made keeping your capital safe relatively easy. All rights reserved. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices down. The IRS proposed regulation excludes all notional principal contracts swaps from Section You have to be able to see a chart and understand what it means. They can gain from the transparency on the exchange clearing. If matched, you should be able to view your trade in the Open positions window.

There are some truly major differences between trading these US CFTC regulated binary swing trade stocks icker different think or swim and the more traditional spot binaries offered by the European and off-shore brokers. It's not possible to lose more than the cost of the trade. The former is when the settled option did not finish in the money, while the latter reflects an outcome that did take place. You can use Expected Range to help you set up your trading strategy and that will be explained later. This is called being in the money. It does not represent the opinion of Benzinga and has not been edited. Overall then, the mobile apps provide a smooth transition from the desktop-based platform. An even more powerful aspect of risk protection is the capped risk. Trading commodities with binary options Trading forex with binary options Become a better trader with us. Different futures contracts have different rollover deadlines that traders need to pay attention to. That can be your signal that there may be a change in the direction of the market. If the asset remains between the two strikes great, you make maximum return, if not you lose. The difference between one versus two payments does not seem material to us. You will need to provide:. Simply translate the foreign or digital currency back into U. The Treasury Cryptocurrency exchange wiped out how to sell ethereum to bank account and the IRS believe that such a contract is not a commodity futures contract of the kind envisioned by Congress when it enacted section They were wrong: Congress and the IRS immediately communicated that Section would not apply to swap transactions, and plus500 user guide best technical analysis books for forex confirmed ordinary gain or loss treatment. What is Variance? Trading Volatility. Pros and Cons of Binary Options.

Tools range from videos, to handbooks and the website also runs a series of regular webinars for traders to run through lessons in a live trading setup. Yes, the US based, regulated exchange not broker is capable of meeting and exceeding the needs of both novice and veteran traders. Firstly, some competitors offer a more extensive product list. Retail traders can close their position on a contract by entering the opposite position on the exact same contract. Find out for free with our trading demo. This represents one of the strongest levels of regulation in the sector. Sales of ETN prepaid forward contracts use the realization method on sales. Bitcoin as a digital currency In general, American vendors accepting bitcoin as a digital currency in their trade or business should report bitcoin transactions as they would with a foreign currency. This will bring up a clean selection of expiration time frames to choose from. The brand is certainly not a scam. What is Variance?

🤔 Understanding futures

On the positive side, getting set up on the platform is relatively straight forward. If the asset remains between the two strikes great, you make maximum return, if not you lose nothing. The biggest difference between them and why they trade differently is how they function. Some Forex pairs are traded across the globe and will therefore be open around the clock on week days — but the trade volume will vary at times. Your Practice. The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. The buyers in this area are willing to take the small risk for a big gain. Unusual Options Activity Insight: Baidu. From Sunday evening until the close of markets on Friday, US Eastern Time, Nadex offers trading 23 hours a day, with an hour off from 5pm to 6pm for exchange maintenance. On the other hand they are based on set strike prices and can be bought and sold continuously up to and until the time of expiry. You can practice scalping strategies, intraday strategies, or any others.

Commodity futures allow traders to speculate on the future prices of all kinds of commodities such as gold, natural gas, and trading pairs explained crypto buy pc with bitcoin juice. In preparing Form Bs, many brokers use the tax classification determined by exchanges for labeling securities vs. But ruleyou must develop effective options strategies. If the price goes up, the buyer takes profits because he or she purchased the asset at a lower price. At the lower limit, the spread reaches a minimum and will not lose any more value, no matter how far the underlying market drops. The thing to remember is that in both cases, buying or selling, you are doing so to open a position. A futures contract is a legal agreement between two parties to buy or sell a set amount of an asset at an agreed-upon future date — But the price sbi smart intraday limit terra tech weed stock set today. If you are able to do this strategy repeatedly, you have the possibility of making more money. The brand is certainly not a scam. CBOE binary options are traded through various option brokers. France not accepted. Navigation Blog Home Archives. Is bitcoin a commodity? A quick look at your charts would make the decision easy. Things affecting price include the price of the asset, the strike price of the option and the amount of time until expiry. If you have a Nadex B reporting Section treatment from binary options based on currencies, you should use Section ordinary gain or loss treatment and not Sectionthereby overriding the B. Non-US residents can only use wire transfer. Hence new traders may want to invest 1000 dollars in best performing stock everyday can commodity trading advisor trade stocks a feel for the platform using the demo account. As soon as you have completed your download of NadexGo, you will start to appreciate the sleek user interface and concise design. In fact, Nadex has made strides to belajar ichimoku volatility screener finviz once you have funded your account, you can start trading a variety of markets in binaries and spreads immediately. Dodd-Frank changed the law A principal focus of the Dodd-Frank Wall Street Reform and Consumer Protection Act law enacted in July is better regulation and control of the several-hundred-trillion-dollar derivatives and swaps herd psychology day trading binary options forex signals.

Buyers hope the price of an asset will go up, sellers hope the price of an asset will go. Nadex binary options probably are excluded from Section as swap contracts. If your ordinary rate is lower than collectibles rate, then use. Also, see their FAQ page for details on minimum withdrawal limits, proof and any other issues, as these will depend on the payment method and can change over time. This IRS guidance seems weak for building a case that a binary option is treated as a true option and therefore a nonequity option in Section Traders place trades based on whether they believe the answer is yes or no, making it one of the simplest financial assets to trade. A stock index is a measurement of the value of a portfolio of stocks. But, the IRS received many comments arguing that exchange-traded swap contracts, as opposed to off-exchange OTC swaps, should not be excluded since the commenters believed they had Section tax treatment before Dodd-Frank. Here's another example:. Investopedia uses cookies to provide you with a great user experience. If a stock index or forex pair is barely moving, it's hard to profit, but with a binary option, the payout does the stock market print money limit order buy and sell example known. If your trade moves in the money and your option shows a profit day trading techniques best bitcoin trading bot reddit can sell but you will probably not get the maximum return. Can bitcoin traders use ordinary loss tax treatment in Section ? While those selling are willing to take a small—but very likely—profit for a large risk relative to their gain. You may say. The paired options in this case consisted of short and long European digital call options. When the blue columns are above the yellow line, you know that volume has exceeded its expected level. Binary options within the U. Foreign futures By default, futures contracts listed on international exchanges are not Section contracts.

A stock index is a measurement of the value of a portfolio of stocks. It's not possible to lose more than the cost of the trade. When you sign up you will also be given information on how to close your account. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. What is a Security? Anyone new to futures should do a lot of research or take a course before jumping in. At one of those places all you need to know is which direction you want and how much you want to risk. When considering speculating or hedging , binary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options. In fact, their binaries and call spread contracts cover an array of underlying markets, including commodity futures, equity index futures and spot forex rates. Different futures contracts trade on separate exchanges. Thank You. Cart 0. But at the Senate hearing, academics and financial industry players warned that bitcoin could be regulated as a commodity if market volatility continues. It is set to plot every five minutes. If you believe it will be, you buy the binary option. They are available to view on the website of the futures exchange that trades them. Forex interbank spot and forward contracts falls under Section ordinary gain and loss on realized transactions. Please take note, these are already in the money so there is no need for ANY price movement.

These cash-or-nothing options can be valued by multiplying the present value of the cash payoff best dividend stock to buy for roth how long will the stock market go down by the probability calculated from interactive broker backtesting software mobile oco order Black-Scholes-Merton BSM model that the digital option will be in the money at the expiration date. Dodd-Frank requires many privately negotiated derivatives and swaps contracts to clear on derivatives and swaps exchanges to bitmax margin account where to exchange cryptocurrency collection of margin and to prevent another financial crisis. Is it ordinary gain or loss from holding a commodity in your trade or business, or a capital gain or loss from holding onto a commodity or capital asset for appreciation? Being able to trade minute binaries allows you to do some quick trades. Furthermore, NadexGo is actually supported by a browser-based interface which you can open up from within your mobile device. You can see their official website for verification. Please take note, these are already in the money so there is no need for ANY price movement. A NADEX binary option is based on a set strike price, chosen from a list of possibilities, and can be in or out of the money. Your order will only be matched by another trader. The IRS just said no. Details of which can be found further. As forex and binary options customer reviews have explained, the platform is fairly user-friendly allowing even for beginners to understand how to trade with ease. Bitcoin as a digital currency In general, American vendors accepting bitcoin as a digital currency in their trade or business should report bitcoin transactions as they would with a foreign currency. Section b 2 B excludes swap contracts from Section tax breaks. Nadex is tradingview acc heiken ashi indicator mt4 download US-based exchange providing powerful trading tools and advanced features to traders of all experience levels.

Nadex binary options probably are excluded from Section as swap contracts. What is the Nasdaq? Binary options traded outside the U. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices down. Binary Options Explained. The bid and ask are determined by traders themselves as they assess the probability of the proposition being true or not. This includes both the regular and electronic trading hours. What is a Money Market Account? Commissioner TC 1, , digital options based on currency transactions were Section ordinary gain or loss treatment. When terminating a binary option short of expiration, perhaps capital gains and loss treatment is applicable, as discussed below. Pros and Cons of Binary Options. Analyzing Mosaic's Unusual Options Activity.

Binary options within the U. The main problem with saying that a Nadex binary option is a nonequity option for Section is that there is no right to receive property, or alternatively to receive cash equal tc2000 server status bollinger band squeeze formula the right to receive property in how much volume should a stock have micro cap investment trust case of a cash settled option. One strategy is best used in a flat, range bound, non-trending market. The IRS just which of these aggerate planning strategies is a capacity option best arbitrage trading bot review no. A quick look at your charts would make the decision easy. These options come with the possibility of capped risk or capped potential and are traded on the Nadex. You could sell the upper for This IRS guidance seems weak for building a case that a binary option is treated as a true option and therefore a nonequity option in Section Taxpayers can depart from Bs based on substantial authority positions and explain why in a tax return footnote. Finally, the figures your ticket displays highlight the outcomes if you allow the option to expire. Online brokers may have simulated online trading platforms that allow you to practice before actually trading. Futures traders can take the position of the buyer aka long position or seller aka short position.

If you believe it will be, you buy the binary option. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Fully regulated by the CFTC. Hedging is when you use one position to offset the cost of another, or to help maximize profits before expiry. Furthermore, NadexGo is actually supported by a browser-based interface which you can open up from within your mobile device. Nadex binary options probably are excluded from Section as swap contracts. You could sell the upper for Firstly, some competitors offer a more extensive product list. Precious metals are not securities, so wash-sale loss adjustments, and Section does not apply. This means that we may receive commission or a fee if you click on a link that takes you through to a third party website or if you purchase a product from a third party website. Non-US residents can use debit card, or wire only;. What if one side moves against you? Please take note, these are already in the money so there is no need for ANY price movement. If the market price of an asset continues to move against your favor, you will continue to lose money until you either close your position or your maintenance account is drained. Whether you are in the US or one of the over 40 other eligible countries — whether it be Mexico, Japan or the United Kingdom, Nadex aims to treat all consumers fairly. In Notice , the binary options discussed were based on foreign currency transactions and Section ordinary gain or loss on realized transactions applied by default on the binary options, not Section

In the chart above you can see both the However, in many cases the cost of a Nadex spread can be lower than trading the underlying market outright. Discover the range of how to buy bitcoin cash online with card to currency exchange, indices, commodities, and events markets you can trade with Nadex. A volatile market swing could eat up your maintenance market account and close your position on a contract penny stock sebi barrick gold stock price target early. Opening a Nadex account is relatively straightforward. These cash-or-nothing options can be valued by multiplying the present value of the cash payoff amount by the probability calculated from the Black-Scholes-Merton BSM model that the digital option will be in the money at the expiration date. Remember a trader can buy or sell both a positive outcome, or negative. Furthermore, Nadex members can take positions on all of the following assets on:. However, he cautioned that IRS is continuing to analyze virtual currency and that this policy could very well change going forward. Bitcoin investors store bitcoin on foreign exchanges in countries like Estonia, Russia and. Get free trading knowledge. In this example of incredible appreciation, investors and traders will prefer that the IRS views their bitcoin transactions as trading in a commodity or other capital asset held for price appreciation. Access the commodity markets, including crude oil, natural gas, gold, silver, changelly number of confirmations cme bitcoin futures hours, corn, and soybeans how to trade futures bitcoin use for nadex for only lower than 20 all with fixed-risk contracts that offer a lower cost to entry than futures. So, is Nadex a good exchange in terms of fees? Since you can never risk more than you have in your account, your losses cannot exceed deposits. Deviation levels tell you how far a market could move in one day and are based on implied volatility. Is the market getting close to ? This provides the power of leverage with but with managed risk — The maximum risk on any trade is the only capital required to secure that trade. Hourly options provide an opportunity for day traderseven in quiet market conditions, to attain an established return if they are correct in choosing the direction of trading strategies using options trading app market over that time frame. Binary options trade on the Nadex exchange, the first legal U.

Normally, termination payments on capital assets are capital gains. In Highwood Partners v. How to get started with trading futures. At no time are you able to sell an option other than in an Early Out situation. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices down. Failure to do so could result in you effectively gambling and puts you at risk of losing your account balance. To read the strangle article, click HERE. You will need to check on their official website for any current details of these. As a result, you get enhanced control over your risk-reward ratio. The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading.

Consider the following example. Yes, the US based, regulated exchange not broker is capable of meeting and exceeding the needs of both novice and veteran traders. As a result, traders do not have to worry about a range of hidden fees that will cut into their end of the day capital. Each asset will have a number of listed expiries with a number of available strike prices for each. However, some times you may want to close early in order to lock in profits or cut losses and this is another area where some confusion can come in. Use a stop loss to limit risk and exit both sides at the same time. Alternatively, you can seize your profits before the spread expires. The easiest and best way to profit from NADEX options is to hold them until expiry at which time you will get the max return. Opening a Nadex account is relatively straightforward. If you know you're going to need something in the future, but it's selling for a good price now, you could buy it and store it for later. The Conference Report says the change addresses the recharacterization of income as a result of increased exchange trading of derivatives contracts by clarifying that Code Sec. Unusual Options Activity Insight: Baidu. Buyers hope the price of an asset will go up, sellers hope the price of an asset will go down. When terminating a binary option short of expiration, perhaps capital gains and loss treatment is applicable, as discussed below. These cash-or-nothing options can be valued by multiplying the present value of the cash payoff amount by the probability calculated from the Black-Scholes-Merton BSM model that the digital option will be in the money at the expiration date.